What is the Custom Procedure Kits Market Size?

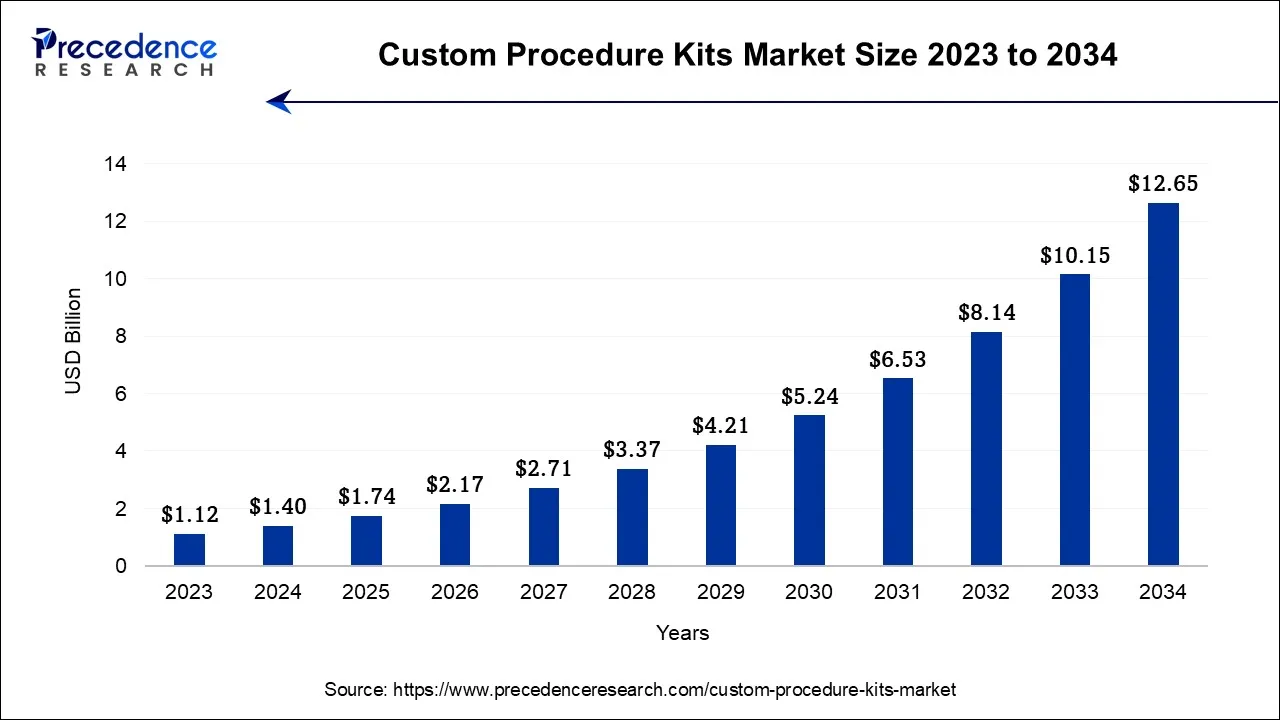

The global custom procedure kits market size is calculated at USD 1.74 billion in 2025 and is predicted to increase from USD 2.71 billion in 2026 to approximately USD 14.82 billion by 2035, expanding at a CAGR of 23.89% from 2026 to 2035.

Custom Procedure Kits Market Key Takeaways

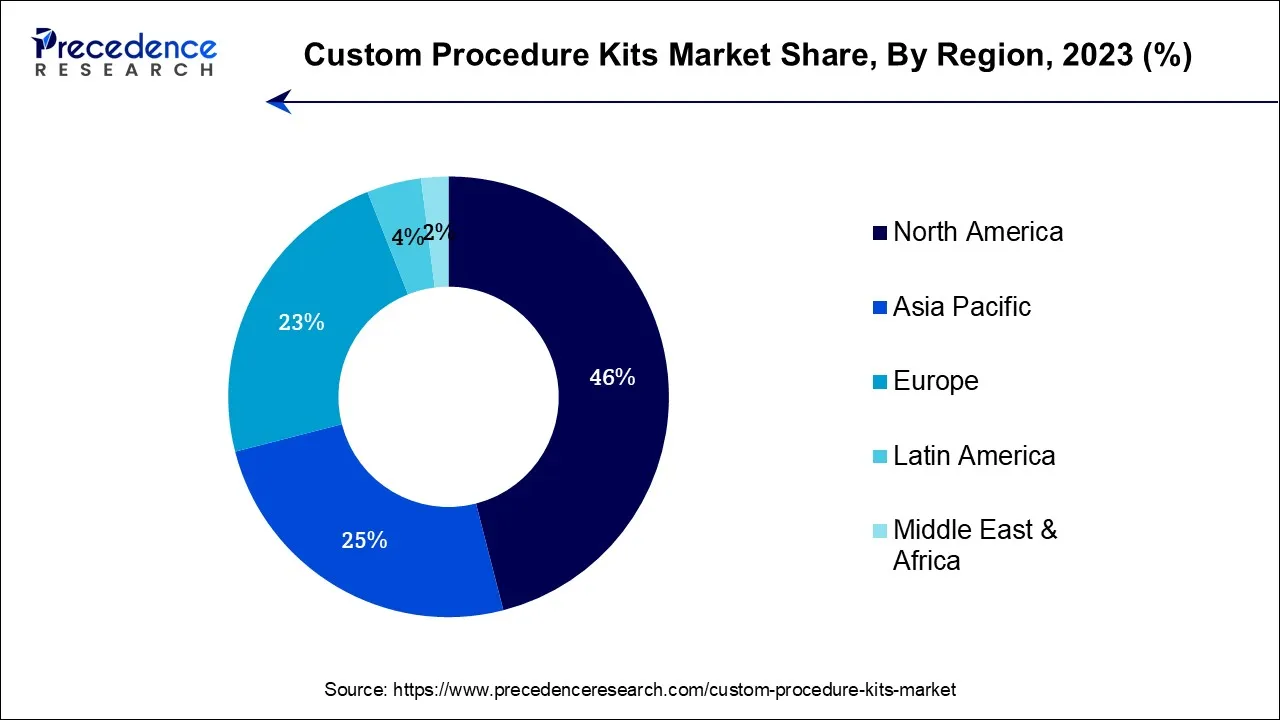

- North America has held the highest revenue share 46% in 2025.

- Asia-Pacific region is estimated to expand at the fastest CAGR between 2026 and 2035.

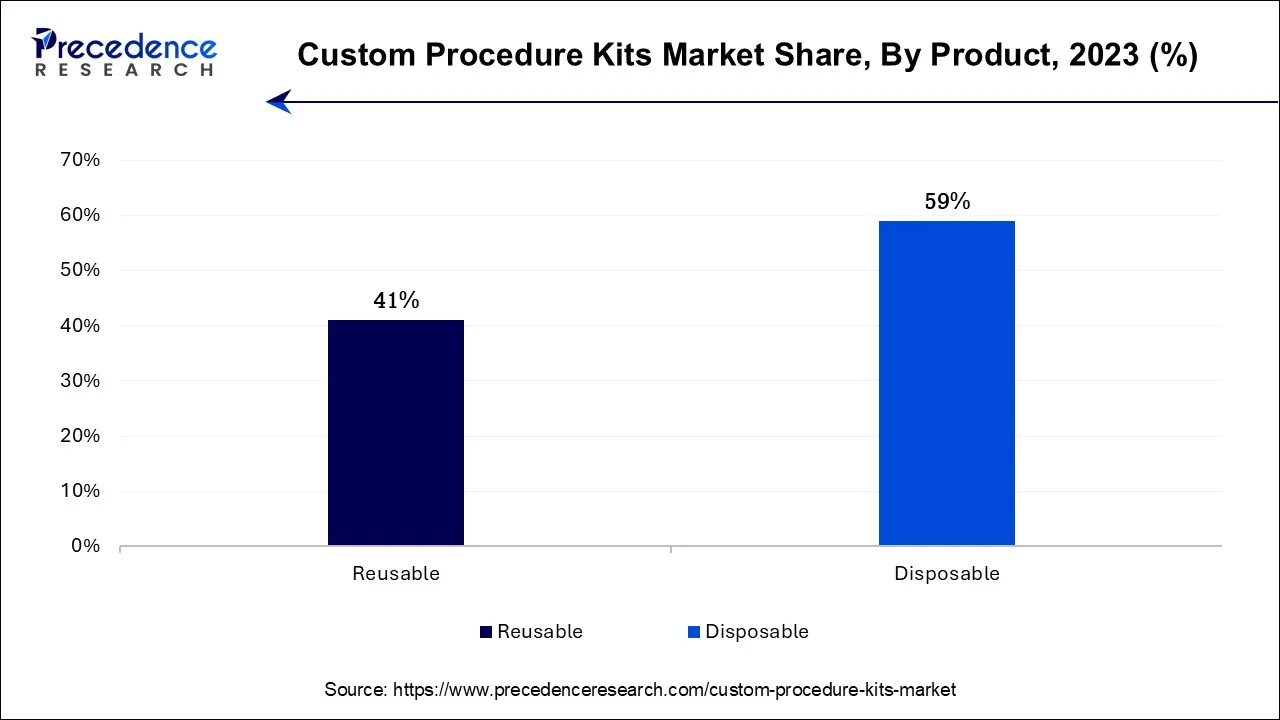

- By Product, the disposables segment contributed more than 59% of revenue share in 2025.

- By Product, the reusable segment is anticipated to expand at a remarkable CAGR of 12.8% during the projected period.

- By Procedure, the orthopedic segment generated more than 23% of revenue share in 2025.

- By Procedure, the cardiac surgery segment is anticipated to grow at the fastest rate over the projected period.

- By End-user, the hospitals segment captured the highest market share of 51.8% in 2025.

- By End-user, the ambulatory surgical centers segment is projected to expand at the fastest rate over the projected period.

What are Custom Procedure Kits?

The custom procedure kits market refers to a specialized segment within the medical industry that offers customized sets of medical instruments, supplies, and accessories tailored to specific medical procedures or surgeries. These kits streamline healthcare processes by ensuring all necessary items are readily available, enhancing efficiency, and minimizing the risk of error.

The market's nature is dynamic, driven by the increasing demand for personalized medical solutions, cost-effective healthcare delivery, and the continuous advancement of medical technologies, reflecting the industry's commitment to optimizing patient care and operational efficiency.

How is AI contributing to the Custom Procedure Kits Industry?

The implementation of artificial intelligence in the custom procedure kits has provided personalized design, better manufacturing efficiency, optimized supply chains, and support of clinical outcomes. AI has its influence in patient-specific customization, design optimization, predictive logistics, quality monitoring, and clinical decision support. It also helps the processes of documentation, gives guidance in real time, which leads to more accurate surgeries, and supports wound healing monitoring and operational efficiency across the workflow of kit development, deployment, and patient care.

Custom Procedure Kits Market Growth Factors

The custom procedure kits market is a specialized sector within the healthcare industry that provides tailored sets of medical instruments and supplies for specific medical procedures or surgeries. These kits are designed to streamline healthcare processes, ensuring the availability of essential items while reducing the risk of errors. As the healthcare landscape evolves, the demand for customized medical solutions is on the rise, making this market increasingly vital for healthcare facilities seeking operational efficiency and improved patient care. Several trends and growth drivers are shaping the custom procedure kits market.

Firstly, there's a growing focus on cost-effective healthcare delivery, prompting healthcare providers to seek efficient solutions like custom procedure kits. Additionally, advancements in medical technology are enabling the development of more specialized kits, further driving market growth. Moreover, the rising trend of outpatient surgeries and the need for infection control measures are boosting the adoption of custom kits.

The custom procedure kits market does face some challenges, including the need for stringent quality control and regulatory compliance. Ensuring that each kit meets rigorous quality standards can be complex, requiring close collaboration with regulatory bodies.

Another challenge is the customization process itself, which demands precise coordination between healthcare providers and kit manufacturers to tailor each kit to the specific needs of different procedures. In this evolving landscape, there are significant business opportunities within the market. Companies that can provide cost-effective, high-quality custom kits while staying compliant with regulatory requirements are poised for growth.

Expansion into emerging markets and diversification of product offerings are other avenues for business development. As the healthcare industry continues to prioritize efficiency and patient safety, custom procedure kits play a pivotal role in delivering on these objectives, making this market ripe with opportunities for innovation and growth.

Market Outlook

- Industry Growth Overview: The market growth is propelled by the increase in surgical operations and the demand for healthcare solutions that are efficient, standardized, and cost-conscious.

- Sustainability Trends: Hospitals are more and more using reusable as well as eco-friendly kits for procedures, with the aim of cutting down on waste and being more sustainable in their operating rooms.

- Global Expansion: While North America is the forerunner in adoption, the Asia Pacific region is catching up quickly, thanks to the increasing healthcare investments and the construction of new medical infrastructure.

- Major Investors: Major players include Medline Industries, Teleflex Incorporated, Owens & Minor, Medtronic, and Cardinal Health.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 23.89% |

| Market Size in 2025 | USD 1.74 Billion |

| Market Size by 2035 | USD 12.82 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Procedure, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advanced medical technology and outpatient surgery trend

The surge in market demand for custom procedure kits is attributed to advanced medical technology. Innovations in medical devices and surgical instruments enable the creation of highly specialized and efficient custom kits. Healthcare providers seek these kits to ensure they have access to the latest, state-of-the-art tools, promoting superior patient outcomes and safety. This increased reliance on advanced technology within custom kits has become a pivotal driver in meeting the evolving needs of modern healthcare and surgical practices. Moreover, The outpatient surgery Trend has significantly boosted demand for the custom procedure kits market.

As more surgical procedures shift from traditional inpatient settings to outpatient facilities and clinics, there's a growing need for efficient, compact, and procedure-specific custom kits. These kits streamline the surgical process, ensuring that all necessary supplies are readily available, contributing to shorter turnaround times, cost savings, and improved patient throughput. As outpatient surgeries become more prevalent, the demand for custom procedure kits continues to surge, making them an essential component of modern healthcare settings.

Restraints

Initial Investment and Surgical Complexity

Developing and implementing a customized kit system often necessitates a significant upfront investment in technology, personnel training, and infrastructure within healthcare facilities. For some providers, this initial financial commitment may appear daunting, particularly if they are accustomed to existing procurement methods. However, it's essential to recognize that the long-term benefits, including cost savings and improved efficiency, typically outweigh these initial investment concerns, making custom kits a valuable addition to modern healthcare practices.

Moreover, surgical complexity restrains the demand for the custom procedure kits market as highly intricate and specialized procedures may not lend themselves well to standardization within custom kits. These complex surgeries often require a wide range of unique instruments and supplies, making it challenging to create one-size-fits-all kits. Consequently, healthcare facilities may opt for traditional procurement methods, hindering the broader adoption of custom kits. Customization limitations in addressing intricate surgical needs can limit market demand, particularly in specialized medical fields.

Opportunities

Technological advancements and diversification of offerings

Technological advancements are propelling demand for the Custom Procedure Kits Market by enhancing kit efficiency and traceability. Integration of technologies like RFID tracking and data analytics streamlines inventory management, reducing errors and costs. Custom kits can now be equipped with smart components, offering real-time data on item usage and expiration dates. This level of customization and sophistication aligns with the growing need for precision in healthcare, making technologically advanced custom procedure kits an attractive choice for healthcare providers seeking improved patient outcomes and operational efficiency.

Moreover, Diversification of offerings in the custom procedure kits market can significantly boost market demand by catering to a broader range of medical needs. By expanding beyond surgical kits to include specialized diagnostic kits, emergency response kits, or kits for non-surgical medical procedures, manufacturers can tap into new market segments. This diversification addresses evolving healthcare demands and allows healthcare providers to source a wide array of customized solutions from a single supplier, simplifying procurement and increasing the appeal of custom kits across various healthcare specialties.

Segment Insights

Product Insights

According to the product, the Disposables has held 59% revenue share in 2023. Disposables in the custom procedure kits industry refer to single-use medical products and supplies included in customized kits. These items are designed for one-time use during medical procedures to maintain sterility and reduce infection risks. Recent trends in disposable custom procedure kits include an increased focus on sustainability. Manufacturers are exploring eco-friendly materials and recyclable options to address environmental concerns. Additionally, there is a growing emphasis on incorporating disposable components that are user-friendly and ergonomically designed, enhancing ease of use for healthcare professionals while maintaining stringent infection control measures.

The reusable segment is anticipated to expand at a significantly CAGR of 12.8% during the projected period In the custom procedure kits industry, "reusable" refers to kits designed with components that can be cleaned, sterilized, and safely used in multiple medical procedures. These kits are eco-friendly and cost-effective, making them an attractive choice for healthcare facilities aiming to reduce waste and optimize resources. Trends in reusable custom procedure kits include the integration of innovative materials that enhance durability, advancements in sterilization techniques, and the development of user-friendly, modular designs. These trends reflect the growing emphasis on sustainability and cost-efficiency in modern healthcare practices.

Procedure Insights

Based on the Procedure, orthopedic is anticipated to hold the largest market share of 23% in 2023. Orthopedic procedures involve the diagnosis and treatment of musculoskeletal conditions and injuries, including surgeries on bones, joints, muscles, ligaments, and tendons. In the custom procedure kits market, there's a growing trend towards specialized orthopedic kits. These customized kits contain instruments and supplies tailored to specific orthopedic procedures, such as joint replacements or spinal surgeries. This trend reflects the increasing demand for precision and efficiency in orthopedic surgeries, driving the market's expansion as healthcare facilities seek custom solutions to optimize patient outcomes and operational workflows.

On the other hand, the Cardiac surgery segment is projected to grow at the fastest rate over the projected period. Cardiac surgery involves surgical procedures performed on the heart and blood vessels to treat various cardiovascular conditions. Custom procedure kits tailored for cardiac surgeries include specialized instruments, implants, and supplies required during procedures like coronary artery bypass grafting and heart valve repair or replacement. Recent trends in the custom procedure kits market for cardiac surgery encompass the incorporation of advanced materials and technologies, such as minimally invasive surgical tools and 3D-printed implants. These kits are designed to enhance precision, reduce surgical time, and improve patient outcomes in the ever-evolving field of cardiac surgery.

End-user Insights

In2023, the Hospitals segment had the highest market share of 51.8% on the basis of the end user. Hospitals, as key end users in the custom procedure kits industry, refer to healthcare institutions where patients receive comprehensive medical care. These facilities require custom procedure kits to streamline surgical and medical procedures, ensuring efficient patient care, reduced costs, and improved infection control. Hospitals often seek customizable solutions that cater to various departments, such as surgery, emergency, and intensive care units.

Recent trends include an increased focus on infection control measures within hospitals, driving the demand for custom kits designed for sterile and aseptic procedures. Additionally, as healthcare facilities strive to optimize resource utilization, there is a growing trend toward adopting standardized custom kits across hospital networks, enhancing operational efficiency while maintaining high-quality patient care. Moreover, technological advancements and the integration of data-driven customization are shaping the future of custom procedure kits in hospitals, aligning them with evolving healthcare needs.

The Ambulatory surgical centers are anticipated to expand at the fastest rate over the projected period. Ambulatory Surgical Centers (ASCs) are healthcare facilities that provide same-day surgical procedures to patients who do not require hospitalization. These centers offer a cost-effective and convenient alternative to traditional hospital-based surgery, focusing on outpatient care and rapid patient recovery. In the custom procedure kits market, there is a growing trend of tailoring kits to the unique needs of ASCs. These kits are designed to optimize efficiency and resource utilization in outpatient settings, ensuring that ASCs have access to specialized instruments and supplies for various procedures. This trend reflects the increasing importance of ASCs in modern healthcare delivery, driving customization and innovation in custom procedure kits to meet the specific demands of these facilities.

Regional Insights

U.S. Custom Procedure Kits Market Size and Growth 2026 to 2035

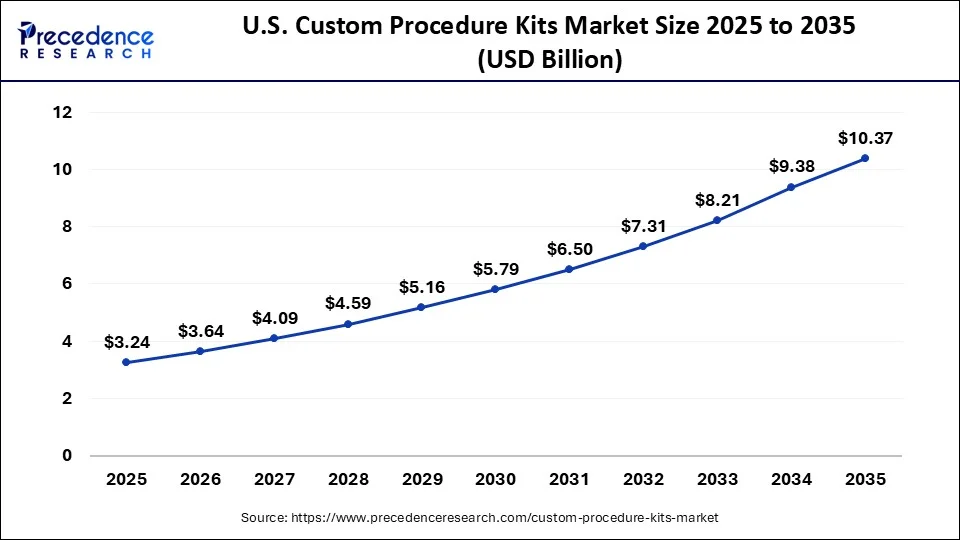

The U.S. custom procedure kits market size is accounted for USD 3.24 billion in 2025 and is projected to be worth around USD 10.37 billion by 2035, poised to grow at a CAGR of 12.34% from 2026 to 2035.

North America has held the largest revenue share 46% in 2025.In North America, the custom procedure kits market is experiencing several notable trends. Increased adoption of outpatient surgical procedures and the growing emphasis on cost-effective healthcare delivery are driving the demand for customized kits. Advanced healthcare infrastructure and a strong focus on infection control measures further stimulate market growth. Additionally, partnerships between kit manufacturers and healthcare facilities are fostering innovation and customization. The market in North America continues to evolve as healthcare providers seek efficient, patient-centric solutions, making it a dynamic and crucial segment within the healthcare industry.

North America: U.S. Custom Procedure Kits Market Trends:

This market has a major impact from high surgical volumes and the shift to value-based care, which in turn creates a technology integration opportunity that will improve the efficiency of procurement, inventory control, and quality standardization across the health plants. The market is driven by an increasing emphasis on operational efficiency, infection control, and the shift toward ambulatory surgical centers.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the custom procedure kits industry is witnessing notable trends. As healthcare infrastructure expands and access to medical services improves, the demand for customized procedure kits is on the rise. Countries like India and China are experiencing a surge in outpatient surgeries and specialized medical procedures, creating opportunities for custom kit providers. Moreover, the adoption of advanced healthcare technologies and the growing awareness of infection control measures are influencing the market's growth in the Asia-Pacific, making it a region of significant potential for custom procedure kits.

Asia Pacific: China/India Custom Procedure Kits Market Trends:

Sales in these two countries are primarily driven by the construction of new hospitals and other healthcare-related buildings, the setting up of medical device factories, the influx of medical tourists, and the demand for affordable, high-quality procedure kits that can reach wider populations of patients. An expanding middle class and growing medical tourism are increasing the demand for standardized and high-quality surgical kits.

What Are the Driving Factors of The Custom Procedure Kits Market in Europe?

Europe continues to be a major market for the adoption of medical devices and equipment, which is mainly due to the fact that there are unified clinical practices, an aging population, and a preference for disposable kits that are in line with sterilization requirements, as well as having a consistent workflow for the procedures.

Germany Custom Procedure Kits Market Trends:

Germany is the frontrunner in the region when it comes to the adoption of new medical technologies, largely due to its strong healthcare system and the increasing popularity of eco-friendly and reusable kits among healthcare professionals who are concerned about the environment and want to save on costs in the long run.

Custom Procedure Kits Market-Value Chain Analysis

- R&D: Uses research activities' efficiency and profitability as criteria to find the target with the highest potential and also to decide where to invest more or less.

Key players: Medline Industries, Cardinal Health, Mölnlycke Health Care - Clinical Trials and Regulatory Approvals: Conducts trial planning, execution, data collection, and regulatory compliance at a faster pace, hence making quicker access to the market.

Key players: PPD (Thermo Fisher Scientific), IQVIA, LabCorp Drug Development - Formulation and Final Dosage Preparation: Analyzes manufacturing efficiency, quality control, and cost during the transformation into final products to get it at the lowest level possible.

Key Players: B. Braun Melsungen, Baxter International - Packaging and Serialization: Evaluates the packaging processes, ensuring the integrity, traceability, compliance with regulations, and prevention of counterfeit products throughout the supply chains.

Key Players: PCI Pharma Services, Sharp Services, Steris plc - Distribution to Hospitals, Pharmacies of Custom Procedure Kits: Recognizes the need for timely, cost-effective delivery of products and thus assesses logistics, inventory management, storage, and transportation processes.

Key players: McKesson Corporation, Owens & Minor

Custom Procedure Kits Market Companies

- Medline Industries, Inc.: They sell complete sets of medical equipment for surgeries and also produce and distribute tailored procedure kits for a variety of healthcare settings.

- Teleflex Incorporated: They provide sterile medical kits along with specialty devices that are meant for the critical care, surgical, and procedural application areas.

- Boston Scientific Corporation: They produce and sell surgical devices that are part of the custom procedure kits, which are used for the treatment of coronary, urological, and certain surgical conditions.

Other Major Key Players

- BD (Becton, Dickinson and Company)

- Owens & Minor, Inc.

- 3M

- Mölnlycke Health Care

- Cardinal Health, Inc.

- B. Braun Melsungen AG

- Halyard Health, Inc.

- Smith & Nephew plc

- Thermo Fisher Scientific Inc.

- Terumo Corporation

- Mölnlycke Health Care AB

- Johnson & Johnson Services, Inc.

Recent Developments

- In October 2025, the CBIC introduced an automated approval process for IFSC registration to simplify customs operations and enhance trade facilitation. This allows electronic transactions through an 11-character alphanumeric code identifying bank branches in India.

(Sourcd: maritimegateway.com ) - In November 2024,SYNDEO Medical announces European Medical Device Regulation approval for its flagship products. The approved products are SYNDEOPack Interventional Procedure Packs™ and Xssential Rapid Delivery Procedure Packs.

(Source: globenewswire.com ) - In 2022,Medline Industries, as part of the European Commission's rescEU program, donated 59 pallets containing 14 tons of medical supplies to Ukraine. The contribution included essential items like delivery kits, oxygen therapy equipment, scrub suits, and scalpels & sutures, aiding healthcare efforts in the country.

- McKesson Medical-Surgical sponsored seven NHCW 2022 events at Community Health Centers: Community Health Association of Spokane, Cumberland Family Medical Centers, East Boston Neighborhood Health Center, Eisner Health, Sun River Health, Tampa Family Health Centers, and Terry Reilly Health Centers.

Segments Covered in the Report

By Product

- Disposable

- Reusable

By Procedure

- Colorectal

- Thoracic

- Orthopedic

- Ophthalmology

- Neurosurgery

- Cardiac Surgery

- Gynecology

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting