What is the Data Center Networking Market Size?

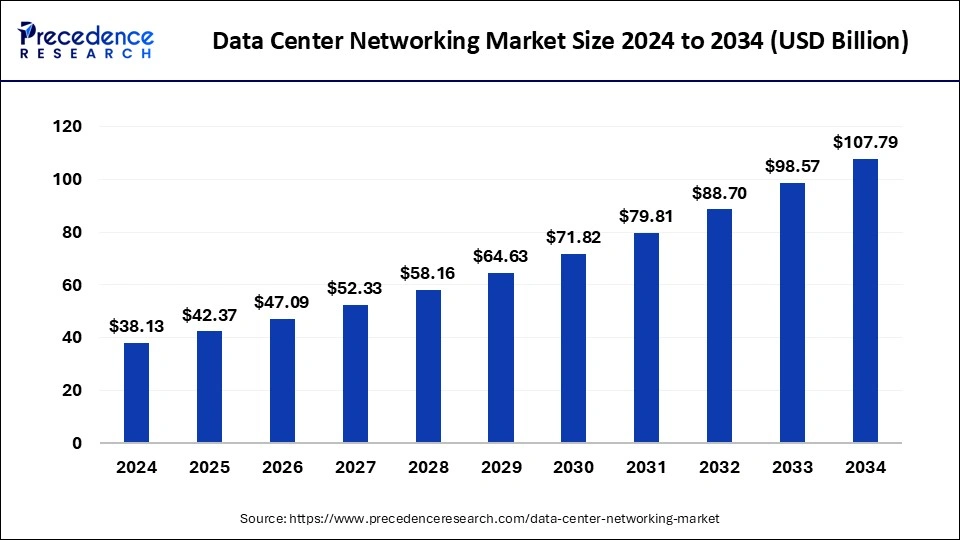

The global data center networking market size is calculated at USD 47.09 billion in 2025 and is predicted to increase from USD 52.33 billion in 2026 to approximately USD 126.80 billion by 2035, expanding at a CAGR of 10.41% from 2026 to 2035. Thegrowing adoption of cloud computing across various industry verticals is expected to drive the growth of the data center networking market.

Data Center Networking Market Key Takeaways

- In terms of revenue, the global data center networking market was valued at USD 42.37 billion in 2025.

- It is projected to reach USD 117.44 billion by 2035.

- The market is expected to grow at a CAGR of 10.73% from 2026 to 2035

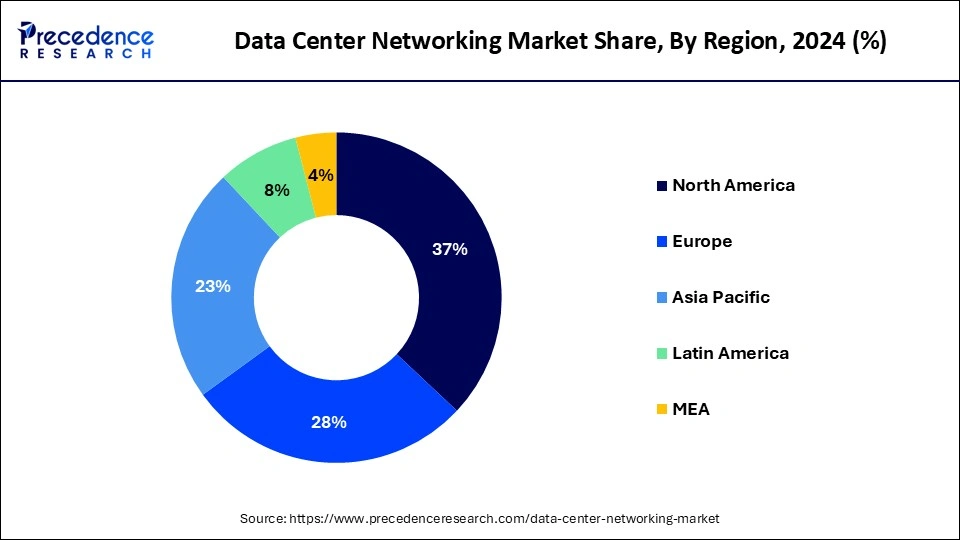

- North America dominated the market with the largest revenue share of 37% in 2025.

- Asia Pacific is projected to grow at the fastest rate during the forecast period.

- By product type, the Storage Area Network (SAN) segment has held the largest revenue share of 27% in 2025.

- By product type, the Wide Area Network (WAN) segment is projected to register notable growth during the forecast period.

- By end-user, the IT & Telecom segment has contributed more than 32% of revenue share in 2025.

- By end-user, the BFSI segment is projected to register the fastest growth during the forecast period.

Market Overview

The data center networking market revolves around the involvement of infrastructure, protocols, and systems that enable communication between storage devices, servers, and other resources within the data center. It includes numerous components like switches, cabling, firewalls software-defined networking (SDN), routers and network management to enhance security and maintain stability. This aims to handle data traffic, support virtualization, and enable data exchange within the data center and other external networks.

The global data center networking market is addressing the demand for efficient data transfer, robust security, and high-speed connectivity to increase the data traffic driven by big data, cloud computing and digital transformations. The market is witnessing significant growth due to the demand for cloud computing, and big data analytics. The need has risen due to the adoption of these services in businesses, they are constantly monitored to ensure that they are up and running across storage resources, network health, and computing. Devices like routers, switches and access points play an important role in the connection of multiple networks for sharing information and interaction. The emergence of new technologies is resulting in a competitive business environment.

- In 2024, Oracle collocated their database services in Google Cloud data centers to simplify its cloud migration and multi-cloud deployments.

Artificial Intelligence: The Next Growth Catalyst in Data Center Networking

AI is profoundly impacting the data center networking industry by driving the need for significantly higher bandwidth and lower latency, essential for training and inference of large AI models. This surge in demand necessitates the deployment of faster network technologies, such as 400G and 800G Ethernet, accelerating the adoption of high-speed networking components.

Consequently, there is a shift towards specialized network architectures, like East-West traffic optimization and the implementation of advanced optical interconnects, to facilitate seamless communication between thousands of AI accelerators.

Data Center Networking Market Growth Factors

- The increasing demand for efficient computing by businesses is leading to the demand for robust and scalable data center networking solutions.

- The rapid expansion of the Internet of Things (IoT) is generating a huge amount of data which is increasing the demand for networking ability in the data centers.

- The ongoing investments by big companies in the expansion of data centers to increase digitalization is fostering the growth of the data center networking market.

- Increasing risks of data security and regulatory compliance are leading to the adoption of security measures in the data center networking areas. This is leading towards the market growth.

Data center networking market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rapid expansion of the BFSI sector coupled with technological advancements in the government organizations globally.

- Major Investors: Numerous market players are actively entering this market, drawn by collaborations, business expansions, R&D and some others. Various data center networking companies such as Juniper Networks, Inc, Microsoft, Huawei Technologies Co, Ltd, Dell, Inc, and some others have started investing rapidly for developing advanced data center networking solutions around the globe.

- Startup Ecosystem: Various startup companies are engaged in developing data center networking solutions. The prominent startup brands dealing in data center networking comprises of Deep Green, Apto Data Centers, Ultrascale Digital Infrastructure and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 126.80 Billion |

| Market Size in 2025 | USD 47.09 Billion |

| Market Size in 2026 | USD 52.33 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.41% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption of cloud-based services

The data center networking market has been witnessing significant growth in recent years due to the widespread adoption of cloud computing. The running businesses throughout the world that migrate data, workload, and applications to the cloud need strong and scalable data centers to handle the traffic. It provides flawless communication between the cloud platforms and distributed users. These qualities are crucial, especially in today's competitive business environment so that companies can scale their operations according to the market demands.

The cloud reduces the need for physical infrastructure and reduces the additional costs. This allows the companies to manage their business operations without budgetary restrictions. Cloud adoption supports innovations which provide access to new technologies like Artificial Intelligence (AI) and Machine Learning (ML). They also require high-performance networking centers which may open the gates for investments in the data center networking market.

Upsurging demand for customized networking platforms

There has been a drastic change in the business world as it has been constantly evolving which makes the networking needs complex and specific, increasing the need to address unique operational requirements. Different domains like finance, retail, manufacturing, healthcare and security. Customized platforms allow them to make personalized solutions according to their standards ensuring their safety. For example, the healthcare industry secures reliable networks for their patient and real-time medical data. Software-defined networking (SDN) has played a vital role in the growth of the data center networking market as it is flexible and programmable for easier automation and customization. Digital transformation is leading to the adoption of new technologies which generate data and can be used to tailor the consumers and contribute to market growth.

Restraint

Low number of skilled professionals

The lack of skilled professionals poses a challenge to the workflow in the data center networking market. There is a lack of experts who can understand concepts and new technologies. This limits the use of these technologies to use them to solve their problems and also causes delays in implementing them to the platforms. The increasing need for customized networks and the lack of professionals become a barrier to the growth of the data center networking market. Many companies are focusing on increasing the number of professionals to match the market requirements.

Opportunities

Upsurging demand for high-speed internet

The need for high speed is increasing as multiple sectors and businesses rely on internet connections. Many companies are keen on investing in the growth of Internet especially in developing countries as they have the fastest-growing urban areas. This can be seized as an opportunity which could help in generating multiple opportunities for the companies to generate profit. The adoption of 100 GB switch ports might play a crucial role in the upcoming years. There is a high demand for broadband and WIFI networks as they help in edge computing. It is where the data is processed close to the sources. With the emerging trend of the adoption of hybrid cloud adoption, the need for high-speed internet increases as it enhances their networking solutions and provides an advantage to the professionals. The focus on the expansion of high-speed internet in the developing nations will create a workspace for the people of that region.

Increasing Investments in data centers

The rapid growth of several technologies might play a vital role in the growth of the data center networking market. As businesses expand there will be a demand for network infrastructure that might help in supporting the upcoming technologies which can smoothen the overall process. AI, ML, and IoT require an adequate amount of data. Investing in data center networking is mandatory because that might help to improve the infrastructure and enhance connectivity. The need for digital transformation, edge computing, 5G networks and global data expansion might lead to multiple investments by key players in the upcoming years.

- In 2024, the Amazon cloud computing unit announced an 11 billion $ investment to build data centers in Northern Indiana. The data center might create 1000 jobs.

Segment Insights

Product Insights

The storage area network (SAN) segment witnessed significant share in the year 2024. Many companies prefer SAN to manage their data without any additional expenses. The main motive behind the innovation of SAN is to improve device accessibility and enhance storage. It provides low latency and high-speed internet which is essential for acquiring the data and the ERP systems. SAN provides enhanced data security features like mirroring, RAID, and many more. These technologies enhance the reliability and reduce the risk of any data loss.

The Wide Area Network (WAN) segment is expected to register rapid growth during the forecast period. The WAN can connect the data centers and branch offices over geographical areas. This plays a crucial role in maintaining the connectivity of organizations throughout the world. It can handle real-time applications without the need for a vast infrastructure. The WAN is beneficial for businesses as it provides fallover mechanisms for business continuity which does not interrupt the workflow.

End-user Insights

The IT & Telecom segment dominated the global data center networking market with the largest share in 2024. The significant growth factor of the market is the rise of video streaming, online gaming, and social media which increases data consumption and also increases the demand for data networking infrastructure to manage the data traffic. The overall significance and expansion of the 5G network infrastructure have contributed to the growth of this segment. The drastic shift towards the SDN allowed these companies to manage their networks more efficiently to match the market needs. The emerging trends would increase smartphone use throughout developing countries which might contribute to the market growth during the forecast period.

The Banking, Financial Services, and Insurance (BFSI) segment is projected to register the fastest growth with an exponential CAGR during the forecast period. These organizations handle a huge amount of financial data which is to be handled carefully, this increases the need for data center networking services in the company. Banking organizations are focusing on the adoption of the cloud due to the higher risk of data security. New emerging trends like online payments and trading platforms play a vital role in the development of the data center networking market. Financial institutions are promoting sustainability through green IT practices. This step aims to reduce the carbon footprints of data centers.

Regional Insights

What is the U.S. Data Center Networking Market Size?

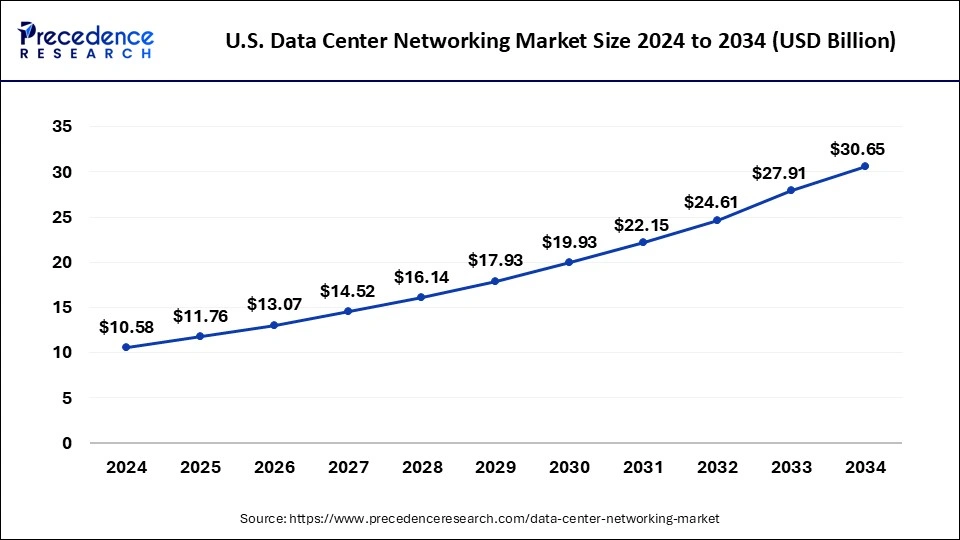

The U.S. data center networking market size was valued at USD 13.07 billion in 2025 and is expected to be worth around USD 36.13 billion by 2035 with a CAGR of 10.70% from 2026 to 2035.

North America dominated the global data center networking market with the largest share in 2024. Countries like the United States and Canada are ahead due to strong internet penetration and cloud adoption. The region focuses on investments that could help innovate new facilities and equipment for the professionals. The region has leading companies like Juniper, Cisco, and IBM, making the economy strong. The urban population in North America has the highest internet consumption rate, increasing the need for highly established infrastructure. The government in these regions also have strict regulations and laws like GDPR and CCPA which enhance the security and increase the reliability of the companies to use these networks. The presence of key market players in the region might help the region to maintain its dominance in the market.

U.S. Data Center Networking Market Trends

The U.S.'s explosive growth in AI training and inference workloads requires massive low-latency networks for GPU clusters, migration to the cloud, and rising internet traffic. A rising need for teal time processing for 5G, IoT, and analytics drives edge data center growth.

Europe held a notable share of the market in 2024. The region has witnessed rapid growth in the number of data networking centers. The United Kingdom is witnessing rapid digitalization across different sectors which leading to the growth of center networking markets. Europe leads in sustainable initiatives which open investments in eco-friendly networking solutions. This also helps to improve regional connectivity and benefits the environment. The data centers are focusing on the reduction of power consumption and other bandwidth requirements which may create opportunities in the data center networking market.

Germany Data Center Networking Market Trends

Germany's integration of AI, big data, and cloud computing demands is driving the need for more powerful, high-density infrastructure. The focus on sustainability, edge computing expansion for 5G and IoT applications, and increased use of colocation services, all under strict data security requirements.

Asia Pacific is expected to register the fastest growth during the forecast period. Countries like India, China, and Japan are witnessing rapid urbanization in developing regions which may help in the expansion of cloud adoption. The region also expects the need for efficient data centers which creates an opportunity for new vendors to step into the data center networking market. The trends like high-speed internet and hybrid cloud computing might help in the growth of the market.

China Data Center Networking Market Trends

China's growth of the digital economy is supported by strategic government incentives aimed at scaling mega-facilities to handle generative AI workloads. Consequently, the market is shifting toward specialized GPU-ready servers and scalable cloud architectures to sustain this rapid technological evolution.

Why Latin America held a considerable share of the data center networking market?

Latin America held a considerable share of the industry. The rising demand for ethernet switches from the manufacturing sector across numerous countries including Brazil, Argentina, Peru and some others has bolstered the market expansion. Also, the rapid investment by government for strengthening the BFSI sector is expected to propel the growth of the data center networking market in this region.

How is Middle East & Africa contributing to the unmanned traffic management market?

The Middle East & Africa held a notable share of the market. The growing adoption of advanced networking solutions in prominent nations including UAE, Saudi Arabia, Qatar and some others has driven the industrial growth. Moreover, the presence of various market players coupled with numerous government initiatives aimed at developing the telecom sector is expected to drive the growth of the data center networking market in this region.

Value Chain Analysis of the Data Center Networking Market

- Technology Development and Hardware Manufacturing

This stage involves the research, design, and production of the physical equipment that forms the backbone of data center networks, such as switches, routers, and interconnects.

Key Players: Cisco Systems, Inc., Arista Networks, Inc., Juniper Networks Inc., NVIDIA Corporation, Broadcom Inc., Hewlett Packard Enterprise (HPE), and - Dell Technologies Inc.

Network Architecture and Infrastructure Deployment

Once the hardware is produced, this stage focuses on designing and physically building the network infrastructure within the data center facility.

Key Players: Equinix, Inc., Digital Realty Trust, Turner Construction Company, DPR Construction, AECOM, and various local construction and engineering firms. - Software and Network Management

This stage involves the development and implementation of software that manages, controls, and optimizes the physical network.

Key Players: VMware, Inc., Cisco Systems, Inc. (through ACI solutions), Nutanix, Microsoft (Azure), and Amazon Web Services (AWS).

Data Center Networking Market Companies

- Cisco Systems: Cisco is an American multinational technology conglomerate headquartered in San Jose, California, that develops, manufactures, and sells networking hardware, software, and telecommunications equipment. This company provides solutions for networking, security, collaboration, and observability, serving businesses, public institutions, governments, and service providers worldwide.

- IBM: IBM (International Business Machines Corporation) is a leading American multinational technology company that specializes in hybrid cloud and AI solutions and consulting services. IBM integrates technology and expertise to help clients solve business problems, primarily focusing on high-growth areas including artificial intelligence (AI) and hybrid cloud computing.

- NEC Corporation: NEC Corporation is a Japanese multinational information technology and technology company that provides IT and network solutions, including AI, cloud services, and telecommunications equipment. The company serves a wide range of industries and has a global presence to provide a wide array of services and products.

- Rahi Systems: Rahi Systems was a global IT solutions provider specializing in the design and integration of data centers, cloud services, and enterprise networks. The company offers a full lifecycle of technology solutions, including physical infrastructure, compute, storage, networking, and professional and managed services.

- Broadcom: Broadcom is a global technology company that designs, develops, and supplies semiconductor and infrastructure software solutions. It is a leader in technologies connecting the world, with a diverse portfolio serving networking, broadband, wireless, storage, and enterprise markets through products used in data centers, smartphones, and some others.

- Apstra: Apstra is an intent-based networking (IBN) automation solution from Juniper Networks designed for managing and automating data center networks. It allows users to define the desired outcome (intent) for the network, and the software then translates this into the necessary configurations for devices, handling tasks such as policy generation and deployment automatically.

- Pluribus Networks: Pluribus Networks is a software-defined networking (SDN) company that provides solutions for data center and cloud networking. This company automates and secures networks, creating a unified fabric across physical and virtual environments and offering cost-efficient and resilient solutions.

- Curvature: Curvature is an IT services company that provides hardware solutions, including new and pre-owned networking and data center equipment, along with third-party maintenance and other lifecycle management services. The company sells new, pre-owned, and third-party equipment, including servers, storage, and networking hardware from manufacturers such as Cisco, Dell, and HPE.

Other Major Key Players

- Hewlett Packard Enterprise Development LP

- Arista Networks

- Juniper Networks, Inc

- Microsoft

- Huawei Technologies Co, Ltd

- Dell, Inc

- Avaya Inc

- Extreme Networks

- VMware, Inc

- ALE International

- Intel Corporation

- Equinix, Inc

Recent Developments

- In January 2026, NVIDIA Rubin Platform: Announced the next-generation platform features Rubin GPUs, Spectrum-6 Ethernet, and the Spectrum-X Ethernet Photonics switch system. These switches offer 5x better power efficiency and use co-packaged optics to scale "AI factories".

(Source: https://nvidianews.nvidia.com ) - In 2024, Juniper Networks, a leading MNC company expanded its Mist AI platform to data centers. This includes new capabilities and releasing two QFX switches and PTX routers for ML and AI data center servers.

- In 2024, NVIDIA alongside top computer manufacturers unveiled Blackwell-powered, AI systems with grace CPUs and networking to build the advanced factors and data centers for AI.

- In November 2025, NetBox Labs launched an AI Data Center Acceleration Program. This program is designed to accelerate the growth and operationalization of hyperscale AI data center networks and infrastructure. (Source: https://www.globenewswire.com )

- In October 2025, Cisco Systems launched a new networking chip. This networking chip is designed for the artificial intelligence data centers.

(Source: https://www.reuters.com ) - In October 2025, Celestica launched DS6000 and DS6001. DS6000 and DS6001 are new 1.6TbE data center switches designed for AI/ML cluster applications.(Source: https://corporate.celestica.com )

Segments Covered in the Report

By Product

- Ethernet Switches

- Routers

- Storage Area Network (SAN)

- Application Delivery Controllers (ADC)

- Network Security Equipment

- WAN Optimization Equipment

- Others

By End-user

- BFSI

- IT and Telecom

- Retail

- Education

- Government

- Media & Entertainment

- Manufacturing

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting