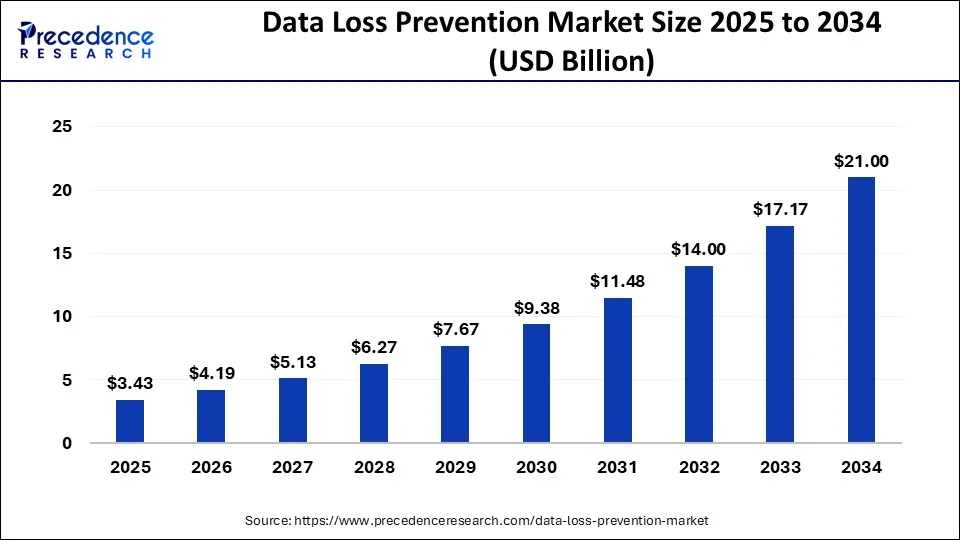

Data Loss Prevention Market Size and Forecast 2025 to 2034

The global data loss prevention market size is projected to reach around USD 21 billion by 2034 from USD 2.80 billion in 2024, at a CAGR of 22.32% from 2025 to 2034. The increasing number of cybercrime cases across the world is driving the growth of the data loss prevention market.

Data Loss Prevention Market Key Takeaways

- In terms of revenue, the data loss prevention market is valued at $3.43 billion in 2025.

- It is projected to reach $21 billion by 2034.

- The data loss prevention market is expected to grow at a CAGR of 22.32% from 2025 to 2034.

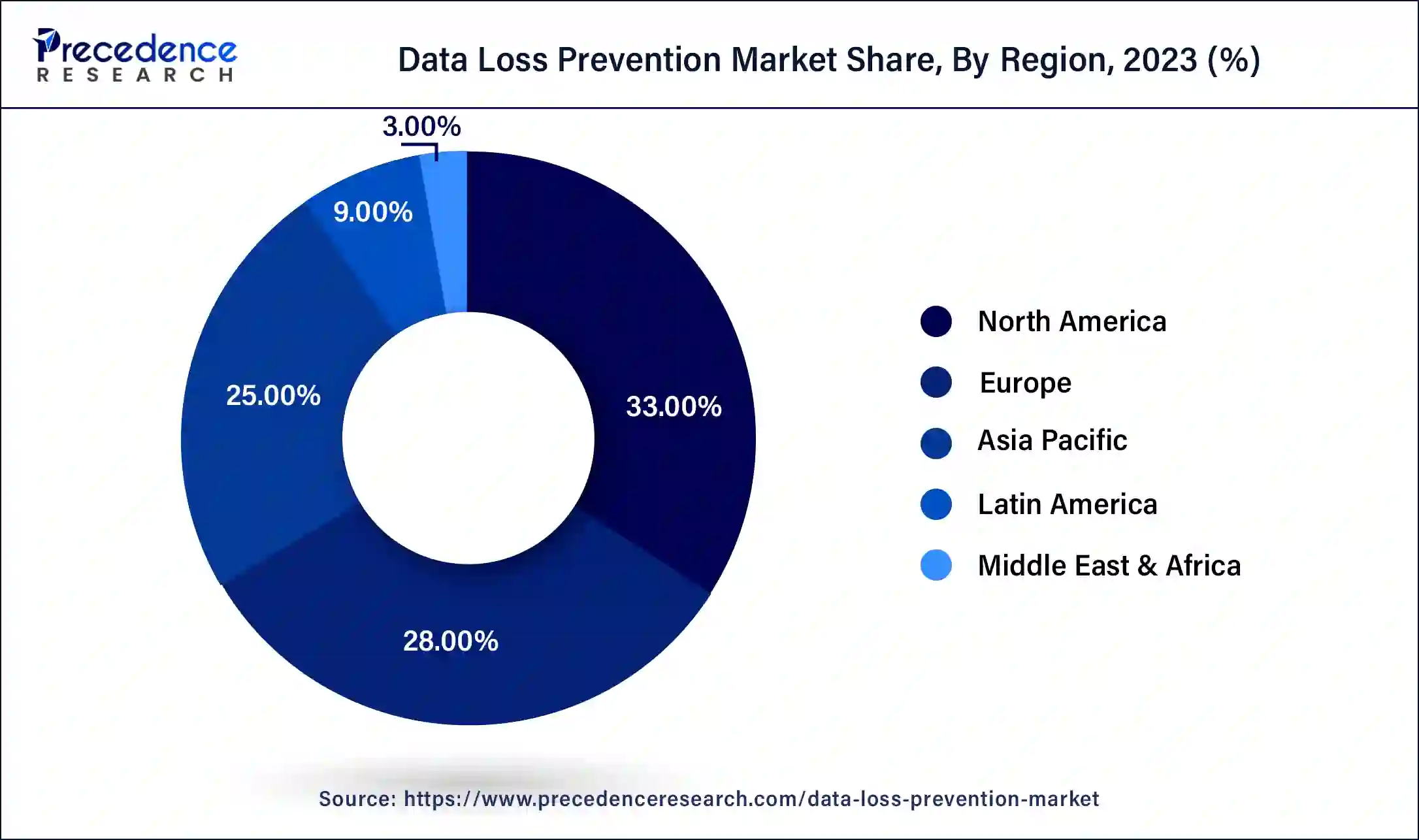

- North America led the data loss prevention market with the largest market share of 33% in 2024.

- Asia Pacific is projected to grow at a solid CAGR of 24.72% during the forecast period.

- By software, the data center and storage-based DLP segment captured more than 41% of market share in 2024

- By software, the endpoint DLP segment is expected to grow with the highest CAGR of 23.84% during the forecast period.

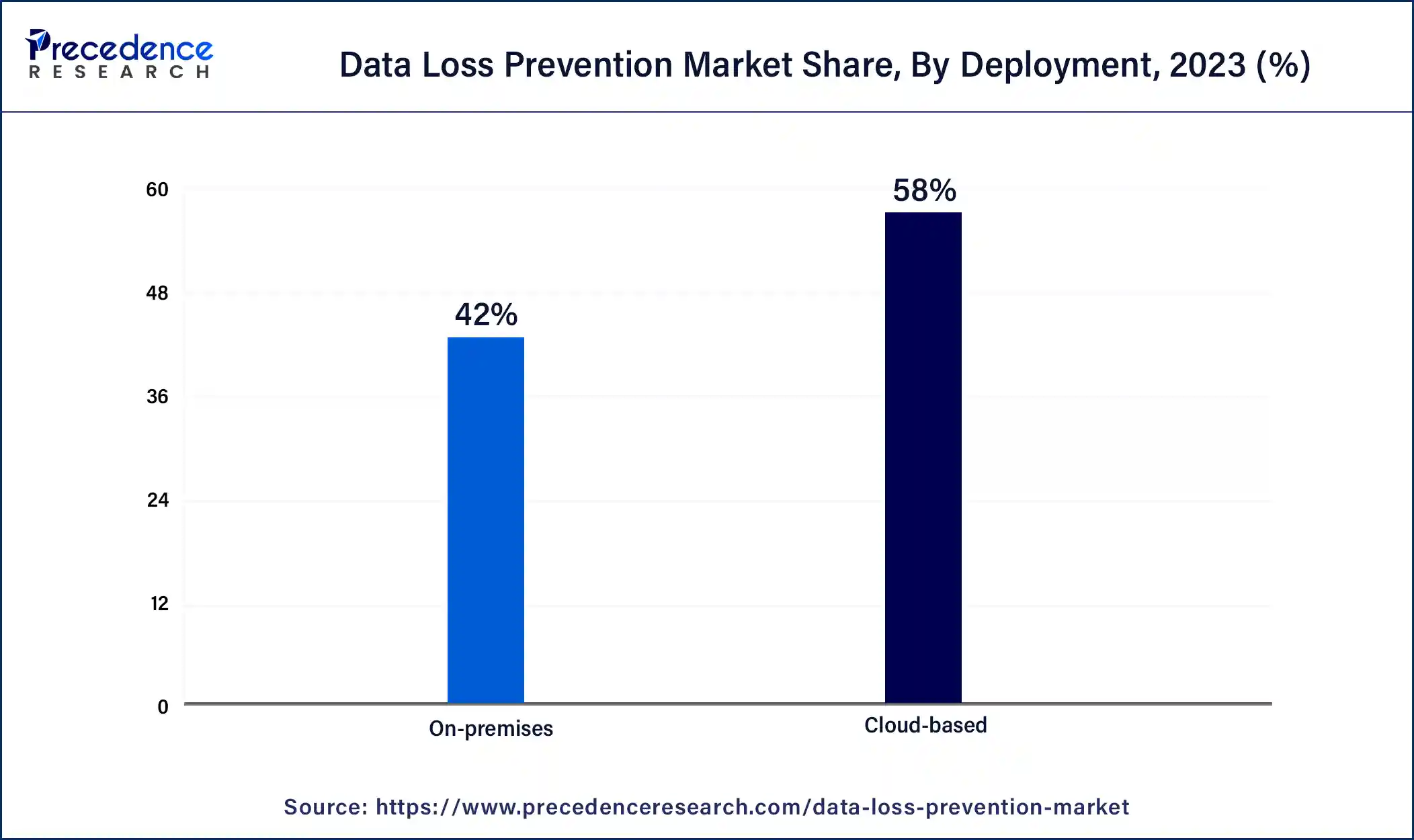

- By deployment, the cloud-based segment accounted for the largest market share of 58% in 2024.

- By deployment, the on-premises segment is estimated to exhibit the fastest CAGR of 24.62% during the forecast period.

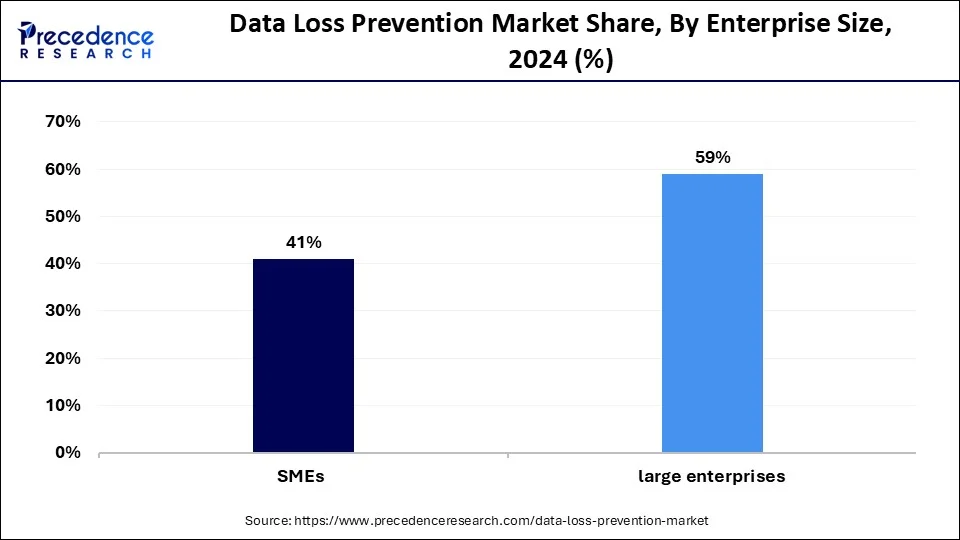

- By enterprise size, the large enterprise segment generated more than 59% of market share in 2024.

- By enterprise size, the SMEs segment is expected to expand at a notable CAGR of 23.23% during the forecast period.

- By application, the encryption segment contributed more than 24% of market share in 2024.

- By application, the policy, standards, and procedures segment is projected to grow at a solid CAGR of 26.33% during the forecast period.

- By end-use, the BFSI segment held the largest market share of 22% in 2024.

- By end-use, the manufacturing segment is expected to grow at a remarkable CAGR of 26% during the forecast period.

What Are the Benefits of AI in the Data Loss Prevention Industry?

AI plays an important role in the IT security industry. Currently, data loss prevention companies have started to integrate AI into their software to increase security. AI can help identify confidential and high-risk information, automate data management protocols, detect irregularities in unauthorized data usage, and strengthen cybersecurity defenses. Thus, the rising integration of artificial intelligence (AI) in the data loss prevention industry is expected to benefit the data loss prevention industry in numerous ways.

- In January 2024, Skyhigh Security launched an AI-powered DLP Assistant. This software uses AI to prevent data losses and simplifies DLP tasks.

U.S. Data Loss Prevention Market Size and Growth 2025 to 2034

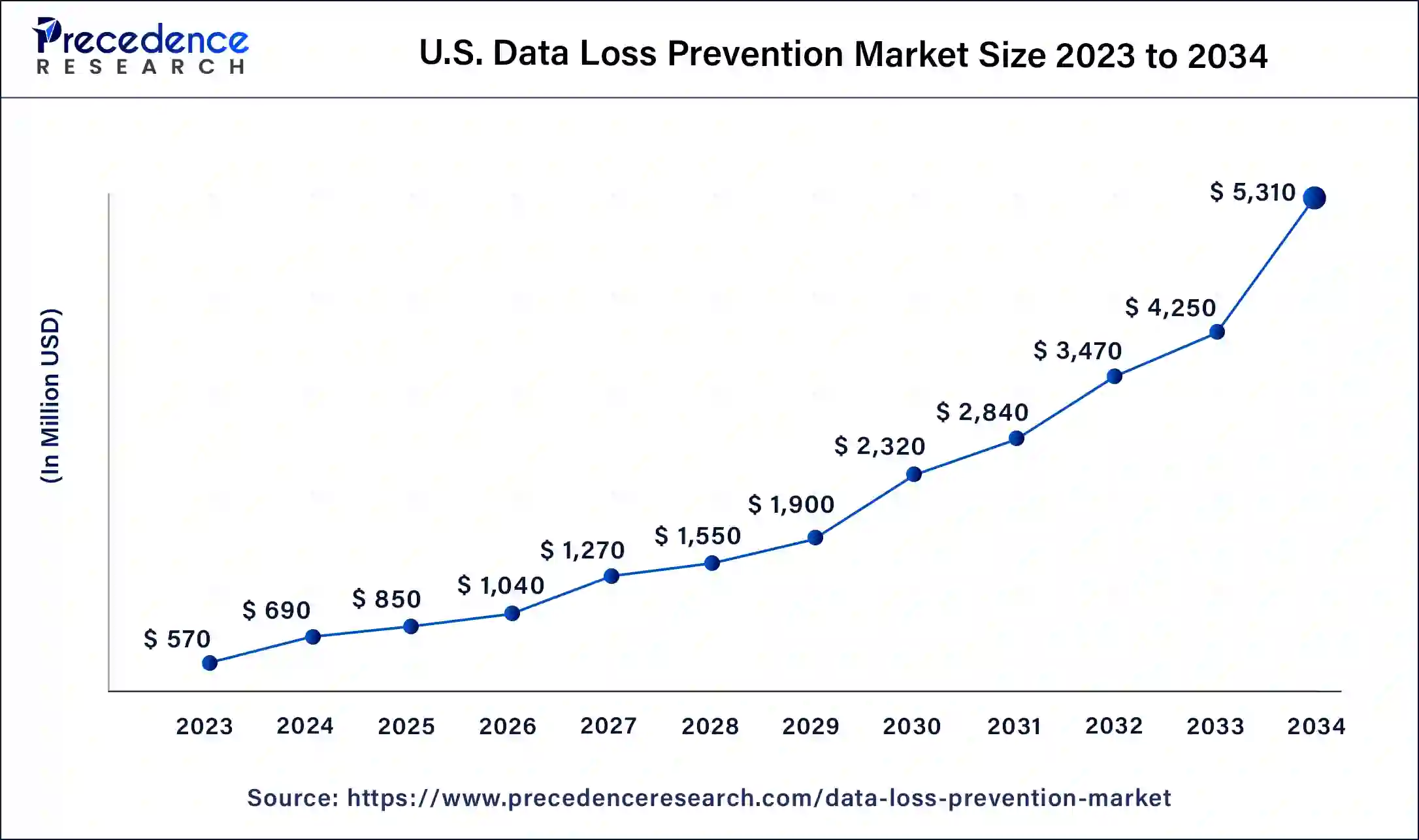

The U.S. data loss prevention market size was exhibited at USD 690 million in 2024 and is projected to be worth around USD 5,310 million by 2034, poised to grow at a CAGR of 22.64% from 2025 to 2034.

North America occupied more than 33% of the market share in 2024. The market's growth in this region is mainly driven by rising advancements in the IT sector and growing government investment in developing the cybersecurity sector in countries such as the U.S. and Canada.

- In April 2024, the government of Canada announced a Cyber Security Innovation Network initiative. Through this initiative, the government will invest US$80 million to support the cybersecurity ecosystem across the country.

The growing developments in the BFSI sector, along with the increasing demand for data loss prevention software by the manufacturing and telecommunication industries, have driven the market growth. Also, the increasing application of DLP software by large enterprises coupled with the upsurge in demand for network DLP software is likely to drive the market growth to some extent.

- In January 2024, DoControl launched a new Data Loss Prevention (DLP) software in the U.S. This Data Loss Prevention (DLP) software will offer a comprehensive and tailored SaaS security solution designed for supporting large organizations.

Moreover, several local market players of data loss prevention solutions, such as Nightfall, Google, Microsoft, and others, are constantly engaged in developing data loss prevention software and adopting strategies such as partnerships, acquisitions, launches, and business expansions, which in turn drives the growth of the data loss prevention market in this region.

- In April 2022, Google launched Automatic DLP. This DLP aims to prevent data loss in large organizations and provide additional security using BigQuery.

Currently, North America is dominating the data loss prevention market. The well-established digitalization and skilled cybersecurity professionals are a major growth factor in the market of the region. The transitional shift and adoption of the technology is an approachable factor and a reason to consider it in big industries and businesses. The strategy and responsive efforts from the cybersecurity department are leveraging the market.

Asia Pacific is expected to expand at a double digital CAGR of 24.72% during the forecast period. The rising development in the data loss prevention industry by private and public entities, along with the growing application of data loss prevention solutions in the healthcare sector in countries such as India, China, Japan, South Korea, and others, is expected to drive the market growth to some extent.

- In December 2023, Safetica announced a partnership with Kaira. This partnership is done to launch Data Loss Prevention (DLP) solutions in the Asia-Pacific (APAC) region for use in the healthcare sector.

Moreover, the increasing demand for DLP software by the retail and logistics sectors, along with the rise in the number of small and medium enterprises, has boosted the market growth. Additionally, the growing application of DLP solutions by government organizations, coupled with the rising deployment of on-premises solutions, is likely to boost market growth. Furthermore, the presence of various local companies of data loss prevention solutions such as Wroffy, Logon Software Asia, Falcongaze, Synersoft Technologies, and some others are developing advanced DLP software across the Asia Pacific region, which in turn is expected to drive the growth of the data loss prevention market in this region.

- In April 2022, Logon Software Asia announced a partnership with Zecurion. This partnership aims to launch an advanced DLP solution for organizations in countries such as India, Hong Kong, Malaysia, Singapore, and Thailand.

Market Overview

The data loss prevention market is one of the most important industries in the ICT and Media sector. This industry deals in developing and distributing high-quality software and solutions to prevent data loss across the world. This market is driven by the growing developments in the IT industry, along with increasing cases of phishing attacks worldwide. This software performs several applications such as encryption, centralized management policy, standards and procedures, web and email protection, cloud storage, incident response, and workflow management. Also, this software is mainly used in several end-user industries, including BFSI, IT and telecommunication, retail and logistics, healthcare, manufacturing, government, and others.

- According to IT Governance Ltd, the total number of data breaches worldwide was around 8,214,886,660 in 2023.

Data Loss Prevention Market Growth Factors

- The growing developments related to the IT industry have led to data loss prevention market growth.

- There is a rise in the number of government initiatives related to the prevention of data loss across the globe.

- Rising trend of remote and hybrid work models among the people.

- The growing investments from public and private sector entities for developing the data loss prevention industry.

- The advancements in technologies related to the data loss prevention industry impact industrial growth positively.

- The increase in the number of data breach incidents has positively accelerated the market.

- There is a growing demand for data visibility along with control for businesses.

- The rising awareness related to insider threats increased the demand for data loss prevention software.

- The increasing demand for data loss prevention software to detect data breaches boosts the market growth.

- The growing proliferation of smartphones due to advancements in internet facilities has driven the growth of the data loss prevention market.

Technological Advancement

Technological advancements in the data loss prevention market feature cloud-based DLP solutions and AI and machine learning. The cloud-based DLP solutions provide flexibility and high-level security. The modern solution has replaced the traditional on-premise solutions. The advanced-level data protection and remote access are a reliable and suitable approach for businesses. The cloud solution is a low-cost, effective solution. The AI and machine learning technology improve threat detection by identifying data breaches and analyzing large data. The data automation classification and discovery distinguish sensitive data to understand DLP policies.

The popular firewalls, antivirus software, and endpoint protection are contributing to the data loss prevention market. The need for elevating development and ways to protect data is in heavy demand as most of the businesses run online. The other processes interconnected to businesses are highly dependent on the security checks and other applications providing data security.

Data Loss Prevention Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21 Billion |

| Market Size in 2025 | USD 3.43 Billion |

| Market Size in 2024 | USD 2.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.32% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Software, Deployment, Enterprise Size, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing adoption of cloud storage by organizations

The popularity of cloud storage is gaining traction among businesses and people worldwide. In recent times, large and medium-sized enterprises have started using a cloud platform as it provides additional security, convenience, accessibility, and usability for storing important data. Thus, with the rising adoption of cloud storage systems in several organizations, the demand for cloud-based DLP software has increased, thereby driving the growth of the data loss prevention market during the forecast period.

- In November 2023, Flow Security launched a cloud-based GenAI DLP module. This new software secures the movement of data to GenAI services and applications, empowering enterprises to build with and consume GenAI securely.

Restraint

Complexities and security vulnerabilities

The data loss prevention industry has gained prominent attention due to several advantages in protecting data in several organizations. Although DLP solutions have several benefits, there are various problems in this industry. Firstly, some of the DLP solutions are programmed in unique ways that create complexities in users' minds. Secondly, a few DLP applications may cause security vulnerabilities in enterprises. Thus, the complexity associated with DLP solutions and security vulnerabilities is expected to restrain the growth of the data loss prevention market during the forecast period.

Opportunity

Integration of different security solutions in the DLP platform to change the future

Businesses around the world are using DLP solutions to provide additional security for the protection of important data. Nowadays, DLP-developing companies have started integrating intrusion detection systems, identity management solutions, firewalls, and some other security solutions in DLP systems to enhance data prevention capabilities. Thus, the integration of numerous security solutions in the DLP platform is expected to create ample opportunities for market players in the future.

- In July 2022, Cato Networks launched a new DLP solution. This new DLP solution integrates Firewall as a Service (FWaaS) to prevent data losses in businesses worldwide.

Software Insights

The data center and storage-based DLP segment occupied more than 41% of the market share in 2024.

The rising demand for DLP software to protect data stored in data centers has driven market growth. Also, the increasing application of storage DLP to provide information about the data stored in the server is likely to boost the market growth to some extent. Moreover, the growing use of DLP software in data centers to provide control over information that is transferred from one organization to another is expected to drive the growth of the data loss prevention market during the forecast period.

- In October 2022, Nightfall launched data loss prevention software for Asana. This launch provides comprehensive data protection to the Asana App.

The endpoint DLP segment is estimated to exhibit the fastest CAGR of 23.84% during the forecast period. The rising proliferation of smartphones has increased the demand for endpoint DLP software to protect sensitive information and has driven market growth. Also, the growing application of endpoint DLP software to identify movement that can cause potential risks in laptops or desktops is likely to boost the market growth. Moreover, the increasing trend of BYOD (Bring Your Own Devices) has increased the demand for endpoint DLP software, thereby driving the growth of the data loss prevention market during the forecast period.

- In September 2022, Netskope launched new endpoint DLP software to provide additional security in hybrid work models.

Deployment Insights

The cloud-based segment dominated the market with the largest market share of 58% in 2024.

The growing demand for cloud-based DLP to monitor network traffic in a cloud environment has driven market growth. Also, the increasing application of cloud-based DLP solutions to prevent exfiltration and leakage of sensitive data will likely foster market growth to some extent. Moreover, the rising demand for cloud-based DLP solutions to maintain regulatory compliances such as HIPAA, PCI DSS, and GDPR is expected to drive the growth of the data loss prevention market during the forecast period.

- In November 2023, Nightfall launched an AI-enabled cloud DLP solution. This new cloud-based DLP solution ensures additional security for Microsoft Teams.

The on-premises segment is estimated to exhibit the fastest CAGR of 24.62% during the forecast period. The rising demand for on-premises DLP solutions is mainly due to avoiding latency issues, which has driven the market growth. Also, the increasing application of on-premises DLP solutions to directly control cybersecurity without depending on servers will likely propel the market growth to some extent. Moreover, the growing integration of on-premises DLP solutions in BFSI and healthcare sectors is expected to drive the growth of the data loss prevention market during the forecast period.

- In April 2024, Safetica launched a unified DLP solution. This unified on-premise DLP solution combines the features of Safetica ONE and Safetica NXT to provide security against data losses in organizations.

Enterprise Size Insights

The large enterprises segment generated the biggest market share of 59% in 2024. The rising demand for cloud-based DLP solutions in large enterprises has driven market growth. Also, the increasing number of cyberattacks in large organizations has increased the demand for advanced DLP solutions for data protection, thereby driving market growth to some extent. Moreover, the growing demand for DLP solutions in large enterprises to comply with regulations and mitigate financial losses is expected to propel the growth of the data loss prevention market during the forecast period.

- In October 2022, Zscaler launched a new DLP solution for large enterprises. This solution is designed to protect data losses in large organizations due to the ongoing trend of BYOD.

The SMEs segment is expected to grow with the highest CAGR of 23.23% during the forecast period. The rise in the number of SMEs worldwide has increased the demand for DLP solutions, thereby driving market growth. Also, the growing demand for low-cost DLP solutions in small and medium enterprises will likely boost market growth. Moreover, the increasing demand for DLP solutions for SMEs to provide ease of administration and the ability to solve numerous security issues simultaneously is expected to drive the growth of the data loss prevention market during the forecast period.

- In August 2024, Netskope announced a partnership with Softbank to provide data loss security to small and medium-sized businesses in Japan.

Application Insights

The encryption segment occupied more than 24% of the market share in 2024.

The demand for advanced DLP solutions for encryption purposes has increased to provide data access only to authorized users, which in turn drives market growth. Also, the growing trend of data encryption to provide additional layers for important data has increased the demand for DLP software, thereby driving the market growth to some extent. Moreover, the rising integration of symmetric cryptography and asymmetric cryptography in DLP solutions is expected to propel the growth of the data loss prevention market during the forecast period.

- In March 2024, Nightfall AI launched data encryption and sensitive data protection, which is aimed at providing additional security to sensitive emails.

The policy, standards, and procedures segment is expected to grow with the highest CAGR of 26.33 during the forecast period. Due to the number of policies and regulations to protect sensitive data, the increasing demand for data loss prevention software has driven the market growth. Also, the growing emphasis of the government on preventing data losses has increased the demand for DLP solutions, thereby driving market growth to some extent. Moreover, the growing applications of DLP solutions to maintain security in government organizations are expected to drive the growth of the data loss prevention market during the forecast period.

- In April 2024, the government of Karnataka in India announced an investment of around Rs 103.87 crores to launch a comprehensive cyber security policy in 2024 to combat cyber crimes.

End-Use Insights

The BFSI segment held the largest market share of 22% in 2024.

The growing developments in the BFSI sector in developed nations have increased the demand for DLP solutions, thereby driving market growth. Also, the rising use of DLP solutions for monitoring sensitive data throughout the network in the BFSI sector is likely to boost the market growth. Moreover, the increasing application of DLP solutions for identifying suspicious behavior in the banking system is expected to drive the growth of the data loss prevention market during the forecast period.

- In February 2024, Escan launched a new DLP solution for the BFSI sector. This solution aims to provide additional security to the banking system.

The manufacturing segment is expected to grow at the fastest CAGR of 26% during the forecast period. The growing number of manufacturing companies worldwide has increased the demand for DLP solutions, thereby driving market growth. Also, the rising application of DLP solutions due to Distributed Denial of Service (DDoS) attacks in the manufacturing sector has propelled the market growth to some extent. Moreover, the increasing demand for DLP software to provide an extra shield against data breaches, safeguard intellectual property, and manage security in manufacturing companies is expected to drive the growth of the data loss prevention market during the forecast period.

- In June 2024, Next DLP launched Secure Data Flow. This launch is aimed at providing additional data security to several end-user industries including manufacturing and healthcare sectors.

Data Loss Prevention Market Companies

- BlackBerry

- Broadcom, Inc

- CheckPoint

- Cisco Systems, Inc

- Citrix Systems

- CrowdStrike

- Digital Guardian Inc.

- IBM

- Mcafee LLC

- Microsoft

- Proofprint

- SAP SE

- Sophos Ltd.

- VMware, Inc.

Recent Developments

- In May 2025, Napatech partnered with Symantec, a division of Broadcom, to introduce a groundbreaking solution that enhances data loss prevention in enterprise and cloud data center networks. (Source - https://www.tipranks.com)

- In March 2025, Forcepoint, a global leader in data security, announced it has been named a leader in the IDC MarketScape for Worldwide Data Loss Prevention (DLP) 2025 vendor assessment. (Source - https://www.businesswire.com)

- In April 2025, Falcon data protection gained new capabilities to protect sensitive data across endpoints and cloud, and SaaS threat services identify and mitigate risk across SaaS environments. (Source - https://www.crowdstrike.com )

- In March 2024, Mindgard launched a new data loss prevention (DLP) tool. This tool will protect customers against AI security risks and other cybersecurity attacks.

- In December 2023, CrowdStrike launched CrowdStrike Falcon Data Protection. This new software takes a streamlined approach to data security and ensures the prevention of valuable data from accidental leakage.

- In January 2023, Forcepoint launched Forcepoint DLP 10.0. This new solution will allow simplified data security management along with data security at scale and personalized policy enforcement in numerous organizations.

- In June 2022, Acronis launched a new Advanced Data Loss Prevention (DLP) solution. This new solution will provide several organizations with a way to prevent data leakage from various cyberattacks.

- In April 2022, SearchInform launched a new version of the DLP system. This new system was launched with the aim of providing additional security for MacOS to support Apple devices.

Segments Covered in the Report

By Software

- Network DLP

- Endpoint DLP

- Data Center/Storage based DLP

By Deployment

- On-premises

- Cloud-based

By Enterprise Size

- Small And Medium Enterprise (SMEs)

- Large Enterprise

By Application

- Encryption

- Centralized Management

- Policy, Standards and Procedures

- Web and Email Protection

- Cloud Storage

- Incident Response and Workflow Management

By End-Use

- BFSI

- IT and Telecommunication

- Retail and Logistics

- Healthcare

- Manufacturing

- Government

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content