What is DDoS Protection and Mitigation Market Size?

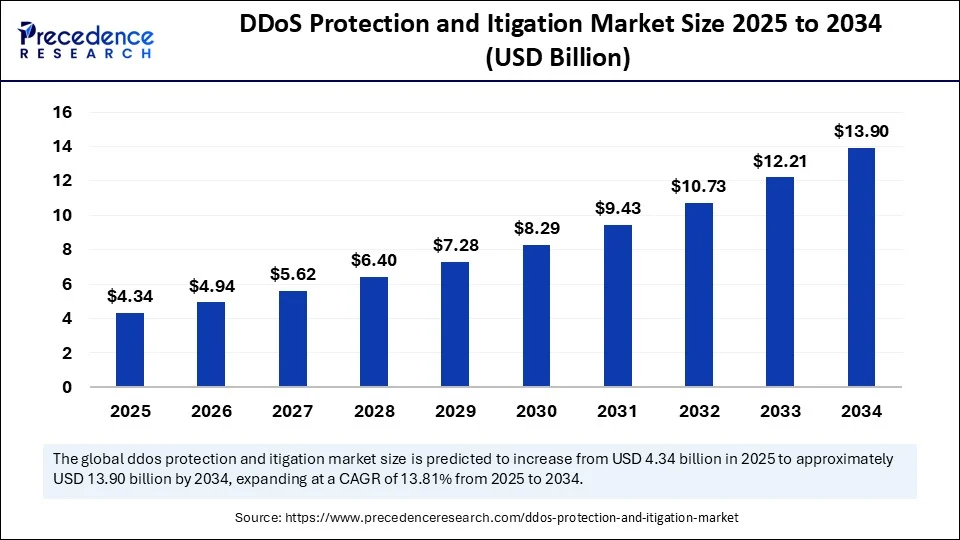

The global DDoS protection and mitigation market size is accounted at USD 4.34 billion in 2025 and predicted to increase from USD 4.94 billion in 2026 to approximately USD 13.90 billion by 2034, expanding at a CAGR of 13.81% from 2025 to 2034. The DDoS protection & mitigation market is driven by the increasing frequency and sophistication of cyber-attacks. Moreover, increasing dependence on digital services and rising adoption of cloud-based security services are expected to boost the growth of the market.

Market Highlights

- Asia Pacific dominated DDoS protection and mitigation market in 2024.

- North America is estimated to expand at the fastest CAGR between 2025 and 2034.

- By component, the solutions segment held the largest market share in 2024.

- By component, the services segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By deployment mode, the cloud segment captured the biggest market share in 2024.

- By deployment mode, the on-premises segment is expected to expand to a notable CAGR over the projected period.

- By organization size, the large enterprises segment contributed the highest market share in 2024.

- By organization size, the small segment is expected to expand to a notable CAGR over the projected period.

- By attack vector, the volume-based attacks segment generated the major market share in 2024.

- By attack vector, the protocol attacks segment is expected to expand at a notable CAGR over the projected period.

- By industry vertical, the BFSI segment held the significate market share in 2024.

- By industry vertical, the government and defense segment are expected to expand at a notable CAGR over the projected period.

What is the DDoS Protection and Mitigation Market?

DDoS protection and mitigation encompass a broad set of solutions and services, ranging from traffic scrubbing centers to real-time monitoring services, cloud-based firewalls, and on-premises hardware and appliance solutions, that detect, mitigate, and stop Distributed Denial of Service (DDoS) attacks. DDoS attacks disrupt availability by inundating networks and applications with malicious network traffic. As a result of DDoS attacks becoming more sophisticated and frequent, organizations are relying on advanced, layered, and multi-layered defense strategies.

The DDoS protection & mitigation sector is growing at a healthy rate. Businesses, governments, and service providers are increasingly focused on cyber security resiliency, driving market growth. The continued adoption of IoT, cloud computing, and remote operations leads to a larger attack surface, which drives demand for better, more effective mitigation solutions. Demand for DDoS Protection solutions tends to be highest in organizations with critical downstream uptime or next-to-zero downtime, such as BFSI, healthcare, e-commerce, and telecom. The ongoing growth of the DDoS protection & mitigation sector has made this market a critical pillar of the overall cybersecurity infrastructure landscape.

How is Artificial Intelligence Revolutionizing the DDoS Protection & Mitigation Market?

Artificial intelligence significantly revolutionizes DDoS protection and mitigation by improving the speed and intelligence of threat detection and response. The increase in attacks illustrates how AI-driven systems are becoming vital in detecting and neutralizing threats in real time. With the ability to absorb vast quantities of traffic and detect anomalies instantaneously, AI can help minimize response time and ultimately reduce downtime.

- For Instance, In March 2025, NETSCOUT SYSTEMS, a leading provider of performance management, cybersecurity, and DDoS attack protection solutions, launched its enhanced Arbor Threat Mitigation System (TMS) Adaptive DDoS Protection solution with additional AI/ML functionality.

AI systems can also enable predictive threat modeling, allowing them to anticipate and prepare for new attack patterns. As DDoS attacks increase sophistication, AI provides automation, adaptability, and scalability to protection. As the cyber threat landscape expands, the role of artificial intelligence in DDoS protection is no longer optional. The most important role of obtaining the best DDoS protection systems is in circumvention, paving the way for DDoS defense through systems that employ doctoral processes.

What are the Major Trends in the DDoS Protection & Mitigation Market?

- Increase in cyberattacks: The rise in frequency and complexity of DDoS attacks has prompted organizations to explore proactive defense options, not only to maintain uninterrupted digital services but also to protect their reputations.

- Growth of Cloud Services: As organizations shift their workloads to the cloud, protection against DDoS attacks for cloud-based infrastructure is increasingly important, driving demand for scalable and cloud-native mitigation capabilities.

- Rise of IoT Devices: The exponential growth of connected IoT devices introduces new vulnerabilities for attackers and provides yet another opportunity for them to gain entry. There is a growing need for automated, robust DDoS defense systems.

- Growing of E-commerce and Online: The increased reliance on and availability of online shopping, streaming, and other digital services precipitates an increase in outage or downtime, driving organizations to deploy DDoS protection to maintain availability and trust.

Market Outlook

- Industry Growth Overview: The growth of the industry is being accelerated by the escalation of cyberattacks, which in turn is causing organizations to be more proactive in their digital operations worldwide, thereby increasing the need for reliable DDoS defense.

- Sustainability Trends: The integration of AI and machine learning takes automated detection to the next level, giving the cybersecurity industry the power to control the impact, be resilient in advance, reduce human intervention, and improve defense.

- Global Expansion: The market is mainly concentrated in North America, whereas the Asia Pacific is experiencing growth as a result of increasing digital adoption, dependence on cloud, investments in cybersecurity, and the development of cybersecurity ecosystems.

- Major Investors: The support of innovation and the strengthening of the global DDoS mitigation are continued by the major players, such as Akamai, Cloudflare, Fortinet, Radware, NetScout, Imperva, and Arbor Networks.

- Startup Ecosystem: The new companies in the sector are choosing to provide customizable, cost-efficient, and cloud-based DDoS protection, which will, in turn, allow them to offer innovative and specialized solutions that will empower the small and medium-sized businesses with scalable above-the-line cybersecurity resilience.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.34 Billion |

| Market Size in 2026 | USD 4.94 Billion |

| Market Size by 2034 | USD 13.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.81% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Organization Size, Attack Vector,Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase Attack Volume Necessitates Intelligent Solutions for DDoS Mitigation

The rapid increase in attacks and the emerging complexity of these DDoS attacks are driving the growth of the DDoS protection & mitigation market. In early 2024, Cloudflare's automated systems blocked over 21.3 million DDoS attacks, representing a 53% increase from the previous year. To put that in perspective, that's 4,870 blocked attacks every hour, so these attacks are consistent and very prominent. During the first quarter of 2025, an additional 20.5 million attacks were blocked, continuing the trend of increasing attacks year-over-year. This is true for any-sized organization; DDoS attacks can pose immediate operational risks, potentially causing organizational and reputational damage.

Multi-vector attacks are explicitly targeting the network, application, and infrastructure layers simultaneously, both of which require intelligent, proactive defense mechanisms. An increase in funding is directly correlated to prompt decisions made on AI-enabled traffic monitoring, mitigation workflows, and behavioral analysis. Smart strategists are recognizing DDoS protection as a crucial component of ensuring uptime, establishing customer trust, and delivering Service Level Agreement (SLA) commitments. This has never been more evident than in sectors whose operational models include digital transactions and service delivery, such as fintech, cloud services, and e-commerce.

Restraint

Integration Barriers and Operational Friction Limit Adoption of DDoS Solutions

A major restraint factor in the DDoS protection & mitigation market is the increasing operational complexity associated with implementing advanced and multifaceted DDoS defenses across hybrid infrastructures. According to Corero's 2025 Threat Intelligence Report, more than 50% of organizations experience a lack of coordination across the teams implementing DDoS mitigation, while 68% of organizations do not demonstrate ROI to the leadership team. These disparate workflows will increase deployment time and introduce unperceived costs in staff training, the orchestration of operational processes, and the tuning of DDoS mitigation systems, ultimately directly impacting the time-to-value of the DDoS protection investment.

The DDoS protection and mitigation operation have high operational overhead, and when the time-to-value is extended due to poor coordination, the justification for any purchasing decision is undermined by increasing attack volumes. Similarly, whenever misalignment occurs among cross-functional teams, there is a higher chance of conflicting decisions that could lead to misconfigurations, false positives, or unnecessary delays in decisions, ultimately hindering uptime, customer experience, or regulatory compliance. The increasing workloads and chaos of internal adoption of DDoS protection, the widespread adoption of DDoS Defenses won't be realized.

Opportunity

Hybrid Infrastructure Trends Create Demand for Scalable DDoS Solutions

With hybrid infrastructures now in demand, there is rising adoption of high-performance DDoS protection hardware appliances, along with cloud-based mitigation services, which creates opportunities in the market. Organizations with latency-sensitive or mission-critical functions, ranging from gaming to streaming to financial services, are increasingly making the decision to invest in on-premise appliances that provide ultra-low response times and inline detection. Concurrently, the rise of remote work and SaaS ecosystems created a higher demand and greater adoption of flexible DDoS protection services delivered from the cloud.

Providers like Cloudflare and AWS Shield are similarly seeing broader adoption as services designed to auto-scale protections during high-scale attacks. This duality provides a layered defense model of hardware at the core, represented by on-premise appliances for ultra-low latency and cloud-based services at the edge, offering flexibility, agility, and available services as needed. From a business investment perspective, the hybrid model enables continuous availability, cost efficiencies, and improved SLA adherence, significantly reducing the need for DDoS protection as a standalone security perimeter add-on and instead making it a key infrastructure investment.

Component Insights

Why Did the Solutions Segment Dominate the Market?

The solutions segment dominated the DDoS protection & mitigation market with a 61.32% market share in 2024. Enterprises are investing in more sophisticated mitigation platforms, traffic analysis solutions, and real-time detection as threats continue to grow. These solutions provide mitigation and automated defenses, in addition to faster responses and easier technology integration into existing IT ecosystems. Because they rely on complex IT systems, large digital infrastructures have no alternative but to invest in solutions to keep them safe.Services are the fastest growing segment with increased reliance on managed security services. With so much being lived and breathed digitally, companies are engaging third-party experts for 24/7 monitoring, real-time response, and adaptive handling of security incidents, especially when internal security processes and technologies are not in place.

Deployment Insights

Why Did Cloud Deployment Preferred in the Market?

The cloud segment dominated the market, accounting for a 67.32% share in 2024. The strong preference for cloud-based deployment stems from its scalability, lower capital costs, and the ability to unify global operations painlessly. Organizations focus on the uptime of cloud solutions with greater flexibility around restrictions relating to building infrastructure and the ability to centrally manage threats more easily.

The on-premises segment is growing at the fastest CAGR, especially in government and healthcare, where data sovereignty and the ability to manage physical infrastructure is particularly important; this is still the fastest growing subsegment. The solutions appeal to large organizations who are legally obligated to maintain data within certain jurisdictions or have concerns about the confidentiality of their data.

Organization Size Insights

How Does the Large Enterprises Segment Lead the Market?

Large enterprises held 71.82% of market share in 2024. Given their extensive networks, critical business functions, and the likelihood of suffering large-scale attack consequences, robust DDoS mitigations become paramount for them. Large organizations tend to have layered and tailored DDoS protection systems, with complete in-house 24/7 security teams. Carbon footprints for organizations can vary. However, those that employ next-gen threat intelligence security platforms tend to have the fewest or limited business interruptions. Ultimately, these security measures are ideal and necessary, as they can deter, delay, or block attack traffic, and customers will continue to shop and digitally trust them.

The SMEs segment is expected to grow at the fastest rate in the coming years because they are digitizing their operations at a rapid pace. Lower costs of cloud DDoS solutions are facilitating small enterprises' use of solutions for e-commerce, remote work infrastructures, and client data. Higher threat propagation among SMEs is moving those businesses towards deploying sophisticated, scalable, and preferably automated security mgt systems to limit their exposure to consequential attack damages.

Attack Vector Insights

What Made Volume-Based Attacks the Dominant Segment in the DDoS Protection & Mitigation Market?

Volume-based attacks held a dominant share of 45.4% in 2024 because these disruptor attacks (or DDoS attacks) are easy, disruptive, and very popular the hackers can use a bot, and even amplification, to launch overwhelming attacks on systems that go after web traffic, financial services, and gaming sites. Attackers focus on sites with high traffic volumes because they can usually extract more from their attack minutes. Protocol attacks are one of the fastest-growing segments of DDoS attacks because cybercriminals focus on exploiting the weaknesses of network protocols, such as TCP/IP and DNS, to completely immobilize the infrastructure. They are stealthier, more resource-efficient, more difficult to identify, and can more easily defend against this makes them relatively simple and very motivating against target businesses that are geared for continuous data exchange of service or uptime.

Industry Vertical Insights

Why Did the BFSI Segment Dominate the Market?

The BFSI segment dominated the DDoS protection & mitigation market with a 33.49% share in 2024. This is largely due to their unique set of characteristics. The BFSI sector needs high-integrity data, ongoing service availability, and heavy regulatory compliance. Given these dynamics, the BFSI sector is a desirable target for cyberattacks; thus, they are likely to invest a sizable amount of their annual IT budget and implementation costs in a layered system of DDoS protection. As the BFSI sector increasingly relies on digital banking, mobile and online transactions, and on fintech platforms, which are rapidly proliferating, the sector will need adequate protection to not only protect the trust of their customers but also to deliver high-performance services without interruption.The government & defence is the fastest growing segment. With inevitable cyber warfare, national security threats, and state-sponsored attacks, public sector entities need to prepare to counter sophisticated DDoS attacks. The ongoing digitization of Government services and critical infrastructure will spur demand for real-time, adaptable protection to reduce risk and eliminate economic loss.

Regional Insights

Why Is Asia Pacific Dominating the DDoS Protection & Mitigation Market?

Asia Pacific is the leading region in the DDoS protection and mitigation market, fuelled by the rapid adoption of digital transformation, high internet expansion, and increased adoption of cloud and IoT-based services. Organizations throughout the region are witnessing a dramatic increase in the risk of cyber-attacks on their organizations, affecting their government, BFSI, and e-commerce sectors. The awareness around data privacy is on the rise, and regulatory efforts in countries such as India, Japan, and Australia have further compelled enterprises to invest in reliable DDoS protection tools.

China's strength in the digital economy and its massive user base are driving the APAC's DDoS protection and mitigation market. Companies in the digital space in China have increased significantly, including Internet companies, online gaming platforms, and fintech startups, which has also created a priority for cybersecurity measures. The cycle of the domestic government forcing cyber changes through recent regulations and initiatives outlined through the country's Cybersecurity Law has also been motivating in many ways to improve mitigation alternatives. Domestic technology players such as Tencent and Alibaba, moving their investments into developing in-house and commercial DDoS protections, have elevated technologies to advance areas in the DDoS protection industry.

What Factors are Driving the Adoption of DDoS Protection in Europe?

Europe is the second-largest market, fueled largely by increasing regulatory scrutiny, enhanced technology integration, and digital e-commerce growth across borders. The introduction of the GDPR compelled enterprises to audit and reassess their security architectures, resulting in increased investment in technology and services, with a focus on real-time threat monitoring and traffic filtration. On the enterprise side, the telecommunications, energy, and critical infrastructure sectors have drawn significant attention and are becoming increasingly favorable targets, particularly due to the new geopolitical landscape and increased hacktivist actions.

Germany is the most promising growth factor in Europe, as it is an industrial powerhouse with a compelling manufacturing base, as well as a highly digitally modernized population of small and medium-sized enterprises. As the volume of companies with operational technology and cloud services increases, German firms are increasingly at risk for volumetric and application denial-of-service attacks. The German government has also mandated IT security laws and priorities, such as the BSI Act, which has ultimately led to highly favorable DDoS protection adoption.

Why Is North America the Fastest Growing Region in This Market?

The DDoS protection market is growing fastest in North America for three main reasons. First, this area has consistently faced large, complex attacks on cloud services, financial systems, and public infrastructure. The rise of hacks and large-scale attacks is a direct result of increased cloud migration, the rollout of 5G, and the proliferation of connected devices. Enterprises are increasingly at risk, given all of these new attack vectors. Coupled with new data protection regulations, such as the CCPA, and cybersecurity frameworks by NIST, organizations will need to utilize multilayered forms of protection. The region also boasts a well-developed cybersecurity ecosystem featuring high-quality solution providers that consistently push the envelope with AI threat detection.

The U.S. is driving the region's momentum, with a substantial enterprise IT footprint and a significant number of DDoS incidents affecting finance, healthcare, and cloud-hosting organizations. Attacks against multiple banks, telecom providers, and government systems have recently brought a broader focus to DDoS attack mitigation, as most organizations need more robust mitigation platforms. The U.S. government has pledged to enhance its investment in national security-related initiatives and expand the public-private partnership model, which will encourage more organizations to implement comprehensive protection solutions.

Value Chain Analysis

- Inbound Logistics: Getting, putting together, and having hardware, software, and global network infrastructure from different suppliers.

Key Players: Amazon Web Services and Microsoft Azure - Operations: Implementing DDoS mitigation systems, checking traffic, identifying attacks, and utilizing filtering methods.

Key Players: Cloudflare and Akamai - Outbound Logistics: Scrubbed yet legitimate traffic is getting delivered back to the servers that are protected, and thus making sure that the servers are available.

- Marketing and Sales: Service value of protection, business continuity, reputation safeguarding concert, and convincing customers.

Key Players: Cloudflare, Akamai, Azure - Service: Post-sale support, real-time assistance, reporting, and threat intelligence updates are all provided continuously.

Key players: Akamai's support teams, AWS Support

DDoS Protection and Mitigation Market Companies

- Netscout

- Akamai Technology

- Radware

- Huawei Technology

- Fortinet

- Link11

- Imperva

- Cloudflare BT

- A10 Networks

- Fastly

- StackPath

- Seceon

- Nexusguard

- HaltDos

- Corero

- RioRey

- PhoenixNAP

- DDoS-Guard

- Allot

- StrataCore

Lateststatements and investments by major players

- In February 2025, NETSCOUT SYSTEMS, INC., a leading provider of performance management, cybersecurity, and DDoS attack protection solutions, announced it enhanced its Arbor Threat Mitigation System (TMS) Adaptive DDoS Protection solutions with additional AI/ML functionality to better detect and block malicious traffic.(Source:https://www.businesswire.com)

- In April 2025, Fastly, Inc., a leader in global edge cloud platforms, has announced key updates to Fastly DDoS Protection that deliver unprecedented visibility into attack mitigation. Fastly DDoS Protection can mitigate attacks in seconds. Fastly DDoS Protection addresses that challenge with rapid mitigation that helps keep legitimate traffic untouched while blocking malicious requests. (Source:https://www.businesswire.com)

- In November 2024, Arelion has expanded its partnership with NETSCOUT, a leading provider of performance management, cybersecurity and DDoS attack protection solutions, to strengthen the Internet carrier's DDoS attack mitigation capabilities.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Component

- Solutions

- Network Layer DDoS Protection

- Application Layer DDoS Protection

- Infrastructure Protection Appliances

- Cloud-Based DDoS Mitigation Platforms

- Services

- Managed Security Services

- Consulting Services

- Incident Response Services

- Support & Maintenance

By Deployment Mode

- On-Premises

- Cloud

- Public

- Private

- Hybrid

By Organization Size

- Large Enterprises

- SMEs

By Attack Vector

- Volume-Based Attacks

- Protocol Attacks

- Application Layer Attacks

By Industry Vertical

- BFSI

- Government & Defense

- Telecom & ITES

- Healthcare

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Education

- Transportation & Logistics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting