Dental Implants and Abutment Systems Market Size and Forecast 2025 to 2034

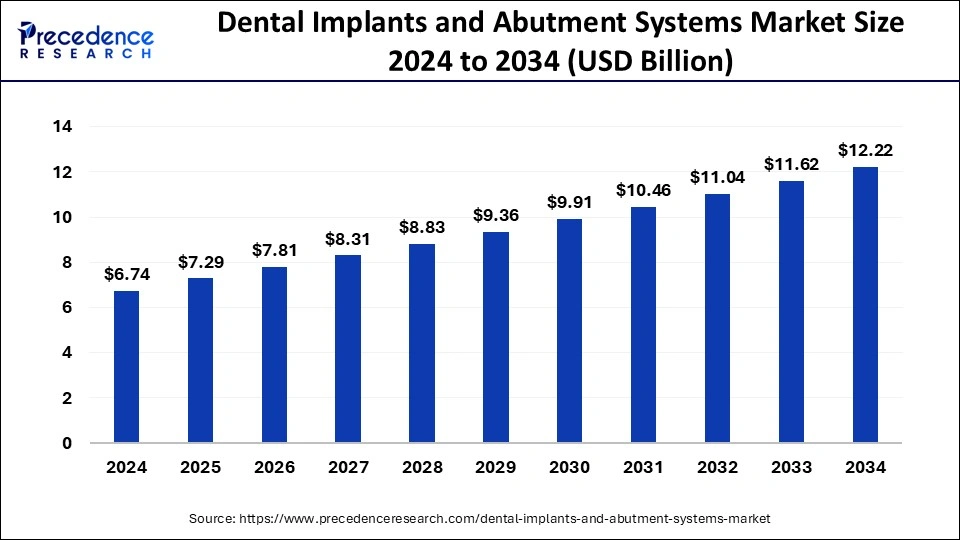

The global dental implants and abutment systems market size was calculated at USD 6.74 billion in 2024 and is predicted to increase from USD 7.29 billion in 2025 to approximately USD 12.22 billion by 2034, expanding at a CAGR of 5.90% from 2025 to 2034. The dental implants and abutment systems market is driven by the global increase in the frequency of dental problems.

Dental Implants and Abutment Systems Market Key Takeaways

- The global dental implants and abutment systems market was valued at USD 6.74 billion in 2024.

- It is projected to reach USD 12.22 billion by 2034.

- The dental implants and abutment systems market is expected to grow at a CAGR of 5.90% from 2025 to 2034.

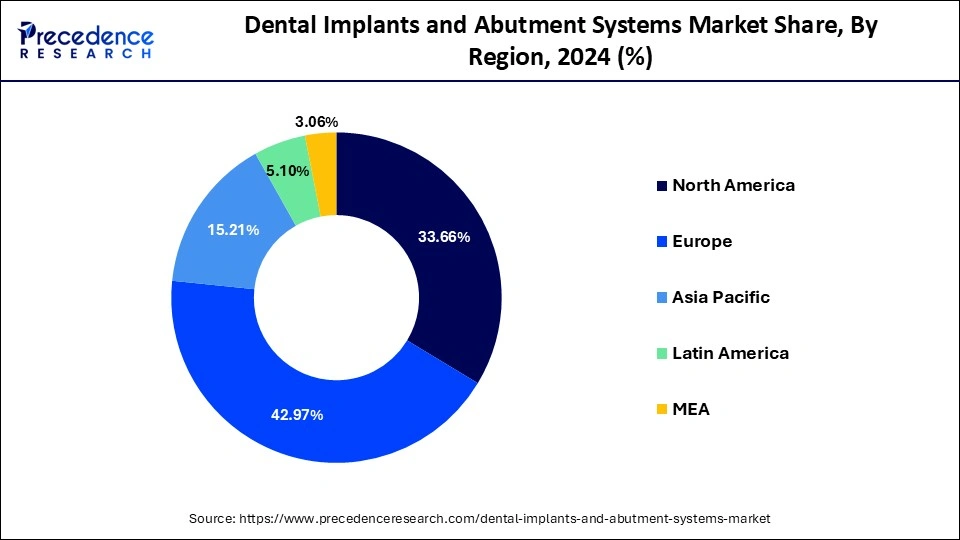

- North America led the market with the biggest market share of 42.97% in 2024.

- By product, the dental implants segment dominated the dental implants and abutment systems market in 2024.

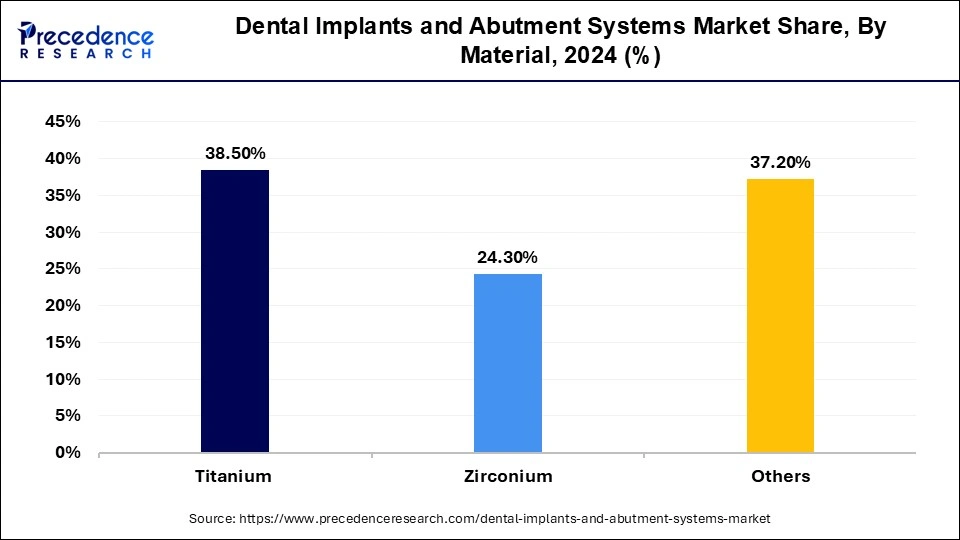

- By material, the titanium segment dominated the market with the largest share in 2024.

- By end-use, the dental clinics segment dominated the dental implants and abutment systems market in 2024.

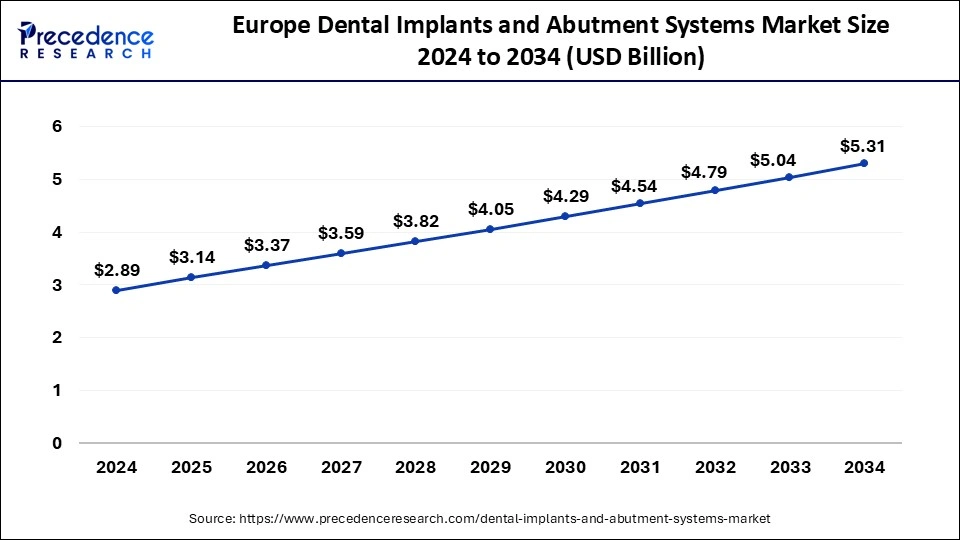

Europe Dental Implants and Abutment Systems Market Size and Growth 2025 to 2034

The Europe dental implants and abutment systems market size was exhibited at USD 2.89 billion in 2024 and is projected to be worth around USD 5.31 billion by 2034, growing at a CAGR of 6.00%.

Europe dominated the dental implants and abutment systems market due to several factors. The region benefits from advanced healthcare infrastructure, a high level of awareness about dental health, and a growing aging population that demands restorative dental procedures. Europe also boasts a strong presence of leading dental implant manufacturers and research institutions, driving innovation and high-quality standards. Additionally, favorable reimbursement policies, high disposable incomes, and improved accessibility to dental care have all contributed to Europe's market leadership in dental implants and abutment systems.

North America has the largest market share of 42.97% in 2024in the dental implants and abutment systems market throughout the predicted timeframe. This area offers one of the world's most sophisticated healthcare systems, with reputable hospitals, dentistry practices, and research institutes. This infrastructure promotes innovation in implant technology and makes dental implant procedures easily accessible. Vast facilities for the study and development of dental implants, with many businesses making significant investments in cutting-edge implant technologies. These developments result in improved osseointegration and long-term success rates. They also include improvements in surface treatments, implant design, and implant materials, such as titanium alloys and ceramic materials.

Asia Pacific is the fastest-growing in the dental implants and abutment systems market during the forecast period. Tooth decay, periodontal diseases, and tooth loss are rising throughout Asia-Pacific due to poor oral hygiene, shifting dietary preferences, and lifestyle decisions. Due to the increase in dental problems, there is a greater need for dental implants and abutment systems as efficient means of regaining oral health and functionality.

People in the region now have more disposable income due to economic growth in their respective nations. An increase in wealth makes it possible for more people to access cutting-edge dental care, such as dental implant operations, which are frequently thought to be superior to more conventional dental prostheses like bridges or dentures.

- The National Dental Commission Bill, 2023, & the National Nursing and Midwifery Commission Bill, 2023, were two health bills the government introduced into Parliament in July 2023.

Market Overview

Dental implant therapy is a clinically proven and well-documented method for replacing lost teeth. Many implant techniques and materials are on the market to help patients live better lives by restoring their appearance and functionality. Proper selection of biomaterials (zirconia, titanium alloys, or titanium-zirconia alloys) for implant placement is essential for an ideal and gratifying outcome because of patients' aesthetic criteria.

- According to WHO estimates, around 3.5 billion people worldwide (or nearly fifty percent of the population) suffer from some oral disease.

Dental Implants and Abutment Systems Market Growth Factors

- The need for replacement teeth due to rising gum disease, tooth loss, and decay drives the market for implants and abutments.

- Technological developments such as biocompatible titanium and creative implant designs enhance functionality, aesthetics, and patient experience, driving the market's expansion.

- Patients have more money to spend on dental implant operations when their disposable income increases, particularly in emerging economies.

- Patients traveling to nations with lower treatment costs due to the growing practice of dental tourism may help certain regions' markets thrive.

- As a result of age-related tooth loss, the need for dental implants to replace lost teeth rises with the aging population, promoting the growth of the dental implants and abutment systems market.

- Implant implantation has become increasingly desirable due to the advent of minimally invasive surgical techniques that lessen patient discomfort and recovery time.

- The market can develop even more due to government programs that raise awareness of oral health issues and improve access to dental treatment, possibly with increased insurance coverage.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.90% |

| Market Size in 2025 | USD 7.29 Billion |

| Market Size by 2034 | USD 12.22 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for cosmetic dentistry

Cosmetic dentistry focuses on making a person's smile look better. Dental implants and abutment systems are frequently used to replace missing teeth or improve the overall look of the teeth. There has been a sharp increase in the demand for dental implants and abutment systems as individuals value aesthetics more and strive for mouths that look natural. In addition to giving patients a more attractive smile, these systems provide a durable alternative for replacing lost teeth.

This dental implants and abutment systems market has grown even more due to developments in dental implant technology, such as creating materials resembling natural teeth' appearance and feel. Furthermore, a broader spectrum of patients can now undergo dental implant surgeries with greater efficiency and accessibility because of advancements in techniques and processes.

Increasing prevalence of dental disorders worldwide

Due to aging-related causes, dental problems such as tooth decay, gum disease, and tooth loss naturally rise as the world's population ages. This demographic trend drives demand for dental implants and abutment systems to restore oral function and aesthetics. Dental implants provide a long-term tooth replacement option that looks and functions remarkably like real teeth. Dentists' rising preference for functional restoration and cosmetic improvement is driving demand for dental implants and abutment systems.

Restraint

High cost of dental implant treatment

High-grade, sometimes pricy materials like titanium or zirconia are often used to make dental implants. Higher labor expenses result from the need for dentists or oral surgeons with specialized training and experience performing implant operations. Patients frequently must pay most treatment costs out of pocket because dental implants are not fully covered by insurance. Dental implant design and placement frequently involve sophisticated imaging technology, such as computed tomography scans and CAD/CAM systems, which raises costs. Treatment costs can increase if each patient's scenario calls for unique treatment regimens and implant parts.

Opportunities

Advancements in implant technology in developed countries

Biocompatible materials are used in the design of modern implants, which lowers the possibility of rejection and encourages better integration with the surrounding bone tissue. This broadens the pool of people who qualify for dental implants and raises the success rate of implant surgeries. Implant dentistry has changed significantly due to integrating digital technology like CAD/CAM systems and 3D imaging. Better patient outcomes arise from dentists using these technologies to plan and perform implant treatments with more accuracy and efficiency. Such advancements are observed to offer lucrative opportunities for the dental implants and abutment systems market.

Due to developments in implant technology, more visually pleasing options are now available, including customizable designs and materials that match teeth. This makes it possible for dentists to provide implants that resemble real teeth, increasing patient acceptance and overall happiness with therapy.

Increasing awareness of dental aesthetics

Growing awareness of the significance of a beautiful smile and its influence on self-esteem and general appearance has increased demand for dental operations that improve aesthetics and functionality. The use of dental implants and abutment systems that provide better tooth alignment, a more natural-looking outcome, and color matching is being driven by this trend. Furthermore, improvements in technology and materials enable more exact customization to meet the demands and preferences of specific patients. Consequently, to maximize the market potential for dental implants and abutment systems, dental practitioners and manufacturers create novel solutions prioritizing functional and aesthetic benefits.

Product Insights

The dental implants segment dominated the dental implants and abutment systems market in 2024. Significant developments in dental implant technology over time have completely changed the industry. Dental implant operation success rates and results have significantly increased thanks to innovations like computer-aided design (CAD), computer-aided manufacture (CAM), three-dimensional imaging, and precision-guided surgery. Dental implants are becoming increasingly popular due to these improvements, which have given patients and dental professionals more trust. The indications for placing dental implants have increased due to technological advancements. Dental implants can now replace one tooth, several teeth, or even a whole arch of lost teeth.

Furthermore, the versatility and application of dental implants in diverse clinical circumstances are increased by their capacity to support a range of prosthetic restorations, such as dentures, crowns, and bridges. Dental implant operations are now more accessible and economical for patients because of improved reimbursement regulations and insurance coverage. More people can afford dental implants as insurance coverage for these procedures expands.

The abutment systems segment shows a significant growth in the dental implants and abutment systems market. Manufacturers work tirelessly to create abutment systems that are more effective, long-lasting, and patient-friendly. These developments include better materials like zirconia and titanium alloys and improved designs that maximize form, function, and aesthetics. Because dental implants are strong, long-lasting, and look natural, they are now the treatment of choice for replacing lost teeth.

Consequently, there has been a consistent increase in the overall market share of dental implants worldwide. The increasing use of dental implants directly contributes to the growth of abutment systems since each implant needs one for the prosthetic restoration to be properly anchored.

Material Insights

The titanium segment dominated the dental implants and abutment systems market in 2024. Excellent biocompatibility refers to the ability of titanium to be absorbed by the human body without triggering adverse reactions or immunological responses. For dental implants to succeed over the long term, they must blend perfectly with the surrounding tissues after being surgically inserted into the jawbone. Many years of clinical study and decades of usage in dental practice attest to titanium dental implants' effectiveness and long-term viability. Titanium implants have been linked to excellent survival rates and positive results in numerous studies, increasing confidence in patients and clinicians.

Titanium implants can be more expensive upfront than implants made of other materials. Still, throughout a patient's lifetime, their success rate and long-term endurance make them more cost-effective. Titanium implants are a fiscally responsible option for patients and healthcare providers since fewer problems and implant failures result in lower maintenance and replacement costs.

The zirconium segment is the fastest growing in the dental implants and abutment systems market during the forecast period. Zirconia is a possible substitute for titanium implants because of its low plaque affinity, white tooth-like tint, and established biocompatibility. For all varieties of dental implants, zirconium satisfies the requirement for meticulous upkeep and monitoring to avert potential issues and guarantee long-term success. Nevertheless, this material has many advantageous mechanical and physical qualities, including low heat conductivity, resistance to corrosion and wear, high fracture toughness, and high flexural strength (900–1200 MPa). Zirconia has proven to be the preferred material in difficult aesthetic situations, having less impact on changing the color than titanium in thin gingival biotypes.

End-use Insights

The dental clinics segment dominated the dental implants and abutment systems market in 2024. Dental specialists with advanced training and specialization, including prosthodontists, oral surgeons, and periodontists with substantial experience in implant dentistry and staff dental clinics. Their proficiency allows them to evaluate patients' appropriateness for dental implants and oral health appropriately. Because of their expertise and ability to build patient trust, dental clinics are the go-to option for implant operations. Strong referral networks are formed by the frequent collaboration of dental clinics with orthodontists, general dentists, and other medical professionals. Due to this network, they can get recommendations for implant situations from many practitioners.

Furthermore, dental clinics can guarantee access to high-quality materials and components because of their established partnerships with dental laboratories and implant manufacturers, which raises the standard of care they offer.

Recent Developments

- In November 2023, Keystone Dental Holdings, a leader in dental implant technology, announced the commercial debut of the GENESIS ACTIVETM Implant System. This cutting-edge surgical technique will revolutionize the way dentists insert and restore implants.

- In September 2023, A pioneer in dental implant solutions, Neoss Group, is happy to announce the release of the latest Multi-Unit Abutment for its revolutionary Neoss4+ Treatment Solution. This system will revolutionize how dentists treat entire arch restorations. With the launch of the Neoss4+ and its ground-breaking Multi-Unit Abutment, Neoss is once more proving its dedication to improving dental implant technology and patient care.

Dental Implants and Abutment Systems Market Companies

- Ziacom

- Dentsply Sirona

- Envista Holdings Corporation

- Biocon LLC

- AB Dental Devices Ltd

- National Dentex Labs

- AVINENT Science and Technology

- Cortex

- Henry Schein Inc.

- Institut Straumann AG

- Osstem Implant Co., Ltd

- ZimVie Inc.

- Biotem

- Dentium

- Adin Dental Implant Systems Ltd.

- Keystone Dental Group

- Dentalpoint AG

- BHI Implants

- Ditron Dental

- Cowellmedi Co. Ltd

- TAV Dental

- Glidewell

- BioHorizons

- BioThread Dental Implant Systems

- Dynamic Abutment Solutions

Segments Covered in the Report

By Product

- Dental Implants

- Tapered Implants

- Parallel-walled Implants

- Abutment Systems

- Stock Abutments

- Custom Abutments

- Abutments Fixation Screws

By Material

- Titanium

- Zirconium

- Others

By End-use

- Hospitals

- Dental Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting