Dental Services Organization Market Size and Forecast 2026 to 2035

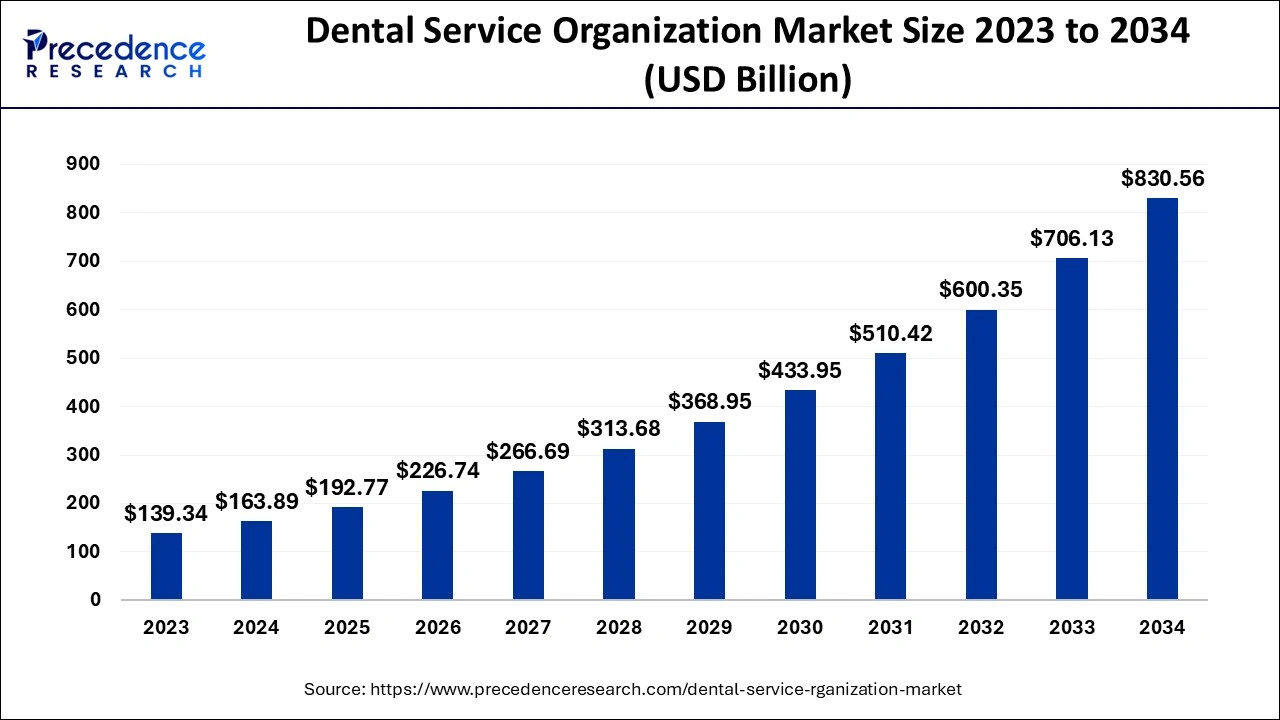

The global dental services organization market size is calculated at USD 192.77 billion in 2025 and is predicted to increase from USD 226.74 billion in 2026 to approximately USD 942.56 billion by 2035, expanding at a CAGR of 17.2% from 2026 to 2035. The dental services organization market is driven by the increasing need, due to economies of scale, for affordable dental treatment.

Dental Services Organization Market Key Takeaways

- In terms of revenue, the market is valued at $192.77 billion in 2025.

- It is projected to reach $942.56 billion by 2035.

- The market is expected to grow at a CAGR of 17.62% from 2026 to 2035.

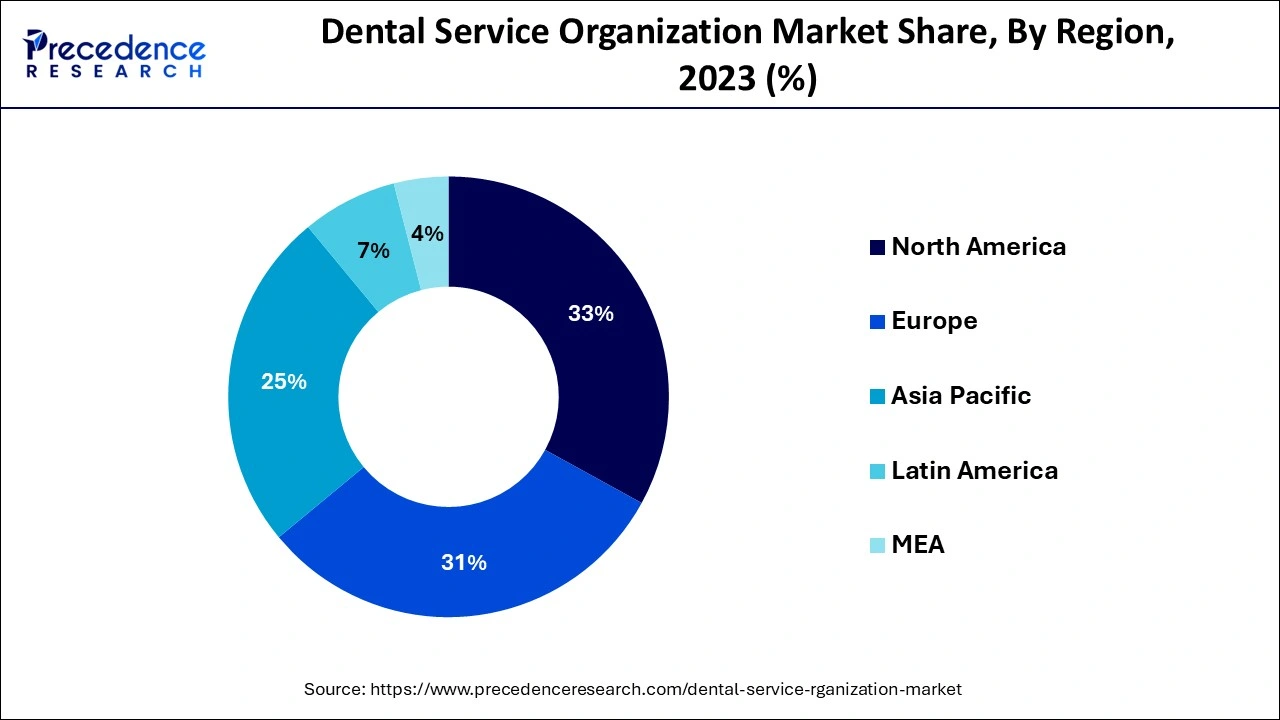

- North America dominated the global market with the largest market share of 33% in 2025.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By service, the medical supplies procurement segment contributed the highest market share in 2025.

- By service, the human resources segment is observed to be the fastest growing during the forecast period.

- By end- use, the general dentists segment captured the biggest market share of 33% in 2025.

- By end- use, the dental surgeons segment expected significant growth during the predicted period.

How Artificial Intelligence is Being Implemented in Dental Services Organizations?

Through sophisticated imaging methods like AI-enhanced radiography, dentists are using AI-powered technologies to help them identify oral malignancies, gum disease, and cavities early on. Treatment planning can be aided by these systems' ability to accurately diagnose conditions by analyzing CT scans, X-rays, and 3D images. AI-powered marketing tools may analyze consumer data to identify trends and create targeted advertisements. DSOs may increase patient retention, cultivate brand loyalty, and communicate more successfully with potential clients by being aware of patient preferences.

Market Overview

Dental services organizations (DSOs) streamline operations and free up physicians to concentrate on clinical care rather than administrative duties by consolidating small, independent dental practices under a single management structure. This consolidation makes consistent service quality and operational effectiveness possible. DSOs lower overall costs by negotiating lower prices for supplies, equipment, and services using economies of scale. Patients can choose from more economical care options due to this efficiency. By standardizing care procedures, increasing customer service, and providing flexible payment plans, DSOs with centralized administration concentrate on raising patient satisfaction.

The dental services organization market is witnessing substantial momentum due to a global shift toward centralized healthcare service delivery, improved patient care models, and the adoption of technology-driven dental solutions. One of the key trends driving the market is the increasing consolidation of dental clinics under dental services organizations (DSOs), which offer dentists operational freedom from administrative burdens while enabling economies of scale. This allows practitioners to focus entirely on clinical care, while DSOs manage billing, HR, marketing, supply procurement, and regulatory compliance. Additionally, the rise in cosmetic and preventive dental care demand, coupled with digital dentistry tools such as 3D imaging, CAD/CAM, and AI-enabled diagnostic tools, is reinforcing the need for organized and well-funded service platforms like DSOs.

- ''Patients First,'' a report released by the Association of Dental Groups (ADG), outlines seven fundamental suggestions for the government that, if followed, will revolutionize the dental experience for patients throughout the United Kingdom.

- It is estimated that around 3.5 billion people suffer from oral illnesses.

Streamlining Smiles Through Scalable Solutions

The dental services organization market is witnessing substantial momentum due to a global shift toward centralized healthcare service delivery, improved patient care models, and the adoption of technology-driven dental solutions. One of the key trends driving the market is the increasing consolidation of dental clinics under dental services organizations (DSOs), which offer dentists operational freedom from administrative burdens while enabling economies of scale. This allows practitioners to focus entirely on clinical care, while DSOs manage billing, HR, marketing, supply procurement, and regulatory compliance. Additionally, the rise in cosmetic and preventive dental care demand, coupled with digital dentistry tools such as 3D imaging, CAD/CAM, and AI-enabled diagnostic tools, is reinforcing the need for organized and well-funded service platforms like DSOs.

Dental Services Organization Market Growth Factors

- The demand for easily accessible and less expensive dental care services is fueled by growing awareness of oral health issues and the increased incidence of dental disorders such as cavities and malocclusion.

- Digital impressions, 3D printing, teledentistry, and AI-assisted diagnostics are innovations that enhance patient outcomes, draw in capital, and broaden the range of services available.

- DSO operations are becoming more accessible as healthcare legislation and reimbursement structures change, particularly in areas that support healthcare privatization and public-private partnerships.

- Due to the DSO model, smaller practices can help from economies of scale, shared resources, and cutting-edge technology. This increases productivity and profitability, and the market is growing because of this tendency to consolidate.

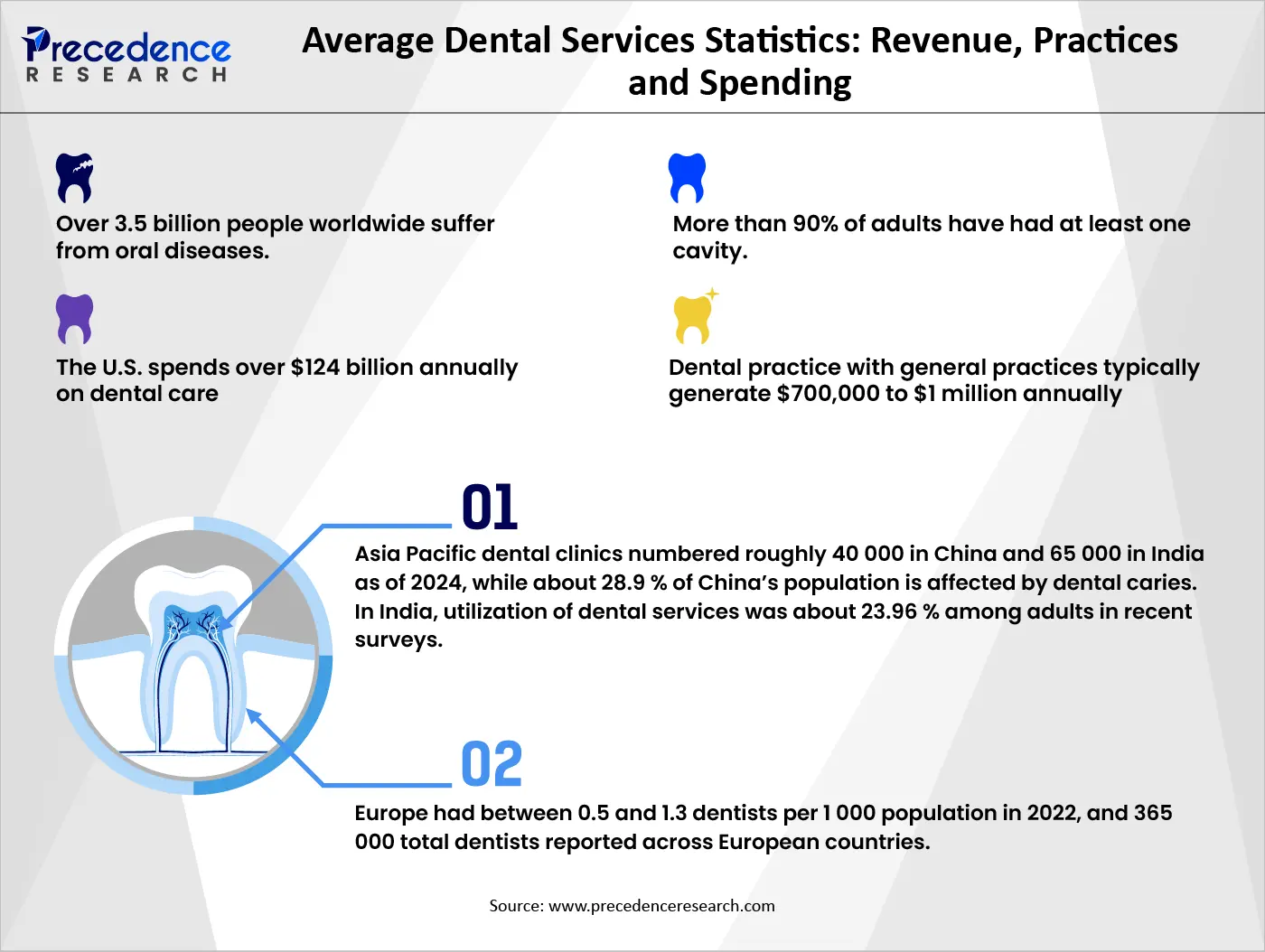

Dental services are expanding rapidly worldwide due to the growing burden of oral health conditions, with over 3.5 billion people affected globally and more than 90% of adults experiencing at least one cavity in their lifetime. This widespread demand drives strong financial growth, particularly in the United States, where annual dental care spending exceeds $124 billion. Additionally, general dental practices typically generate between $700,000 and $1 million annually, highlighting the increasing utilization of dental services and the industry's strong economic performance across regions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 192.77 Billion |

| Market Size in 2026 | USD 226.74 Billion |

| Market Size by 2035 | USD 942.56 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 17.2% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

Increasing prevalence of oral health disorders

The two most prevalent issues with oral health are dental caries and periodontal infections. Caries in permanent teeth are the most common dental illness, affecting over 3.5 billion people globally, according to the World Health Organization (WHO). There is a greater demand for dental services as a result of people seeking routine examinations and treatments due to the growing global awareness of the significance of dental hygiene. A more significant portion of the population now has more accessible access to dental treatment due to the rise in dental insurance coverage, especially in developed nations.

The demand for dental care has increased due to this change, caused mainly by governments and private businesses improving their insurance policies. Because insured people are more inclined to seek routine dental care, dental services firms profit from this trend.

Restraint

High operational costs

Highly qualified individuals, including dentists, dental assistants, and dental hygienists, are needed in the dental services sector. Substantial compensation goes a long way toward covering operating costs. Dental clinics and offices incur ongoing maintenance costs, including keeping dental equipment in top working order. These institutions must also follow strict health and safety laws, frequently requiring further improvements, maintenance, and inspection fees.

Opportunity

Technological advancements

As tele-dentistry enables distant consultations, diagnosis, and follow-up visits, it is increasing access to dental treatment. Dentists and patients can communicate about oral health issues through digital platforms or video chats. Those living in underprivileged areas who cannot physically visit a dental clinic would particularly benefit from this strategy. Due to electronic health records, DSOs can handle patient data in a centralized, digital format. In addition to reducing paperwork and improving data accessibility, it guarantees that patient records, treatment plans, and billing are safely kept and readily available to all authorized specialists in various locations.

Service Insights

The medical supplies procurement segment shows a significant share in the dental services organization market in 2024. Under the same corporate structure, dental services businesses frequently run several dental practices. DSOs can save prices per unit and buy medical supplies in bulk by centralizing the procurement process. DSOs can negotiate better contracts with suppliers when they place larger orders. Due to centralized procurement, individual practices no longer need to oversee their purchase procedures. DSOs may manage vendor relationships, track inventory, and automate supply orders with the help of digital solutions. Data is used by procurement teams to estimate supplier requirements, plan delivery times, and cut down on waste. Real-time tracking lowers the chance of supply chain interruptions and guarantees on-time delivery.

The human resources segment is observed to be the fastest growing in the dental services organization market during the forecast period. The need for qualified workers in the dentistry sector, such as dentists, hygienists, and administrative personnel, is rising. In a competitive labor market, DSOs depend increasingly on specialized HR teams to draw in and hire talent. As DSOs grow, HR departments are crucial to managing workforce scaling and making sure that staffing levels satisfy the needs of both new and existing locations. HR assists DSOs in luring and keeping top staff by providing benefits, including family-friendly policies and telehealth choices.

End-use Insights

The general dentists segment dominated the dental services organization market in 2024. General dentists serve the majority of dental patients. This segment naturally sees more significant patient volumes since most people need general dental care rather than specialist procedures. The DSOs use this patient base to maintain operations and increase income. DSOs can expand into underdeveloped areas because general dentists are geographically more widely scattered than specialists. Patient acquisition and retention for DSOs are improved by this accessibility. When a patient needs specialized care, general dentists are the first to be contacted. By acting as the referral source, they help DSOs maintain an integrated care model by ensuring that patients stay in the organization's environment for innovative treatments.

The dental surgeons segment is observed to be the fastest growing in the dental services organization market during the forecast period. Dental doctors can concentrate on clinical care by using DSOs to handle administrative and operational tasks. Dental surgeons can handle more patients and complex problems since they have less administrative work to do. DSOs expand the spectrum of treatment by making costly surgical instruments and technologies more accessible. Under DSO networks, dental surgeons' skill sets are improved via chances for interdisciplinary cooperation and professional growth.

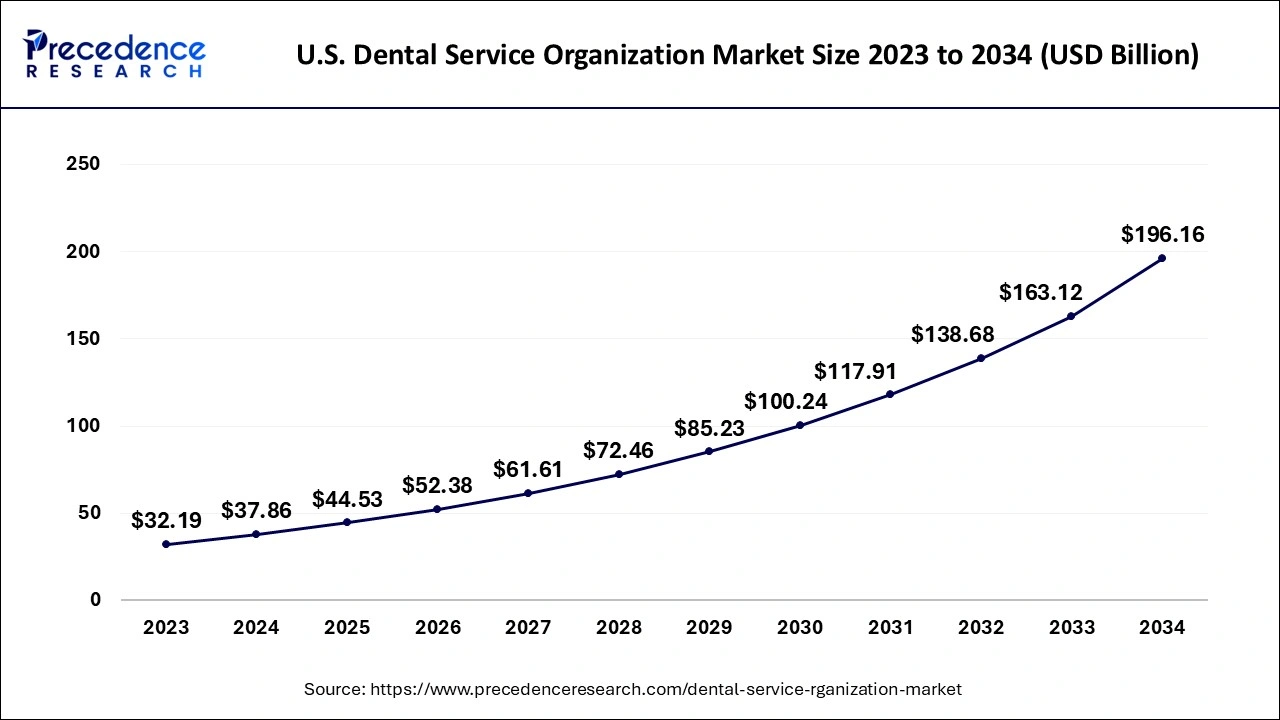

U.S. Dental Services Organization Market Size and Growth 2026 to 2035

The U.S. dental services organization market size was exhibited at USD 44.53 billion in 2025 and is expected to be worth around USD 223.47 billion by 2034, growing at a double-digit CAGR of 17.51% from 2026 to 2035.

North America dominated the dental services organization market in 2025. Digital radiography, 3D printing, and CAD/CAM systems are some of the cutting-edge dental technologies widely used in North America's sophisticated healthcare facilities. The need for preventative and corrective dental care has grown due to public health campaigns and educational programs that have raised awareness of the value of good oral hygiene. Dental practices are becoming more accurate and efficient because of the increasing usage of AI in diagnosis, treatment planning, and patient management.

- According to the WHO Global Oral Health Status Report 2022, oral disorders impact about 3.5 billion people globally, with middle-income nations accounting for three out of four cases. 514 million children worldwide suffer from primary tooth caries, and an estimated 2 billion adults have permanent tooth caries.

North America remains the dominant region in the DSO market, fuelled by early adoption of the DSO model, a high demand for dental services, and favourable government support. The United States leads the market, primarily due to the growth of corporate dental groups, private equity investment in healthcare, and robust insurance coverage through public and private schemes. Canada follows closely, with increased awareness about oral health and a rising elderly population that demands frequent dental care.

Government initiatives in this region include incentives for dental practices joining DSO networks and support for value-based care models, which reward clinics based on patient outcomes rather than service volume. Additionally, tele-dentistry programmes and digital integration incentives from health authorities are fuelling innovation. These factors collectively make North America the hub of DSO evolution, with prominent players constantly expanding across states and provinces.

Asia-Pacific is observed to be the fastest growing in the dental services organization market during the forecast period. Small dental practices are increasingly joining big DSOs to take advantage of shared resources, access cutting-edge technologies, and benefits of economies of scale. Many Asia-Pacific nations have simplified their regulations to promote international investments in healthcare, mainly dental services. Tax breaks and loosened rules for DSOs and healthcare providers have further encouraged growth. To make dentistry services more accessible, governments are increasingly setting aside funds to improve healthcare infrastructure.

Asia-Pacific is emerging as the fastest-growing region in the DSO market, primarily due to a booming population, increasing disposable incomes, and heightened awareness of oral hygiene. Countries like India, China, Japan, South Korea, and Australia are experiencing a surge in demand for advanced dental procedures, including orthodontics and cosmetic dentistry. The shift from small, unorganised clinics to larger group practices is accelerating due to urbanisation, infrastructure development, and the entry of foreign dental chains.

Furthermore, educational initiatives promoting dental wellness, integration of digital tools in dental education, and supportive policies for foreign investments in healthcare are contributing to growth. DSOs in the region are now investing in mobile dental clinics, AI-based diagnostics, and remote consultation tools, bridging the rural-urban care divide.

Dental Services Organization Market Companies

- Pacific Dental

- DentalCare Alliance

- 42North Dental

- Dentelia

- MB2 DENTAL

- Colosseum Dental Group

- GSD Dental Clinics

- Heartland Dental

- Aspen Dental

Recent updates on Dental Services Organization

Technological advancements transforming dental services

- On 15 March 2025, significant technological advancements are occurring in the dental sector, and DSOs are leading the way in implementing new technologies like 3D printing, tele dentistry, and AI-driven diagnostics. By making it possible for more precise diagnoses, effective treatment planning, and easier access to dental services, these technologies are improving patient care. Additionally, DSO can ensure consistent service quality and operational efficiency by streamlining operations across multiple locations through the integration of centralized practice management systems.

Emerging models emphasize patient-centric care

- On 5 April 2025, DSO will place a greater emphasis on patient-centric models, giving convenience and individualized care top priority. To increase patient satisfaction and engagement, this entails providing flexible appointment scheduling, clear treatment plans, and improved communication channels. To guarantee high-quality care and stay up to date with changing patient demands and technological breakthroughs, DSOs are also funding dental professionals' training programs.

Recent Developments

- On 10 January 2025, Heartland Dental announced the launch of Heartland Dental University, a comprehensive training and development program aimed at enhancing the skills of dental professionals within its network. This initiative underscores the organization's commitment to continuous learning and excellence in patient care.

- On 21 February 2025, Dental Care Alliance partnered with Patient Prism, an AI-powered platform to optimize patient acquisition and retention strategies. This collaboration aims to leverage data analytics to improve patient experiences and operational efficiency.

- On 25 March 2025, Aspen Dental introduced a new mobile app designed to facilitate virtual consultations, appointment scheduling, and real-time communication between patients and dental care providers. This digital tool reflects the industry shift towards integrating technology to enhance patient convenience and engagement.

- In October 2024, to provide dental care to the isolated areas of Ladakh, JCBL Limited established a Dental Clinic on Wheels. By delivering necessary dental services directly to rural populations, this initiative addresses the dearth of easily accessible healthcare in isolated locations. The mobile clinic is a component of a larger initiative to provide underprivileged areas with cutting-edge dental care.

- In October 2024, the largest chain of branded dental offices, Aspen Dental, and Royal Philips, a leader in health technology, today announced a partnership to introduce Philips Sonicare, the top brand of sonic toothbrushes recommended by dental professionals worldwide, to Aspen Dental's nationwide network of more than 1,100 locations.

- In March 2024, LIBERTY Dental Plan introduced two cutting-edge developments in its B.R.U.S.H. program and case management platform.

Latest Announcements by Industry Leaders

- Stephen Thorne, CEO of Pacific Dental Services (PDS), recently addressed the significant growth of dental services organizations and the factors contributing to the industry's expansion. Thorne stated that DSOs are gaining traction due to their ability to integrate cutting-edge technology into dental practices, such as artificial intelligence for diagnostic imaging and patient care management.

Segments Covered in the Report

By Service

- Human Resources

- Marketing & Branding

- Accounting

- Medical Supplies Procurement

- Others

By End-use

- Dental Surgeons

- Endodontists

- General Dentists

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting