What is the Dental Support Organizations Market Size?

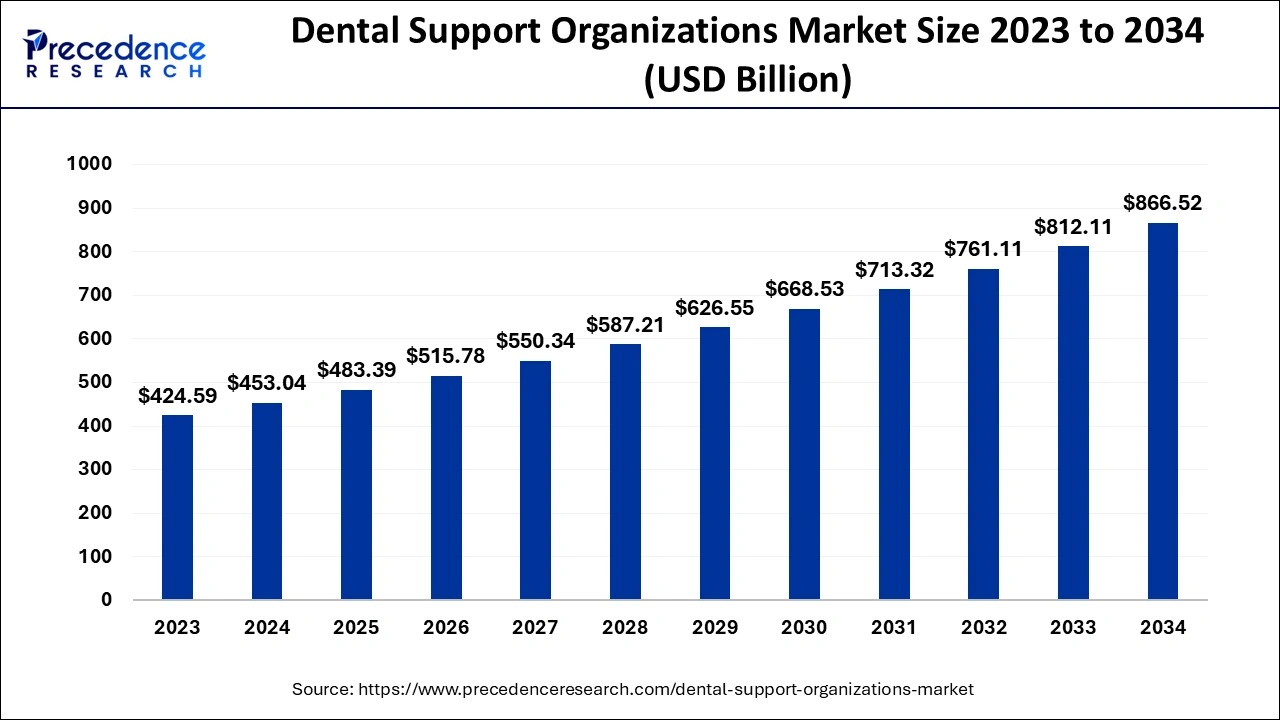

The global dental support organizations market size was calculated at USD 483.39 billion in 2025 and is predicted to increase from USD 515.78 billion in 2026 to approximately USD 918.66 billion by 2035, expanding at a CAGR of 6.63% from 2026 to 2035.

Dental Support Organizations Market Key Takeaways

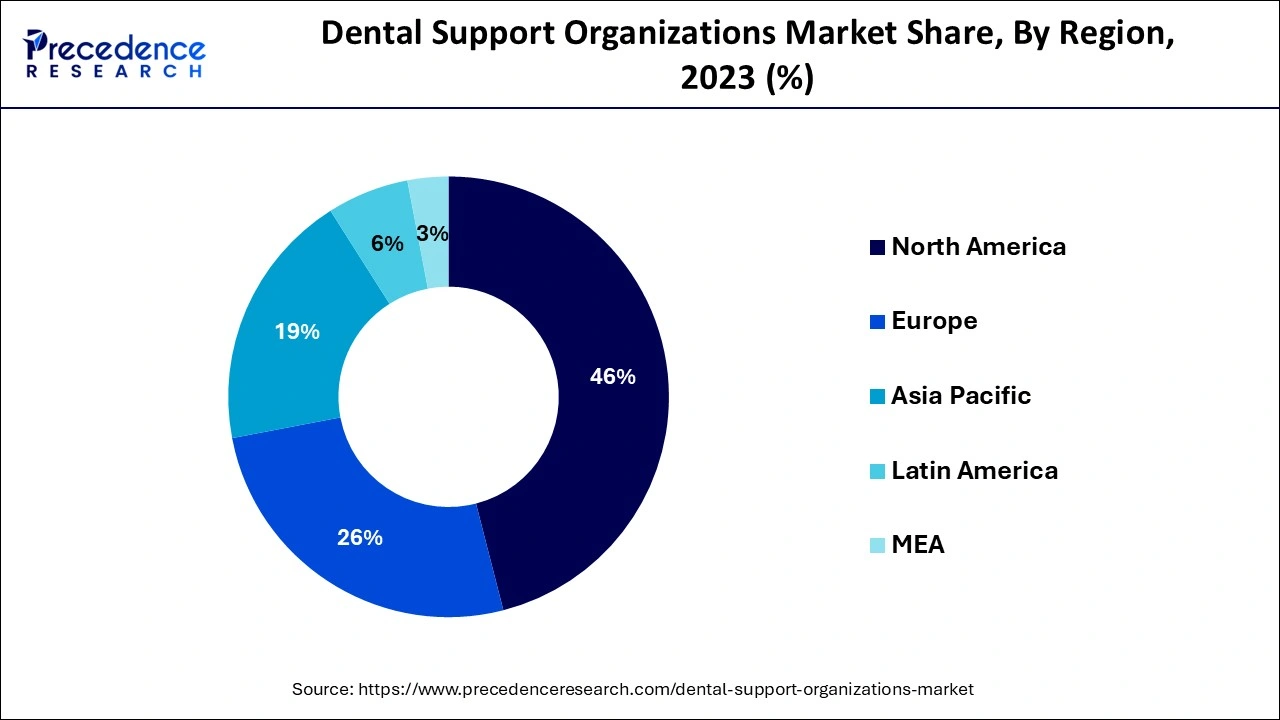

- North America dominated dental support organizations market in 2025.

- By end user, the dental clinics segment will gain a significant market share in 2025.

- By procedure, the cosmetic dentistry segment significant market share in 2025.

Market Overview

Dental Support Organizations are also known as a contract with dental practices which provide critical business management to support non-clinical operations. DSO is not a group practice. DSO is an isolated entity that is typically owned by a private equity group. This contracts with a dental practice to deliver all non-clinical operations. These operations such as accounting, billing, HR, IT, supply procurement, marketing, and even the ownership and leasing of equipment. Dental Support Organization allowed dentists to take full advantage of their practice with the support of professional office management.

Artificial Intelligence: The Next Growth Catalyst in Dental Support Organizations

AI is profoundly impacting the dental support organizations (DSOs) industry by driving operational efficiency, standardizing clinical protocols, and enhancing the patient experience. DSOs are leveraging AI to automate administrative tasks like scheduling, billing, and insurance claims processing, which reduces overhead costs and human error. Clinically, AI-powered tools assist in analyzing radiographs and scans with high accuracy, providing dentists with a reliable "second opinion" for diagnosing conditions like cavities, bone loss, and oral cancer across all their locations.

Market Outlook

- Market Growth Overview: The dental support organizations market is expected to grow significantly between 2025 and 2034, driven by private equity and institutional investment, growing dentist and practice trends, and growing demand for cost-effectiveness.

- Sustainability Trends: Sustainability trends involve the reduction of waste, toxic material management, and energy and water conservation.

- Major Investors: Major investors in the market include Heartland Dental, Pacific Dental Services, and Aspen Dental.

- Startup Economy: The startup economy is focused on new service models, dentist burnout, and private equity interest.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 |

USD 483.39 Billion |

| Market Size in 2026 |

USD 515.78 Billion |

| Market Size by 2035 |

USD 918.66 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.63% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Type, End-Users, Procedure, and Geography |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Dynamics

The increasing prevalence of dental cavities and other oral diseases among the population is driving the growth of dental services organizations globally. The increasing various factors in oral health such as the increasing popularity of the dental service sector, increasing dental implantations, rising demand for cosmetic odontology, and innovative technological advancements in dental services these factors are driving the growth of the dental support organizations market across the globe. The surging importance of dental support organizations is performing a vital role in changing the delivery model of the dental services market. The increasing demand for several dental support organizations has been witnessing positive growth in the market due to the rising in-house dental services. Dental support organizations are a core part of this industry owing to the contracts with the dental service providers which offer management services to deliver non-clinical dental services to the clients. Additionally, increasing demand for unseen teeth braces and aligners has expanded fast purchases among customers. Moreover, increasing demand among the young population regarding their appreciation of beauty is rising the growth of the Dental support organizations market globally.

Increasing disposable income, growing awareness amongst the people regarding oral health globally, and increasing investments in developing healthcare infrastructure are witnessing a positive growth of the dental services market globally. In the U.S. nearly 90% of the young population have dental caries and out of all dentate adults, almost 94% have indications of coronal caries. According to the Centers for Disease Control and Prevention, (CDC), they stated that in the U.S 47. 2 % of the total population who are above 30 years those people are suffering from periodontal disease.

The dental support organization industry is achieving massive growth in the overall dental market, a massive USD 136+ billion firms that continues to grow at 6% per year. Dental support organizations witnessing positive growth in the market due to the increasing popularity among dental professionals such as specialization within the wider dental sector development. In 2019, an Individual 10% of over 200,000 U.S. dentists were associated with a dental support organization.

The dental support organization industry is providing dental professionals and gives suggestions for the prevention, treatment, and diagnosis of dental disorders. Additionally, the rising occurrence of dental disorders such as dental caries and periodontal disease people is witnessing positive growth in the dental services market globally. Moreover, technological advancements, growing adoption of laser dentistry, increasing awareness about dentistry, and rising demand for cosmetic dentistry among the youth population are driving the growth of the global dental services market. Although, according to the World Health Organization, the occurrence of dental caries is decreasing due to the number of public health measures and enhanced self-care performed in technologically advanced countries, therefore, these factors are restraining the growth of the dental support organization market globally.

The maximum amount of population base as well as increasing government initiatives is boosting the growth of the dental services market in developing countries. The dental services market is estimated to grow during the forecast period to the transformation in its delivery model with the help of dental support organizations. This helps to lead to the increasing group of corporate practices.

COVID-19 Impact

The COVID-19 pandemic has impacted the dental care market due to the strict social distancing guidelines; dental practices were shut down during the pandemic in many countries. The American Dental Association issued public guidance to delay elective dental trials or dealings. A procedure such as oral examinations, orthodontic treatments, routine cleaning, cosmetic procedures, and radiographs was postponed. Only emergency dental services such as dental or facial trauma, tooth fractures, painful caries, oral bleeding, and abnormal tissue biopsies were allowed to perform.

During the pandemic, Pacific Dental Services a leading dental support organization declared the launch of the Tele Dentistry platform for patients in the U.S. The pandemic continues to put people in hospital emergency rooms and urgent care centers. This launch of the Tele Dentistry platform is witnessing a positive impact on the Dental Support Organizations market.

Segment Insights

Service Insights

The oral and dental problems like dental exams, crowns, fillings, and root canals are taken care of by general dentists is driving the growth of the market. Dental implants such for the diagnosis, prevention, and treatment of diseases of the oral cavity. Increasing occurrences of dental diseases, an increasingly aging population as well as the availability of well-established healthcare infrastructure are estimated to drive the demand and supply of the dental services segment.

Additionally, orthodontics and prosthodontics are anticipated to be exploiting the immediate opportunity for this segment due to the advanced technology and development of affordable and modern technology such as digital photography, digital intraoral scanners, computer-aided design, and computer-aided manufacturing. Hence, these factors are driving the growth of the service segment during the forecast period. Laser dentistry is estimated to boost the market owing to the services offered by eliminating the need for the usage of surgical instruments.

According to the American Association of Oral and Maxillofacial Surgeons, approximately 70% of adults aged 34 years to 44 years have lost at least one tooth permanently owing to diseases, decay, and accident. Moreover, the demand for transplants or implants is increasing in the young population. The major prominent vendors are investing in R&D in the field of dental implants and offering better biomaterials, surface modifications, and improved implant designs.

End-User Insights

Dental clinics held a significant share of the end user segment in the year 2025. By End-User, the Dental Support Organizations market is segmented into hospitals and dental clinics. This can be attributed to the expert dental services provided by the dental clinics and to provide comfort and convenience offered to clients. Additionally, the hospital's segment is estimated to grow during the forecast period and increase investments by the government in better healthcare infrastructure. Owing to the increasing mergers and collaborations between insurance companies, dental clinics are estimated to drive the growth of the market. The major part of dental patients visits private practice dental clinics due to the availability of specialists and eighty percent of the dental practices are run by the owners. The increasing number of dental practices is due to the cost-effectiveness, availability of specialists, and new technological advancement in equipment.

Procedure Insights

Cosmetic dentistry held a significant share in the procedure segment in the year 2025. By procedure type, the Dental Support Organizations market is segmented into Cosmetic Dentistry and Non-Cosmetic Dentistry. The increasing prevalence of dental caries among people and rising aesthetic concerns among the young population are contributing to the growth of the market. Cosmetic dentistry is estimated to be exploiting the immediate opportunity for this segment during the forecast period.

The increasing private health insurance coverage and an increasing number of patients suffering from periodontal disease are factors driving the growth of the market. However, a rising proportion of sugar-based medication and existing lifestyle factors are contributing to the growth of the Dental Support Organizations market. Moreover, rising personal appearance and advanced technology materials, and methods are enlarging the demand for cosmetic and elective dental services.

Regional Insights

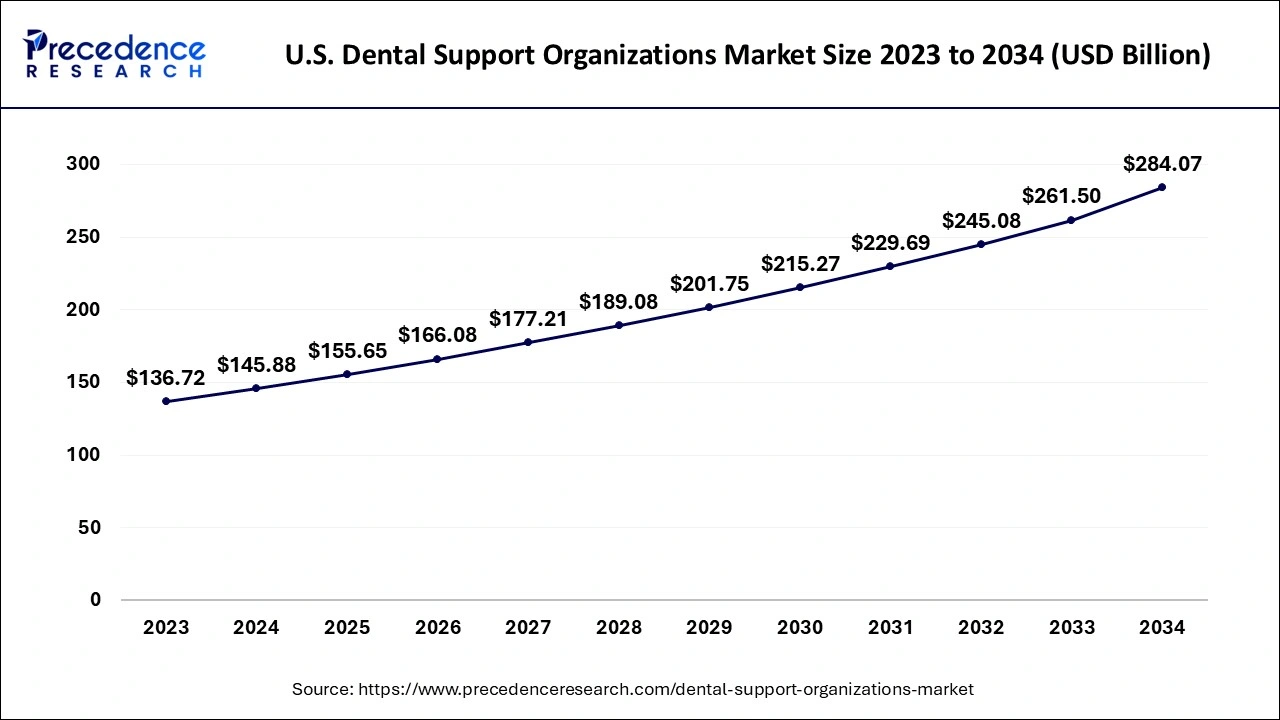

U.S. Dental Support Organizations Market Size and Growth 2026 to 2035

The U.S. dental support organizations market size was evaluated at USD 155.65 billion in 2025 and is predicted to be worth around USD 302.54 billion by 2035, rising at a CAGR of 6.87% from 2026 to 2035.

North America held the largest share of the global market for dental support organizations market owing to the increasing prevalence rate of dental caries. According to WHO, in North America, 90% of people are diagnosed with dental caries. Moreover, Asia & Pacific regions are estimated to have the highest growth rate in a CAGR owing to the population accepting smile makeover treatment. According to the World Health Organization, approximately 10 million people are injured or disabled owing to road accidents every year. Moreover, according to the American Academy for Implant Dentistry, approximately 15 million people in the U.S. suffer from bridge & peak replacements for missing teeth each year, therefore this helps the growth of the dental support organization market.

U.S. Dental Support Organizations Market Trends

U.S. market growth is driven by the rapidly expanding market as solo practitioners increasingly leverage these models to offload administrative burdens like billing, IT, and marketing, allowing them to focus solely on patient care.

According to the American Academy of Implant Dentistry, 3 million people in have dental healthcare industry is severely dependent on China. Therefore, China is the 4th leading supplier of gaining critical mechanisms, raw materials as well as complex finished medical products supplier of medical technology to the U.S. The pandemic is the major reason for the shutdown of manufacturing industries in China and had a negative impact on the market.

According to the North American Dental Group survey, approximately 71% of the members reported a decline in dental visits for non-emergency care owing to the pandemic condition.

Dental equipment giant Straumann Group lost sales of approximately USD 30 million in the first quarter of 2020 in the APAC region. Hence, a reduction in the number of pandemic cases due to the introduction of vaccines in the market is driving the growth of the market. Moreover, hospitals start scheduling appointed dealings, increasing the capacity of admission, and patient relief level is witnessing positive growth in the market.

In APAC, the market is estimated to witness the fastest growth over the forecast period due to rising economic stability as well as disposable income. A dense population and an increasing geriatric population are the factors driving the growth of the market. The increasing adoption of cosmetic dental implants procedure is one of the major factors driving the market growth. Moreover, novel technologies, such as CAD/CAM-based dental restorations, and rising awareness regarding dental trials have boosted the growth of the Dental Support Organization's market.

China Dental Support Organizations Market Trends

China's surge in demand for high-margin cosmetic and restorative procedures is supported by advanced CBCT imaging and 3D printing technologies that enhance clinical throughput. Consequently, these structural shifts, paired with the urgent prosthetic needs of a rapidly aging population, are positioning Chinese DSOs as dominant institutional forces in global oral healthcare.

How did Europe experience notable growth in the Dental Support Organizations Market?

Europe's favorable private equity climate and the operational efficiencies gained from large-scale consolidation. DSOs are leveraging centralized procurement and administration to allow dentists to focus purely on care, while simultaneously investing heavily in cutting-edge technologies like AI-driven diagnostics, CAD/CAM systems, and teledentistry solutions.

Dental Support Organizations Market Companies

- National Health Service England (NHS England): While primarily a publicly funded healthcare system, the NHS contributes to the DSO market by contracting with and commissioning services from large dental groups and corporate entities to deliver a substantial portion of NHS dental care.

- The British United Provident Association Limited (Bupa): As a major international healthcare group, Bupa operates numerous dental practices as part of its comprehensive health services, functioning as a large-scale DSO to provide private and insurance-based dental care to its members and the general public.

- Integrated Dental Holdings (IDH), now part of the mydentist group: As one of Europe's largest dental groups operating under the mydentist brand, IDH contributes to the DSO market through its extensive network of practices across the UK.

- Aspen Dental Management, Inc. (ADMI): ADMI is a significant player in the North American DSO market, providing business support and administrative services to independently owned Aspen Dental practices across the United States.

- InterDent, Inc., Dental Services Group I: InterDent operates as a large DSO in the United States, providing comprehensive management services to its affiliated dental practices across multiple states.

Dental Support Organizations Market Companies

- National Health Service England

- The British United Provident Association Limited

- Integrated Dental Holdings

- Aspen Dental Management Inc.

- InterDent, Inc., Dental Services Group

- Pacific Dental Services

- Great Expressions Dental Centers

- Gentle Dentistry, LLC

- Coast Dental Services, LLC

- Abano Healthcare Group

- Smile 360

- Healthway Medical Corporation

Recent Developments

- In April 2020, Pacific Dental Services launched the Tele Dentistry platform in the US.

- In June 2020, Aspen Dental announced a digital platform that is available in forty-one states, which helped the affected patients to be able to their dental visits.

- In May 2024, Straumann Group launched a dedicated DSO brand offering scalable, customizable implant and orthodontic solutions specifically designed for large-group infrastructure.

https://www.dental-tribune.com

Segments Covered in the Report

By Service

- Dental Implants

- Orthodontics

- Periodontics

- Root Canal – Endodontics

- Cosmetic Dentistry

- Laser Dentistry

- Dentures

- Oral and Maxillofacial Surgery

- Smile Makeover

By Type

- Device Management Service

- Accounting Services

- IT Services

- Administrative Services

- Human Resource Services

By End-Users

- Hospital

- Dental Clinics

By Procedure

- Cosmetic Dentistry

- Non-Cosmetic Dentistry

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting