What is the U.S. Dental Support Organizations (DSO) Market Size?

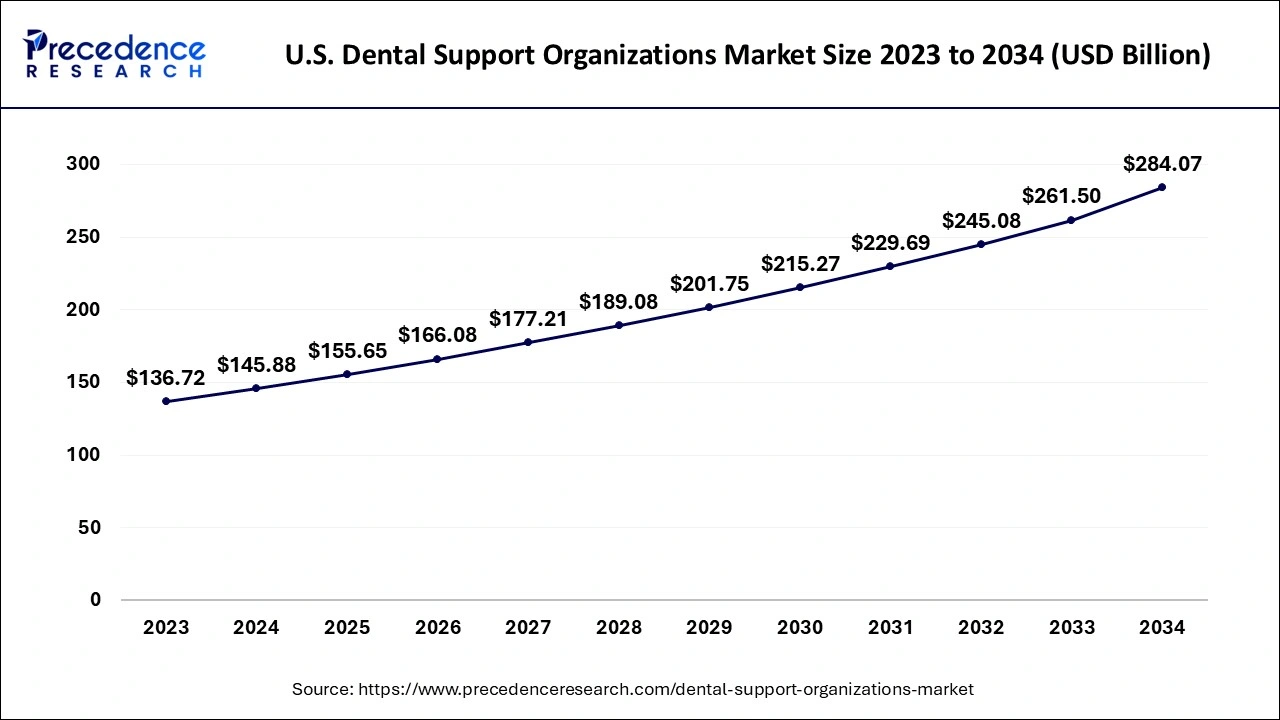

The U.S. dental support organizations (DSO) market size accounted for USD 155.65 billion in 2025 and is predicted to increase from USD 166.08 billion in 2026 to approximately USD 302.54 billion by 2035, expanding at a CAGR of 6.87% from 2026 to 2035. The market is witnessing substantial growth driven by the increasing prevalence of oral diseases, rising public awareness of oral hygiene, and a growing aging population with complex dental needs. This expansion is further fostered by the increasing consolidation of independent dental practices into DSOs, for enhanced operational efficiency, economies of scale, and improved work-life balance for dentists, with a major focus on patient care.

Market Highlights

- South region dominated the dental support organizations market with 36.70% of the market share in 2025.

- West region is expected to grow at the fastest CAGR of 6.60% between 2026 and 2035.

- By service/support function, the medical supplies and procurement services segment contributed the highest market share of 27.80% in 2025.

- By service/support function, the IT and digital support services segment is projected to grow at a strong CAGR of 7.20% between 2026 and 2035.

- By end-user dental specialty, the general dentistry segment captured the highest market share of 54.60% in 2025.

- By end-user dental specialty, the implantology and cosmetic dentistry segment is poised to grow at a healthy CAGR of 7.40% between 2026 and 2035.

- By business/operating model, the roll-up/acquisition model segment generated the biggest market share of 41.30 % in 2025.

- By business/operating model, the equity-backed DSO model segment is expanding at the fastest CAGR of 7.00% between 2026 and 2035.

- By practice size/scale, the medium group practices segment accounted for the largest market share of 38.90% in 2025.

- By practice size/scale, the large DSO networks segment is projected to grow at a solid CAGR of 6.80% between 2026 and 2035.

What is the U.S. Dental Support Organizations (DSO) Market?

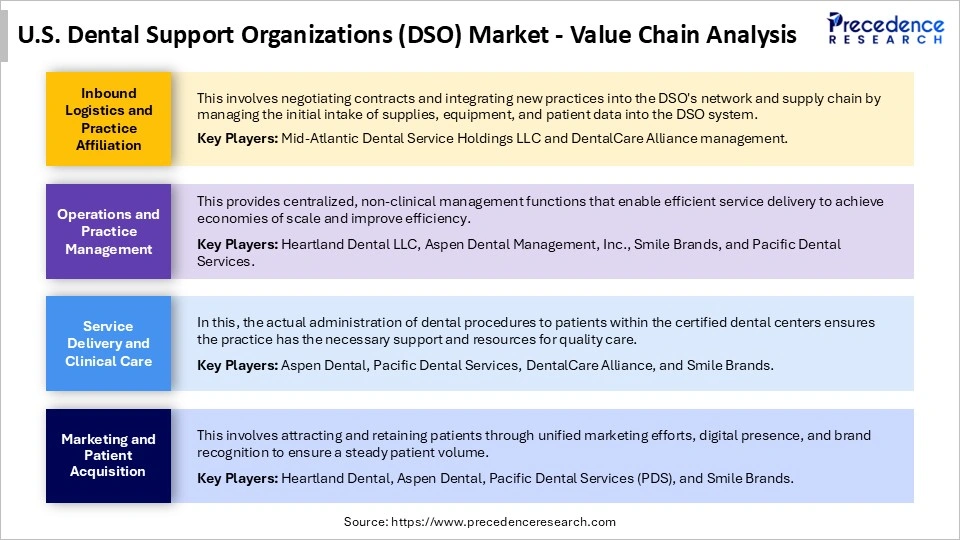

The U.S. dental support organization (DSO) market consists of companies that provide centralized, non-clinical business support, such as human resources, marketing, IT, and billing, to multiple dental practices. This structure allows dentists to focus on patient care, thereby driving market growth through enhanced efficiency, technology adoption, and increased access to care. Significant consolidation and private equity investment have further fueled this expansion, as practices offload administrative burdens to achieve better work-life balance and scale. Overall, these DSOs manage the business side of dentistry, reducing administrative workloads for dentists and improving practice profitability and efficiency.

Growth is further supported by DSOs' ability to standardize clinical workflows and negotiate favorable supplier contracts. Centralized data systems enable better patient scheduling, revenue cycle management, and performance tracking across locations. Expansion into underserved and suburban markets is improving patient access to dental services. Increasing adoption of digital dentistry tools within DSO networks is also reinforcing long-term operational scalability.

How Will AI Transform the U.S. Dental Support Organizations (DSO) Market?

Artificial intelligence (AI) is transforming the market by leveraging vast datasets to automate administrative and clinical workflows and make data-driven decisions across multiple locations. AI can analyze radiographs, enhancing diagnostic accuracy and consistency among providers. This capability helps detect conditions like bone loss and caries earlier, improving patient case acceptance rates. Additionally, AI streamlines the revenue cycle by automating insurance verification, coding, and claims processing, significantly reducing denial rates and administrative burdens. This technology also helps manage supply chains and offers data-driven performance benchmarking for supported practices, which can help reduce no-shows.

U.S. Dental Support Organizations (DSO) Market Outlook

- Industry Growth Overview: The market is experiencing robust growth from 2026 to 2035, driven by increased dentist affiliations, consolidation, and greater access to capital for dentists, making DSOs an attractive investment for healthcare providers seeking scale and efficiency in a fragmented market.

- Dentist Consolidation: More independent dentists are selling to DSOs to escape administrative burdens, benefiting from scale, centralized procurement, and technology investments, leading DSOs to provide business support, improve efficiency, and expand access to care, with consolidation and cost-effectiveness fueling this shift.

- Major Investors: Major players like Heartland Dental, Aspen Dental, Pacific Dental, and 42North Dental, along with tech integration, consumer demand for convenience, and value-based care models, continue to shape this expansion with potential for growth in a fragmented healthcare sector.

- Startup Ecosystem: Many startups focus on innovative solutions in dental technology, patient engagement apps, and new care delivery models, with an increasing focus on value-based care to improve outcomes while controlling costs, similar to how contact lens companies focus on better materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 155.65 Billion |

| Market Size in 2026 | USD 166.08 Billion |

| Market Size by 2035 | USD 302.54 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.87% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service/Support Function, End-User Dental Specialty, Business/Operating Model, and Practice Size/Scale |

Segment Insights

Service/Support Function Insights

What Made the Medical Supplies and Procurement Services Segment Dominate the U.S. Dental Support Organizations (DSO) Market in 2025?

The medical supplies and procurement services segment is dominated with a market share of 27.80% in 2025. This dominance is primarily due to DSOs using their scale to centralize purchasing, negotiate significant discounts, and ensure the consistent quality of supplies across many locations. This efficiency is crucial as DSOs manage rising costs and patient volumes, leveraging bulk purchasing power and advanced procurement technology for enhanced supplier terms and inventory management. Furthermore, procurement serves as a strategic tool to combat rising inflation in dental consumables and control operational overhead, ultimately improving profitability.

The IT and digital support services segment is expected to experience the fastest growth, with a CAGR of 7.20%. This is largely because the adoption of centralized technology boosts efficiency, reduces costs, improves patient care, and strengthens compliance, allowing dentists to focus on clinical work while DSOs scale their operations. Digital tools, such as intraoral scanners, digital smile design, and AI, enhance treatment predictability, patient engagement, and overall satisfaction, driving loyalty through better outcomes and revenue. Standardized digital systems also support rapid expansion and simplify compliance with complex regulatory requirements.

End-User Dental Specialty Insights

How did the General Dentistry Segment Lead the U.S. Dental Support Organizations (DSO) Market in 2025?

The general dentistry segment led the market with a 54.60% share in 2025. This is mainly because general dentists provide the foundational and most common types of dental care, resulting in a high and consistent volume of patient visits. They offer a broad range of services, including preventive care, basic restorative procedures, and diagnostics focused on oral health maintenance. DSOs provide centralized resources, such as bulk purchasing power for supplies and equipment, which helps reduce overhead costs and facilitates the adoption of advanced, expensive technologies.

The implantology and cosmetic dentistry segment is anticipated to grow the fastest, with a CAGR of 7.40%. This growth is driven by increasing consumer demand for aesthetic procedures, technological advancements, and the DSO model's ability to efficiently invest in and offer these specialized, higher-cost services. DSOs provide economies of scale, centralized administration, and increased purchasing power, which allows them to invest heavily in expensive, cutting-edge digital dentistry equipment like intraoral scanners, 3D printers, and CAD/CAM systems. This makes cosmetic and implant procedures more efficient, accurate, and appealing to patients.

Business/Operating Model Insights

Why Did the Roll-Up/Acquisition Model Segment Lead the U.S. Dental Support Organizations (DSO) Market in 2025?

The roll-up/acquisition model segment led the market in 2025, accounting for 41.30% of the market share. This dominance is primarily due to the highly fragmented nature of the industry, which offers significant economies of scale and attractive exit strategies for independent dentists. The roll-up model enables dental service organizations to centralize non-clinical administrative functions, such as human resources, marketing, billing, and procurement of medical supplies, thereby reducing overhead costs, improving operational efficiency, and enhancing profitability for all affiliated practices.

The private equity-backed DSO model segment is anticipated to experience the fastest growth, with a CAGR of 7.00%. This growth can be attributed to DSOs providing dentists with relief from business burdens, enhancing efficiency through technology, and achieving economies of scale in purchasing and marketing. Furthermore, these firms recognize the significant potential in the fragmented dental market, which allows them to secure the capital needed to acquire practices, expand networks, and modernize infrastructure. PE-backed DSOs rapidly acquire independent practices, increasing market share, negotiating power with insurers, and creating large, valuable networks.

Practice Size/Scale Insights

How did the Medium Group Practices Segment Lead the U.S. Dental Support Organizations (DSO) Market in 2025?

The medium group practices segment held a 38.90% market share in 2025. This is largely due to ongoing consolidation, which offers dentists reduced administrative burdens, better work-life balance, economies of scale for supplies, and access to advanced technology. DSOs leverage their size for improved purchasing power, enabling them to negotiate lower prices for dental supplies, equipment, and insurance, benefiting both the organization and potentially the patients. Additionally, DSOs facilitate investments in advanced digital technologies, such as AI, 3D printing, and digital workflows, while also offering specialized services that make care more efficient and personalized.

The large DSO networks segment is expected to see the fastest growth, with a CAGR of 6.80%. Their size allows for significant leverage in centralized procurement, enabling the adoption of expensive digital technologies like AI and 3D printing, and also attracting talent with competitive compensation packages. Substantial capital investments fuel aggressive acquisition strategies and nationwide expansion. Moreover, Large DSOs utilize bulk purchasing through centralized procurement to lower costs for supplies and technology, creating a competitive advantage. Smaller practices often join larger DSOs for survival and access to resources, further accelerating growth.

Regional Insights

How Did the South Region Dominate the U.S. Dental Support Organizations (DSO) Market in 2025?

The south region dominated the market with 36.70% market share in 2025. This dominance is mainly driven by a favorable regulatory environment, a significant number of underserved and Medicaid-dependent populations, and strategic expansion by key DSO players. The Southern U.S. has a growing population and an aging demographic, leading to increased demand for comprehensive dental services, including restorative and prosthetic treatments, to offer a wide range of specialized services under one roof. The dental industry's consistent revenue growth and fragmented nature in the South make it an ideal target for private equity investment and consolidation.

Why Will the West Region Be the Fastest-Growing Region in the U.S. Dental Support Organizations (DSO) Market in 2025?

The west region is anticipated to have the fastest growth with a CAGR of 6.60%. This growth is due to large patient volume, an increase in dental conditions, and a high rate of affiliation among dental professionals. A significant portion of the adult population in the U.S., including the West, is affected by dental ailments like periodontal disease, increasing the demand for consistent dental services and treatments. More independent practices and general dentists in the West are choosing to affiliate with DSOs to offload administrative burdens, access advanced technology, and benefit from economies of scale.

U.S. Dental Support Organizations (DSO) Market Value Chain Analysis

Emerging Initiatives in the U.S. Dental Support Organizations (DSO) Market

| Initiative Area | Specific Initiatives | Key Benefits |

| Technology Integration | Digital Dentistry Tools | Cuts lab turnaround times, improves patient satisfaction, and standardizes treatment planning across clinics. |

| Operational Strategy | Centralized & Streamlined Management | Achieves economies of scale, lowers supply costs, ensures compliance, and allows dentists to focus on clinical care. |

| Patient & Talent Focus | Talent Recruitment & Retention | Attracts and retains skilled professionals, ensuring consistent quality of care and supporting scalability. |

| Business & Market Strategy | Consolidation & Specialization |

Broadens patient base, allows for cross-referrals, and provides a full suite of services under one organizational umbrella. |

Who are the Major Players in the U.S. Dental Support Organizations (DSO) Market?

The major players in the U.S. dental support organizations (DSO) market include Heartland Dental, The Aspen Group (TAG), Pacific Dental Services (PDS), MB2 Dental, Affordable Care, and Dental Care Alliance.

Recent Developments

- In July 2025, RipeGlobal launched in the U.S., leveraging its success in 35 countries to offer immersive, simulation-based training for dentists through DSOs, groups, and private practices. Dr. Roshan Parikh was appointed Chief Revenue Officer to drive growth and partnerships across North America, supported by a Global Advisory Committee led by legal expert Brian Colao and Dr. Farzeela Rupani from Colosseum Dental.(Source: https://www.ripeglobal.com)

- In April 2025, PDS Health launched PDS Health Technologies, introducing integrated technology and revenue cycle services. It became the first large dental organization to implement Epic for unified health records across over 1,000 locations, improving care coordination. We are accelerating the adoption of integrated solutions to enhance care delivery, remarked CEO Stephen E. Thorne IV.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Service/Support Function

- Medical Supplies & Procurement Services

- Dental consumables procurement

- Capital equipment & technology procurement

- Inventory management & vendor contracting

- Human Resources & Workforce Management

- Recruitment & staffing

- Payroll, benefits & compensation management

- Training, credentialing & compliance

- Financial & Accounting Services

- Revenue cycle management (billing & collections)

- Accounts payable & receivable

- Financial reporting & analytics

- Marketing & Patient Acquisition

- Brand management

- Digital marketing & advertising

- Patient acquisition & retention programs

- IT & Digital Support Services

- Practice management software

- EHR/EMR & data integration

- Cybersecurity & cloud infrastructure

- Legal, Regulatory & Compliance Services

- HIPAA & OSHA compliance

- Contract & risk management

- Regulatory advisory services

- Real Estate & Facilities Management

- Site selection & lease management

- Clinic design, build-out & maintenance

- Other Value-Added Services

- Teledentistry enablement

- Operational consulting & analytics

By End-User Dental Specialty

- General Dentistry

- Orthodontics

- Oral & Maxillofacial Surgery

- Periodontics

- Endodontics

- Pediatric Dentistry

- Implantology & Cosmetic Dentistry

By Business/Operating Model

- Management Services Agreement (MSA) Model

- Joint Venture/Partnership Model

- Roll-Up/Acquisition Model

- Sub-DSO/Affiliate Platform Model

- Private Equity-Backed DSO Model

By Practice Size/Scale

- Solo & Small Practices

- Medium Group Practices

- Large DSO Networks

- Mega/National DSOs

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting