What is the Dermatophytic Onychomycosis Treatment Market Size?

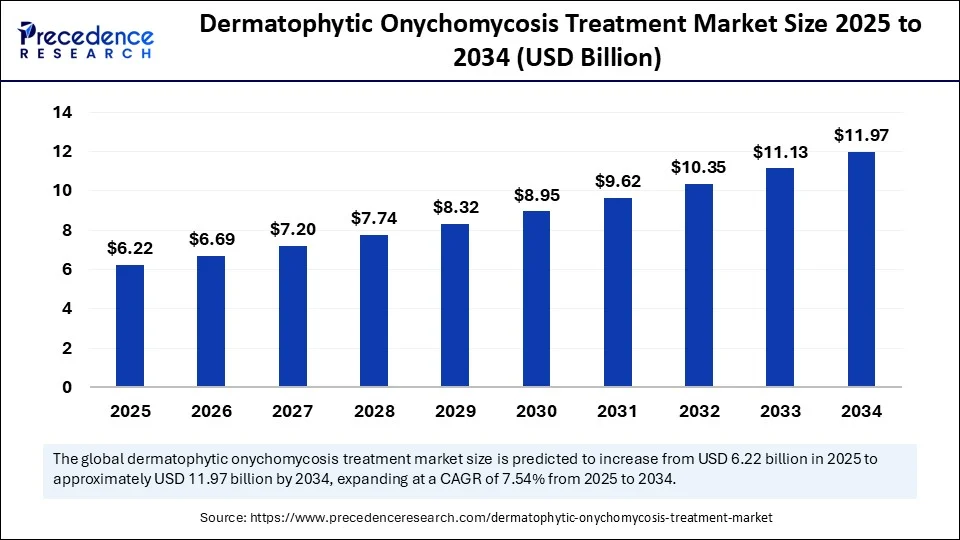

The global dermatophytic onychomycosis treatment market size is accounted at USD 6.22 billion in 2025 and predicted to increase from USD 6.69 billion in 2026 to approximately USD 11.97 billion by 2034, expanding at a CAGR of 7.54% from 2025 to 2034. The dermatophytic onychomycosis treatment market is expanding due to rising fungal infections, improved awareness, and increased demand for advanced topical and oral therapies.

Dermatophytic Onychomycosis Treatment MarketKey Takeaways

- In terms of revenue, the global dermatophytic onychomycosis treatment market was valued at USD 5.79 billion in 2024.

- It is projected to reach USD 11.97 billion by 2034.

- The market is expected to grow at a CAGR of 7.54% from 2025 to 2034.

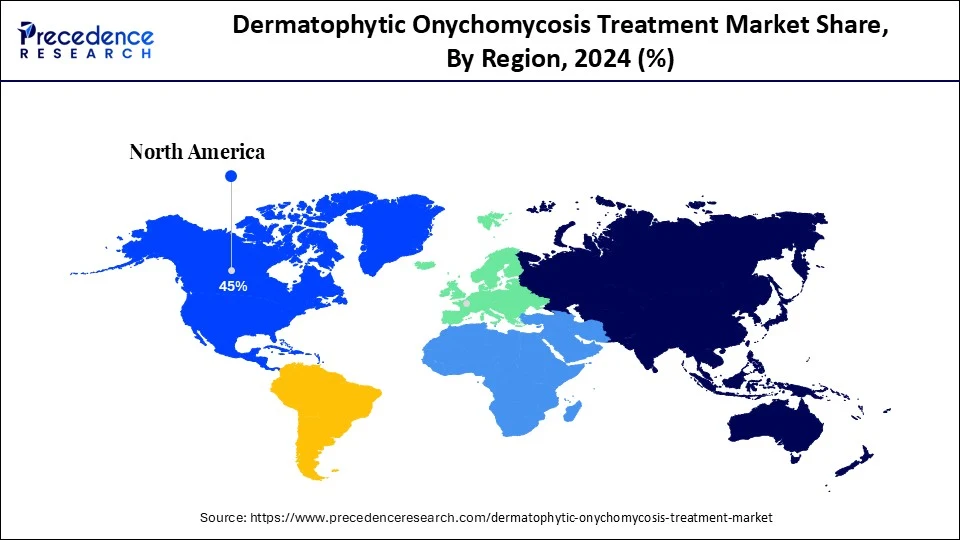

- North America led the dermatophytic onychomycosis treatment market with the highest share of 45% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR in the market between 2025 and 2034.

- By product type, the nail paints segment held the largest market share in 2024.

- By product type, the tablet segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By route of administration, the topical segment captured the biggest market share in 2024.

- By route of administration, the oral segment is expected to expand at a notable CAGR over the projected period.

- By type, the Over-the-Counter (OTC) segment contributed the major market share in 2024.

- By type, prescribed segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the Retail Pharmacies segment accounted for the significant market share in 2024.

- By distribution channel, the online channels segment is expected to expand at a notable CAGR over the projected period.

Artificial Intelligence: The Next Growth Catalyst in Dermatophytic Onychomycosis Treatment

The dermatophytic onychomycosis treatment market is rapidly evolving because of artificial intelligence which is improving how we diagnose disease, discover drugs and provide treatment to patients. An AI model trained on 1,604 clinical photos achieved segmentation accuracy in diagnosis with an IOU of 0.75/F-score of 0.85 and 81 % classification of infection, which provided effective follow-up monitoring of treatment response.

Similarly, applications and teledermatology services that leverage artificial intelligence will help improve patient compliance and support earlier intervention to minimize delays to treatment. The onychomycosis treatment market is evolving quickly, clinching new advances in the field, and will continue to shift, with innovative imaging modalities (e.g. OCT) and new digital technologies converging with intelligent diagnostic solutions for an increasingly safe, rapid, and personalized treatment approach.

The market outlook indicates that AI will streamline antifungal drug discovery programs, lead to better personalized treatment planning, and aid in the earliest possible diagnosis of onychomycosis and other fungal nail disease, resulting in significantly faster growth in the onychomycosis treatment market. With the introduction of telemedicine and digital diagnostics on a larger scale, AI stands to improve treatment outcomes and revolutionize this underdeveloped market.

Strategic Overview of the Global Dermatophytic Onychomycosis Treatment Industry

Dermatophytic onychomycosis (onychomycosis) is a fungal infection of the nails, most commonly caused by dermatophytes like Trichophyton rubrum. Symptoms typically include discoloration, thickening, and/or separation of the nail from the nail bed. It is one of the most common nail disorders in the world and can significantly reduce quality of life and alter cosmesis. Globally, the dermatophytic onychomycosis treatment market is developing as a result of enhanced clinical awareness, capable diagnostic capabilities, as well as utilized topical and oral antifungal medications. Improved drug delivery systems, such as nail lacquers and transungual therapeutics, have enhanced the effectiveness and adherence of treatments.

The market also includes new types of non-medicated interventions such as laser treatments and photodynamic therapies. Investigations into antifungal resistance and treatment relapse support innovation. Furthermore, market growth is being facilitated by increasing consultations with dermatologists, particularly in urban health systems in advanced developed and developing countries. Therefore, this market represents a long-range therapeutic opportunity for investment.

Dermatophytic Onychomycosis Treatment MarketGrowth Factors

- Growing infection rate: Higher incidence within the elderly, diabetics, and immune compromised populations can be met with urgent use of effective onychomycosis treatment across developing and developed regions.

- Advanced Therapies: Clinical studies establishing newer topical agents, less toxic oral agents, and non-invasive laser therapies will be increasing established cure rates and global therapeutic options for patients.

- Diagnostic Improvements: Modern diagnostic practices using PCR testing and dermatoscopic imaging will contribute to faster, and increasingly accurate means of identifying fungal infections; and subsequently enable faster, more directed treatment for patients.

- Increased Awareness:Heightened awareness of nail appearance and concern for hygiene has resulted in a greater number of individuals presenting for treatment early, particularly in urban and semi-urban regions.

- Greater access to treatments: Increased dermatological clinical services and access to home-use treatment products will aid in accessibility of treatment options, particularly in remote, underserved areas.

Market Outlook

- Market Growth Overview: The dermatophytic onychomycosis treatment market is expected to grow significantly between 2025 and 2034, driven by the rising incidence of fungal infections, innovations in the therapy, and growing awareness.

- Sustainability Trends: Sustainability trends involve safer topical treatments, preventing recurrence through environmental interventions, and antifungal stewardship and resistance management.

- Major Investors: Major investors in the market include Bausch Health Companies Inc., Pfizer Inc., Novartis AG, GlaxoSmithKline plc (GSK), and Kaken Pharmaceuticals Co., Ltd.

- Startup Economy: The startup economy is focused on developing innovative topical solutions, next-generation drug formulations, and leveraging novel technologies to improve patient outcomes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.97 Billion |

| Market Size in 2025 | USD 6.22 Billion |

| Market Size in 2024 | USD 5.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Route of Administration, Type, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Diabetic Population Acting as a Driver for the Dermatophytic Onychomycosis Treatment Market

A key driver of the dermatophytic onychomycosis treatment market is the increase in diabetes worldwide, as it increases risk of suffering from fungal infections in the nails. In 2024, the International Diabetes Federation reported that there were approximately 589 million adults (20-79 years) are living with diabetes, and that number is expected to rise to 853 million by 2050. Diabetic patients tend to have altered immune responses and poor peripheral circulation, which can put them at risk for infections, including dermatophytic onychomycosis.

The Centers for Disease Control and Prevention (CDC) indicates that fungal infections tend to be more common in people with chronic conditions, especially diabetes. In addition, the World Health Organization indicates that at-risk populations should have early treatment for fungal infections to prevent negative outcomes. This growing at-risk population is fostering a greater demand for antifungal therapies and strategies for managing fungal nail infections.

Restraint

Safety issues and side effects be delaying treatment utilization

One limiting factor in the dermatophytic onychomycosis treatment market is the considerable side-effect burden of systemic antifungals like oral terbinafine, the gold standard treatment. Terbinafine is often considered the gold standard treatment as it is approximately 76% effective, but it comes with risk for liver toxicity, which requires liver function monitoring. According to FDA guidelines and the literature, monitoring liver enzyme activity is recommended in therapy to avoid serious hepatotoxicity.

A cost-effectiveness analysis in the U.S. noted that the cost of treatment with terbinafine is just $10, but $43 would also need to be included for the necessary liver tests due to the safety profile, and the laboratories and monitoring needed. Safety and monitoring demands can compel the clinician not to prescribe oral antifungals, especially for patients with liver conditions which may further delay adoption of effective oral therapies from their toxicity profile.

Opportunity

Rapidly Growing Population of Older Adults Represent the Largest Treatment Opportunity for Fungal Nail Infections

A significant opportunity in the dermatophytic onychomycosis treatment market is represented by the increasing global number of older adults, who tend to be at high risk for fungal-related nail infections as the World Health Organization (WHO) reported that the percentage of people 60 years and older is increasing in the worldwide population and projected to be 22% of the population by 2050. Age is a high-risk factor for fungal nail infection due to increased co-morbidities and conditions that lead to nail problems, decreased immune system performance, decreased nail growth, concurrent diabetes, peripheral vascular disease and etc.

Onychomycosis, a common fungal nail infection, affects > 20% of adults over age 60 and > 50% of people over age 70, leading to significant demand for topically-based therapies that are less risky than systemic anti-fungal medications. In February 2024, Sweden granted marketing approval to Terclara (MOB-015), a topical terbinafine with low systemic absorption and a 76% mycologic cure rate, a safe option for older adults. With more government and public health groups focusing on elderly care, this demographic shift is a substantial, sustainable opportunity for manufacturers of advanced fungal nail infection treatments.

Product Type Insights

Why the Nail Paints Segment Is Dominating Product Type?

Nail paints, also referred to as antifungal lacquers, are leading this market thanks to their simple application, non-invasive nature and appeal to cosmetic and medical indications. Nail paints are particularly relevant for mild to moderate infections even when physicians deem systemic therapy to be unnecessary, since they are providing local treatment with reduced side effects. Consequently, nail paint formulations are generally widely available over-the-counter (OTC) or non-prescription, which eliminates the need to seek medical consultation or make expensive co-pays. The relative ease of applications and the independent ability to cover nail discoloration positively influences patient compliance.

Tablets segment is growing at fastest CAGR, with their effectiveness for treating moderate to severe fungal infections either not completed or fully resolved using topical treatments. Oral antifungal therapies are systemic agents that provide systemic treatment for nail fungus in contrast to topical products that may not penetrate the nail unit as deeply. This systemic agent enters the bloodstream and gets delivered to the nail matrix where it produces antifungal effects. Oral medications such as terbinafine or itraconazole are prescribed by dermatologists with increased frequency for chronic or recurrent onychomycosis since they are able to obtain faster improvements in patient symptoms. With improved awareness around dermatophytic onychomycosis, patients are increasingly obtaining professional diagnoses and prescriptions for treatment.

Route of Administration Insights

Which Route of Administration is Dominating Market?

Topical administration occupies a dominant role in dermatophytic onychomycosis treatment due to its localized action, low systemic absorption, and low toxicity. Antifungal nail paint/cream and ointments are easily and accepted user-friendly common methods by people who suffer from a mild to moderate infection; they have excellent ease of application. Self-treatment with convenience is aided with the ease of purchasing topical antifungals without prescriptions at retail pharmacies and drug stores. Commonly topical agents were the first line of therapy option and usual add-on therapy with oral antifungals providing adjunctive treatment options making them a cornerstone in the leading segment of the market.

Oral administration is growing at fastest CAGR because of its systemic activity, but it may be prescribed for depth or recurrence of a fungal infection. Oral medications can access the infection site with the bloodstream, and they are appropriate for severe or chronic onychomycosis. Oral antifungals, such as terbinafine and itraconazole, are the preferred treatment advised by dermatologists because of their rapid cure rate and long-term success. Given the increasing number of dermatology consultations, an influx of untreated fungal infections complications, and, for reasons that are unclear, increased oral prescription adherence through both clinical consultations and patient self-reporting, healthcare providers are increasingly depending on the oral route. This trend will continue with improved diagnostic tools and experiences.

Type Insights

Why Over-the-Counter (OTC) is Dominant Market Segment?

Over-the-Counter (OTC) holds the largest markets share in the dermatophytic onychomycosis market since they are inexpensive, accessible and do not require a prescription. Antifungal nail lacquer, antifungal topical creams, and antifungal topical sprays are readily accessible at retail stores or pharmacies that lend themselves easily to self-medication by a consumer with mild to moderate infections. Many consumers feel most comfortable with OTC products because of convenience, cost and safety, particularly when their symptoms are mild or mild-moderate in severity. The prevalence of commercially driven marketing saturated with ads and promotional efforts is also influencing public awareness of nail fungus and ultimately increases demand in OTC products.

Prescribed treatments are the fastest growing segment of the market due in part to patient visits to dermatologist and general practitioners for chronic and severe nail infections. Prescribed treatments generally involve systemic oral antifungals and stronger topical treatments that require proper diagnosis and clinical monitoring. Patient's awareness of the negative risks associated with not treating nail fungus, like spreading the infection or degrading nail health, has prompted them to seek out treatment options. In addition, it is clear that physicians are emphasizing laboratory confirmation before prescribing treatments in order to achieve more efficient outcomes.

Distribution Channel Insights

Why Retail Pharmacies is the Dominant Distribution Channel?

Retail pharmacies have an advantage in the distribution channel segment for treating dermatophytic onychomycosis given their availability, convenience of purchasing, and trust of consumers in stores. Retail pharmacies accommodate both prescribed needs, as well as over the counter (OTC) needs, making them a convenient approach for patients. Patients often wish to access dermatological products at a retail pharmacy due to in-person purchasing, particularly if it's a product that a consumer wants to speak to their pharmacist about. In developing regions, retail pharmacies play an important role in facilitating steady and widespread product access, as there is likely limited access to digital access to the product.

The Online channel is growing at the fastest CAGR due to the rising use of online pharmacies and digital health platforms. E-pharmacies that offer a wider variety of treatments available from home (e.g., nail lacquers, antifungals in oral formulations, and home delivery), a significant increase in use of digital pharmacies and online prescription platforms due to telehealth growth facilitating appointment to obtain virtual prescriptions for antifungal drugs, and growing online sales via access to other key drivers of segment growth (e.g., privacy, accessibility and user-friendly product comparison and discounts). Growing access to smartphones and e-health literacy in the pandemic period has enabled consumers to purchase onychomycosis treatments using digital pharmacies.

Regional Insights

U.S. Dermatophytic Onychomycosis Treatment Market Size and Growth 2025 to 2034

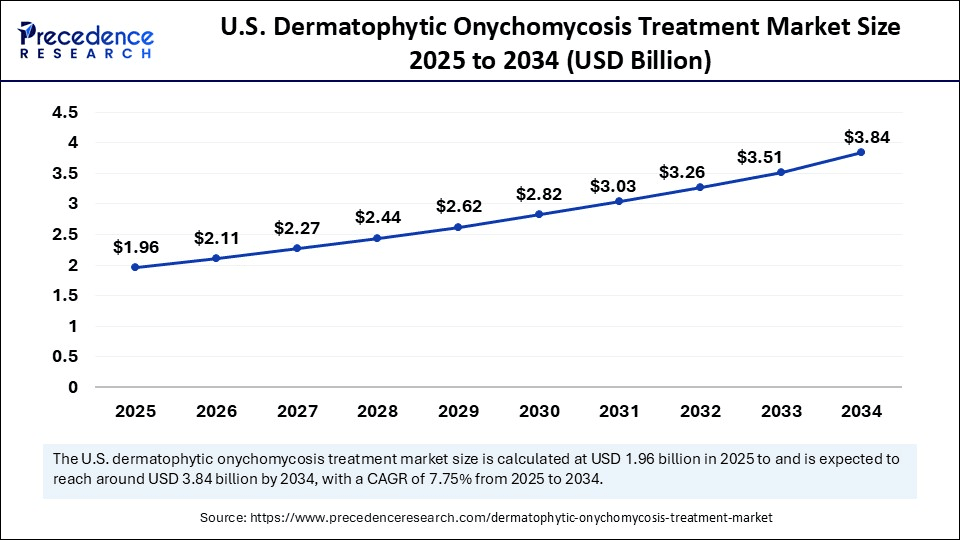

The U.S. dermatophytic onychomycosis treatment market size is exhibited at USD 1.96 billion in 2025 and is projected to be worth around USD 3.84 billion by 2034, growing at a CAGR of 7.75% from 2025 to 2034.

Which Region Dominated the Dermatophytic Onychomycosis Treatment Market?

North America is the frontrunner in the dermatophytic onychomycosis treatment market related to its superior healthcare and treatment capabilities, good awareness of nail fungus, and the wide availability of topical and oral therapies that are available early in the treatment process. This is aided by the engagement of the public health sector and established clinical services in clinical dermatology. With many pharmaceutical companies actively engaged in marketing prescription medications such as efinaconazole and tavaborole, we can see that awareness campaigns are also being run by numerous health organizations to aid their knowledge retention and foster a directive towards early diagnosis and early treatment. Additionally, the US FDA has recently granted approval for certain therapies, generic ones too that allow the end user to benefit, thus improving access and affordability.

The U.S. is leading the market largely due to the large patient population suffering from diabetes and common aging-related nail disorders; both conditions are risk factors for the dermatophytic onychomycosis development. In 2024 clinics across popular retail chains are making generic antifungal treatment more widely available; this approach to market has made treatment more affordable for the patient population. Furthermore, an influx of patients with fungal nail disorders to the dermatology clinics and podiatry clinics across the geographical states such as California and Florida, patient awareness was noticed to have increased due to a lack of knowledge of treatment options and direct-to-consumer marketing of topical antifungal treatments.

Why is Asia Pacific Emerging as the Fastest Growing Region?

Treatment demand in Asia Pacific is rapidly increasing because of improvements in health care accessibility, the rapidly increasing awareness of hygiene, and the increase in concern about individuals' ready access to skin and nail health in more urban areas. Countries in the region are seeing increased penetration of OTC fungal treatments and local prescription drug companies broadening their dermatology portfolios. Higher incidences of diabetes, where fungal infections tend to plague patients with uncontrolled blood sugars, humidity in many parts of Asia to aid fungal proliferation, and efforts to encourage patients to seek help sooner are defining this rapid uptake of antifungal treatments. Government health campaigns and increased digital health dissemination have driven demand for antifungal solutions.

China Dermatophytic Onychomycosis Treatment Market Trends

China has become the pressing story, due to improved domestic production of antifungal medications and better healthcare financing in urban and rural areas. In 2023, domestic drug companies wanting to capture share of the skin infections treatment were launching all manner of topical solutions into local markets. Various hospitals and dermatology centres in Shanghai and Beijing now employ improved diagnostics for nail fungus, enabling earlier detection and targeted therapy as soon as possible.

Europe Dermatophytic Onychomycosis Treatment Market Trends

Europe is also ranked fast growing product-market because its dermatology market is beyond mature but is still growing, and the increase in use of over-the-counter (OTC) medicines continues to drive performance. Patients are becoming more proactive in treating fungal nail infections in many countries across Europe for cosmetic reasons, as well as the better accessibility of these products. The rise of teledermatology and pharmacist-consult led treatment programs have also led to more patients seeking self-treatment. Also, preliminary lines of treatment by local providers and pharmacies are routinely modified with new antifungal formulations, especially when patients fail the previous lines of therapies.

Germany Dermatophytic Onychomycosis Treatment Trends

Germany is the leader in Europe due to its structured healthcare system and presence of large pharmaceutical manufacturers. In 2023, many of the local or European drug manufacturers launched topical antifungal creams and sprays, yielding the potential for better efficacy profiles and adverse effects. Pharmacists and technicians in Germany are the first point of contact for many patients with suspicious or early signs of fungal nail infections, leading to better early treatment rates. In addition, dermatology clinics are now pursuing laser therapy as an ongoing treatment option for patients with chronic or recurrent cases, with laser combined with their traditional treatment strategies.

Dermatophytic Onychomycosis Treatment Market Value Chain Analysis

- Research & Development (R&D) and Discovery

This stage focuses on identifying novel antifungal compounds, understanding the pathology of onychomycosis, and formulating new delivery methods.

Key Players: Novartis AG, Pfizer Inc., and Bausch Health Companies Inc. - Manufacturing & Formulation

This stage involves the large-scale production of active pharmaceutical ingredients (APIs), the formulation of final dosage forms, and rigorous quality control measures.

Key Players: Teva Pharmaceutical Industries Ltd., Bayer AG, and Dr Reddy's Laboratories Ltd. - Distribution & Sales

This stage involves the logistics, warehousing, marketing, and sales of onychomycosis treatments to hospitals, clinics, pharmacies, and patients.

Key Players: Walgreens Boots Alliance, CVS Health, Henry Schein, and McKesson Corporation. - Clinical Application & Post-Sales Service

This final stage focuses on the use of treatments by patients under professional guidance, monitoring for efficacy and side effects, and ensuring patient adherence to typically long treatment regimens.

Key Players: Healthcare Providers, Patient Advocacy Groups and Educational Platforms, and Pharmaceutical Companies' Pharmacovigilance Teams.

Top Companies in the Dermatophytic Onychomycosis Treatment Market & Their Offerings:

- Bausch Health Companies Inc.: Through its Ortho Dermatologics division, Bausch Health develops and commercializes various prescription dermatological products, including topical and oral treatments for onychomycosis.

- Pfizer Inc. (U.S.): Pfizer is a major player in the antifungal treatment market globally, offering a wide range of medications, including fluconazole (Diflucan), a commonly prescribed oral treatment for onychomycosis.

- Galderma (Switzerland): As a pure-play dermatology company, Galderma focuses on providing science-based solutions for skin, hair, and nail health.

- GlaxoSmithKline plc (GSK) (U.K.): GSK has a significant presence in consumer healthcare and pharmaceuticals, offering both prescription and over-the-counter (OTC) antifungal treatments.

- Janssen Pharmaceuticals, Inc. (U.S.): A pharmaceutical company of Johnson & Johnson, Janssen developed and markets itraconazole (Sporanox), another critical oral treatment used for onychomycosis.

- Cipla Inc. (India): As a leading global pharmaceutical company, Cipla manufactures and supplies a variety of affordable generic antifungal medications worldwide, including those used for onychomycosis.

- Kaken Pharmaceuticals Co., Ltd. (Japan): Kaken Pharmaceuticals is a significant contributor through its development of topical treatments like efinaconazole (Jublia/Clenafin), a highly effective solution for onychomycosis. Their innovation in topical delivery methods has provided a valuable alternative to oral medications.

Recent Developments

- In January 2024, Vanda Pharmaceuticals Inc. (Vanda) (Nasdaq: VNDA) today announced that the U.S. Food and Drug Administration (FDA) has approved the Investigational New Drug (IND) application to evaluate VTR-297 for the treatment of onychomycosis. Onychomycosis, or tinea unguium, is a fungal infection of the nail. Onychomycosis can result in discoloration of the nail, onycholysis (nail separation from the nail bed), and nail plate thickening.

Dermatophytic Onychomycosis Treatment Market Companies

- Bausch Health Companies Inc. (Canada)

- Pfizer Inc. (U.S.)

- Galderma (Switzerland)

- GlaxoSmithKline plc (U.K.)

- Janssen Pharmaceuticals, Inc. (U.S.)

- Cipla Inc. (India)

- Kaken Pharmaceuticals Co., Ltd. (Japan)

Segments Covered in the Report

By Product Type

- Tablets

- Nail Paints

By Route of Administration

- Oral

- Topical

By Type

- Prescribed

- Over-the-Counter (OTC)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting