Wjat is Die Attach Equipment Market Size?

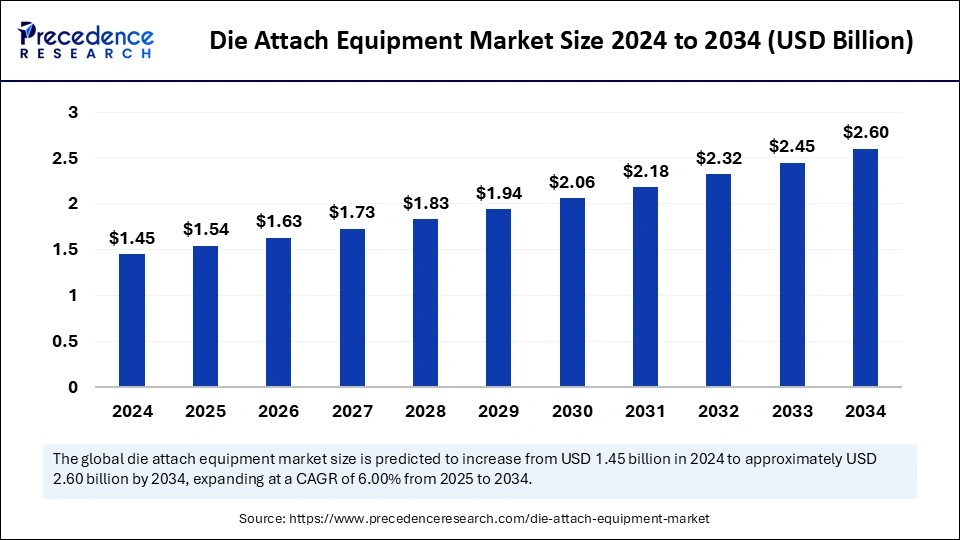

The global die attach equipment market size accounted for USD 1.54 billion in 2025 and is predicted to increase from USD 1.63 billion in 2026 to approximately USD 2.60 billion by 2034, expanding at a CAGR of 6.00% from 2025 to 2034. The rising demand for semiconductor devices is expected to boost the growth of the market during the forecast period. Ongoing technological advancements in semiconductor technology further support market growth.

Market Highlights

- Asia Pacific dominated the die attach equipment market in 2024.

- North America is expected to witness rapid growth in the coming years.

- By type, the die bonder segment dominated the market in 2024.

- By type, the flip chip bonder segment is projected to grow at a significant rate during the forecast period.

- By technique, the epoxy segment held the largest market share in 2024.

- By technique, the soft solder segment is anticipated to expand at a notable CAGR between 2025 and 2034.

- By application, the LED segment led the market in 2024.

- By application, the optoelectronics segment is expected to grow at a notable rate during the projection period.

How is AI contributing to the Die Attach Equipment Market?

Artificial intelligence (AI) is changing the landscape of the die attach equipment market. AI-driven systems can analyze real-time data from die attach equipment to identify any defects or misalignments, which enhances the precision of the die attach process. With AI algorithms, the die placement process can be optimized by considering factors like thermal stress. This helps to improve the durability and reliability of the connections between semiconductor chips and die pads.

AI's predictive maintenance capability identifies flaws in the equipment, avoiding sudden disruptions by enabling a more proactive maintenance approach. AI technology helps in engineering adhesives for specific applications, which helps boost long-term performance. AI integration in the die attach equipment helps improve precision, reliability, and efficiency and enables features like automation and predictive maintenance.

What is the Die Attach Equipment Market?

The die attach equipment is a crucial aspect of semiconductor packaging. This equipment helps permanently attach a semiconductor chip (die) to a substrate. The primary reason for the growth of the die attach equipment market is the incredible growth of the semiconductor industry. The increasing demand for consumer electronics across the world further influences the market. With the rising demand for compact and high-performance electronics, the utilization of this equipment has become vital.

The rising applications of semiconductors in different industries like automotive, healthcare, consumer electronics, and aerospace are propelling the market's growth. Technological advancements have improved the production and efficiency of die attach equipment, helping the market keep up with growing demand. Integration of technologies like AI, Internet of Things, and 5G in various industries is boosting the growth of the market. The rising investments by governments to boost the production of semiconductors further support market expansion.

Die Attach Equipment Market Growth Factors

- The rising demand for semiconductor chips is a major factor boosting the growth of the die attach equipment market.

- An increase in demand for consumer electronics, like smartphones, laptops, wearables, and TVs, is fueling the market's growth.

- The rising adoption of AI, the Internet of Things (IoT), and 5G technologies is further propelling market growth.

- The growing applications of semiconductors in industries like automotive, IT, telecommunications, and consumer electronics will continue boosting market growth.

- Advancements in the die attach equipment have enhanced precision and efficiency, broadening the scope of applications.

Market Outlook

- Industry Growth Overview: The demand for die attach equipment all over the world gets a boost from the market activity of AI, IoT, 5G, and automotive electronics.

- Sustainability Trends: The use of eco-friendly manufacturing processes gains ground as a result of the switch to adhesive materials instead of solders, which in turn leads to the reduction of hazardous substances and energy consumption.

- Global Expansion: Asia-Pacific is the beneficiary of the tech wave as the die attach technology gets the support of the local manufacturing ecosystems and attractive government incentives.

- Major Investors: The competitive landscape is shaped by ASM Pacific Technology, BE Semiconductor Industries, Kulicke & Soffa, Palomar Technologies, and Shinkawa through their collaboration in innovation.

- Startup Ecosystem: The market is becoming more technologically diverse as the new companies are introducing advanced packaging and power electronics solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.54 Billion |

| Market Size in 2026 | USD 1.63 Billion |

| Market Size by 2034 | USD 2.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.00% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technique, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Semiconductors

The increasing demand for semiconductors across the globe is a key factor driving the growth of the die attach equipment market. With a rise in applications, the demand for semiconductors is consistently increasing in various sectors like healthcare, consumer electronics, and automotive. For instance, according to the Semiconductor Industry Association (SIA), in 2024, the semiconductor sales reached USD 627.6 billion, which is an increase of 19% compared to the previous year.

Such a surge in sales of semiconductors is directly impacting the market growth of die attach equipment. Moreover, the increasing production of electronic devices further boosts the demand for semiconductors. With the rising adoption of 5G technology, high-performance data centers, and cloud computing, the need for semiconductor devices is increasing.

Restraint

High Cost

The high costs of die attach equipment are a major factor limiting the growth of the market. Substantial initial investment is required to obtain this equipment. This equipment also requires regular maintenance, adding to operation costs. This creates barriers, especially for small and medium-sized organizations. Moreover, producing die attach equipment requires high-quality materials and suitable infrastructure, leading to high production costs. As die attach equipment involves sophisticated technology, it requires skilled knowledge, encouraging semiconductor manufacturers to explore alternative methods like adhesive tapes.

Opportunity

Technological Advancements

Ongoing technological advancements create immense opportunities in the die attach equipment market, boosting innovations and efficiency of the equipment. Technologies like the Internet of Things (IoT) and AI led to the development of automated die attach equipment with improved efficiency and user-friendly features. Innovations in packaging techniques, such as wafer-level packaging, unlock new avenues for the development of sophisticated die attach equipment. Key players operating in the market are also focusing on improving the scalability of this equipment, which further supports market expansion.

Segment Insights

Type Insights

The die bonder segment led the die attach equipment market with the largest share in 2024. This segment growth is driven by the rise in demand for high-end consumer electronics, like laptops, smartphones, and UHD TVs. These devices are equipped with integrated circuits where the die bonder is widely utilized in semiconductor fabrication. The constant rise in the production of consumer electronics across the world will continue to boost the growth of this segment.

Meanwhile, the flip chip bonder segment is projected to grow at a significant rate during the forecast period. Flip chip bonders are suitable for innovative technologies like 3D and 2.5D semiconductor packaging, which improves the efficiency and reliability of electronic gadgets. The rising production of new-generation gadgets, which require sensors and networking connections, further supports segmental growth.

Technique Insights

The epoxy segment held the largest share of the die attach equipment market in 2024. Epoxy offers excellent resistance to thermal cycling, vibrations, and shock. The utilization of epoxy helps improve the longevity of adhesion, which enhances the life span of semiconductor chips. Such features make the epoxy technique a preferred choice, bolstering the growth of this segment.

On the other hand, the soft solder segment is anticipated to expand at a notable CAGR over the studied period. The ability of soft solder techniques to provide superior heat dissipation while improving necessary thermal characteristics and its low melting point makes it suitable for various applications like semiconductor connections on chips. This technique helps in avoiding connection failure that can be caused because of thermal stress.

Application Insights

The LED segment dominated the die attach equipment market in 2024. The segment growth is driven by the rise in the utilization of LEDs in different fields like marine, healthcare, horticulture, and consumer electronics. Semiconductor packaging plays a crucial role in enhancing the performance of LED products. The increasing demand for LED devices further supports segmental growth.

Meanwhile, the optoelectronics segment is expected to grow at a notable rate during the projection period. Optoelectronics find applications in industries like consumer electronics, telecommunications, and automotive. Die attach is essential in the thermal management of optoelectronics. The rising production of consumer electronics and automotive lighting systems is expected to boost segmental growth.

Regional Insights

Asia Pacific dominated the die attach equipment market by capturing the largest share in 2024. This region has a strong presence of semiconductor manufacturing companies, which is a key reason behind the region's market dominance. Governments of various Asian countries are investing heavily to boost the production of semiconductors. There is a high demand for consumer electronics which bolstered the market growth in the region.

Countries like China and India are leading contributors to the Asia Pacific die attach equipment market. India is emerging as a major player in semiconductor manufacturing, supporting market growth. China and India boast some of the leading IT, automobile, consumer electronics, and telecommunication companies, contributing to market growth. Moreover, the increasing government investments in semiconductor companies and the rising demand for consumer electronics boost the growth of the market in Asia Pacific.

- In March 2025, India Semiconductor Mission (ISM), Tata Semiconductor Manufacturing Private Limited, and Tata Electronics signed a fiscal support agreement. This agreement is signed to establish India's first commercial semiconductor fab in Dholera, Gujarat, India.

North America is expected to witness rapid growth in the coming years. The widespread adoption of innovative technologies and an established semiconductor industry in the region are likely to boost the market growth in the region. The region is home to some of the renowned semiconductor manufacturing companies like Intel and Qualcomm. With the increasing demand for sophisticated consumer electronics and advanced medical devices among the population, the demand for semiconductor chips is increasing.

There is a heightened demand for electric vehicles (EVs), boosting the need for semiconductor components. The integration and acceptance of advanced technologies like AI, 5G, Internet of Things (IoT), and wearables further support regional market growth. The U.S. stands out as the leading marketplace for die attach equipment. The country is one of the world's largest manufacturers of semiconductors, boosting the demand for die attach equipment.

Europe is observed to witness a notable growth in the foreseeable period. The region's well-established healthcare and automotive industries lead to the development of medical devices and automotive components, boosting the demand for semiconductors. The European governments are investing in the semiconductor industry, fostering innovations in die attach equipment. The region's commitment to sustainability and innovation in the industrial sector further boosts the development of energy-efficient die attach equipment. In addition, the increasing adoption of AI and IoT is expected to contribute to regional market growth.

Value Chain Analysis

- Raw Material Procurement: The sources of ultra-pure silicon wafers and process gases necessary for semiconductor manufacturing were obtained through raw material procurement.

Key Players: SUMCO, GlobalWafers, Siltronic; Gases: Air Products, Merck, Dow Chemicals - Wafer fabrication (Front-end): The process involved creating integrated circuits on silicon wafers through a series of fabrication steps in very clean and specialized buildings.

Key Players: TSMC, Intel, Samsung, GlobalFoundries - Photolithography and etching: The creation of semiconductor structures with a high level of accuracy was done by circuit tracing and material removal.

Key players: ASML, Lam Research, and Applied Materials - Doping and layering processes: The electrical properties and interconnect features were shaped by the introduction of dopants and the deposition of thin films.

Key Players: Applied Materials, Lam Research, Tokyo Electron (TEL), Hitachi High-Tech - Assembly and packaging: Wafers were sliced, dies were attached, and packaged devices were protected for long-lasting semiconductor performance.

Key Players: Amkor Technology, ASE Group, JCET Group

Die Attach Equipment Market Companies

- Fasford Technology Co. Limited

- Inseto UK Limited

- Shinkawa Limited

- BE Semiconductor Industries N.V

- MicroAssembly Technologies Limited

- ASM Pacific Technology Limited

- Palomar Technologies

- Dr. Tresky AG

- Panasonic Industry Co., Ltd.

- Kulicke

- Soffa Industries

Recent Developments

- In November 2025, Hanmi Semiconductor aims to launch the "Wide TC Bonder" for the next-gen HBM market by late 2026, addressing the shift towards wide HBM as vertical DRAM stacking reaches limits. (Source: https://www.businesskorea.co.kr)

- In July 2024, Indium Corporation launched its new Au-based Precision Die-Attach (PDA) Preforms. These preforms offer a high level of precision, along with high-yield performance and reliability, in critical die attach applications.

- In May 2024, an established company based in Netherlands, ITEC, announced that its ADAT3 XF TwinRevolve is able to achieve die bonding at up to 60,000 flip-chips per hour.

- In October 2024, Creative Materials launched two die-attach adhesives: 110-19(SD) and 129-50LS-2. These two electrically conductive semiconductor die-attach adhesives offer enhanced performance and durability, making them suitable for critical applications.

Segments Covered in the Report

By Type

- Flip Chip Bonder

- Die Bonder

By Technique

- Epoxy

- Soft Solder

- Sintering

- Eutectic

- Others

By Application

- RF and MEMS

- Optoelectronics

- Logic

- Memory

- CMOS image sensors

- LED

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting