Digital Remittance Market Size and Forecast 2025 to 2034

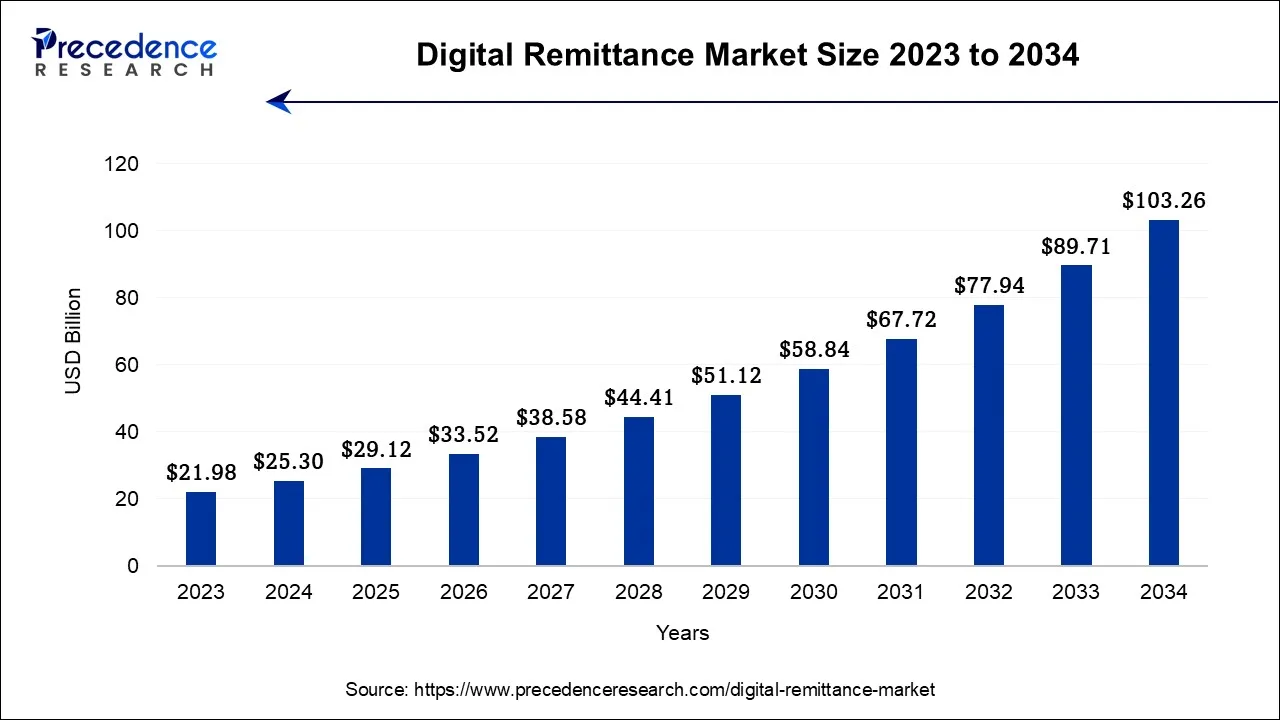

The global digital remittance market size was valued at USD 25.30 billion in 2024, and is projected to be worth around USD 29.12 billion by 2025, and is anticipated to reach around USD 103.26 billion by 2034, expanding at a CAGR of 15.1% over the forecast period from 2025 to 2034.

Digital Remittance Market Key Takeaways

- In terms of revenue, the market is valued at $29.12 billion in 2025.

- It is projected to reach $103.26 billion by 2034.

- The market is expected to grow at a CAGR of 15.1% from 2025 to 2034.

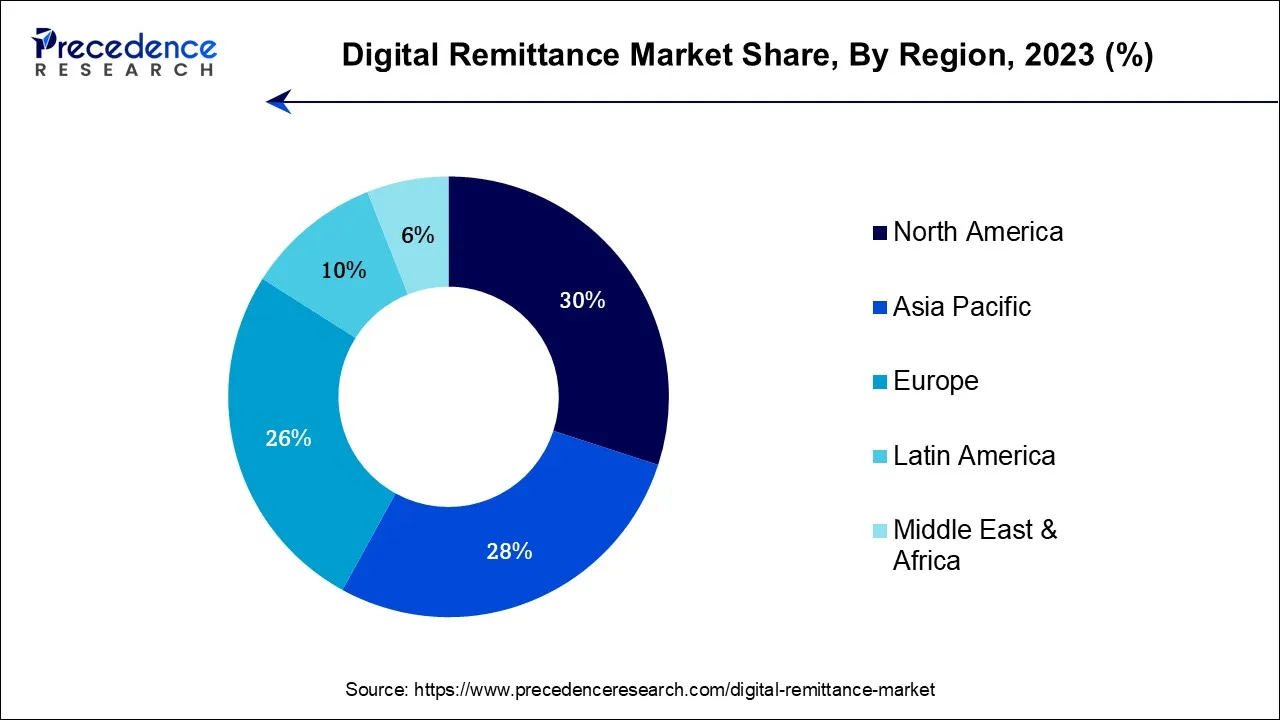

- North America led the global market with the highest market share of 30% in 2024.

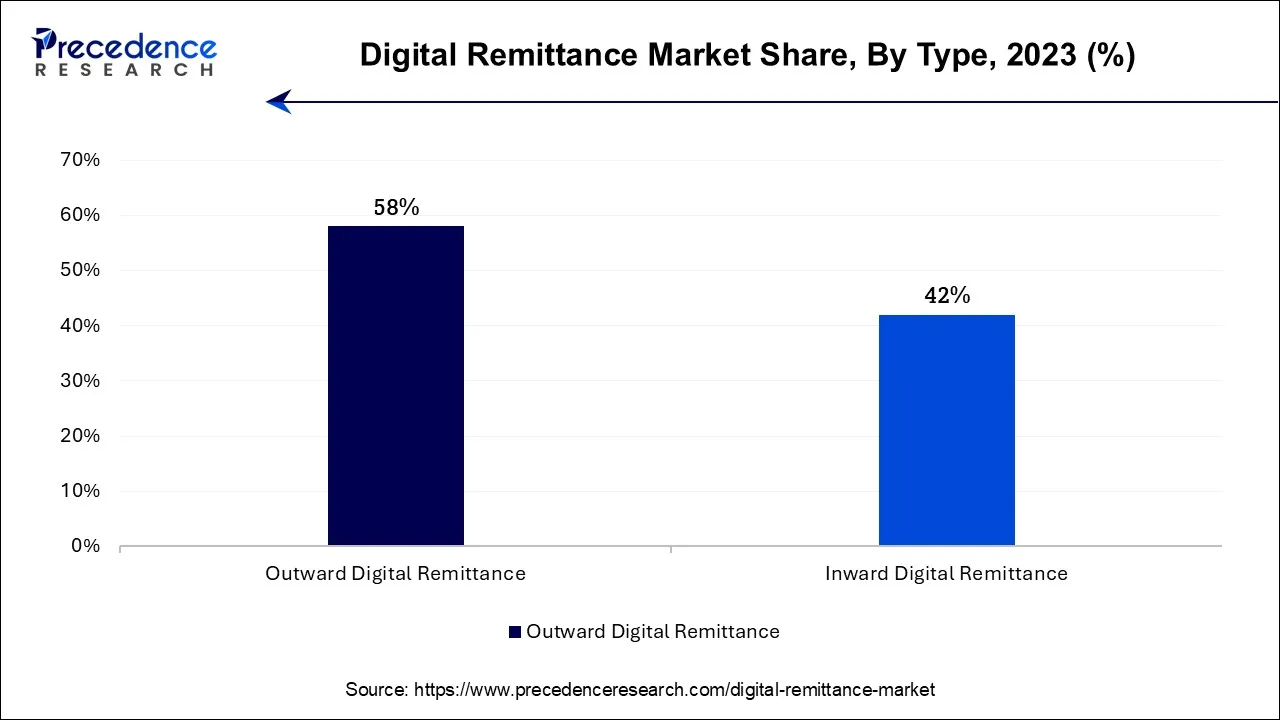

- By Type, the outward digital remittance segment contributed more than 58% of revenue share in 2024.

- By Type, the inward digital remittance segment is anticipated to grow at a remarkable CAGR of 18.7% during the projected period.

- By Channel, the money transfer operators segment had the largest market share of 39.8% in 2024.

- By Channel, the online platforms segment is predicted to expand at the fastest CAGR over the projected period.

- By End-use, the personal segment held the highest revenue share of 44.9% in 2024.

- By End-use, the migrant labor workforce segment is estimated to grow at a noteworthy CAGR of 15.9% over the predicted period.

U.S. Digital Remittance Market Size and Growth 2025 to 2034

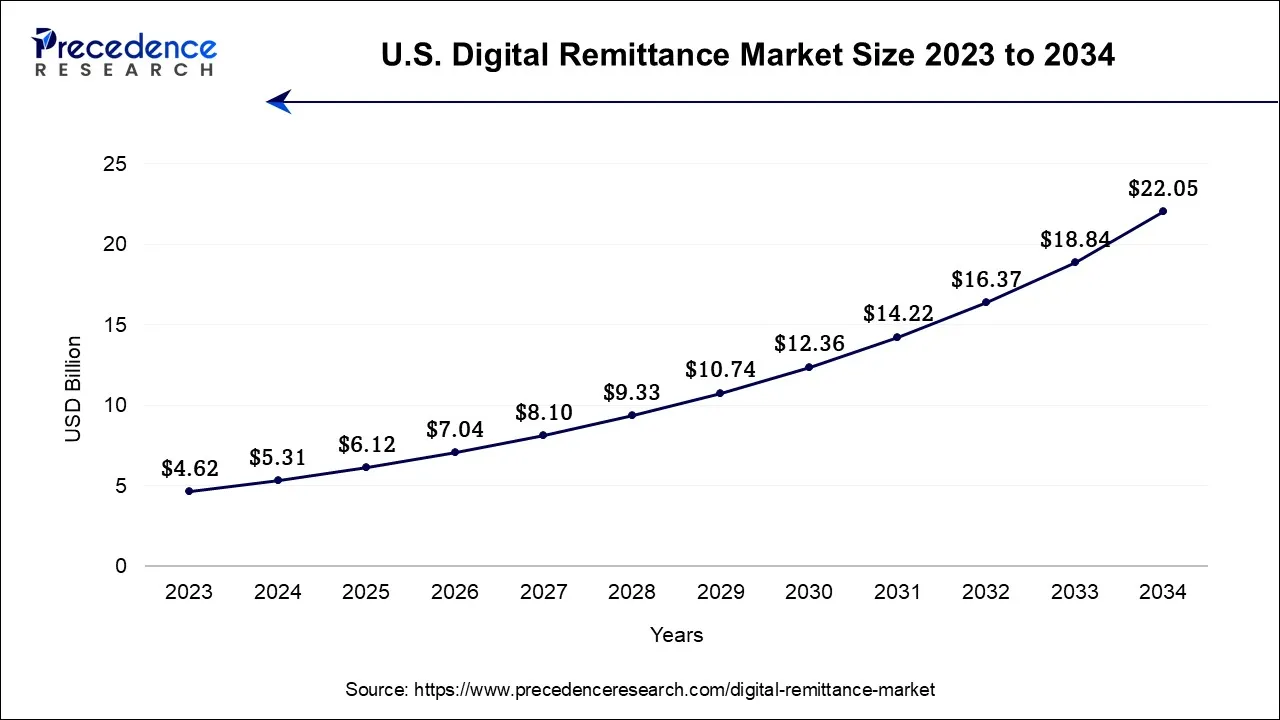

The U.S. digital remittance market size accounted for USD 5.31 billion in 2024 and is projected to be worth around USD 22.05 billion by 2034, poised to grow at a CAGR of 15.3% from 2025 to 2034.

North America has held the largest revenue share of 30% in 2024. North America claims a significant share in the digital remittance market due to several key factors. First, the region boasts a substantial immigrant population, including a considerable number of remittance senders, who rely on digital channels for cross-border money transfers. Second, the well-developed financial infrastructure and high internet penetration rates in North America facilitate the adoption of digital remittance services. Furthermore, a competitive landscape and the presence of leading fintech companies offering innovative remittance solutions contribute to North America's dominant market position. Finally, a strong regulatory framework instills trust among users, further fueling the region's market share.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific secures a dominant growth in the digital remittance market due to several pivotal factors. Firstly, it boasts a substantial migrant worker population who frequently remit funds to their countries of origin, generating robust demand for cross-border remittance solutions. Secondly, the region's robust economic growth and accelerated digitalization have propelled the adoption of online and mobile payment platforms, fostering market expansion. Lastly, the supportive regulatory environment and government policies promoting fintech and digital payment initiatives, particularly in nations such as India, China, and the Philippines, have further catalyzed the growth of digital remittance services, reaffirming Asia-Pacific's prominent market growth.

Market Overview

The digital remittance market encompasses the utilization of digital advancements within the financial sector to facilitate the seamless transfer of funds across international borders. It entails the electronic transmission of money across nations, predominantly through online platforms or mobile applications, which offer unparalleled convenience, rapidity, and cost-efficiency in contrast to conventional channels.

This market has witnessed substantial expansion in recent times, propelled by globalization, augmented international migration, and the heightened adoption of digital payment solutions. Entities operating within this market provide services that empower individuals and enterprises to conduct international money transfers, rendering it an indispensable element of the worldwide financial landscape and a vigorously competitive sector characterized by continuous technological advancements.

Key Factors Influencing the Future Market Trends

- Smartphone penetration and internet access: More access to smartphones and the Internet allows for easier and faster transfers of digital money, particularly in emerging markets with generally limited banking infrastructure.

- Growing migration and cross-border employment: With more migration and cross-border employment globally, workers are increasing their demand for reliable and affordable digital remittance services to send money back home.

- Fintech innovation and API integrations: Fintech evolution and API (Application Programming Interface) based models are reducing friction in remittance services, allowing for a greater user experience and real-time transfers across different currencies and financial platforms.

- Government and regulatory support: Supportive policies and regulations in many countries are fostering a transition from cash-based remittances to secure digital remittance services with traceability.

Digital Remittance Market Growth Factors

The digital remittance sphere has emerged as a dynamic and transformative segment within the financial realm. It revolves around harnessing digital technology to expedite secure cross-border money transfers. This innovative approach has garnered attention due to its efficiency, cost-efficiency, and user-friendliness, surpassing conventional remittance methodologies. Key players offer online platforms and mobile applications that empower individuals and enterprises to conduct global fund transfers, cementing the digital remittance market as an integral component of the worldwide financial framework.

Numerous pivotal trends and growth catalysts are steering the digital remittance market's trajectory. Foremost among these is the rapid globalization and heightened international mobility, which amplifies the demand for streamlined cross-border fund transfers. Moreover, the ubiquitous adoption of smartphones and internet connectivity has further accelerated the digital remittance market's expansion, rendering it accessible to a wider audience. The ongoing evolution of blockchain and cryptocurrency-based remittance solutions also holds substantial potential, offering swifter and more secure transactions while reducing transaction costs.

Despite its promising prospects, the digital remittance sector encounters distinct challenges. Compliance with intricate regulations and disparate financial norms across diverse nations can pose formidable obstacles for service providers. Moreover, persistent concerns pertaining to cybersecurity and data privacy remain pertinent, given the industry's handling of sensitive financial data. Market competition is fierce, compelling companies to continually innovate to stand out and seize market share. Economic volatility and fluctuations in exchange rates can also impact the appeal of digital remittances for consumers.

Within these challenges lie significant business prospects. Concentrating on regulatory adherence and forging strategic alliances with financial institutions can aid companies in navigating the intricate regulatory landscape. Innovations in cyber security and data safeguarding can cultivate trust among users, positioning a provider as a secure option. The rising prominence of digital currencies and blockchain technology opens doors for companies to pioneer fresh, efficient remittance solutions. Furthermore, broadening service offerings to underserved regions and enhancing user experiences through intuitive interfaces can unlock hitherto untapped markets.

In summation, the digital remittance market is undergoing remarkable expansion propelled by globalization, technological advancements, and evolving consumer preferences. Nonetheless, it is not devoid of its share of challenges, ranging from regulatory intricacies to cybersecurity apprehensions. Nevertheless, these challenges can be transformed into opportunities through strategic initiatives and inventive solutions, positioning the digital remittance market as a pivotal player in the continually evolving landscape of international finance.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 103.26 Billion |

| Market Size in 2025 | USD 29.12 Billion |

| Market Size in 2024 | USD 25.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.1% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Channel, End-use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Globalization and international migration

Globalization and the surge in international migration play pivotal roles in propelling the digital remittance market's expansion. Firstly, the ongoing process of globalization fosters increased cross-border economic interactions and global trade, heightening the demand for efficient, cost-effective cross-border money transfer solutions. Digital remittance services aptly cater to this need, providing rapid, accessible, and often more economical avenues for international fund transfers, aligning seamlessly with the interconnected nature of contemporary global commerce. Secondly, the uptick in international migration has given rise to a larger diaspora of individuals residing and working abroad, many of whom regularly send financial support to their families and networks in their countries of origin.

Digital remittances emerge as a dependable and expeditious conduit for channeling these funds, ensuring that financial assistance reaches its intended recipients promptly and effectively. This reliance on digital remittance mechanisms underscores their relevance in serving a diverse, globally dispersed user base, thereby fortifying the market's role as a vital element within the intricate web of international finance.

Restraint

Cybersecurity risks

Cybersecurity risks present a significant restraint on the digital remittance market's growth. As these services handle sensitive financial data and transactions, they become prime targets for cybercriminals seeking to exploit vulnerabilities. Security breaches, data theft, or fraudulent activities can erode user trust and confidence in digital remittance platforms. Such incidents not only result in financial losses for users but also inflict reputational damage on service providers, hindering market growth.

To mitigate these risks, digital remittance companies must allocate substantial resources to cybersecurity measures, including encryption, multi-factor authentication, and continuous monitoring. These investments add to operational costs and can reduce profit margins, impacting the competitiveness of digital remittance services. Moreover, regulatory bodies increasingly require stringent cybersecurity compliance, necessitating ongoing adaptations and investments to meet evolving standards. Failure to meet these regulatory requirements can result in legal challenges and penalties, further restraining market growth. Overall, the persistent and evolving nature of cybersecurity threats poses a substantial challenge to the digital remittance market's expansion and sustainability.

Opportunities

Blockchain and cryptocurrency integration

The integration of blockchain technology and cryptocurrencies within the digital remittance market is forging compelling opportunities for advancement and expansion. Blockchain's decentralized, immutable ledger system offers heightened security, transparency, and traceability, cultivating trust among users seeking dependable and secure cross-border transaction solutions, thus propelling market adoption. Meanwhile, cryptocurrencies, particularly stablecoins, introduce the potential for swift and cost-effective international transfers, effectively bypassing conventional intermediaries such as banks. This can translate into more competitive pricing and faster transaction settlements, effectively addressing longstanding grievances associated with traditional remittance methods.

Furthermore, the versatility of blockchain and cryptocurrencies allows providers to penetrate previously underserved markets with limited banking infrastructure, significantly broadening the market's accessibility and global reach. With these technologies continually maturing and gaining acceptance, digital remittance entities that embrace them can distinguish themselves, captivate tech-savvy clientele, and innovate new revenue streams, strategically positioning themselves for success within this rapidly evolving industry.

Type Insights

According to the Type, the outward digital remittance sector has held 58% revenue share in 2024. The outward digital remittance segment holds a major share in the market due to several reasons. Firstly, it caters to the substantial demand from individuals and businesses sending money across borders to support families, invest, or conduct international trade. Secondly, the segment benefits from the convenience, speed, and cost-effectiveness of digital platforms compared to traditional methods.

Additionally, globalization and increased international migration have fueled the need for outward remittances. Lastly, providers have focused on expanding their outbound services to reach a wider customer base, solidifying the segment's dominance in the digital remittance market.

The inward digital remittance sector is anticipated to expand at a significantly CAGR of 18.7% during the projected period. The inward digital remittance segment commands a substantial growth in the market due to several key factors. Firstly, it caters to the significant volume of international migrants who send money to their home countries, reflecting the growing trend of global migration. Secondly, it benefits from the convenience and cost-effectiveness of digital platforms, which are often preferred by recipients. Additionally, inbound remittances are generally less susceptible to regulatory barriers compared to outbound transfers. As a result, service providers focus on enhancing the accessibility, speed, and competitive pricing of inward digital remittance services, contributing to their dominant market growth.

Channel Insights

In 2024, the money transfer operators sector had the highest market share of 39.8% on the basis of the Channel. Money transfer operators (MTOs) hold a significant share in the remittance market due to their established networks, wide accessibility, and trusted brand recognition. They have built robust partnerships and extensive agent networks, allowing them to reach even remote areas. Additionally, MTOs offer various options for sending and receiving money, catering to diverse customer preferences. Their familiarity and long-standing presence in the market instill confidence in users, particularly in regions with limited digital infrastructure. While digital remittance is growing, MTOs continue to play a vital role in serving the needs of millions of customers, contributing to their dominant market share.

The online platforms is anticipated to expand at the fastest rate over the projected period. Online platforms command a substantial growth in the digital remittance market primarily due to their user-friendly interfaces, convenience, and round-the-clock accessibility. These platforms empower users to initiate cross-border fund transfers effortlessly, utilizing their devices from virtually anywhere.

The ubiquity of smartphones and internet connectivity has further amplified the dominance of online platforms. Moreover, they frequently provide competitive exchange rates and reduced transaction costs in comparison to conventional banking avenues or physical remittance agents. Consequently, consumers and enterprises are increasingly opting for the rapidity, cost-effectiveness, and ease of use offered by online platforms, underscoring their significant market growth.

End-use Insights

The personal segment held the largest revenue share of 44.9% in2024. The personal segment holds a major share in various markets due to its substantial user base and diverse needs. In the context of digital remittance, the personal segment includes individual users sending money to family members, friends, or for personal expenses. This segment dominates the market because of the sheer volume of personal transactions made on a regular basis, often driven by factors like international migration, education, and financial support for loved ones. The convenience, speed, and cost-effectiveness of digital remittance services appeal to this broad user base, making it a dominant force in the market.

The migrant labor workforce is anticipated to grow at a significantly faster rate, registering a CAGR of 15.9% over the predicted period. The migrant labor workforce segment exerts significant growth on the market owing to its substantial impact on cross-border remittances. Migrant workers consistently remit a substantial portion of their earnings to their home nations, supporting their families and local communities. Consequently, they heavily rely on digital remittance services for efficient, cost-effective money transfers. The sheer magnitude of the global migrant labor force, coupled with the frequency and magnitude of their financial transactions, positions them as a dominant and influential user category, cementing their role as a primary driving factor within the digital remittance market.

Digital Remittance Market Companies

- Azimo Limited

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings, Inc.

- Ria Financial Services Ltd.

- TransferGo Ltd.

- TransferWise Ltd.

- Western Union Holdings, Inc.

- WorldRemit Ltd.

Recent Developments

- In February 2025, Western Union and Penny Pinch announced the launch of international money transfer services within the Penny Pinch app. The co-branded service enables customers in the country to send and receive money globally, based on their convenience and needs.

- In March 2025, XLink Communications, a Vodacom subsidiary, unveiled XLink Send, a new remittance-as-a-service solution designed to streamline cross-border payments across Africa. This launch marks a significant step toward improving financial accessibility for individuals and businesses that rely on seamless money transfers across borders.

- In April 2025, VirgoCX forged an alliance with Web3 Banking operating system Vaulta to launch VirgoPay, launch stablecoin-based remittance network. The service will allow users to fund transactions through local payment methods such as bank transfers and card payments, or directly from a cryptocurrency wallet.

- In April 2025, e& Egypt launched instant transfers via digital wallet. The feature is currently active for all users of the digital wallet and allows direct fund receipt via mobile devices. It was developed in collaboration with Banque du Caire, which serves as the company's banking partner for the initiative.

- In April 2025, Emirates NBD, a leading banking group in the Middle East, North Africa, and Türkiye (MENAT) region, partnered with Visa, a global leader in digital payments, to become the first bank in the UAE to launch Visa+ (Visa Direct Alias Directory) for its customers.

- In 2022, Western Union made a significant move by acquiring Uphold, a digital currency exchange. This strategic acquisition positions Western Union to broaden its array of remittance choices, notably introducing cryptocurrency options for its customer base.

- In 2022, PayPal strengthened its digital remittance services by acquiring Curv, a digital asset security firm. This acquisition bolsters PayPal's security capabilities, enhancing the safety of its digital remittance offerings.

- In 2022, acquired TransferWise, a fellow digital remittance company. This merger forms a more expansive and diverse digital remittance provider, catering to a broader spectrum of user needs.

- In 2021, Ant Group, the parent company of Alipay, joined forces with Western Union, forging a partnership aimed at facilitating cross-border remittances in China. This collaboration simplifies and economizes the process of sending money overseas for Chinese consumers.

- In 2021, Mastercard collaborated with Remitly, a digital remittance company. This partnership equips Mastercard cardholders with a streamlined avenue for sending funds to Mexico, ensuring greater ease and convenience in supporting their loved ones south of the border.

- In August 2021,WorldRemit Ltd. launched its money transfer services in Malaysia, allowing WorldRemit users to send money from Malaysia, in addition to 50 other countries, including the U.S. and the U.K., to more than 130 destinations.

Segments Covered in the Report

By Type

- Inward Digital Remittance

- Outward Digital Remittance

By Channel

- Banks

- Money Transfer Operators

- Online Platforms

- Others

By End-use

- Migrant Labor Workforce

- Personal

- Small Businesses

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting