What is the Direct Air Capture Market Size?

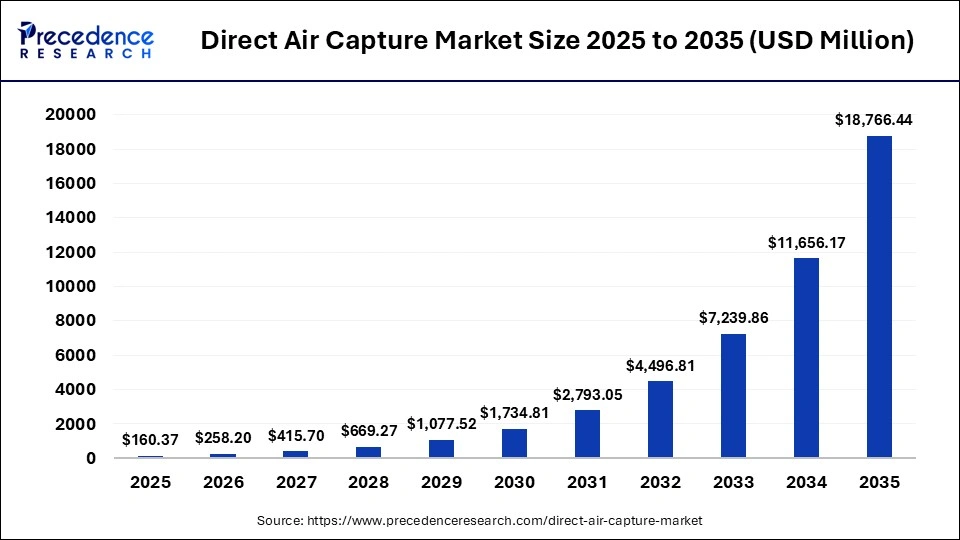

The global direct air capture market size accounted for USD 160.37 million in 2025 and is predicted to increase from USD 258.20 million in 2026 to approximately USD 18,766.44 million by 2035, expanding at a CAGR of 61.00% from 2026 to 2035. The market is driven by the rising consumer awareness to reduce CO2 emissions, along with the rapid investment by the heavy industries in deploying advanced DAC solutions to remove excessive CO2. Moreover, the surging adoption of Liquid-DAC (L-DAC) in the oil & gas industry, as well as technological advancements in the manufacturing sector is playing a prominent role in shaping the industrial landscape.

Market Highlights

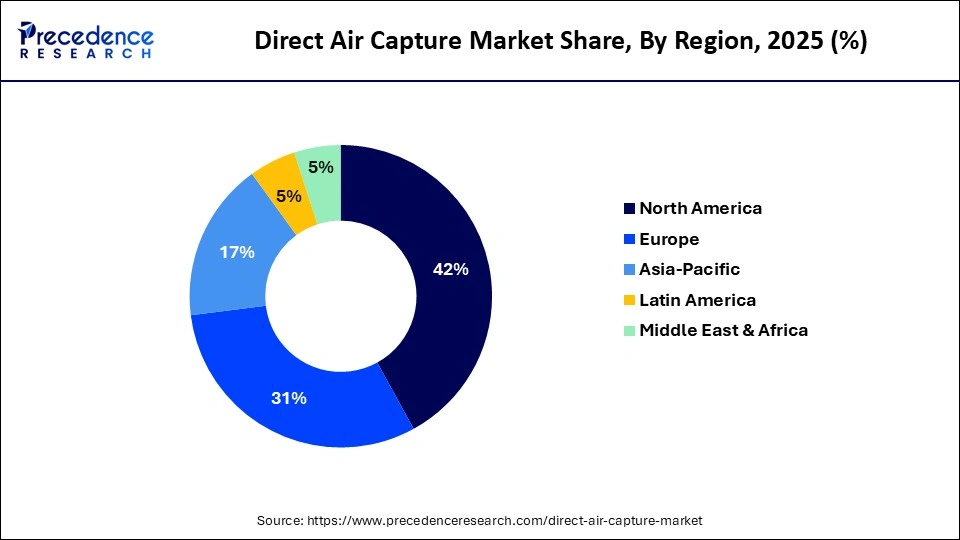

- North America led the direct air capture market with the largest share of around 42% in 2025.

- Asia Pacific is expected to expand at the highest CAGR from 2026 to 2035.

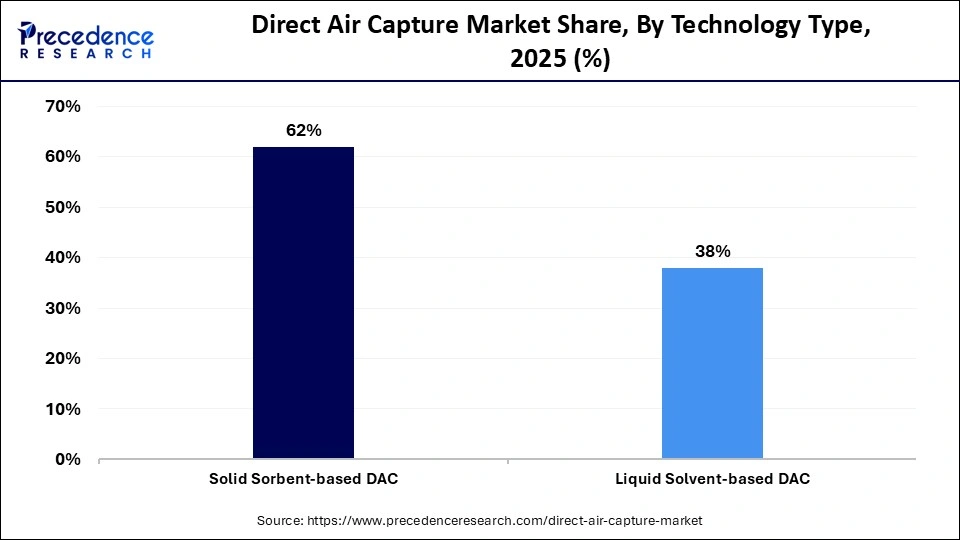

- By technology type, the solid sorbent-based DAC segment held the largest market share of 62% in 2025.

- By technology type, the liquid solvent-based DAC segment is expected to grow at a remarkable CAGR between 2026 and 2035.

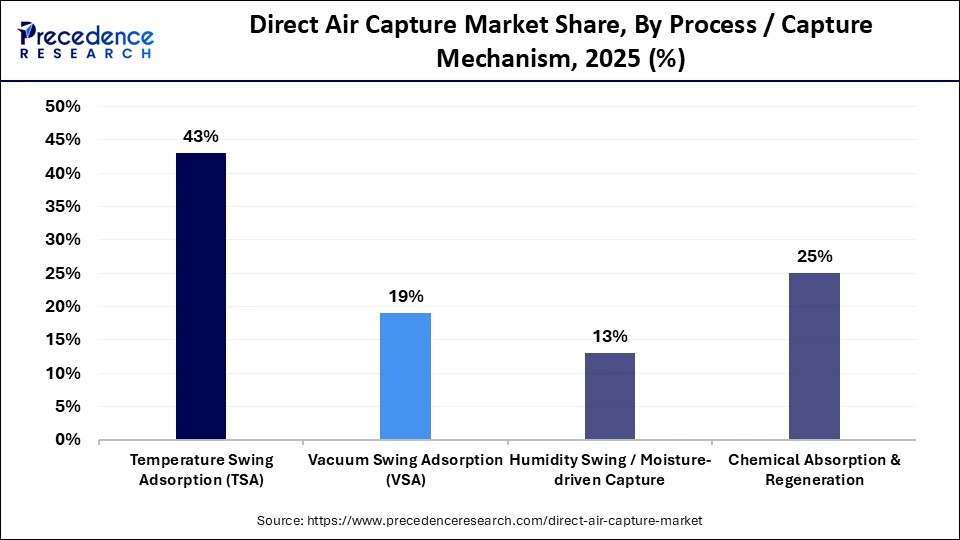

- By process / capture mechanism, the temperature swing adsorption (TSA) segment dominated the market with a share of 43% in 2025.

- By process / capture mechanism, the humidity swing / moisture-driven capture segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By service / value chain type, the DAC plant development & EPC segment held the largest market share of 38% in 2025.

- By service / value chain type, the carbon removal MRV & digital services segment is expected to expand at the fastest rate between 2026 and 2035.

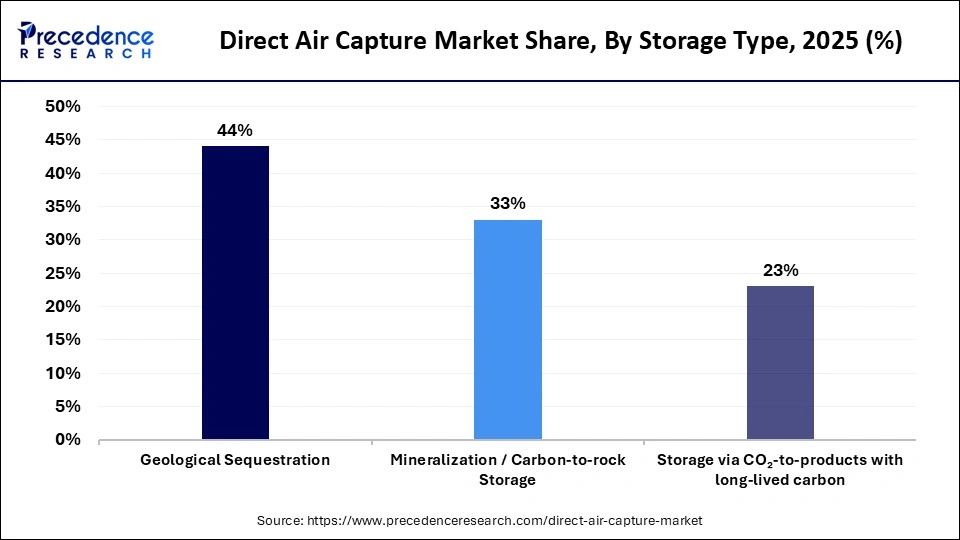

- By storage type, the geological sequestration segment dominated the market with a 44% share in 2025.

- By storage type, the mineralization / carbon-to-rock storage segment is expected to grow at the highest CAGR between 2026 and 2035.

What is the Significance of the Direct Air Capture System?

A direct air capture system is an advanced system that helps to capture carbon dioxide (CO2) directly from the ambient air. This system acts as a filter that draws a large volume of ambient air and passes it through a capture medium that binds with CO2, letting other components pass through. The growing emphasis of the aviation companies deploying advanced air capture systems in airports for reducing CO2 emissions, as well as technological advancements in the energy and power industry, is expected to drive the growth of the market.

How is AI Influencing the Direct Air Capture Market?

AI is significantly influencing the market. Nowadays, AI has been integrated into Direct Air Capture (DAC) units for optimizing efficiency, lowering costs, and accelerating material discovery. Also, AI revolutionizes Direct Air Capture (DAC) solutions by improving site selection, enhancing predictive modelling, and advancing energy management. Additionally, AI helps in real-time monitoring of CO2 emissions and improving energy efficiency in DAC systems.

- In August 2025, Meta's Fundamentalartificial intelligence Research (FAIR) collaborated with Cusp AI and the Georgia Institute of Technology. This collaboration aims at accelerating the discovery of DAC sorbent materials using AI.

What are the Major Trends Influencing the Direct Air Capture Market?

- Partnerships: Numerous shipping services brands are partnering with tech providers to deploy commercial DOC plants across the world. For instance, in March 2025, Mitsui O.S.K. Lines (MOL) signed a landmark agreement with Captura Corp to purchase 30,000 carbon removal credits, becoming the first company to secure large-volume COâ‚‚ removal using Direct Ocean Capture (DOC) technology. The credits will be delivered from Captura's early commercial DOC facilities by 2030, supporting MOL's net-zero 2050 commitment.

- Government Initiatives: The governments of several countries, including the U.S., Germany, the UAE, Norway, and Brazil, are launching several initiatives to lower CO2 emissions in the environment. For instance, in August 2025, the government of Norway announced an investment of 15 billion. This investment is made to launch the Norwegian Global Emission Reduction (NOGER) Initiative for lowering emissions in this nation.

- Innovations: Several market players are engaged in innovating advanced air capture systems for the end-users around the globe. For instance, in September 2025, DACLab launched Kelvin. Kelvin is an advanced DAC system designed to commercialize carbon removal solutions for e-fuels companies and CO2 sequestration operators.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 160.37 Million |

| Market Size in 2026 | USD 258.20 Million |

| Market Size by 2035 | USD 18,766.44 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 61.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology Type, Process/Capture Mechanism, Service/Value Chain Type, Storage Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Type Insights

Why is the Solid Sorbent-Based DAC Segment Leading the Direct Air Capture Market?

The solid sorbent-based DAC segment led the market with the largest share of 62% in 2025 and is expected to maintain its growth trajectory in the upcoming period. This is mainly due to its higher COâ‚‚ capture efficiency, lower energy requirements, and modular scalability compared to alternative technologies. Solid sorbent-based direct air capture (DAC) uses solid materials (sorbents) to chemically bind and remove COâ‚‚ directly from the atmosphere. Additionally, numerous advantages of solid sorbent-based direct air capture (DAC), including better water management, high CO2 selectivity, and suitability for low-grade waste heat drives its adoption.

The liquid solvent-based DAC segment is expected to grow at a remarkable CAGR over the forecast period due to its ability to capture large volumes of COâ‚‚ efficiently, making it suitable for industrial-scale applications. Liquid solvent-based DAC solution removes CO2 directly from ambient air for storage or utilization (CCUS), which enables climate change mitigation. Moreover, numerous advantages of liquid solvent-based DAC, such as low operating cost, high-temperature regeneration, high scalability, and favorable heat transfer is expected to boost its adoption.

Process/Capture Mechanism Insights

What Made Temperature Swing Adsorption (TSA) the Dominant Segment in the Market?

The temperature swing adsorption (TSA) segment dominated the direct air capture market with a share of 43% in 2025. This is mainly due to the increased use of temperature swing adsorption (TSA) to separate and purify gases by cycling between low-temperature adsorption and high-temperature regeneration. Moreover, numerous advantages of temperature swing adsorption (TSA), such as handling high impurities, enhanced purity & recovery, and low-pressure operation, are expected to propel the growth of the segment.

The humidity swing / moisture-driven capture segment is expected to grow at the highest CAGR during the forecast period. The growth of the segment is driven by the growing application of humidity swing / moisture-driven capture systems to remove CO2 directly from the atmosphere at ambient temperatures. Additionally, several advantages of humidity swing / moisture-driven capture, including minimal energy consumption, energy-efficient regeneration, and low-temperature operation, are expected to accelerate the growth of the segment.

Service/Value Chain Type Insights

Why Did the DAC Plant Development & EPC Segment Dominate the Direct Air Capture Market?

The DAC plant development & EPC segment dominated the market while holding the largest share of 38% in 2025 because it provides end-to-end solutions for designing, building, and commissioning large-scale DAC facilities. These services ensure efficient integration of capture technologies, compliance with safety and environmental standards, and optimized plant performance, which are critical for commercial viability. Furthermore, the rise in government-backed initiatives and private investments in DAC projects has further strengthened the demand for specialized EPC services, contributing to the segment's dominance.

The carbon removal MRV & digital services segment is expected to grow with the highest CAGR during the forecast period due to the increasing need for transparent, reliable, and verifiable carbon accounting to meet regulatory requirements and corporate net-zero commitments. These services enable real-time monitoring of COâ‚‚ capture, storage performance, and lifecycle emissions, building trust with investors, policymakers, and customers. Additionally, the integration of digital platforms, data analytics, and blockchain technologies is enhancing accuracy and scalability, driving strong adoption across emerging DAC projects.

Storage Type Insights

What Made Geological Sequestration the Dominant Segment in the Direct Air Capture Market?

The geological sequestration segment dominated the market with a major revenue share of around 44% in 2025. This is mainly due to the increased use of geological sequestration for capturing carbon dioxide (CO2) by industrial sources and storing it deep underground in rock formations. Additionally, numerous advantages of geological sequestration storage solutions, including permanence, high storage capacity, and technical viability, are likely to sustain segmental growth in the coming years.

The mineralization / carbon-to-rock storage segment is expected to grow with the highest CAGR during the forecast period. This is primarily due to the rising use of carbon-to-rock storage solutions for converting captured carbon dioxide into stable solid rock. Moreover, several advantages of carbon-to-rock storage systems, such as minimal leakage risk, rapid conversion time, and a safe storage mechanism, are expected to propel the growth of the segment.

Regional Insights

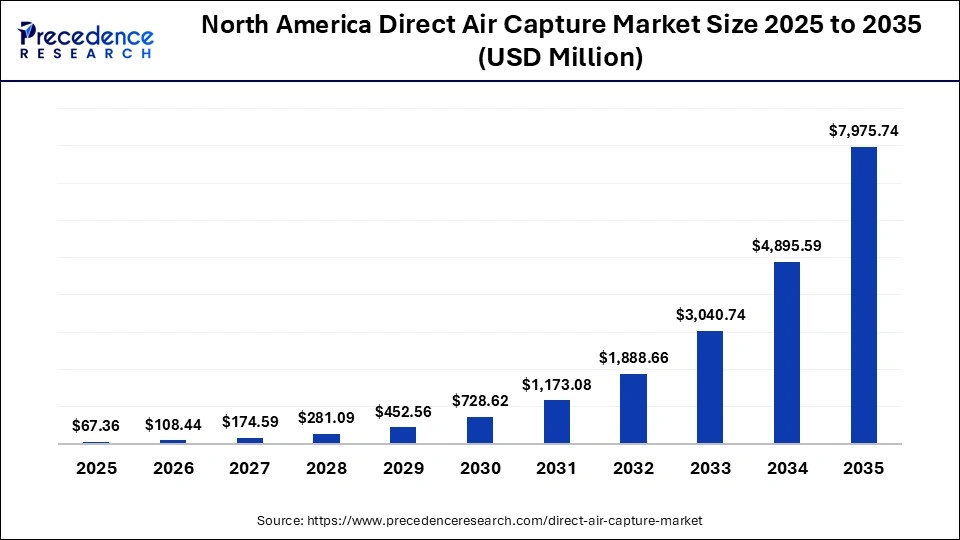

How Big is the North America Direct Air Capture Market Size?

The North America direct air capture market size is estimated at USD 67.36 million in 2025 and is projected to reach approximately USD 7,975.74 million by 2035, with a 61.19% CAGR from 2026 to 2035.

Why Did North America Dominate the Direct Air Capture Market in 2025?

North America dominated the direct air capture market with a major revenue share of around 42% in 2025. This is primarily due to the increased deployment of Liquid-DAC (L-DAC) solutions in the corporate sector across the U.S., Canada, and Mexico. Also, the rapid investment by the government for lowering CO2 emissions, along with the increasing focus of energy companies on constructing new direct air capture units, is positively contributing to the region's market dominance. Moreover, the presence of various market players, such as Carbon Engineering ULC, Heirloom Carbon Technologies, and CarbonCapture Inc., is expected to ensure the long-term market growth in the region.

- In June 2024, Heirloom Carbon Technologies announced an investment of US$ 475 million. This investment is made for constructing an air capture facility in Louisiana, U.S.

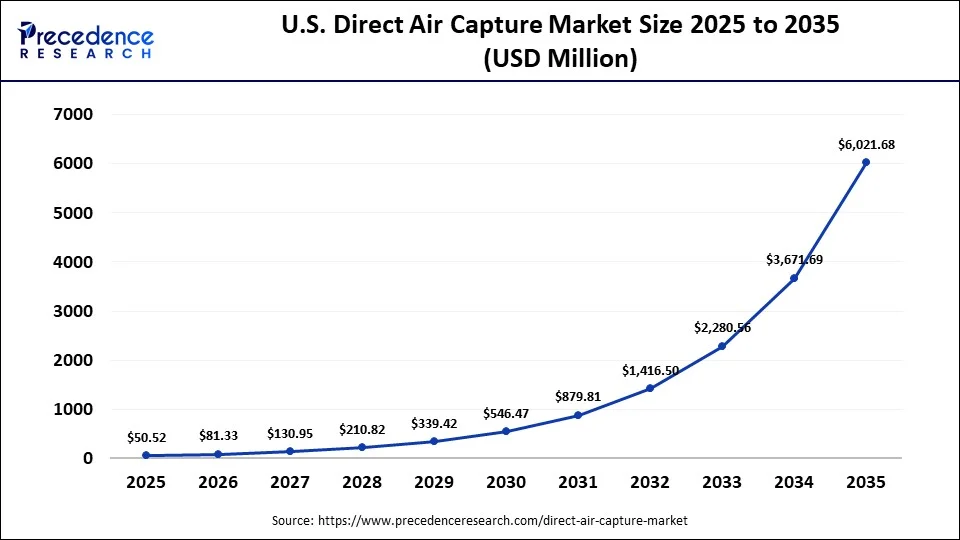

What is the Size of the U.S. Direct Air Capture Market?

The U.S. direct air capture market size is calculated at USD 50.52 million in 2025 and is expected to reach nearly USD 6,021.68 million in 2035, accelerating at a strong CAGR of 61.30% between 2026 and 2035.

U.S. Direct Air Capture Market Analysis

The market in the U.S. is growing due to the increasing focus of automakers to deploy advanced DAC systems in their production plants to lower CO2 emissions. Additionally, numerous government initiatives aimed at reducing emissions, as well as the rapid investment by the aviation companies for integrating advanced solutions for lessening emission is playing a prominent role in shaping the industrial landscape.

Why is Asia Pacific Considered the Fastest-Growing Region in the Direct Air Capture Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This is mainly due to the growing adoption of solid sorbent-based DAC by the energy & industrial companies across several nations, including China, India, Japan, South Korea, and Australia. Also, numerous government initiatives aimed at deploying advanced solutions in the research centers to lower CO2 emission is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players, such as Core CarbonX, Devic Earth, Abhitech, Ducon Infratechnologies, NABLA Mobility, and Tialoc, is expected to accelerate the growth of the market in this region.

- In September 2025, Ducon Infratechnologies launched a new R&D Program in India. This program is designed to develop solvent-based carbon capture technology for the end-users in this nation.

China Direct Air Capture Market Trends

China is a major contributor to the market within Asia Pacific. The rising deployment of liquid solvent-based DAC solutions in the electronics manufacturing industry for lowering carbon dioxide emissions is driving the market in China. Additionally, technological advancements in the automotive sector, as well as the rapid investment in carbon storage systems are positively contributing to the market.

Who are the Major Players in the Global Direct Air Capture Market?

The major players in the direct air capture market include Climeworks, Carbon Engineering ULC., Global thermostat, Skytree, RepAir, Heirloom Carbon Technologies, Soletair Power, CarbonCapture Inc, Avnos, Inc., and Noya PBC.

Recent Developments

- In September 2025, Carbyon launched Carbyon GO. Carbyon GO is a high-quality DAC machine that enhances carbon capture performance.(Source: https://www.carbyon.com)

- In September 2025, GE Vernova partnered with Deep Sky. This partnership is aimed at deploying Direct Air Capture technology at Deep Sky Alpha in Canada.

- In March 2025, Saudi Aramco launched a direct air capture (DAC) test unit in Saudi Arabia. This DAC unit is developed in collaboration with Siemens Energy to remove up to 12 tonnes per year (TPY) of carbon dioxide from the atmosphere.(Source: https://theenergyyear.com)

Segments Covered in the Report

By Technology Type

- Solid Sorbent-based DAC

- Amine-functionalized sorbents

- Porous adsorbents (MOFs, zeolites)

- Liquid Solvent-based DAC

- Alkaline solvent systems

- Carbonate looping approaches

By Process / Capture Mechanism

- Temperature Swing Adsorption (TSA)

- Vacuum Swing Adsorption (VSA)

- Humidity Swing / Moisture-driven Capture

- Chemical Absorption & Regeneration (solvent loop)

By Service/Value Chain Type

- DAC Plant Development & EPC

- COâ‚‚ Capture Equipment & Modules

- Operations & Maintenance (O&M)

- COâ‚‚ Transport, Conditioning & Compression

- Carbon Removal MRV & Digital Services

By Storage Type

- Geological Sequestration

- Mineralization / Carbon-to-rock Storage

- Storage via COâ‚‚-to-products with long-lived carbon

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting