What is the Direct Methanol Fuel Cell Market Size?

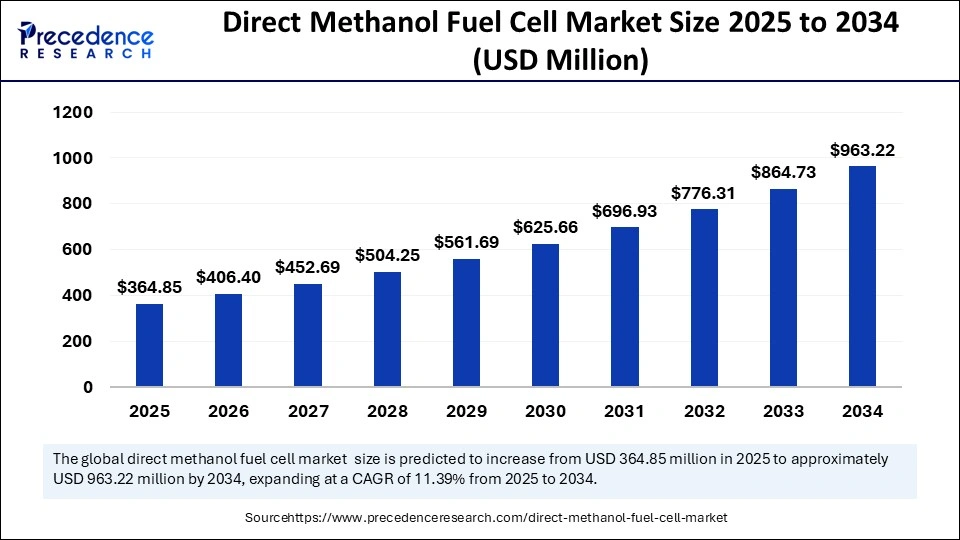

The global direct methanol fuel cell market size is valued at USD 364.85 million in 2025 and is predicted to increase from USD 406.40 million in 2026 to approximately USD 963.22 million by 2034, expanding at a CAGR of 11.39% from 2025 to 2034. The market growth is attributed to the increasing demand for clean and efficient energy solutions across various applications, including transportation, portable devices, and off-grid power systems.

Direct Methanol Fuel Cell Market Key Takeaways

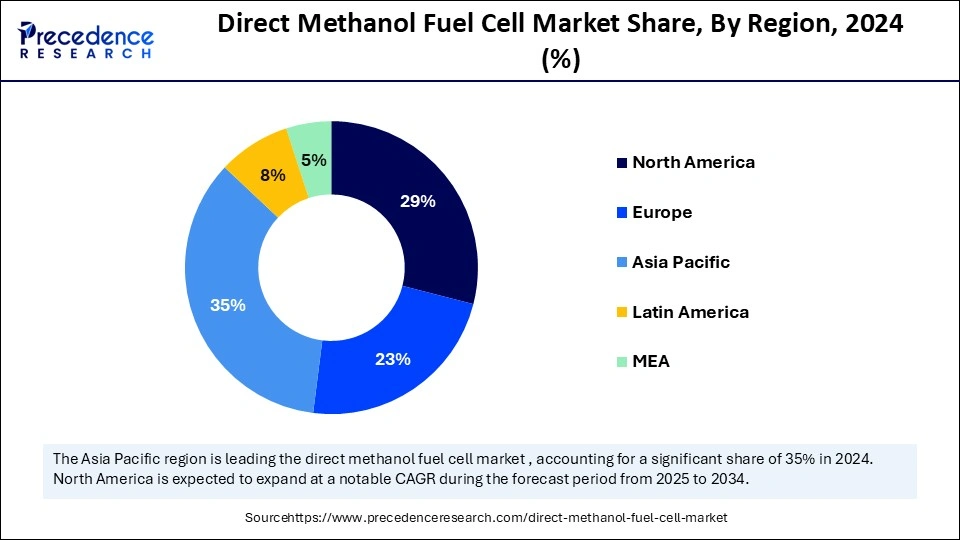

- Asia Pacific dominated the global market with the largest market share of 35% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By component, the electrode segment led the market in 2024.

- By component, the balance of stacks segment is projected to grow at the highest CAGR in the coming years.

- By application, the portable segment accounted for a considerable share in 2024.

- By application, the transportation segment is expected to grow at the fastest CAGR during the projection period.

Artificial Intelligence: The Next Growth Catalyst in the Direct Methanol Fuel Cell Market

The energy sector is witnessing rapid transformation through artificial intelligence, as it streamlines operations, enhances system efficiency, and speeds up research and development processes. The implementation of AI algorithms optimizes fuel cell designs and enhances predictions regarding cell performance. Furthermore, AI provides different methods to meet worldwide clean energy requirements. AI also helps in the development of fuel cells, optimizes performance, and reduces waste generation.

Strategic Overview of the Global Direct Methanol Fuel Cell Industry

The direct methanol fuel cell market is experiencing rapid growth due to the rising global interest in clean energy solutions. Direct methanol fuel cells (DMFCs) develop into an attractive power technology, as their operation with liquid methanol enables convenient transportability and high energy density. Methanol conversion into electricity occurs directly through electrochemical processes in this technology. This delivers better efficiency and low pollution output than traditional combustion engines. The rising funding for fuel cell research further supports market growth. In 2023, the U.S. DOE funded over USD 150 million in fuel cell research. Furthermore, the rising government efforts to promote renewable energy are expected to boost the adoption of DMFCs, thus fuelling the market.

Direct Methanol Fuel Cell Market Growth Factors

- The rising need for off-grid power solutions in remote locations is expected to boost the adoption of DMFCs.

- Growing demand for high-efficiency energy systems in portable consumer electronics is likely to drive market growth.

- Increasing investments in renewable energy technologies are anticipated to propel the development of fuel cell technologies.

- Advancements in methanol production and distribution networks are projected to influence the market.

- Rising environmental concerns and stricter emissions regulations are expected to accelerate the shift toward clean energy solutions, supporting market growth.

- Enhanced performance characteristics of DMFCs, such as longer operational lifespans, are likely to attract more industries.

- The expanding use of DMFCs in military and emergency backup applications is projected to drive market growth.

Market Outlook

- Market Growth Overview: The Direct Methanol fuel cell market is expected to grow significantly between 2025 and 2034, driven by logistical advantages, government support for clean energy, and technological advancement.

- Sustainability Trends: Sustainability trends involve green methanol production, energy efficiency, and low emissions, and research and development in sustainable materials.

- Major Investors: Major investors in the market include Breakthrough Energy Ventures, Maersk Growth, DEUTZ AG, Harbert Management, Vaekstfonden, Cummins Inc., SFC Energy AG and FC TecNry.

- Startup Economy: The startup economy is focused on catalyst and membrane innovation, system miniaturization and integration, and green methanol production.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 963.22 Million |

| Market Size in 2025 | USD 364.85 Million |

| Market Size in 2026 | USD 406.40 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.39% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Reliable Portable Power in Critical and Remote Applications

The rising demand for better portable power systems leads to greater adoption of DMFCs, which further drives the growth of the direct methanol fuel cell market. Portable electronic devices, including military-grade communication tools, medical devices, and remote sensors, require energy solutions that are lightweight. DMFCs deliver high energy capacity for easy fuel refill capabilities that enable their use in military or off-the-grid deployments. These cells can be used at low temperatures, making them attractive solutions. The WHO documented a 20% rise in portable medical diagnostics tool deployments to remote areas in 2023, as reliable mobile power is essential for medical operations. Furthermore, the rising production and adoption of portable electronics are driving the growth of the market, as DMFCs provide consistent power to these devices.

Restraint

Methanol Toxicity and Handling Concerns

The high methanol toxicity and handling concerns are expected to hinder the growth of the direct methanol fuel cell market. Methanol is flammable and toxic, requiring careful handling and storage. Moreover, the hazardous nature of methanol can pose several health risks, like creating problems in breathing or causing skin irritations. This forces regulatory entities to enforce strict safety protocols throughout their shipping and storage phases and operational periods. The U.S. CDC recognizes methanol as a dangerous material, which exposes damage to the nervous system, leading to death. The management of this hazardous material adds operational expenses and demands unique safety tools with trained professionals for proper control. Thus, the safety concerns related to using methanol limit the widespread adoption of DMFCs.

Opportunity

Technologies Improvements in Fuel Cell Components

Technological innovations in fuel cell components lead to the development of superior direct methanol fuel cells, creating immense opportunities for the players competing in the market. The enhancements in proton exchange membranes combined with nanostructured catalysts and decreased methanol crossover have improved DMFC performance. This increases their usage potential across various fields. Furthermore, rising investments in R&D to develop enhanced DMFCs for both low-power and mid-power applications create lucrative growth opportunities. The US DOE's published report indicates that there was 18% growth in 2023 in funding provided for low-temperature fuel cell materials research, owing to the heightened efforts to resolve performance and durability problems. Next-generation fuel cells, including methanol-based systems, received substantial funding from the ‘Clean Hydrogen Partnership,' which operates under the fuel cells and Hydrogen Joint Undertaking (FCH JU) through its €300 million in 2023-24 R&D budgets.

Component Insights

The electrode segment led the direct methanol fuel cell market in 2024, as electrodes are essential components in DMFCs. They convert chemical energy into electrical energy. Electrochemical reactions within fuel cells depend heavily on electrodes, as their performance influences the system's efficiency and operational lifespan. Technological innovations focusing on electrode catalysts increased efficiency levels.

The balance of stacks segment is projected to grow at the highest CAGR in the coming years. Balance of stack (BOS) contains important parts that include power conditioning systems with cooling elements and monitoring devices. This enables the efficient operation of the fuel cell stack. The BOS segment expands because industrial and military sectors with portable applications need systems with high reliability and high performance. Furthermore, the rising need for durable, scalable, and affordable solutions in BOS components supports segmental growth.

The membrane segment is projected to grow at a significant rate in the future years. Membranes represent the essential element in fuel cells, as they enable ion movement and stop harmful methanol leakage that decreases efficiency. Proton exchange membrane (PEM) facilitates the transport of protons between anode and cathode, improving the performance of DMFCs. Rising improvements in membrane materials contribute to segmental growth. The U.S. Department of Energy (DOE) directed USD 50 million of financial support in 2023 for improving membrane materials, specifically to extend PEM functionality while cutting operating costs. Additionally, scientists are developing composite membranes to improve durability and reduce the degradation of fuel cells, further boosting the segment.

Application Insights

The portable segment held a considerable share of the direct methanol fuel cell market in 2024. DMFCs are suitable for portable applications like consumer electronics, backup power devices, and military communication equipment. Superior characteristics of these fuel cells, including small size and high power density, allow them to work efficiently in mobile or independent power systems. The rise in the demand for portable electronic devices further bolstered the segment's growth.

The transportation segment is expected to grow at the fastest rate during the projection period, owing to the increasing preferences for pollution-free mobility solutions. The use of DMFCs enables viable static and portable range extenders/auxiliary power units, which operate quietly with lower emissions. Public transit agencies and automakers are investing in developing fuel cell-powered systems to reduce their fossil fuel dependency. The European Commission dedicated funds through its Horizon Europe program in 2024 to conduct multiple testing initiatives for DMFCs in light-duty or last-mile delivery vehicles, further fueling the segment.

Regional Insights

Asia Pacific Direct Methanol Fuel Cell Market Size and Growth 2025 to 2034

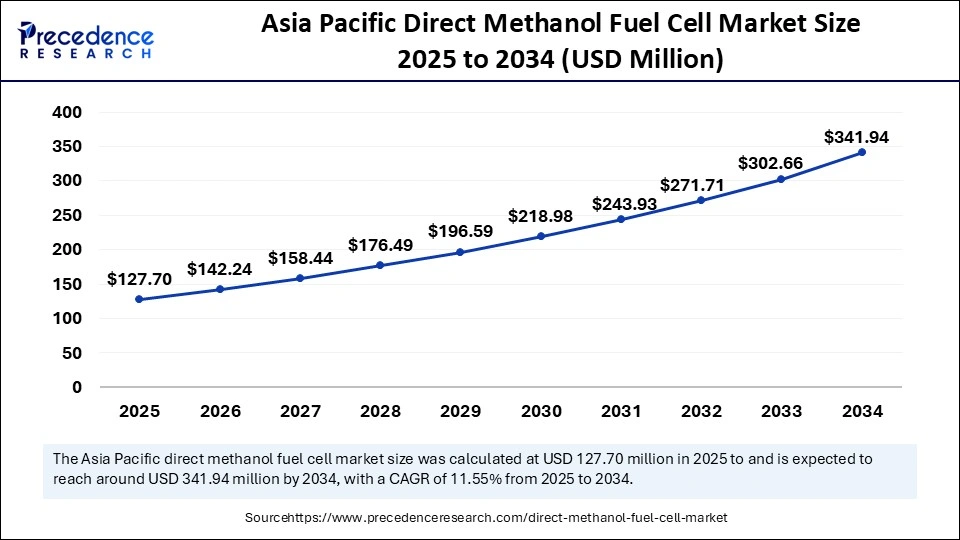

The Asia Pacific direct methanol fuel cell market size is exhibited at USD 127.70 million in 2025 and is projected to be worth around USD 341.94 million by 2034, growing at a CAGR of 11.55% from 2025 to 2034.

Asia Pacific led the direct methanol fuel cell market by capturing the largest share in 2024. This is mainly due to the powerful governmental backing and improved technologies with escalating funding for clean energy technology. Countries like Japan, China, and South Korea are investing in fuel cell technologies, especially DMFCs. Chinese government's target to reduce carbon emissions by 2024 further boosted the demand for alternative energy solutions, like DMFCs. The increased production of consumer electronics and electric vehicles further contributed to region's dominance.

North America is projected to witness rapid growth during the forecast period. This is mainly due to the increasing demand for portable power and government efforts to reduce emissions. In the last few years, fuel cell technology research received strong backing from the U.S. Department of Energy (DOE) with significant financial commitments to create efficient, affordable technologies using methanol fuel cells. Furthermore, the expansion of the electric vehicle industry and the focus on developing off-grid energy solutions are boosting the adoption of DMFCs.

Europe is seen to grow at a notable rate in the foreseeable future. The growth of the direct methanol fuel cell market in Europe can be attributed to strict environmental regulations and carbon neutrality targets. This creates a favorable environment for DMFCs. The European Union's Green Deal has set a 2050 deadline to reach net-zero emissions, making alternative energy solutions, including fuel cells, more appealing. There is a rise in the adoption of fuel cells in commercial vehicles. The rising demand for portable power solutions further contributes to regional market growth.

China Direct Methanol Fuel Cell Market Trends

China's increasing demand for portable and off-grid power solutions in consumer electronics and military applications. The substantial R&D efforts focused on improving catalyst and membrane technologies to enhance performance and durability. The market also benefits from the logistical ease of handling liquid methanol fuel compared to hydrogen, making it ideal for remote power.

U.S. Direct Methanol Fuel Cell Market Trends

The U.S. direct methanol fuel cell market is driven by demand from the military and defense sectors for silent, portable power and from remote infrastructure for reliable, long-duration backup power. The technological advancements in areas like catalyst development continue to support its growth in specific niches and off-grid applications.

Germany Direct Methanol Fuel Cell Market Trends

Germany's increasing demand for stationary power in remote locations and military applications, supported by strong government initiatives for clean energy. Major domestic players like SFC Energy are actively developing technology, particularly for niche off-grid and military uses.

Value Chain Analysis of the Direct Methanol Fuel Cell Market

- Research & Development (R&D) and Intellectual Property (IP) Development

This foundational stage involves intensive research to develop new catalysts, membranes, and system designs to improve DMFC efficiency, durability, and reduce costs.

Key contributors: Johnson Matthey. - Raw Material Sourcing & Component Manufacturing

This stage focuses on procuring and processing the highly specialized materials required for DMFCs, including platinum-based catalysts, proton exchange membranes (PEMs), bipolar plates, and micro-pumps.

Key contributors: Johnson Matthey (catalysts and MEAs), W. L. Gore & Associates (membranes) - System Assembly & Integration

Manufacturers assemble the various components, including the fuel cell stack, fuel reservoir, control units, and balance-of-plant components (e.g., pumps, fans), into a complete, functional DMFC system.

Key contributors: SFC Energy AG, Oorja Fuel Cells, Inc., Viaspace, and Fujikura Ltd. - Distribution & Sales

The completed DMFC systems are sold through a network of direct sales teams, distributors, and value-added resellers (VARs) to reach niche markets like military, remote sensing, and off-grid power applications. - Installation, Service & Maintenance

After the sale, specialized field service teams install the systems and provide ongoing maintenance, repair, and fuel supply management.

Key contributors: SFC Energy AG

Top Companies in the Direct Methanol Fuel Cell Market & Their Offerings

- Advent Technologies: Advent specializes in fuel cell components, particularly advanced membranes and membrane electrode assemblies (MEAs) that can operate at high temperatures.

- Antig Technology Co. Ltd.: Antig is an original equipment manufacturer (OEM) and original design manufacturer (ODM) of portable DMFC systems used in various consumer and industrial applications.

- Blue World Technologies: Blue World Technologies focuses on methanol fuel cell systems as a clean alternative to diesel generators and for automotive auxiliary power units (APUs).

- DMFC Corporation: DMFC Corporation develops and commercializes direct methanol fuel cells for portable electronic devices and small power systems. The company focuses on the miniaturization and optimization of DMFC technology for consumer and niche industrial markets.

- MeOH Power: This company is involved in the development and provision of methanol-based power solutions, including DMFC systems for various applications. They contribute by supplying both the technology and the methanol fuel logistics necessary for practical deployment.

- Mitsubishi Gas Chemical Trading, Inc. (MGC): MGC contributes to the DMFC market primarily as a major producer and supplier of high-purity methanol fuel, which is a key component for the operation of these fuel cells. They also develop related chemical products and materials that are integral to fuel cell technology.

- Oorja Protonics: Oorja specializes in integrated methanol fuel cell power systems designed for material handling, such as forklifts in warehouses and distribution centers, and for backup power. They provide a viable, drop-in replacement for traditional lead-acid batteries in these specific industrial applications.

- Panasonic Corporation: Panasonic has been involved in the research and development of fuel cell technology, including DMFCs for small, portable power applications. Their contributions have included innovations in materials and system design, though their primary focus remains on a wide range of other electronic products.

- Roland Gumpert: Roland Gumpert is a German automotive manufacturer known for high-performance electric vehicles, but they are also developing solutions that incorporate methanol fuel cells (sometimes in hybrid configurations) as range extenders or primary power sources.

- SFC Energy AG: SFC Energy is a leading manufacturer of DMFCs, particularly for military, off-grid, and stationary power applications, using their proprietary EFOY brand technology.

- Toshiba Energy Systems & Solutions Corporation: Toshiba has historically been involved in R&D and pilot projects for various fuel cell technologies, including DMFCs for niche applications. Their expertise in energy systems contributes to the overall technological advancements in fuel cell design and integration.

- Treadstone Technologies Inc.: Treadstone focuses on developing and commercializing components for fuel cells, particularly on advanced, low-cost bipolar plates that are critical for improving the performance and reducing the cost of DMFC stacks.

Direct Methanol Fuel Cell Market Companies

- Advent Technologies

- Antig Technology Co. Ltd.

- Blue World Technologies

- DMFC Corporation

- MeOH Power

- Mitsubishi Gas Chemical Trading, Inc.

- Oorja Protonics

- Panasonic Corporation

- Roland Gumpert

- SFC Energy AG

- Toshiba Energy Systems & Solutions Corporation

- Treadstone Technologies Inc.

Latest Announcement by Industry Leader

- In March 2025, Sushui Energy Technology is set to showcase its direct methanol fuel cell series products at the Annual Event of the British Association of Public Safety Communications Officials in Coventry on the 5th–6th of March. This marks the first time that Sushui Tech will present its products in Europe. Following a successful year of testing in Japan, the company now aims to explore new markets that demonstrate similar potential for direct methanol fuel cell technology. Daniel Lou, Global Marketing Director of Sushui Tech, said, “We are learning from our clients in the market to see more possibilities for our technology and for our company, as we value close and timely ties with our clients as the utmost important prerequisite of our success in every market.”

Recent Developments

- In January 2025, SFC Energy AG, a leading provider of hydrogen and methanol fuel cells for hybrid power solutions, initiated a joint pilot project with HÖRMANN Warnsysteme GmbH to demonstrate the use of fuel cells in securing long-term emergency power supply for siren warning systems. This initiative supports critical infrastructure resilience and highlights the practical deployment of methanol fuel cells in stationary applications.

- In December 2024, Jinbei and Geely's Farizon announced plans to launch methanol-hydrogen hybrid vehicles in 2025 as part of a strategic collaboration targeting the new energy commercial vehicle market in cold climate regions. The announcement followed the rollout of two jointly developed electric models from Jinbei's assembly line in Shenyang, Liaoning Province. Geely Holding Group Chairman Li Shufu described the partnership as a step forward in strategic innovation and sustainable mobility.

- In February 2025, Toyota Motor Corporation revealed its third-generation fuel cell system (3rd Gen FC System), designed to serve the commercial vehicle sector with durability comparable to diesel engines. The new system offers enhanced fuel efficiency and reduced costs compared to its predecessor. Toyota plans to deploy this system across commercial fleets in Japan, Europe, North America, and China starting 2026, reinforcing its commitment to advancing hydrogen-based mobility solutions.

Segments Covered in the Report

By Component

- Electrode

- Membrane

- Balance of Stacks

By Application

- Stationary

- Portable

- Transport

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting