What is the DSL Tester Market Size?

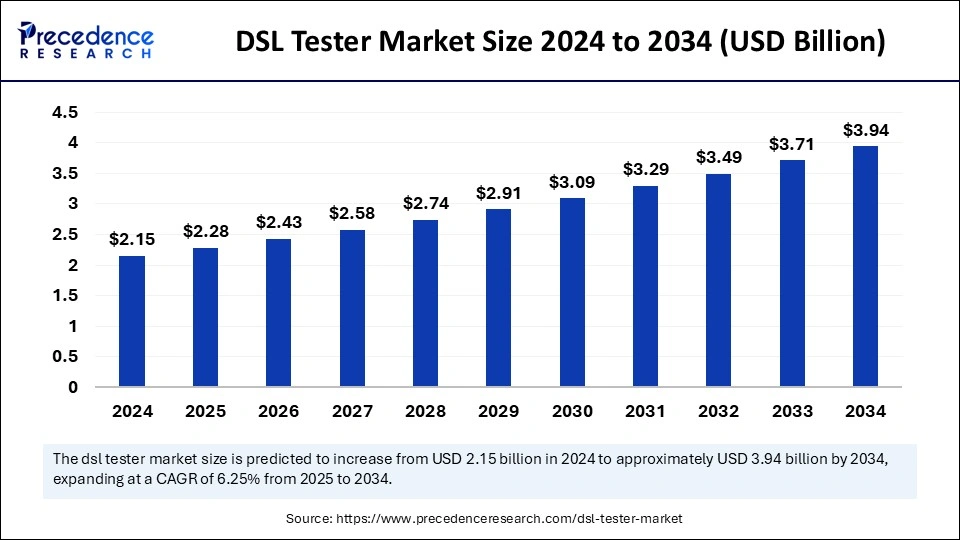

The global DSL tester market size is valued at USD 2.28 billion in 2025 and is predicted to increase from USD 2.43 billion in 2026 to approximately USD 3.94 billion by 2034, expanding at a CAGR of 6.25% from 2025 to 2034. The growth of the market is driven by the increasing internet connections and the growing need to ensure network reliability.

DSL Tester Market Key Takeaways

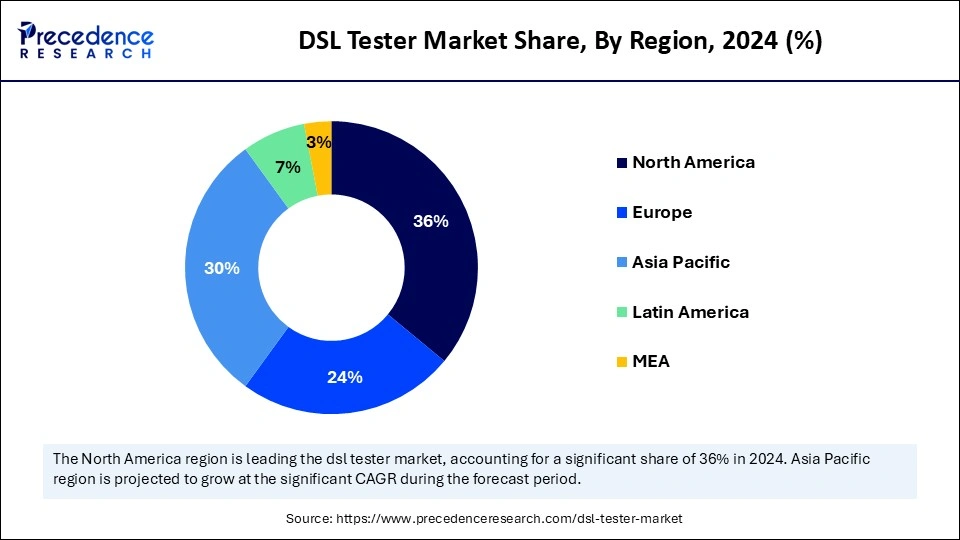

- North America dominated the global market with the largest market share of 36% in 2024.

- Asia Pacific is projected to witness the fastest growth in the coming years.

- By product type, the handheld DSL testers segment contributed the biggest market share in 2024.

- By product type, the rack-mounted DSL testers segment is expected to grow at the fastest CAGR in the upcoming period.

- By technology, the ADSL segment held the highest market share in 2024.

- By technology, the VDSL segment is projected to expand at the fastest CAGR during the forecast period.

- By end-use, the telecom operators segment captured the largest market share in 2024.

- By end-use, the service providers segment is anticipated to grow at a notable CAGR between 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in DSL Tester

The integration of Artificial intelligence algorithms in DSL testers predicts and prevents potential failures by analyzing vast amounts of data. These testers help automate the testing processes and address issues proactively, accelerating the testing process and improving the quality of DSL networks. AI-powered DSL testers monitor connections remotely, identify issues, and troubleshoot them automatically. This streamlines procedures and reduces manual work and errors.

- For Instance, VIAVI's OneExpert DSL tester, equipped with AI-based fault localization, significantly reduced average troubleshooting time by 37% during trials with British Telecom.

Strategic Overview of the Global DSL Tester Industry

Digital subscriber line (DSL) is an internet access technology that uses a standard phone line to offer high-speed internet access. With DSL, a various frequency is used for digital and analog signals, which means that consumers talk on the phone while uploading data. DSL attracts an excessive deal of interest from service providers and integrators as it offers high-bandwidth data speeds to scattered sites with little changes to the current telecommunications infrastructure. The DSL tester market is growing rapidly due to the rising demand for high-speed internet. DSL testers are crucial for measuring the quality of DSL internet connections. They help identify potential issues in network, enhancing the quality and efficiency. DSL testers are crucial in activities such as streaming, large file downloads, online gaming, video conferencing, and VoIP phone calls.

DSL Tester Market Growth Factors

- The rising number of DSL subscribers boosts the growth of the market. Increasingly modular and customizable DSL testing apparatuses offer flexibility to collaborate, customize, and improve testing procedures, permitting continuous innovation and improvement while avoiding heavy licensing fees.

- The rising adoption of energy-efficient telecom devices creates an impetus to the standard development organizations, telecom service providers, and telecom industry to regulate telecom network efficacy, supporting market growth.

- The increasing trend of cloud-based digital subscriber line testing provides benefits like accessibility, faster testing cycles, cost-effectiveness, and scalability, allowing for well-organized resource allocation and global collaboration, contributing to market expansion.

Market Outlook

- Market Growth Overview: The DSL Tester market is expected to grow significantly between 2025 and 2034, driven by the shift to multi-technology solutions, growing internet service demand, and advancements such as integrated testing functionalities, cloud-based solutions, and remote diagnostics.

- Sustainability Trends: Sustainability trends involve reducing the environmental impact of test equipment manufacturing and use. This includes designing more durable, multi-functional testers to extend product lifespan and minimize e-waste.

- Major Investors: Major investors in the market include Keysight Technologies, VIAVI Solution Inc., EXFO Inc., Anritsu Corporation, and BlackRock, Inc.

- Startup Economy: The startup economy is focused on specialization, a lack of dedicated DSL taster startups, and emphasis on software-defined instrumentation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.94 Billion |

| Market Size in 2025 | USD 2.28 Billion |

| Market Size in 2026 | USD 2.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.25% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising 5G Backhaul Demands

The rising demand for 5G backhaul is driving the growth of the DSL tester market. The fast deployment of 5G networks, characterized by dense small-cell infrastructure and heavy traffic loads, is increasing the demand for backhaul architecture to deliver high throughput, cost efficiency, scalability, and low latency. DSL lines are being increasingly leveraged to support the surge in data traffic across 5G backhaul networks, particularly in suburban and rural deployments where fiber may be economically unworkable. This shift is significantly driving the demand for DSL testers, which are essential for validating and maintaining DSL line performance under high data loads.

Restraint

Transition to Fiber Optic Internet Creates Challenges

The rapid shift toward alternatives to DSL, like fiber optic and cable internet, creates challenges in the DSL tester market. As major telecom providers phase out DSL infrastructure in favor of high-bandwidth, low-latency solutions such as fiber, the relevance of DSL technology declines steadily, predominantly in well-connected and urban areas. Fiber optic networks have become ideal for modern digital communication due to their greater data capacity and negligible signal loss.

Opportunity

Adoption of DSL for High-Speed Connectivity

The extensive adoption of digital subscriber line (DSL) technology as an affordable solution for high-speed Internet access creates a significant opportunity for the DSL tester market. DSL allows simultaneous voice and data transmission over existing telephone infrastructure, eliminating the requirement for additional network investments and ensuring broad accessibility across rural and urban areas. This makes it a smart option for businesses and consumers seeking uninterrupted and reliable internet connection. DSL has become a foundational element in recent business internet facilities with benefits like faster download speeds, improved streaming capabilities, and improved connection stability compared to outdated dial-up services. This sustained reliance on DSL technology underscores the growing need for advanced DSL testers to ensure quality of service, support efficient installation, and maintain network performance.

Product Type Insights

The handheld DSL testers segment captured the largest share of the DSL tester market in 2024. The segment growth is driven by the increasing need for on-site network diagnostics. These testers generally feature a small LCD screen that displays the test outcomes and a keypad for monitoring the device, which makes them user-friendly. These testers are easy to use in the field, reducing test periods and enhancing reliability and accuracy for DSL line testing and troubleshooting.

The rack-mounted DSL testers segment is expected to grow at the fastest rate in the upcoming period. Rack-mounted testers take up minimal space in the work environment, making them the best choice for environments with limited space. These testers provide advantages like easy access for troubleshooting and maintenance, standardized testing, and the capability to test DSL modems and authenticate network connectivity.

Technology Insights

The ADSL testers segment dominated the DSL tester market with the largest share in 2024. This is mainly due to the rise in the demand for high bandwidth. Asymmetric digital subscriber line (ADSL) testers enable quick transmission of data at a huge bandwidth on present copper wire telephone lines to businesses and home applications. ADSL instantaneously accommodates voice information and data on a similar phone line. It delivers traffic at various speeds, depending on direction, and supports a broad range of applications.

The VDSL testers segment is projected to expand at the fastest rate during the forecast period. Very high-speed digital subscriber line (VDSL) testers provide higher upload and download speeds. VDSL uses existing telephone lines; thus, extending the network facilities is often cost-effective and easier as compared to fiber optics.

End-use Insights

The telecom operators segment dominated the DSL tester market in 2024. DSL testers enable simultaneous data and voice transmission, allowing telecom operators receive and make phone calls while using the internet. The signals of DSL and voice are separated in the different frequency channels, confirming that they do not interfere with each other. It has low installation expenses for network deployment, so DSL is a good option for telecom operators.

The service providers segment is anticipated to grow at a notable rate in the coming years. DSL testers enable service providers to maintain and upgrade huge networks. DSL tester is more beneficial than the cable as it provides stronger protection. Consumers will typically have a connection with various networks. DSL offers high-speed internet access that allows for faster browsing, streaming, and downloads. As compared to dial-up connections, DSL provides a more reliable and stable connection.

Regional Insights

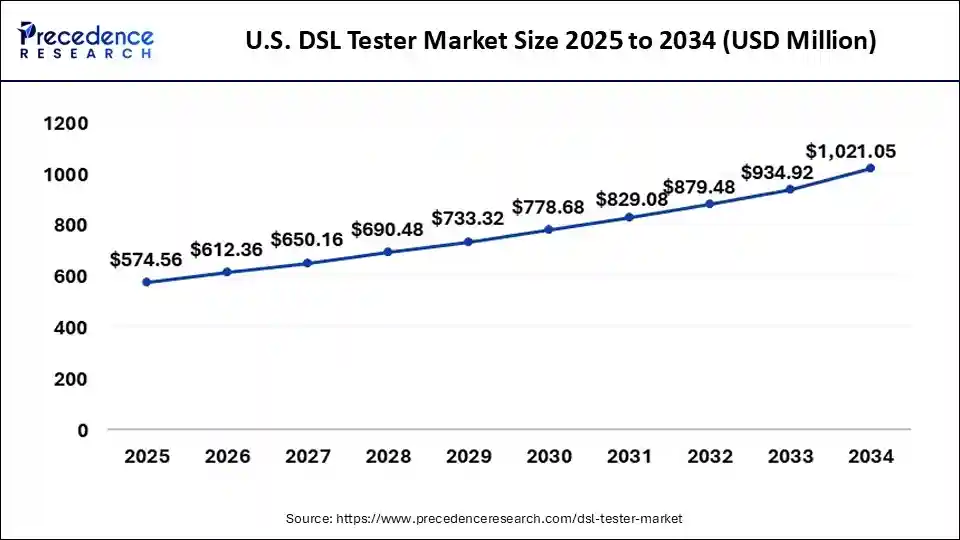

U.S. DSL Tester Market Size and Growth 2025 to 2034

The U.S. DSL tester market size is evaluated at USD 574.56 million in 2025 and is projected to be worth around USD 1,021.05 billion by 2034, growing at a CAGR of 6.57% from 2025 to 2034.

North America: U.S. DSL Tester Trends

North America dominated the DSL tester market in 2024. This is mainly due to its vast telecommunications infrastructure. There is a high demand for high-speed Internet in the region. DSL tester serves a broad range of requirements, from basic phone facilities in rural areas to high-speed Internet in urban centers. The increased usage of connected devices, IoT devices, and streaming services further bolstered the market growth in the region. In addition, the heightened usage of theInternet supported the region's dominance. In 2024, around 90.0% of North Americans were internet users.

The U.S. is a major contributor to the North American DSL tester Market. In the U.S., mobile networks are progressively being used to provide broadband services for businesses and homes, driving the demand for DSL testers. Government programs like the Rural Digital Opportunity Fund are bridging the digital divide to support the deployment of broadband networks in rural areas. The strong presence of the high-tech workforce in the U.S. further supports market growth.

Asia Pacific: China & India DSL Tester Market Trends

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The regional market growth can be attributed to the rapid expansion of network infrastructure and increasing broadband access. Governments around the region are playing a significant role in driving digital transformation through incentives and ambitious policies. These initiatives not only encourage innovation but also create a favorable environment for citizens and businesses to thrive in the digital era.

China and India are expected to have a stronghold on the Asia Pacific DSL tester market. The presence of major telecom service providers in China, such as China Telecom, China Unicom, and China Mobile, drives the growth of the market. In addition, there is a high demand for high-speed internet in India. The Indian government is making efforts by launching various programs to improve access to the Internet, especially in rural areas. Increasing government programs related to digital networks, such as the Bharatnet project, further supports market growth.

Europe: A Notably Growing Region

Europe is observed to grow at a significant rate in the foreseeable future. This is mainly due to the increasing government support for electronic communication, such as the mission of BEREC to assist the Commission and national government authorities in the implementation of the EU telecoms rules. The rising mobile and internet usage in the region further contributes to market growth. In addition, the rapid expansion of the telecommunication sector is likely to support the growth of the market in Europe.

Europe: Germany DSL Tester Market Trends

Germany's market is in transition, primarily influenced by the rapid national shift towards fiber optic (FTTH) networks. The evolving demand for multi-functional test equipment capable of handling both legacy copper and emerging fiber infrastructure. While traditional DSL use is declining in the long term, strong B2B and industrial demands for reliable connectivity sustain a niche market. Technological integration of AI, automation, and cloud-based solutions is improving testing efficiency and accuracy.

DSL Tester Market Value Chain Analysis

- Raw Material and Component Sourcing

This initial stage involves procuring essential electronic components, such as microcontrollers, integrated circuits, displays, and probes, from various specialized suppliers.

Key Players: Amphenol Corporation, Analog Devices Inc., Bosch, Keysight Technologies, and Fluke Corporation. - Research & Development (R&D) and Design

This stage involves the intellectual property development, engineering design, and software creation necessary for the tester's functionality, usability, and multi-network capabilities (DSL, fiber, Ethernet).

Key Players: Keysight Technologies, VIAVI Solutions Inc., EXFO Inc., and Spirent Communications. - Manufacturing and Assembly

This involves the physical assembly of the components into portable or benchtop DSL testers, followed by rigorous quality control and calibration processes.

Key Players: VIAVI Solutions Inc., EXFO Inc., Keysight Technologies, Rohde & Schwarz GmbH & Co. KG, and Shandong Senter Electronic Co., Ltd. - Distribution and Sales

The finished products are distributed globally through direct sales teams, specialized distributors, and dealers to reach a wide customer base, primarily telecommunication service providers and network equipment manufacturers.

Key Players: 3M, Keysight Technologies, VIAVI Solutions Inc., a wide network of regional and local distributors/dealers.

Top Companies in the DSL Tester Market & Their Offerings:

- Keysight Technologies: Keysight provides sophisticated testing solutions that often encompass or integrate DSL testing capabilities within broader network validation platforms used in lab environments and by service providers.

- EXFO: EXFO offers a comprehensive portfolio of handheld and portable DSL testers designed for field technicians, enabling efficient installation, maintenance, and troubleshooting of copper-based access networks.

- Viavi Solutions: Viavi specializes in test and measurement solutions for telcos, offering a range of handheld devices capable of testing and verifying DSL services alongside other technologies like fiber and Ethernet. Their integrated solutions facilitate streamlined testing processes for service providers globally.

- Fluke Networks (owned by Fluke Corporation): Fluke Networks provides rugged, handheld testing tools for network professionals, with some devices offering basic verification and troubleshooting functionalities for DSL lines within premises. Their equipment is known for its durability and ease of use, serving a niche market of installation and maintenance technicians.

- Anritsu Corporation: Anritsu contributes to the DSL market with advanced test and measurement solutions, including multi-functional network testers that verify DSL performance and quality of service. Their focus is often on high-end, precise analysis for telecommunication carriers and network equipment manufacturers.

- Tektronix (a subsidiary of Fortive): Tektronix primarily focuses on oscilloscopes and general-purpose test equipment that may be used in the R&D and manufacturing phases of DSL modem and equipment development. While not a major player in the field of DSL testers, their precise measurement tools are used for fundamental electronics testing related to DSL technology.

- Calnex Solutions: Calnex focuses on testing network synchronization and timing for modern telecommunications infrastructure, ensuring accurate time delivery over various networks, including those transitioning from DSL to fiber. They enable service providers to maintain precise network timing crucial for the performance of advanced digital services.

- Broadcom: As a leading semiconductor company, Broadcom designs and manufactures the actual DSL chipsets found within modems and central office equipment, enabling the technology itself.

- Ixia (a Keysight company): Ixia, now part of Keysight, provides network test and visibility solutions that simulate real-world traffic to validate the performance of network infrastructure, including systems running DSL services.

- Chroma ATE: Chroma manufactures automated test equipment used by electronics manufacturers to test the quality and functionality of DSL modems, routers, and related customer premises equipment during the production phase.

Recent Development

- In March 2025, Viavi Solutions Inc. signed an agreement to acquire Spirent Communications plc's high speed ethernet and network security business lines from Keysight Technologies, Inc. for USD 410 million base cash consideration and an additional USD 15 million contingent cash consideration to be paid at closing, subject to customary closing adjustments and conditions.

DSL Tester Market Companies

- EXFO

- Fluke Networks

- Anritsu Corporation

- Tektronix

- Calnex Solutions

- Broadcom

- Ixia (a Keysight company)

- Chroma ATE

Segments Covered in the Report

By Product Type

- Handheld DSL Testers

- Rack-mounted DSL Testers

By Technology

- ADSL (Asymmetric Digital Subscriber Line) Testers

- VDSL (Very High-Speed Digital Subscriber Line) Testers

- VDSL2 Testers

- G. fast Testers

- Hybrid DSL-Fiber Testers

By End-use

- Telecom Operators

- Service Providers

- Network Equipment Manufacturers

- Government and Educational Institutions

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting