eHealth 2.0 Market Size and Forecast 2025 to 2034

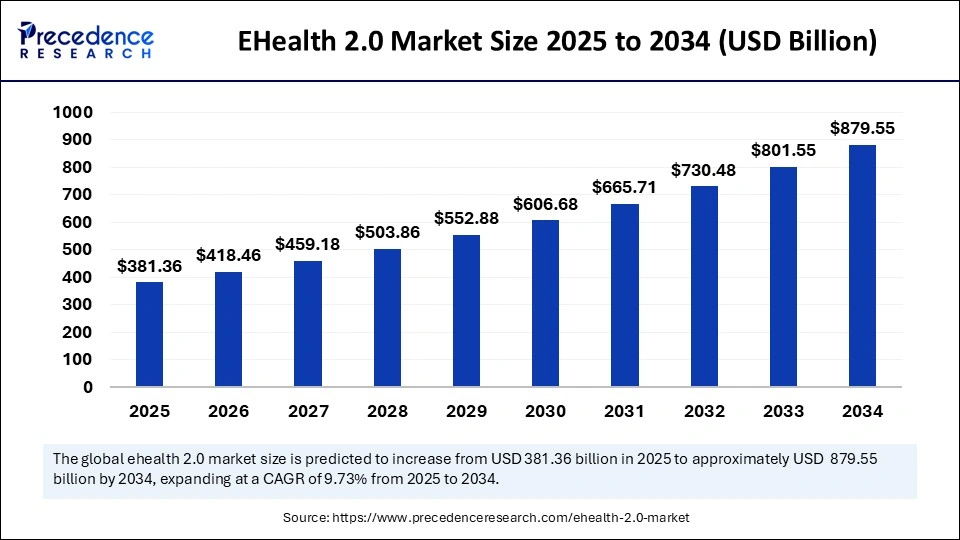

The global eHealth 2.0 market size accounted for USD 347.54 billion in 2024 and is predicted to increase from USD 381.36 billion in 2025 to approximately USD 879.55 billion by 2034, expanding at a CAGR of 9.73% from 2025 to 2034. The rising adoption of eICU, increasing need for remote patient monitoring, a surge in the number of telehealth clinics, and rapid technological innovation in healthcare technologies are expected to drive the growth of the global eHealth 2.0 market throughout the projected period.

eHealth 2.0 Market Key Takeaways

- In terms of revenue, the market is valued at 381.36 billion in 2025.

- It is projected to reach 879.55 billion by 2034.

- The market is expected to grow at a CAGR of 9.73% from 2025 to 2034.

- North America dominated the eHealth 2.0 market in 2024.

- Europe is expected to grow at a significant CAGR during the forecast period.

- By type, the telemedicine segment held the largest market share in 2024.

- By type, the electronic health records segment is expected to expand at a significant CAGR in the upcoming period.

- By service, the monitoring segment contributed the major market share in 2024.

- By service, the diagnosis segment is expected to grow at a notable CAGR in the coming years.

- By end-user, the healthcare providers segment captured the biggest market share in 2024.

- By end-user, the insurers segment is expected to grow at a notable CAGR during the forecast period.

How is Artificial Intelligence (AI) Impacting the Growth of the eHealth 2.0 Market?

In the era of a rapidly evolving digital landscape, the integration of artificial intelligence has paved the way for a new paradigm of the eHealth 2.0 market. AI-powered remote patient monitoring and diagnostics are some of the crucial innovations positively influencing the growth of the market. AI-powered eHealth technologies can substantially reduce delays often encountered with patient treatment by lowering the time-consuming process. AI-driven chatbots and virtual assistants help patients at every stage of their treatment journey. Artificial intelligence (AI) can significantly enhance patient care at the intersection of technology and healthcare.

Market Overview

Over the years, healthcare systems around the world recognized the potential of digital health. eHealth 2.0 is the advanced digital healthcare solutions that leverage innovative technologies such as the Internet of Things (IoT), big data, cloud computing, and artificial intelligence (AI) to improve healthcare delivery services. eHealth 2.0 assists in streamlining workflows, enhancing patient outcomes, and improving accessibility. eHealth 2.0 highly focuses on offering personalized and data-driven healthcare services. The major components include wearable health devices, mobile health apps, telemedicine, electronic health records (EHRs), and others.

eHealth 2.0 Market Growth Factors

- The rising demand for personalized and data-driven healthcare services is anticipated to drive the growth of the eHealth 2.0 market during the forecast period.

- The rising penetration of smartphones and increasing adoption of virtual healthcare assistants are anticipated to contribute to the overall growth of the eHealth 2.0 market in the coming years.

- The rising demand for electronic health records, coupled with the rising popularity of telemedicine platforms, is anticipated to promote the market's expansion in the coming years.

- The increasing investment in the development of innovative healthcare technologies is bolstering the market's expansion in the coming years.

- The market has witnessed transformative growth with the increasing adoption of telemedicine and remote health services during the forecast period.

- The rising awareness of the significance of digital health solutions and supportive government initiatives are likely to push the healthcare sector toward digital transformation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 879.55 Billion |

| Market Size in 2025 | USD 381.36 Billion |

| Market Size in 2024 | USD 347.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.73% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Service, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Cases of Non-communicable Diseases

The surging incidence of non-communicable diseases around the world is anticipated to boost the growth of the eHealth 2.0 market during the forecast period. The market has witnessed the rising prevalence of non-communicable diseases, including cardiovascular diseases, chronic respiratory diseases, lung diseases, stroke, cancer, diabetes, neurological disorders, and others, which has significantly increased the adoption of eHealth platforms. For instance, according to the World Health Organization (WHO), non-communicable diseases (NCDs), including heart disease, stroke, cancer, diabetes, and chronic lung disease, are collectively responsible for 74% of all deaths worldwide. More than three-quarters of all NCD deaths, and 86% of the 17 million people who died prematurely or before reaching 70 years of age, occur in low- and middle-income countries. eHealth 2.0 connects doctors, patients, and healthcare providers through digital platforms and enables efficient, faster, and cost-effective healthcare services. In addition, a rising aging global population is anticipated to spur the demand for eHealth solutions, as these technologies assist in the early disease detection of chronic diseases, continuous monitoring, and more efficiently managing the healthcare resources. Such factors are fuelling the market's growth significantly.

Restraint

Shortage of Skilled Personnel

The lack of skilled professionals is anticipated to hamper the growth of the eHealth 2.0 market. Managing e-health services and solutions requires skilled knowledge. Several middle and lower-income countries lack proper infrastructure for ehealth 2.0 and qualified personnel. In addition, concerns over data security and the lack of reimbursement policies in several countries are likely to limit the global adoption of eHealth 2.0.

Opportunities

Growing popularity of E-Health services

The increasing popularity of E-health services is projected to create lucrative opportunities in the eHealth 2.0 market. As the global healthcare demands escalate, the development of groundbreaking, digital, and patient-centric care technologies plays an integral role in improving service quality and patient experiences. Moreover, the emergence of telemedicine 2.0 assists in remotely monitoring patients and provides effective communication channels to healthcare professionals. Remote care, such as remote consultations, offers a personalized approach to remote patient care and treatment.

Type Insights

The telemedicine segment held the largest share of the eHealth 2.0 market in 2024. This is mainly due to the increased need for remote healthcare delivery. Telemedicine is the delivery of healthcare services where the patient and healthcare professional are not present in the same physical location. It increases access to care and improves convenience while enhancing continuity of care. Telemedicine facilitates remote monitoring of chronic conditions, improving patient outcomes.

On the other hand, the electronic health records segment is expected to expand at a significant CAGR in the upcoming period. With rapid digitization in the healthcare sector, the adoption of Electronic Health Records (EHRs) is rising. EHRS improves the healthcare services by effectively managing patient records. This significantly improves decision-making and patient outcomes.

Service Insights

The monitoring segment dominated the eHealth 2.0 market with the largest market in 2024. This is mainly due to the increased need for remote patient monitoring to enhance patient care. eHealth 2.0 enables remote monitoring through telemedicine. The increased prevalence of chronic diseases also bolstered the growth of the segment. Chronic diseases often require regular monitoring to manage conditions. However, monitoring services enable healthcare providers to keep an eye on patients from remote locations, reducing complexities.

On the other hand, the diagnosis segment is expected to grow at a notable rate in the coming years. Diagnostic services offer rapid connectivity to patients, which assists in diagnosing various chronic diseases. The rising demand for early detection of diseases, along with the increasing prevalence of life-threatening diseases, is likely to support segmental growth.

End-User Insights

The healthcare providers segment dominated the eHealth 2.0 market with the largest share in 2024. eHealth 2.0 provides convenience to healthcare providers and improves the delivery of patient care. The rising patient pool in hospitals and clinics is encouraging the adoption of digital technologies to improve care delivery. In addition, the rising government initiatives to promote digital transformation in the healthcare sector propels the segment's growth.On the other hand, the insurers segment is expected to grow at a notable rate during the forecast period. The growth of the segment is driven by the increasing adoption of eHealth 2.0 by insurers to manage customer data and keep track of their health status and prepare insurance policies accordingly. eHealth 2.0 also assists in faster claim settlement.

Regional Insights

What Factors Contributed to North America's Dominance in the eHealth 2.0 Market?

North America dominated the market with the largest revenue share in 2024. This is mainly due to the early adoption of eHealth in North American countries like the U.S. and Canada. The region is at the forefront of innovations in healthcare technology, reshaping the healthcare industry. The region's dominance is further attributed to the presence of a well-established healthcare industry, a rise in the aging population, supportive government initiatives, a rise in healthcare expenditure, a rising incidence of chronic diseases, and an increasing number of e-health companies. The rising use of virtual healthcare assistants, telemedicine, and wearable devices in the region is expected to sustain the region's dominance. Several e-health service providers are increasingly investing in e-health 2.0 services contributing to market growth.

Europe is expected to grow at a significant CAGR during the forecast period. European countries such as France, the UK, Italy, and Germany are the major contributors to the market due to their highly developed healthcare infrastructure. The region's rapid growth is driven by the rapid development of e-health services and products such as telemedicine, chatbots and virtual assistants, and medical apps, growing demand for personalized and data-driven healthcare services, rising preference for remote health services, and the increasing investment by key market players in the modernization of healthcare facilities. Moreover, the Government is heavily investing and implementing various programs to encourage the use of e-health services and solutions in the region.

Asia Pacific is expected to grow at a notable rate, owing to the wide adoption of advanced healthcare technologies and the increasing prevalence of chronic diseases. The support from the government and public authorities to promote digitization, the increasing popularity of virtual and augmented reality in healthcare, the rising geriatric population, increasing awareness regarding digital health, and increasing penetration of smartphones are supporting the growth of the market. In addition, increased demand for E-health services and increasing government spending on the upgradation of the healthcare systems contribute to regional market growth.

eHealth 2.0 Market Companies

- Athenahealth Inc.

- iCliniq

- Medtronic

- Epocrates

- Medisafe

- Teladoc Health, Inc.

- LiftLabs

- CompuMed Inc.

- GE Healthcare

- Telecare Corporation

- Optum Health

- Siemens Healthineers

- Veradigm LLC

- eClinicalWorks

Recent Developments

- In May 2025, eHealth Technologies announced the availability of eHealth Connect Clinical Summary. Built uniquely for oncology care teams, the solution puts the power of generative AI and direct EHR integration to work to rapidly create easily digestible, holistic longitudinal patient histories from fragmented data sources.

- In February 2025, Quokka Care, a healthcare technology solutions provider advancing the Remote Patient Monitoring (RPM) space, announced the successful completion of a strategic growth investment led by prominent health tech entrepreneur Ray Guzman, Montecito Medical Real Estate, and other notable healthcare investors. This investment marks a milestone in the company's journey to redefine how chronic conditions are managed remotely through its innovative, patient-centered approach.

- In February 2025, Validic, a leading provider of intelligent digital health solutions, announced a strategic integration with Tenovi, a leading cellular-connected platform that automates data capture from connected medical devices, to expand the reach and impact of remote patient monitoring (RPM) programs. This collaboration enables healthcare organizations to deliver a frictionless, scalable, and cost-effective RPM experience for patients and care teams, especially in rural and underserved communities.

- In November 2024, Bajaj Finserv Health announced its plan to invest INR 1,000 crore in advancing its products and technology. Following its acquisition of third-party administrator (TPA) Vidal Health in April 2024, the company is set to enhance its offerings with innovative services, including the introduction of its ‘Health Saathi' concierge service.

- In February 2025, GOQii partnered with Acrannolife Genomics, a pioneer in precision diagnostics, to introduce GrafCare, an innovative program poised to transform post-transplant care. This collaboration leverages the power of genomic diagnostics, artificial intelligence (AI), and personalized health monitoring to address the critical needs of organ transplant recipients.

Segments Covered in the Report

By Type

- Telemedicine

- Electronic Health Records (EHRS)

- E-Prescription

- Remote Patient Monitoring

- mHealth

- Health Information Exchange (HIE)

- Others

By Service

- Monitoring

- Diagnostic

- Treatment

By End-User

- Healthcare Providers

- Insurers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting