What is Electric Vehicle Sound Generator Market Size?

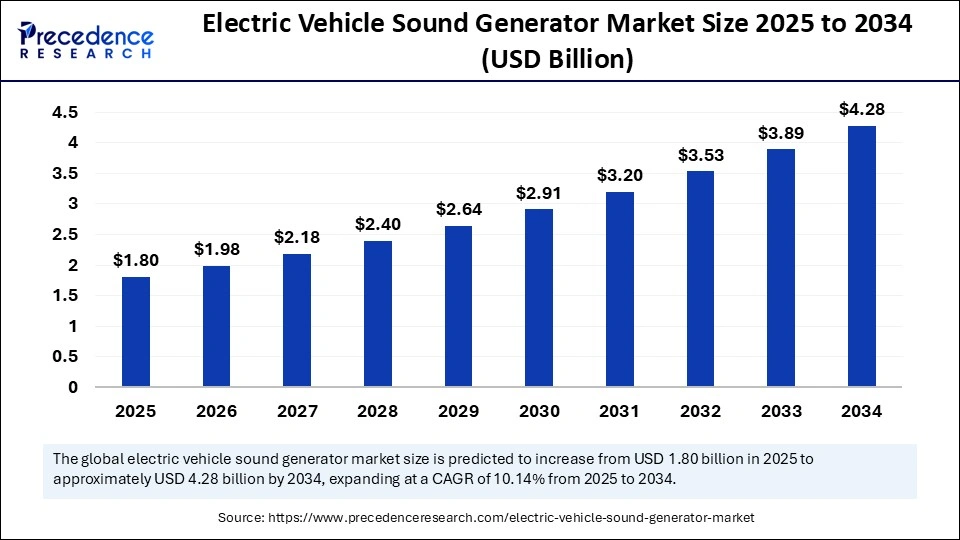

The global electric vehicle sound generator market size accounted for USD 1.80 billion in 2025 and is predicted to increase from USD 1.98 billion in 2026 to approximately USD 4.28 billion by 2034, expanding at a CAGR of 10.14% from 2025 to 2034. The market is witnessing significant growth due to increasing demand for electric and hybrid vehicles. Electric vehicle sound generators ensure the overall safety of pedestrians.

Market Highlights

- Asia Pacific dominated the electric vehicle sound generator market in 2024.

- Europe is anticipated to grow at the fastest CAGR during the forecast period from 2025 to 2034.

- By sales channel, the OEM segment held a dominant share of the market in 2024.

- By sales channel, the aftermarket segment is projected to expand rapidly in the upcoming period from 2025 to 2034.

- By propulsion, the battery electric vehicles (BEV) segment held a significant share of the market in 2024.

- By propulsion, the hybrid electric vehicle (HEV) segment is expected to expand at the fastest rate during the forecast period from 2025 to 2034.

- By product, the internal sound generators segment led the market with the largest share in 2024.

- By product, the external sound generator segment is expected to witness the fastest growth during the predicted timeframe from 2025 to 2034.

- By vehicle, the passenger vehicles segment dominated the market with the highest share in 2024.

- By vehicle, the commercial vehicles segment is likely to grow at a significant rate between 2025 and 2034.

- By component, the hardware segment captured the biggest market share in 2024.

- By component, the software segment is expected to grow at the fastest rate in the upcoming years from 2025 to 2034.

- By speed range, the full-speed range segment (above 30 km/h) led the electric vehicle sound generator market in 2024.

- By speed range, the low-speed sound generators (0-30 km/h) segment is anticipated to show lucrative growth in the market during the forecast period.

Understanding EV Sound Generation and Their Role in Road Safety

The electric vehicle sound generator market deals with the production and sale of sound generators specifically designed for electric vehicles, which include hybrid and electric vehicles. These generators are integrated into vehicles to produce audible warnings at various speeds and conditions, enhancing road safety. EV sound generator systems are also known as Acoustic Vehicle Alerting Systems, which generate sounds to alert pedestrians, cyclists, and other road users to the presence of electric vehicles, particularly in areas where they might not be easily heard.

How is Artificial Intelligence Altering the Performance of Sound Generation Systems?

Artificial Intelligence is revolutionizing the electric vehicle sound generator market by optimizing sound generation, improving user experience, and enhancing vehicle safety. AI algorithms have the capability to analyze various factors like speed, acceleration, and environmental conditions to generate custom and more realistic immersive soundscapes. Additionally, they can also provide predictive maintenance by monitoring the performance of sound generation systems and predicting potential failures, preventing breakdowns. Overall, AI is used to generate unique vehicle sounds for branding, personalize sound profiles for various driving modes, and improve the efficiency of sound generation systems.

What are the Key Trends in the Electric Vehicle Sound Generator Market?

- Increasing Electric Vehicle Adoption: The global shift toward electric mobility is due to the fact they are intrinsically quieter than internal combustion engine vehicles. This silence necessitates the use of sound generators to fortify pedestrian safety and awareness.

- Rigorous Safety Regulations: Governments are enacting regulations requiring electric vehicles to emit audible warnings at low speeds to improve road safety, especially for visually impaired individuals and pedestrians. This regulatory pressure directly fosters the demand for sound generators.

- Personalized Driving Experiences: Sound generators also enable drivers to personalize their driving experience, despite offering unique signature sounds for different vehicle models, as these devices are growingly being adopted in both hybrid and fully electric passenger vehicles.

- Technological Advancements: Improvements in sound generator technology, including the development of more realistic and customizable sounds, like different sound profiles for different driving modes, are also contributing to market growth. Also, AI-powered sound systems facilitate features like adaptive sound profiles based on speed, location, and environmental conditions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.80 Billion |

| Market Size in 2026 | USD 1.63 Billion |

| Market Size by 2034 | USD 4.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.14% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Sales Channel, Propulsion, Product, Vehicle, Component, Speed Range, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Adoption of Electric Vehicles

The increasing adoption of electric vehicles is a major factor driving the growth of the electric vehicle sound generator market. These vehicles often require audible warnings due to their quiet operation. Regulations requiring electric vehicles to emit sound at low speeds to enhance pedestrian safety is one of the important factors supporting the growth of the market. Advancements in sound generation technology and the growing necessity for personalized sound profiles further propel the growth of the market.

Restraint

Lack of Standardization and Stringent Regulations

The lack of standardization and varying regulations are likely to retain the growth of the electric vehicle sound generator market. Various countries have different requirements for electric vehicle sound generator specifications, leading to inconsistencies in their implementation and sound requirements. This results in a fragmented landscape where manufacturers need to design and produce sound generators that comply with multiple regulations. Moreover, integrating sound generators into EVs can be complex, requiring careful design with vehicle systems, limiting the growth of the market.

Opportunity

Improvement In Acoustic Comfort

The key future opportunity in the electric vehicle sound generator market is improvements in acoustic comfort, which is further supported by generating a unique driving experience for electric vehicle customers. As the global shift toward electric vehicles continues to rise, consumers increasingly seek premium and advanced features. Thus, manufacturers are investing in developing sound generators to emulate the sounds of traditional combustion engines or to develop entirely new and unique auditory experiences.

Segment Insights

Sales Channel Insights

The OEM segment held a dominant share of the electric vehicle sound generator market in 2024. This is mainly due to the increased integration of sound generators into new vehicles at the factory level, driven by regulatory compliance and growing electric vehicle adoption. This reinforces customization and ensures the sound generator meets the specific requirements and standards of the vehicle. This regulatory push directly spurs the necessity for electric vehicle sound generators within the OEM segment. OEMs also have a significant demand for electric vehicle sound generators, usually mandated by governments to ensure the safety of electric vehicles in pedestrian areas.

The aftermarket segment is projected to expand rapidly in the upcoming period. Nowadays, electric vehicles are gaining more popularity, and they often have limited sound generator options at the point of sale. Aftermarket sound generators provide a wider variety of sounds, styles, and customization options with advanced features like volume control, different sound profiles, and integration with the audio system of the vehicle. Consumers are seeking to upgrade their sound generator systems in the aftermarket by making a higher demand for aftermarket parts, accessories, and services. The rising electrification of existing fleets further supports segmental growth.

Propulsion Insights

The battery electric vehicles (BEV) segment held a significant share of the electric vehicle sound generator market in 2024. This is mainly due to their increased popularity and higher adoption, along with the inherent necessity for sound generation in these vehicles. BEVs generally depend entirely on electric motors as they are naturally quiet but can pose safety concerns for pedestrians and cyclists. Therefore, sound generators are installed to address these concerns, making BEVs more conspicuous. The rising production of BEVs sustains the long-term growth of the segment.

The hybrid electric vehicle (HEV) segment is expected to expand at the fastest rate during the forecast period. The growth of the segment is attributed to the rising adoption of HEVs, coupled with the advantages of fuel efficiency and reduced emissions. HEVs are becoming increasingly popular due to their reliability, affordability, and lower maintenance costs compared to pure-electric vehicles, with enhanced performance and acceptance range.

Product Insights

The internal sound generators segment dominated the market with the largest share in 2024. This is due to the primary safety regulations and increased adoption of electric vehicles. These systems are essential for making nearly silent electric vehicles audible to pedestrians and cyclists at low speeds as mandated by various global regulations. Moreover, internal sound generators facilitate the advantage of being customizable and scalable, providing acoustic comfort, affordability, and flexibility for manufacturers to tailor the sounds to specific vehicle models and target demographics, making them a viable solution.

The external sound generator segment is expected to witness the fastest growth during the predicted timeframe. This is due to rigorous safety regulations, increasing electric vehicle adoption, together with technological advancements. The global shift toward electric mobility as demand for sound generator systems increased to meet safety standards and enhance the driving experience. Furthermore, technological advancements include directional sound capabilities, AI-driven sound adaptation based on traffic conditions, and interactive functionalities, contributing to the market.

Vehicle Insights

The passenger vehicles segment dominated the electric vehicle sound generator market with the highest share in 2024. This is mainly due to the increased sales volume of passenger vehicles. Consumers often prefer features like safety and comfort in passenger vehicles, leading to a more enjoyable driving experience. Overall, the adoption of passenger electric vehicles, including BEVs and PHEVs, leads to a greater demand for electric vehicle sound generators.

The commercial vehicles segment is likely to grow at a significant rate in the coming years. The growth of the segment is attributed to the increasing emphasis on sustainable urban transportation and government regulations mandating electric vehicle sound generators. The rising adoption of electric buses and vans for public transit and delivery services, along with a growing awareness of environment and government initiatives to reduce pollution and emissions, contributes to segmental growth.

Component Insights

The hardware segment captured the biggest share of the electric vehicle sound generator market in 2024. This is mainly due to its direct impact on the sound quality and overall performance of the sound generator system of the vehicles. This segment not only encompasses the physical components like speakers, amplifiers, and microcontrollers essential for producing and delivering sound, but also offers sophisticated sound systems, including personalized sound profiles and noise cancellation features. There is a strong focus on improving sound quality and functionality, boosting the growth of the segment.

The software segment is projected to grow at the fastest rate in the upcoming years. This is due to its ability to personalize and enhance the driving experience. The software can fine-tune the sound output based on driving conditions, speed, and other parameters by offering a consistent and pleasant auditory experience for the driver and passengers. Moreover, software-driven sound generators allow customization of vehicle sounds.

Speed Range Insights

The full-speed range segment (above 30 km/h) led the electric vehicle sound generator market in 2024. This is mainly due to the global shift toward electric vehicles and regulations mandating Acoustic Vehicle Alerting Systems at low speeds. There is a high demand for customized sound experiences in electric vehicles. Although regulations are primarily focused on low-speed alerting, advancements in an electric vehicle sound generators are also being made for higher-speed ranges to enhance the overall driving experience.

The low-speed sound generators (0-30 km/h) segment is anticipated to show lucrative growth in the market during the forecast period. The growth of the segment is attributed to regulatory compliance and safety concerns to ensure pedestrian and cyclist's safety. Sound generators alert pedestrians and cyclists to the presence of silent electric vehicles, specifically at slower speeds where sound is crucial.

Regional Insights

Why Asia Pacific Dominated the Electric Vehicle Sound Generator Market?

Asia Pacific registered dominance in the market by capturing the largest share in 2024. The region's dominance is mainly attributed to swift electric vehicle adoption. The region is likely to sustain its position in the market due to greater consumer demand and preferences of EVs, particularly in countries like China, India, and Japan. This is further attributed to a massive population base, rapid urbanization, and increased disposable incomes. Furthermore, governments' support and policies in the region actively promote electric vehicle adoption, offering subsidies, tax breaks, and production mandates to encourage automakers to invest in electric vehicle manufacturing and enhance their availability. The widespread EV charging networks make electric vehicles more competitive and accessible, boosting the adoption of electric vehicles and significantly sound generators.

- In August 2022, by forming a Core Group on e-mobility intending to create an E-Mobility Basic R&D Roadmap for Surface Transportation, the government of India set an ambitious target of 30% electric vehicle penetration by 2030. This initiative, aligned with the "Viksit Bharat by 2047" vision, emphasizes developing a robust domestic EV ecosystem through research and development.

China: A Key Force in the Electric Vehicle Sound Generator Market

China is emerging as a major market due to its significant electric vehicle adoption and government support. As China is the world's largest producer of electric vehicles, there is a high demand for sound generators. Additionally, different subsidies, tax breaks, and relaxed licensing regulations for electric vehicles in urban areas are also driving the market.

European Electric Vehicle Sound Generator Market

Europe was the second-largest shareholder in 2024 and is anticipated to grow at the fastest rate during the forecast period. This is due to the significant surge in electric vehicle sales. Governments around the region are making initiatives to promote electric mobility solutions. There is a strong emphasis on safety for vulnerable road users. Many European countries like Norway, Iceland, Sweden, and the Netherlands have already achieved impressive electric vehicle adoption rates, along with the implementation and planning to enact regulations requiring new electric vehicles to be equipped with an Acoustic Vehicle Alerting System, supporting the market's growth. Germany plays a crucial role in the market. Germany is actively developing and implementing standards for the Acoustic Vehicle Alerting System, reinforcing uniform and pleasant sounds across the country by ensuring safety and compliance with EU regulations.

North America: A Notable Region in The Electric Vehicle Sound Generator Market

North America is a significantly growing area in the market for electric vehicle sound generator. This is mainly due to increasing consumer demand for EVs, necessitating sound generators as a crucial component for electric vehicle safety, especially at lower speeds. Furthermore, the region prioritizes pedestrian safety, resulting in the adoption of sound generators in electric vehicles to ensure adequate warning systems for pedestrians and minimize noise pollution. Governments around the region are offering subsidies and incentives to boost the adoption of EVs, creating the need for sound generators.

- In the U.S., the IRA provides USD 1 billion for vehicles and infrastructure specifically for heavy-duty vehicles, including subsidies, and the funding package of the state of California for charging infrastructure will see 70% of funds dedicated to charging for heavy-duty vehicles

Regulation and Innovation Fuel U.S. EV Sound Generator Growth

The U.S. electric vehicle sound generator market is growing due to regulatory mandates requiring Acoustic Vehicle Alerting Systems (AVAS) on EVs and hybrids to improve pedestrian safety. Rising EV adoption, increased urban traffic, and growing awareness of silent vehicle risks are driving demand. Additionally, aftermarket customization, technological advancements in sound systems, and government incentives for electric vehicles further contribute to the market's rapid expansion.

Why is the UK Electric Sound Generator Market Expanding

The UK electric vehicle sound generator market is expanding due to stricter pedestrian safety regulations requiring Acoustic Vehicle Alerting Systems (AVAS) on all new EVs. Growing EV adoption, increased urban traffic, and heightened awareness of road safety further drive demand. Additionally, aftermarket upgrades and customization options for sound generators are gaining popularity, while government incentives for EVs and investments in smart vehicle technologies support sustained market growth.

Value Chain Analysis

- Component Manufacturing: EV sound generator component production focuses on crafting core parts such as speakers, amplifiers, and control modules.

Manufacturing demands strong electronic engineering, mechanical design, and precision assembly to ensure clear sound output and long-lasting performance.

Key players: Faurecia, Harman International, Brigade Electronics, Continental AG, and SoundRacer. - Vehicle Assembly and Integration:EV sound generator assembly involves installing the Acoustic Vehicle Alerting System (AVAS), including speakers, into the vehicle body, commonly at the front or underbody.The system connects to the vehicle's electronic control unit (ECU), which regulates sound volume and pitch based on speed and compliance with safety regulations.

Key players: Faurecia, Harman International, Continental AG, Valeo, Bosch. - Retail Sales and Financing: EV sound generators (AVAS) are sold primarily in the aftermarket, allowing vehicle owners to upgrade or customize sounds beyond standard regulatory requirements.Financing is usually bundled with broader automotive loans or provided by specialized aftermarket lenders.

Key players: Faurecia, Harman International, Continental AG, Valeo, Bosch, Alpine Electronics.

Key Players in Electric Vehicle Sound Generator Market and their Offerings

- Ansys: Provides simulation and design software, Ansys Sound / ASDforEV, that allows automakers to design, tune, and validate EV sound profiles (AVAS, speed-acceleration feedback, etc.) using real-time vehicle data.

- ECCO: Offers the Electric Vehicle Alert System (EVAS), a speaker-based AVAS device with customizable tones, durable design (resistant to corrosion, dust, vibration), and broad frequency range for pedestrian warning and brand identity.

- Denso: Supplies AVAS hardware (alert devices), including modules like buzzers and speaker-based alert systems for EVs/hybrids, designed for pedestrian warning and regulatory compliance.

- Aptiv: A Tier 1 automotive supplier known to provide EV sound-generation systems; its solutions deliver dynamic sound modulation (via software) in response to vehicle speed and other parameters.

- Hyundai: Through its parts division (Hyundai Mobis), develops a Virtual Engine Sound System (VESS) / warning AVAS system. One design uses the front grille as a vibrating plate to generate alert sounds, reducing weight and size.

Recent Developments

- In March 2025, Toyota announced the integration of Innova Hycross with the AVAS system, which is a pedestrian-safety device commonly found in electric and hybrid, and plug-in hybrid vehicles as these cars have no engine sound, which may cause danger to pedestrians. This system alerts pedestrians about their presence by emitting a low-frequency sound. (Source: https://timesofindia.indiatimes.com)

- In July 2024, Brose developed its own Acoustic Vehicle Alerting System that generates artificial driving noise at speeds below 50 km/h. The mechatronics specialist drew on its expertise in the fields of acoustics and electronics, where the company will equip several million electric and hybrid vehicles in Europe and North America with the new product.(Source- https://www.autocarpro.in)

Segments Covered in the Report

By Sales Channel

- OEM

- Aftermarket

By Propulsion

- Battery electric vehicles (BEV)

- Hybrid electric vehicles (HEV)

- Plug-in hybrid electric vehicles (PHEV)

- Fuel cell electric vehicles (FCEV)

By Product

- External sound generators

- Internal sound generators

- Customizable sound systems

By Vehicle

- Passenger vehicles

- Sedan

- SUV

- Hatchback

- Commercial vehicles

- LCVs

- MCV

- HCV

- Two and three wheelers

- Off-highway vehicles

By Component

- Hardware

- Speakers

- Amplifiers

- Controllers

- Actuators

- Wiring harnesses

- Software

- Sound design applications

- Control systems

- User interface systems

By Speed Range

- Low-speed sound generators (0-30 km/h)

- Full-speed range sound generators (more than 30 km/h)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting