What is the Electroencephalography (EEG) Devices Market Size?

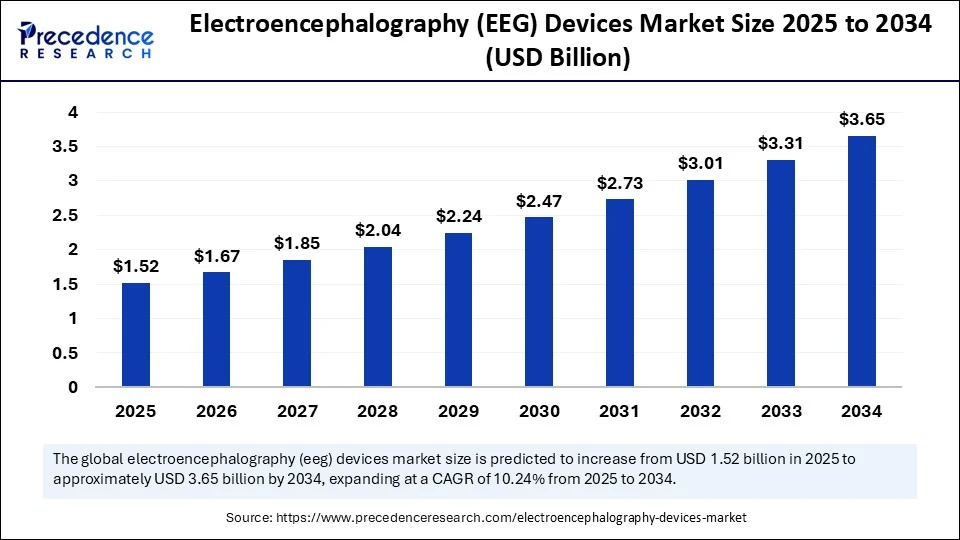

The global electroencephalography (EEG) devices market size is calculated at USD 1.52 billion in 2025 and is predicted to increase from USD 1.67 billion in 2026 to approximately USD 3.65 billion by 2034, expanding at a CAGR of 10.24% from 2025 to 2034. The growth of the market is driven by the increased prevalence of neurological disorders.

Electroencephalography (EEG) Devices MarketKey Takeaways

- In terms of revenue, the global electroencephalography (EEG) devices market was valued at USD 1.38 billion in 2024.

- It is projected to reach USD 3.65 billion by 2034.

- The market is expected to grow at a CAGR of 10.24% from 2025 to 2034

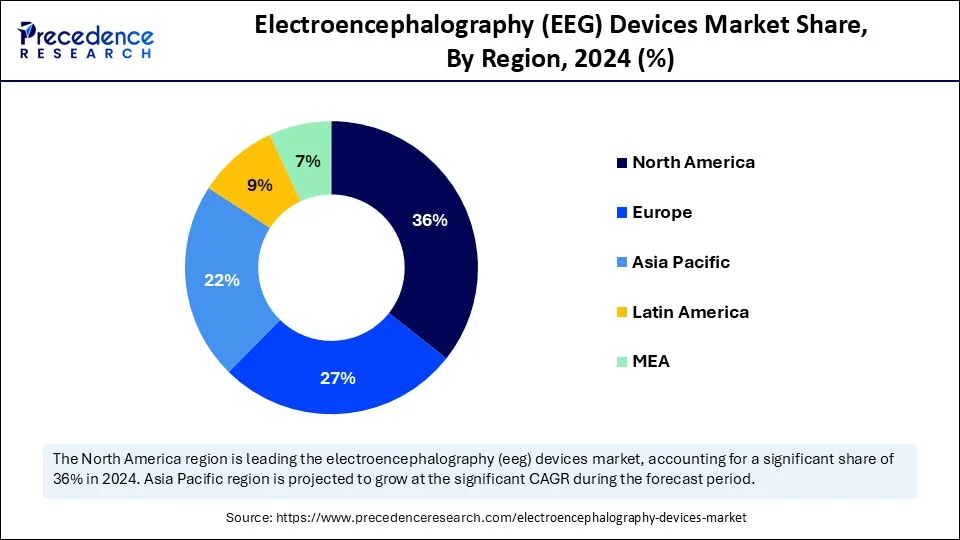

- North America dominated the electroencephalography (EEG) devices market with largest market share of 36% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the standalone EEG devices segment held the biggest market share in 2024.

- By product type, the wearable EEG devices segment is expected to grow at a significant CAGR between 2025 and 2034.

- By modality, the standard EEG segment generated the highest market share in 2024.

- By modality, the video EEG segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By application type, the disease diagnosis segment captured the major market share in 2024.

- By application type, the brain-computer interface (BCI) is expected to grow at the highest CAGR between 2025 and 2034.

- By end-user, the hospitals segment led the market share in 2024.

- By end-user, the neurofeedback clinics and rehab centers is expected to grow at the fastest rate between 2025 and 2034.

- By channel type, the 21-channel EEG segment accounted for largest market share in 2024.

- By channel type, the 64-channel EEG segment is expected to grow at a significant CAGR between 2025 and 2034.

- By portability type, the fixed EEG systems segment contributed the highest market share in 2024.

- By portability type, the mobile/wireless EEG systems segment is expected to grow at the highest CAGR between 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in Electroencephalography (EEG) Devices

Artificial intelligence is revolutionizing the ECG devices landscape by enabling smarter, faster, and more accurate interpretation of brainwave data. Traditional EEG interpretation required an expert neurologist and was often time-consuming and subjective. AI, particularly machine learning and deep learning models, can now detect abnormalities, seizure patterns, or cognitive anomalies in real time with greater precision. These intelligent systems also help identify subtle patterns that may go unnoticed by human analysis, thereby enhancing early diagnosis and treatment planning. Furthermore, AI-powered EEG tools are being integrated with portable devices, facilitating remote monitoring and tele-neurology services. This not only expands access to care but also improves outcomes in areas such as epilepsy management, sleep studies, and neurodevelopmental assessments.

Strategic Overview of the Global Electroencephalography (EEG) Devices Industry

The electroencephalography (EEG) devices market refers to the global industry focused on the development, manufacturing, and commercialization of medical devices that record the electrical activity of the brain. EEG devices are non-invasive and widely used in diagnosing neurological disorders such as epilepsy, sleep disorders, brain tumors, stroke, and dementia and in monitoring brain activity during surgeries and in critical care. They are also increasingly used in brain-computer interfaces and research settings. With an aging population and growing awareness about brain health, the demand for non-invasive, cost-effective diagnostic tools is on the rise. Advancements in wireless and wearable EEG systems are making brain monitoring more convenient for both patients and caregivers. These portable solutions enable a broader range of applications, from ICU brain monitoring to home-based neurotherapy. Moreover, increased investment in neuroscience research and brain-computer interface technologies is fueling product innovation.

What are the Major Trends in the Electroencephalography (EEG) Devices Market?

- Rise of Portable and Wearable EEG Devices: The demand for compact, user-friendly, and mobile EEG systems is surging. Wearable EEG headsets are designed for home use, brain-computer interface research, or consumer neurofeedback and are transforming brain monitoring from a clinic-bound procedure.

- Integration of AI and machine learning: EEG interpretation is being revolutionized by AI, which can quickly detect patterns, anomalies, and neurological biomarkers. AI-driven EEG analytics are enabling real-time seizure prediction, cognitive load measurement,

- Growing Adoption in Non-Clinical Applications: Beyond hospitals and clinics, EEG devices are finding new ground in areas such as gaming, meditation, education, and mental performance optimization.

- Increased Focus on Brain-Computer Interfaces (BCIs): EEG is at the heart of BCI innovation, allowing individuals to control external devices using brain signals. With rising interest in assistive technology, neuroprosthetics, and augmented reality, EEG-based BCI systems are gaining momentum across research labs and startups alike.

- Expansion of Tele-Neurology and Remote Diagnostics: The push for decentralized healthcare and post-pandemic digital health acceleration has made remote EEG monitoring a critical trend.

Market Outlook:

- Market Growth Overview: The Electroencephalography (EEG) Devices market is expected to grow significantly between 2025 and 2034, driven by the growing prevalence of neurological disorders, innovation in EEG technology is enhancing diagnostic capabilities and user experience, and expansion in home-care and telemedicine.

- Sustainability Trends: Sustainability trends involve a shift towards enhancing energy efficiency, eco-friendly materials and design, and improved signal processing.

- Major Investors: Major investors in the market include Medtronic plc, Koninklijke Philips N.V., GE Healthcare, Natus Medical Inc., and Masimo Corporation.

- Startup Economy: The startup economy is focused on innovative hardware and sensors, funding and investor support, and expanding application areas.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.65 Billion |

| Market Size in 2025 | USD 1.52 Billion |

| Market Size in 2026 | USD 1.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Modality, Application, End User, Channel Type, Portability and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Neurological Disorders

One of the major drivers of the electroencephalography (EEG) devices market is the global surge in the prevalence of neurological disorders. Conditions like epilepsy, Alzheimer's disease, Parkinson's, stroke, and sleep disorders are rising dramatically due to aging populations, lifestyle changes, and improved detection. EEG remains one of the most efficient, non-invasive, and cost-effective tools for diagnosing and monitoring such brain-related conditions. Electroencephalography (EEG) devices are essential tools used to record and analyze electrical activity in the brain, offering critical insights for diagnosing neurological disorders. The growing demand for early diagnosis and long-term neurological monitoring is prompting healthcare providers to invest more in advanced EEG systems.

Unlike MRI or CT scans, EEG devices are portable, relatively affordable, and allow real-time assessment of brain activity. It is thus playing a critical role not just in diagnostics but also in treatment follow-ups and cognitive rehabilitation. Technological advances are also driving the market. Innovations like wireless EEG, dry electrodes, AI-based analytics, and cloud-based EEG platforms are making the devices more precise, accessible, and convenient. These improvements are enabling continuous monitoring and enhancing diagnostic accuracy, especially in epilepsy detection and ICU brain monitoring.

Restraint

Lack of Skilled Personnel and High Costs of EEG Devices

The electroencephalography (EEG) devices market faces several hurdles that are slowing mass adoption and scalability. Chief among them is the interpretation complexity and dependency on skilled neurologists. Raw EEG data, even with advanced equipment, often requires expert analysis. In regions lacking neurology specialists, this poses a major bottleneck. The high cost of advanced EEG systems is another concern. Although portable and consumer-grade devices are emerging, full-scale clinical EEG machines with multi-channel inputs, software packages, and maintenance support remain expensive. This restricts adoption in resource-constrained hospitals and clinics, particularly in developing economies.

There are also technical limitations. EEG, while excellent for temporal resolution, lacks spatial precision. This makes it less ideal for detecting deep brain abnormalities or for use in certain neurosurgical planning. As a result, it often needs to be used in conjunction with imaging tools like MRI or CT, which increases the overall diagnostic cost. The market also suffers from regulatory complexity and a lack of standardization. Different countries have varying rules for EEG device certification, especially for wellness-oriented applications. This slows down international expansion and often requires product redesigns for compliance.

Opportunity

Expanding Applications

While EEG technology has long been a clinical staple, the true market opportunity lies in its emerging non-clinical and interdisciplinary applications. The fusion of EEG with areas like digital health, brain-computer interface (BCI), and wellness is opening new frontiers for growth. Furthermore, EEG keeps promises in neurorehabilitation and neurofeedback training. From helping stroke survivors regain brain function to assisting children with developmental disorders, EEG-driven therapy is becoming a vital component of cognitive recovery. This opens the market to therapists, rehabilitation centers, and special-needed educators. The education sector is also emerging as an unexpected arena.

Cognitive load monitoring and attention tracking through EEG could enhance adaptive learning platforms, leading to the development of smart classrooms and neuroscience-backed pedagogical tools. Ultimately, the market has immense untapped potential not only in healthcare but across human performance, education, and digital interface sectors, making it a goldmine for future investment and innovation.

Product Type Insights

Why Did the Standalone EEG Devices Segment Dominate the Market in 2024?

The stand-alone EEG devices segment dominated the electroencephalography (EEG) devices market with the largest revenue share in 2024. This is mainly due to their comprehensive features, clinical accuracy, and adaptability across a wide spectrum of neurological applications. These units, typically housed in hospital neurology departments or research laboratories, offer multi-channel precision that remains unmatched by smaller or wearable models. These devices are particularly favored in complex neurological diagnostics, such as in epilepsy monitoring units, ICU brain function monitoring, or long-duration sleep studies. Their ability to provide long-term, multi-site electrode coverage, along with compatibility with other imaging and patient monitoring tools, makes them indispensable in critical care.

Stand-alone EEG devices also excel in data integrity and reliability, which is crucial in hospital environments where false positives or signal artifacts could impact treatment decisions. Their stable hardware, high signal resolution, and extensive storage capacity ensure dependable, repeatable results in high-stakes clinical settings. Hospitals and tertiary care centers often choose these units because they can be upgraded with advanced software modules, integrated with AI-based analytics, and operated by trained neurotechnicians, making them future-ready and clinically robust.

On the other hand, the wearable EEG devices segment is expected to grow at the fastest rate during the forecast period, as they bring portability, accessibility, and patient comfort to the forefront of neurological monitoring. These lightweight, headband-style or cap-based units are designed for easy self-application, remote monitoring, and real-time brainwave tracking. One of the major reasons for the segment's growth is their appeal to both clinical and non-clinical users.

In healthcare, wearable EEGs are being used for outpatient seizure tracking, sleep analysis, and pediatric monitoring. In wellness and research, they are employed for meditation, neurofeedback, cognitive training, and focus enhancement. Wearables solve a key limitation of traditional EEGs: mobility. Patients no longer need to visit a hospital or be confined to a bed for hours. Instead, they can wear compact EEGs while at home, at work, or even while sleeping, enabling real-world brain data collection, especially useful in behavioral studies and ambulatory diagnosis.

Modality Insights

How Does the Standard EEG Segment Dominate the Electroencephalography (EEG) Devices Market?

The standard EEG segment dominated the market with the largest share in 2024. Standard EEG remains the most widely used modality because of its clinical versatility, procedural simplicity, and broad diagnostic scope. It provides a snapshot of brain electrical activity over a defined period, ideal for detecting general neurological dysfunction. This modality is effective for diagnosing epileptic seizures, encephalitis, dementia, and various sleep or psychiatric disorders. Due to its short setup time and manageable data size, it fits seamlessly into routine neurological workflows.

Standard EEGs are often the first-line test before advanced imaging or invasive procedures are considered. Their non-invasive nature and proven reliability make them suitable for patients of all ages, from infants to the elderly. The affordability of standard EEG devices also makes them attractive to small and mid-sized clinics, especially in developing nations. They provide essential diagnostic capabilities without the infrastructure demands of high-end modalities.

Meanwhile, video EEG is the fastest-growing segment because it offers a multidimensional view of brain function and behavior, combining electrical activity data with synchronized video footage of the patient's physical responses. This method is particularly valuable in epilepsy monitoring, where capturing a seizure on camera while simultaneously recording brain waves allows clinicians to accurately correlate electrical and behavioral patterns. Video EEG is increasingly used in pre-surgical evaluation, especially in drug-resistant epilepsy, where pinpointing the exact seizure onset zone is vital. Video EEG delivers unmatched context, making it crucial for personalized treatment planning. Pediatric neurologists and psychiatric clinics rely on vEEG to differentiate between true seizures and psychogenic non-epileptic events, improving diagnostic accuracy and avoiding unnecessary medication.

Application Insights

What Made Disease Diagnosis the Dominant Segment in the Market?

The disease diagnosis segment dominated the electroencephalography (EEG) devices market in 2024, due to the central role of EEG devices in both diagnosis and long-term management of conditions such as epilepsy. It remains the gold standard for detecting abnormal brainwave activity, such as spikes, sharp waves, and seizures. Patients suspected of epilepsy undergo EEG to confirm the type and origin of seizures, helping doctors tailor treatment plans, particularly with anti-epileptic drugs or surgical interventions. No other diagnostic tool provides such precise and immediate data on brain function in real-time during an episode.

Moreover, EEG plays a crucial role in post-diagnosis monitoring, particularly in evaluating treatment effectiveness and medication side effects. Long-term EEG monitoring, sometimes paired with video, helps neurologists distinguish between epileptic and non-epileptic events. The growing prevalence of epilepsy globally, especially in pediatric and geriatric populations, keeps the demand for EEG high.

On the other hand, the brain-computer interface (BCI) segment is expected to grow at the fastest CAGR in the coming years. BCI applications represent one of the most exciting frontiers in EEG technology, offering groundbreaking possibilities in communication, control, and cognition. BCIs translate brain signals into machine-readable commands, and EEG is currently the most practical tool for capturing those signals non-invasively. BCI applications are expanding rapidly in fields like assistive technology, where they empower individuals with paralysis or motor impairments to control prosthetic limbs, type on a virtual keyboard, or even drive a wheelchair using brain activity.

The gaming and VR industries are also exploring EEG-powered BCIs to create immersive, thought-responsive experiences. Users can control avatars or interact with environments using neural impulses, enhancing engagement and creating new genres of brain-based entertainment. Neurofeedback-based learning platforms are applying BCI to monitor attention, fatigue, or emotional states, adapting the pace and content of educational material in real time. This cognitive optimization holds the potential for e-learning, therapy, and skill training.

End-User Insights

Why Did the Hospitals Segment Dominate the Electroencephalography (EEG) Devices Market in 2024?

The hospitals segment dominated the market with a major revenue share in 2024. This is mainly due to the increased patient volume requiring full-scale neurological diagnostics and monitoring. EEGs are core components of neurology departments, intensive care units, emergency care, and pediatrics. Hospitals typically conduct a broad range of EEG-based evaluations, from routine diagnostics for seizures and headaches to continuous monitoring for brain trauma, coma, or post-stroke care. Their multi-disciplinary nature makes hospitals a central hub for EEG use across multiple departments. They also benefit from high-grade stand-alone EEG systems with multi-channel capabilities, integration with imaging systems, and sophisticated data analysis tools.

Hospitals invest in advanced EEG systems with video telemetry and often have dedicated neurotechnicians, attracting more patients. Another strength lies in interdisciplinary collaboration. EEG results are often interpreted in conjunction with imaging, blood work, and cognitive testing, enabling clinicians to make informed, holistic treatment decisions. Hospitals also have the advantage of insurance coverage and reimbursement infrastructure, making EEG services more accessible and affordable to a wider patient base, which fuels routine usage.

On the other hand, the neurofeedback clinics & rehabilitation centers segment is expected to grow at the fastest rate during the projection period due to the rising demand for non-invasive cognitive therapies and mental wellness solutions. These settings use EEG-based tools to monitor and retrain brain activity, especially in individuals with ADHD, anxiety, PTSD, or brain injuries. Neurofeedback therapy, which allows patients to gain real-time feedback on their brainwaves and learn to self-regulate, is becoming a preferred alternative to medication, especially for children, athletes, and professionals seeking focus and stress relief. Rehabilitation centers use EEG to support post-stroke recovery, neuroplasticity training, and memory enhancement. The non-pharmacological nature of EEG-based rehab is attractive in long-term care, particularly for the elderly or patients.

Channel Type Insights

How Does the 21-Channel EEG Remain the Industry Standard?

The 21-channel EEG segment dominated the electroencephalography (EEG) devices market in 2024 as it provides the perfect balance between diagnostic detail, operational efficiency, and clinical familiarity. This setup, based on the internationally recognized 10–20 electrode placement system, is trusted globally for most neurological evaluations. Clinicians can detect epileptiform discharges, focal abnormalities, and generalized activity with high confidence. It is widely accepted as sufficient for routine EEGs in diagnosing epilepsy, encephalopathies, sleep disorders, and post-stroke cognitive deficits. Most EEG technicians and neurologists are trained in this configuration, ensuring uniformity in data collection and interpretation across hospitals, clinics, and research settings. Its consistent use enables comparison across time and populations, enhancing diagnostic reliability.

Meanwhile, the 63-channel EEG segment is witnessing rapid growth as advanced neuroscience research, surgical mapping, and brain-computer interfaces (BCIs) demand more granular brain activity data. With enhanced spatial resolution, this high-density configuration is redefining how detailed brain diagnostics are performed. In applications like epilepsy surgery or tumor localization, the 63-channel EEG provides precise localization of cortical abnormalities, supporting neurosurgeons in planning more effective, targeted interventions. Its resolution surpasses standard setups and is especially useful in detecting deep or subclinical activity. Researchers favor this configuration for studies in cognition, memory, and emotion, where tracking subtle electrical shifts across brain regions is crucial.

Portability Insights

What Made Fixed EEG Systems the Dominant Segment in the Electroencephalography (EEG) Devices Market in 2024?

Fixed EEG systems continue to dominate the market because they offer superior reliability, diagnostic depth, and high-quality data acquisition, which are essential in clinical settings. These systems are the benchmark for neurology departments, especially when long-duration, high-resolution brain activity recordings are required. Fixed systems provide the full-spectrum capability to manage multi-channel inputs, artefact filtering, and real-time monitoring, making them ideal for epilepsy monitoring units, neuro-ICUs, and academic research facilities. Their ability to integrate seamlessly with imaging modalities and hospital networks ensures accurate diagnostics and streamlined workflow. The robust hardware and larger storage capacities in fixed systems support extended recording durations vital for capturing infrequent or nocturnal seizures and for assessing neurodegenerative progression. Portable devices often lack the infrastructure to match such clinical intensity.

On the other hand, mobile wireless EEG systems are the fastest growing segment as they represent the future of flexible, patient-centric, and decentralized brain monitoring. With increasing demand for home care and ambulatory diagnostics, these devices are revolutionizing how EEG data is captured and used. One of the key drivers is freedom of movement. Wireless EEGs allow patients to engage in daily activities while being monitored, capturing brain activity in natural environments, which is essential for accurate behavioral and cognitive analysis. In acute care and emergency rooms, portable systems offer rapid setup and bedside testing, especially for unresponsive or trauma patients. This on-the-spot capability reduces delays in care and increases diagnostic reach across hospital departments.

Regional Insights

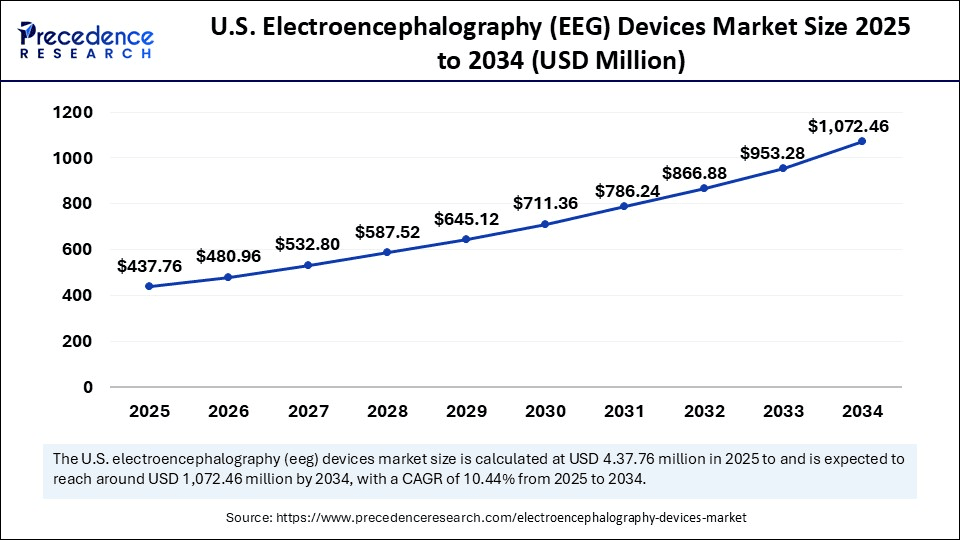

U.S. Electroencephalography (EEG) Devices Market Size and Growth 2025 to 2034

The U.S. electroencephalography (EEG) devices market size is exhibited at USD 437.76 million in 2025 and is projected to be worth around USD 1,072.46 million by 2034, growing at a CAGR of 10.44% from 2025 to 2034.

What Made North America the Dominant Region in the Electroencephalography (EEG) Devices Market in 2024?

North America held the largest share of the market in 2024. This is mainly due to its well-established healthcare infrastructure, high adoption of medical technology, and strong neurological research base. Countries like the U.S. and Canada are consistently investing in advanced diagnostic tools, with EEG systems being integral to neurology departments in both public and private health systems. The region has a high prevalence of neurological disorders, including epilepsy, dementia, and sleep-related conditions. With an aging population and growing mental health awareness, demand for early diagnosis and continuous neurological monitoring is rising, making EEG an indispensable clinical tool.

U.S. Electroencephalography (EEG) Devices Market Trends

The U.S. Electroencephalography (EEG) Devices market is a moving diagnostic beyond traditional clinical settings into ambulatory and remote care. The integration of AI for advanced data analysis and cloud-based platforms is improving diagnostic accuracy and supporting the rise of telemedicine and neurofeedback applications.

Constant innovation, FDA approvals, and collaborative research sustain the region's lead in technological refinement and product launch cycles. North America also benefits from robust insurance coverage and reimbursement policies, which encourage EEG testing for conditions like ADHD, autism, and sleep apnea. Financial accessibility is critical for the widespread clinical adoption, especially among pediatric and geriatric populations. Moreover, the region is a leader in tele-neurology, a growing field where EEG plays a central role. Portable EEG systems are being integrated into remote care programs, helping neurologists monitor patients in rural or underserved areas without compromising quality.

What are the Major Trends in the Asia-Pacific Electroencephalography (EEG) Devices Market?

Asia Pacific is expected to witness the fastest growth in the coming years due to its expanding healthcare infrastructure, increasing neurological awareness, and rising burden of brain-related disorders. With countries like China, India, Japan, and South Korea making aggressive healthcare investments, EEG devices are gaining attention as essential diagnostic assets. One of the primary drivers is population scale. With over half of the world's population residing in this region, the sheer volume of patients needing neurological assessment is significantly high. Aging populations, coupled with urban lifestyles, are increasing incidences of stroke, epilepsy, and neurodegenerative diseases. Healthcare accessibility in Asia-Pacific is transforming.

Governments around the region are focusing on affordable diagnostic tools, especially in rural areas, where EEG is preferred over more expensive imaging methods. Mobile and portable EEG units are being adopted in community health centers and regional hospitals, expanding reach and reducing urban-rural disparities. Another factor is the adoption of digital health and wearable technologies. Tech-forward countries like Japan and South Korea are leading in EEG-integrated consumer wellness devices, while India and China are promoting telemedicine and AI-powered diagnostic platforms, creating a broad and diverse base for EEG deployment. Moreover, educational and research institutions in the region are increasingly investing in neuroscience research, driving the demand for research-grade EEG systems. Collaborations between universities, startups, and healthcare providers are fostering product customization and local innovation.

What Opportunities Exist in the European Electroencephalography (EEG) Devices Market?

Europe is witnessing notable growth, driven by its strong public healthcare systems, proactive regulatory environment, and commitment to neurological research. While not growing as rapidly as Asia-Pacific, Europe is steadily expanding its EEG market with a focus on precision diagnostics, ethical compliance, and patient-centric innovation. The European medical community places high value on the early detection of neurodegenerative disorders such as Alzheimer's, Parkinson's, and multiple sclerosis. EEG devices play a vital role in routine neurology diagnostics and ongoing cognitive assessments, particularly within elderly care facilities and outpatient monitoring services.

Europe is also home to several pioneering neuroscience institutions in countries like Germany, France, Sweden, and the Netherlands. These centers actively invest in EEG-based research, from epilepsy and sleep studies to developmental neuropsychology. Such academic strength supports both demand and technological evolution in the EEG market. The European Union's strong regulatory frameworks, while rigorous, provide clarity and consistency in device approvals and clinical use. CE-marked EEG devices are widely used across both public and private sectors, and harmonized standards foster smooth adoption across borders.

China Electroencephalography (EEG) Devices Market Trends

China is experiencing rapid growth, driven by substantial government investment in neurotechnology and favourable policies promoting domestic production. Significant advancement in brain-computer interface applications of healthcare infrastructure and a rise in portable EEG equipment.

Germany Electroencephalography (EEG) Devices Market Trends

Germany's electroencephalography (EEG) devices market is driven by a shift toward portable, wireless EEG systems for use in home-care settings, offering greater flexibility and accessibility. The integration of artificial intelligence is enhancing the accuracy and speed of EEG data analysis, assisting clinicians in making faster diagnoses.

Value Chain Analysis of the Electroencephalography (EEG) Devices Market

- Research & Development (R&D) and Design

This initial stage focuses on conceptualising new EEG technologies, including novel electrode materials (e.g., dry electrodes), hardware miniaturization, and advanced software for signal processing and interpretation (AI/ML algorithms).

Key Players: Medtronic, Koninklijke Philips N.V., Compumedics Limited, Natus Medical Incorporated. - Raw Material Sourcing & Component Manufacturing

This stage involves procuring materials like specialised polymers, conductive materials for electrodes, and complex electronic components such as amplifiers, microprocessors, and wireless communication modules. - Assembly, Integration & Testing

Components are assembled into the final EEG device, whether it's a large clinical machine or a compact wearable headset.

Key Players: Koninklijke Philips N.V., Medtronic, Nihon Kohden Corporation, Natus Medical Incorporated. - Distribution & Sales

This stage involves marketing, sales, and logistics to get the EEG devices to end-users, including hospitals, clinics, research institutions, and direct-to-consumer channels for wearable devices.

Key Players: Medical device distributors, direct sales teams of OEMs (e.g., Siemens Healthineers), online retailers and pharmacies (for consumer-grade devices). - Operation, Service & Support

Post-sale activities include installation, training for clinical staff, maintenance, software updates, repairs, and customer support.

Key Players: Koninklijke Philips N.V., Medtronic

Top Companies in the Electroencephalography (EEG) Devices Market & Their Offerings

- Natus Medical Inc.: Natus is a leading provider of medical devices, software, and services for the diagnosis and monitoring of brain disorders in pediatric and adult patients.

- Nihon Kohden Corporation: This company develops, manufactures, and distributes medical electronic equipment, including advanced EEG systems with neurographic analysis software and remote monitoring capabilities. Its contributions focus on innovative products for diverse medical fields, particularly neuroscience.

- Compumedics Limited: Compumedics is a global provider of computer-based sleep, neurophysiology, and cardiac diagnostic systems. It contributes to the EEG market by offering a comprehensive suite of high-performance neurodiagnostic products, including clinical and research-grade EEG systems.

- Neurosoft: This Russian company specializes in the development and production of neurophysiological and audiometric equipment, contributing to the EEG market with affordable, reliable systems for hospitals and clinics. It focuses on functional diagnostics and physical therapy equipment.

- Cadwell Industries Inc.: Cadwell focuses on developing innovative neurophysiology instruments used for neurology, sleep, and intraoperative monitoring. Its contributions include high-quality, reliable EEG systems that provide comprehensive diagnostic capabilities.

- Micromed Group: This Italian company specializes in the design and development of neurophysiology medical devices used for the diagnosis of neurological disorders. It contributes to the market through innovative and reliable systems for EEG and Epilepsy monitoring.

- Brain Products GmbH: Brain Products is a leading producer of hardware and software for neurophysiological research, particularly high-density EEG systems and brain imaging solutions. Its focus is on the research segment, providing tools for cutting-edge neuroscience studies.

g.tec medical engineering GmbH: This company develops hardware and software for biosignal acquisition and - Brain-Computer Interface (BCI) research and medical applications. It contributes to the EEG market with specialised systems for real-time BCI implementation and neurofeedback therapy.

- Electrical Geodesics Inc. (EGI) – now part of Philips: EGI specialises in high-density EEG systems (hdEEG), which use a large number of electrodes for detailed brain mapping, and is now integrated into Koninklijke Philips N.V.'s neuroimaging portfolio. Its technology offers enhanced spatial resolution for neurodiagnostic research and clinical applications.

- NeuroSky Inc.: NeuroSky is a pioneer in developing brain-computer interface technologies for consumer and educational markets, providing low-cost EEG sensors and chips. It contributes to the market by making basic EEG technology accessible for non-clinical applications like wellness and entertainment.

- Bitbrain Technologies: This company specialises in developing advanced monitoring solutions for neuroscience and neuromarketing, offering both wireless and mobile EEG systems. Its focus is on providing flexible and user-friendly tools for brain research and performance monitoring.

- EMOTIV Inc.: EMOTIV creates high-resolution, portable, and wireless EEG headsets and brain-sensing technology designed for research and consumer use. It contributes to the market by making advanced brain monitoring more accessible and less invasive.

- Biosemi B.V.: Biosemi focuses on developing highly accurate, Active Two EEG systems for research applications, emphasising high signal quality and flexibility. It contributes to the market by providing a non-gel-based electrode system that is ideal for demanding research environments.

- Advanced Brain Monitoring Inc.: This company specialises in developing innovative, medical-grade brain monitoring devices for diagnostics, clinical trials, and home care. It contributes to the market with user-friendly, high-fidelity EEG systems designed for comfortable, long-term monitoring.

- Wearable Sensing: Wearable Sensing develops advanced, dry-electrode-based wireless EEG systems for real-world applications in health, performance monitoring, and research. It contributes to the market by focusing on comfortable, non-invasive technology that simplifies data acquisition outside of traditional lab settings.

- Masimo Corporation: Through its acquisition of certain EEG monitoring capabilities, Masimo integrates brain function monitoring into its comprehensive patient monitoring solutions used in operating rooms and intensive care units.

- Mindray Medical International Limited: Mindray is a leading global developer of medical devices, offering various patient monitoring systems that can integrate EEG modules for comprehensive patient care. It contributes to the market by providing affordable, high-quality solutions across different medical disciplines globally.

- Medtronic plc: A global leader in medical technology, Medtronic provides solutions for a wide range of medical conditions, including neurological disorders.

Integra LifeSciences: Integra focuses on neurosurgery and regenerative medicine, offering specialized products that support neurological procedures, including those requiring intraoperative neurophysiological monitoring. - Deymed Diagnostic: Deymed specialises in the development and manufacture of high-quality neurodiagnostic equipment, including advanced EEG and EMG systems.

Electroencephalography (EEG) Devices Market Companies

- Natus Medical Inc.

- Nihon Kohden Corporation

- Compumedics Limited

- Neurosoft

- Cadwell Industries Inc.

- Micromed Group

- Brain Products GmbH

- g.tec medical engineering GmbH

- Electrical Geodesics Inc. (EGI) – now part of Philips

- NeuroSky Inc.

- Bitbrain Technologies

- EMOTIV Inc.

- Biosemi B.V.

- Advanced Brain Monitoring Inc.

- Wearable Sensing

- Masimo Corporation (via acquisition of EEG monitoring capabilities)

- Mindray Medical International Limited

- Medtronic plc

- Integra LifeSciences

- Deymed Diagnostic

Recent Developments

- In May 2025, Natus Medical Incorporated announced the launch of BrainWatch, the highly anticipated point-of-care EEG solution. This solution is designed to bring the reliability and trust expected from the world's largest neurodiagnostic company into critical-care environments.

(Source: https://www.prnewswire.com) - In April 2024, Soterix Medical Inc. launched MxN-GO EEG, a combined High Definition transcranial Electrical Stimulation (HD-tES) and EEG system with a unique untethered design. The system is intended for research applications requiring electrical stimulation and recording of brain activity in mobile and natural environments. The MxN-GO EEG features 33 stimulation channels and 32 recording channels, providing unparalleled precision and application-specific targeting.

(Source: https://soterixmedical.com)

Segments Covered in the Report

By Product Type

- Standalone EEG Devices

- Portable EEG Devices

- Wearable EEG Devices

By Modality

- Standard EEG

- Ambulatory EEG

- Video EEG

- Invasive EEG (Intracranial/Depth Electrodes)

By Application

- Disease Diagnosis

- Epilepsy

- Sleep Disorders

- Brain Tumors

- Stroke

- Others (e.g., Alzheimer's, Encephalopathies)

- Monitoring

- Anesthesia Monitoring

- ICU Monitoring

- Trauma & Injury Monitoring

- Brain-Computer Interface (BCI)

- Research

By End User

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Research & Academic Institutes

- Neurofeedback Clinics & Rehabilitation Centers

By Channel Type

- 8-Channel EEG

- 21-Channel EEG

- 32-Channel EEG

- 64-Channel EEG

- 128-Channel EEG

- 256-Channel EEG and Above

By Portability

- Fixed EEG Systems

- Mobile/Wireless EEG Systems

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting