What is the Electroplating Market Size?

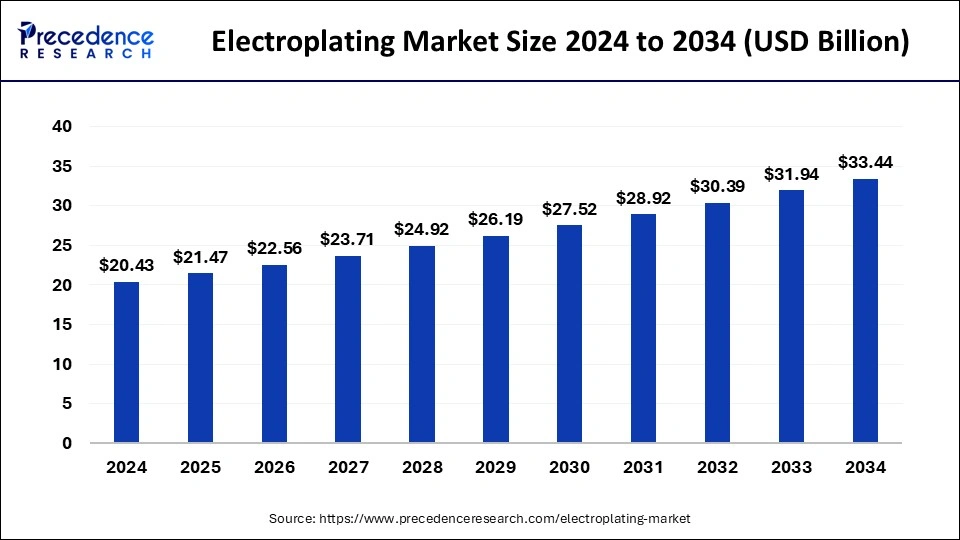

The global electroplating market size is calculated at USD 21.47 billion in 2025 and is predicted to increase from USD 22.56 billion in 2026 to approximately USD 33.44 billion by 2034, expanding at a CAGR of 5.05% from 2025 to 2034. Automobile elements, including functional components and decorative trim, require electroplating, which is why demand for the electroplating market is increasing.

Electroplating Market Key Takeaways

- Asia Pacific held the largest share of the electroplating market in 2024.

- North America is expected to host the fastest-growing market during the forecast period.

- By type, the barrel plating segment held the largest share of the market in 2024.

- By type, the rack plating segment is expected to grow at the fastest rate in the market over the studied years.

- By metal type, the gold segment dominated the market in 2024.

- By metal type, the chromium segment is expected to grow at the highest CAGR in the market during the forecast period.

- By end use, the automotive segment dominated the market in 2024.

- By end use, the electrical & electronics segment is expected to grow rapidly in the market over the forecast period.

What is the Electroplating Market?

Within the global surface finishing business, the electroplating market is a prominent segment that is appreciated for its capacity to improve the functionality, durability, and look of metal parts in a variety of industries. The growing demand for electroplating in the automotive, electronics, aerospace, and industrial sectors has led to an expansion of the global market. It is anticipated to expand gradually because of the requirement for decorative coatings, corrosion resistance, and technological breakthroughs.

Trivalent chromium and other non-toxic substitutes are examples of sustainable plating technologies that have been developed in response to growing environmental concerns. For accuracy and efficiency, automated plating methods are becoming more and more popular. Adherence to strict environmental regulations on the handling of hazardous materials and wastewater treatment. Eco-friendly technology implementation can be expensive, which affects smaller firms' profit margins.

Prominent corporations in the electroplating market that emphasize innovation and global expansion include Atotech, Advanced Plating Technologies, Precision Plating Company, and others. The requirement for high-performance surface finishes and regulatory compliance, coupled with technological improvements and rising demand across a range of end-use sectors, are driving the ongoing evolution of the electroplating industry.

How is AI Contributing to the Electroplating Market?

AI is the one changing the game in the electroplating market by introducing automation in process control, better accuracy, and efficient resource use. Machine learning algorithms are adjusting the plating conditions to the best, while computer vision is making sure the surface is of the highest quality. Predictive maintenance is cutting down the downtime, and smart forecasting is making the supply chain stronger. AI, besides these, also pushes the boundaries of existing knowledge with new material simulations and thus, enables green and less energy-consuming production, which is changing the whole landscape of traditional plating factories into intelligent, data-driven manufacturing units.

Electroplating Market Growth Factors

- Automotive parts can be made more resilient, aesthetically pleasing, and resistant to corrosion by electroplating, which will fuel the electroplating market expansion. Improving the strength and visual appeal of automobile parts requires electroplating.

- Utilized to increase conductivity and corrosion resistance in semiconductor components, connections, and printed circuit boards (PCBs).

- Because electronic gadgets and components are becoming more and more common, electroplating is essential to maintaining their longevity and functionality and driving up demand in the electroplating market.

- Due to their increased quality and efficiency, electroplating innovations such as pulse plating and nanotechnology applications are driving the electroplating market.

- Greener alternatives are being adopted as a result of the increased focus on environmentally friendly plating methods and materials, which is propelling the electroplating market expansion.

- For aerospace and defense applications, where components need high-performance coatings for dependability and safety, electroplating is crucial and helps to expand the market. Offers coatings that protect airplane parts against abrasive situations.

- Construction and associated industries are experiencing a surge in demand for electroplated materials due to investments in infrastructure projects, especially in emerging economies.

Market Outlook:

- Industry Growth Overview: The electroplating market is growing at a steady rate all over the world for the simple reason that the automotive, electronics, and industrial sectors are increasing their demand for coatings that are not only durable but also have good aesthetic appeal.

- Sustainability Trends: The industry is gradually becoming more natural by phasing out the use of harmful chemicals, installing closed-loop water systems, and practicing resource conservation to comply with global environmental standards.

- Global Expansion: The market is still very much in the process of expansion in various parts of the world, with the Asia-Pacific region being the most advanced in manufacturing, while both North America and Europe are working on the smarter and greener technology adoption front.

- Major Investors: Top companies are pouring money into machines, research, and environmentally friendly innovations that would not only make them up-to-date but also enable them to have a larger share in the global market.

- Startup Ecosystem: The startup environment is vibrant with the introduction of innovations in eco-friendly materials, automatic plating systems, and high-tech coating methods that change the standard in terms of performance and efficiency.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 33.44 Billion |

| Market Size in 2025 | USD 21.47 Billion |

| Market Size in 2026 | USD 22.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.05% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type Synthesis Metal Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Growing electronics industry

The electroplating market is significantly impacted by the expanding electronics industry. In the electronics industry, electroplating is essential because it gives components like printed circuit boards, semiconductor devices, and connectors better conductivity, corrosion resistance, and aesthetic appeal. For electronics used in automobiles, wearable technology, smartphones, and other gadgets, electroplating helps to improve the performance and longevity of electrical components while also helping to reduce their size. Innovation in electroplating processes is driven by the need for novel materials with superior qualities, such as higher conductivity, heat dissipation, and corrosion resistance. Modern electroplating techniques, like high-speed and pulse plating, address the particular efficiency and precise requirements of the electronics sector.

Restraint

Rising raw material costs

In the electroplating market, metals such as nickel, copper, and chromium are needed. Production expenses are directly impacted by changes in their prices. Processes involving electroplating demand large energy inputs. Price increases for energy have the potential to increase total production costs. The price volatility of chemicals used in electroplating, including bases, acids, and specialty chemicals, can have an effect on operating expenses. Raw material shortages and price increases can result from supply chain disruptions brought on by natural catastrophes, transportation problems, or geopolitical concerns. Increased prices may result from the adoption of more costly, ecologically friendly methods and raw materials due to stricter environmental restrictions.

Opportunity

Advanced materials and technologies

Using nanotechnology in the development of coatings that are harder, more resistant to corrosion, and have a smaller environmental impact. The creation of environmentally friendly procedures that employ safer chemicals consumes less energy and produces less trash. Use sophisticated alloys for electroplating, such as cobalt-phosphorus, nickel-tungsten, and others, to attain increased durability and wear resistance. Robotics and automation are combined to provide accurate control over plating operations, increase consistency, and save labor expenditures. Smart coatings are used for a variety of industrial uses, including self-healing, anti-fouling, and sensing properties. Improvements in electroless plating methods eliminate the need for electrical current and allow for the uniform coating of complex geometries.

Type Insights

The barrel plating segment held the largest share of the electroplating market in 2024. One electroplating technique that is particularly useful for small, intricate, or fragile parts that would be challenging to plate using other techniques is barrel plating. Parts, plating solutions, and media—such as balls or stainless-steel pins—are all placed inside a spinning barrel during the barrel-plating process. The components tumble as the barrel rotates, guaranteeing even exposure to the plating solution for a consistent coating. This process makes it possible to efficiently plate delicate features while maintaining product quality, which makes it useful for the mass manufacture of small parts like nuts, screws, and connectors. It's widely utilized in sectors including consumer products, electronics, and automotive manufacturing that demand high-volume production at constant quality.

The rack plating segment is expected to grow at the fastest rate in the electroplating market over the studied years. A specialized method of electroplating called rack plating involves hanging the components to be plated one at a time on racks. This approach makes it possible to uniformly plate intricate forms or components that must stay apart during the plating process. It's frequently applied to objects that need a certain plating thickness, have complicated decorations, or are delicate. It is possible to place each component separately, guaranteeing equal plating thickness and coverage. Appropriate for parts of different sizes and forms without the possibility of their contacting one another when plating. This technique is popular in sectors where accurate and reliable plating quality is essential, like aerospace, electronics, and the automotive industry.

Metal Type Insights

The gold segment dominated the electroplating market in 2024. Gold metal is a major player in the electroplating industry because of its superior conductivity, resistance to corrosion, and visual attractiveness. It is frequently utilized in ornamental applications where its shine and durability are highly prized, such as jewelry and luxury items. Gold plating is also essential for electronics in industrial settings because it offers continuous electrical conductivity and dependable contact surfaces that are resistant to tarnishing. In the electroplating market, the gold metal segment primarily deals with the deposition of gold onto surfaces for a variety of uses, including jewelry, decorative finishes, electronics (for conductivity and corrosion resistance), and so on. The demand from the electronics manufacturing sector, changes in the jewelry industry, and improvements in electroplating technology are some of the factors that frequently impact this market.

The chromium segment is expected to grow at the highest CAGR in the electroplating market during the forecast period. In the electroplating market, chromium metal is important, especially for industrial hard chrome plating and decorative chrome plating. Because it can give surfaces like those of automobiles, faucets, and home fixtures a glossy, corrosion-resistant finish, chromium is frequently employed in these applications. Chromium is utilized in industrial applications to give parts like molds, piston rings, and hydraulic cylinders hardness and wear resistance. Surface finishing is essential for both performance and appearance in the automotive, aerospace, and electronics industries, and it has an impact on the market, including chromium plating. The market dynamics are influenced by the growing focus on eco-friendly substitutes and laws governing the use and disposal of chemicals used in chromium plating.

End-use Insights

The automotive segment dominated the electroplating market in 2024. The market for electroplating is heavily influenced by the automobile sector. Electroplating is frequently utilized in the production process to improve an automotive component's longevity, corrosion resistance, and visual appeal. Important uses include plating interior elements like dashboard highlights and door handles, as well as external pieces like bumpers, grilles, and trim. The necessity for superior surface finishing in the automobile industry, which increases the aesthetic appeal and prolongs the life of automotive parts exposed to adverse climatic conditions, is what fuels the demand for electroplating.

The electrical & electronics segment is expected to grow rapidly in the electroplating market over the forecast period. Electroplating is a common technique used in the electrical and electronics sectors to improve the robustness, conductive properties, and visual appeal of parts and equipment. This covers the plating of circuit boards, semiconductors, connections, and different electronic housings. Electroplating is a common technique used in the electrical and electronics sectors to improve the robustness, conductive properties, and visual appeal of parts and equipment. This covers the plating of circuit boards, semiconductors, connections, and different electronic housings. Specific electroplated metals, such as silver and gold, are employed to increase conductivity in electrical contacts and connectors and guarantee dependable electrical connections. The electrical and electronics industries' demands for performance improvements and compactness are being met by ongoing advancements in electroplating technologies.

Regional Insights

Asia Pacific held the largest share of the electroplating market in 2024. Asia Pacific's electroplating market is expanding rapidly due to growing industrialization, technical breakthroughs, and rising demand from a variety of end-user sectors, including electronics, aircraft, and automobiles. The major players in this market are China, India, Japan, South Korea, and Taiwan because of their extensive manufacturing bases and growing investments in industrial sectors and infrastructure. Regulations that are changing to favor greener practices and advancements in plating technology to increase productivity while lessening environmental effects also have an impact on the market.

North America is expected to host the fastest-growing electroplating market during the forecast period. Market expansion is fueled by advancements in electroplating materials and techniques. Market practices are impacted by stringent laws governing the use of chemicals and the disposal of waste. The aerospace, electronics, and automotive sectors need to drive market growth. Improving the durability and attractiveness of consumer goods requires electroplating. Environmental laws, technical improvements, and industrial growth all have an impact on the North American electroplating industry. It includes a number of industries, including jewelry, electronics, automotive, and aerospace. The requirement for high-performance surface finishes in manufacturing and long-lasting, corrosion-resistant coatings is driving the market's expansion. Innovations in more environmentally friendly electroplating techniques have also been sparked by environmental concerns.

How is Asia Pacific Performing in the Electroplating Market?

The region's market leader position can be attributed to its strong automotive and electronics industries. The regional growth is primarily supported by the adoption of technology, expansion of manufacturing capabilities, and investment in sustainable production. Besides, the rising industrialization and the innovations in plating technologies are making the adoption of eco-friendly surface finishing methods more widespread in the different sectors that they support.

China Electroplating Market Trends:

China is the biggest center for electroplating and is taking advantage of its extensive manufacturing ecosystem. It is still investing in state-of-the-art plating technologies and is setting up sustainable operations and innovation in materials strategy. The country's integrated supply chain, coupled with reliance on technology for its future are reason why it still holds a significant position in the global surface finishing markets, which range from automotive and electronics to industrial applications.

How is North America Performing in the Electroplating Market?

The demand for precision coatings in the aerospace, automotive, and electronics sectors drives the region. Automation, regulatory compliance, and sustainability are the main forces modernizing the manufacturing processes. Consequently, manufacturers are upgrading their equipment to ensure operational safety with less waste and more quality finishes, thus fulfilling both the region's technological standards and its environmental goals.

The U.S. market's growth is mainly due to innovation in high-performance coatings for advanced industries. Intensified R&D efforts and the introduction of automation are factors that are helping to increase the efficiency of the process. The country is focusing on closed-loop systems, eco-friendly chemistries, and smart manufacturing solutions in order to stay competitive and be responsible in terms of the environment amidst the changing nature of its industrial landscape.

What are the Driving Factors of the Electroplating Market in Europe?

Europe has a well-defined market that mainly thinks of sustainability and regulatory compliance. One of the reasons why the market is steady is because of innovative coatings and the high-end sectors like automotive and aerospace, asking for such coatings. Policies in the region promoting the use of non-hazardous materials instead of toxic ones are the main reason for the continued technological breakthrough and production process efficiency.

The German electroplating industry is all about precision cutting, the best quality, and the most advanced ideas. The country is keen on being eco-friendly, digitalized, and being very strict to the letter in observing environmental laws. Furthermore, Germany is leading the way in surface finishing solutions in Europe that are not only efficient but also very compliant, owing to its advanced industrial ecosystem that supports high-value manufacturing.

Value Chain Analysis:

- Feedstock Procurement: This is the process of acquiring and getting raw materials and chemicals that are needed for production to be done efficiently.

Key Players: BASF, Dow, and DuPont - Chemical Synthesis and Processing: This is the stage when raw feedstocks are converted into chemical products that can be intermediates or final products.

Key Players: MacDermid Alpha Electronics Solutions and Coventya - Quality Testing and Certification: This is the process that checks and guarantees that all products comply with the very high quality and industry standards.

Key players: SGS S.A., Intertek Group, and Bureau Veritas - Packaging and Labelling of Electroplating: This is the last step that involves the safe containment, packaging, and compliance labeling of the product.

Key Players: Atotech and Padmavati Chemtech

Electroplating Market Companies

- Allied Finishing, Inc

- Atotech Deutschland Gm

- Birmingham Plating Co Ltd

- Sharretts Plating Company

- Interplex Industries, Inc.

- Bajaj Electroplaters

- Metal Surfaces Inc

- Toho Zinc

- J & N Metal Products Inc

- Electro-Spec, Inc.

- Nicoform, Inc.

Recent Developments

- In July 2023, according to a top industry executive, the electroplating business in the nation is valued at over Rs 12,000 crore, driven by the increased demand for electric vehicles, batteries, and hydrogen. According to U Kamachi Mudali, vice-chancellor of the Homi Bhabha National Institute, the global electroplating market is predicted to reach USD 30 billion. At the Confederation of Indian Industry's (CII) fourth edition of Surface and Coating Expo 2023, Mudali mentioned that the industry employs more than three lakh electroplaters nationwide.

- In March 2023, Today, DuPont Electronics & Industrial unveiled their latest semiconductor fabrication solution, ULTRAFILLTM 6001 dual damascene copper. This most recent addition to the DuPontTM ULTRAFILLTM and NANOPLATETM series of dual damascene copper plating baths is ideal for lower, middle, and upper metal layers and is specifically designed to enable the back end of line (BEOL) electroplating process for copper interconnects in the tens to hundreds of nanometer range.

-

In October 2025, BEP Surface Technologies is undertaking a £600,000 project to upgrade a 70-year-old Churchill TWR roll grinder to enhance precision to 0.001mm. The refurbishment aims to increase capacity for high-growth sectors over two years, partnering with Siemens and Made Smarter.

https://www.themanufacturer.com -

In August 2025, MCX will launch Nickel futures contracts on August 18, 2025, enhancing risk management for nickel-consuming industries and addressing challenges from price and currency fluctuations for sectors dependent on nickel imports.

https://scanx.trade

Segment Covered in the Report

By Type

- Barrel Plating

- Rack Plating

- Continuous Plating

- Line Plating

By Metal Type

- Gold

- Zinc

- Platinum

- Copper

- Nickel

- Chromium

- Others

By End use

- Automotive

- Electrical and electronics

- Aerospace and defense

- Jewelry

- Industrial machinery

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting