What is the Decorative Coatings Market Size?

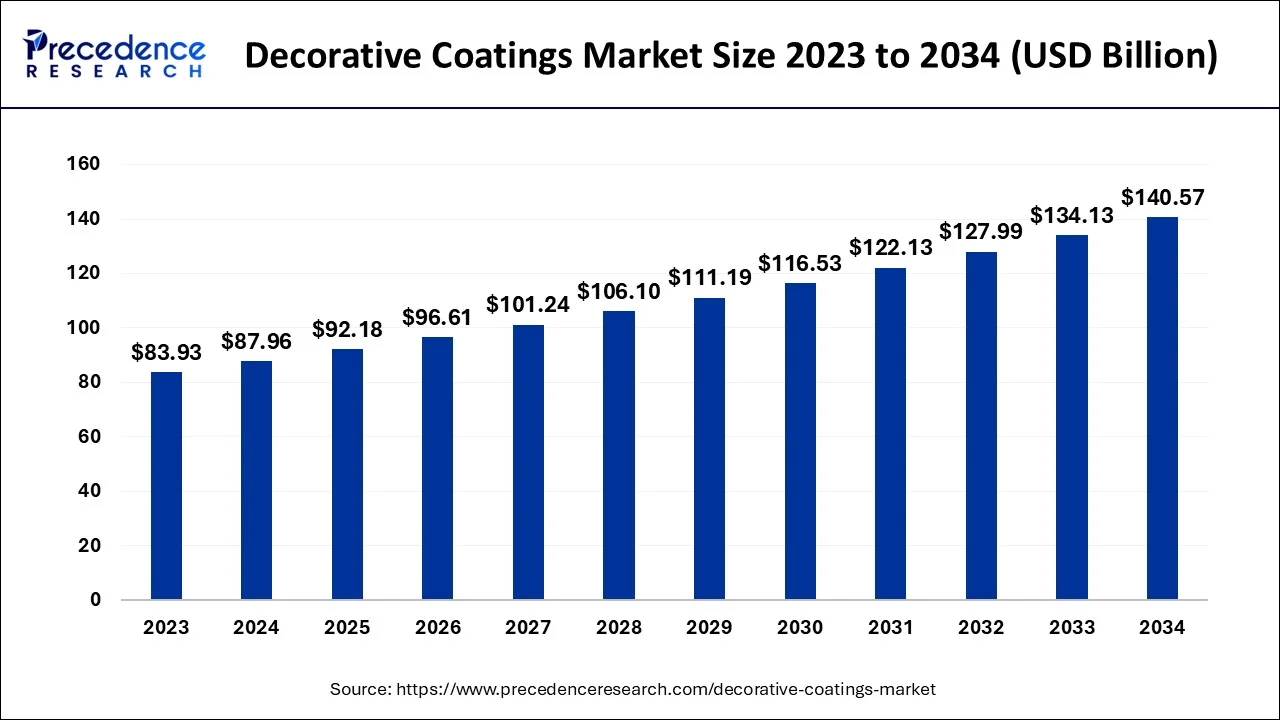

The global decorative coatings market size is calculated at USD 92.18 billion in 2025 and is predicted to increase from USD 96.61 billion in 2026 to approximately USD 147.01 billion by 2035, expanding at a CAGR of 4.78% from 2026 to 2035. The market is driven by rapid urbanization and rising construction activities, particularly in emerging economies.

Decorative Coatings Market Key Takeaways

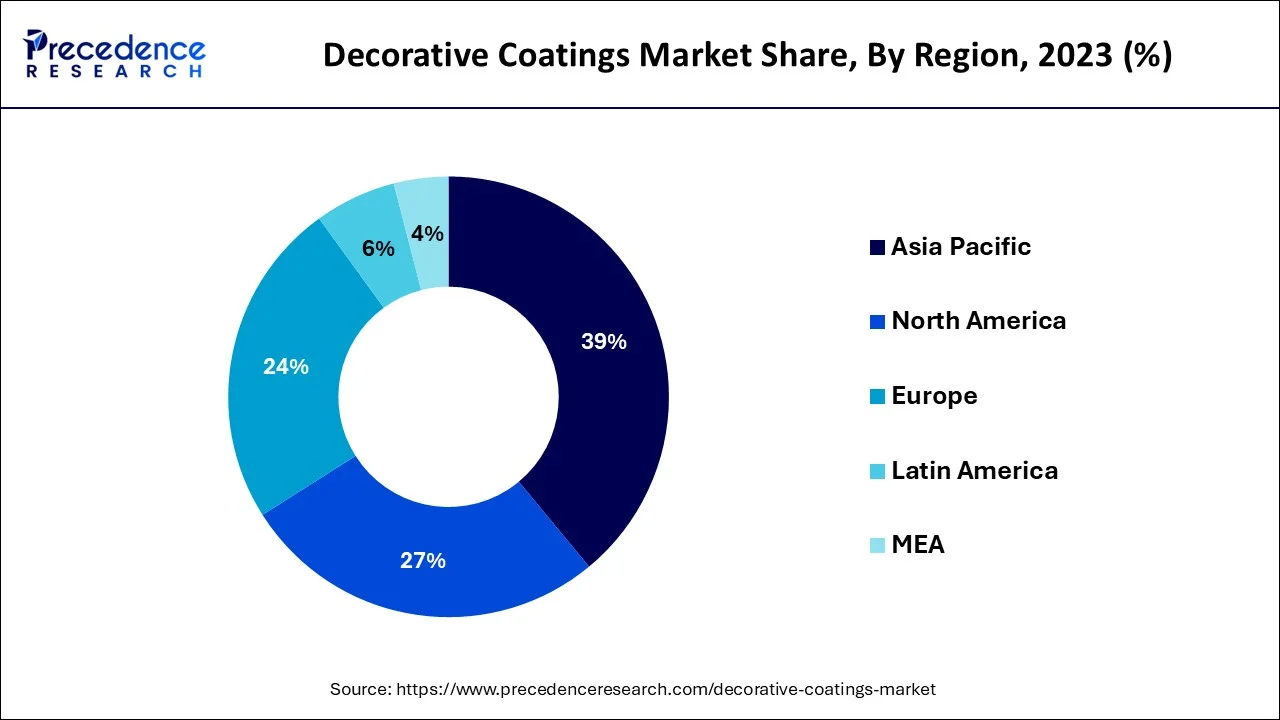

- North America generated for the largest revenue share in 2025.

- Asia-Pacific is predicted to grow at the fastest CAGR between 2026 and 2035.

- By Resin Type, the acrylic segment held the biggest revenue share in 2025.

- By Product, the powder coatings segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By Application, the residential segment led the global market in 2025.

Market Overview

All varieties of varnishes, paints, and lacquers are employed as decorative coatings on buildings and related structures. In this industry, building walls, wood fences, decking, and other surfaces receive the majority of the paint applications. Water-based emulsion paints are frequently used, especially for wall paints. In addition, compared to other coatings segments, the DIY segment in decorative coatings is one of the largest. The use of decorative coatings, which are scratch-resistant and give metal and plastic substrates a vibrant color, is widespread. Examples include automotive interior and exterior components and various consumer products. The growing construction industry, along with rising demand for eco-friendly products, is anticipated to augment the growth of the decorative coatings market during the forecast period.

How is AI Influencing the Decorative Coatings Market?

AI algorithms help manufacturers optimize paint formulations for durability, performance, and cost while reducing physical trial-and-error testing. They also support the development of eco-friendly, low-VOC coatings to meet strict environmental regulations. Companies like Asian Paints and Sherwin-Williams use AI to analyze consumer data, offer personalized recommendations, and provide AR tools for customers to visualize colors in their own spaces.

Decorative Coatings Market Growth Factors

Decorative coatings are applied for both residential and commercial purposes, including in homes, offices, hotels, and retail stores. These coatings are available in a variety of colors, textures, and patterns, and can be customized to meet the specific design needs of a particular space. The construction industry is growing rapidly in emerging economies such as China, India, and Southeast Asia, driven by factors such as population growth, urbanization, and infrastructure development. This is likely to increase the demand for decorative coatings for use in residential, commercial, and industrial applications. Furthermore, there is a growing trend towards sustainable and eco-friendly coatings worldwide. Consumers are becoming more aware of the environmental impact of products they use and are demanding eco-friendly alternatives which has resulted in an increase in demand for low-VOC and zero-VOC coatings, which are more environmentally friendly.

Additionally, the decorative coatings market is constantly evolving, with new technologies and materials being developed to improve the performance and aesthetics of coatings. Manufacturers are investing heavily in research and development to develop new and innovative coatings that offer superior performance, durability, and aesthetics. Also, there is a growing demand for premium coatings worldwide, which offer superior aesthetics, durability, and performance. This is also expected to drive the demand for decorative coatings during the forecast period.

Market Outlook

- Industry Growth Overview: The decorative coatings market is expanding at a significant rate from 2025 to 2034, driven by rising disposable incomes, rapid urbanization, construction growth, and demand for both aesthetic and functional finishes, with trends leaning toward eco-friendly, high-performance, and low-VOC coatings.

- Global Expansion: The market is growing worldwide due to rising construction activities, increasing urbanization, higher disposable incomes, and growing demand for aesthetic and durable finishes. Emerging regions offer opportunities through expanding residential and commercial projects, adoption of eco-friendly and low-VOC coatings, and increasing awareness of premium and high-performance decorative solutions.

- Major Investors: Major investors in the market include paint and chemical companies, private equity firms, and venture capitalists who fund innovation and market expansion. They contribute by financing research and development of eco-friendly, high-performance, and low-VOC coatings, supporting production scale-up, and enabling global distribution and marketing efforts.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 92.18 Billion |

| Market Size in 2026 | USD 96.61 Billion |

| Market Size by 2035 | USD 147.1 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.78% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Resin Type, By Product, By Technology, By Coating Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Growing construction industry

The increase in construction activities is anticipated to augment the growth of the decorative coatings market during the forecast period. This is owing to the increasing population across the globe. According to the UN's most recent estimate, by 2030, there may be 8.5 billion people on the planet. In addition to significant changes in fertility rates, rising urbanization, and significant migration, the population rise has been primarily driven by an increase in the number of people who survive to reproductive age. Future generations will be significantly impacted by these tendencies.

Additionally, improvements in contemporary medicine and the decline of world poverty have contributed significantly to the expansion of the world's population during the past two centuries. Due to this, child, newborn, and maternal mortality have been greatly reduced, which has increased life expectancy.

With this rising population, there is a need for new residential and commercial buildings to accommodate the expanding population. These buildings require decorative coatings for aesthetic appeal as well as for protection. Additionally, as the disposable income of the consumers and consumer spending increases, the demand for renovation and remodeling of the construction products also increases. Thus, owing to the increasing construction activities the demand for decorative coatings is expected to rise during the forecast period to enhance the appearance of homes, buildings and furniture.

Restraints

Innovation of new paint & coating technologies

The introduction of new paint and coating technologies are expected to act as alternatives to decorative coatings and are likely to restrain the growth of the market during the forecast period. These technologies include solar paint and self-cleaning paint, among others. Even some modern painting techniques can assist in going greener. Tiny light-sensitive particles are used in solar paint, which collects sunlight and turns it into electricity.

To bind this energy, some wiring is essential, but the majority of the installation is as simple as painting a wall. One may use solar paints to transform the roof or a wall into a sizable solar panel. Even though this technology isn't yet as effective as traditional solar panels, it can help them produce the cleanest energy possible. The globe may then more readily make the transition to a greener future. Thus, with the introduction of such new technologies, the market for decorative coatings is expected to slow down within the estimated timeframe.

Opportunities

Rising demand from emerging economies

The increasing demand from emerging economies such as China and India is expected to offer lucrative opportunities for the growth of the decorative coatings market in the years to come. The strong growth in the economy of the emerging economies has resulted in an increase in construction projects which is expected to drive the demand for decorative coatings. Furthermore, the government in these economies is heavily investing in the infrastructure development and housing projects which in turn is likely to support the growth of the market. For instance, infrastructure in India is a significant promoter in the country's growth to a US$26 trillion economy.

The investments in physical infrastructure remain crucial to raising efficiency and costs, especially when made in coordination with initiatives to make conducting business easier. Given the number of projects that have lately been introduced, it is clear that the government is focused on developing the future infrastructure. In order to bring about systematic and effective reforms in the sector, the national master plan of US $1.3 trillion for infrastructure, Gati Shakti, has been a pioneer and has already made tremendous progress. Thus, this is expected to increase the demand for decorative coatings in the years to come.

Type Insights

On the basis of resin type, the acrylic segment held the largest revenue share in 2025. Acrylic resin is made up of acrylic monomers. They are often functionalized by adding other chemical classes and are esters of acrylic, methacrylic, or a mixture of these acids. In general, these resins are resistant to both chemical and photochemical attack. They are frequently employed in a wide range of applications, including coatings that are both solvent- and water-based. Acrylic resins offer superior properties such as good adhesion, flexibility, weather resistance, and durability, making them an ideal choice for decorative coatings. These properties make acrylic resin-based coatings suitable for a wide range of applications, including exterior and interior walls, wood, concrete, and metal surfaces. Water-based acrylic resin coatings are gaining popularity due to their low VOC content, low odor, and ease of application. Consumers are becoming more environmentally conscious and are demanding coatings that are safe for the environment and human health. This is likely to support the segment growth of the decorative coatings market during the forecast period.

Technology Insights

The powder coatings segment is expected to grow at a considerable CAGR during the forecast period. Powder coatings are known for their superior durability and longevity compared to other types of coatings. They are resistant to scratches, fading, chipping, and corrosion, which makes them ideal for applications in high-traffic and harsh environments. Powder coatings are considered to be more environmentally friendly compared to traditional solvent-based coatings. This is because they contain very less VOCs or no volatile organic compounds (VOCs) that can contribute to air pollution and health problems. This is likely to support the segment growth of the decorative coatings market during the forecast period.

Application Insights

Based on application, the residential segment dominated the global decorative coatings market. As consumers are becoming more conscious about the appearance and décor of their homes, and are increasingly seeking visually appealing interior and exterior spaces, the demand for decorative coatings in the residential segment has increased, as they offer a wide range of color and texture options to enhance the appearance of homes. Additionally, the growing middle-class population in emerging economies along with an increase in disposable income and purchasing power is also expected to support the segment growth of the decorative coatings market during the forecast period.

Regional Insights

What is the Asia Pacific Decorative Coatings Market Size?

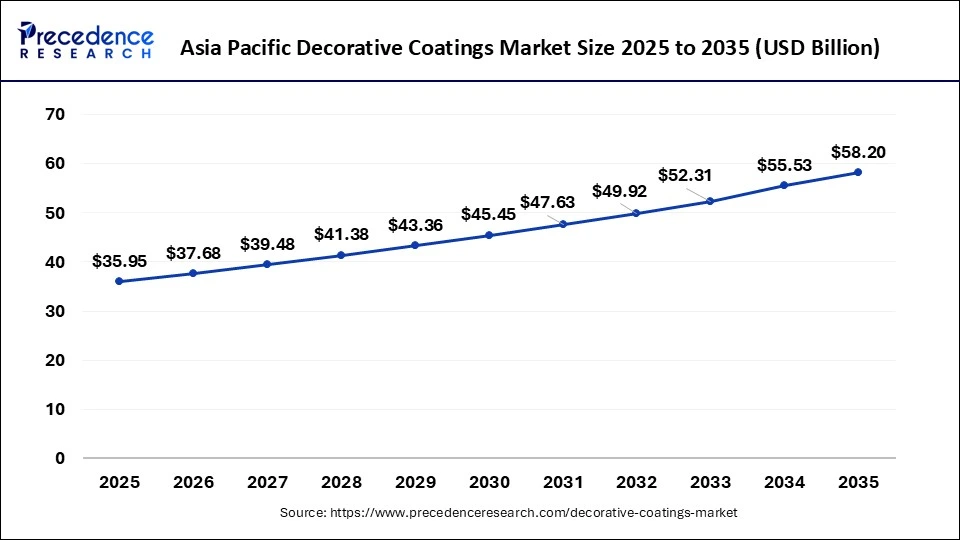

The Asia Pacific decorative coatings market size accounted for USD 35.95 billion in 2025 and is expected to be worth around USD 58.20 billion by 2035, growing at a CAGR of 4.94% from 2026 to 2035.

North America held considerable revenue share in 2025. This is owing to the increasing demand for sustainable and eco-friendly coatings in the region as consumers are becoming more aware of the environmental impact of products they use. Furthermore, the increase in residential as well as non-residential construction in the region is also likely to support the regional growth of the market. Additionally, presence of key players such as PPG Industries, Sherwin-Williams, RPM International and Axalta Coating Systems, among others is also expected to contribute to the growth of the market in the region.

U.S. Market Trends

The U.S. decorative coatings market is driven by strong construction and renovation activities, rising disposable incomes, and growing demand for aesthetic and durable finishes. Increasing awareness and adoption of eco-friendly, low-VOC coatings, along with technological innovations like AI-driven color personalization and AR visualization tools, further fuel market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This is attributable to the increasing rapid urbanization and industrialization, driven by factors such as population growth and economic development in the region. Additionally, the rising disposable income in countries like China, India, and Southeast Asia is also likely to support the market growth in the region. Furthermore, the growing demand from the application sector is also likely to support the regional growth of the decorative coatings market during the forecast period.

China Market Trends

China is a major contributor to the Asia Pacific decorative coatings market due to rapid urbanization, robust construction activities, and increasing demand for both residential and commercial paints. Rising disposable incomes and growing adoption of eco-friendly, high-performance, and low-VOC coatings further strengthen its market position in the region.

What Makes Europe a Significant Region?

Europe is a significant region in the decorative coatings market due to its mature construction industry, high demand for premium and eco-friendly coatings, and strict environmental regulations. Strong consumer preference for durable and aesthetically appealing finishes, coupled with innovations in low-VOC and sustainable products, drives market growth. Additionally, the presence of leading coating manufacturers and advanced distribution networks reinforces Europe's market significance.

Germany Market Trends

Germany is a major contributor to the European decorative coatings market due to its strong construction and renovation activities, high consumer preference for premium and eco-friendly coatings, and strict regulatory standards. The country's focus on sustainable, low-VOC, and high-performance decorative solutions further strengthens its leading position in the region.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities for the decorative coatings market. These opportunities arise from rapid urbanization, large-scale infrastructure projects, and expanding residential construction. Rising investments in the development of commercial buildings and smart cities are increasing the demand for aesthetic and protective coatings. Additionally, growing awareness of eco-friendly and durable coatings, along with a rising DIY culture, is supporting market expansion.

Egypt Market Trends

Egypt's decorative coatings market is expanding due to strong growth in residential and commercial construction, driven by urban development programs and new housing projects. Rising demand for affordable housing, renovation activities, and government-led infrastructure initiatives are increasing paint consumption. Additionally, growing consumer preference for durable, weather-resistant, and aesthetically appealing coatings suited to Egypt's climate is supporting sustained market growth.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing an opportunistic growth in the market due to expanding residential construction, urban renewal projects, and rising home renovation activities. Growth in middle-class populations is boosting demand for aesthetically appealing interiors and exteriors. Additionally, increasing availability of affordable paints, gradual adoption of eco-friendly formulations, and strong demand from DIY and professional application segments are driving market expansion across the region

Brazil Market Trends

Brazil's market is expanding due to rapid urbanization, growth in residential and commercial construction, and increased renovation activities. Rising consumer demand for vibrant, durable, and eco-friendly coatings, coupled with government infrastructure projects and a growing DIY segment, is further boosting paint consumption. Additionally, the recovery of the housing sector is supporting sustained market growth.

Value Chain Analysis of the Decorative Coatings Market

- Feedstock Procurement

It involves sourcing key raw materials, such as resins, pigments, solvents, and additives, primarily from global petrochemical and chemical supply chains. - Chemical Synthesis and Processing

It involves formulating and combining specialized chemical components, such as binders, pigments, solvents, and additives, through physical and chemical processes to produce paints with desired aesthetic and performance properties, such as color, gloss, and durability. - Packaging and Branding

This stage involves designing functional and visually appealing packaging that preserves product quality and enhances brand recognition. - Distribution and Logistics

Decorative coatings are distributed through wholesalers, retailers, e-commerce platforms, and direct sales, ensuring timely delivery to residential, commercial, and industrial customers.

Top Companies in the Decorative Coatings Market

- AkzoNobel:Offers a wide range of decorative paints and coatings for residential and commercial applications, including eco-friendly, low-VOC, and high-performance interior and exterior solutions.

- PPG Industries: Provides premium paints, coatings, and specialty finishes for residential, commercial, and industrial sectors, emphasizing durability, aesthetics, and sustainable formulations.

- Sherwin-Williams: Supplies decorative paints, stains, and coatings for homes and commercial buildings, focusing on color innovation, high-quality finishes, and environmentally friendly low-VOC options.

- RPM International: Offers a broad portfolio of decorative and protective coatings, including specialty paints, stains, and sealants for architectural, industrial, and DIY applications.

- Axalta Coating Systems: Provides advanced decorative coatings and finishes for residential and commercial applications, focusing on sustainable, high-performance, and color-customized solutions.

- BASF SE: Produces decorative coatings and resins for paints, focusing on sustainability, low environmental impact, and high-quality performance in construction and industrial applications.

- The Valspar Corporation: Valspar Corporation provides a broad portfolio of products for the decorative coatings market. These products cater to both do-it-yourself (DIY) users and professional markets, covering a broad range of interior, exterior, and specialty applications.

- Asian Paints Ltd: Asian Paints provides a comprehensive range of decorative coatings, including wood finishes, interior/exterior wall paints, metal paints, waterproofing solutions, wall coverings, adhesives, textures, and related services such as painting, color consultancy, and also integrated home decor.

Other Major Key Players

- Kansai Paint Co. Ltd

- Nippon Paint Holdings Co. Ltd

- Berger Paints India Ltd

- Hempel A/S

Recent Developments

- In February 2025, AkzoNobel N.V. transferred decorative paint IP to its Indian division and proposed acquiring the Powder Coatings business and International Research Center from AkzoNobel India, aiming to make the subsidiary a more independent, focused paint and coatings company.

(Source: https://www.akzonobel.com ) - In February 2025, Sherwin-Williams announced plans to acquire BASF's Brazilian architectural paints business for $1.15 billion in cash, strengthening its Latin American presence. The deal aims to drive profitable growth and operational synergies, with closing expected in the second half of 2025, pending regulatory approval.

(Source: https://investors.sherwin-williams.com ) - In December 2024, PPG sold its U.S. and Canada architectural coatings business, including brands like Glidden, Dulux, and Sico, to American Industrial Partners. This divestment aligns with PPG's portfolio optimization strategy and strengthens its global focus.

(Source: https://investor.ppg.com ) - In October 2020, AkzoNobel, a global coatings firm, announced the acquisition of Industrias Titan S.A.U.'s decorative paints business. According to AkzoNobel, the move intends to expand further in Europe with Titan's joint commitment to sustainable product innovation. The acquisition will allow us to better service our clients and give further momentum, while also demonstrating that we are the European paints and coatings reference.

- In June 2021,PG reported the acquisition of all Tikkurila shares tendered under PPG's tender offer as of the offer's expiration date of June 4, 2021. Tikkurila stockholders were paid €34.00 in cash for each of the 38,711,646 million Tikkurila shares tendered. PPG now owns 97.1% of Tikkurila's issued and existing shares, in addition to the shares it previously acquired. The remaining 2.9% will be obtained through a squeeze out process that will begin immediately.

- In October 2025, BASF completed the sale of its Brazilian decorative paints business to Sherwin-Williams for $1.15 billion, following competition approval in August. The transaction included production sites in Demarchi and Jaboatão, the Suvinil and Glasu! brands, related contracts, and about 1,000 employees. With $525 million in 2024 sales, the business operated mainly in Brazil, offering a wide range of paints, paint preparation products, and digital solutions, with limited synergy with BASF's other coatings operations.(Source:https://www.basf.com )

Segments Covered in the Report

By Resin Type

- Acrylic

- Polyurethane

- Alkyd

- Vinyl

- Others

By Product

- Enamel

- Primer

- Emulsions

- Others

By Technology

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

By Coating Type

- Interior

- Exterior

By Application

- Residential

- Non-Residential

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting