Eliquis Market Size and Forecast 2025 to 2034

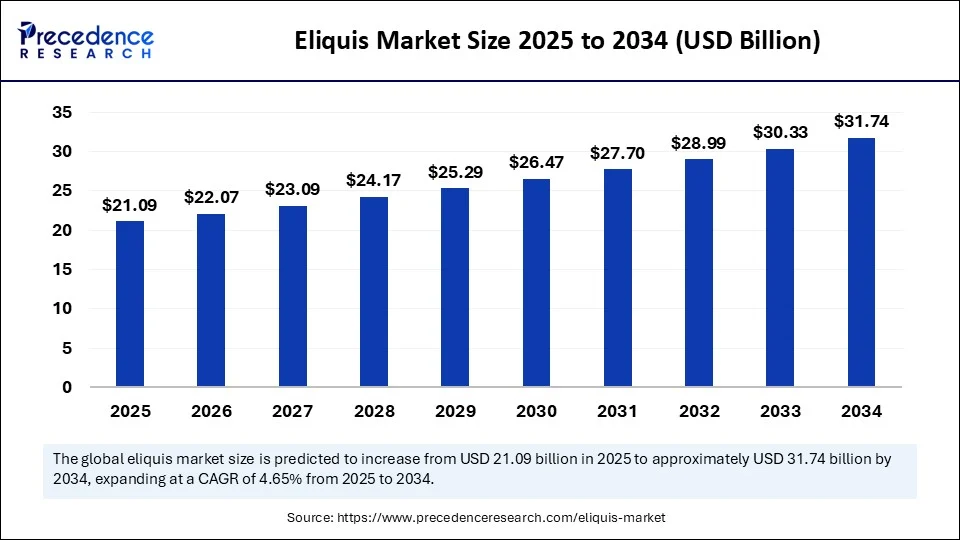

The global eliquis market size accounted for USD 20.15 billion in 2024 and is predicted to increase from USD 21.09 billion in 2025 to approximately USD 31.74 billion by 2034, expanding at a CAGR of 4.65% from 2025 to 2034.The market is significantly expanding due to increasing incidences of fatal illnesses like CVDs, cancer, which can be treated effectively by the Eliquis molecule, which is supported by regulatory bodies as well.

Eliquis MarketKey Takeaways

- In terms of revenue, the global eliquis market was valued at USD 20.15 billion in 2024.

- It is projected to reach USD 31.74 billion by 2034.

- The market is expected to grow at a CAGR of 4.65% from 2025 to 2034.

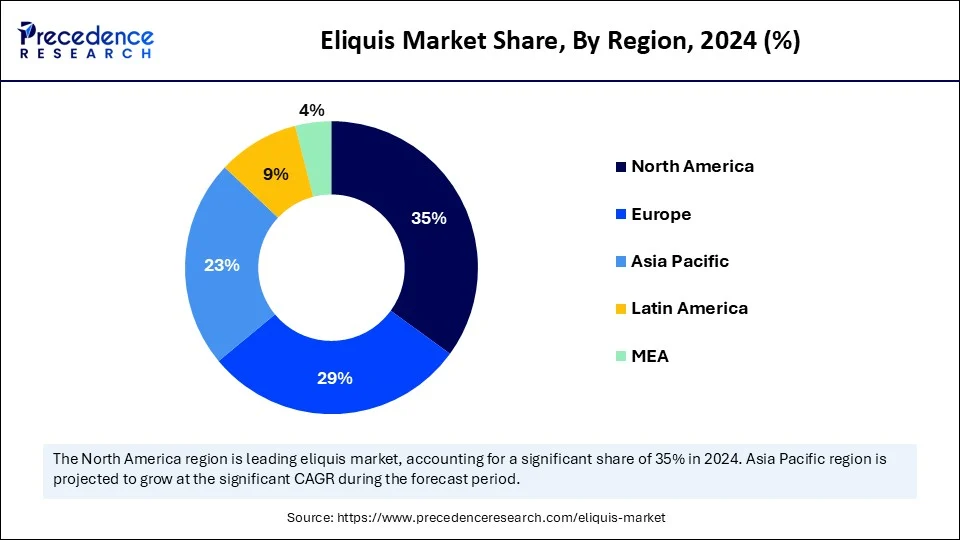

- North America dominated the global market with the largest market share 35% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By indication/application, the non-valvular atrial fibrillation (NVAF) segment led the market in 2024.

- By indication/application, the deep vein thrombosis (DVT) segment is expected to witness the fastest growth during the foreseeable period.

- By strength/dosage, the 5 mg tablet segment captured the biggest market share in 2024.

- By strength/dosage, the 2.5 mg tablet segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034.

- By distribution channel, the hospital pharmacies segment contributed the highest share of the Eliquis market in 2024.

- By distribution channel, the online pharmacies segment is expected to witness the fastest CAGR during the foreseeable period.

- By payer/pricing, the insured/reimbursed (commercial/Medicare) segment generated the major market share in 2024.

- By payer/pricing, the direct-to-consumer (cash/discount programs) segment is expected to witness the fastest CAGR during the forecasted years.

How is AI Transforming the Eliquis Market?

Artificial intelligence cannot directly impact the formulation of Eliquis tablets, but it can help to adjust its dosage to patients with specific medical conditions, predict the adverse effects of Eliquis, and determine how to release it, which helps in better outcomes. AI indirectly supports clinical decisions with accuracy and improves medication effectiveness by proper usage and following medical guidelines.

AI-based tools that are built to use for medical purpose can identify potential drug target by analyzing patients medical history and current health conditions including parameters like age, weight, medical conditions and tablets for it, blood pressure, pulse rate and how much dosage of anesthesia will be safe on a person as per their health status which will further decide dosage and amount of Eliquis tablets that would work effectively. Further AI tools can be used as a reminder to take these pills on time and send alerts to healthcare professionals or nursing staff in case of emergency for safer treatment. Therefore, AI can be used as an assistant for 24 hours.

U.S. Eliquis Market Size and Growth 2025 to 2034

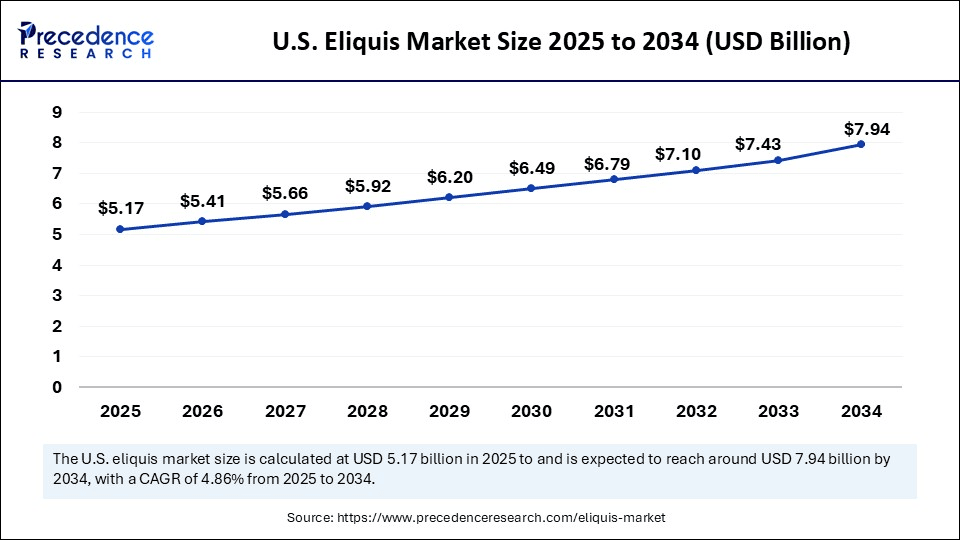

The U.S. eliquis market size was exhibited at USD 4.94 billion in 2024 and is projected to be worth around USD 7.94 billion by 2034, growing at a CAGR of 4.86% from 2025 to 2034.

North America

What are the factors supporting the dominance of the North American Eliquis market?

North America held the largest market share in 2024. The increasing awareness about the prevention of strokes and blood clots is crucial for people suffering from fatal diseases like cancer, and various cardiovascular diseases are a major driving factor for the North America Eliquis market. The growing geriatric population in North America, especially in leading countries like the U.S. and Canada creating a huge shift in the market. Elder individuals are highly susceptible to the various medical conditions that require Eliquis molecule for better outcomes, indirectly propelling the market growth in the region.

Advanced healthcare facilities with government-backed reimbursement polices and incentives for medical treatments, regulatory approvals, and ongoing trials that increase the efficiency of Eliquis medications, and a growing focus on technological integration into research and development of the healthcare sector, along with collaboration of medical institutes, the research sector, and leading players, are major reasons for market growth in North America.

- In July 2025, leading players in the healthcare sector, Pfizer and Bristol Myers Squibb, made an alliance to offer a new option, direct-to-patient, to purchase Eliquis with the help of their resource-Eliquis 360 support.

Asia pacific

Why will Asia Pacific significantly impact the Eliquis market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period in the global Eliquis market. A combination of reasons is highly impacting the region's growth, which includes increasing cases of thromboembolic disorders, increasing geriatric population, and increasing healthcare expenditure due to rising healthcare issues among leading countries, which further improves diagnostic capabilities and greater outcomes of healthcare treatments in the region. Moreover, increasing inclination towards generic drug production and sustainable plus cost-effective manufacturing practices has significantly offered a boost to the market.

Regulatory bodies in the region are offering faster drug approval methods, which enable local production to grow further with wider distribution practices. Countries with advanced healthcare facilities, infrastructure, and highly skilled professionals have witnessed a surge in medical tourism, further affecting the region's growth in the Eliquis market.

Market Overview

Eliquis market refers to the commercial ecosystem surrounding apixaban—the branded anticoagulant jointly marketed by Bristol-Myers Squibb and Pfizer—used primarily to prevent stroke in non-valvular atrial fibrillation and to treat or prevent venous thromboembolism (DVT, PE). The market encompasses formulations, distribution channels, and geographies. It is driven by the aging population, prevalence of thromboembolic disorders, preference for NOACs over warfarin (no routine monitoring), and expanding clinical applications.

What are the Key Trends in the Eliquis Market?

- Generic versions of Eliquis: A significant trend that the global Eliquis market holds is the growing expiration of patents that are expected to be used for the production of effective molecules of Eliquis with less price than before, which will surely affect market revenue for a longer period. Healthcare systems worldwide are adopting cost-effective solutions to reach maximum people and treat them with better molecules for positive results, further creating downward pressure on Eliquis prices. This showcases a strong tussle between Eliquis and its competitors to maintain their position in the global market.

- Sustainable manufacturing methods:Another major trend that is propelling the market growth is the sustainable manufacturing of Eliquis medication, as, healthcare industry is continuously pushing for eco-friendly and sustainable manufacturing and packaging instead of practices that might harm the environment and show side effects while treating medical conditions. Research is currently being performed by many players in the market to improve the efficiency and indication of the existing Eliquis molecule, further pushing boundaries of the Eliquis market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 31.74 Billion |

| Market Size in 2025 | USD 21.09 Billion |

| Market Size in 2024 | USD 20.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Indication / Application, Strength / Dosage, Distribution Channel, Payer / Pricing Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Supportive regulations for the use of Eliquis

A major benefit that Eliquis offers is its safe usage and approval of its usage by medical regulations. It is a US FDA-approved drug, which allows medical professionals to use it for patients suffering from various cardiovascular diseases. Especially atrial fibrillation, pulmonary embolism, and deep vein thrombosis. These diseases are the primary cause of fatal heart attacks, strokes, and other complications, which can be effectively reduced by the Eliquis molecule. It is basically a direct oral anticoagulant that reduces the risk of bleeding complications and minimizes frequent blood tests, making it a highly adoptable medication by the healthcare system and patients as well. It further simplifies the routine to take Eliquis with a fixed dosage and timing, and it also offers an oral suspension for which will be helpful for patients who are having problems swallowing tablets for of Eliquis tablets.

- In January 2024, the NHS released new guidelines on the application and dosage of generic Eliquis for the treatment of Atrial Fibrillation.(Source:tps://www.londoncardiovascularclinic.co.uk)

Restraint

Alternatives to Eliquis

Despite having significant benefits of Eliquis medications, a foremost challenging factor for the market growth is tough competition from the established alternatives to Eliquis. It includes medications like Rivaroxaban and Pradaxa. These drugs have also met regulatory standards of safety and efficacy as a coagulant, same as of Eliquis. And their application is also supported by large-scale phase-3 clinical trials, showcasing their potential to give tough competition for the adoption of Eliquis in the market. However, regulatory bodies are continuously rearranging and supervising real-time effects of these alternatives to ensure their claimed efficacy.

Opportunity

Technology-based clinical trials

Clinical studies regarding drug development are continuously refining their methods and comparing long-term outcomes of dosage of specific drugs like Eliquis. This approach continues to offer further clarity on safety profiles due to the availability of reversal agents and advance design of clinical trials, like virtual clinical trials, to improve patient outcomes. Technology-based clinical trials are expected to revolutionize the Eliquis market by integrating real-world performance data and its results into it, which provides a holistic approach for drug development, creating a lucrative opportunity for the market to grow significantly on a global scale to treat cardiovascular diseases effectively with technology integration.

Indication insights

Why is Atrial Fibrillation the most prevalent disease in the Eliquis market?

The non-valvular atrial fibrillation (NVAF) segment held the largest market share in 2024. This segment's dominance is related to the growing cases of atrial fibrillation and stroke risk associated with it, along with the safety and efficacy profile of Eliquis than other anticoagulants. Atrial fibrillation is a common heart condition in people with certain genetic conditions or older adults. Eliquis is highly effective in such patients and reduces stroke risk, provided with a regular dosage of Eliquis with the recommended amount. Also, cardiology guidelines are increasingly suggesting oral anticoagulants would be effective such as Eliquis, further expanding the segment's growth.

The deep vein thrombosis (DVT) segment is expected to witness the fastest growth rate during the foreseeable period. DVTs are increasingly becoming common diseases due to ageing individuals, patients with cancer, and heart disease, who are highly susceptible to these health conditions. Patients who are frequently hospitalized become more prone to such a disease. Eliquis presents an effective treatment to treat such conditions, propelling the segment's growth in the global Eliquis market.

DosageInsights

Why is the 5mg dosage majorly used by professionals who support Eliquis market growth?

The 5 mg tablet segment held the largest market share in 2024. Patients who are prescribed Eliquis mostly require at least a 5mg dosage of it to be effective, and it's a standard consideration for adults. This range is also approved by medical authorities and regulations to reduce symptoms and side effects of atrial fibrillation and possible stroke. This fixed dose can support the patient's treatment plan and is suitable for a number of patients with similar illnesses. This provides comfort and safety of dosage by eliminating risk factors associated with it, further expanding the segment's growth.

The 2.5 mg tablet segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. 2.5 mg dose of Eliquis is particularly suitable for people having conditions like nonvalvular atrial fibrillation and aged more than 80 years, having a weight of 60kg or less, along with people who are diagnosed with kidney dysfunction. This amount of Eliquis dose is mainly taken by people to prevent DVT/PE after surgeries of knee replacement or hip replacement.

Distribution Channel Insights

What are the benefits offered by hospital pharmacies in the Eliquis market?

The hospital pharmacies segment held the largest share of the Eliquis market in 2024. Hospital pharmacies are mainly located near hospitals or within the campus of hospitals to provide easy access to required medications. Therapies like managing the viscosity of blood after surgery are crucial and should not be discontinued abruptly this may worsen the symptoms in patients having cardiovascular diseases or who are in the process of Afre surgery care. Hospital pharmacies often have every medicine in bulk to meet increasing demand for particular medicines that are highly consumable by patients who are regular visitors to that hospital, which facilitates collaboration between the hospital team and patients.

The online pharmacies segment is expected to witness the fastest CAGR during the foreseeable period. Segment is expanding due to a couple of factors, includes convenience and affordability provided by e-commerce platforms, along with the growing rate of E-commerce platforms and their adoption worldwide. Medications like anticoagulants are highly crucial for blood blood-thinning process after surgery or for people having severe illnesses like atrial fibrosis. Online pharmacies are available 24 hours and offer many discounts with a wider range of medications by avoiding overhead costs. This is majorly helpful for patients having physical impairment and living independently in remote areas.

Payer Insights

How did Insured/reimbursed Dominate the Eliquis market?

The insured/reimbursed (commercial/Medicare) segment held the largest market share in 2024. Developed countries across the globe offer reimbursement policies that include patients having CVDs and are regular consumers of anticoagulants like Eliquis medications, so that several people can use these medicines with cost-friendliness. Many patients are accessing Eliquis due to reimbursement policies and due to its clinical profile, further expanding the market growth.

The direct-to-consumer (cash/discount programs) segment is expected to witness the fastest CAGR during the forecasted years of 2025 to 2034. This program is primarily driven by affordability and easy access for many patients, especially for those who are going to pay out of pocket and are not covered under any reimbursement policies. This program is known as Eliquis 360 support, which offers direct purchasing from the manufacturer with several options for discounts.

Eliquis Market Companies

- Bristol-Myers Squibb

- Pfizer

- Bayer (competitor with Xarelto)

- Teva Pharmaceutical

- Mylan

- Dr. Reddy's Laboratories

- Cipla

- Sun Pharmaceutical Industries

- Sanofi

- Novartis (Sandoz)

- Johnson & Johnson (Janssen—Pradaxa competitor)

- Boehringer Ingelheim (Warfarin/Xarelto competitor)

- AstraZeneca

- GSK

- Merck & Co.

- Hikma Pharmaceuticals

- Lupin

- Aspen Pharmacare

- Apotex

- Generic manufacturers (collective)

Recent Developments

- In April 2025, the API-CAT trial with phase III shows that, even after reducing the dosage of Eliquis to 2.5 mg from 5.0 mg, with extended anticoagulant therapy, would not affect its efficacy as a drug and still prevent recurrent venous thromboembolism in patients having active cancer.(Source: https://www.appliedclinicaltrialsonline.com)

- In August 2024, the Centers for Medicare & Medicaid Services announced its plan to minimize Medicare Part D prices for 10 drugs. Among which, Eliquis is one of them. And this will be effective at the starting of the year 2026.(Source: https://www.healio.com)

Segments Covered in the Report

By Indication / Application

- Non-valvular Atrial Fibrillation (NVAF) – stroke/systemic embolism prevention

- Deep Vein Thrombosis (DVT) treatment/prevention

- Pulmonary Embolism (PE) treatment/prevention

- Post-operative VTE prophylaxis (e.g., hip/knee replacement)

By Strength / Dosage

- 5 mg tablets

- 2.5 mg tablets

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Mail-Order Pharmacies

By Payer / Pricing Model

- Insured/reimbursed (commercial/Medicare)

- Direct-to-consumer (cash/discount programs)

By Region

- North America (especially the U.S.)

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting