What is the EMEA 3D CBCT Market Size?

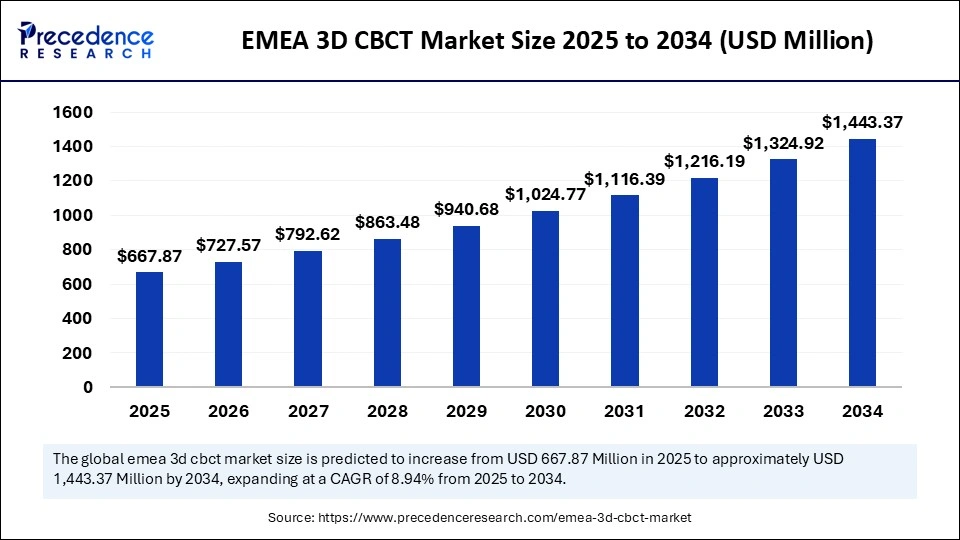

The global EMEA 3D CBCT market size accounted for USD 667.87 million in 2025 and is predicted to increase from USD 727.57 million in 2026 to approximately USD 1,443.37 million by 2034, expanding at a CAGR of 8.94% from 2025 to 2034. The increasing prevalence of dental diseases, the growing geriatric population, the importance of aesthetics with rising disposable income, and government-backed programs supporting dental tourism and major investments in advanced healthcare infrastructure are major drivers of the markets dominance.

Market Highlights

- Europe held the largest market share in the EMEA 3D CBCT market in 2024.

- The Middle East & Africa is expected to witness the fastest CAGR from 2025 to 2034.

- By application, the dental implantology segment held the largest market share in 2024.

- By application, the ENT subsegment of the non-dental segment is expected to witness the fastest CAGR from 2025 to 2034.

- By detector type, the flat-panel detector segment contributed the biggest market share in 2024.

- By detector type, the image intensifier segment is growing at a fastest CAGR between 2025 and 2034.

- By end user, the dental clinics segment held the major market share in 2024.

- By end user, the imaging/diagnostic centers segment is expected to witness the fastest CAGR from 2025 to 2034.

Breaking Down the EMEA 3D Cone Beam CT Market: Devices, Software & Service Ecosystem

3D CBCT (Cone-Beam Computed Tomography) is a specialized type of CT imaging that captures volumetric (3D) scans with a relatively lower radiation dose than traditional CT. In the EMEA region, CBCT systems are widely used in dental, ENT (ear, nose, throat), and other medical practices for diagnostics, surgical planning, and guided interventions. The EMEA 3D CBCT market reflects combined demand across Europe, the Middle East, and Africa, driven by the increasing adoption of digital dentistry, rising awareness of ENT disorders, infrastructure development, and growing healthcare investments.

AI Shifts in the EMEA 3D CBCT Market: From Image Reconstruction to Predictive Diagnostics

Artificial intelligence is significantly transforming the EMEA 3D CBCT market by driving foundational changes in diagnostic accuracy, patient care, and clinical efficiency, resulting in enhanced image quality, streamlined workflows, and highly personalized treatment. Deep learning models are increasingly being used to analyze CBCT images with high accuracy, often overshadowing human capabilities.

The most impactful benefit of AI is its ability to automate image processing. AI can automatically capture individual teeth, nerve canals, roots, and other dental details in less time than it would take manual intervention. It further yields highly precise 3D models that can be ideal for surgical planning and the personalized design of devices such as clear aligners.

EMEA 3D CBCT Market Outlook

The EMEA 3D CBCT market is growing rapidly due to the rising prevalence of dental disorders, the aging population, and the ongoing demand for dental implants and cosmetic dentistry. The CBCT system provides detailed 3D images with a lower radiation dose than conventional CT scans. Also, the increasing number of dental care professionals with established clinics in the region further supports market growth.

The sustainability trend is a crucial driver of market growth, primarily driven by regulatory pressure and the increasing shift towards eco-friendly treatments using biodegradable materials and recyclable waste. Manufacturers are further adding power management systems and algorithms to help optimize energy use.

The major investors include key European venture capital funds actively investing in health tech, such as Hoxton Ventures, Kli Capital, and Apex Ventures. Also, major players include the Saudi Public Investment Fund and the Abu Dhabi Investment Authority, which are supporting the growth of the EMEA 3D CBCT market on a significant scale.

The start-up ecosystem in the EMEA 3D CBCT market is slightly fragmented yet assertive in driving the regions growth. Start-ups like TESCAN 3DIM use AI-powered 3D image analysis software for orthopedic and dental implant treatments. Also, initiatives such as the Dubai3D printing Strategy further fuel the markets growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 667.87 Million |

| Market Size in 2026 | USD 727.57 Million |

| Market Size by 2034 | USD 1,443.37 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.94% |

| Dominating Region | Europe |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Detector Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

EMEA 3D CBCT Market Segmental Insights

Application Insights

The dental implantology segment held the largest share in the EMEA 3D CBCT market 2024, as it requires accurate pre-surgical planning and post-surgical care, assessment, and feedback. which is exactly what 3D CBCT technology provides, with detailed images of jawbones and the overall internal mouth structure. The growing demand for dental implants and tooth replacement is a major factor supporting the segment growth.

The ENT subsegment of the non-dental segment is expected to witness the fastest CAGR during the foreseeable period. The segment is expanding due to the rising prevalence of ENT (Ear, Nose, and Throat) disorders, patients seeking non-invasive methods with rapid outcomes, and technological advancements in CBCT offerings.

The orthodontics segment is growing rapidly due to the extensive applications of 3D CBCT, particularly because it provides clear diagnostic information on inherent three-dimensional problems in orthodontics, which are often misinterpreted with traditional 2D measurement methods due to the intricacies of orthodontics.

The oral & maxillofacial surgery segment is notably expanding in the EMEA 3D CBCT market, driven by complex anatomy that requires high precision and detailed 3D visualization for subsequent processes. Limitations of 2D imaging, such as distortion and superimposition, have been overcome by the 3D CBCT method, which directly improves surgical outcomes. Surgeons in this specialty rely on accurate imaging to plan interventions involving bone structures, nerve pathways, dental roots, and soft tissue interfaces, especially in trauma repair, tumor evaluation, and corrective procedures. The need for precise mapping and clear assessment of surgical zones has strengthened the use of CBCT as a dependable diagnostic tool across hospitals and specialized clinics in the region.

Detector Type Insights

The flat-panel detector segment held the largest market share in 2024. The segment is dominant due to its excellent ability to convert X-rays into high-quality digital images with a lower radiation dosage requirement, thereby meeting the growing demand for safety, accuracy, and operational efficiency in the rapidly emerging digital dentistry domain in the EMEA region.

The image intensifier segment is expected to witness the fastest CAGR during the foreseeable period. The segment is growing due to its low radiation dose requirement for scanning dental structures and its lower initial purchase price, appealing to dental clinics with budget constraints. They have a superior ability to offer real-time and dynamic imaging

End User Insights

The dental clinics segment held the largest market share in 2024. The segment is dominant due to a couple of factors, such as enhanced dental treatment planning with precision and reduced radiation exposure that prioritize patients safety. This approach perfectly aligns with strict European safety regulations on radiation use in the healthcare sector. Also, the digital nature of CBCT data enables integration with other advanced dental technologies.

The imaging/diagnostic centers segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The segment is growing because CBCT scans require specialized training and expertise, especially in oral and maxillofacial radiology. Dental practitioners can easily refer patients for detailed scans through their referral networks.

Academic & Research Institutes

The segment is growing significantly due to CBCTs crucial role in modern dental practices, which offers students an opportunity to learn pathology, 3D anatomy, and treatment planning in a simulated environment with highly realistic simulations.

Case Study

CBCT-led Diagnosis of Dental Bone Dislocation- A Study by Talibah University

In 2024, the Department of Diagnostic Radiology at Talibah University, Saudi Arabia, conducted a case study that has completely altered the way bone disorders are diagnosed and treated, particularly in the dental and maxillofacial domains. They have compared conventional imaging methods and CBCT techniques, emphasizing the benefits of CBCTs superior3D imaging capabilities, which enable highly precise treatment planning and better outcomes. The conclusion of this case study highlights the revolutionary impact of CBCT on dental clinical practices while emphasizing responsible use.

EMEA 3D CBCT Market Regional Insights

Europe held the largest market share in 2024. The region is dominating due to the increased adoption rate of advanced technology, well-established healthcare infrastructure, the number of dental professionals in the region, and the higher rate of dental issues, requiring skilled professionals. Also, European dental practices and institutes are rapidly embracing highly advanced diagnostic methods and digital dentistry workflows. This also includes CBCT imaging to improve diagnostic precision and treatment planning.

Germany 3D CBCT Market Trends

Germany is leading in the EMEA 3D CBCT market due to its strong domestic healthcare system and presence of globally leading companies. Germany is well known as the largest medical device market and has secured its position among the top 10 countries that spend heavily on healthcare. Germany is home to leading players in the dental technology sector. For example, Dentsply Sirona is a popular firm and the worlds largest manufacturer of professional dental products, as well as innovative technologies.

The Middle East & Africa are expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The region is the fastest-growing due to a combination of factors, including technological advancements and the adoption of digital dentistry to tackle the high prevalence of dental ailments, increasing dental tourism, rising awareness of oral health and its implications, and robust healthcare infrastructure and facilities.

Moreover, countries like Turkey and the UAE have become popular dental tourism destinations for patients worldwide, attracting international patients seeking high-quality, cost-effective dental procedures, particularly aesthetic treatments and dental implants. Increasing disposable income in some regions of the Middle East and Africa is another key driver of the markets expansion in the MEA region.

UAE 3D CBCT Market Analysis

The UAE is a leading country in the EMEA 3D CBCT market, driven by rapid technological adoption, growing oral health awareness among the public due to the increased prevalence of dental disorders, and the governments support for digital solutions in dentistry.

A major burden of oral health issues in the UAE, like the growing rate of dental caries, periodontal diseases, and the need for dental implants due to cavities, requires critical skills and handling of dental devices. It is skillfully handled by the region dentists, further attracting dental tourists.

EMEA 3D CBCT Market Value Chain

Its a primary stage that involves sourcing, receiving, and warehousing the necessary raw materials/components, including X-ray tubes, sensors, electronic devices, and software modules.

Key Players- Varex Imaging, Canon Electron Tubes and Devices, Hamamatsu Photonics

This stage involves activities such as R&D, design, and manufacturing, which ultimately translate into engineering, assembly, quality control, and testing of CBCT devices.

Key Players- Planmeca Group, Dentsply Sirona, CEFLA S., VATECH Co.Ltd, J. MORTIA, and Carestream Dental.

This stage involves storing, packaging, and distributing fully assembled CBCT units to regional dealers, dental clinics, and other medical facilities.

Key Players- DHL Supply Chain, DB Schenker, Kuehne and Nagel, UPS Healthcare, FedEx HealthCare Solutions

EMEA 3D CBCT Market Companies

A major Finnish dental and medical imaging manufacturer known for advanced CBCT systems featuring low-dose imaging and high-resolution diagnostics. The company holds a strong footprint in Europe through its integrated digital dentistry platforms.

Operates KaVo Kerr, a global dental technology leader offering CBCT units with advanced 3D imaging and workflow integration. The company maintains a significant presence in EMEA clinics and hospitals.

A leading global dental equipment manufacturer offering CBCT systems with broad clinical applications, from implant planning to orthodontics. Its systems are widely adopted across dental practices in Europe and the Middle East.

Provides CBCT imaging solutions known for high-quality 3D reconstruction, modular workflow tools, and patient-focused design. The company has a well-established distribution network across EMEA.

A major South Korean dental imaging provider offering cost-effective, high-performance CBCT systems. Vatech has rapidly expanded within EMEA through strong partner networks and advanced imaging software.

A Japanese pioneer in dental imaging and diagnostics with premium CBCT units recognized for exceptional clarity and low-dose exposure. The brand has a solid EMEA presence, particularly in specialist clinics.

A French medical and dental imaging supplier with CBCT systems designed for compact clinics and versatile diagnostic needs. ACTEON is notable for integrating imaging with its broader dental equipment portfolio.

A U.S.-based company delivering high-resolution CBCT solutions optimized for endodontics, implantology, and oral surgery. PreXion continues to grow its EMEA market coverage through strategic distributors.

Specializes in CBCT systems for orthopedic and podiatric imaging, offering weight-bearing 3D imaging solutions. The company maintains a niche yet expanding presence in EMEA medical facilities.

A European dental imaging manufacturer known for compact and affordable CBCT units. Owandy maintains strong penetration in dental clinics across France, Spain, and other EMEA markets.

A European-based dental equipment provider offering CBCT systems designed for accessibility and clinical versatility. The brand is expanding across EMEA through reliable distribution channels.

Recent Developments

- In March 2025, Carestream Dental is offering advancement in CBCT imaging with AI-powered software, along with collaboration with Straumann. This will empower workflows of clinicians via efficient integration of Carestream dental imaging with the Straumann digital ecosystem.(Source: https://www.carestreamdental.com)

- In May 2025, GE Healthcare introduced CleaRecon DL technology, which is powered by a deep learning algorithm aiming to enhance CBCT image quality. This AI-based solution is engineered to eliminate streak artifacts caused by the pulsatile nature of blood flow.(Source: https://investor.gehealthcare.com)

EMEA 3D CBCT MarketSegments Covered in the Report

By Application

- Dental/Dental Implantology

- Orthodontics

- Oral & Maxillofacial Surgery

- Non-Dental/Medical

- ENT

- Radiology & Others

By Detector Type

- Flat-Panel Detector

- Image Intensifier

By End-User

- Dental Clinics

- Hospitals/Maxillofacial Surgery Centres

- Imaging/Diagnostic Centers

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting