What is the End Stage Renal Disease Market Size?

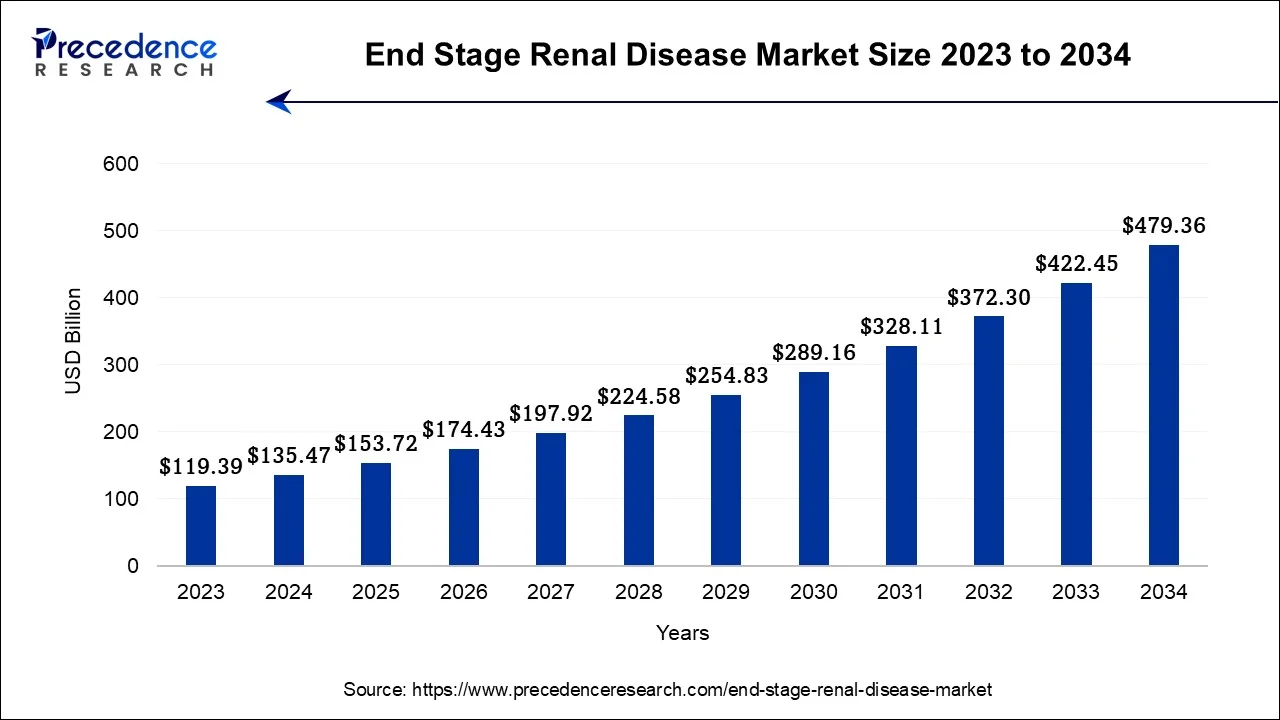

The global end stage renal disease market size is calculated at USD 153.72 billion in 2025 and is predicted to increase from USD 174.43 billion in 2026 to approximately USD 531.76 billion by 2035, expanding at a CAGR of 13.21% from 2026 to 2035. The market is driven by the rising global prevalence of chronic conditions such as diabetes and hypertension, which directly cause kidney damage. An aging population leads to a surge in patients demanding dialysis or transplants, thereby boosting the need for renal care products and services.

End Stage Renal Disease Market Key Takeaways

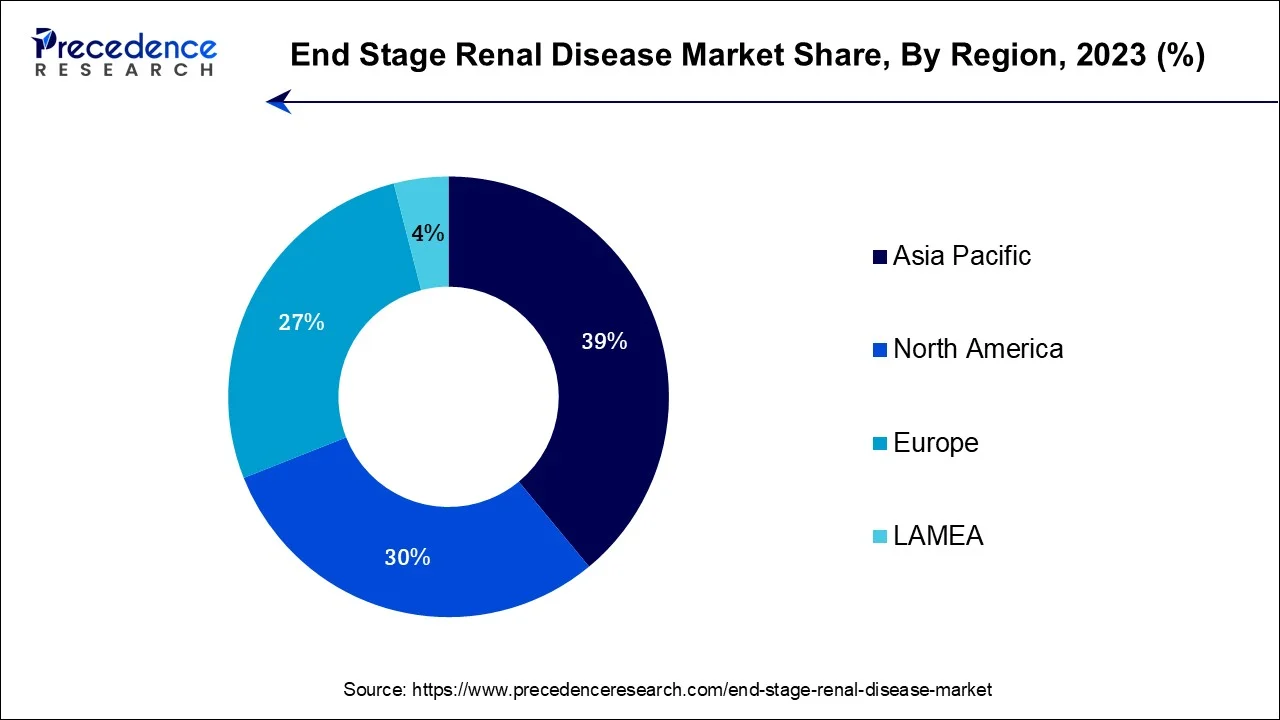

- Asia Pacific contributed more than 39% of revenue share in 2025.

- By Treatment, the dialysis segment dominated the market with the largest market share of 79% in 2025.

- By Treatment, the transplant segment is expected to expand at the fastest CAGR from 2026 to 2035.

Market Overview

The global end stage renal disease market offers solutions, treatments, diagnosis services and other healthcare services for kidney-related health conditions that can cause terminal renal failure which can be irreversible. End-stage renal diseases occur when the kidneys' ability to function on their own is severely compromised. Dialysis or a kidney transplant is required for a patient with end-stage renal failure to live more than a few weeks. The number of patients with end-stage renal disease is expected to increase, driving market trends. A large number of people are affected by end stage renal disease, with chronic kidney disease being one of the main reasons. According to the National Center for Chronic Disease Prevention and Health Promotion's statement, approximately 15% of adults in the United States have chronic kidney disease.

End Stage Renal Disease Market Growth Factors

- The end stage renal disease market is anticipated to expand significantly due to an increase in kidney failure patients and the availability of technologically improved equipment like artificial kidneys and low-maintenance dialysis machines.

- End stage renal disease patients are becoming more dependent on dialysis as their main form of treatment because there are fewer kidney transplants available. The need for dialysis services and associated equipment has expanded as a result.

- Growing public awareness of renal health and the significance of kidney disease early diagnosis has resulted in earlier diagnosis and intervention, further propelling market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 479.36 Billion |

| Market Size in 2025 | USD 135.47 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.21% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Aging population

The market for treatments for end-stage renal disease (ESRD) is significantly impacted by the aging population. According to WHO, by 2030, 1 in 6 individuals worldwide would be 60 years of age or older. The prevalence of kidney-related disorders including ESRD tends to rise when countries around the world experience demographic shifts with more people living longer. Medical gadget producers, pharmaceutical firms, and healthcare systems all must consider the effects of this demographic shift.

Elderly people are more prone to chronic diseases including diabetes and hypertension, both of which are major contributors to end stage renal disease (ESRD). If these disorders are not treated effectively, they may develop to more severe stages, causing kidney damage and ultimately ESRD. Older people are more susceptible to kidney-related problems because of the aging process itself, which contributes to the reduction of kidney function.

Medical services, such as ESRD diagnosis, treatment, and management, are in higher demand as the older population rises. Healthcare professionals adjust to older patients' unique needs, which frequently necessitate more extensive and long-term care. This includes having access to renal replacement therapies like dialysis or transplantation as well as drugs specially formulated to address the physiological changes experienced by aged people.

Pharmaceutical firms are motivated to provide medications that address the particular difficulties of treating ESRD in elderly patients, taking into account elements including numerous comorbidities, drug interactions, and frailty. Manufacturers of medical equipment are also motivated to develop technologies that are user-friendly for elderly patients, such as remote monitoring systems that let seniors get treatment in the comfort of their homes or dialysis devices that are simpler to operate.

Restraint

High-cost treatment

The high expense of treating end stage renal disease (ESRD) is one of the main obstacles to controlling this condition, which presents a significant healthcare issue. Renal replacement therapy, primarily in the form of dialysis or kidney transplantation, is often required for ESRD. Although these therapies are necessary for ESRD patients to survive, they come at a significant financial cost to both patients and healthcare systems.

The common treatment for ESRD, dialysis, is a time- and resource-consuming procedure. The majority of ESRD patients must have regular dialysis treatments for the remainder of their lives, frequently many times each week. These sessions require expensive overhead, specialized medical staff, and complex technology.

As a percentage of total healthcare spending, Medicare dialysis costs in the United States average around $60,000 per patient. As the long-term cost of dialysis is high, individuals without appropriate health insurance may find it especially difficult to afford treatment.

While a longer-term alternative to dialysis that is more cost-effective, kidney transplantation nevertheless entails high costs. The cost of the operation, the immunosuppressive drugs required after the transplant to avoid organ rejection, and continuing monitoring and care are also factors. Furthermore, there is frequently a long waiting list for kidney transplants, and some patients may have to travel a great distance for the procedure, adding to the expense. Moreover, these high treatment costs for ESRD affect not only the individuals suffering from the condition but also strain healthcare systems and insurance providers. Dialysis and transplant services account for a significant portion of healthcare budgets in many countries. This financial strain can limit the capacity of healthcare systems to provide timely and comprehensive care to all ESRD patients.

Opportunity

Demand for home-based dialysis

Home-based dialysis is a fast-expanding trend in end-stage renal disease (ESRD) therapy, providing both patients and healthcare professionals with a number of opportunities. The majority of ESRD patients have historically received hemodialysis at dialysis centers as their primary form of dialysis care. However, home-based dialysis techniques, such as peritoneal dialysis and home hemodialysis, are becoming more and more common for a number of reasons. Home-based dialysis allows patients to get treatments in the comfort of their own homes, removing the need for frequent travel to dialysis facilities. Patients and their carers' workload are lessened, and their general quality of life is enhanced.

Patients on home-based dialysis have more flexibility in scheduling their treatments. They can choose the timing and frequency of dialysis sessions that best fit their lifestyles, making it easier to maintain employment and engage in daily activities. In the long term, home-based hemodialysis may be less expensive than in-centre hemodialysis. Potential cost reductions for healthcare organizations and payers can be attributed to lower overhead expenses like staffing and facility maintenance. Thus, the rising demand for home-based dialysis is observed to offer an opportunity for the market to expand.

Treatment Insights

The dialysis segment had the greatest share, and it is anticipated that it would continue to dominate during the forecast period. The main driver is the increasing incidence of end-stage renal disease (ESRD) and chronic kidney disease (CKD). Globally, risk factors for kidney disease from lifestyle variables like obesity, diabetes, and hypertension are on the rise. As a result, the number of patients in need of renal replacement therapy, such as dialysis, is increasing.

Technology and medical technique advancements are also crucial. Hemodialysis and peritoneal dialysis equipment advancements, as well as the creation of at-home dialysis options, have increased patient accessibility and convenience. The use of telehealth and remote monitoring devices has also improved patient care and lessened the stress of regular in-person clinic appointments.

In the global market, the transplant segment is seen as having the fastest rate of growth. The need for kidney transplants has increased as a result of the rising prevalence of chronic kidney disease (CKD), which frequently causes ESRD. The rising prevalence of CKD is a result of aging populations and lifestyle variables such poor diet and inactivity.

The success rates of kidney transplants have also greatly increased as a result of medical innovations in immunosuppressive medications and surgical methods. These developments make transplantation a more appealing choice by lowering the possibility of graft rejection and improving patient outcomes. The demand of transplant has increased due to the scarce supply of donor organs.

Due to the lack of organs, there are now more efforts being made to encourage organ donation and improve organ allocation procedures. Governments around the world have put laws in place to encourage organ donation and transplantation after realizing the value of transplantation in the management of ESRD. Market expansion has been further encouraged by financial support and incentives for both donors and receivers.

Regional Insights

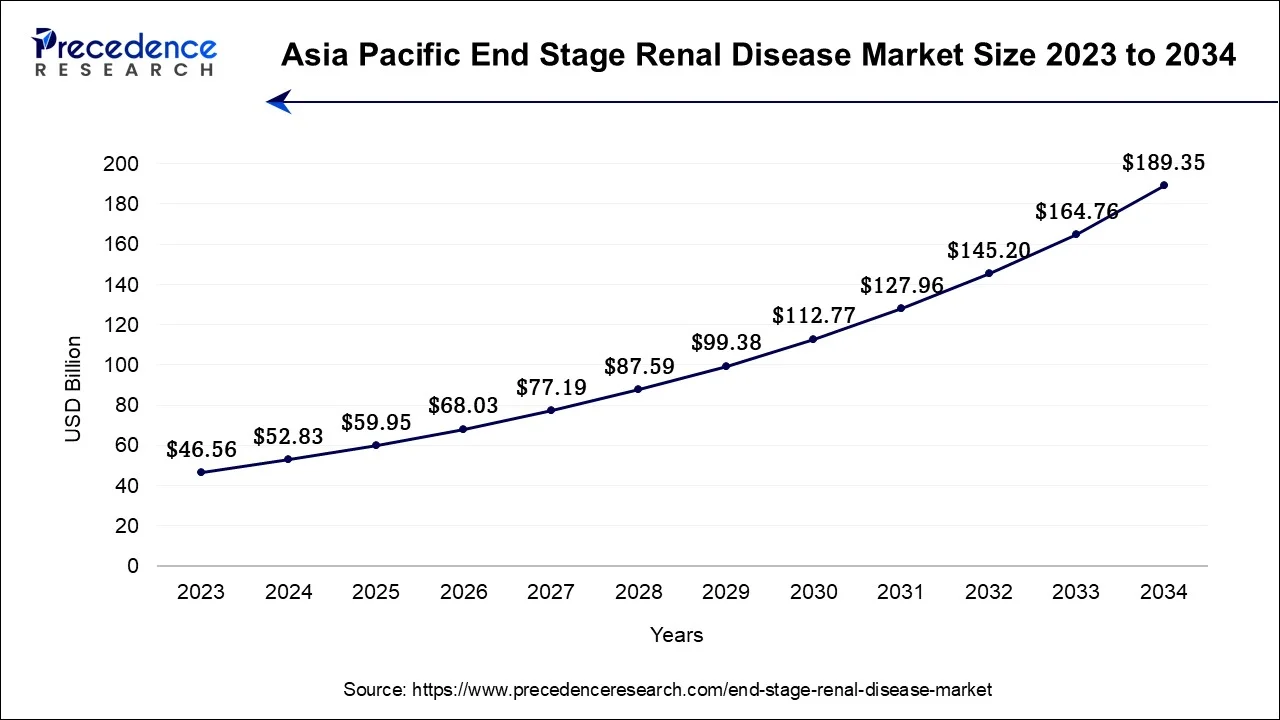

Asia Pacific End Stage Renal Disease Market Size and Growth 2026 to 2035

The Asia Pacific end stage renal disease market size is exhibited at USD 59.95 billion in 2025 and is projected to be worth around USD 213.94 billion by 2035, poised to grow at a CAGR of 13.57% from 2026 to 2035.

How did Asia Pacific dominate the End Stage Renal Disease Market?

Asia Pacific dominated the market in 2025, the region is expected to continue to grow at a significant rate during the forecast period due to a number of important factors. The number of people with ESRD has grown as a result of the rising incidence of diabetes and chronic kidney disease (CKD), which are major risk factors for the condition. The number of CKD-related ESRD cases increases as urbanization, aging population, and changes in lifestyle persist. Bettering healthcare systems and access to renal care facilities in many Asia Pacific countries have made it possible to detect ESRD earlier and manage it better. This has led to an increase in the need for kidney transplants as well as renal replacement therapies like hemodialysis and peritoneal dialysis.

China Market Trends

China is a major contributor to the Asia Pacific end stage renal disease market due to its large population and high prevalence of chronic kidney disease driven by diabetes and hypertension. The country's expanding dialysis infrastructure and increasing government investment in renal care services support market growth. Additionally, rising awareness and improving access to treatment further strengthen China's leading position in the regional ESRD market.

A larger percentage of the population may now receive modern ESRD treatments due to increased disposable incomes in various Asian countries. Modern dialysis equipment, medications, and transplant procedures have all been funded by rising healthcare costs, both public and private.

What Makes North America the Fastest-Growing Region in the Market?

North America is expected to have the fastest rate of growth as a result of a convergence of demographic changes, technological advances in medicine, and changes in healthcare regulations. These elements are altering the ESRD care landscape and stimulating market growth. Aging populations are a major factor in the rise of ESRD, according to demographic trends. Chronic diseases like diabetes and hypertension, which can result in kidney damage, are becoming more common as the Baby Boomer population ages. This rise in at-risk individuals results in a larger pool of ESRD patients. When it comes to medical technology innovation, North America has been on the cutting edge. This is demonstrated in the ESRD industry by the advancement of patient-friendly, more effective dialysis equipment as well as at-home dialysis solutions like peritoneal dialysis. These breakthroughs improve patient outcomes, lighten the load on healthcare institutions, and stimulate market expansion.

U.S. Market Trends

The U.S. end stage renal disease market is driven by the high prevalence of diabetes and hypertension, which are the leading causes of kidney failure. An aging population and increasing incidence of chronic kidney disease further fuel demand for dialysis and renal replacement therapies. Additionally, advanced healthcare infrastructure and favorable reimbursement policies support continued market growth.

Europe: A Notably Growing Region

Europe is considered a notably growing region in the end stage renal disease market due to the rising prevalence of chronic kidney disease driven by aging populations and lifestyle-related conditions such as diabetes and hypertension. Strong healthcare systems and widespread access to dialysis and renal care services support early diagnosis and treatment. Additionally, government initiatives and reimbursement frameworks promoting advanced renal therapies are contributing to steady market growth across the region.

Germany Market Trends

The market in Germany is driven by a growing aging population and the high prevalence of diabetes and hypertension, which are leading causes of kidney failure. Germany's well-established healthcare system and broad access to advanced dialysis and renal care services support sustained demand. Additionally, favorable reimbursement policies and strong adoption of innovative renal treatment technologies contribute to market growth.

What made Latin America hold a considerable share of the End Stage Renal Disease Market?

Latin America is expected to experience significant growth in the market due to the shift to cost-effective treatments, the adoption of AI-driven remote monitoring and telemedicine, which improve early detection of diseases and patient adherence. The major government programs and policy updates in this region are Mexico's Alliance for Kidney Health, Brazil's SUS Budget Increase, and the WHO Landmark Resolution.

What is the Potential of the End Stage Renal Disease Market in the Middle East and Africa?

The Middle East and Africa are expected to grow at a lucrative rate in the market, driven by the strategic expansion of global healthcare players, the national healthcare programs, the adoption of home-based dialysis, and advancements in digital health platforms. The government-backed healthcare reforms, the implementation of clinical practice guidelines, and the WHO resolution on kidney health contribute to the regional expansion.

Top Companies Operating in the End Stage Renal Disease Market & Their Offerings

- Nipro Corp.: It provides a wide range of dialysis products, including dialyzers, blood tubing systems, and dialysis machines for ESRD treatment.

- Fresenius Medical Care AG & Co. KGaA: It offers comprehensive renal care solutions encompassing dialysis equipment, consumables, pharmaceuticals, and dialysis services.

- Baxter International, Inc.: It delivers renal care products such as peritoneal dialysis systems, hemodialysis equipment, and related disposables for ESRD management.

- Medtronic Plc: It supplies medical technologies for vascular access, monitoring, and supportive therapies used in the treatment of patients with end-stage renal disease.

Value Chain Analysis of the End Stage Renal Disease Market

- R&D

This stage includes device innovations such as wearable artificial kidneys, portable peritoneal dialysis, and bioartificial and implantable organs.

Key Players: Fresenius Medical Care, DaVita Inc., Medtronic, Baxter International, AWAK Technologies. - Distribution to Hospitals, Pharmacies

This stage is expanding due to inventory management, add-on payments, cold-chain and specialized handling, and the Drug Supply Chain Security Act (DSCSA).

Key Players: Fresenius Medical Care, Vantive, Nipro Corporation, B. Braun Melsungen AG, Asahi Kasei - MedicalCardinal Health, Medline Industries.

Patient Support & Services

This stage involves integrated care teams, home dialysis management, value-based care coordination, and more.

Key Players: Diaverum, Dialysis Clinic, Inc., Outset Medical, Satellite Healthcare, Vantive, NephroPlus, U.S. Renal Care, Fresenius Medical Care.

End Stage Renal Disease Market Companies

- Nipro Corp.

- Fresenius Medical Care AG & Co. KGaA

- Baxter International, Inc.

- Medtronic Plc

- B. Braun Melsungen AG

- BD

- Asahi Kasei Medical Co., Ltd.

- Cantel Medical

- Nikkiso Co., Ltd.

- JMS Co. Ltd.

Recent Developments

- In September 2022, Cytecare, Bengaluru announced the launch of state-of-the-art dialysis centre for the treatment of kidney-related diseases. With the launch of this centre, Cytecare aims to advance its holistic approach towards healthcare services.

- In May 2023, a private, last-stage biopharma company, Pathalys Pharma announced its first patient enrolled ahead of schedule in pivotal phase program, designed for hemodialysis.

- In January 2023, according to Boehringer Ingelheim and Eli Lilly and Company (NYSE: LLY), the U.S. Food and Drug Administration (FDA) has approved a supplement new drug application for Jardiance tablets, which is being researched as a potential treatment to lower the risk of kidney disease progression and cardiovascular deaths in adults with chronic kidney disease.

- In June 2025, Fresenius Medical Care launched its Strategy FME Reignite, which aims to lead kidney care through excellent patient care and innovation. The plan introduces a new capital allocation framework to enhance value creation.

Source: https://freseniusmedicalcare.com

Segments Covered in the Report

By Treatment

- Transplant

- Dialysis

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting