What is ndomyocardial Biopsy Market Size?

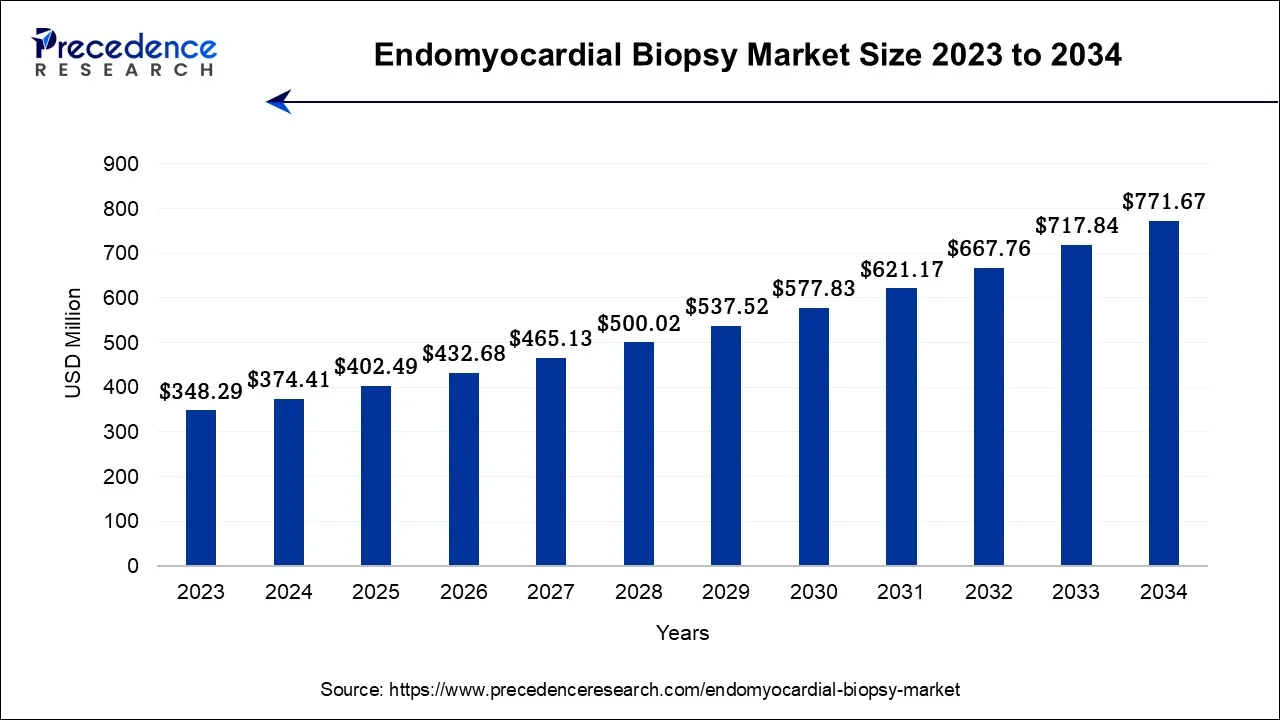

The global endomyocardial biopsy market size accounted for USD 402.49 million in 2025 and is anticipated to reach around USD 771.67 million by 2034, growing at a CAGR of 7.50% between 2025 and 2034.

Market Highlights

- North America contributed more than 44% of revenue share in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Product, the forceps integration segment has held the largest revenue share of 72% in 2024.

- By Product, the accessories segment is anticipated to grow at a fastest CAGR of 8.7% during the projected period.

- By Tip, the straight tip segment had the largest market share of 36% in 2024.

- By Tip, the pre-curved is estimated to expand at the fastest CAGR over the projected period.

- By End-use, the hospital segment captured the largest revenue share of 50% in 2024.

Market Size and Forecast

- Market Size in 2025: USD 402.49 Million

- Market Size in 2026: USD 432.68 Million

- Forecasted Market Size by 2034: USD 771.67 Million

- CAGR (2025-2034): 7.50%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Strategic Overview of the Global Endomyocardial Biopsy Industry

The endomyocardial biopsy market refers to the global healthcare sector's demand and supply dynamics related to endomyocardial biopsy procedures and associated products. This diagnostic procedure involves the collection of heart tissue samples for analyzing heart conditions such as myocarditis and rejection in heart transplant patients. The endomyocardial biopsy market encompasses various components, including biopsy catheters, imaging equipment, and laboratory services. Factors driving market growth include increasing heart-related diseases, advancements in biopsy technologies, and rising organ transplant procedures. The market is characterized by competitive dynamics among medical device manufacturers and diagnostic service providers, with potential for future expansion due to evolving healthcare needs.

Endomyocardial Biopsy Market Growth Factors

The endomyocardial biopsy market is a crucial segment within the global healthcare industry, focused on the diagnosis and monitoring of heart-related conditions. This market involves the utilization of specialized procedures and equipment to obtain tissue samples from the heart, aiding in the diagnosis of diseases like myocarditis and rejection in heart transplant recipients. The market encompasses various components, including biopsy catheters, imaging technologies, and laboratory services, catering to the growing demand for accurate cardiac diagnostics.

One significant trend in the endomyocardial biopsy market is the continuous advancement in biopsy technologies. Innovations such as minimally invasive biopsy procedures and improved imaging guidance systems have made the process safer and more effective, driving market growth. Additionally, the rising prevalence of heart-related diseases and the growing number of heart transplant surgeries are substantial growth drivers. As the global population ages and lifestyle factors contribute to heart ailments, the demand for these diagnostic procedures is expected to surge. Furthermore, the increasing availability of organ transplant facilities globally is boosting the requirement for endomyocardial biopsies to monitor transplant recipients, thereby expanding the market.

Despite its growth prospects, the endomyocardial biopsy market faces several challenges. One notable hurdle is the invasive nature of the procedure, which carries inherent risks for patients. Ensuring the safety and minimizing complications during the biopsy process remains a challenge for healthcare providers. Moreover, there is a shortage of skilled healthcare professionals proficient in conducting endomyocardial biopsies, limiting market accessibility. Additionally, the cost associated with these procedures, including specialized equipment and laboratory services, can be a barrier, especially in resource-constrained healthcare settings.

Amidst these challenges, there are notable business opportunities within the endomyocardial biopsy market. Collaborations and partnerships between medical device manufacturers, healthcare institutions, and research organizations can foster the development of safer and more cost-effective biopsy technologies, addressing both safety concerns and affordability issues. Training and education programs to enhance the skills of healthcare professionals in performing endomyocardial biopsies can bridge the workforce gap and expand market reach. Moreover, market players can explore opportunities in emerging economies, where the demand for advanced cardiac diagnostics is on the rise, and healthcare infrastructure is evolving rapidly.

In conclusion, the endomyocardial biopsy market plays a crucial role in cardiac healthcare by facilitating the diagnosis and monitoring of heart-related conditions. While it faces challenges related to invasiveness, skill shortages, and costs, the market is poised for growth driven by technological advancements, increasing heart diseases, and expanding organ transplant procedures. Businesses that address these challenges and tap into emerging opportunities can thrive in this vital healthcare segment.

Market Outlook

- Market Growth Overview: The Endomyocardial Biopsy market is expected to grow significantly between 2025 and 2034, driven by the rising heart transplant procedures, growing burden of cardiovascular diseases, and continuous improvements in biopsy forceps design, adoption of ambulatory surgical centers.

- Sustainability Trends: Sustainability trends involve single-use devices and infection control, eco-friendly materials and design, waste management and recycling programs, and energy efficiency manufacturing.

- Major Investors: Major investors in the market, Boston Scientific and Medtronic, BlackRock and the Vanguard Group,

Startup Economy: The startup economy in the market is focused on alternative diagnostics, AI and software integration, and dominance of established players.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 402.49 Million |

| Market Size by 2026 | USD 432.68 Million |

| Market Size by 2034 | USD 771.67 Million |

| Growth Rate from 2025to 2034 | CAGR of 7.5% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025to 2034 |

| Segments Covered | Product, Tip, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in biopsy technologies

The endomyocardial biopsy market is experiencing robust growth driven by continuous innovations in biopsy technologies. These technological strides have not only enhanced the procedure's overall effectiveness but have also rendered it safer and more accessible. Firstly, the ascent of minimally invasive biopsy techniques has been instrumental in reducing patient discomfort and post-procedure recovery periods. This has not only mitigated the inherent risks but has also spurred greater patient acceptance, resulting in heightened demand.

Secondly, improved imaging guidance systems, such as advanced echocardiography and fluoroscopy, have enhanced the precision of tissue sample collection. This ensures that samples are obtained from the target area accurately, reducing the need for repeat procedures and increasing diagnostic reliability. Furthermore, the development of more sophisticated biopsy instruments has made the process smoother and more efficient for healthcare providers. These instruments offer better maneuverability and control during the biopsy, further minimizing patient risks. Overall, these technological advancements not only enhance patient outcomes but also attract healthcare professionals and institutions to incorporate endomyocardial biopsy into their diagnostic arsenal, thereby boosting the market's growth prospects.

Restraints

Invasive nature of the procedure

The endomyocardial biopsy industry faces a significant constraint due to the invasive nature of the procedure. This inherent invasiveness poses challenges and limitations that impede market growth. Primarily, the procedure's invasiveness can deter potential patients, as they may be apprehensive about the associated risks, including bleeding, infections, and potential damage to surrounding tissues. These concerns can lead individuals to opt for less invasive diagnostic methods, thereby limiting the market's growth potential. Secondly, the invasive nature of endomyocardial biopsies necessitates specialized training and expertise among healthcare professionals.

The shortage of such skilled practitioners can constrain the availability of these procedures, particularly in underserved regions. This limitation hinders patient access to this important diagnostic tool. Overall, the invasive aspect of endomyocardial biopsies not only affects patient willingness to undergo the procedure but also impacts the healthcare infrastructure's capacity to provide this service, thereby restraining the market's expansion.

Opportunities

Patient education and awareness

Patient education and heightened awareness campaigns are carving out notable opportunities within the endomyocardial biopsy industry. To begin, the informed patient base is becoming more receptive to the procedure's benefits in diagnosing and managing heart conditions. As individuals become better acquainted with the advantages of early detection through endomyocardial biopsies, they are increasingly likely to consent to the procedure when recommended by healthcare providers. This surge in awareness can effectively broaden the pool of potential candidates for biopsies.

Moreover, targeted awareness initiatives serve to mitigate the apprehension linked to the procedure's invasiveness. A comprehensive understanding of the process and its potential advantages can alleviate patient fears, making them more inclined to undergo endomyocardial biopsies. Consequently, this expanded comprehension has the potential to amplify the market's outreach. In essence, patient education and awareness campaigns are pivotal in establishing opportunities within the Endomyocardial Biopsy market by bolstering patient acceptance, reducing hesitation, and fostering a deeper appreciation of the procedure's significance in cardiac care.

Segment Insights

Product Insights

According to the product, the forceps Integration sector has held 72% revenue share in 2024. The forceps segment holds a significant share due to its critical role in obtaining tissue samples during the procedure. Forceps are commonly used for this purpose because they offer precision and control in collecting cardiac tissue, ensuring accurate diagnosis. Healthcare providers rely on forceps for their effectiveness and safety in tissue extraction, making them a preferred choice. As endomyocardial biopsies continue to be a vital diagnostic tool for heart-related conditions, the forceps segment remains a major player in the market, meeting the essential need for tissue sample acquisition.

The accessories sector is anticipated to expand at a significantly CAGR of 8.7% during the projected period. The accessories segment holds a significant growth in the endomyocardial biopsy industry primarily because it encompasses essential components required for conducting the procedure. These accessories include biopsy catheters, guidewires, and sheaths, among others, which are crucial for obtaining tissue samples safely and accurately.

As endomyocardial biopsies are performed routinely, the demand for these consumable accessories remains consistently high. Moreover, advancements in accessory technologies have improved the safety and efficiency of the procedure, further driving their adoption. Hence, the accessories segment plays a pivotal role and commands a major growth in the market.

Tip Insights

In 2024, the straight tip segment had the highest market share of 36% on the basis of the Tip. The straight tip segment holds a major share due to its established track record of safety and reliability. Straight-tip biopsy catheters are widely used in clinical practice and are favored by healthcare professionals for their ease of use and maneuverability. They have a well-documented history of successful tissue sampling with lower risks of complications. This trust in their performance has made straight-tip catheters the preferred choice for endomyocardial biopsies, contributing significantly to their dominant market share compared to other catheter types.

The pre-curved is anticipated to expand at the fastest rate over the projected period. The pre-curved segment holds a significant growth due to its superior maneuverability and accuracy during the biopsy procedure. Pre-curved catheters are designed with a curved tip, allowing for easier navigation through the heart's chambers, which can be challenging with straight catheters. This enhanced precision in sample collection reduces the risk of complications, making it the preferred choice for healthcare professionals. Additionally, pre-curved catheters have proven effectiveness in transplant monitoring, further driving their adoption. Their ability to streamline the biopsy process and improve diagnostic outcomes cements their prominent market growth.

End-use Insights

The hospital segment held the largest revenue share of 50% in 2024. The dominant presence of hospitals in the endomyocardial biopsy market can be attributed to distinct factors. Hospitals serve as central nuclei for cardiac healthcare, featuring specialized cardiology units and cutting-edge facilities crucial for diagnosing and managing heart-related ailments. Their robust infrastructure, along with proficient medical teams and access to state-of-the-art biopsy equipment, firmly establishes them as principal centers for conducting endomyocardial biopsies. Furthermore, hospitals frequently manage intricate cardiac cases, notably heart transplant recipients necessitating regular biopsies, further cementing their pivotal role as primary purveyors of this indispensable diagnostic procedure and reinforcing their substantial market influence.

The retail and consumer goods sector is anticipated to grow at a significantly faster rate, registering a CAGR of 7.9% over the predicted period. The ambulatory surgical center (ASC) segment holds a significant growth due to its advantages in terms of cost-effectiveness, convenience, and reduced hospitalization times. ASCs offer a more efficient and less resource-intensive setting for performing endomyocardial biopsies, making them a preferred choice for both patients and healthcare providers. Patients benefit from shorter recovery periods and lower costs, while healthcare facilities find ASCs to be a financially viable option. This trend is further driven by the increasing focus on outpatient care, especially for less complex procedures, which has boosted the ASC's market growth.

Regional Insights

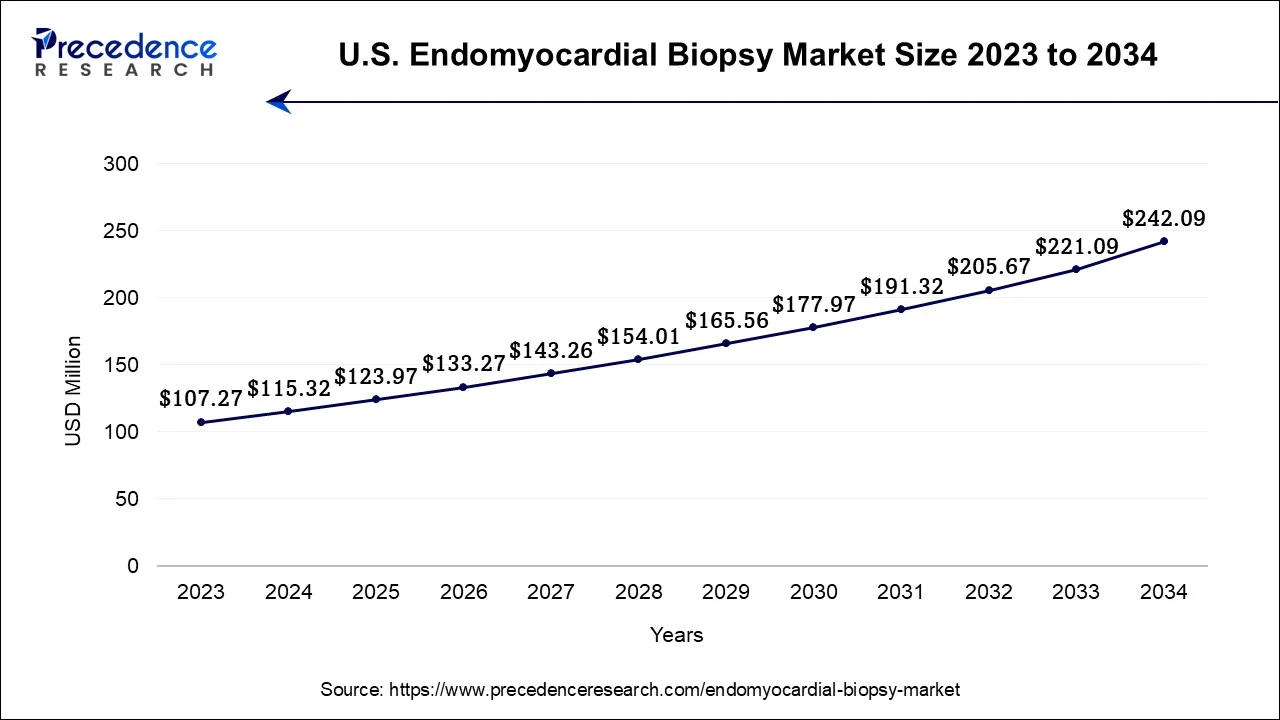

U.S. Endomyocardial Biopsy Market Size and Growth 2025to 2034

The U.S. endomyocardial biopsy market size accounted for USD 123.97 million in 2025 and is expected to be worth around USD 242.09 million by 2034, growing at a CAGR of 7.69% from 2025to 2034.

U.S. Endomyocardial Biopsy Market Trends

The U.S. is increasing number of heart transplants and the critical need for post-transplant monitoring using biopsy forceps. The market is shifting towards minimally invasive procedures conducted in ambulatory surgical centers, with advancements in pre-curved tips enhancing procedural safety and efficacy.

North America has held the largest revenue share 44% in 2024.The region boasts advanced healthcare infrastructure, a high prevalence of cardiovascular diseases, and a well-established organ transplantation ecosystem, necessitating frequent biopsies for monitoring. Moreover, robust research and development initiatives and technological advancements in diagnostic procedures contribute to the market's growth. Additionally, favorable reimbursement policies and a high level of patient awareness further support the North American market's dominance, making it a key hub for endomyocardial biopsy procedures and services.

Asia-Pacific is estimated to observe the fastest expansion. The region has witnessed a growing prevalence of cardiovascular diseases, driving the demand for advanced cardiac diagnostic procedures like endomyocardial biopsies. Additionally, Asia-Pacific has a large population base and an expanding elderly demographic, further contributing to the high incidence of heart-related conditions. Improvements in healthcare infrastructure and increased access to healthcare services have also boosted the adoption of these procedures. Moreover, favorable government initiatives and rising healthcare investments in countries like China and India have propelled market growth in the region.

China Endomyocardial Biopsy Trends

China has a high cardiovascular disease burden and a growing number of heart transplant procedures requiring monitoring. The market relies heavily on technological advancements in biopsy forceps and is supported by increased government investment in healthcare infrastructure and local device production.

United Kingdom Endomyocardial Biopsy Trends

The U.K.'s endomyocardial biopsy market is driven by the essential role in monitoring heart transplant rejection and the increasing diagnosis of cardiac amyloidosis. Biopsy forceps remain the dominant product, with ongoing improvements in design enhancing procedural safety and efficacy within experienced centers.

Endomyocardial Biopsy Market Value Chain Analysis

- R&D and Product Design This stage involves the foundational research and development of biopsy instruments and accessories, focusing on improving their safety, maneuverability, and efficacy.

Key Players: Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, B. Braun Melsungen AG, and Argon Medical Devices, Inc. - ManufacturingThis stage focuses on the precise fabrication and assembly of endomyocardial biopsy forceps, catheters, and other accessories in a sterile, quality-controlled environment.

Key Players: Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Teleflex Incorporated, Merit Medical Systems, Inc., Cook Medical LLC, Argon Medical Devices, Inc., and Olympus Corporation. - Distribution and LogisticsFinished EMB devices are distributed through a complex network to hospitals, ambulatory surgical centers (ASCs), and specialized clinics globally.

Key Players: Cardinal Health, Inc., Terumo Corporation, and global distributors with specialized medical device logistics networks. - Clinical Application (Procedure and Analysis)The final stage involves the performance of the biopsy procedure by skilled interventional cardiologists in a clinical setting like a hospital or ASC.

Key Players: Hospitals (like transplant centers), ASCs, university medical centers, and pathology labs that provide expertise in cardiovascular tissue analysis.

Endomyocardial Biopsy Market Companies

- Abbott Laboratories Abbott contributes through a broad cardiovascular product portfolio, which includes relevant imaging technologies and devices used to support structural heart procedures like the endomyocardial biopsy.

- Boston Scientific CorporationAs a major manufacturer of medical devices, Boston Scientific is a key player in the endomyocardial biopsy (EMB) market with its line of biopsy forceps designed for accurate tissue sampling.

- Medtronic plcMedtronic is a significant contributor with a wide range of cardiovascular products that can support the EMB procedure, from catheters to imaging support systems.

- Johnson & JohnsonThrough its various medical device subsidiaries, J&J contributes with products used in a variety of interventional cardiology procedures, potentially including accessories for EMB.

- Becton, Dickinson and CompanyBD, through its BD Biosciences unit, contributes to the broader diagnostic aspect of the market by providing tools and reagents used in the analysis of the biopsied tissue samples.

- Cardinal Health, Inc.Cardinal Health plays a critical role in the distribution and logistics stage of the value chain, ensuring that EMB devices and accessories are efficiently delivered to hospitals and clinics.

- Teleflex IncorporatedTeleflex is a key manufacturer of various medical devices, including a range of catheters and access products that are essential for performing minimally invasive procedures like EMB.

- Terumo CorporationTerumo contributes a variety of cardiovascular systems and interventional devices, including guide wires and sheaths used during the EMB procedure.

- Argon Medical Devices, Inc.Argon is a specialized manufacturer of a range of biopsy products, providing specific device contributions to the EMB market.

- Merit Medical Systems, Inc.Merit Medical manufactures a range of accessories and disposable kits used during cardiac catheterization and biopsy procedures.

- BD BiosciencesAs a segment of Becton, Dickinson and Company, BD Biosciences provides the tools and expertise for analyzing the cellular components of the biopsied tissue. They are crucial for the accurate immunological and pathological assessment of the sample.

- Cook MedicalCook Medical manufactures a range of interventional medical devices, including access sheaths and potentially biopsy-related tools used during complex cardiovascular procedures.

- Novartis AGNovartis operates primarily in the pharmaceutical sector, but its focus on cardiovascular diseases and treatments means it invests heavily in the diagnostic landscape.

- Roche DiagnosticsRoche Diagnostics provides the in vitro diagnostic equipment and reagents used in the pathology labs to analyze the biopsied tissue for specific biomarkers and conditions.

- Siemens HealthineersSiemens Healthineers contributes through its advanced medical imaging systems (MRI, CT, ultrasound) that are used for pre-procedural planning and guidance during the EMB procedure. Their technology helps ensure the accuracy and safety of the biopsy.

- Maquet Getinge GroupAs a major medical technology company, Maquet (part of Getinge Group) provides equipment for operating rooms and critical care units where EMB procedures are performed. Their infrastructure solutions ensure a sterile and efficient environment for the procedure.

- MicroPort Scientific CorporationMicroPort is a medical device company with a focus on cardiovascular devices, offering a range of interventional products that can be used during the EMB procedure.

- CryoLife, Inc.CryoLife focuses on surgical adhesives and preservation solutions for cardiac tissues, contributing to the post-procedural care and tissue handling stages of the value chain.

- SentreHEART, Inc.SentreHEART focuses on minimally invasive solutions for left atrial appendage closure, which is a different cardiac procedure. While not directly in the biopsy device market, their R&D in minimally invasive cardiac procedures influences the broader trend towards less invasive diagnostic and treatment options.

Recent Developments

- In May 2022,Terumo Corporation (Terumo India) forged a partnership agreement with Argon Medical to offer advanced healthcare solutions that encompass the entire spectrum from diagnosis to treatment, thereby providing comprehensive support to patients.

- In February 2020,Teleflex Corporation successfully completed the acquisition of IWG High Performance Conductors, Inc. (HPC), a prominent manufacturer specializing in cutting-edge minimally invasive medical products and high-performance conductors. These strategic acquisitions significantly enrich the company's product portfolio.

- In July 2019, Argon Medical Devices, Inc. made a significant announcement regarding a definitive license agreement with Hatch Medical, L.L.C. ("Hatch Medical"). This agreement granted exclusive global rights for the marketing and distribution of the Scorpion TIPS Access Systems. Such acquisitions empower businesses to expand their global presence and reach in the medical industry.

Segments Covered in the Report

By Product

- Forceps

- Accessories

By Tip

- Maxi-curved

- Straight

- Pre-curved

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting