What is the Endoscopy Equipment and Software Market Size?

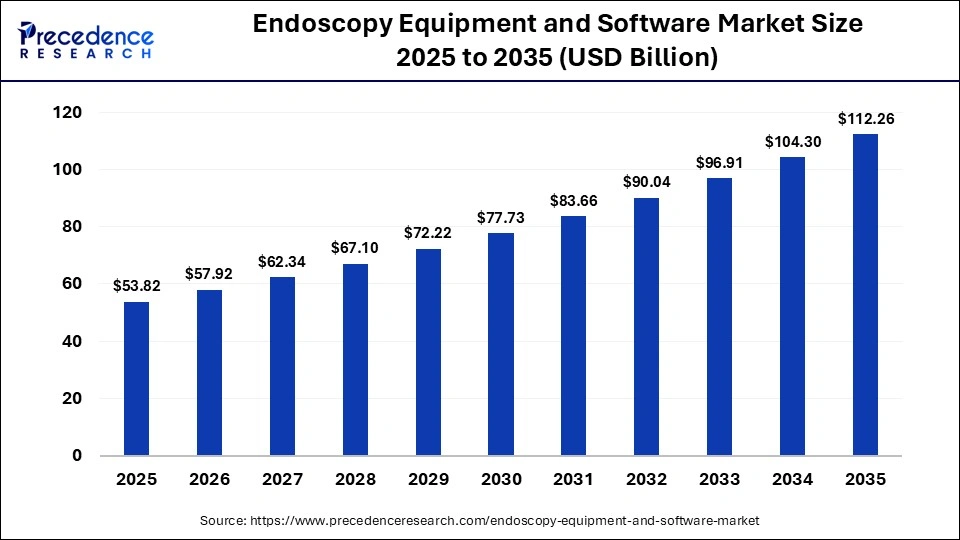

The global endoscopy equipment and software market size was calculated at USD 53.82 billion in 2025 and is predicted to increase from USD 57.92 billion in 2026 to approximately USD 112.26 billion by 2035, expanding at a CAGR of 7.63% from 2026 to 2035.The market is driven by the growing demand for minimally invasive procedures, rising chronic disease rates, and technological advancements like AI-driven imaging and disposable endoscopes.

Market Highlights

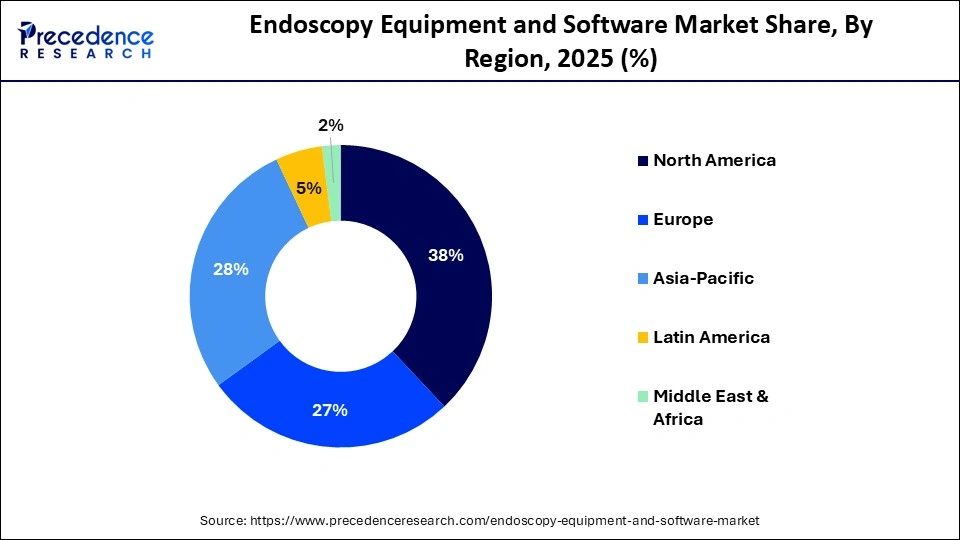

- North America dominated the market with a major share of around 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

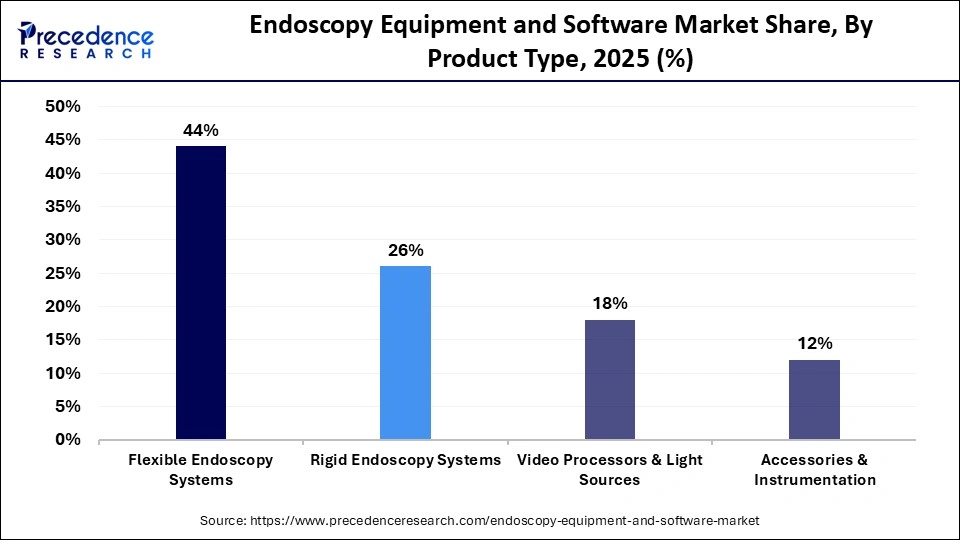

- By product type, the flexible endoscopy systems segment contributed the highest market share of around 44% in 2025.

- By product type, the video processors & light sources segment is expected to grow at a strong CAGR between 2026 and 2035.

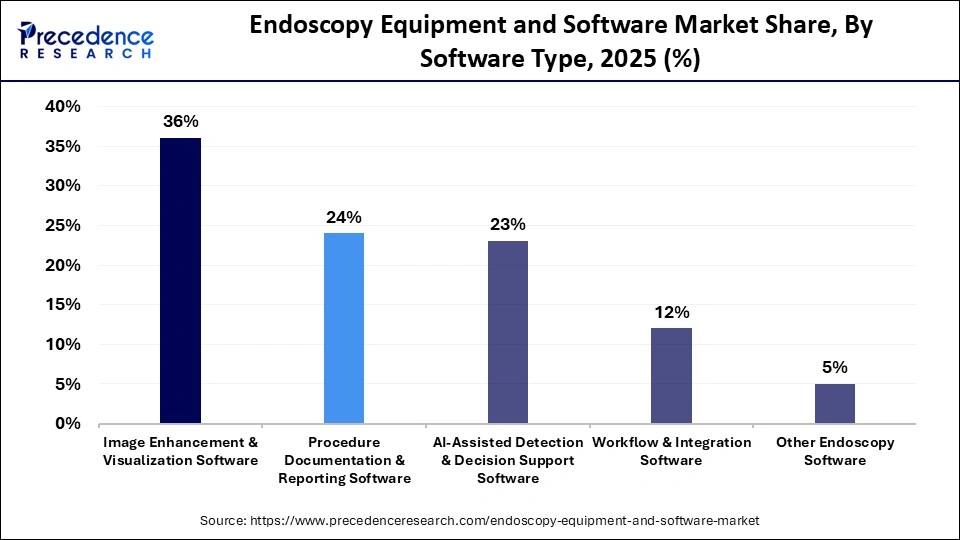

- By software type, the image enhancement & visualization software segment held a major market share of around 36% in 2025.

- By software type, the AI-assisted detection & decision support software segment is expected to expand at the fastest CAGR from 2026 to 2035.

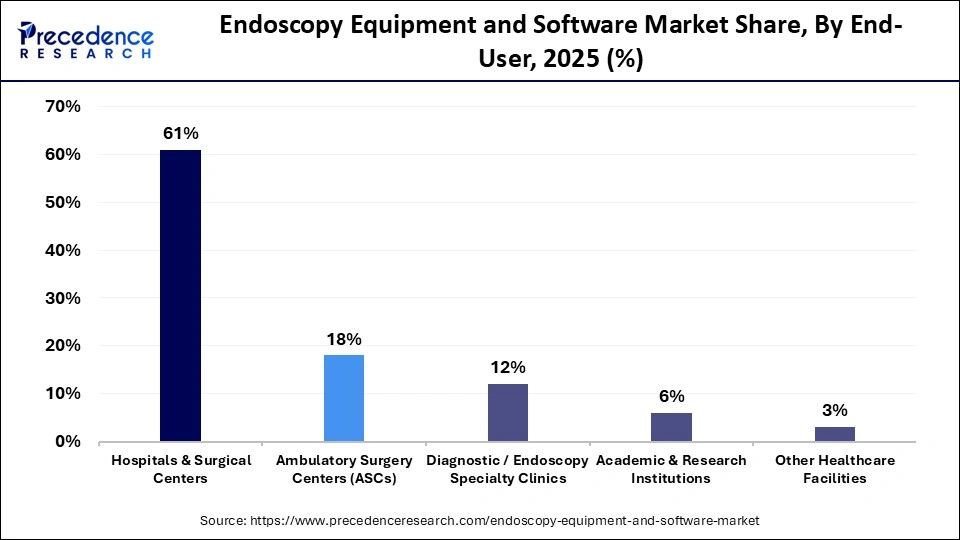

By end-user, the hospitals & surgical centers segment generated the biggest market share of around 61% in 2025. - By end-user, the ambulatory surgery centers (ASCs) segment is expanding at the fastest CAGR between 2026 and 2035.

- By procedure type, the diagnostic endoscopy segment accounted for the largest market share of about 42% in 2025.

- By procedure type, the interventional / advanced therapeutic procedures segment is expected to grow at a solid CAGR between 2026 and 2035.

- By technology, the high-definition (HD) imaging systems segment captured the highest market share of 46% in 2025.

- By technology, the 4K Ultra HD & advanced imaging segment is poised to grow at a healthy CAGR between 2026 and 2035.

What is the Endoscopy Equipment and Software Market?

The global endoscopy equipment and software market includes a range of medical devices, accessories, and advanced software systems used for both diagnostic and therapeutic endoscopic procedures in various fields, such as gastrointestinal, urology, gynecology, and respiratory applications. The market encompasses rigid and flexible endoscopes, video processors, light sources, instrument accessories, surgical tools, and integrated software solutions. These solutions feature capabilities like image enhancement, procedure documentation, AI-assisted detection, workflow management, and tele-endoscopy. The market is driven by increasing procedural volumes, advancements in imaging technology, and the growing adoption of endoscopy solutions.

How is AI Transforming the Endoscopy Equipment and Software Market?

Artificial intelligence (AI) is transforming the endoscopy equipment and software market by providing real-time computer-aided detection (CADe) and diagnosis (CADx) of abnormalities. AI acts as a second pair of eyes to identify polyps, tumors, and other irregularities in real-time, thereby improving detection rates. It streamlines procedures, reduces the time needed for manual image review in video capsule endoscopy, and assists with automated reporting. AI algorithms help in characterizing lesions to guide treatment, leading to lower inter-operator variability and ensuring consistent, high-quality diagnoses, regardless of the operator's experience level.

Major Trends in the Endoscopy Equipment and Software Market

- AI and Digital Integration in Diagnostics: AI is revolutionizing endoscopy by enhancing lesion detection, improving diagnostic accuracy, and facilitating real-time clinical decision-making during procedures.

- Shift Toward Single-Use Endoscopes: The demand for single-use or disposable endoscopes is surging due to increased infection control measures, significantly reducing the risk of cross-contamination and infections.

- High-Definition and Advanced Imaging Technologies: There is a notable shift towards high-definition imaging, virtual chromoendoscopy, and narrow-band imaging, allowing for more precise diagnosis of gastrointestinal and respiratory diseases.

- Robotic-Assisted and Advanced Therapeutic Endoscopy: Robotic-assisted systems are increasingly common as they enhance the precision of therapeutic procedures.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 53.82Billion |

| Market Size in 2026 | USD 25.44 Billion |

| Market Size by 2035 | USD 112.26Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Software Type, End-User, Procedure Type, Technology and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

How Did the Flexible Endoscopy Systems Segment Dominate the Endoscopy Equipment and Software Market?

The flexible endoscopy systems segment held a dominant market share of approximately 44% in 2025. This leadership is primarily driven by the strong demand for video endoscopes, which provide superior high-resolution imaging, enhanced maneuverability, and improved patient comfort during minimally invasive procedures. Additionally, the increasing prevalence of gastrointestinal disorders necessitates frequent and accurate diagnostic screenings. The ongoing shift toward less invasive procedures, aimed at facilitating faster recovery times and safer hospital stays, further supports the growing popularity of flexible devices over rigid ones.

The video processors & light sources segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the swift transition from standard-definition to 4K and 3D imaging, the integration of AI-powered diagnostics, and the demand for high-intensity, efficient light sources. These light sources are essential for real-time, AI-enabled image analysis and CADe, which helps in identifying lesions and enhancing accuracy in gastrointestinal and pulmonology procedures. The demand for LED and laser-driven light sources is rising due to their superior efficiency, long-term reliability, and higher luminous intensity.

Software Type Insights

What Made Image Enhancement & Visualization Software the Leading Segment in the Endoscopy Equipment and Software Market?

The image enhancement & visualization software segment led the market with about 36% share in 2025. This dominance is largely due to a transition toward data-rich diagnostic systems and the evolution of endoscopic visualization from a passive tool to an AI-driven solution. AI-enabled software, such as CAD and polyp detection, significantly drives growth by allowing for real-time analysis and improved lesion characterization. The shift from standard definition to 4K and 3D imaging enhances color accuracy, better tissue differentiation, and improves depth perception, thus increasing the need for advanced software capable of processing high-definition data.

The AI-assisted detection & decision support software segment is expected to grow at the fastest rate in the coming years due to the rising need for specialized AI software and platforms. AI algorithms, especially CAD and CADx, play a crucial role in identifying abnormalities, often outperforming traditional methods in real-time, which reduces false-negative rates and enhances early disease detection. AI software streamlines the endoscopy workflow by automating routine tasks, thereby minimizing the workload on healthcare professionals and improving overall resource utilization. It provides immediate, actionable insights that aid in making faster and more accurate decisions.

End-User Insights

Why Did the Hospitals & Surgical Centers Segment Dominate the Endoscopy Equipment and Software Market?

The hospitals & surgical centers segment accounted for about 61% of the market share in 2025. This dominance is primarily driven by high patient volumes, advanced infrastructure, and the capacity to perform complex, specialized, and emergency procedures. These facilities serve as primary centers for a wide range of gastrointestinal, pulmonary, urological, and gynecological procedures, requiring advanced and diverse equipment. They possess financial resources to invest in cutting-edge, high-definition, AI-enabled, and robotic-assisted endoscopy systems, enhancing diagnostic accuracy and workflow, thus keeping pace with demand.

The ambulatory surgery centers (ASCs) segment is expected to witness the fastest growth during the forecast period. This growth is fueled by a rapid shift towards cost-effective, high-volume, and minimally invasive outpatient procedures. ASCs offer procedures at lower costs than hospitals, attracting both patients and insurers, particularly for GI, orthopedic, and ear, nose, and throat procedures. ASCs are increasingly implementing AI-driven, 4K imaging, and, in some instances, single-use devices to uphold high standards of sterilization and efficiency, accelerating the demand for mid-tier endoscopy systems.

Procedure Type Insights

What Made Diagnostic Endoscopy the Leading Segment in the Endoscopy Equipment and Software Market?

The diagnostic endoscopy segment led the market with approximately 42% of the market share in 2025. The segment's leadership is largely driven by the rising incidence of chronic diseases, a growing geriatric population, and a preference for minimally invasive procedures. The increasing occurrence of gastrointestinal disorders, such as gastroesophageal reflux disease, inflammatory bowel disease, and colorectal cancer, underscores the need for frequent, routine, and early diagnostic screenings. Diagnostic endoscopies are preferred for their minimally invasive nature, which reduces patient trauma and enables faster recovery compared to traditional surgeries, driving demand for these procedures.

The interventional / advanced therapeutic procedures segment is expected to experience the fastest growth, mainly due to a paradigm shift from traditional open surgeries to minimally invasive alternatives. The relocation of procedures from hospitals to outpatient centers, focusing on cost-effective and minimally invasive options, accelerates the demand for advanced equipment in these settings. The integration of 4K and 3D imaging, AI, and specialized imaging techniques facilitates precise visualization for complex interventions, addressing infection control risks and reducing reprocessing costs.

Technology Insights

How Did the High-Definition (HD) Imaging Systems Segment Dominate the Endoscopy Equipment and Software Market?

The high-definition (HD) imaging systems segment dominated the market with approximately 46% share in 2025. This dominance is attributed to the clarity, color fidelity, and resolution provided by these systems, which are essential for precise, minimally invasive surgeries and early disease diagnosis. HD imaging allows physicians to detect abnormalities more accurately, such as identifying flat lesions during cancer screenings. The rise in minimally invasive procedures for gastroenterology, urology, and gynecology heavily relies on advanced imaging, which enhances patient satisfaction and reduces hospital stays.

The 4K Ultra HD and advanced imaging segment is expected to experience the fastest growth. This growth is primarily driven by intense demand for superior visualization, improved surgical precision, and enhanced diagnostic accuracy. 4K resolution offers four times the resolution of Full HD, allowing surgeons to see tissues with greater depth and detail, which improves both diagnostic performance and surgical outcomes. The integration of 4K technology with AI-powered diagnostics and fluorescence imaging leads to better lesion detection and real-time navigation, attracting significant investment.

Regional Insights

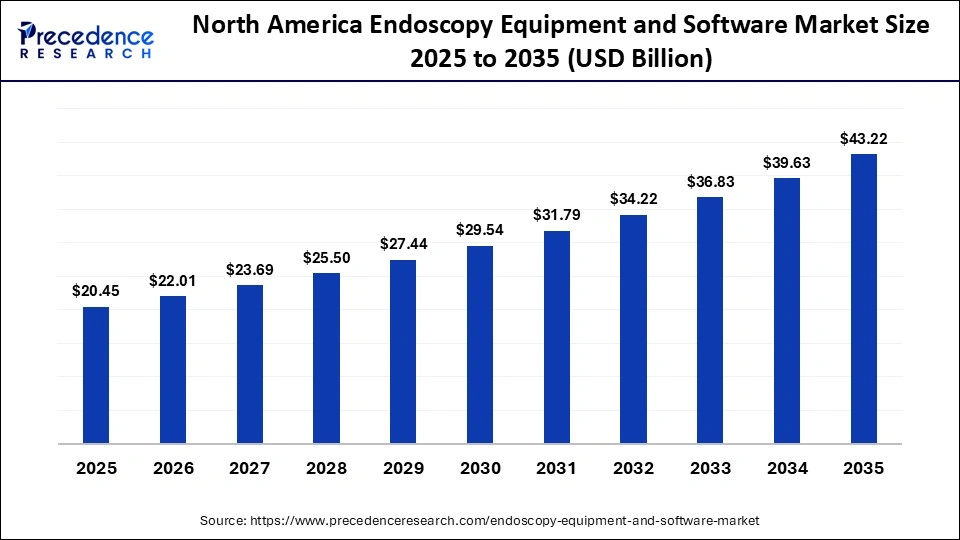

How Big is the North America Endoscopy Equipment and Software Market Size?

The North America endoscopy equipment and software market size is estimated at USD 7.87 billion in 2025 and is projected to reach approximately USD 214.95 billion by 2035, with a 39.20% CAGR from 2026 to 2035.

How Did North America Dominate the Endoscopy Equipment and Software Market?

North America dominated the endoscopy equipment and software market with about 38% share in 2025. The region's dominant position in the market is largely attributed to the high adoption of minimally invasive procedures, advanced healthcare infrastructure, and favorable reimbursement policies. The region utilizes high-definition imaging, robotic-assisted platforms, and AI-driven diagnostic tools heavily, improving procedural precision and patient outcomes. Hospitals and ambulatory surgical centers have made extensive investments in healthcare infrastructure for advanced, often expensive equipment, supported by strong reimbursement frameworks for endoscopic procedures.

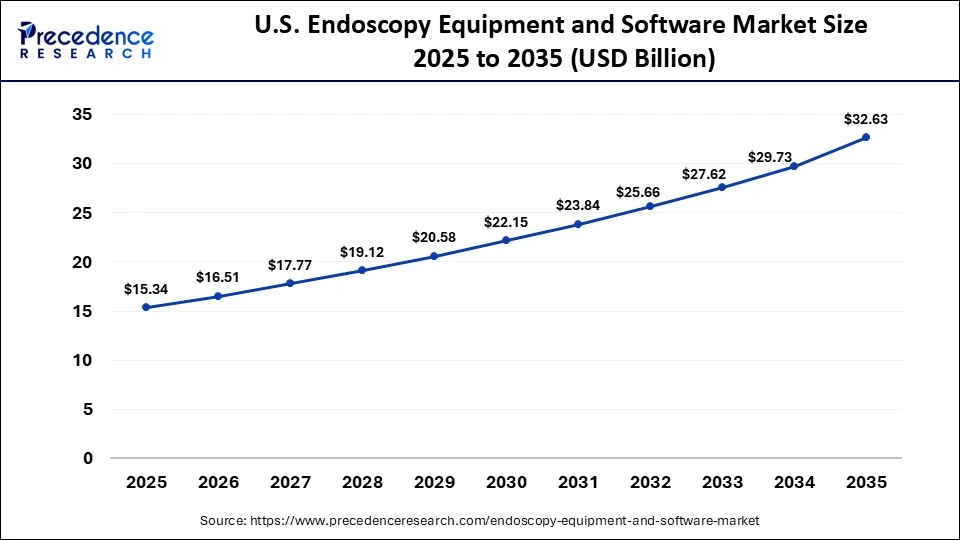

What is the Size of the U.S. Endoscopy Equipment and Software Market?

The U.S. endoscopy equipment and software market size is calculated at USD 5.90 billion in 2025 and is expected to reach nearly USD 162.95 billion in 2035, accelerating at a strong CAGR of 39.30% between 2026 and 2035.

U.S. Endoscopy Equipment and Software Market Trends

The U.S. plays a dominant role within the region, mainly characterized by high investments in R&D, resulting in the introduction of AI-enabled diagnostic platforms and advanced robotics. Additionally, with favorable reimbursement policies, U.S. endoscopy procedures are increasingly shifting to ASCs, increasing demand for portable, efficient equipment. Also, the country is home to major global manufacturers, including Stryker Corporation, Boston Scientific, and Medtronic, which drive innovation in surgical endoscopy.

Why is Asia Pacific Considered the Fastest-Growing Region in the Endoscopy Equipment and Software Market?

Asia Pacific is expected to experience the fastest growth during the forecast period, mainly fueled by a high prevalence of gastrointestinal disorders, increased demand for minimally invasive surgeries, and rapid infrastructure development. The modernization of healthcare systems in countries such as China and India, coupled with rising healthcare expenditure, is driving the acquisition of advanced endoscopy units. Patients and doctors increasingly favor endoscopic techniques over open surgeries due to benefits such as reduced pain, shorter hospital stays, quicker recovery, and a lower risk of complications.

India Endoscopy Equipment and Software Market Trends

India is an emerging market within the region, mainly due to the high burden of gastrointestinal diseases and cancer, as well as rising awareness of early, non-invasive detection. Through government initiatives like the Production-Linked Incentive scheme, India is lowering its reliance on imports and manufacturing mid-tier, cost-effective endoscopy systems. Its reputation for affordable, high-quality medical services attracts international patients, further driving the demand for advanced, imported endoscopes and software.

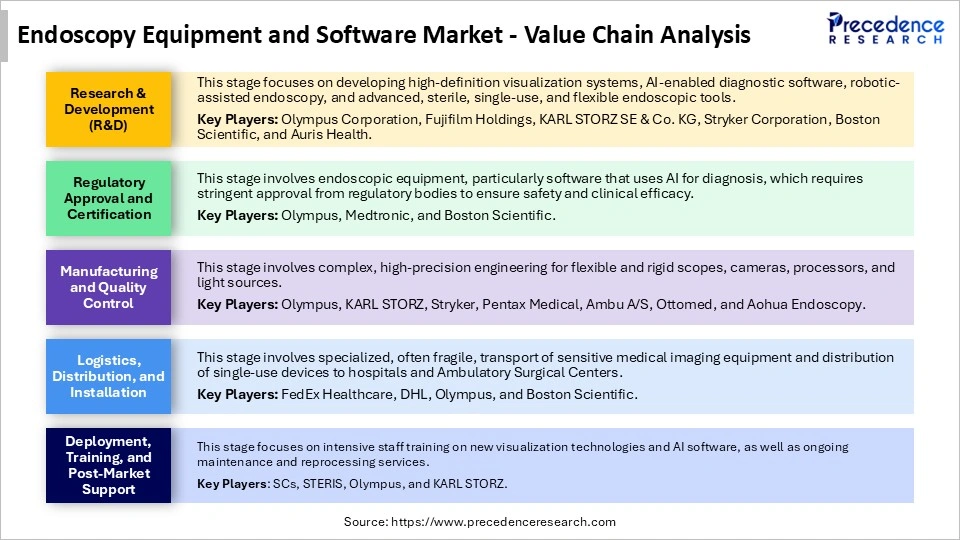

Endoscopy Equipment and Software Market Value Chain Analysis

Who are the Major Players in the Global Endoscopy Equipment and Software Market?

The major players in the endoscopy equipment and software market include Olympus Corporation, KARL STORZ SE & Co. KG, Fujifilm Holdings Corporation, Boston Scientific Corporation, Medtronic plc, Stryker Corporation, PENTAX Medical, Ambu A/S, Smith & Nephew plc, Cook Medical Inc., Richard Wolf GmbH, CONMED Corporation, Johnson & Johnson, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Intuitive Surgical, Inc.

Recent Developments

- In April 2025, FUJIFILM India launched the ELUXEO 8000 Therapeutic Endoscopy Solution at the 22nd MUMBAI LIVE Endoscopy event. Previously available only in Japan and Europe, this technology focuses on enhanced image quality and workflow efficiency. The system boasts advanced features like ACI, TNR, and E-DRIP for precise therapeutic procedures. Mr. Koji Wada, Managing Director of FUJIFILM India, emphasized their commitment to innovative healthcare solutions.(Source: https://www.fujifilm.com)

- In May 2025, Olympus showcased its OLYSENSE™ Platform with the CADDIE™ computer-aided detection device. This platform utilizes cloud-based AI technology to assist gastroenterologists in detecting polyps during colonoscopies. Olympus will also present its complete portfolio of ADR solutions, including the ENDOCUFF Vision™ device and Texture and Color Enhancement Imaging (TXI™) technology to providing optimal solutions for gastroenterologists.(Source: https://www.prnewswire.com)

- In April 2024, Medtronic launched ColonPRO™, an AI-powered software upgrade for the GI Genius™ intelligent endoscopy system, which enhances colorectal polyp detection with a larger dataset and improved algorithms. The update also integrates with electronic health records through a partnership with Modernizing Medicine (ModMed). Raj Thomas, president of the Endoscopy business at Medtronic, highlighted their focus on innovation and efficiency in endoscopic care.(Source: https://news.medtronic.com)

Segments Covered in the Report

By Product Type

- Flexible Endoscopy Systems

- Gastrointestinal (GI) endoscopes

- Bronchoscopes

- Ureteroscopes

- Hysteroscopes

- Rigid Endoscopy Systems

- Arthroscopes

- Laparoscopes

- Cystoscopes

- ENT endoscopes

- Video Processors & Light Sources

- High-resolution processors

- LED/Xenon light sources

- Accessories & Instrumentation

- Biopsy forceps, snares

- Sleeves, insufflation tubing

- Cleaning & sterile components

By Software Type

- Image Enhancement & Visualization Software

- Procedure Documentation & Reporting Software

- AI-Assisted Detection & Decision Support Software

- Workflow & Integration Software

- Other Endoscopy Software

By End-User

- Hospitals & Surgical Centers

- Ambulatory Surgery Centers (ASCs)

- Diagnostic / Endoscopy Specialty Clinics

- Academic & Research Institutions

- Other Healthcare Facilities

By Procedure Type

- Diagnostic Endoscopy

- Therapeutic Endoscopy

- Interventional / Advanced Therapeutic Procedures

By Technology

- High-Definition (HD) Imaging Systems

- 4K Ultra HD & Advanced Imaging

- 3D & Enhanced Depth Visualization Systems

- Single-Use Endoscopes

- Other Emerging Technologies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting