What is the Enterprise Asset Leasing Market Size?

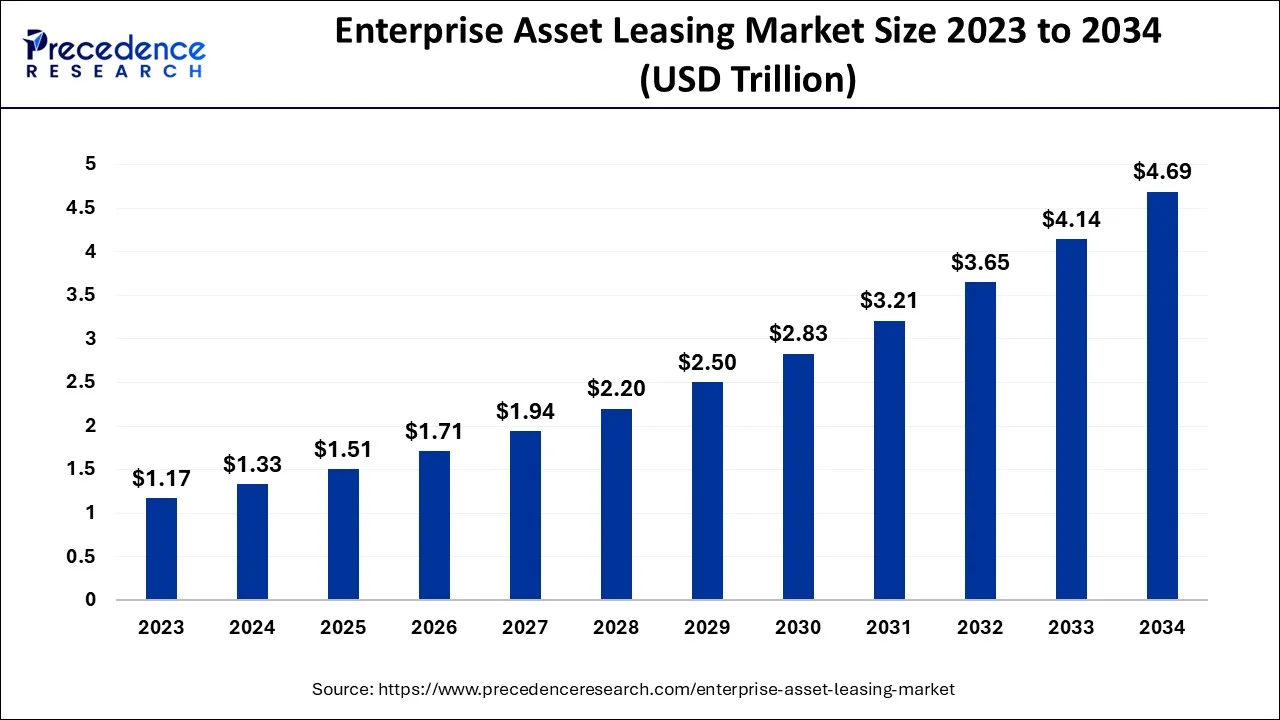

The global enterprise asset leasing market size is estimated at USD 1.51 trillion in 2025 and is predicted to increase from USD 1.71 billion in 2026 to approximately USD 5.20 trillion by 2035, expanding at a CAGR of 13.16% between 2026 to 2035.

Enterprise Asset Leasing Market Key Takeaways:

- North America captured the highest revenue share in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR between 2026 to 2035.

- By Asset Type, the commercial vehicles segment recorded the largest revenue share in 2025.

- By Industry Vertical, the transportation and logistics segment contributed the maximum revenue shares in 2025.

What is Enterprise Asset Leasing?

An enterprise asset lease is a contract, or a clause within a contract, that transfers the right to use an asset (the underlying asset) for a specific amount of time in return for payment. For many years, leasing in all its forms has shown to be a reliable method for financing capital equipment at all stages of the business cycle. Many businesses lease assets including land, buildings, vehicles, ships, and manufacturing and construction machinery.

An organization can access assets through leasing while having less exposure to the hazards associated with asset ownership. Finance leases and operating leases are the two types of leases. Whether or not the risk and profit associated with the asset are shifted to the lessor determines how the two differ from one another. The growing demand for commercial vehicles along with the rising demand for flexible asset management solutions is anticipated to augment the growth of the enterprise asset leasing market during the forecast period.

How is AI contributing to the Enterprise Asset Leasing Industry?

Artificial Intelligence indeed has a significant impact on enterprise asset leasing. It does so by performing automated contract management, speeding up credit evaluations, giving a better value to the asset, and making it possible to do predictive maintenance. AI-powered analytics bolster the risk management, compliance, and pricing aspects of the business, while the use of chatbots also leads to customer service improvements.

In general, AI promotes portfolio effectiveness, lowers operational expenses, lessens time losses, and assists in making quick, data-based leasing decisions over complicated enterprise asset portfolios.

Enterprise Asset Leasing Market Growth Factors

Enterprise asset leasing is the need for businesses to save capital. Leasing assets allows companies to avoid the significant upfront costs associated with purchasing equipment and properties, which can be especially beneficial for startups and small businesses with limited resources. Leasing also allows businesses to spread out the cost of acquiring assets over time, making it easier to manage cash flow and budgeting.

Furthermore, the trend of outsourcing non-core activities is likely to increase the demand for enterprise asset leasing within the estimated timeframe. By leasing assets, companies can avoid the burden of managing and maintaining their own equipment and properties, allowing them to focus on their core operations. This trend has been especially prevalent in industries such as transportation, construction, and manufacturing, where leasing assets can help companies stay competitive and agile in a rapidly changing business landscape.

Additionally, technological advancements are also likely to contribute to the growth of the enterprise asset leasing market. As leasing companies leverage technology to improve asset tracking and management, they are able to offer higher quality and more efficient leased assets to their customers. For example, cloud-based asset management solutions allow businesses to track and manage their leased assets in real-time, making it easier to monitor usage, maintenance, and repairs.

Market Outlook

- Industry Growth Overview:

The Enterprise Asset Leasing Market is experiencing significant growth, driven by companies seeking cost efficiency, financial flexibility, and optimized capital, allowing them to access needed equipment (machinery, vehicles, property) without huge upfront costs. - Global Expansion:

The Enterprise Asset Leasing Market expanded globally as it allows companies to quickly scale assets up or down and stay current with rapidly evolving technology. North America is dominant in the market due to its strong economy, mature financial systems, and advanced tech adoption. - Major investors:

Major investors are the large financial institutions like BNP Paribas, GE Capital, Wells Fargo, Sumitomo Mitsui, and Mitsubishi UFJ, specialized leasing companies such as Hitachi Capital, DLL, Element Fleet Management, Orix, and Air Lease Corp.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.51 Trillion |

| Market Size in 2026 | USD 1.71 Trillion |

| Market Size by 2035 | USD 5.20 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 13.16% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Asset Type, By Leasing Type, By Organization Size, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Enterprise Asset Leasing Market Dynamics

Driver

Increasing trend of outsourcing non-core activities

Outsourcing non-core activities is becoming increasingly popular as businesses look for ways to be more efficient and competitive. Through outsourcing activities such as IT infrastructure, logistics, and equipment maintenance, businesses can reduce their operating costs and free up resources to invest in their core operations. This trend is especially prevalent in industries such as transportation, and manufacturing, where companies need to maintain large inventories of equipment and properties to support their operations.

Furthermore, leasing companies are able to provide companies with the equipment and properties they need to support their non-core activities. Leasing companies offer a wide range of assets for lease, including IT equipment, vehicles, construction equipment, and real estate properties. By leasing these assets, businesses can avoid the initial costs associated with purchasing and maintaining their own equipment and properties, while still having access to the assets they need to support their operations. In addition to cost savings, leasing assets can also provide industries with greater flexibility and scalability. Leasing agreements can be customized to meet the specific needs of each business, allowing them to adjust their equipment and property needs as their operations evolve. This flexibility can be especially valuable for businesses in rapidly changing industries, where the ability to adapt quickly is critical to success. Consequently, this is likely to increase the demand for enterprise asset leasing within the estimated timeframe.

Restraints

Rising competition in the market

The high level of competition has led to pricing pressures, as leasing companies compete to offer the most competitive pricing and terms to clientele. This is expected to result in reduced profit margins for leasing companies, which can make it difficult for them to invest in new technologies and expand their services. This competition is driven by factors such as the large number of players in the market and the relatively low barriers to entry. Many companies have entered the market in recent years, including startups and established players. This has led to increased competition for customers, with leasing companies vying to offer the most attractive pricing and terms to win business.

The pricing pressures in the market are exacerbated by the fact that many customers are highly price-sensitive when it comes to leasing assets. As a result, leasing companies must offer competitive pricing in order to gain business, even if this means accepting lower profit margins.

However, in order to address these challenges, leasing companies must focus on differentiating themselves from their competitors. This can involve offering specialized services, such as industry-specific leasing solutions or value-added services like maintenance and repair. Additionally, leasing companies can invest in new technologies, such as IoT and AI, to improve the efficiency and effectiveness of their operations and differentiate themselves from their competitors.

Opportunities

Rising demand for cloud-based asset management solutions

With the help of cloud-based software, customers may track and manage their assets remotely. This kind of software can be used to monitor the lifecycle of any asset, including stock, machinery, cars, and real estate. Asset tracking, asset upkeep, and asset reporting are just a few of the services that cloud-based asset management solutions often offer. To enhance asset visibility and maximize asset utilization, firms of all sizes can employ these technologies. Thus, with the use of cloud-based solutions, leasing companies can manage their assets remotely, without the need for on-premise servers or other hardware. This reduces the need for expensive IT infrastructure and support staff, allowing leasing companies to allocate resources more efficiently.

Further, cloud-based asset management solutions offer greater flexibility and accessibility. Leasing companies can access their asset management systems from anywhere, at any time, using a variety of devices, including smartphones, tablets, and laptops. This allows leasing companies to work more efficiently and effectively, and to respond more quickly to customer needs. The adoption of cloud-based asset management solutions is also driving innovation in the enterprise asset leasing market.

With the use of cloud-based solutions, leasing companies can leverage advanced technologies such as IoT and AI, which can improve the efficiency and effectiveness of their operations. For example, IoT sensors can be used to monitor the condition and location of leased assets, allowing leasing companies to optimize their maintenance schedules and improve asset utilization. This in turn is expected to support the growth of the market in the years to come.

Segment Insights

Asset Type Insights

On the basis of asset type, the commercial vehicles segment held the largest revenue share in 2025. Fleet operators can receive vehicles through leasing without the primary expenses and credit restrictions of ownership. Additionally, leasing eliminates the requirement for a down payment and permits fleet operators to expense the cost of the vehicle on a monthly basis as opposed to recording it as a liability on their balance sheet. More tax savings and more credit flexibility allow fleet operators to reallocate their money. These benefits offered are likely to support the segment growth of the enterprise asset leasing market during the forecast period. Furthermore, the growing logistics industry along with increasing demand for rental vehicles with advanced features is also expected to contribute to the segmental growth of the market within the estimated timeframe.

Industry Vertical Insights

Based on industry verticals, the transportation and logistics segment held considerable shares in the global enterprise asset leasing market. The increasing number of organizations that rent or lease commuter cars and trucks is likely to support the segmental growth of the market. Furthermore, the growing necessity to strengthen distribution capabilities from interconnected stakeholders across the supply chain is also likely to support the segment growth of the enterprise asset leasing market during the forecast period. Additionally, increasing demand for data-driven tracking and intelligent temperature monitoring systems is also expected to contribute to the growth of the segment in the enterprise asset leasing market in the years to come.

Regional Insights

North America: Presence of advanced commercial equipment

North America held the largest revenue share in 2023. The US accounted for the largest share of the North America enterprise asset leasing market. This is attributable to the rapid shift towards novel and advanced commercial equipment to conduct business operations in this region. Further, the increasing adoption of advanced platforms incorporating solutions for the operative management of fleet operations, stock, permit, and compliance for the equipment across the region is also expected to support the growth of the market. Additionally, the availability of asset leasing services at economical interest rates is also likely to create immense growth opportunities for the market in the region.

U.S. Enterprise Asset Leasing Market Trends

In the U.S., well-developed economic systems and high credit ratings in the region offer the necessary capital to support large-scale leasing operations. U.S. law typically excludes leased assets from the bankruptcy estate, granting lessors important rights and making it a safer investment for financial institutions.

Canada Enterprise Asset Leasing Market Trends

Canada's market is growing as businesses increasingly prefer leasing over ownership to conserve capital, manage cash flow, and maintain operational flexibility. Digital transformation is a key trend, with online leasing platforms, data analytics, and asset-tracking technologies improving efficiency and transparency. Companies are also demanding more customized and flexible leasing contracts, including short-term and usage-based models, to adapt to changing business needs.

Asia Pacific: Extensive adoption of enterprise asset leasing services

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. In Asia Pacific region, China dominated the enterprise asset leasing market. This is owing to the extensive adoption of enterprise asset leasing services by various small and medium-sized enterprises in the region. Furthermore, rapid industrialization and urbanization in the developing economies such as China and India is also expected to support the regional growth of the market. Additionally, the growing adoption of advanced technologies is also likely to support the regional growth of the market growth during the forecast period.

China Enterprise Asset Leasing Market Trends

In China, rapid technological changes mean companies prefer leasing to avoid obsolescence and easily upgrade IT, healthcare, and manufacturing equipment. Leasing support companies optimize resource allocation, stay competitive, and manage economic burdens, huge infrastructure development, manufacturing expansion, and improved commercial activity.

India Enterprise Asset Leasing Market Trends

India's market is expanding as businesses increasingly adopt leasing to reduce capital expenditure, improve cash flow, and enhance operational flexibility. Digitalization is a major trend, with the use of IoT, cloud-based platforms, and automated lease management systems improving asset utilization and transparency. Demand for flexible, short-term, and usage-based leasing models is rising, particularly among startups and fast-growing enterprises.

Additionally, growing awareness of sustainability is driving interest in leasing energy-efficient and environmentally friendly assets across industries.

Europe: Increasing government initiative

Europe is experiencing significant growth in the market as stringent EU environmental guidelines and goals drive organizations to lease eco-friendly vehicles and equipment. Leading in digital leasing processes and using AI-driven solutions for asset management improves efficiency. Mature economies with high manufacturing output create a huge demand for asset financing.

The UK Enterprise Asset Leasing Market Trends

In the UK, mature economies with high industrial output create a huge demand for asset financing. Early involvement from UK merchant banks created tax-efficient structures, making leasing attractive for large corporations. It supports companies in keeping assets modern without significant capital outlay, according to United Telecoms UK.

What are the Advancements in the Enterprise Asset Leasing Market in Latin America?

Latin America is expected to witness substantial growth in the market, driven by factors like rapid industrialization, urbanization, and increasing investments in infrastructure. Countries like Brazil and Mexico are leading players due to a rising trend towards leasing as businesses seek to optimize capital expenditure and enhance operational flexibility. The region's regulatory support and favorable economic conditions further boost market growth.

Brazil Enterprise Asset Leasing Market Trends

The country is witnessing an increasing adoption of technology in leasing processes, such as digital platforms and data analytics, which is helping in transforming the market, making it more efficient and customer-centric. Technological advancements such as digital platforms and streamlined leasing processes are improving accessibility, transparency, and operational efficiency for lessees and lessors alike.

What are the Key Trends in the Enterprise Asset Leasing Market in the Middle East and Africa?

The Middle East and Africa are expected to witness steady growth in the upcoming years. This growth is driven by increasing investments in infrastructure and a shift towards leasing as a financial strategy among businesses. Countries like the UAE and South Africa are leading players in the region, due to supportive government initiatives that are aimed at diversifying economies and promoting private sector growth. The region's regulatory environment seems to be evolving, encouraging more companies to consider leasing as a more feasible option.

Saudi Arabia Enterprise Asset Leasing Market Trends

The region's market landscape is characterized by a growing awareness of the benefits of leasing, particularly in sectors like construction and transportation. As the region continues to develop, the potential for growth in the enterprise asset leasing market will grow even more. Government investment in infrastructure and mega projects is boosting leasing activity, while regulatory reforms and improved access to financing are making leasing more attractive to local and international firms.

Enterprise Asset Leasing Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

China |

Deep asset management expertise and strong global network |

Bohai Leasing Co., Ltd. specializes in leasing services. The group's activity is organized into various sectors such as financing, leasing, and sales of aircraft. |

|

|

Japan |

Strong solution proposal and implementation capabilities |

In October 2025, SMFL Mirai Partners is set to acquire 50 solar power plants by 2026, enhancing renewable energy capacity and corporate offerings. |

|

|

BNP Paribas Leasing Solutions |

France |

Deep industry expertise, strong alignment with sustainability goals |

In October 2025, BNP Paribas Leasing Solutions ranks among the Top 5 lenders by outstanding and also wins the award for Strongest growth in five years (€). |

|

General Electric Company |

United States |

Global presence and a diversified portfolio |

GE Aerospace is a pure-play aviation and defense company, focused on aircraft engines, components, and services. |

|

ICBC Financial Leasing Co. Ltd |

Beijing |

Strong parental support |

In June 2025, ICBC Financial Leasing priced a US$400 million 3-year floating-rate green bond offering via its new issuing entity, ICIL Aero Treasury Limited. |

Other Major Key Players

- ORIX Corporation

- White Oak Financial LLC

- Wells Fargo Bank N.A.

- Enterprise Asset Leasing

- Origa Leasing

- Air Lease Corporation

Recent Developments

- In July 2025, SA Tech Software India Ltd. launched SAT Leasing, a subsidiary offering flexible. SAT Leasing is an AI-driven IT infrastructure leasing solutions for enterprises, government departments, public sector units, and educational institutions.(Source: https://www.business-standard.com )

- In April 2025, Incuspaze launched FlexLeaze, providing 360-degree leasing solutions for large corporates. This new enterprise offering enters the fit-out lease services sector, led by Co-Founder and CEO Rahul Sarin, focusing on end-to-end leasing solutions, growth, innovation, and diversification across various asset classes, including offices and logistics.(Source: https://www.rprealtyplus.com )

- In March 2023,Ecotrak, the industry's top enterprise facilities management tool, and Leasecake, a cloud-based platform for lease and location management, have announced a new strategic alliance. Customers will be able to manage locations, growth, assets, and facilities more effectively across platforms due to the collaboration. During new location openings and turnover, the integration closes the communication gap between the real estate, construction, and facilities departments.

- In March 2021,Enrich Software Corp., a provider of enterprise fleet asset management solutions, and Volvo and Mack Leasing Systems recently announced a new agreement that calls for the use of Enrich software to oversee the corporate Volvo and Mack leased fleet in North America. A consolidated approach for the various billing needs of Volvo and Mack corporate leasing customers will be made possible by the strong contract management and billing module of Enrich Software.

Segments Covered in the Report:

By Asset Type

- Commercial Vehicles

- Real Estate

- Machinery and Industrial Equipment

- Others

By Leasing Type

- Operating Lease

- Financial Lease

By Organization Size

- SMEs

- Large Enterprises

By Industry Vertical

- Manufacturing

- Construction

- Government and Public Sector

- Transportation and Logistics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting