Estrogen Replacement Therapy Market Size and Forecast 2025 to 2034

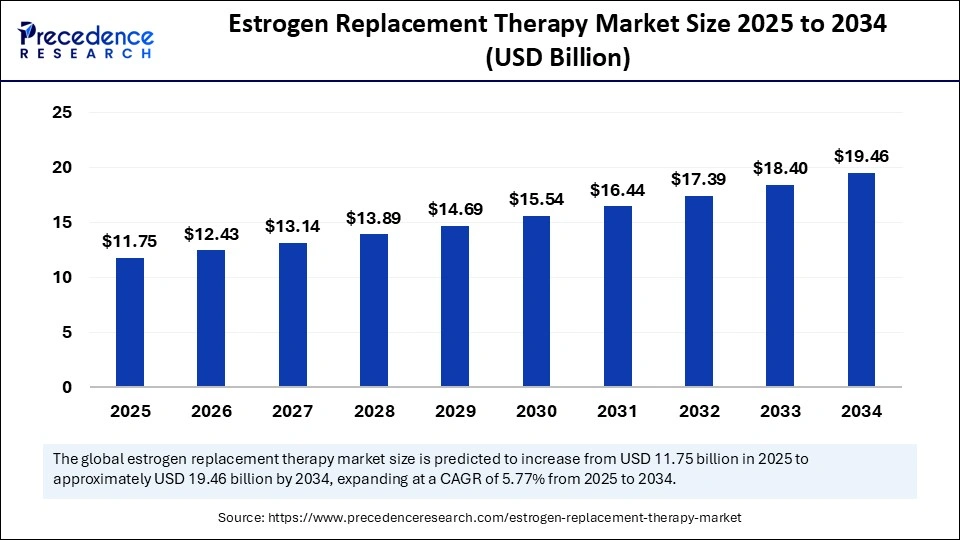

The global estrogen replacement therapy market size was calculated at USD 11.12 billion in 2024 and is predicted to increase from USD 11.75 billion in 2025 to approximately USD 19.46 billion by 2034, expanding at a CAGR of 5.77% from 2025 to 2034. The increasing aging female population, rising awareness of post-menopausal health management, and growing adoption of bioidentical and personalized hormone therapies are expected to drive the growth of the global market for estrogen replacement therapy over the forecast period. Several key players in the market are widely adopting effective strategies like new product launches and mergers to expand their market share and gain a competitive edge. Additionally, the market is increasing in emerging regions, particularly North America, fuelled by the robust presence of pharmaceutical companies and advanced healthcare infrastructure.

Estrogen Replacement Therapy Market Key Takeaways

- In terms of revenue, the global estrogen replacement therapy market was valued at USD 11.12 billion in 2024.

- It is projected to reach USD 19.46 billion by 2034.

- The market is expected to grow at a CAGR of 5.77% from 2025 to 2034.

- North America dominated estrogen replacement therapy market in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By therapy type, the combined estrogen-progestin therapy (EPT) segment captured the largest market share of 45% in 2024.

- By therapy type, the bioidentical hormone therapy segment is also experiencing the fastest growth during the forecast period

- By route of administration, the oral tablets/capsules segment contributed the biggest market share of 40% in 2024.

- By route of administration, the transdermal patches & vaginal products segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By indication, the menopause symptom management segment held the highest market share of 55% in 2024.

- By indication, the osteoporosis prevention & treatment segment is expanding at a significant CAGR from 2025 to 2034.

- By end user, the hospitals & gynecology clinics segment generated the major market share of 60% in 2024.

- By end user, the home care settings segment is experiencing rapid growth during the forecast period.

Market Overview

The estrogen replacement therapy market refers to pharmaceutical treatments designed to replace or supplement declining estrogen levels in women, primarily during menopause, perimenopause, or after hysterectomy/ovariectomy. These therapies help to manage symptoms such as hot flashes, night sweats, osteoporosis, vaginal dryness, and mood swings. ERT is available in multiple formulations, including oral tablets, transdermal patches, topical gels/creams, vaginal products, and injectable solutions.

How Can AI Impact the Growth Estrogen Replacement Therapy Market?

As advances in artificial intelligence continue to evolve, the integration of artificial intelligence emerges as an emerging force, holding great potential to revolutionize the growth of the estrogen replacement therapy market by enabling more precise, personalized, and efficient treatment options. AI can effectively analyze vast data and interpret multi-sample hormone testing data, leading to earlier diagnosis of hormonal disorders. AI algorithms help optimize estrogen replacement therapy dosages by analyzing a patient's individual symptoms, medical history, lifestyle data, and genetic factors, which can significantly enhance efficacy and reduce side effects. Artificial intelligence-based algorithms can also identify women at a higher risk for menopause-related complications such as cardiovascular disease, osteoporosis, and other diseases. Moreover, the integration of AI is being used to optimize clinical trial design and patient recruitment, which results in making clinical trials more cost-effective, accurate, and representative of diverse populations.

Major Trends in the Market for Estrogen Replacement Therapy

- The rising efforts of key players to launch innovative estrogen replacement therapy are estimated to accelerate the growth of the estrogen replacement therapy market during the forecast period.

- The rising cases of hormonal disorders around the world are anticipated to contribute to the overall growth of the market.

- The surge in healthcare spending and supportive government framework is anticipated to boost the expansion of the market for estrogen replacement therapy.

- The personalized and bioidentical therapies are anticipated to accelerate the market's revenue during the forecast period. These therapies are considered safe and can be tailored to individual needs.

- The rising expansion of reimbursement policies is anticipated to drive the market's growth in the coming years. The improved insurance coverage makes estrogen replacement therapy more accessible and affordable.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 19.46 Billion |

| Market Size in 2025 | USD 11.75 Billion |

| Market Size in 2024 | USD 11.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.77% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Route of Administration, Indication, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Awareness of Menopausal Symptoms Among Women

The rising awareness of menopausal symptoms is expected to boost the growth of the estrogen replacement therapy market during the forecast period. The high awareness of menopausal symptoms, such as hot flashes, night sweats, sleep disturbances, and vaginal discomfort, encourages women to seek innovative treatment. Estrogen replacement therapy assists in effectively managing and treating the symptoms associated with menopause. Moreover, the advancements in estrogen replacement therapy (ERT) formulation that are safer and more effective treatments are expected to significantly contribute to the growth of the market for estrogen replacement therapy.

- In September 2025, Care England, the largest representative body for independent adult social care providers, joined forces with Menopause Support, a not-for-profit organisation offering 1-1 menopause support for individuals, a community of over 36,000 women, and awareness training for organisations to launch a powerful new series of educational webinars.(Source: https://www.carehomeprofessional.com)

Restraint

High Cost of Undertaking the Treatment for Estrogen Replacement

The high cost associated with estrogen replacement therapy (ERT) is anticipated to hamper the market's growth. The increased cost of estrogen replacement therapy (ERT) often prevents individuals from receiving necessary treatment. In addition, the potential side effects associated with long-term estrogen use, such as increased risk of stroke, breast cancer, blood clots, and others, may lead to caution among healthcare providers and patients. Such factors may hinder the growth of the global estrogen replacement therapy market during the forecast period.

Opportunity

How Are Advances in Drug Delivery Systems Expected to Impact Market Expansion in the Coming Years?

The technological advancements in drug delivery systems are projected to offer lucrative growth opportunities to the estrogen replacement therapy market during the forecast period. The rapid innovations in drug delivery systems, such as transdermal patches, gels, and combination therapies, significantly enhance the effectiveness of estrogen replacement therapy with improved safety and reduced side effects, resulting in a higher adoption rate. These delivery methods offer improved patient compliance and a more stable release of hormones with potential reduced side effects. Moreover, the rising number of women entering and living through menopause is expected to fuel the demand for estrogen replacement therapy during the forecast period. Several research efforts are increasingly focusing on developing new and improved drug delivery systems, which can significantly enhance therapeutic effectiveness and patient adherence.

Therapy Type Insights

What Made the Combined Estrogen-Progestin Therapy (EPT) Segment Lead the Estrogen Replacement Therapy Market in 2024?

The combined estrogen-progestin therapy (EPT) segment dominated the market in 2024. The growth of the segment is mainly driven by the increasing demand for relief from menopause symptoms such as hot flashes, insomnia, irregular periods, vaginal dryness, and osteoporosis prevention. Combined therapy of estrogen and progestin is considered an effective treatment for women to treat menopause symptoms. Also, it includes the essential function of protecting the uterus from endometrial cancer in women. On the other hand, the bioidentical hormone therapy segment is witnessing the fastest growth, driven by rapid advancements in drug delivery systems, such as bioidentical hormone therapy (BHT). Bioidentical hormone therapy has a chemical structure that is identical to the body's natural hormones. These therapies are generally derived from plant sources and are widely available in various forms, including patches, pills, sprays, creams, and vaginal tablets.

Route of Administration Insights

What Has Led the Oral Tablets/Capsules Segment to Dominate the Estrogen Replacement Therapy Market in 2024?

The oral tablets/capsules segment held the largest market share of the global market for estrogen replacement therapy in 2024. Oral tablets/capsules are the most common form of ERT and are often a more affordable choice for many patients. The ease of use and administration of oral medications significantly contribute to the segment dominance. Oral tablets/capsules primarily involve taking estrogen pills to alleviate to manage menopausal symptoms and prevent bone loss in women. However, the oral form of estrogen therapy is associated with certain health risks as the estrogen passes through the liver.

On the other hand, the transdermal patches segment is also experiencing the fastest growth. Transdermal patches deliver estrogen directly through the skin to treat several menopausal symptoms like hot flashes, irregular periods, night sweats, sleep disturbances, mood changes, fatigue, vaginal dryness, and prevent osteoporosis. Estrogen replacement therapy with transdermal patches offers benefits like liver bypass, which potentially lowers the risk of various side effects compared to oral estrogen. Patches are convenient and applied once or twice weekly to a clean, dry skin area, offering a convenient dosing schedule compared to daily oral medications.

Indication Insights

How Did the Menopause Symptom Management Segment Dominate the Estrogen Replacement Therapy Market in 2024?

The menopause symptom management segment dominated the market in 2024. The growth of the segment is driven by the rising women aging population and rapid growth in public education and increasing acceptance of menopause as a medical condition among women, especially in developed and developing countries, requiring treatment for menopause symptoms such as hot flashes, vaginal dryness, fatigue, sleep disturbances or insomnia, and osteoporosis. Menopause symptom management significantly improves the quality of life by relieving uncomfortable symptoms. On the other hand, the osteoporosis prevention & treatment segment is expected to register the fastest growth, owing to estrogen's effectiveness in increasing bone mineral density (BMD) and preventing fractures in postmenopausal women. Estrogen replacement therapy plays a vital role in preventing and treating postmenopausal osteoporosis by maintaining bone density and strength. During the menopause period, the decrease in your level of oestrogen can cause the process of breaking down bone to speed up, which enhances the chance of osteoporosis. Thus, the adoption of ERT prevents osteoporosis in the years around menopause and strengthens bones.

- In October 2024, the National Women's Council (NWC) welcomed the announcement in Budget 2025 that Hormone Replacement Therapy (HRT) will be free for all women experiencing menopause, from January 2025. The new investment will fund the cost of HRT medicines, patches, and devices. NWC has also welcomed the expansion of the Free IVF scheme. (Source:https://www.nwci.ie)

End-user Insights

How Does the Hospitals & Gynecology Clinics Segment Dominate the Estrogen Replacement Therapy Market in 2024?

The hospitals & gynecology clinics segment held the largest segment of the estrogen replacement therapy market in 2024. The growth of the segment is driven by the rising diagnoses of hormonal imbalances, growing public awareness of menopausal health, and rapid advancements in drug delivery technologies. Hospitals and specialized gynecology clinics offer tailored treatment options, expert guidance for menopausal women, and integrated services including diagnostic and clinical care, using advanced equipment for estrogen replacement therapy (ERT). Hospitals & gynecology clinics provide advanced medical equipment services and state-of-the-art facilities for estrogen replacement therapy to ensure patient comfort and effective management of menopausal symptoms. On the other hand, the home care settings segment is expected to witness the fastest growth in the coming years. Homecare settings are a significant end-user widely leveraging these convenient administration methods for managing menopausal symptoms and improving patient adherence. Home care settings facilitate patient-friendly administration methods, allowing patients to effectively manage their treatment in the comfort of their homes. The development of patient-friendly drug delivery systems, which include transdermal patches and gels, plays a pivotal role in home care settings.

Regional Insights

How Did North America Lead the Estrogen Replacement Therapy Market in 2024?

North America held the dominant share of the estrogen replacement therapy market in 2024. The region benefits from a well-developed healthcare infrastructure, an increasing number of clinical trials, and supportive healthcare regulations. The region's rapid growth is attributed to the rising prevalence of hormonal disorders, a surge in the aging population, increased access to healthcare, widespread awareness campaigns about managing menopause symptoms, and improved accessibility through various distribution channels, including retail and online pharmacies. Several pharmaceutical companies are increasingly investing in the region to develop advanced and effective ERT products. Favorable government initiatives and widespread health insurance coverage for estrogen replacement therapy in the U.S. and Canada are driving the regional market dominance. The rapid expansion of telehealth platforms is making menopause treatments more accessible and convenient for patients in the region. Additionally, the rising advancements in patient-friendly drug delivery systems improve patient compliance, convenience, and therapeutic efficacy, propelling the growth of the market in the region during the forecast period.

The U.S. Estrogen Replacement Therapy Market Trends

The U.S. continues to be a major contributor to the global estrogen replacement therapy market, supported by its advanced healthcare infrastructure, rising prevalence of hormonal disorders, increasing presence of key market players, high per capita expenditure on estrogen replacement therapy, and ongoing innovation in drug delivery systems. The U.S. market also leads in developing and adopting advanced delivery systems, such as transdermal patches, topical gels, and vaginal estrogen drugs. These innovative delivery methods offer safety by offering more consistent hormone levels delivery and improving patient adherence. Transdermal methods are gaining immense popularity in the country over oral tablet/capsule options, owing to the better safety profiles. Such factors make the estrogen replacement therapy more accessible and effective for patients.

- In April 2025, Spark Hormone Therapy, a leader in bioidentical hormone replacement, launched its innovative Auto Injector device, aiming to transform the at-home treatment experience by eliminating injection-related anxiety and discomfort. Designed with user comfort and precision in mind, the Auto Injector addresses common challenges faced by patients self-administering hormone therapies. By ensuring a consistent injection angle and stability, the device minimizes pain and potential side effects, making self-injection more accessible and less intimidating.(Source: https://fox59.com)

What Made Asia Pacific the Fastest-Growing Region in the Estrogen Replacement Therapy Market in 2024?

Asia Pacific is expected to grow at the fastest rate in the estrogen replacement therapy market during the forecast period. The most rapid growth of the region is mainly fuelled by the increasing awareness of menopausal symptoms among women, significant research and development investment, an expanding aging population, and a surge in healthcare spending, favourable reimbursement policies, and growing adoption of advanced drug delivery systems. The robust presence of pharmaceutical companies and the modernization of healthcare infrastructure are improving access to better healthcare and driving the adoption of ERT in countries such as China, Japan, South Korea, and India. The increasing acceptance of innovative dosage forms such as transdermal patches, gels, and other patient-friendly methods to deliver estrogen enhances treatment efficacy and patient compliance. Such a combination of factors is anticipated to accelerate the market's revenue during the forecast period.

Estrogen Replacement Therapy Market Companies

- Pfizer Inc.

- Bayer AG

- Novartis AG

- Merck & Co., Inc.

- Abbott Laboratories

- Novo Nordisk A/S

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (Viatris Inc.)

- Endo International plc.

- TherapeuticsMD, Inc.

- Allergan plc. (AbbVie Inc.)

- Amgen Inc.

- Ipsen Biopharmaceuticals

- Orion Pharma

- Ferring Pharmaceuticals

- Aspen Pharmacare Holdings Limited

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Glenmark Pharmaceuticals Ltd.

Industry Leader Announcements

- In February 2025, the HRT Club launched to expand access to hormonal care. The HRT Club provides access to a network of over 700 healthcare providers who can prescribe hormone replacement therapies. Nearly 85% of women and 30% of men experience hormonal challenges in their lifetime. Recognizing this, the HRT Club is stepping up by providing consumers access to hormone replacement therapies, treatments that replace lost hormones and are commonly used for menopause. The HRT Club already has more than 3,000 members across 42 states. (Source: https://medcitynews.com)

Recent Developments

- In February 2025, Noom, the leading digital healthcare company committed to chronic disease prevention and empowering people to live better longer, announced it is expanding into Hormone Replacement Therapy (HRT) to provide critical support for women as they navigate menopausal hormone shifts. Noom has welcomed over 8 million women aged 40 to 60 into its program, many of whom have voiced how menopause-related symptoms create additional hurdles in their weight loss journey.(Source: https://www.globenewswire.com)

- In June 2025, SynergenX, a national leader revolutionizing hormone therapy, TRT, weight loss, and wellness services, announced the launch of the SynergenX App, available for free download on the Apple App Store and Google Play. This user-friendly digital platform is designed to give patients more control, convenience, and confidence in managing their care, anytime, anywhere.(Source: https://www.businesswire.com)

- In May 2024, the US National Institutes of Health held a round table on future directions in menopause research, and through a White House Initiative that year, the administration of then-president Joe Biden awarded US$113 million to women's health research.(Source: https://www.nature.com)

- In May 2024, researchers from Harvard University and UCLA conducted randomized clinical trials and found that showed definitively that menopausal hormone therapy are effective in treating vasomotor symptoms among women in early menopause. (Source: https://jamanetwork.com)

Segments Covered in the Report

By Therapy Type

- Estrogen-Only Therapy (EOT)

- Combined Estrogen-Progestin Therapy (EPT)

- Bioidentical Hormone Therapy

- Selective Estrogen Receptor Modulators (SERMs)

By Route of Administration

- Oral Tablets/Capsules

- Transdermal Patches

- Topical Creams & Gels

- Vaginal Products (Rings, Suppositories, Creams)

- Injectable Formulations

By Indication

- Menopause Symptom Management

- Osteoporosis Prevention & Treatment

- Hypoestrogenism (Surgical or Primary Ovarian Insufficiency)

- Vaginal & Urogenital Atrophy

- Others (Cardiovascular Health, Cognitive Health Research)

By End User

- Hospitals & Gynecology Clinics

- Ambulatory Care Centers

- Homecare Settings

- Research & Academic Institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting