Europe End-of-Line Packaging Market Size and Growth 2025 to 2034

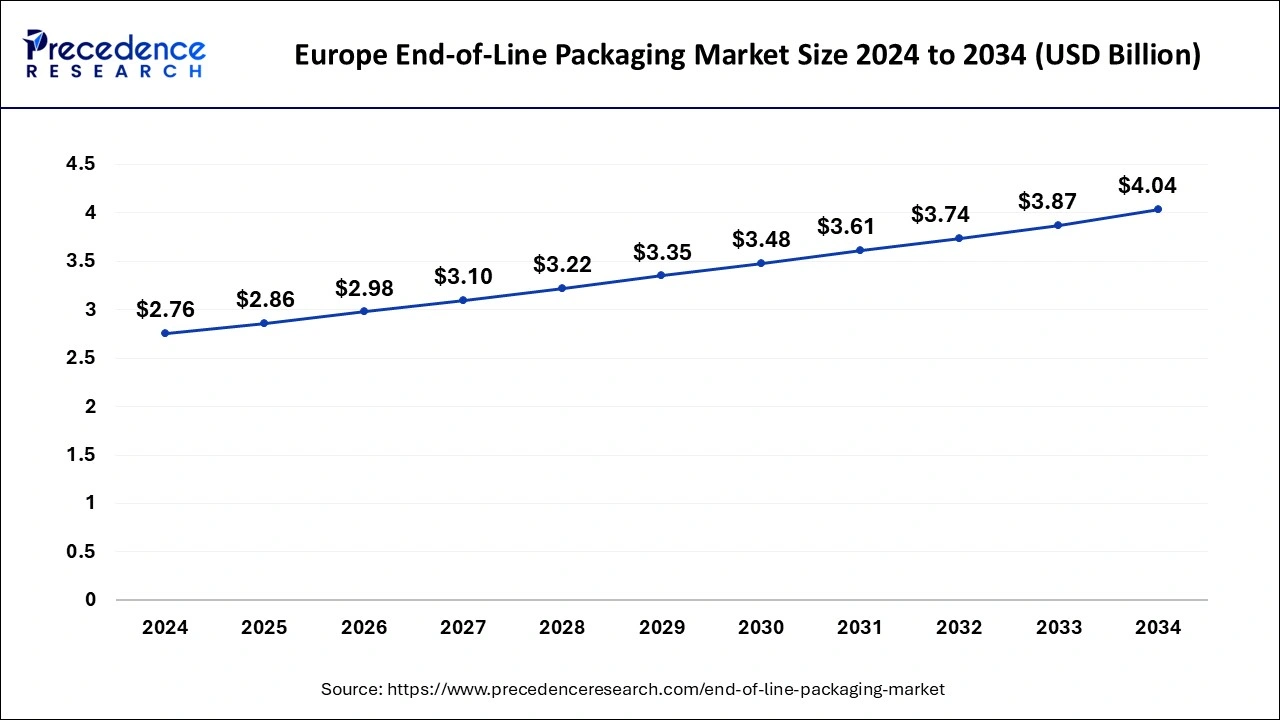

The Europe end-of-line packaging market size was estimated at USD 2.50 billion in 2024 and is predicted to increase from USD 2.61 billion in 2025 to approximately USD 3.84 billion by 2034, expanding at a CAGR of 4.40% from 2025 to 2034. The European end-of-line packaging market is driven by the growing need for automation.

Europe End-of-Line Packaging Market Key Takeaways

- In terms of revenue, the Europe end-of-line packaging market was valued at USD 2.50 billion in 2024.

- It is projected to reach USD 3.84 billion by 2034.

- The market is expected to grow at a CAGR of 4.40% from 2025 to 2034.

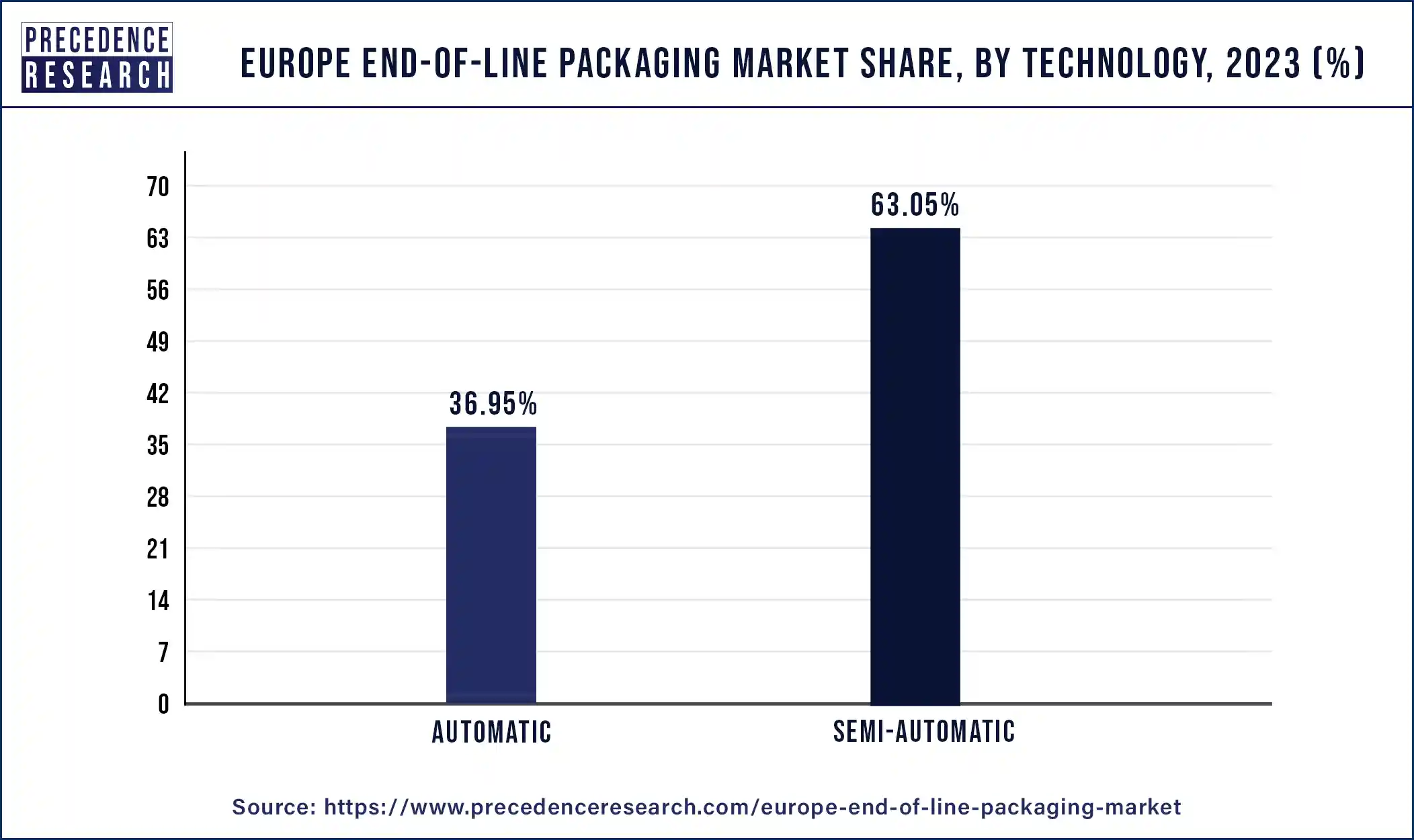

- By technology, the semi-automatic segment held the largest revenue share of 62.32% in 2024.

- By technology, the automatic segment is observed to grow significantly CAGR of 6.4% during the forecast period.

- By order type, the standard segment captured the biggest market share of 61.91% in 2024.

- By order type, the customized segment is observed to grow significantly CAGR of 6% during the forecast period.

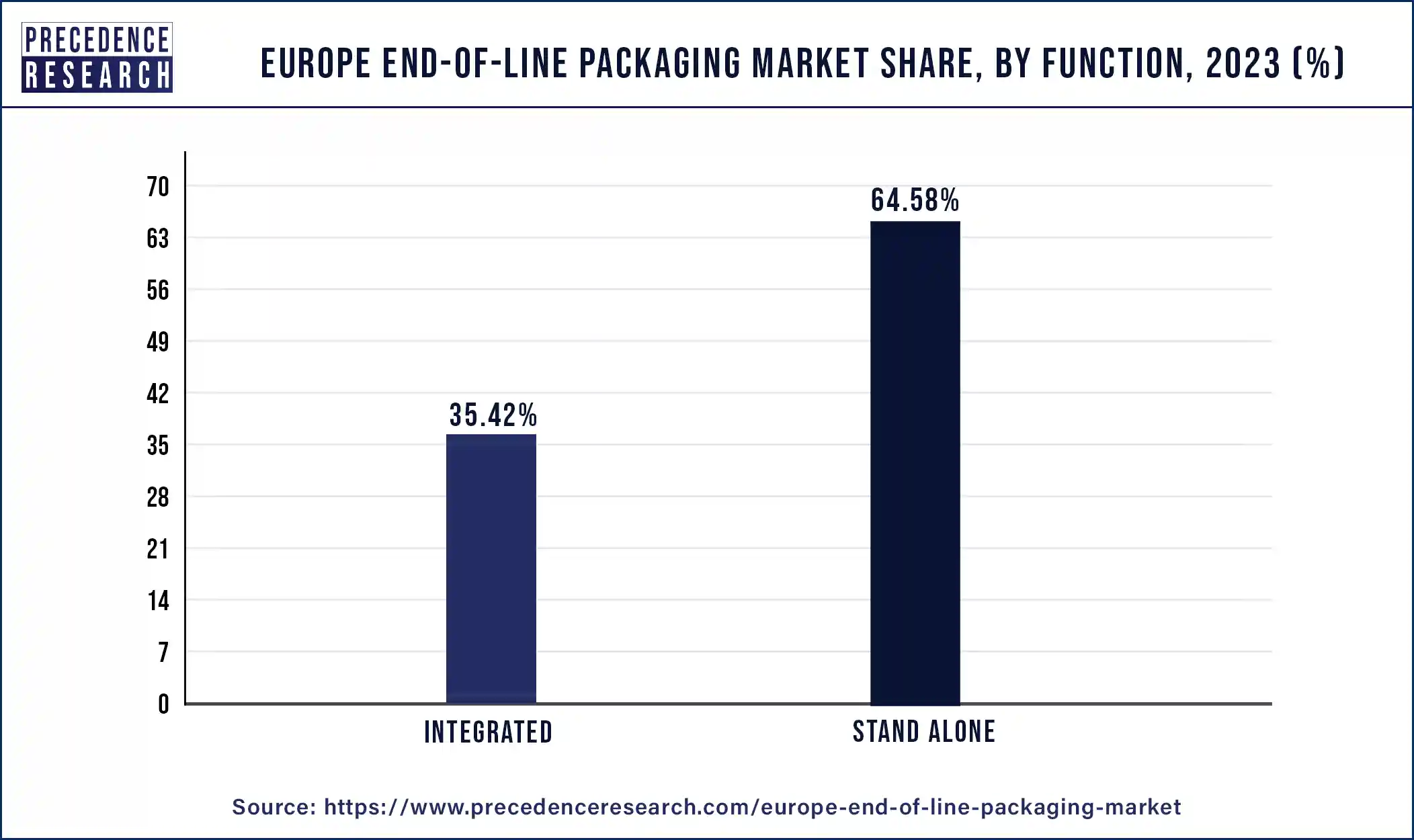

- By function, the stand-alone segment held the highest market share of 64.26% in 2024.

- By function, the Integrated segments are expected to grow at a notable CAGR of 5.3% during the forecast period.

- By end- use, the food industry segment generated the major market share of 38.56% in 2024.

- By end- use, the pharma industry segment is expected to grow at a notable CAGR of 5.7% during the forecast period.

What is the Role of AI in the Europe End of Line Packaging Market?

Artificial intelligence (AI) can improve supply chain management by tracking inventory levels in real time, predicting supply chain disruptions, and recommending the most efficient delivery routes. This leads to faster delivery times, cost savings, and a more sustainable approach to packaging production by minimizing wasted resources. AI can improve the design development process by enabling packaging designers to achieve better results with less efforts. Corresponding tools are not only able to process large amounts of data, but are also capable of recognizing correlations between the data and all this in a short time.

AI helps to improve packaging design to reduce material waste, extend shelf life, and ensure product freshness. Machine learning (ML) and predictive analytics improve inventory management and supply chain efficiency, reducing spoilage and overpackaging. Smart packaging features includes QR code and AI-based sensors can transform product unboxing into unique, immersive, and interactive experience.

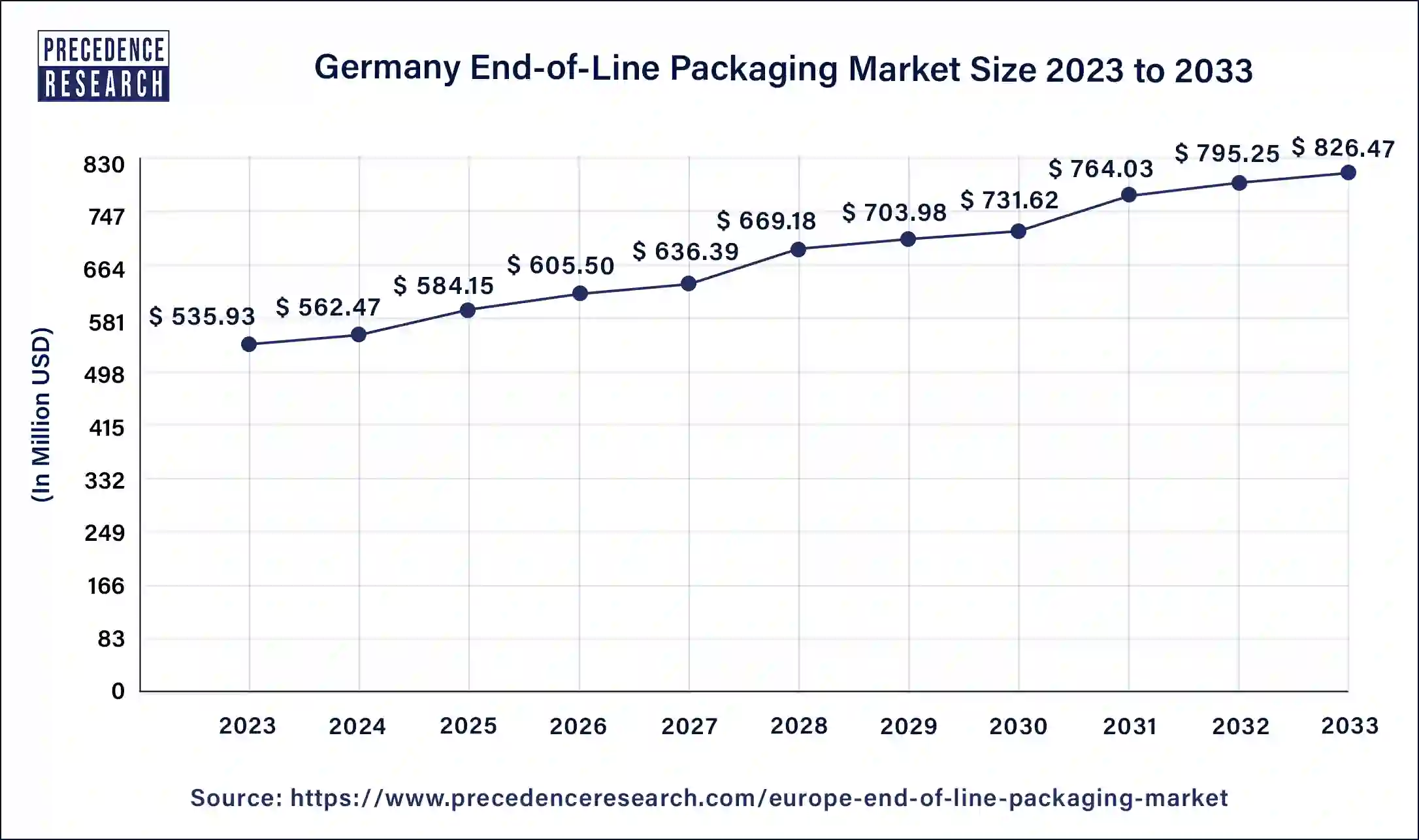

Germany End-of-Line Packaging Market Size and Growth 2025 to 2034

The Germany end-of-line packaging market size was estimated at USD 562.47 million in 2024 and is predicted to be worth around USD 830.59 million by 2034 with a CAGR of 4.0% from 2025 to 2034.

The increasing food and beverage industry is increasing demand for end-of-line packaging solutions in countries such as Spain and Italy. Packaging designs are influenced by traditional craftsmanship and handcrafted goods, with a growing emphasis on branding and aesthetics. Economic obstacles may impede rapid technical growth, yet the gradual use of automation increases productivity. Economical solutions are given precedence, which results in a predilection for semi-automatic packing supplies and machinery. A growing integration with supply chains in Western Europe influences packaging standards and quality criteria.

Market Overview

The area of the packaging business that deals with the last packing phase, when goods are ready for distribution and sale, is known as the European end-of-line packaging market. Case sealing, palletizing, labeling, and other procedures required to prepare goods for shipping are all part of end-of-line packing. It is noteworthy because it is essential to maintaining the product's effectiveness, security, and appeal in transit and on retail shelves.

Effective end-of-line packaging procedures can assist businesses in cutting expenses, minimizing product damage, improving brand perception through eye-catching presentation, and adhering to legal requirements.

Europe End-of-Line Packaging Market Growth Factors

- Effective packaging solutions for various products are needed, spurring end-of-line automation innovation.

- A growing emphasis on environmentally friendly materials such as biodegradables and recyclables encourages innovation in sustainable end-of-line solutions.

- Boost accuracy, cut labor costs, and increase production to drive demand for sophisticated packing equipment.

- Manufacturers spend money on technology to satisfy consumer needs for beautiful packaging, ease of use, and product safety.

- Constant improvements lower expenses, improve operational effectiveness and optimize packing procedures.

- Scalable end-of-line solutions are required to address the increasing market needs due to the increased requirement for packaged goods.

Market Trends

- Labor shortages and increasing wages

- Investing in innovative packaging systems

- Increased integration of innovative technologies

- Rising demand for sustainability and eco-friendly solutions

Market Scope

| Report Coverage | Details |

| Market Size By 2034 | USD 3.84 Billion |

| Market Size in 2025 | USD 2.61 Billion |

| Market Size in 2024 | USD 2.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.40% |

| Dominated Country | Germany |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Order Type, Function, and End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising demand for sustainable packaging solutions across various industries

Many businesses are adopting CSR efforts that prioritize protecting the environment and incorporating sustainability into their corporate ethos. End-of-line packaging solutions that support these ideals are becoming increasingly popular, helping businesses improve their reputation and win over ecologically sensitive customers. Many organizations understand the long-term cost advantages associated with reduced material usage, waste disposal costs, and possible incentives for adopting environmentally friendly practices, even though an initial investment may be necessary to switch to sustainable packaging solutions. Consequently, the market for end-of-line packaging in Europe is seeing growth in the affordability of sustainable packaging options. This is propelling the growth of the Europe end-of-line packaging market.

Restraint

Susceptible to supply chain disruptions

The packaging industry's end-of-line operations are dependent on complex supply chains that encompass raw materials, equipment, and distribution channels. These supply chains are so interconnected that any interruption at any point might have repercussions for the whole operation. Product quality assurance and the operation of complex packing machinery require skilled expertise. Nonetheless, the sector has trouble drawing in and keeping qualified personnel. Production can be hampered by any disruption brought on by work stoppages, shortages, or skill deficiencies.

Opportunity

Increasing demand for packaged goods across various industries

Europe's retail scene has changed due to the growth of e-commerce. The increasing number of online consumers has increased the demand for effective packaging solutions that guarantee product security throughout transportation while optimizing the unboxing experience. Packaging at the end of the line is essential to getting goods ready for shipping, which increases the need for packaging supplies and equipment. Automation, robots, and artificial intelligence are just a few of the fast-moving technical innovations that have completely changed the end-of-line packaging business.

These technologies allow packaging processes to operate more efficiently, with higher precision and faster production rates. Businesses investing in state-of-the-art technologies might get a competitive advantage by providing creative packaging solutions that satisfy their clients' changing needs. Thereby, expanding the Europe end-of-line packaging market.

Technology Insights

The semi-automatic segment dominated in 2024 with a 62.32% market share in the Europe end-of-line packaging market. Semi-automatic devices are generally easier to operate and maintain than fully automatic systems, which may require specialized training. They frequently have simple controls and intuitive interfaces, making it easy for users to pick up the basics and quickly operate the machinery. Because of its ease of operation, this packing method is streamlined and requires less highly skilled staff.

- In May 2025, new TA series of Sunfort dry film photoresist as material for backend processing of advanced semiconductor packaging used in AI servers was launched by Asahi Kasei. This product is positioned as a strategic offering within Asahi Kasei's Material sector, aiming to strengthen its footprint in the rapidly growing market for next generation chip packaging. ( Source: https://www.asahi-kasei.com/ )

Semi-automatic packaging equipment is renowned for its dependability and toughness, with sturdy construction and premium parts guaranteeing dependable operation over time. Because of its dependability, organizations may successfully satisfy client demand and maintain unbroken production schedules while minimizing downtime and maintenance expenses.

- In January 2025, the groundbreaking of a new HBM (high bandwidth memory) advanced packaging facility in Singapore was announced by U.S. based memory giant Micron Technology. ( Source: https://www.trendforce.com/ )

Europe End-of-Line Packaging Market Revenue, By Order Type 2022-2024 (USD Million)

| Order Type | 2022 | 2023 | 2024 |

| Customized | 819.63 | 878.88 | 943.31 |

| Standard | 1,442.30 | 1,486.23 | 1,559.98 |

Order Type Insights

The standard segment dominated in 2024 with a 62.49% market share in the Europe end-of- line packaging market. Many European suppliers offer standard end-of-line packaging materials and equipment. Because of its accessibility, businesses are guaranteed many options, promoting healthy competition and spurring market innovation. Furthermore, because standard solutions are widely accessible, companies can quickly obtain the tools and supplies they need, cutting down on lead times and guaranteeing the continuous operation of their packaging processes.

- In May 2025, custom-fit cardboard, paper packaging across Europe was launched by Amazon. Amazon announced that it deploy advanced machines for making custom-fit packaging across its European network, enabling the production of custom-made cardboard boxes and paper bags for customer deliveries. In addition to reducing waste and materials usage, Amazon highlighted sustainability benefits of the new packaging, including emissions reductions by maximizing vehicle space to allow more deliveries with fewer vehicles. ( Source: https://www.esgtoday.com/ )

The customized segment is significantly growing in the Europe end-of-line packaging market during the forecast period. The requirement for tailored packaging solutions to serve market groups is rising as consumer tastes become more complex and varied. With customized packaging, businesses can showcase their goods in a way that best suits their target market's specific needs and tastes. Advancements in technology, such as digital printing and packaging automation, have made producing bespoke packaging in lower numbers easier and more affordable for businesses. This helps companies offer customized packaging solutions without paying high overhead expenses and react swiftly to shifting consumer preferences and market trends.

Function Insights

The stand-alone segment dominated in 2024 with a 64.26% market share in the Europe end-of-line packaging market. More customization and adaptation to various packaging needs is possible with stand-alone end-of-line packaging machinery. This flexibility is highly valued in the European market, where customer tastes are varied and ever evolving. With their sophisticated control systems and precise engineering, stand-alone packaging machines guarantee reliable performance and premium packing. This is especially crucial for the pharmaceutical and food manufacturing sectors that have high quality criteria.

- In December 2024, the Third-generation collaborative palletizer was launched by FlexLink. It is designed to improve efficiency and safety in the end-of life operations, the RC12 provides a streamlined, flexible palletizing solution for demanding production environments requiring no robotics programing skills to operate. ( Source: https://www.packagingstrategies.com/ )

The integrated segment is significantly growing in the Europe end-of-line packaging market during the forecast period. Sustainability is now a crucial factor for businesses everywhere, even in Europe. Eco-friendly materials and procedures are frequently incorporated into integrated end-of-line packaging solutions, supporting sustainable supply chain practices. These integrated solutions, which minimize packaging waste and maximize resource use, align with the sustainability objectives of European companies, which encourage market acceptance and growth.

- In February 2025, to create paper-based stand-up pouches for dishwasher tabs replacing the previous plastic packaging Mondi was collaborated with Proquimia. (Source: https://www.labelsandlabeling.com/)

End-User Insights

The food industry segment dominated in 2024 with a 38.64% market share in the Europe end-of-line packaging market. There's a growing emphasis on sustainable packaging options within the food business due to worries about plastic contamination and environmental awareness. European customers favor environmentally friendly packaging solutions that reduce waste and carbon emissions. In response to this change, end-of-line packaging technologies have developed, providing recyclable materials, biodegradable films, and lightweight packaging designs. Since the food industry's embrace of sustainable packaging practices aligns with broader societal and governmental trends toward environmental responsibility, it further secures its dominance in the end-of-line packaging sector.

- In November 2024, revolutionary ‘smart heat battery' for eco-friendly, on-demand heating in food and beverage packaging was launched by Varie T Technology. ( Source: https://www.alcircle.com/)

The pharma industry segment is the second largest in 2024, with 19.20% market share in the Europe end-of-line packaging market during the forecast period. Prescription pharmaceuticals, over-the-counter medications, biologics, vaccines, and medical devices are just a few of the goods that fall under the umbrella of the pharmaceutical sector. Specific packaging needs for each category of pharmaceutical products may arise from factors such as dose form, shelf-life, stability, and regulatory considerations. Due to the variety of products offered, different end-of-line packaging options customized to fulfill requirements are required. Pharmaceutical companies frequently look for scalable packaging options for various product types and container arrangements. The pharmaceutical sector of the European end-of-line packaging industry is expanding due to the need for flexible and adaptive packaging machinery.

- In January 2025, an innovative temperature-controlled packaging solution for the pharmaceutical industry was launched by DS Smith. ( Source: https://www.themanufacturer.com/ )

Europe End-of-Line Packaging Market Revenue, By End User 2022-2024 (USD Million)

| End User | 2022 | 2023 | 2024 |

| Pharma Industry | 429.35 | 456.77 | 486.40 |

| Food Industry | 876.03 | 919.10 | 965.21 |

| Bio Factory | 168.18 | 178.68 | 190.02 |

| E-Commerce | 262.69 | 279.18 | 296.99 |

| Electronics & Semiconductors | 201.40 | 206.25 | 211.42 |

| Others | 324.29 | 338.44 | 353.25 |

Europe End-of-Line Packaging Market Companies

- B&R

- Coesia Group

- DS Smith

- Endoline Machinery Ltd

- Festo Inc

- Flex Link

- Fromm Group

- OPTIMA Packaging Group GmbH

- Quin Systems Ltd, RADPAK

- Robert Bosch GmbH

- Shemesh Automation LTD

Recent Developments

- In May 2025, a fully automated production line to package nutritional supplements vials containing recycled PET, claiming to bolster both product quality and production capacity was launched by Greiner Packaging and Orthomol. Greiner highlights their low oxygen permeability and high transparency, citing the availability of rPET in Europe and Beyond. (Source: https://packagingeurope.com)

- Greiner Packaging and Orthomol launch automated rPET vial production line | Packaging Europe

In September 2024, a major advancement in Arkema's Net Zero trajectory with its new Kizen LIME range of packaging adhesives was announced by Bostik, the Arkema Group's adhesive solutions segment. The launch marks an important step in Bostik's commitment to reducing carbon footprints and improving the sustainability of packaging solutions. (Source: https://www.indianchemicalnews.com )

Segments Covered in the Report

By Technology

- Automatic

- Semi-automatic

By Order Type

- Customized

- Standard

By Function

- Stand Alone

- Integrated

By End-user

- Pharma Industry

- Food Industry

- Bio Factory

- E-Commerce

- Electronics and Semiconductors

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting