Europe Logistics Automation Market Size and Growth 2025 to 2034

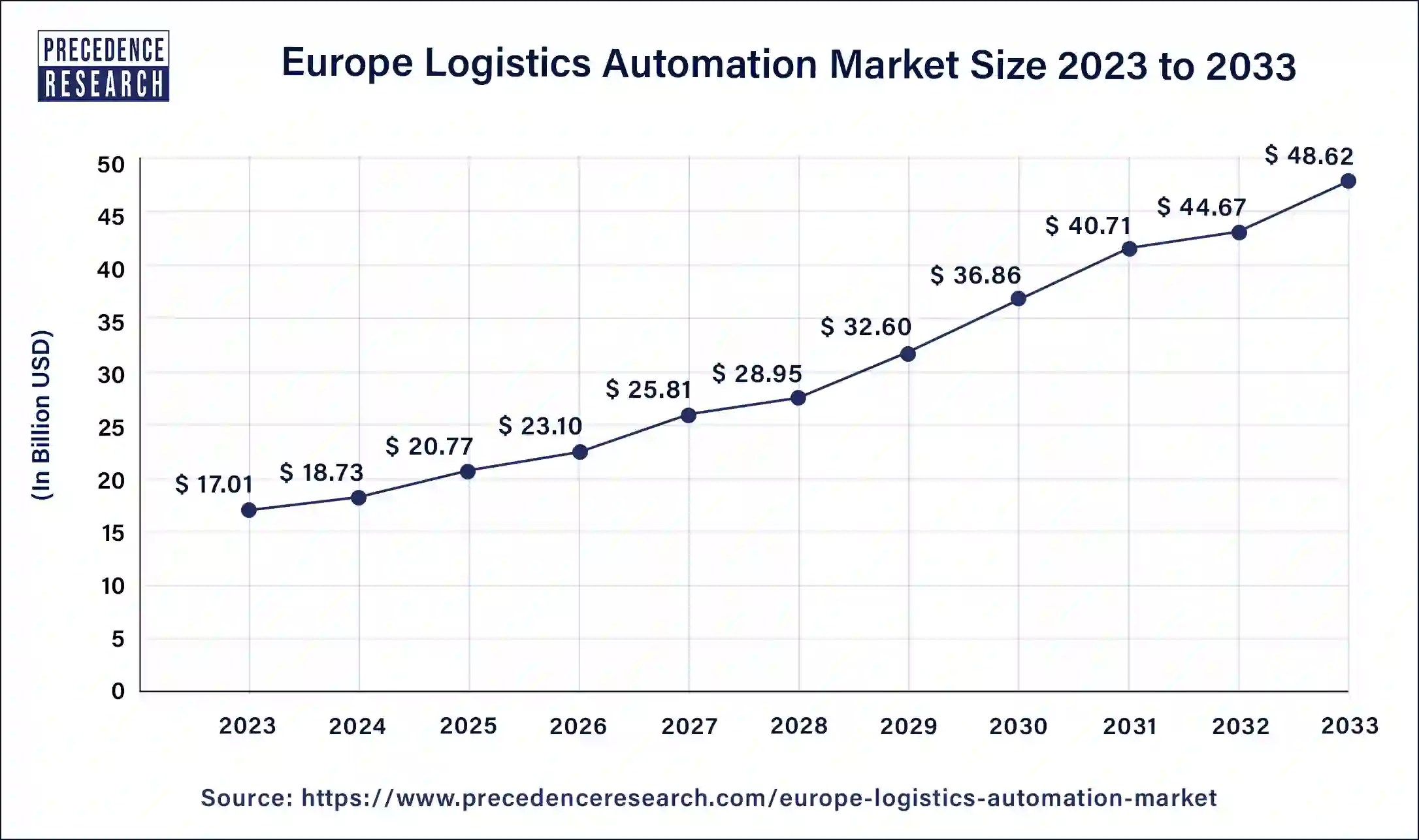

The Europe logistics automation market size was valued at USD 18.73 billion in 2024 and is anticipated to reach around USD 52.58 billion by 2034, growing at a CAGR of 10.9% from 2025 to 2034. The Europe logistics automation market is driven by the fast growth in both the retail and e-commerce industries.

Europe Logistics Automation Market Key Takeaways

- By type, the production logistics segment dominated the market with the largest revenue share of 50.26% in 2024.

- By type, the sales logistics segment was the second largest with 27.53% revenue share in 2024.

- By component, the hardware has held the biggest revenue share of 56.02% in 2024.

- By component, the software segment is observed to be the fastest growing in the revenue during the forecast period.

- By organization size, the large enterprises segment has contributed the major revenue share of 65.68% in 2024.

- By mode of freight transport, the road segment led the market with the highest revenue share of 55.20% in 2024.

- By mode of freight transport, the sea segment is observed to be the fastest growing in the revenue during the forecast period.

- By application, the transportation management segment has held the major revenue share of 69.96% in 2024.

- By end-user, the automotive segment led the market with the major revenue share of 30.87% in 2024.

- By end-user, the retail and e-commerce segment is observed to grow at a significant rate in revenue during the forecast period.

Market Overview

The part of the logistics industry that focuses on using automated methods and technologies to streamline and optimize various operations involved in the transfer of goods is the logistics automation revenue. These procedures cover order fulfillment, inventory control, shipping, and warehousing. Automation makes processes faster and more accurate by reducing the need for manual labor. As a result, logistics operations operate more efficiently and with higher throughput.

Better order processing, on-time delivery, accurate tracking, and real-time shipment visibility improve the overall customer experience. Certain automation technologies, such as energy-efficient warehousing systems and route optimization algorithms, can lessen their total environmental impact and carbon emissions.

Geographical landscape

One of the biggest revenueplaces in Europe is Germany. In addition, this nation has one of the world's most alluring logistics revenues. However, not only the location in central Europe is the primary cause. Germany is known for its highly advanced infrastructure, cutting-edge technology, and superior quality and size of warehouses compared to most other European nations. Because of this, logistics play a crucial role in the German economy.

- In October 2023, In Germany's Beverungen, Hegla is constructing a new logistics facility. To increase the space available for production, the center will merge separate warehouses. The facility will have movable pallet and high-bay storage racks, warehouse lift equipment, and contemporary warehouse management software to streamline procedures and workflows. The new technology will help software automatically determine the best storage locations, making thousands of pallets more accessible. The operations will be managed and observed through automated labeling and scanning.

Europe Logistics Automation Market Growth Factors

- Reduced cost due to decreased need for manpower

- High use of robotics in warehouse management

- Rising use of IoT platform in logistics and supply chain management

- Increasing adoption of big data in automated logistics technologies

- Rising adoption by the e-commerce platforms

Market Scope

| Report Coverage | Details |

| Market Size in 2034 | USD 52.58 Billion |

| Market Size in 2025 | USD 10.9 Billion |

| Market Size in 2024 | USD 18.73 Billion |

| Market Growth Rate | CAGR of 11.18% from 2025 to 2034 |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, Organization Size, Mode of Freight Transport, Application, and End-user |

Market Dynamics

Driver

Shortage of labor force

Europe has a comparatively high labor cost compared to other locations. This makes hiring and retaining employees financially difficult for logistics companies. Because automation reduces the need for human labor and lowers operating costs over time, it presents a financially viable option. Significant cost reductions can result from investments in automation technology like automated guided vehicles (AGVs), drones, and warehouse management systems. Human error can result in expensive blunders in the logistics process, including delayed deliveries, misplaced goods, and inaccurate shipments.

Automation reduces these errors by employing precise algorithms and machines that carry out extremely accurate and reliable activities. Technologies like barcode scanners, RFID systems, and machine learning algorithms make accurate inventory tracking and management possible, improving dependability and customer satisfaction. Thereby, driving the Europe logistics automation revenue.

Restraint

High initial costs

Implementing automation technologies in logistics operations costs a lot of money up front. This covers the price of investing in automation machinery such as robotic arms, conveyor systems, sorting systems, automated guided vehicles (AGVs), and warehouse management software. The first capital investment can be intimidating for logistics organizations, which are comparatively smaller or medium-sized businesses with constrained financial resources. Automation can simplify processes and eliminate the need for human labor in some situations, but maintaining and operating automated systems frequently calls for specialized workers.

Businesses might need to hire expert technicians and engineers with experience in automation technology or invest in training programs to upskill their employees. Furthermore, a workforce reorganization brought on by the shift to automation may necessitate severance payments or reassignment expenses for fired workers.

Opportunities

Growth of e-commerce

The increasing demand for same-day and next-day delivery is making it difficult for conventional logistics systems to keep up. Automated solutions give merchants the speed and accuracy they need to satisfy these demands, allowing them to process orders more quickly and effectively. In today's very competitive industry, the customer experience is crucial. Faster order processing, precise tracking, and on-time delivery are made possible by automated logistics solutions, increasing customer happiness and encouraging loyalty.

Improving customer experience

Customers nowadays expect deliveries of items that are quicker and more effective. Logistics organizations may improve efficiency, shorten processing times, and provide faster delivery by using automation technologies like robotic process automation (RPA), automated guided vehicles (AGVs), and autonomous drones. When packages arrive at their destinations on time and meet or exceed expectations, this increases customer satisfaction. Scalability and flexibility are provided via automation systems to satisfy changing client needs.

Automated systems can swiftly modify processes and capacity levels in response to revenue trends or peak season demand fluctuations. Because of their agility, logistics companies can maintain excellent customer experiences by upholding high service standards even in the face of growing demand. This eventually expands the Europe logistics automation revenue.

Type Insights

The production logistics segment underwent notable growth in the Europe logistics automation market during 2024.

- In April 2025, the opening of a new ?227 crore state of the art manufacturing facility in Hyderabad, Telangana was announced by Daifuku Intralogistics India, a subsidiary of Japan-based Daifuku, a global leader in intralogistics and material handling automation. This facility is designed to meet the growing demand for automation across industries, including automotive, retail, e-commerce, pharmaceutical and FMCG.

Daifuku Intralogistics India opens manufacturing facility in Hyderabad

The sales logistics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- In February 2025, the availability of the Conexiom Ideal Order Platform, designed to help manufacturers and distributors achieve the ideal balance of customer satisfaction and profitability for every sales order was announced by Conexiom, the leader in Sales Order Automation.

Conexiom Launches AI-Powered Ideal Order Platform to Revolutionize Sales Order Automation

Component Insights

The hardware segment enjoyed a prominent position in the market during 2024.

- In August 2025, to develop a new mobile solution designed to measure the size, volume, and weight of boxes and pallets with speed and precision, Honeywell was announced a collaboration with Stereolabs.

The software segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- In August 2025, SelectShip, an AI-powered shipping engine designed to automate parcel decisions, reduce unforeseen delivery costs, and meet rising customer expectations without operational overhead, was launched by DCL Logistics.

DCL Logistics Launches AI-Powered Shipping Engine | Supply & Demand Chain Executive

Organization Size Insights

The large enterprises segment captured a significant portion of the Europe Logistics Automation market in 2024.

- In September 2024, new adidas distribution center in Mantova, Northern Italy was officically opened by Kuehne+Nagel. The logistics hub combines growth opportunities, next-level digitalization and sustainability.

Kuehne+Nagel inaugurates largest-ever logistics hub

The small and medium enterprises segment is set to experience fastest rate of the market growth from 2025 to 2034.

- In November 2023, the mission of making automation accessible for small and medium-sized enterprises (SMEs) across the UK was launched by Autrix, a new robotic automation company. Formed from leaders in the robotics space and talent from automation companies, Autrix aims to allow SMEs to compete globally through increased efficiency, productivity, and innovation.

Robotics Automation Company Launches - Logistics Business Ma

Mode of Freight Transport Insights

The road segment maintained a leading position in the Europe logistics automation market in 2024.

- In June 2025, to form PlusAI, with AI-led virtual drivers for the autonomous trucking Plus Automation collaborated with Churchill IX.

The sea segment is anticipated to grow with the highest CAGR in the market during the studied years.

Europe Logistics Automation Market Revenue (US$ Bn), By Mode of Freight Transport 2022 to 2024

| By Mode of Freight Transport | 2022 | 2023 | 2024 |

| Air | 1.5 | 1.64 | 1.80 |

| Road | 8.53 | 9.36 | 10.34 |

| Sea | 5.51 | 6.01 | 6.59 |

Application Insights

The transportation management segment dominated the market.

- In August 2025, a first fully automated cross border logistics warehouse in Dongguan was launched by AliExpress, a subsidiary of BABA-W. The facility uses conveyor belt matrix technology to replace manual handling, potentially shortening domestic transportation time by upto 6 hours.

The warehouse and storage management segment is projected to expand rapidly in the market in the coming years.

The adoption of TMS in the European revenue is largely motivated by its cost-effectiveness, as transportation costs account for a substantial amount of overall logistics costs. Real-time data and historical patterns are utilized to identify the most efficient routes, thereby reducing fuel consumption and transit times.

Europe Logistics Automation Market Revenue (US$ Bn), By End User 2022 to 2024

| By End User | 2022 | 2023 | 2024 |

| Manufacturing | 2.12 | 2.32 | 2.54 |

| Healthcare and Pharmaceuticals | 1.33 | 1.45 | 1.60 |

| Fast Moving Consumer Goods | 1.14 | 1.26 | 1.38 |

| Retail and E-Commerce | 2.68 | 2.95 | 3.27 |

| Automotive | 4.7 | 5.2 | 6.47 |

| Others | 3.56 | 3.84 | 4.53 |

End-user Insights

The automotive segment registered its dominance over the Europe logistics automation market in 2024.

- In July 2025, Turnkey Logistics Solution to drive automotive growth in South Africa was launched by DP World. The new hybrid model, combining contract logistics with tailored expansion services, was piloted with Chinese Commercial Vehicle manufacturer Foton Motor and is now positioned as a blueprint for automotive original equipment manufacturers (OEMs) seeking to enter one of the world's fastest growing vehicles market.

DP World Launches Turnkey Logistics Solution to Drive Automotive Growth in South Africa

The retail and e-commerce segment is predicted to witness significant growth in the market over the forecast period.

- In March 2023, operations at one of the largest automated e-commerce facilities servicing its retail customers in Spain, Portugal, and France was opened DB Schenker.

Recent Developments

- In April 2025, the launch of a new automated warehouse called the O-Mega Robot was announced by Dutch fasion platform Otrium. According to the company, this AutoStore system has upto 400 percent better space utilization than traditional warehouses.

Otrium launches automated warehouse - In February 2025, the three new products at LogiMAT India 2025 in Mumbai, was launched by Addverb, a global robotics and automation firm. These include Trakr 2.0, an advanced quadruped robot; HOCA, a high-speed order consolidation and automation system; and Brisk, a user-friendly interface for enhanced picking processes.

Addverb unveils next-gen robotics solutions at LogiMAT India 2025, ETManufacturing

Europe Logistics Automation Market Companies

- E&K Automation

- Jungheinrich

- Knapp

- SSI Schaefer

- Swisslog

- System Logistics

- TGW Logistics Group

- SAP

Segments Covered in the Report

By Type

- Sales Logistics

- Production Logistics

- Recovery Logistics

By Component

- Hardware

- Software

- Services

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Mode of Freight Transport

- Air

- Road

- Sea

By Application

- Transportation Management

- Warehouse and Storage Management

By End-user

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast Moving Consumer Goods

- Retail and E-commerce

- Automotive

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting