What is Inbound Logistics Market Size?

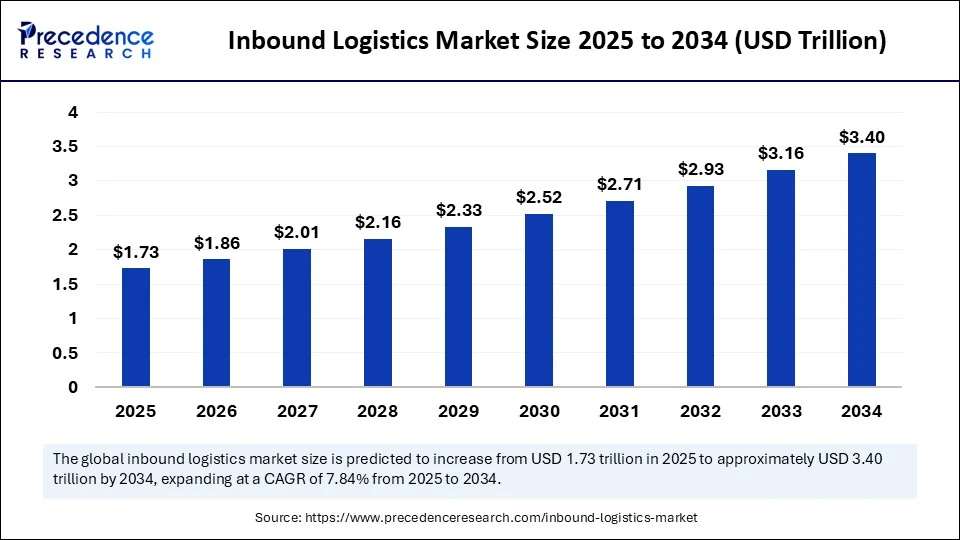

The global inbound logistics market size accounted for USD 1.73 trillion in 2025 and is predicted to increase from USD 1.86 trillion in 2026 to approximately USD 3.4 trillion by 2034, expanding at a CAGR of 7.84% from 2025 to 2034. The market is shaped by technological innovations, evolving trade regulations, and the growing focus on sustainability in transportation and warehousing.

Market Highlights

- North America dominated the inbound logistics market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the upcoming years.

- By service type, the transportation segment held the maximum revenue share of around 38% in 2024.

- By service type, the procurement & supplier sourcing services segment is expected to witness the fastest growth over the forecast period.

- By mode of transportation, road/trucking segments captured the biggest market share of 45% in 2024.

- By mode of transportation, the intermodal and rail corridors segment is expected to witness the fastest growth over the forecast period.

- By industry vertical/end-use, the retail & e-commerce segment led the market in 2024.

- By industry vertical/end-use, the electronics & high-tech manufacturing segment is anticipated to grow with the highest CAGR during the studied years.

- By service provider/delivery model, the third-party logistics segment held the biggest revenue share in 2024.

- By service provider/delivery model, the fourth-party logistics segment is expected to witness the fastest growth over the forecast period.

- By warehousing type, the ambient storage segment held the largest revenue share in in 2024.

- By warehousing type, the temperature-controlled segment is expected to witness the fastest growth over the forecast period.

- By ownership/contract type, the long-term contract logistics agreements segment led the market in 2024.

- By ownership/contract type, the dedicated contract logistics segment is expected to witness the fastest growth over the forecast period.

- By geographic coverage type, the domestic inbound segment contributed the highest market share in 2024.

- By geographic coverage type, the cross-border/regional inbound segment is expected to witness the fastest growth over the forecast period.

Inbound Logistics Market: A Rising Star Towards Success

Inbound logistics covers the activities, systems, and service providers that manage the flow of raw materials, components, and purchased goods from suppliers into a firm's manufacturing plants, warehouses, or distribution hubs. It includes procurement & sourcing, transportation from suppliers/ports, receiving/inspection, warehousing and storage, inventory control, supplier coordination, quality checks, returns from suppliers, and the enabling IT/visibility systems and 3PL/contract logistics services that operate these flows. Inbound logistics is distinct from outbound logistics and is increasingly strategic as manufacturers and retailers optimize lead times, working capital, and supplier networks.

The inbound logistics market is experiencing steady growth, driven by the expansion of global supply chains and the need for efficient material management. Industries such as automotive, electronics, pharmaceuticals, and FMCG are heavily dependent on streamlined inbound processes to maintain production continuity. Increasing demand for multimodal transport, including road, rail, sea, and air, is shaping the market structure. The rise of e-commerce has further accelerated the importance of timely inbound logistics to support faster product cycles. Additionally, companies are investing in digital tracking systems and warehouse automation to minimize delays and disruptions. Overall, the market is evolving into a technology-driven, efficiency-focused ecosystem.

How Is AI Transforming the Inbound Logistics Market?

Artificial Intelligence (AI) is redefining the inbound logistics market by enabling smarter, data-driven decision-making across the supply chain. AI-powered predictive analytics helps businesses forecast demand and optimize raw material procurement. Machine learning algorithms streamline route planning, reducing transit delays and transportation costs. Real-time monitoring, powered by AI-enabled IoT devices, enhances visibility into supplier shipments and warehouse inventory. Automated systems are minimizing human errors, ensuring accurate demand-supply alignment. Moreover, AI-driven risk assessment tools are proving invaluable in mitigating disruptions caused by geopolitical issues or natural disasters. As adoption accelerates, AI is becoming the cornerstone of efficiency and resilience in inbound logistics.

Market Key Trends

- Growing adoption of digital platforms for supplier coordination and tracking

- Increasing use of multimodal and intermodal logistics solutions

- Rising emphasis on sustainable practices, including green transportation.

- Expansion of e-commerce is reshaping supply chain strategies.

- Advanced warehouse automation with robotic and IoT

- Integration of blockchain for supply chain transparency and security.

Market Outlook

- Industry Growth Overview: The inbound logistics market is growing, driven by the rising trend of e-commerce, globalization, and technological development such as automation and digitalization. This technology concentrates on sustainability and digitalization to enhance efficiency and meet emerging demands.

- Global Expansion: The inbound logistics market is experiencing global expansion, as businesses escalating internationally are growing the complexity of their supply chains, which drives the requirement for more advanced inbound logistics services. North America is dominated by strong manufacturing and a well-developed healthcare infrastructure.

- Major investors: Major investors in the inbound logistics industry include large worldwide logistics corporations such as DHL and Maersk, as well as specialized venture capital (VC) firms like Foundamental, Eclipse Ventures, and Ironspring Ventures.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.73 Trillion |

| Market Size in 2026 | USD 1.86 Trillion |

| Market Size by 2034 | USD 3.4 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Mode of Transportation, Industry Vertical / End-Use, Service Provider / Delivery Model, Warehousing Type, Ownership / Contract Type, Geographic Coverage, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What Drives Growth in the Inbound Logistics Market?

The inbound logistics market is largely driven by the demand for cost-effective and efficient transportation of raw materials and supplies. Globalized trade has expanded supplier networks, requiring advanced logistics systems to manage cross-border operations. Industries are pushing for greater supply chain resilience, creating demand for real-time tracking and risk management tools. Just-in-time manufacturing strategies continue to pressure companies to streamline inbound flows without increasing inventory costs. Additionally, sustainability goals are driving investments in eco-friendly transport solutions and optimized routes. The constant need for faster, leaner, and smarter supply chains keeps the market for inbound logistics in strong growth momentum.

Opportunity

Where Do Opportunities Lie in the Inbound Logistics Market?

The growing integration of digital technologies offers significant opportunities for inbound logistics players. Companies investing in AI, IoT, and blockchain can gain a competitive edge in visibility, security, and efficiency. The expansion of e-commerce in emerging markets opens new avenues for inbound logistics providers to support faster fulfillment cycles. Demand for multimodal logistics services is rising, offering companies opportunities to optimize costs and reduce carbon emissions. Additionally, partnerships between logistics providers and technology firms are creating innovative solutions for smarter supply chains. With globalization increasing sourcing complexity, inbound logistics is positioned as a critical growth enabler for industries worldwide.

Restraint

What Holds the Market for Inbound Logistics Back?

Despite its growth, the inbound logistics market is held back by volatile fuel prices and rising transportation costs pose significant hurdles for cost optimization. Global trade tensions and regulatory uncertainties disrupt cross-border logistics planning. Infrastructure limitations in emerging markets slow down the adoption of advanced inbound systems. Additionally, supply chain disruptions caused by pandemics, natural disasters, or geopolitical conflicts remain high-risk factors. Companies also face the challenge of integrating digital technologies into legacy systems. These restraints highlight the need for flexibility, resilience, and investment in future-ready inbound logistics solutions.

Segment Insights

Service Type Insights

Why Transportation is Dominating the Inbound Logistics Market?

The transportation has become a dominant force in the inbound logistics industry, driven by businesses across industries that rely on road, sea, rail, and air freight networks to ensure timely delivery from suppliers. Transportation providers are investing heavily in fleet optimization, route planning, and fuel-efficient solutions to reduce costs and delays. With globalization, the complexity of supply routes has increased, making transport reliability even more critical. The growing demand for just-in-time delivery in the automotive, electronics, and FMCG sectors further strengthens the dominance of transportation services. In essence, transportation serves as the backbone of inbound logistics, driving operational continuity.

The procurement & supplier sourcing services segment has become the fastest-growing segment in the inbound logistics market, increasingly focused on strategic partnerships with vendors. This segment goes beyond moving goods; it ensures businesses secure the right raw materials at the right price and from reliable suppliers. The rise of global supply chain disruptions has amplified the importance of robust supplier management strategies. Advanced procurement platforms powered by AI and blockchain are gaining traction, offering transparency, cost efficiency, and risk mitigation. Companies are outsourcing procurement functions to specialized service providers, enabling them to streamline inbound flows while focusing on core activities. As supply chains become more vulnerable to risks, procurement services are evolving into a critical growth driver for inbound logistics.

Mode of Transportation Insights

Why Road/Trucking Is Dominating the Inbound Logistics Market?

Road/trucking made up the largest share of the inbound logistics market, due to its unmatched flexibility and extensive reach. Trucks allow direct door-to-door delivery, minimizing handling and ensuring faster supplier-to-factory connections. The segment is highly adaptable, serving industries ranging from automotive to FMCG with diverse cargo needs. Continuous investments in fleet technology, telematics, and route optimization keep trucking cost-efficient and reliable. In regions like North America, road transport serves as the primary link between ports, warehouses, and production units. Despite the rise of multimodal solutions, trucking remains indispensable for short and medium-haul inbound flows.

The Intermodal (road-rail) and rail corridors (nearshoring & sustainability-driven) segment has become the fastest-growing segment in the inbound logistics space, driven by their cost and environmental advantages. Rail corridors allow bulk shipments over long distances at lower costs compared to trucking. The growing emphasis on sustainability is pushing companies toward greener transport modes like rail. Intermodal solutions combining rail with road or sea are proving effective for cross-border inbound flows. Infrastructure development in Asia and Europe is further boosting rail's role in supply chain networks. As businesses seek efficiency and eco-friendly alternatives, rail and intermodal logistics are becoming the growth engines of inbound logistics.

Industry Vertical / End-Use Insights

Why Is Retail & E-commerce Dominating the Inbound Logistics Market?

The retail & e-commerce segment dominated the inbound logistics market during 2024, fueled by the explosion of online shopping and omnichannel strategies. The rapid turnover of inventory and consumer demand for faster delivery make inbound logistics essential in this space. Businesses are increasingly investing in digital platforms for supplier coordination to support quick replenishment cycles. Cross-border sourcing of products further amplifies the need for agile inbound logistics solutions. Warehousing and fulfillment centers depend on efficient inbound flows to maintain stock accuracy and reduce lead times as consumer expectations for speed and availability rise; retail and e-commerce inbound logistics will continue to expand rapidly.

The electronics & high-tech manufacturing segment is set to become the fastest-growing in the inbound logistics industry because these industries require complex supply networks for components and raw materials. Precision, speed, and reliability are crucial to ensure production continuity for smartphones, semiconductors, and consumer electronics. The globalized nature of electronics supply chains makes inbound logistics highly strategic. Companies depend on multimodal transport, advanced tracking systems, and just-in-time delivery to avoid costly delays. Warehousing plays a critical role in holding high-value electronic components securely before assembly. As the demand for electronics continues to surge globally, inbound logistics tailored for this sector maintains dominance.

Service Provider / Delivery Model Insights

Why Third-Party Logistics Is Dominating the Inbound Logistics Market?

The third-party logistics led the inbound logistics market because they act as strategic partners for businesses, managing large-scale inbound operations efficiently. Companies benefit from the scalability, expertise, and cost savings provided by 3PLs in coordinating cross-border inbound flows. Major industries, from automotive to retail, rely on 3PLs for end-to-end inbound solutions. With established networks and advanced technologies, 3PL continues to hold the largest market share.

The fourth-party logistics segment is expected to become the fastest-growing segment in the market for inbound logistics and businesses seek higher levels of supply chain orchestration. Unlike 3PLs, 4PLs manage multiple logistics providers, offering strategic oversight and digital integration of inbound flows, leveraging advanced analytics and AI-driven tools. Companies facing complex global supply networks are increasingly outsourcing to 4PLs for efficiency and resilience. The rise of digital platforms that consolidate logistics data into a single control tower is fueling 4PL adoption. As supply chains grow more complex, the demand for 4PL solutions is set to accelerate sharply.

Warehousing Type Insights

Why Ambient Storage Logistics Is Dominating the Inbound Logistics Market?

The ambient storage logistics segment maintained a leading position in the market for inbound logistics in 2024, due to warehousing, supporting a wide range of non-perishable goods. It provides flexible space for raw materials, semi-finished products, and general supplies across industries. The relatively low cost of ambient facilities compared to specialized storage gives it an advantage. Most manufacturing sectors rely heavily on ambient storage for components before production. Logistics providers are upgrading these facilities with automation and digital tracking to improve efficiency. As a versatile and cost-effective solution, ambient storage continues to lead the warehousing segment.

The temperature-controlled segment is projected to experience the highest growth rate in the market between 2025 and 2034, driven by demand from pharmaceuticals, food, and specialty chemicals. These sectors require precise storage conditions to maintain product integrity. The COVID-19 pandemic further accelerated demand for temperature-controlled inbound logistics for vaccines and biologics. Advances in cold chain technologies are expanding the adoption of these facilities worldwide. Companies are also investing in hybrid solutions combining ambient and temperature-controlled storage to meet diverse needs. With the rise of sensitive goods, temperature-controlled storage is emerging as the most dynamic warehousing segment.

Ownership / Contract Type Insights

Why Are Long-Term Contract Logistics Agreements Dominating the Inbound Logistics Market?

The long-term contract logistics agreements maintained a leading position in the market, as businesses seek stability and reliability in supplier relationships. Such agreements provide predictable costs, guaranteed capacity, and long-term efficiency gains. Industries like automotive and high-tech manufacturing rely on these contracts for uninterrupted raw material flow. Logistics providers benefit from steady revenue streams, enabling investment in infrastructure and innovation. These contracts foster trust and stronger collaboration between suppliers and logistics providers. As a result, long-term agreements form the foundation of most inbound logistics operations.

The dedicated contract logistics segment has become the fastest-growing segment in the inbound logistics market, due to its unique supply chain needs. Unlike long-term agreements, dedicated contracts offer flexibility with specialized fleets, routes, and warehousing setups. They allow companies to scale quickly with changing production or demand patterns. Industries with fluctuating requirements, such as retail and e-commerce, are driving adoption. Providers offering dedicated solutions are investing in AI-enabled planning tools to enhance efficiency. As companies look for agility and tailored logistics services, dedicated contracts are emerging as a key growth driver.

Geographic Coverage Insights

Why Are Domestic Inbound Agreements Dominating the Inbound Logistics Market?

The domestic inbound enjoyed a prominent position in the market during 2024, ensuring faster and more cost-effective deliveries. It provides greater control, fewer risks from global disruptions, and simplified regulatory processes. Industries rely on domestic inbound flows to reduce lead times and maintain just-in-time manufacturing strategies. Strong road networks and warehouse facilities in developed regions further support domestic inbound dominance. Companies are increasingly aligning with domestic suppliers to improve sustainability and reduce carbon footprints. For reliability and efficiency, domestic inbound continues to hold the largest market share.

The cross-border/regional inbound segment has become the fastest-growing segment in the inbound logistics sector, fueled by globalization and expanding international trade. Manufacturers sourcing materials from multiple countries require efficient cross-border inbound flows. Trade agreements and infrastructure investments are accelerating this growth, particularly in the Asia-Pacific and Europe. The rise of regional supply hubs and intermodal transport corridors is enhancing cross-border efficiency. Digital platforms are playing a vital role by streamlining documentation and customs processes. As businesses diversify suppliers globally, cross-border inbound logistics is emerging as a key growth frontier.

Regional Insights

Why Does North America Lead the Inbound Logistics Market?

North America continues to dominate the inbound logistics market, due to its highly developed transportation infrastructure and strong industrial base. The region benefits from advanced road, rail, and port networks that support efficient material movement. The automotive, aerospace, and electronics industries drive demand for reliable inbound logistics solutions. Furthermore, strong investments in supply chain digitization enhance operational visibility and efficiency. The presence of major third-party logistics (3PL) providers ensures wide service coverage and innovation adoption. With sustainability goals gaining momentum, companies are also exploring greener inbound logistics strategies in the region.

U.S. Title: U.S. E-commerce Dominance Fuels Logistics Growth

The U.S., in particular, leads with its robust e-commerce sector, which demands efficient inbound flows to distribution centers. Canada's logistics sector is expanding through cross-border trade integration, while Mexico's manufacturing hub strengthens its role in regional inbound networks. AI-driven logistics platforms are seeing strong adoption across the region, offering predictive insights and real-time visibility. The North American Free Trade Agreement (USMCA) also plays a key role in streamlining cross-border material flow. These factors collectively cement North America's leadership in the inbound logistics landscape.

Why Is It Asia Pacific the Fastest-Growing Inbound Logistics Market?

Asia Pacific is the fastest-growing region in the inbound logistics market. Countries such as China, India, and Vietnam are emerging as global production centers, creating strong demand for inbound logistics solutions. The region's cost advantages in manufacturing attract global companies, intensifying the need for efficient supplier coordination. Rapid urbanization and consumer demand for quick product availability further accelerate inbound logistics development. Investments in infrastructure, including ports and transport corridors, are also driving growth. Additionally, increasing adoption of digital platforms is transforming how inbound logistics is managed in the region.

China Title: China Inbound Logistics Sector: Growth & Trends

China dominates the regional market with its vast supplier ecosystem and advanced logistics capabilities. India is witnessing the rapid adoption of digital supply chain tools to support its growing manufacturing and e-commerce sectors. Southeast Asia is emerging as a critical inbound logistics hub, supported by trade agreements and regional connectivity projects. The rise of electric vehicles and electronics manufacturing is also fueling demand for high-efficiency inbound systems. Companies in the region are increasingly exploring green logistics solutions to align with sustainability goals. These trends make Asia Pacific the most dynamic and fastest-evolving inbound logistics sector globally.

Europe: Presence of a robust transportation network

Europe is significantly growing in the market as it has a massive, consistent economy, a strong industrial base, and developed infrastructure, specifically in rail, road, and water transport. This region is a hub for major industries, particularly automotive, which creates a huge demand for inbound logistics to manage raw materials and components. Europe owns a widespread and well-developed network of waterways, which are significant for moving goods effectively.

UK: Strong manufacturing sector

In the UK, logistics organizations are at the forefront of adopting novel technologies, including AI, IoT, and blockchain, to modernize operations, improve transparency, and enhance supply chain efficiency. The UK has a large and active manufacturing sector, which is a major consumer of inbound logistics solutions.

South America: Infrastructure advancement and upgrades

South America is significantly growing in the market as this region is the main source of raw materials, including agricultural products like soybeans and coffee, minerals like copper and lithium, and oil. The logistics for moving these bulk merchandise, mainly by sea and inland waterways, are a significant component of the regional market. There is continuing public and private spending in R&D infrastructure, like Peru's Chancay megaport and Brazil's port expansions.

Brazil: Extensive infrastructure:

Brazil has one of the world's largest highway networks, which is a significantly mode of transportation for goods. This massive network helps a high volume of both domestic and international logistics processes, even though there are confines in other areas, such as rail.

Inbound Logistics Market– Value Chain Analysis

- Raw Materials

Inbound logistics within the raw material sourcing market refers to the management and coordination of acquiring materials and overseeing their movement from suppliers to a company's manufacturing or storage facilities.

Inbound Logistics Market Companies

- DHL Supply Chain & Global Forwarding

- Kuehne + Nagel

- DB Schenker

- DSV / Panalpina (DSV)

- UPS Supply Chain Solutions

- FedEx Logistics

- C.H. Robinson

- XPO Logistics / GXO Logistics

- Kuehne + Nagel (note: repeated in some rankings)

- Maersk Logistics (APM Terminals / Maersk Logistics & Services)

- CEVA Logistics

- Nippon Express

- J.B. Hunt Transport Services

- Expeditors International

- GEODIS

- DACHSER

- Ryder System, Inc.

- Kerry Logistics Network

- CJ Logistics

- DB Cargo / DB Schenker Rail

Recent Development

- In August 2025, KLN Pharma will leverage its GMP-compliant facilities, multi-temperature, temperature-controlled fleet, and proprietary inventory systems to maintain regulatory compliance and safeguard product integrity. The collaboration covers the entire range of logistics services, including inbound logistics services, including inbound logistics, inventory management, order fulfillment, marketing logistics, and regulatory support.(Source: https://aircargoweek.com)

Segments Covered in the Report

By Service Type

- Transportation (road, rail, air, sea, intermodal)

- Warehousing & distribution (storage, racking, bonded/temperature controlled)

- Procurement & supplier sourcing services (outsourced procurement support)

- Receiving, inspection & quality control services

- Inventory management & VMI (vendor-managed inventory)

- Returns-to-supplier / reverse inbound logistics

- Value-added services (kitting, light assembly, labelling)

- Customs brokerage & trade compliance (import handling)

- IT & visibility solutions (WMS, TMS, supplier portals, EDI, control tower)

By Mode of Transportation

- Road/trucking (FTL, LTL)

- Rail / intermodal

- Air freight (express / deferred)

- Sea freight (containerized / break-bulk)

- Couriers & express for inbound critical parts

- Intermodal (road+rail) and rail corridors (nearshoring & sustainability-driven)

By Industry Vertical / End-Use

- Automotive & auto components

- Electronics & high-tech manufacturing

- Retail & e-commerce (imported finished goods to DCs)

- Food & beverage (including cold-chain inbound)

- Pharmaceuticals & healthcare (regulated inbound supply)

- Industrial & heavy machinery

- Consumer packaged goods (CPG)

- Aerospace & defense

By Service Provider / Delivery Model

- In-house/captive logistics (company-owned)

- Third-party logistics (3PL) — contract logistics providers

- Fourth-party logistics (4PL / control-tower orchestration)

- Freight forwarders & NVOCCs (for international inbound)

- Managed services (procurement + inbound ops bundled)

By Warehousing Type

- Ambient storage (standard warehousing)

- Temperature-controlled (cold chain / chilled/frozen)

- Bonded / customs-bonded warehouses

- High-value / secure warehousing (pharma, electronics)

- Cross-dock / flow-through facilities

By Ownership / Contract Type

- Short-term spot / ad-hoc contracts

- long-term contract logistics agreements

- Dedicated contract logistics (onsite/DC-dedicated teams)

- Shared multi-customer facilities

By Geographic Coverage

- Domestic inbound (within-country supplier networks)

- Cross-border / regional inbound (nearshoring corridors)

- Global / oceaned inbound (intercontinental supply chains)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting