What is the EV Platform Market Size?

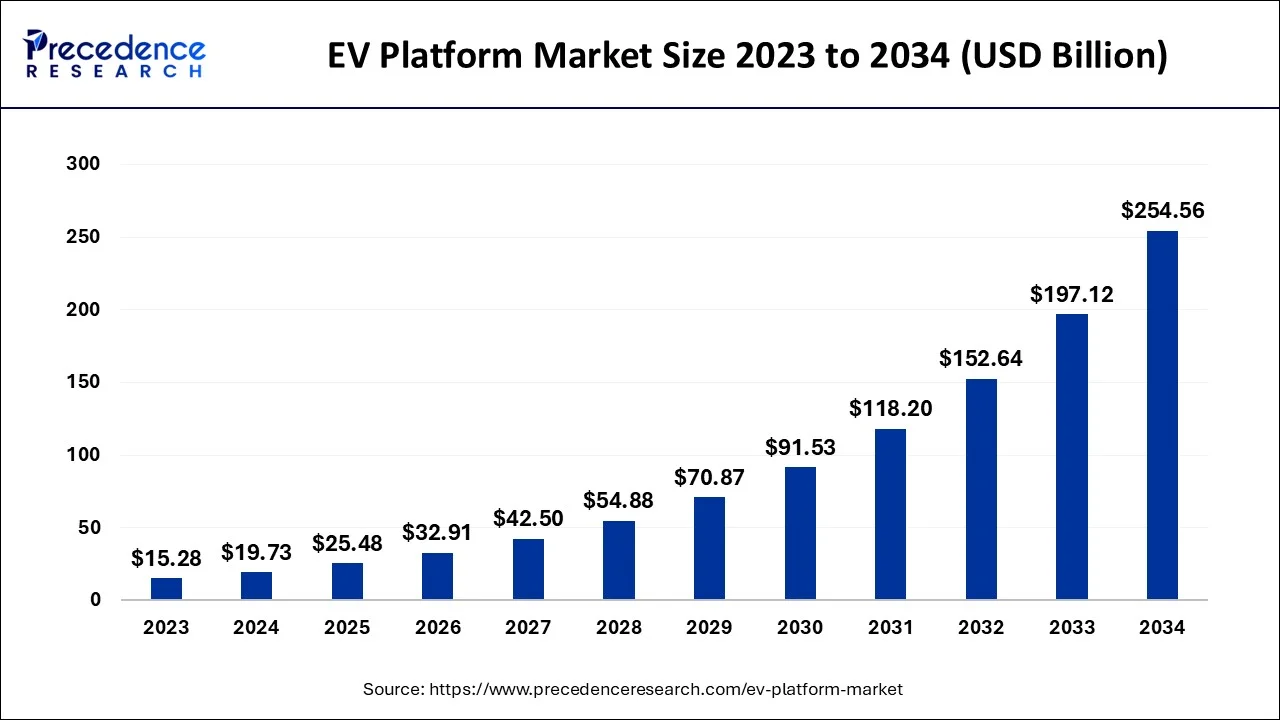

The global EV platform market size is estimated at USD 25.48 billion in 2025and is predicted to increase from USD 32.91 billion in 2026 to approximately USD 303.36 billion by 2035, expanding at a CAGR of 28.11% between 2026 to 2035. The growth in infrastructure and environmental awareness are the key factors driving growth of global EV platform market.

EV Platform Market Key Takeaway

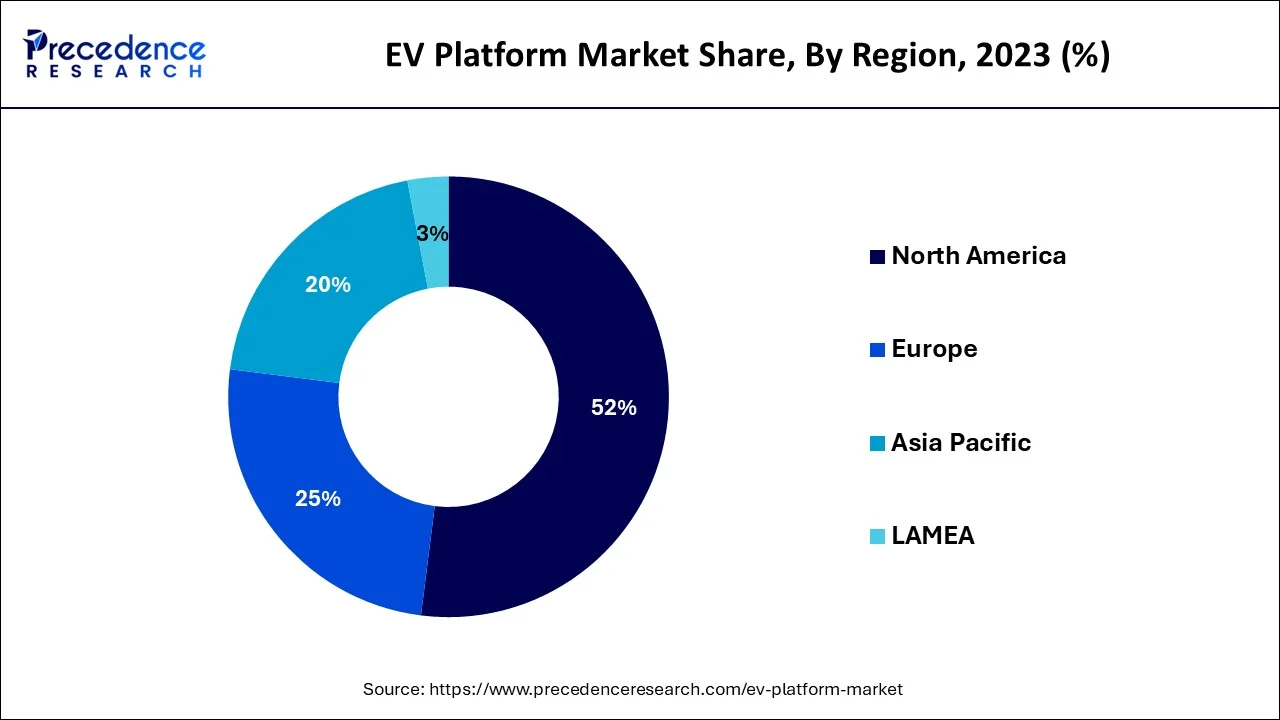

- Asia Pacific generated more than 52% of the revenue share in 2025.

- By Component, the steering system segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By Electric Vehicle Type, the battery electric vehicle segment is expected to dominate the market with the highest revenue between 2026 to 2035.

- By Vehicle Type, the utility vehicle segment contributed to the largest market in 2025.

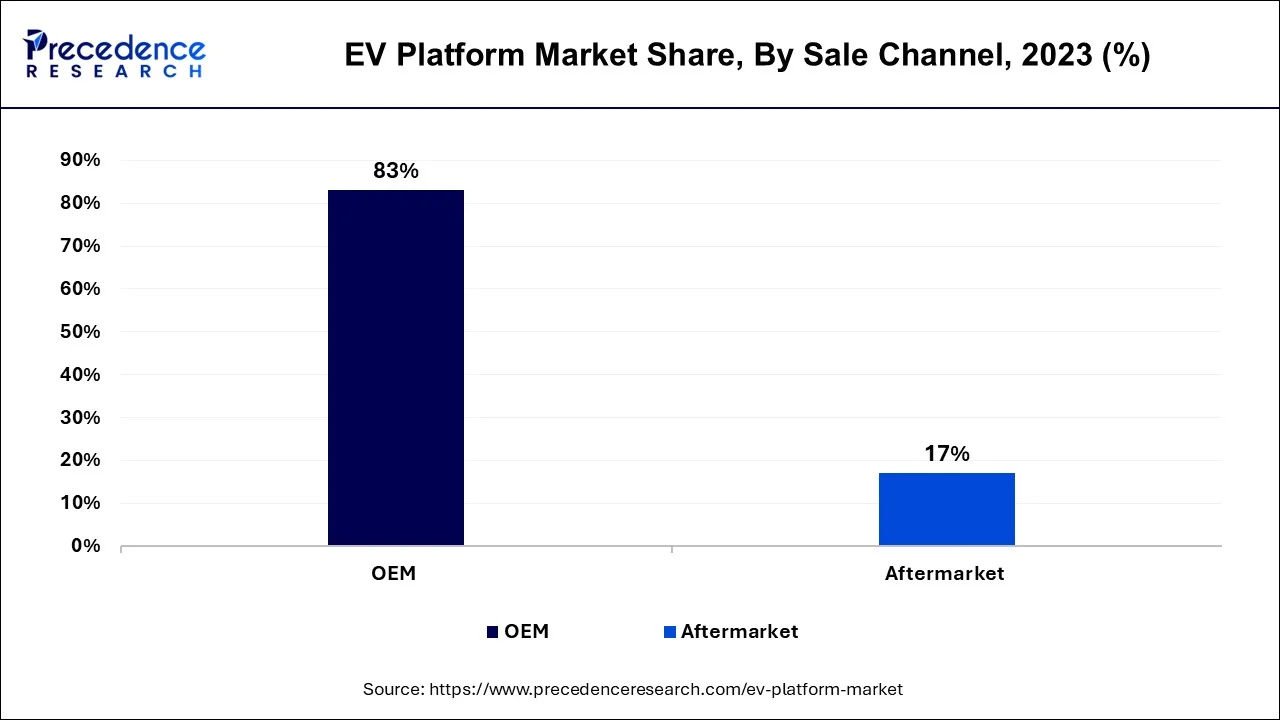

- By Sale Channel, the OEM segment is predicted to capture the largest market share from 2026 to 2035.

- By Sale Channel, the aftermarket segment is projected to register the largest CAGR from 2026 to 2035.

- By Application, the passenger vehicles segment holds the largest market share from 2026 to 2035.

Strategic Overview of the Global EV Platform Industry

The electric vehicle landscape rapidly varies as technology and interest evolve; the forthcoming years will have many more electric vehicles that will take to the roads. When the design is finalized, the production process moves to manufacture the individual components. These components may include the battery pack, electric motor, power electronics, charging system, and other parts that play a key part in the operation of EVs. Being one of the most integral and crucial parts of the electric vehicle, the EV platform acts as a base layer for the electric vehicle.

The global EV platform revolves around the production and distribution of the structure of electric vehicles. The structural part of the electric vehicle which is known as the EV platform is later fitted with a drive unit, suspension, and body.

Artificial Intelligence: The Next Growth Catalyst in EV Platform

AI is fundamentally transforming the electric vehicle (EV) platforms market by enhancing core functionalities and enabling new business models. It significantly improves battery performance and lifespan through advanced AI-driven Battery Management Systems (BMS) that optimize charging cycles and predict potential issues before they occur. AI is the backbone of autonomous driving and Advanced Driver Assistance Systems (ADAS), processing real-time sensor data to enhance safety and navigation capabilities.

EV Platform Market Growth Factors

The demand for EVs has grown significantly because of environmental concerns, the availability of models, increased cost competitiveness with conventional gas vehicles, and improved vehicle ranges. Rising fuel prices, alongside deteriorating air quality index in important cities globally, has significantly driven demand in the market. EVs are becoming increasingly cost-competitive with traditional gas-powered vehicles, particularly when it comes to the total cost of ownership over the vehicle's lifetime. This is making EV platforms more attractive to both consumers and fleet operators.

Moreover, multiple manufacturers are focused on the production of EV platforms to offer additional features that are observed to offer smooth and better driving experiences. For instance, The CMF-EV platform, the newest electric vehicle architecture from Nissan, offers designers several creative chances to completely reimagine the driver and passenger experiences.

Market Outlook

- Market Growth Overview: The EV platform market is expected to grow significantly between 2025 and 2034, driven by the rising government policies, technological advancements, and rising consumer demand.

- Sustainability Trends: Sustainability trends involve the circular economy and sustainable materials, battery technology advancement and recycling, and integration with renewable energy and smart grids.

- Major Investors: Major investors in the market include Tesla, VW, GM, Hyundai, BYD, Tata Motors, CATL, and LG Chem.

- Startup Economy: The startup economy is focused on innovation in R&D, niche market solutions, and infrastructure development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.48 Billion |

| Market Size in 2026 | USD 32.91 Billion |

| Market Size by 2035 | USD 303.36 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 28.11% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Electric Vehicle Type, By Vehicle Type, By Sale Channel, and By Application |

| Regions Covered | Covered North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing awareness of environmental Sustainability among urban areas

Rapid growth in population and pollution driving shift toward sustainability by several urban areas. The main reason for adoption of EVs in urban areas is that electric vehicles are eco-friendly as they do not release CO2 in environment. Rapid growth in population and pollution driving shift toward sustainability. To improve air quality and reduce the emission, urban areas has been focusing on increasing the awareness of EV vehicles.

Additionally, raising noise pollution is driving focus of government on limiting traditional transportations. Electric vehicles are able to reduce their noise and run smoothly. Moreover, the affordability of EVs compared to conventional vehicles are boosting their success rates. For the all-human concerns and sustainability maintenance some urban areas as made strict rules regarding EV transportations. For instant, Delhi has regulated to “only sell electric vehicles” as of 2030.

- According to the Stated Policies Scenario (STEPS), the global electric vehicle stock except two and three-wheelers is projected to reach around 250 million by 2030 and vehicles to reach 525 million by 2035. Sales is expected to reach above 50% in 2035.

- According to the Announced Pledges Scenario (APS), by the end of 2035, sale of EVs will be reach to around 585 million, market share will be 66%.

- As per the Net Zero Emissions goal by 2050 Scenario (NZE), the global EV stock is expected to reach 790 million by 2035, with EV vehicle sale of around 95%, to reach Net Zero goal till 2050.

- Europe region is projected to archive about 14 million EVs by 2025, with low estimate EV sales to reach 85%, and high estimates to near 95% in 2035.

Restraint

Fluctuation in component prices

Raw materials and components are part of complete vehicles in a vehicle assembly plant. The fluctuating prices of components used for the production of EV platform act as a restraint for the market. It accounts for all the incoming materials, parts, supplies, workforce, and utilities and compares them against the vehicles. The battery pack is the essential component of an electric vehicle platform, and lithium is mainly used as a raw material. As the lithium supply is limited, the overall price of EV platform becomes expensive. The shortage of such raw materials causes fluctuation in the prices which may hamper the growth of the market by limiting manufacturers.

Opportunities

Rising utilization of electric vehicles in commercial applications

Some companies involved in last-mile delivery, such as online food delivery companies, e-commerce platforms, and courier services, are incorporating electric vehicles into their fleets. EVs are well-suited for urban delivery due to zero emissions. They help reduce pollution, such as air and noise while providing savings on fuel and maintenance. For instance, in India, companies like Ola and Uber are encouraging their drivers to switch into electric vehicles. Electric vehicles are well-suited for short-distance urban trips, and their lower operating costs can increase the drivers' earnings. Few cities offer incentives, such as access to reducing licensing fees and charging infrastructure to promote the use of EVs in the industry.

Companies are transitioning their internal fleets to electric vehicles, including companies with delivery services and field service operations. Electric vehicles in corporate fleets help reduce pollution from carbon footprints, maintenance costs, and lower fuel and align with sustainability goals. This element is expected to open lucrative opportunities for the EV platform market by increasing the pace of electric vehicle production.

Segment Insights

Component Insights

The steering system segment is expected to increase rapidly during the forecast period. Electric steering systems are efficient since they do not need a pump to develop hydraulic pressure, which can help extend an EV's range. The need for EV platforms and increased safety regulations by creating precise and responsive steering systems, reducing the risk of accidents, and enhancing the safety of EVs will increase the demand for steering systems during the upcoming period.

- In April 2023, to advance affordability, Modular Rack-Assist Electric Power Sterring (mREPS) in EVs was implanted by Nexteer Automative. mREPS are able to meet several Original Equipment Manufacturers (OEMs) production needs for cutting-edge steering system, specially for heavy vehicles like EVs and light commercial vehicles.

- In October 2023, The Competition Commission of India (CCI) was authorized with Hitachi Estemo Ltd (HAL) by Japan Investment Corporation and Honda Motor Co Ltd (HMCL) for the research and development related two-wheeler vehicles.

Based on component, battery segment accelerated as the fastest growing market segment in 2023. Advanced battery technologies are able to reduce charging time and driving range, that drives major preference of consumer toward electric vehicles. Moreover, government of worldwide has been encouraging competitive landscapes for further innovations, boosting advantages and applications in batteries. For instant, lithium batteries have made electric vehicles cost-effective and practice. Companies are investing for enhance energy storage in lithium batteries for more safety, effectiveness and sustainability. Industry has witness significant rang in electric vehicles for energy renewable with advancement and adoption of AI-powered technology. Along with this technology advancement, 2024 is likely to archive mature developments of lithium batteries, which will help to maintain cleanness world and efficient energy landscape.

Electric Vehicle Type Insights

The battery electric vehicle segment is expected to lead the market with the highest revenue during the forecast period. The evolution of lithium-ion technology has raised the requirement for the growth of batteries, which has been a prominent solution for automobile developers that can give power to electric vehicle batteries. The main factors driving the market's growth are increased technological advancement, zero-emission assets, and the ability to not emit toxic gases.

For instance, In June 2022, General Motors announced that it was partnering with Honda to develop and produce Ultium batteries for both companies' electric vehicles.

- China is leading country for innovations in electric vehicle battery, for instant, in September 2024, China's $115 billion Contemporary Amperex Technology (300750.SZ), has created novel tab and its smaller compatriots accounted for power cells uses in batteries of electric cars.

Vehicle Type Insights

The utility vehicle is the maximum contributor towards the EV platform market.

With the rising demand for electric vehicles to carry heavy loads, the significance of utility vehicles will continue to grow. Utility vehicles require fast charging; the EV platform provides a well-established, compatible charging network. Several automotive manufacturers are focused on customizing EV platforms according to durability and reliability requirements, especially for utility vehicles. This element highlights the segment's growth for the upcoming years. Companies extensively adopt this due to greater public demand and sales. For instance, in 2022, India's Mahindra and Mahindra showcased its forthcoming electric SUV - XUV-300 - re-badged as XUV-400.

- In January 2024, the novel premium utility vehicle called the ridge SxS was launched by Kawasaki, a Japan based vehicle company. ridge SxS has the several features like HVAC system, selectable 4WD, sturdy chassis, and full-cab configuration. This utility vehicle is being used in work places as well as in sports.

The hatchback segment shows attractive growth during the forecast period.

Hatchback vehicles are often small with compact designs; EV platforms offer efficient use of space and proper weight distribution. Hatchback vehicles require an EV platform to maintain the battery capacity. The rising demand for personal vehicles as a transportation mode and the emphasis on the development of electric carswill boost the segment's growth.

- China is well-known for holding largest stock of plug-in light commercial vehicle and electric bus. China was able to dominated the market with highway legal plug-in passenger cars with 20.4 million units in December 2023.

- In February 2024, Honda Motors exported all-novel hydrogen fuel electric vehicle CR-V e: FCEV sports utility vehicles type to Japan. Japan's carmakers will e first to supply an FCEV with plug-in charging, allow an external power used to charge the onboard battery.

Sale Channel Insights

OEM captured the largest market share during the forecast period.

The vehicle returns to its original state since they make OEM parts easier to install with less room for error. If the car is in its original condition, it fits with the vehicle. The quality and safety of the product is maintained.

- In January 2024, the collaboration within Hofer Powertrain and VisIC Technologies Ltd. Was made for the development of gallium nitride (GaN)-based electric vehicles with 800V high-frequency inverters advantages. These inverters have made efficient, affordable according to the recent market demands. It provides fast speed with small and light design to reduce overall cost of EVs.

Aftermarket is anticipated to register the highest CAGR during the projected period.

The rising demand for vehicle conversion and customization will fuel the segment's growth. The automotive market is experiencing a massive demand for do-it-yourself automotive parts; the aftermarket sales channel offers an opportunity for consumers to choose their platforms. Cheaper and affordable as compared to OEM. Rising retrofitting activities will grow the segment.

- The direct sale of Original Equipment (OE)-manufactured spare parts in the Independent Aftermarket (IAM) was started by Vitesco Technologies in July 2023. The aim of company was to offer affordable range of spare parts and services for EVs for both passenger and commercial vehicles.

Application Insights

The passenger vehicles segment holds a significant position in the EV platform market. The enormous demand for personal vehicles and changing consumer preference towards electric vehicles promote the growth of the segment. The rise in middle-income population, especially in multiple developing countries highlights the demand for electric vehicles, which subsequently promotes the production of EV platforms.

- In may 2023, the Astroinno, novel AV battery with 1000 km range was launched by the Gotion High Tech Co. Ltd., a chines battery manufacturing company for electric vehicles. Astroinno have 240 watt-hours per kilogram and 190 Wh/kg energy density at the system level.

- According to China Passenger Car Association (CPCA), Tesla China's passenger electric vehicle sales reached to 19.2% in September of 2024 compared to last year.

The commercial vehicles segment plays a significant role in the EV platform market. Electric commercial vehicles produce zero emissions, reducing air pollution and greenhouse gas emissions compared to gasoline or diesel-powered vehicles, which makes them more environmentally friendly and helps in combating climate change.

The segment is expected to grow primarily owing to the increasing demand for minibusses and vans. The substantial demand for commercial vehicles from companies and industries will also promote the growth of the segment in the upcoming years. Light commercial vehicles are expected to witness an enormous demand in the future.

- In June 2024, Tata Motors divided its automative business in commercial vehicle and passenger vehicle entities to showcase advantages of commercial vehicles to improve its adoption and sale.

- In September 2024, Foton Motor and ZF Group collaborated at 2024 Hannover International Commercial Vehicles Show, for the launching of modern commercial vehicle hybrid drive system for Chinese market in order to support the demand of new energy transformation.

Electric commercial vehicles are highly efficient in converting energy into motion. They have higher energy efficiency than internal combustion engine vehicles, which results in better mileage per unit of energy consumed.

Regional Insights

What is the Asia Pacific EV Platform Market Size?

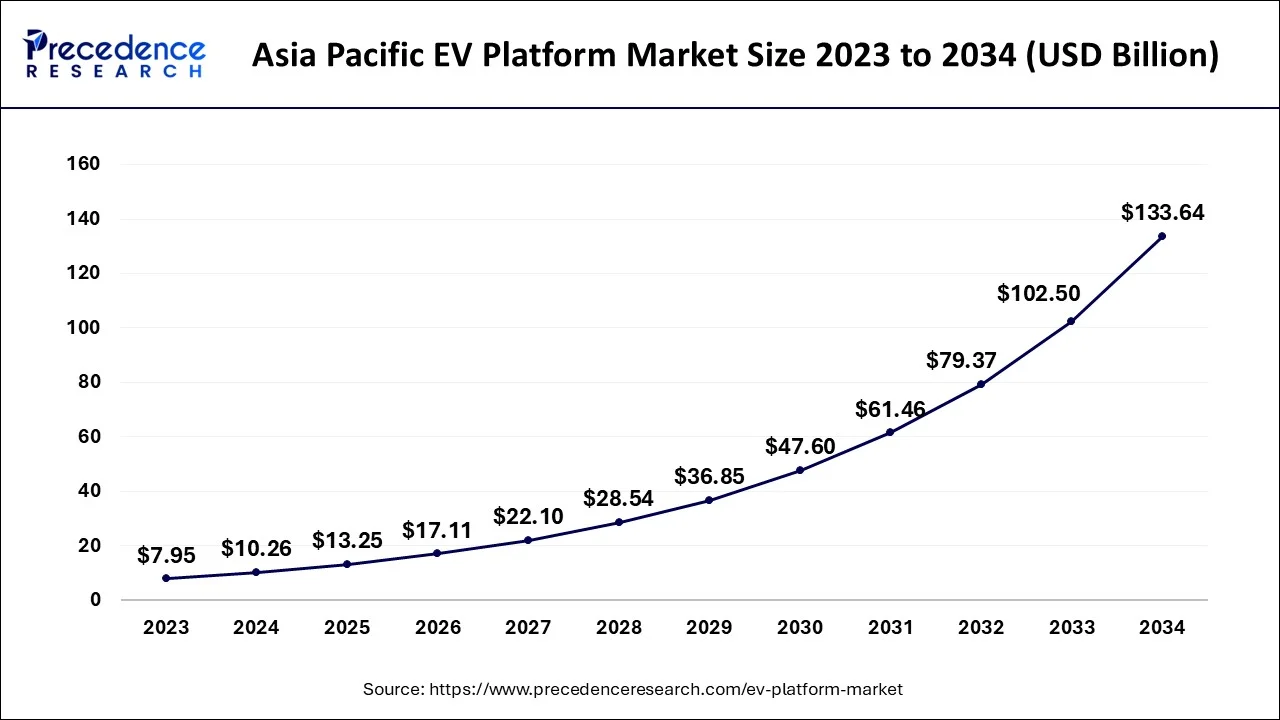

The Asia Pacific EV platform market size accounted for USD 13.25 billion in 2025 and is predicted to surpass around USD 159.44 billion by 2035, growing at a CAGR of 28.24% from 2026 to 2035.

Asia Pacific dominates the global EV platform market; the region is expected to sustain its position in the market throughout the predicted timeframe. Several governments of the Asian countries including Japan, China and India have assisted the proliferation of EV demand through subsidies and favorable policies for EVs by distressing the use of gasoline-diesel vehicles. China dominates the global electric vehicle market, the rising production and advancements of electric vehicles in the country highlight the growth of the EV platform market for upcoming years.

India EV Platform Market Trends

Indian government plays crucial role in the development of EVs market in country due to its increased population and rapid growing urbanization. Indian government has initiated with policy to engage more sources like Reliance New Energy, Ola, ACC Energy Storage to start EV battery manufacturing in the country. Additionally, government policy scheme for Advanced Chemistry Cells (ACC) and the recent policy change and reduction in import duties on EVs above 15% are highly contributing in countries EV market growth.

- In March 2024, Indian government announced the Electric Mobility Promotion Scheme (EMPS) of RD 500 crore for four months of period in order to encourage and support the two and three-wheeler segment sales.

China EV Platform Market Trends

China's intense competition and innovation, growth in battery technology, and focus is shifting to advanced software, user experience, and seamless digital integration, with startups leading innovation in this area. Overall, China's focus on advanced EV architectures and smart mobility solutions is strengthening its leadership in the global EV platform market.

Growing awareness of sustainability and zero emission goal are driving market growth in Europe. Several European companies has been participating to encourage EV adoption among region. For instant, France introduced its bonus-malus scheme for awarding companies who supports countries new CO2 emission requirements. European government activities like tax credit and subsidies are encouraging consumer for adoption of electric vehicles. Overall, Europe's strict emission standards and sustainable vehicle promotions are fueling for regions market expansion.

- In November 2023, UKs government introduced new EV charging regulations 2023 for public charge points to improve consumer charging experience nationwide. This regulation aims to complete public charging point operators by 2024 with two years in the case of the Payment Roaming regulation.

Germany EV Platform Market Trends

Germany's increase in BEV sales, rising consumer demand for sustainable transport, and supportive government policies. Shift to dedicated platforms, massive investment in charging infrastructure, and integration of V2G technology. Overall, regulatory pressure to reduce emissions, ongoing investments in electrification, and competition from global EV players are driving continuous innovation in Germany's EV platform market.

How Did North America Notably Grow in the EV Platform Industry?

North America's government support and supporting policies, huge investment in battery plants and assembly facilities, and growing consumer preference for sustainable transport and adoption of new technologies. Key developments include high-voltage architectures for enhanced performance and fast charging, as well as software-defined vehicle platforms that enable connectivity, over-the-air updates, and advanced driver-assistance systems.

U.S. EV Platform Market Trends

The U.S.'s rising demand for higher energy density, faster charging systems, and solid-state batteries is pushing platform innovation, integration of ADAS, V2X, OTA update, and advanced infotainment, making them digital hubs. Strategic collaborations and domestic manufacturing investments are shaping the landscape, although policy shifts and evolving consumer demand are affecting EV rollout timing and platform investment decisions.

Value Chain Analysis of the EV Platform Market

- Research and Development (R&D) & Design

This stage involves the conceptualization, design, and engineering of the core EV platform and its related technologies.

Key Players: Volkswagen (MEB platform), Hyundai/Kia (E-GMP platform), Tesla, Canoo, REE Auto, and Open Motors. - Component Manufacturing/Inbound Logistics

This stage focuses on sourcing and manufacturing critical components such as batteries, e-motors, power electronics, chassis, and suspension systems.

Key Players: CATL, LG Energy Solution, Panasonic, and BYD. - Assembly/Operations

Here, all the components are integrated and assembled into the final electric vehicle. Automakers adapt their manufacturing processes to produce EV-specific platforms and integrate large components like the battery pack and electric drivetrain efficiently.

Key Players: Tesla, BYD, BMW, Ford, Volkswagen, and Volvo, which integrate components into complete vehicles.

EV Platform Market Companies

- Nissan Motor: Nissan leverages its CMF-EV platform, a globally scalable architecture developed with the Renault-Mitsubishi Alliance, to support a wide range of electric models.

- Open Motors: This company specializes in open-source EV platforms, such as the modular "Edit" platform, designed to be easily white-labeled and modified by other businesses or startups.

- REE Auto: REE Automotive provides a revolutionary software-defined platform featuring REEcorner technology, which integrates all critical vehicle components, steering, braking, and powertrain, into a single compact module between the chassis and wheel.

- Rivian: Rivian pioneered the proprietary "skateboard" platform, which integrates the battery pack, drive units, and suspension to provide a rugged and capable base for high-performance adventure vehicles like the R1S and R1T.

- SAIC Motor: SAIC Motor is a major global player that develops multiple specialized architectures, including those designed to optimize cabin space and support rapid battery swapping technology.

- XAOS Motors: XAOS Motors focuses on the development of high-performance, modular electric architectures tailored for the luxury and specialty vehicle segments.

- BAIC Motor: BAIC Motor contributes through its BE21 and BE11 modular platforms, which are engineered to support a diverse lineup from compact cars to full-size luxury SUVs under its Arcfox and Beijing brands.

Other Major Key Players

- BMW

- BYD

- Byton

- Canoo

- Toyota

- Volkswagen

- Volvo

- Chery

- Daimler

- Faraday Future

- Fisker

- Ford

- Geely

- Zotye

Recent Developments

- In March 2024, Rivian midsize platform launched the R2 SUV and the smaller R3 crossover, to make it more affordable. The R2 platform is exclusive development by Rivian with high performance, range and affordability.

- In August 2024, BMW Group added BEV options in all companies' main segments. BMW announced production of over 15 fully-electric models in 2024.

- In August 2024, Nissan and Honda announced the partnership for the standardization of features of their e-Axles by medium to long term. This partnership was made to improve efficiency and enhance performance of companies' next generation EV products.

- In June 2023, Israel-based power electronics Solar Edge's new software-allowed solution directs and optimizes the EV charging blueprint for sites with solar resources and vast numbers of EVs requiring dynamic load control.

- In December 2022, during an event on China Tech Vision Day 2022, General Motors disclosed a new Chevy EV sedan theory, the FNR-XE, premised on General Motors's Ultium platform.

- In August 2022, Mahindra & Mahindra and Volkswagen Group dealt with a term sheet on the supply of electric components for Mahindra's latest Electric SUV. Both firms will explore potential opportunities for alliance in India in e-mobility, including charging and energy solutions, cell manufacturing, and vehicle projects.

Segment Covered in the Report

By Component

- Chassis

- Steering System

- Suspension System

- Drivetrain

- Battery

- Vehicle Interior

By Electric Vehicle Type

- Battery Electric Vehicle

- Hybrid Electric Vehicle

By Vehicle Type

- Sedan

- Hatchback

- Utility Vehicle

- Others

By Sale Channel

- OEM

- Aftermarket

By Application

- Passenger Vehicles

- Commercial Vehicles

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting