What is the Financial App Market Size?

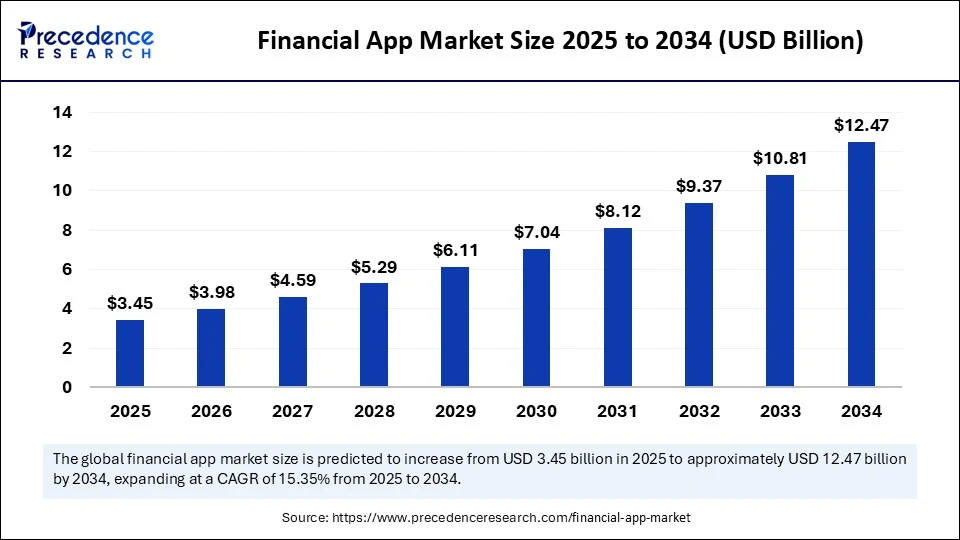

The global financial app market size accounted for USD 3.45 billion in 2025 and is predicted to increase from USD 3.98 billion in 2026 to approximately USD 13.98 billion by 2035, expanding at a CAGR of 15.02% from 2026 to 2035. The growth of the market is attributed to ongoing technological advancements, rising usage of smartphones, and the growing digitalization of financial services.

Financial App MarketKey Takeaways

- In terms of revenue, the global financial app market was valued at USD 3.45billion in 2025.

- It is projected to reach USD 13.98billion by 2035.

- The market is expected to grow at a CAGR of 15.02% from 2026 to 2035.

- North America dominated the financial app market in 2025.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By software, the risk and compliance segment contributed to the biggest market share in 2025.

- By software, the BI and analytics segment is expected to grow at the fastest CAGR in the coming years.

- By application, the investments segment captured the highest market share in 2025.

- By application, the cost tracking saving segment is expected to grow at the highest CAGR in the upcoming period.

Market Overview

The financial app market encompasses financial activities like personal finance management, payments, investments, and other financial services. The key advantages of these financial apps are convenience, accessibility, and the innovative solutions they bring to the market. A broad range of apps currently operate within the market, including personal finance managers, payment platforms, investment tools, and even cryptocurrency applications. The rapid growth of digitization, alongside the widespread use of the internet and smartphones, provides the essential foundation for the market's expansion. These apps have become a daily part of people's lives, as digital transactions are favored over cash due to automated expense records and the ease of tracking, with cashless payments offering greater convenience compared to cash, which is fueling the market growth.

How is AI Revolutionizing the Financial App Market?

Artificial Intelligence enhances user experience through personalized features, offering tailored guidance for better financial decisions. Users benefit from 24/7 chatbot support and various AI tools. AI helps prevent fraud by identifying potential threats. It analyzes factors beyond traditional credit reports, such as transaction history, social media activity, and employment patterns, to assess credit scores. Virtual assistants manage routine customer inquiries, allowing human agents to solve more complex issues. These assistants answer questions, provide account information, schedule payments, and help open new accounts. AI tools add a personal touch, enhancing the overall customer experience. AI's rapid pattern analysis and decision-making capabilities are used in algorithmic trading, leading to more accurate and informed trading decisions and better profitable trading strategies.

Financial App MarketGrowth Factors

- The increased availability of smartphones to the general public serves as the primary platform, providing direct accessibility to financial apps for consumers.

- Growing awareness of financial management and various initiatives promoting financial services have increased the use of personal finance and money management tools among the general public.

- Supportive regulatory policies are creating a favorable environment for the growth of the financial app market.

- The market is growing rapidly due to continuous technological innovations in the fintech sector and improvements in financial apps.

- Post-COVID, consumers have adopted financial applications as part of their routine for digital transactions and utilizing various banking services via financial apps on their smartphones, boosting the growth of the market.

Financial App Market Outlook

- Industry Growth Overview: The market is growing, driven by ongoing technological advances, as well as changing user preferences. As individuals increasingly seek to handle their finances through digital platforms, the need for innovative solutions continues to rise.

- Major Investors: Major investors in the market include large venture capital firms such as Chime and Coinbase, strategic corporate investors like PayPal, major banks including ICICI and HDFC, and established fintech players such as Ant Group's Alipay and Revolut. Beyond funding, these investors provide industry expertise, mentorship, and strategic networks, helping startups scale efficiently and navigate competitive and regulatory challenges.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 13.98Billion |

| Market Size in 2025 | USD 3.45 Billion |

| Market Size in 2026 | USD 3.98 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.02% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Software, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Digitization and Trend Toward a Cashless Economy

The growing digitization of banking services and rapid shift toward cashless economy are major factors driving the growth of the financial app market. With the widespread use of smartphones and rise of digital banking, financial apps have become a common norm. Traditional in-person access to financial services, such as banks and share market investments, is becoming less common due to the digital revolution in the fintech sector. Financial apps have brought the accessibility of traditional banking services to a previously underserved population, providing access to microloans, digital insurance, and various other financial products. Financial apps offer convenient access to financial services anytime, enabling users to do payments from remote locations.

Technological Advancements

Ongoing technological advancements drive the growth of the market. Technologies like AI, blockchain, and biometrics are enhancing app functionalities and security. These technologies can improve security, transparency, and efficiency in transactions. Moreover, the rapid growth of the fintech industry contributes to market growth.

Restraint

Security Concerns and Lack of Technical Literacy

Data breaches and cyberattacks are major challenges in the financial app market, as these apps are prime targets for hackers globally. Inadequate security, encryption, or other cybersecurity failures frequently lead to significant financial losses. Furthermore, the lack of technical literacy among users makes them vulnerable to scammers and hackers, resulting in substantial personal financial losses. Many users hesitate to use financial apps due to trust issues stemming from a lack of awareness about technology and app interfaces. This fear of technology and potential financial losses deters them from using financial app services. Lack of accessibility to high-speed internet connectivity, particularly in remote locations, limits the adoption of these apps.

Opportunity

Collaboration and Seamless Integration of Banks and Financial Institutions

The collaboration and integration of banks and financial institutions are fostering a fintech ecosystem where all financial services and products are available in one place. This provides features like bank account and credit card integration, allowing users to track spending. The rise of financial apps has increased investment convenience in the share market and other alternatives, boosting market expansion through increased investments. Financial apps simplify tax preparation, offer expense tracking, and e-filing, adding significant value to businesses and individuals. These unique offerings enhance user experience.

Segment Insights

Software Insights

Why did the risk & compliance segment dominate the financial app market in 2024?

The risk & compliance segment dominated the market by holding the largest share in 2024. This is mainly due to the increased need to ensure the security of financial transactions and user data. Financial apps handle sensitive information, making them prime targets for cyberattacks and fraud. To mitigate these risks, robust risk management and compliance measure software are important.Due to the rise in cyber fraud, governments have imposed stringent regulations on financial apps. This has led to the increased demand for risk management solutions. Financial institutions, being primary targets for cybercriminals, must implement stringent cyber fraud prevention measures, ensuring long-term growth of the segment.

The BI & analytic segment is expected to grow at the fastest rate in the market during the forecast period. The growth of the segment is attributed to the increasing need for data-driven decision-making. Financial apps generate vast amounts of data, providing valuable insights into customer behavior, market trends, and operational efficiency. BI and analytics software help financial institutions personalize services, improve risk management, and optimize business strategies.

With the rise of AI and automation, businesses are increasingly turning to data-driven insights. The abundance of market data is key to deriving crucial business insights. These insights, delivered through Business Intelligence and analytical tools, are vital for making critical decisions related to investments and product development.

Application Insights

How does the investments segment dominate the financial app market in 2024?

The investments segment dominated the financial app market with the biggest share in 2024. This is mainly due to the ability of these platforms to provide access to a wide range of investment products, from stocks and ETFs to crypto and other financial instruments. The convenience of these platforms is significantly contributing to the rapid growth within the investment sector. This lowers traditional barriers that previously existed for the general public to enter the investment market. A diverse array of investment options are available in these platforms, including stocks, ETFs, and cryptocurrency, among other financial instruments. Investment apps have democratized investing, making it easier for anyone to start with small amounts of money. These apps also offer intuitive interfaces, making investing less intimidating for beginners.

On the other hand, the cost tracking saving segment is expected to grow at the fastest rate during the forecast period. The growth of this segment is attributed to the growing consumer awareness about personal finance and the importance of budgeting. The usage of cost tracking and savings apps is growing due to increased consumer awareness of personal finance and the ease of use of these apps. They offer personalized insights, automated features, and integration with financial services, making it simple to monitor spending and achieve goals. With tools like expense trackers and budget planners, these apps help users track expenses, purchases, and financial budgeting. The growing need to secure the future through saving and investment further support segmental growth.

Regional Insights

What are the major factors contribute to North America's dominance in the financial app market?

North America registered dominance in the financial app market by capturing the largest share in 2024. This is mainly due to the presence of leading fintech companies, particularly in the U.S. The region has advanced technological infrastructure, creating foundation for financial apps and related services. The increased digital economy also bolstered the growth of the market in the region. Moreover, there is a high adoption of cryptocurrency. The U.S. is a major player in the market due to the early adoption of digital financial services, robust digital infrastructure, and supportive government regulations.

UK Market Trends

The market in the UK is driven by rising smartphone penetration and digital literacy, with 85% of adults owning smartphones, fueling demand for intuitive and personalized financial management solutions. Additionally, the Financial Conduct Authority (FCA) has implemented stringent data privacy standards aligned with GDPR, emphasizing user protection and data security, which is shaping the development and adoption of fintech applications in the region.

Why is Asia Pacific witnessing the fastest growth?

Asia Pacific is expected to grow at the fastest rate during the forecast period. This is mainly due to the expanding digital infrastructure, the increasing number of tech-savvy individuals, and the rapid adoption of digital payment methods across the region. Following demonetization in India, banks and financial institutions have cultivated a favorable environment for digital payments and financial applications, transitioning payment modes towards digital methods and gradually decreasing cash transactions in the market. Post-COVID, there has been a notable shift in consumer behavior within this region, leading to a greater inclination towards cashless payments. With the assistance of financial applications, the stock market has seen a considerable rise in retail investors.

Additionally, other investment avenues, such as cryptocurrency, have demonstrated substantial growth due to the expansion of the financial app market in this region. The transparency and convenience provided by financial apps have made them increasingly popular in the region, with a strong technology infrastructure and widespread 5G networks further fueling the growth of the market. Supportive government policies and regulations promoting digital financial services further contribute to regional market growth.

China Market Trends

The financial app market in China is growing due to the rising use of investment applications, fueled by rising interest in personal finance and wealth management. Recent data shows that around 30% of Chinese consumers actively use investment apps to manage their portfolios, with the trend particularly pronounced among millennials and Gen Z, who prefer digital solutions for investment opportunities. This shift is driving fintech companies to innovate and expand their app-based investment offerings to capture the digitally savvy population.

What opportunities exist in the European financial app market?

Europe is considered to be a significantly growing area. Digital revolution, shifting consumer behavior, and preference for digital payments are fueling market growth in this region. Stringent government regulations and secure digital infrastructure support the financial app market. A robust tech infrastructure and SaaS model make financial apps accessible and affordable, further driving market growth. Increased smartphone usage and internet penetration create a large user base. Fintech innovation, including AI and blockchain, enhances app features. The demand for convenient financial solutions and the rise of digital-first consumers also contribute to regional market expansion.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing an opportunistic rise in the financial app market due to increasing smartphone penetration, growing digital literacy, and the demand for convenient, accessible financial services. Consumers are increasingly adopting mobile banking, investment, and payment apps to overcome traditional banking limitations, particularly in underbanked regions. Brazil is a major contributor to the market, driven by rising adoption of smartphones, the growth of digital payment solutions such as Pix, and an increasing preference for online banking services among users.

What Potentiates the Financial App Market in the Middle East & Africa?

The market in the Middle East & Africa (MEA) is mainly driven by rising smartphone penetration and enhanced internet connectivity in the region. Moreover, advancements in internet infrastructure, including the growth of 4G and the rollout of 5G networks, are improving mobile connectivity and enabling the usage of data-intensive applications.

Saudi Arabia Market Trends

Saudi Arabia's financial app market is booming, driven by the digital transformation initiatives under Vision 2030 and strong government support through SAMA's regulatory sandbox. Vision 2030, aimed at reducing the Kingdom's reliance on oil and diversifying its economy, is accelerating financial inclusion, fintech innovation, and digital adoption, creating a fertile environment for mobile banking, payments, and investment apps.

Financial App Market Companies

- PayPal Holdings

- Square Inc. (Block)

- Revolut Ltd.

- Robinhood Markets Inc.

- Monzo

- N26

- Google Pay

- Apple Pay

- Alipay

- WeChat Pay

- Venmo

- Cash App

- Plaid

- Stripe

Recent Developments

- In March 2025, Finvasia collaborated with YES Bank and launched Jumpp, an AI-enabled financial super app aimed at simplifying personal finance by combining banking, saving, payments, investing, and borrowing into one platform. The app enables users to open savings accounts with YES Bank and integrate all financial accounts into a single view through the Account Aggregator ecosystem.

(Source: https://yourstory.com) - In February 2025, Reserve Bank launched a mobile app 'RBIDATA.' The app will provide access to more than 11,000 different series of economic data related to the Indian economy. This app offers macroeconomic and financial statistics relating to the Indian economy in a user-friendly and visually engaging format.

(Source: https://www.business-standard.com) - In October 2024, Reliance's financial services arm announced the launch of a New JioFinance App that will be available for users on Google Play Store, Apple App Store, and MyJio.

(Source: https://economictimes.indiatimes.com)

Segments Covered in the Report

By Software

- Audit

- Risk & Compliance

- BI & Analytics Application

- Business Transaction Processing

By Application

- Cost Tracking Saving

- Investing

- Tracking Debts

- Taxes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting