What is Fire Department Software Market Size?

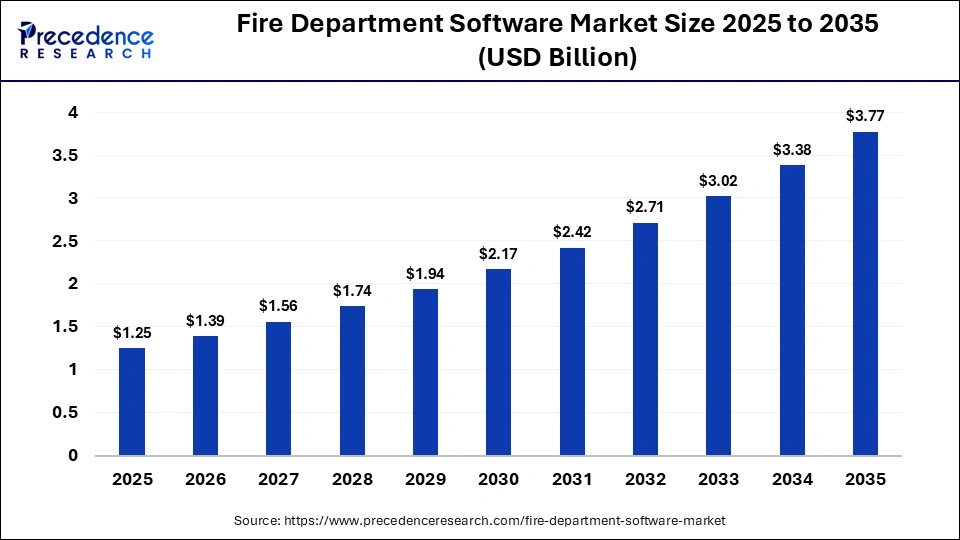

The global fire department software market size was calculated at USD 1.25 billion in 2025 and is predicted to increase from USD 1.39 billion in 2026 to approximately USD 3.77 billion by 2035, expanding at a CAGR of 11.70% from 2026 to 2035. The market is driven by the rising adoption of advanced fire detection software by large organizations, along with the rapid investment by governments around the world in deploying high-quality software to enhance fire safety.

Market Highlights

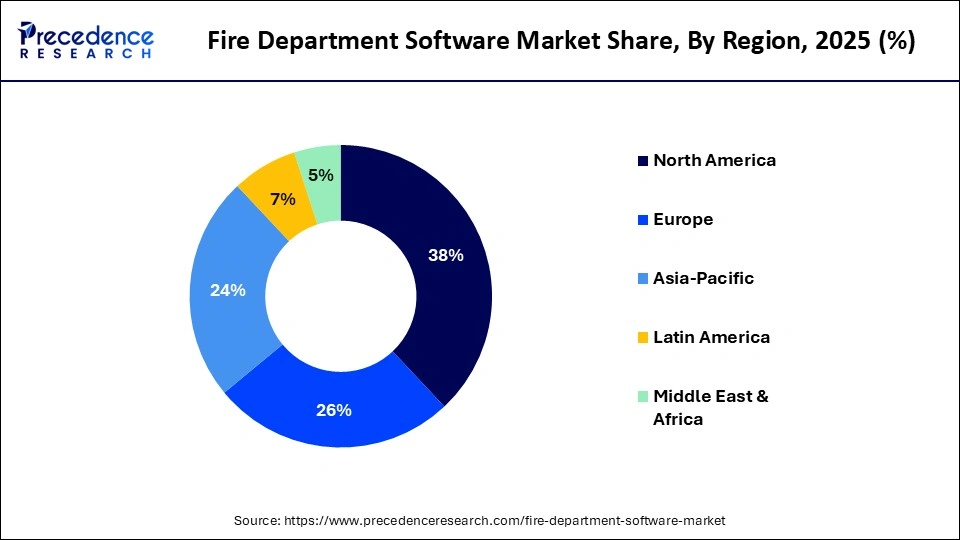

- North America led the market with a share of 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

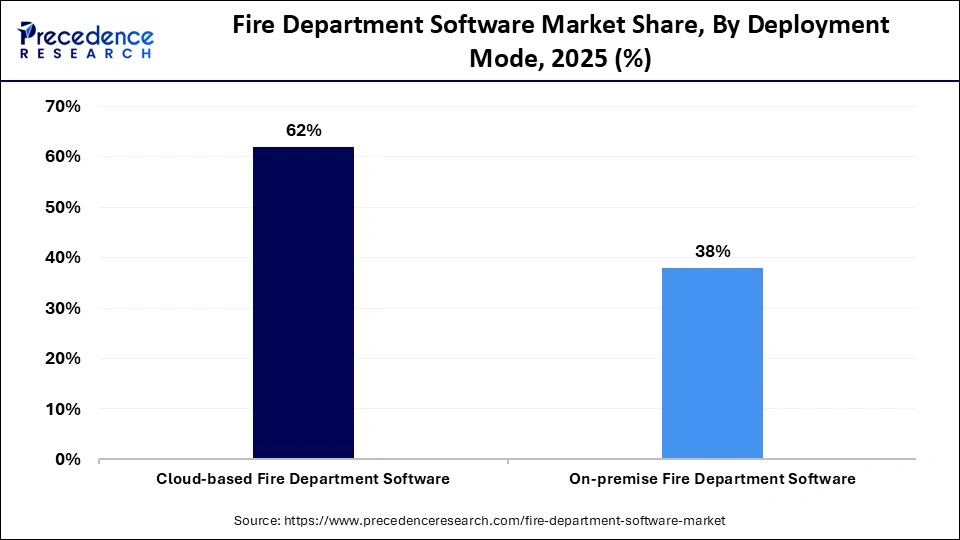

- By deployment mode, the cloud-based fire department software segment held the largest market share of 62% in 2025.

- By deployment mode, the on-premises segment is expected to expand at a notable rate during the forecast period.

- By software type, the computer-aided dispatch (CAD) systems segment held a major market share of 29% in 2025.

- By software type, the mobile/field response applications segment is expected to grow at the highest CAGR between 2026 and 2035.

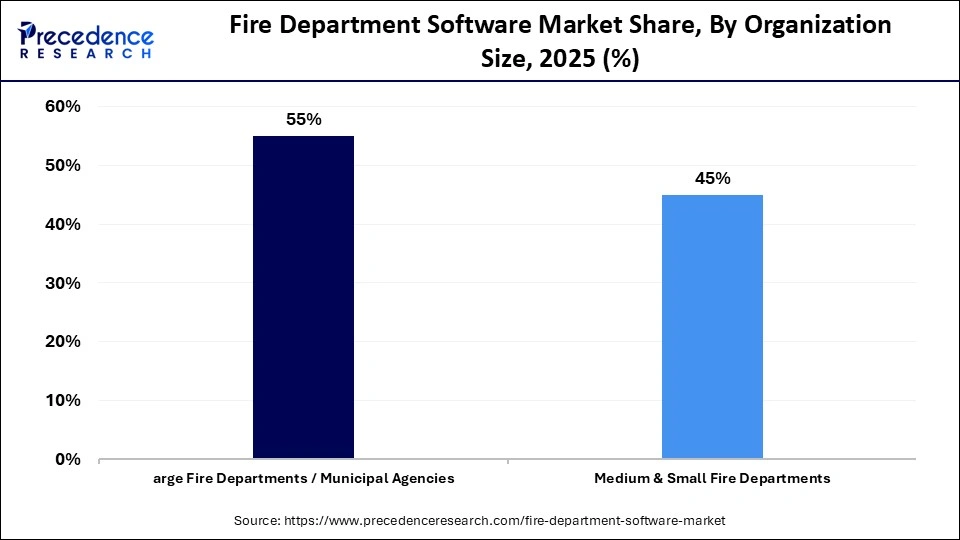

- By organization size, the large fire departments / municipal agencies segment held the highest share of 55% in the market in 2025.

- By organization size, the medium & small fire departments segment is expected to grow at the fastest CAGR during the forecast period.

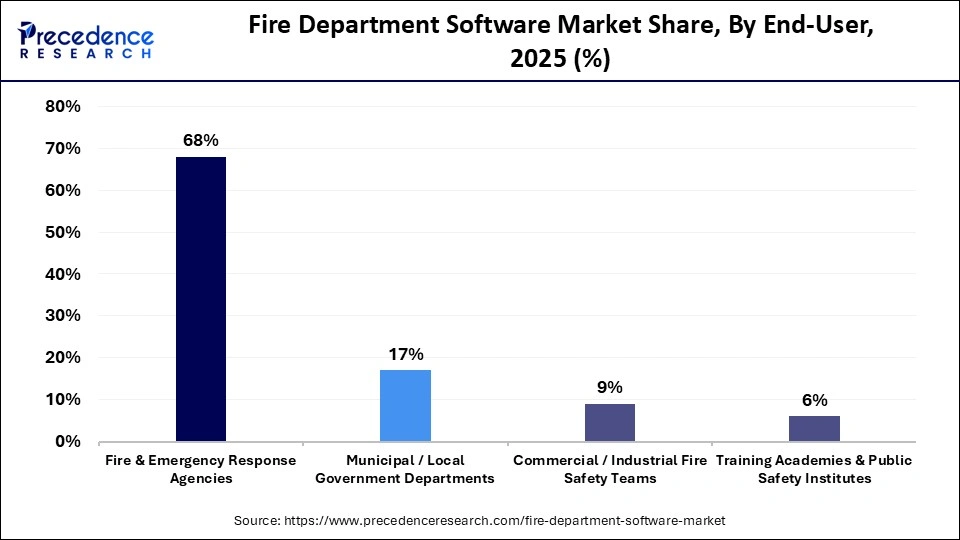

- By end-user, the fire & emergency response agencies segment dominated the market with a share of 68% in 2025.

- By end-user, the municipal/local government departments segment is expected to expand at the highest CAGR during the forecast period.

- By functionality, the dispatch & incident management segment held the highest share of 31% in 2025.

- By functionality, the performance analytics & reporting segment is expected to grow at the fastest CAGR during the forecast period.

- By integration capability, the integrated platforms (ERP / Public Safety Suites) segment held the largest share of 54% in 2025.

- By integration capability, the standalone software solutions segment is expected to grow at a significant CAGR during the forecast period.

- By pricing model, the subscription / SaaS / recurring revenue segment dominated the market in 2025 with a share of around 61%.

- By pricing model, the usage-based / transaction pricing segment is expected to expand at a considerable CAGR during the forecast period.

- By deployment scale, the multi-station/ enterprise deployments segment led the market with a share of around 63%.

- By deployment scale, the single-station deployment segment is expected to grow at a notable CAGR during the forecast period.

Market Overview

The fire department software industry is a prominent branch of the ICT sector. This industry deals with the design and development of advanced software to enhance fire protection capabilities. This software supports fire department operations, emergency response management, dispatching, analytics, resource & personnel management, incident reporting, training compliance, and community risk reduction. It helps fire departments to improve response times, streamline workflows, ensure regulatory compliance, and enhance situational awareness through mobile applications, integrated platforms, cloud services, and analytics dashboards. The growth of the market is driven by the rising adoption of digital solutions that streamline emergency response, incident management, and resource allocation for enhanced safety and operational efficiency.

Fire Department Software Market Trends

- Partnerships: Various market players are partnering with non-profit organizations to develop advanced software for mitigating wildfires. For instance, in November 2025, OroraTech partnered with Earth Fire Alliance (EFA). This partnership aims to develop an advanced software solution for delivering protection against forest fires.

- Increasing Cases of Forest Fires: The surging cases of forest fires in different regions have increased the demand for fire department software. According to Our World in Data, there were around 53,168 cases of forest fires that occurred in Australia in 2025.

- Government Initiatives: Governments of various countries, such as the U.S., Italy, Canada, and France, are launching numerous initiatives for rising awareness about forest fires. For instance, in November 2025, the government of Austin, U.S., launched No-Ember November. No-Ember November is a new campaign designed to educate the public about wildfire risks in the U.S.

How is AI Contributing to the Fire Department Software Market?

Artificial intelligence has drastically reshaped the landscape of the software industry over the years. In the software industry, AI helps in code generation, automated testing, enhancing productivity, predictive analytics, and debugging. Nowadays, fire department software developers have started integrating AI into their platforms to enhance emergency response, routing optimization, early detection, and training of professionals. AI enables predictive analytics for fire risk assessment, optimizing emergency response routes, and automating resource allocation. It also enhances real-time decision-making during incidents, improves incident reporting accuracy, and supports data-driven strategies for fire prevention and community safety.

- In December 2025, S&I Corporation launched an AI-enabled fire safety agent. This AI-based safety solution is designed to prevent fire in the real estate and construction sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.25 Billion |

| Market Size in 2026 | USD 1.39 Billion |

| Market Size by 2035 | USD 3.77 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.70% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Deployment Mode,Software Type,Organization Size,End-User,Functionality,Pricing Model,Integration Capability,Deployment Scale, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Analysis

Deployment Mode Insights

Why Did the Cloud-Based Fire Department Software Segment Dominate the Fire Department Software Market?

The cloud-based fire department software segment dominated the market with the largest share of 62% in 2025 and is expected to continue its growth trajectory in the coming years. This is due to the surging adoption of cloud-based fire protection software by numerous industries, driven by its ability to provide real-time access to critical data, seamless collaboration across departments, and easy scalability without heavy IT infrastructure. Moreover, numerous advantages of cloud software, such as cost efficiency, scalability, flexibility, superior performance, and accessibility, have driven its adoption.

The on-premises fire department software segment is expected to expand at a notable rate during the forecast period, as organizations are prioritizing data security, full control over IT infrastructure, and compliance with local regulations. There is a significant rise in the deployment of on-premises fire management software by the emergency response agencies to reduce fire-related risks in urban areas. Moreover, several benefits of on-premises software, including high security, offline accessibility, superior customization, and advanced data control, are accelerating its adoption.

Software Type Insights

What Made Computer-Aided Dispatch (CAD) Systems the Leading Segment in the Market?

The computer-aided dispatch (CAD) systems segment led the fire department software market with a share of 29% in 2025. This is due to the surging use of computer-aided dispatch (CAD) systems in urban areas to reduce response time and identify the location of incidents. These systems streamline emergency response by enabling rapid call processing, real-time resource allocation, and efficient coordination among multiple units. The adoption of these systems has increased to improve personnel safety and enhance communication capabilities.

The mobile/field response applications segment is expected to grow at the highest CAGR between 2026 and 2035. The growth of this segment is driven by the growing application of mobile-based response software in the fire department for providing immediate access to critical information. Moreover, numerous advantages of mobile/field response applications, such as enhanced situational awareness, fast response time, and streamlined operational efficiency, are expected to foster their adoption.

Organization Size Insights

Why Did the Large Fire Departments / Municipal Agencies Segment Dominate the Fire Department Software Market?

The large fire departments / municipal agencies segment dominated the fire department software market with a major share of 55% in 2025. This is due to their strong focus on mitigating fire risks, which boosted the adoption of fire department software solutions. Additionally, the rapid investment by the municipal agencies in deploying fire safety solutions for reducing fire risks in towns is expected to sustain the continued dominance of the segment.

The medium & small fire departments segment is expected to grow at the fastest CAGR during the forecast period. This is because these departments increasingly adopt digital solutions to improve operational efficiency, incident tracking, and resource management. Affordable, scalable, and user-friendly software options allow smaller organizations to modernize their workflows, enhance emergency response, and maintain compliance without heavy IT investments.

End-User Insights

How Does the Fire & Emergency Response Agencies Segment Dominate the Fire Department Software Market?

The fire & emergency response agencies segment dominated the fire department software market with the largest share of 68% in 2025. This is due to their high investment in deploying high-quality fire monitoring software to gather information about fire damage. These agencies handle the highest volume of emergency incidents and require advanced software for dispatch, incident management, and resource coordination. Their need for real-time data, predictive analytics, and seamless communication drives extensive adoption of comprehensive fire department software solutions, ensuring faster response times and improved public safety outcomes.

The municipal/local government departments segment is expected to expand at the highest CAGR during the forecast period. This is due to the surging focus of the local governments to improve the fire safety departments. These entities increasingly invest in digital solutions to enhance public safety, improve emergency response efficiency, and ensure regulatory compliance. Adoption is driven by the need for centralized data management, real-time incident tracking, and integration across multiple civic services, helping municipalities modernize fire and emergency operations.

Functionality Insights

What Made Dispatch & Incident Management the Dominant Segment in the Fire Department Software Market?

The dispatch & incident management segment dominated the market with a share of 31% in 2025. This is because it is critical for coordinating emergency responses, allocating resources efficiently, and reducing response times. By providing real-time incident tracking, automated alerts, and centralized communication, these solutions enhance operational efficiency and ensure timely, accurate action during emergencies, making them indispensable for fire departments.

The performance analytics & reporting segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is primarily driven by the increasing adoption of reporting software by municipal corporations to monitor the risk of urban fire. Departments increasingly rely on data-driven insights to evaluate response times, resource utilization, and overall operational efficiency. Advanced analytics and reporting tools help identify areas for improvement, support compliance with regulations, and enable strategic decision-making, driving adoption across both large and small fire organizations.

Integration Capability Insights

Why is the Integrated Platforms (ERP / Public Safety Suites) Segment Dominating the Market?

The integrated platforms (ERP / Public Safety Suites) segment dominated the fire department software market with a share of 54% in 2025 and is expected to grow at the fastest rate in the coming years. This is due to the surging adoption of public safety suites by the fire departments for detecting fire risks in different areas. These platforms combine multiple functionalities, such as dispatch, incident management, resource tracking, and reporting, into a single, centralized system. This integration enhances operational efficiency, improves data visibility across departments, and reduces the need for multiple standalone solutions, making it the preferred choice for modern fire and emergency agencies.

The standalone software solutions segment is expected to expand at a significant CAGR during the projection period. This is due to the rapid deployment of standalone software solutions by municipal corporations to mitigate the risks of urban fires. Numerous advantages of standalone software solutions, including superior performance, offline functionality, advanced security, and low maintenance cost, are driving their adoption.

Pricing Model Insights

Why Did the Subscription / Saas / Recurring Revenue Segment Dominate the Fire Department Software Market?

The subscription / SaaS / recurring revenue segment dominated the market with a share of around 61% in 2025. This is due to the high use of subscription-based software by fire safety departments. Cloud-based subscription models provide continuous software updates, remote accessibility, and predictable budgeting, making them highly attractive to fire departments of all sizes seeking efficiency and flexibility. Also, collaborations among AI developers and software companies to provide subscription-based software have driven the segment.

The usage-based / transaction pricing segment is expected to grow at the fastest rate in the upcoming period. This is owing to the surging adoption of usage-based fire safety software from the industrial sector. It allows departments to pay only for the software features or services they actually use, making it cost-efficient and flexible. This model is particularly attractive to small and medium-sized fire departments or agencies with fluctuating workloads, as it reduces upfront costs while enabling access to advanced functionalities on demand.

Deployment Scale Insights

What Makes Multi-Station/ Enterprise Deployments the Leading Segment in the Fire Department Software Market?

The multi-station/ enterprise deployments segment led the fire department software market with a share of around 63% and is expected to continue its upward trajectory throughout the forecast period. This is because large agencies and municipal networks require centralized systems that can coordinate multiple stations, units, and teams simultaneously. These deployments enable seamless communication, real-time resource allocation, and consistent data management across the entire organization, improving operational efficiency and emergency response effectiveness.

The single-station deployments segment is expected to expand at a notable CAGR during the forecast period. This is because smaller or independent fire departments prefer simple, cost-effective solutions that can be quickly implemented for a single station. These deployments offer easy setup, minimal IT requirements, and focused functionality, allowing departments to modernize operations and improve response efficiency without the complexity of multi-station systems.

Regional Insights

How Big is the North America Fire Department Software Market Size?

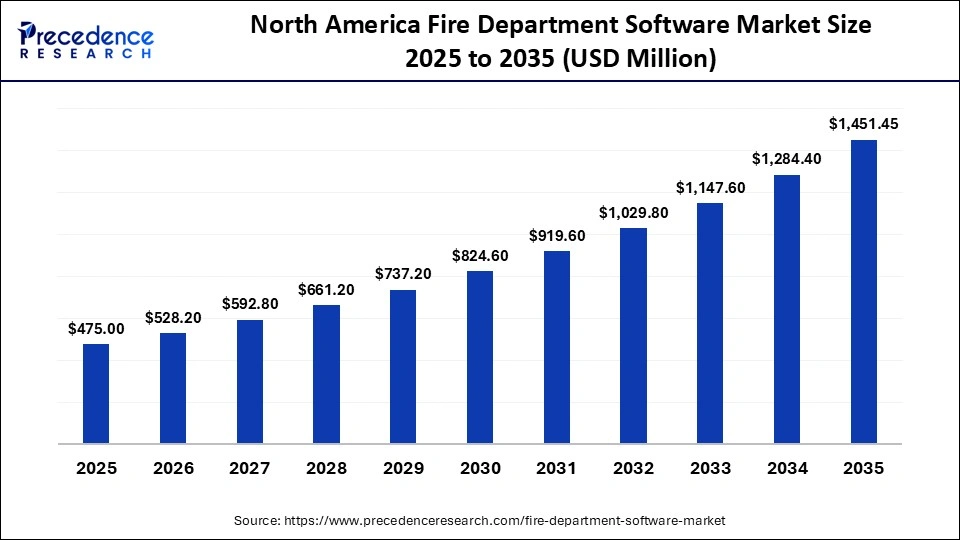

The North America fire department software market size is estimated at USD 475.00 million in 2025 and is projected to reach approximately USD 1,451.45 million by 2035, with a 11.82% CAGR from 2026 to 2035.

Why Did North America Dominate the Fire Department Software Market?

North America dominated the fire department software market, accounting for 38% in 2025. This is due to the growing demand for standalone software solutions from the local governments, as well as the rapid deployment of cloud-based fire threat detection software in the manufacturing sector. There is a strong focus on public safety, boosting the adoption of these software solutions in isolated areas. Moreover, the presence of various market players, including ImageTrend, Vector Solutions, FirePrograms Software, and StationSmarts, which are focusing on developing sophisticated software to cater to the needs of end-users, is expected to propel the growth of the market in this region.

- In February 2026, Vector Solutions launched TargetSolutions Volunteer Edition. TargetSolutions Volunteer Edition is a new range of software solutions designed for training the fire fighters in the U.S.

What is the Size of the U.S. Fire Department Software Market?

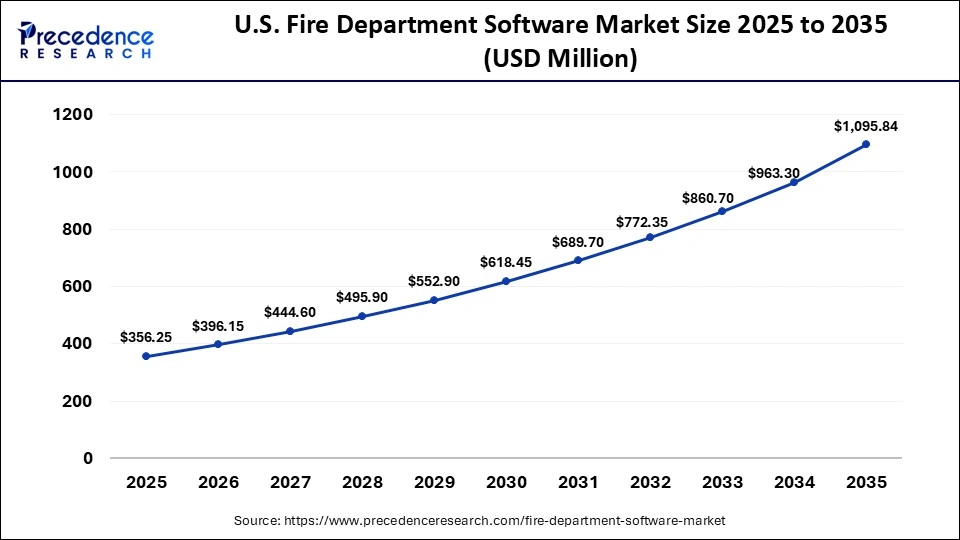

The U.S. fire department software market size is calculated at USD 356.25 million in 2025 and is expected to reach nearly USD 1095.84 million in 2035, accelerating at a strong CAGR of 11.89% between 2026 to 2035.

U.S. Fire Department Software Market Trends

The market in the U.S. is primarily driven by the rise in the number of software startups, along with the rapid investment by fire safety departments in deploying advanced software to manage fire-related operations. Also, the surging emphasis of fire & emergency response agencies to adopt training & compliance management software in their centers is expected to accelerate the market growth.

Why is Asia Pacific Considered the Fastest-Growing Region in the Market?

Asia Pacific is expected to expand at the fastest CAGR in the market during the forecast period. This is due to the increasing cases of wildfires in several countries, including India, China, South Korea, and Japan, which are increasing the demand for fire safety software. Numerous government initiatives aimed at improving the fire safety department, as well as technological advancements in the software development sector, are positively contributing to the market. Moreover, the presence of various market players such as Hochiki Corporation, Gulf Security Technology, Shenzhen Orena Technology Co., Ltd., and Insight Robotics is expected to foster the growth of the fire department software market in this region.According to Our World in Data, around 28,743 cases of wildfires occurred in India during 2025.

China Fire Department Software Market Analysis

China is one of the major contributors to the market in Asia Pacific. The growing emphasis of municipal agencies to deploy cloud-based record management software for enhancing fire safety capabilities is driving the market in China. Additionally, the surging focus of software companies to develop high-quality incident recording software is playing a prominent role in shaping the industrial landscape.

Who are the Major Players in the Global Fire Department Software Market?

The major players in the fire department software market include Accela, Adashi Systems, CivicPlus, Eaton, EPR Systems, ESO Solutions, firecloud365, FirePrograms Software, Gentex Corp., Halma, Hitachi, Tyler Technologies, United Technologies, Vector Solutions, Hochiki Corp., Honeywell International, ImageTrend, Johnson Controls, Napco Security, Nittan Company, Robert Bosch, Siemens Building Technologies, Space Age Electronics, and StationSmarts

Value Chain Analysis

- Software Development & Design: This stage involves designing and coding fire department software solutions, focusing on features like dispatch, incident management, and analytics.

Key Players: Tyler Technologies, Motorola Solutions, and Hexagon Safety & Infrastructure. - System Integration & Customization: At this stage, software is integrated with existing IT infrastructure and customized for specific departmental needs, ensuring seamless communication and workflow optimization.

Key Players: Intergraph, ZOLL Data Systems, and Firehouse Software. - Distribution & Licensing: This stage covers delivering software to fire departments through cloud-based subscriptions, SaaS, or on-premises licensing.

Key Players: Tyler Technologies, Vector Solutions, and Emergency Reporting.

Recent Developments

- In February 2026, FireSat launched orbit-visualization software. This orbit visualization software is designed to help firefighters worldwide.

(Source: https://spacenews.com) - In November 2025, Inim Electronics launched FireDesigner. FireDesigner is a new software designed for fire safety professionals to enhance efficiency.

(Source: https://www.sourcesecurity.com) - In August 2025, Ladris Technologies launched FuelsRx. FuelsRx is an advanced software designed to mitigate wildfire risks.

(Source: https://www.ladris.com)

Segments Covered in the Report

By Deployment Mode

- Cloud-based Fire Department Software

- On-premise Fire Department Software

By Software Type

- Computer-Aided Dispatch (CAD) Systems

- Records Management Systems (RMS)

- Incident Reporting & Documentation Software

- Mobile / Field Response Applications

- Training & Compliance Management Software

- Analytics & Reporting Dashboards

By Organization Size

- Large Fire Departments / Municipal Agencies

- Medium & Small Fire Departments

By End-User

- Fire & Emergency Response Agencies

- Municipal / Local Government Departments

- Commercial / Industrial Fire Safety Teams

- Training Academies & Public Safety Institutes

By Functionality

- Dispatch & Incident Management

- Personnel Scheduling & Resource Allocation

- Training & Certification Tracking

- Maintenance & Equipment Logs

- Performance Analytics & Reporting

- Other Functionalities

By Integration Capability

- Standalone Software Solutions

- Integrated Platforms (ERP / Public Safety Suites)

By Pricing Model

- Subscription / SaaS / Recurring Revenue

- Perpetual Licensing

- Usage-based / Transaction Pricing

By Deployment Scale

- Single-Station Deployments

- Multi-Station / Enterprise Deployments

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting