Fire Insurance Market Size and Forecast 2025 to 2034

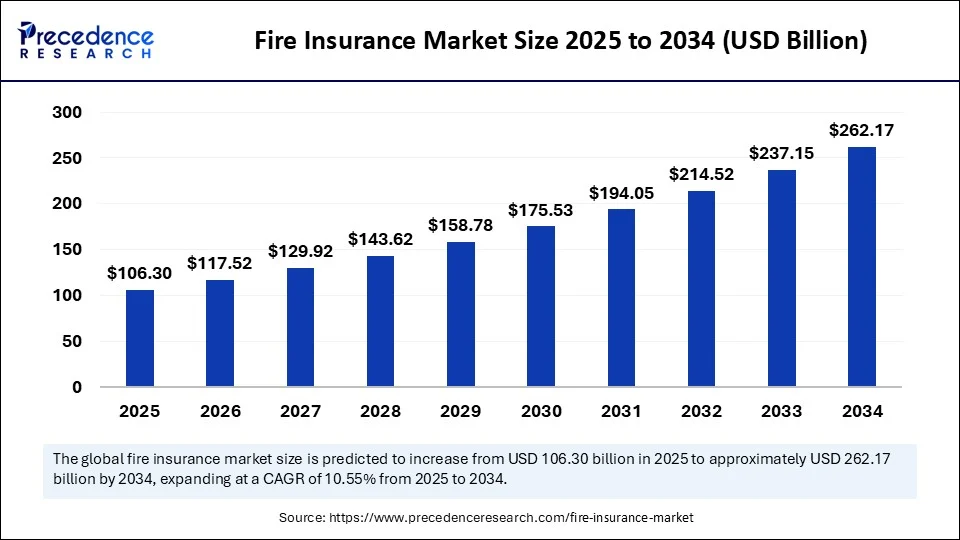

The global fire insurance market size accounted for USD 96.16 billion in 2024 and is predicted to increase from USD 106.3 billion in 2025 to approximately USD 262.17 billion by 2034, expanding at a CAGR of 10.55% from 2025 to 2034. The market is experiencing rapid growth due to increasing industrialization, along with the rising use of electronic devices and climate change effects.

Fire Insurance MarketKey Takeaways

- In terms of revenue, the global fire insurance market was valued at USD 96.16 billion in 2024.

- It is projected to reach USD 262.17 billion by 2034.

- The market is expected to grow at a CAGR of 10.55% from 2025 to 2034

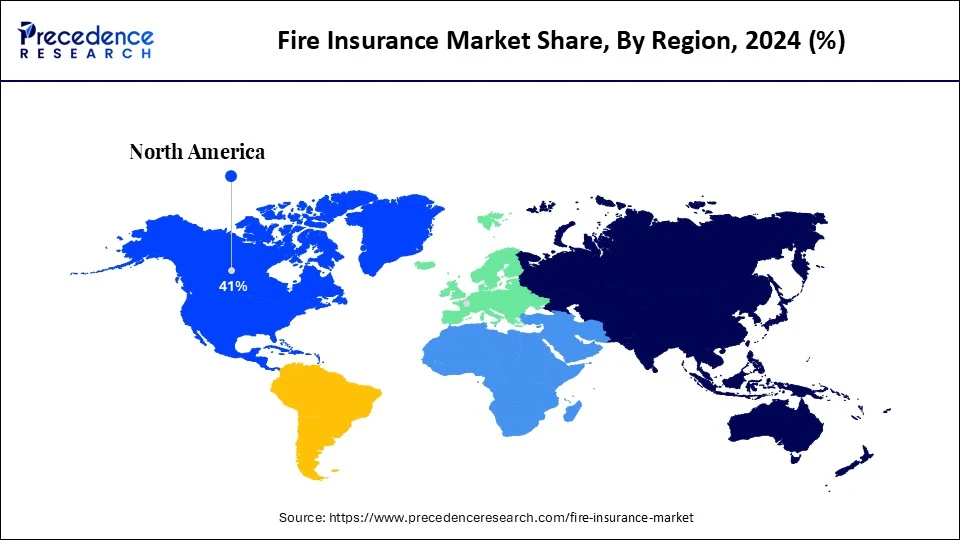

- North America dominated the fire insurance market with the largest share of 41% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By coverage type, the property fire insurance segment contributed the biggest market share 2024.

- By coverage type, the business interruption insurance segment is expected to expand with the fastest CAGR in the coming years.

- By property type, the commercial property segment generated the major market share 2024.

- By property type, the industrial property segment is predicted to grow at the fastest CAGR in the upcoming period.

- By policy term, the annual policies segment held the highest market share 2024

- By policy term, the multi-year policies segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By deductibility, the high-deductible fire insurance segment captured the largest market share in 2024.

- By deductibility, the low-deductible fire insurance segment is expected to grow at the fastest CAGR in the coming years.

- By distribution channel, the brokers segment led the market in 2024.

- By distribution channel, the captive agents segment is expected to expand at the fastest CAGR during the forecast period.

AI Impact on the Fire Insurance Market

Artificial intelligence helps in the precise assessment of risk at specific locations, leveraging historical data. These insights enable the calculation of accurate premiums for each location. AI-powered tools automate claims from initial notification to settlement, leading to faster processing with reduced human intervention and more accurate verification. Insurance fraud is a key challenge in the fire insurance market. However, AI-powered software tools have significantly improved the detection of fraudulent claims by analyzing patterns and identifying anomalies that might be overlooked by human investigators. AI-powered data analytics tools enable insurance businesses to analyze vast data, extracting key insights for business strategies, product development, and risk assessment, influencing insurance premiums. These tools also facilitate dynamic policy pricing, helping companies stay competitive, meet customer needs, and create effective insurance solutions.

U.S. Fire Insurance Market Size and Growth 2025 to 2034

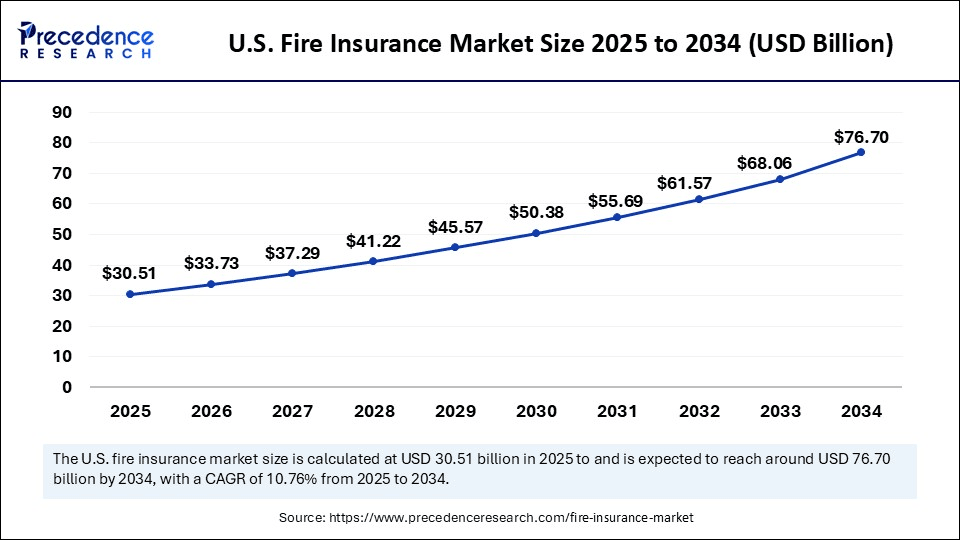

The U.S. fire insurance market size was exhibited at USD 27.60 billion in 2024 and is projected to be worth around USD 76.70 billion by 2034, growing at a CAGR of 10.76% from 2025 to 2034.

What Made North America the Dominant Region in the Fire Insurance Market?

North America registered dominance in the market by holding the largest share in 2024. The region's dominance is mainly attributed to high asset valuation and stringent government regulations regarding safety. There is a high level of awareness regarding fire safety precautions, boosting the adoption of fire insurance coverage. The region's robust industrial base and continuous construction activities further contribute to the region's dominance.

The U.S. is a major player in the market. Many large commercial, real estate, and industrial infrastructures are opting for fire insurance. The U.S. government has enforced stringent regulations regarding the adoption of fire insurance coverage. The general public in this country is relatively more aware of fire safety and fire insurance policies, which contributes to market growth.

Why Asia Pacific is Growing Rapidly in the Merket?

Asia Pacific is the fastest-growing region in the fire insurance market. Rapidly growing economic activity in this region is leading to the growth of industrial and urban infrastructure. Ongoing construction projects and the rising risks of fire due to climate change are supporting market growth. China, India, and Southeast Asian countries are experiencing a abrupt surge in the adoption of fire insurance. Increasing per capita income and rising awareness of fire safety and insurance for financial loss protection contribute to market growth. Digitization of insurance services has increased public accessibility, and the adoption process has become convenient with technology. Educational campaigns for fire insurance awareness show significant impact, increasing fire insurance adoptions in the region.

What Opportunities Exist in the European Fire Insurance Market?

Europe is expected to grow at a notable rate in the upcoming period. This is mainly due to the increasing awareness of the importance of fire insurance, particularly in recovering financial losses and as a safety net against uncertain incidents like fire. Governments around the region have also imposed stringent safety regulations, boosting the adoption of fire insurance among businesses. The European fire insurance market is relatively stable and mature, showing stable growth.

Market Overview

Similar to property insurance, fire insurance covers the losses caused due to fire. Fire insurance provides coverage for the belongings from fire and natural calamities such as forest fires, thunderstorms, etc. An increasing number of properties on a global level is contributing to the increased adoption of fire insurance policies. Rapid development of infrastructure in urban and industrial areas is increasing the potential for fire breakouts, which is significantly contributing to the growth of the fire insurance market. Considering this increased threat, just to ensure protection against any such kind of incident, majority of people are considering purchasing fire insurance. One of the notable factors boosting the growth of the market is the rising awareness regarding the benefits of fire insurance.

Fire Insurance MarketGrowth Factors

- The growth of urban infrastructure, industrial development, and increased technology use have led to more frequent fire incidents, boosting the growth of the market.

- Climate change and rising temperatures have increased the risk of wildfires, which are creating a greater need for fire insurance.

- People have become more aware of having fire insurance to reduce financial losses, contributing to market growth.

- Insurance companies are offering new, affordable policies with wider coverage to reach more customers, including homeowners, SMEs, and high-net-worth individuals, with various policies available.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 262.17 Billion |

| Market Size in 2025 | USD 106.3 Billion |

| Market Size in 2024 | USD 96.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Coverage Type, Property Type, Policy Term, Deductible, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Uncertainty of Fire Incidents and the Requirement for Financial Protection of Valuable Assets

In recent times, various natural calamities such as wildfires, lightning, storms, cyclones, tornadoes, and typhoons have resulted in substantial damage to properties. This has emphasized the importance of fire insurance among the public. People are considering fire insurance as a backup and protection strategy against these kinds of uncertainties.

Insurance providers are responding to the growing need by enhancing their products with added coverages to maintain their market position. Climate change forecasts indicate a potential increase in fire incidents due to rising global temperatures and intense heat waves, especially during the summers of 2023 and 2024, which were among the hottest in recent history. Simultaneously, expanding economies have led to a significant rise in asset values, amplifying the potential for substantial financial losses. This makes it crucial to implement protective measures like fire insurance. These combined factors are fueling the market's expansion and are projected to persist in the future.

Restraint

Lack of Awareness Regarding the Fire Insurance Policies

A major obstacle in the fire insurance market is the public's limited understanding of fire insurance policies. This issue must be addressed by educating consumers about these policies through various media channels. The industry faces challenges such as complex insurance documentation that the general public may not easily understand. Traditional communication methods may not effectively reach and inform the target audience. Many people assume that existing property protection covers major fire-related disasters, but many policies may not cover significant losses, with some only covering basic damages.

Opportunity

Use of technology and Data Analytics Tools

The emergence of advanced technologies creates immense opportunities in the fire insurance market. Technologies like big data analytics are employed to determine precise and dynamic premiums based on conditions, location, and historical data. These data-driven insights enable the creation of personalized products tailored to various customer segments through accurate assessment. The integration of blockchain technology has enhanced transparency, security, and efficiency in insurance operations, proving highly effective in expediting claim settlements and preventing fraud.

Insurance companies are increasingly using advanced analytics to develop effective products based on market needs. These technologies enable the creation of highly customized products for diverse customer segments, including homeowners, business owners, and high-net-worth individuals. This technological advancement significantly contributes to market growth by offering efficient services to customers.

Coverage Type Insights

Why Did the Property Fire Insurance Segment Dominate the Fire Insurance Market in 2024?

The property fire insurance segment dominated the market with the highest share in 2024. The primary reason behind the dominance of this segment is its wide applicability and fundamental nature. It provides essential coverage for property damage caused by fire, including structural damage, loss of contents, and other basics. Many regions have mandated the purchase of insurance, making this category a leader in essential insurance purchases.

The business interruption insurance segment is expected to grow at the highest CAGR in the upcoming period. The increasing demand for financial protection against uncertainties and economic stability in businesses is driving the growth of this segment. The use of automation and technology-driven equipment increases the risk of fire incidents and significant financial losses. To mitigate financial losses and provide protection against unforeseen events, most businesses consider fire insurance a basic necessity.

Property Type Insights

What Made Commercial Properties the Dominant Segment in 2024?

The commercial properties segment dominated the fire insurance market with the biggest share in 2024. The high value of commercial real estate increases the risk of substantial financial losses from fire incidents. High-rise buildings, offices, hotels, and retail spaces involve significant investments beyond the real estate itself. The risk-benefit analysis for purchasing insurance in this segment is very high, making it essential for commercial property owners to have suitable fire insurance policies, which leads to the dominance of this segment.

The industrial property is the fastest-growing segment in the market. Increased industrial growth is driving the growth of this segment. The industrial sector inherently faces various fire risks across industries like manufacturing, chemicals, and energy. Machinery and equipment generate significant heat, and high-voltage electricity is common in industrial areas, making them prone to fires, especially in summer. Such incidents are common, making it essential for industries to have fire insurance.

Policy TermInsights

How Does the Annual Policies Segment Dominate the Fire Insurance Market?

The annual policies segment dominated the market with a major revenue share in 2024. This is mainly due to the increased demand for affordable policies. Annual fire insurance policies are relatively affordable, flexible, and simple to understand due to their lower complexity. They offer full coverage for a year without long-term commitments or high upfront premiums, which can be a disadvantage of long-term policies.

The multi-year policies segment is expected to grow at the fastest rate in the upcoming period. The growth of the segment is attributed to the increased awareness of fire incidents due to factors like climate change and the rise of electrical devices in homes, offices, and industries. There is a high adoption of automation systems among industries to replace manual labor, which are prone to electrical short circuits and fires, leading to financial losses. To ensure financial safety and business stability, businesses are increasingly opting for multi-year policies. The rising awareness of long-term benefits of multi-year policies is boosting the growth of the segment.

DeductibleInsights

What Made High-Deductible Fire Insurance the Dominant Segment in the Market in 2024?

The high-deductible fire insurance segment dominated the fire insurance market with the largest share in 2024. The dominance of this segment is attributed to the lower premiums of policies with high deductibles, making them popular for individuals and businesses seeking economical insurance solutions. This segment caters to consumers looking for insurance with smaller premiums for various reasons.

The low-deductible fire insurance segment is experiencing the fastest growth in the market. Its affordability and wide applicability make it the preferred choice. This low-deductible fire insurance segment offers a basic level of protection. Many property owners, especially those with lower-value assets seeking cost-effective insurance, boosting the adoption of low-deductible fire insurance.

Distribution Channel Insights

Why Did the Brokers Segment Dominate the Fire Insurance Market in 2024?

The brokers segment dominated the market with a maximum share in 2024. The complex processes in insurance documents is often difficult for the average user to understand. Brokers play a crucial role in bridging this gap, offering expert advice to help consumers make informed decisions and navigate the policy process, including necessary documentation. Users are often unaware of the intricate process that needs to be followed. Even during the making of the policy, brokers help consumers to follow the process and do the necessary documentation.

The captive agents segment is expected to witness the fastest growth in the coming years. Increased awareness regarding fire insurance, along with the rise of bancassurance, where many insurance products are sold through banks, is evident. Captive agents are embedded within banking operations and work with the sales process of insurance products, coupled with similar and convenient purchases of relevant financial solutions, particularly in banks and financial institutions. As the complexity of the insurance landscape continuously grows, and a wide range of products are continuously entering the market, captive agents, dedicated to a specific insurer, hold in-depth knowledge and help provide personal advice for consumers, based on their requirements, aiding in financial planning and management.

Recent Developments

- In June 2025, BimaPay Finsure launched India's first premium financing solution for corporate insurance, enabling businesses to pay premiums in easy EMIs instead of upfront lump sums. The offering covers group medical, fire, and personal accident insurance across sectors such as IT, logistics, healthcare, and manufacturing. The company aims to finance over ₹20 crore worth of premiums by the end of FY26.

(Source: https://www.cnbctv18.com) - In May 2025, IFFCO-Tokio announced the launch of ‘Comprehensive Home Protector', a home insurance product that covers the risk of loss/ damage of physical assets, interests, liabilities of the Insured and their family making no insurance gap. The insurance product comes with de-bundled fire coverage and insured can choose ‘Basic Fire Cover', besides opting for other natural and human-made disasters/sections as additional coverage, such as earthquake, storm, cyclone typhoon, tempest, hurricane, tornado, tsunami, floods, inundation, lightening, landslide, and act of terrorism, riots, strikes, malicious damage bush fire, forest fire, damage resulting from action of civic authorities etc.

(Source: https://www.tripurastarnews.com)

Fire Insurance Market Companies

- Allstate Insurance Company

- Travelers Companies, Inc.

- Tokio Marine Nichido Fire Insurance Co., Ltd.

- Generali Group

- The Hartford Financial Services Group, Inc.

- Zurich Insurance Group Ltd

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Ping An Insurance (Group) Company of China, Ltd.

- Munich Reinsurance Company

- Allianz SE

- Farmers Insurance Group of Companies

- Chubb Ltd.

- AXA SA

- Liberty Mutual Insurance Group, Inc.

Segments Covered in the Report

By Coverage Type

- Property Fire Insurance

- Business Interruption Insurance

- Commercial Fire Insurance

- Industrial Fire Insurance

- Residential Fire Insurance

By Property Type

- Commercial Property

- Industrial Property

- Residential Property

By Policy Term

- Annual Policies

- Multi-Year Policies

- Short-Term Policies

By Deductible

- High-Deductible Fire Insurance

- Low-Deductible Fire Insurance

By Distribution Channel

- Brokers

- Captive Agents

- Direct Writers

- Independent Agents

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting