Fluorescence Imaging Systems Market Size and Forecast 2025 to 2034

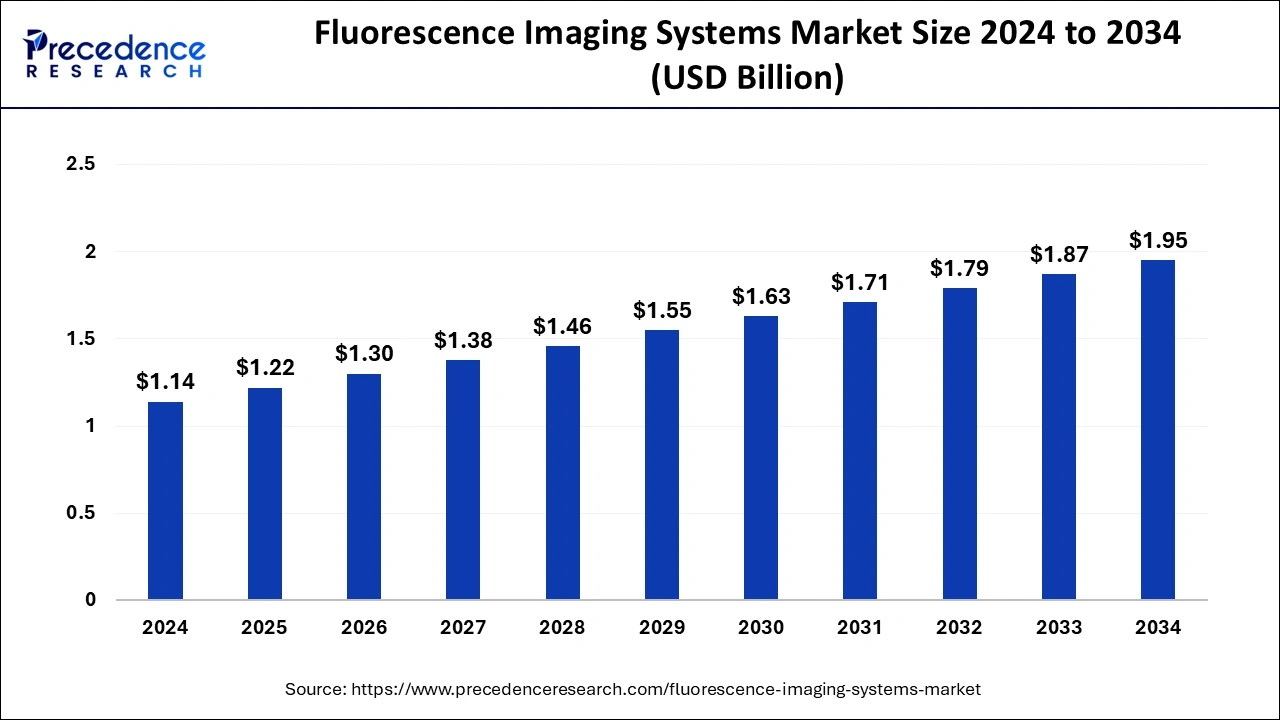

The global fluorescence imaging systems market size was calculated at USD 1.14 billion in 2024 and is predicted to increase from USD 1.22 billion in 2025 to approximately USD 1.95 billion by 2034, expanding at a CAGR of 5.51% from 2025 to 2034.

Fluorescence Imaging Systems MarketKey Takeaways

- The global fluorescence imaging systems market was valued at USD 1.14 billion in 2024.

- It is projected to reach USD 1.95 billion by 2034.

- The market is expected to grow at a CAGR of 5.51% from 2025 to 2034.

- North America held the largest share of the market in 2024.

- Asia Pacific is expected to witness the fastest rate of growth during the forecast period.

- By type, the upright fluorescence microscopy segment held the largest segment of the fluorescence imaging systems market in 2023. The segment is expected to sustain the position throughout the forecast period.

- By type, the inverted fluorescence imaging segment is expected to grow at a significant rate during the forecast period.

- By technology, the wide-field imaging segment dominated the market in 2024.

- By technology, the total internal reflection fluorescence imaging segment is expected to grow at a notable rate.

- By component, the equipment segment dominated the market in 2024.

- By component, the software consumables segment is expected to grow at a notable rate.

- By end user, the research laboratories segment held the largest share of the market in 2024.

- By end user, the diagnostics centers segment is expected to grow at a notable rate.

Market Overview

The fluorescence imaging systems market encompasses specialized technology used in various scientific and medical applications to capture and visualize fluorescence signals emitted by fluorophores. Fluorophores are molecules that can absorb light at a specific wavelength and re-emit it at a longer wavelength. This phenomenon is commonly used in fields such as biology, chemistry, and medicine for imaging cellular structures, studying molecular interactions, and detecting specific molecules. These systems typically include components such as light sources, filters, detectors, and cameras, all optimized for capturing and analyzing fluorescence signals. The market serves a wide range of industries and research disciplines, including life sciences, medical diagnostics, drug discovery, and materials science.

Fluorescence Imaging Systems Market Data and Statistics

- In Journal of Biophotonics published in January 2024, according to the research article, it proposed an innovative in vivo cortical fluorescence image restoration approach and provide deep learning for high-fidelity brain imaging denoising and inpainting.

- The U.S. FDA currently reviewing Fluorescence imaging system may improve cancer care. According to them a handheld imaging probe may support surgeons detect residual cancer after surgery with a contrast agent.

Fluorescence Imaging Systems Market Growth Factors

- Continuous advancements in fluorescence imaging technologies, such as improvements in sensitivity, resolution, and speed, contribute to the growth of the fluorescence imaging systems market. Innovations in detectors, cameras, and imaging software enhance the overall performance of fluorescence imaging systems.

- The use of fluorescence imaging systems is widespread in life sciences, including cell biology, molecular biology, and neuroscience. As research in these fields expands, there is an increasing demand for advanced imaging tools, boosting the growth of the fluorescence imaging systems market.

- Fluorescence imaging is employed in medical diagnostics for applications such as cancer detection, surgical guidance, and molecular imaging. The adoption of fluorescence-based techniques in medical imaging contributes to the market's growth, driven by the need for accurate and non-invasive diagnostic tools.

- Fluorescence imaging systems play a crucial role in drug discovery and development processes. They are used for high-throughput screening, target identification, and monitoring cellular responses to potential drug candidates. The pharmaceutical industry's focus on developing new therapies fuels the demand for advanced imaging systems.

- Ongoing research and development activities in various scientific disciplines create a demand for sophisticated imaging tools. Fluorescence imaging systems are essential for researchers studying cellular processes, protein interactions, and other molecular activities.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.51% |

| Market Size in 2025 | USD 1.22 Billion |

| Market Size by 2034 | USD 1.95 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, Component, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Non-invasive nature of fluorescent imaging

- In November 2023, OptoMedic Technologies Inc. introduced its Stellar 4K3D fluorescence endoscopy imaging platform. It is a high-end medical device for minimally invasive surgery, endoscopes have developed rapidly in the field of 3D, 4K, and fluorescence subdivided technologies.

The non-invasive nature of fluorescence imaging emerges as a compelling driver fueling the growth of fluorescence imaging systems market. In fields such as medicine and biology, the ability to capture detailed images without invasive procedures is invaluable for studying dynamic processes within living organisms. In medical diagnostics, the non-invasive nature of fluorescence imaging is particularly advantageous, offering a safer and more patient-friendly alternative to traditional invasive diagnostic procedures.

It facilitates procedures like intraoperative imaging, where surgeons can visualize and precisely target specific tissues or tumors without the need for extensive incisions. This characteristic is crucial for reducing patient discomfort, minimizing the risk of complications, and expediting recovery times. The demand for fluorescence imaging systems is propelled by the increasing recognition of the significance of non-invasive imaging in both research and clinical applications, underscoring the technology's role in advancing scientific knowledge, improving diagnostic accuracy, and enhancing patient care.

Restraint

High cost of equipment

The fluorescence imaging systems market faces a significant challenge due to the high cost of equipment, potentially restraining widespread demand. The initial investment required for acquiring fluorescence imaging systems can be a deterrent, particularly for research institutions, smaller laboratories, and healthcare facilities operating with limited budgets. The financial constraints may hinder the accessibility of these advanced imaging tools, limiting their adoption in environments where cost considerations play a crucial role in decision-making.

Moreover, the high cost of equipment not only impacts the affordability for end-users but also influences the economic feasibility of large-scale implementation across various industries. Researchers and clinicians may face challenges in securing funding for the acquisition and maintenance of fluorescence imaging systems, impacting the pace of technological adoption.

Opportunity

Increasing use of fluorescent imaging in research and development

Researchers across diverse scientific disciplines, from biology to materials science, are increasingly leveraging fluorescent imaging techniques to gain intricate insights into cellular and molecular processes. The versatility of fluorescence imaging systems enables scientists to visualize and analyze dynamic interactions within living cells and organisms with high precision and sensitivity. In drug discovery and development, fluorescence imaging plays a pivotal role by facilitating high-throughput screening, monitoring cellular responses to candidate compounds, and aiding in the identification of potential therapeutic targets. The ability to track molecular and cellular dynamics in real-time provides a crucial advantage in understanding complex biological mechanisms. Additionally, in fields like materials science, fluorescence imaging is employed for studying material properties and behaviors at the microscopic and nanoscopic levels.

Type Insights

The upright fluorescence microscopy segment dominated the fluorescence imaging systems market in 2024; the segment is observed to continue the trend throughout the forecast period. Upright fluorescence microscopy features a configuration where the objective lens is positioned above the specimen, while the light source and condenser are situated below. This setup is commonly used for imaging thick specimens, such as tissue sections or larger biological samples. Upright fluorescence microscopy is prevalent in applications like histology, pathology, and neuroscience research, where the examination of tissue structures and complex specimens is essential.

The inverted fluorescence microscopy segment is expected to grow at a significant rate throughout the forecast period. Inverted fluorescence microscopy involves a configuration where the objective lens is positioned below the specimen, while the light source and condenser are situated above it. This setup is particularly useful for imaging cells or biological specimens cultured in dishes or multi-well plates. In life sciences research, inverted fluorescence microscopy is often employed for observing living cells, cell cultures, and dynamic cellular processes. The design allows for easy manipulation and intervention during live-cell imaging experiments.

- In April 2019, Olympus launched an inverted imaging platform, IXplore, that provides high-quality fluorescence imaging and aimed to fast-track results and research.

Technology Insights

The wide-field fluorescence imaging segment held the largest share of the fluorescence imaging systems market in 2024. Wide-field fluorescence imaging involves illuminating the entire specimen with excitation light and capturing the emitted fluorescence across the entire field of view. This technique is known for its speed and sensitivity, making it suitable for applications such as live-cell imaging and high-throughput screening. Wide-field imaging is valuable when a large area of the sample needs to be observed, making it a versatile choice in various biological and medical research settings.

The total internal reflection fluorescence (TIRF) imaging segment is expected to generate a notable share in the fluorescence imaging systems market. TIRF imaging is a specialized technique that utilizes total internal reflection of light to selectively illuminate a thin section near the specimen surface. This results in high spatial resolution and reduced background fluorescence, making it particularly useful for imaging events at or near the cell membrane. TIRF imaging is widely employed in studies related to cell adhesion, membrane dynamics, and single-molecule fluorescence.

Component Insights

The equipment segment held the dominating share of the fluorescence imaging systems market in 2024. The segment encompasses the physical instruments and hardware required for fluorescence imaging. This includes the imaging systems themselves, comprising components such as light sources, filters, detectors, cameras, and optical lenses. The equipment is designed to capture, visualize, and analyze fluorescence signals emitted by fluorophores in biological or material samples. This segment represents the tangible and often high-tech hardware that constitutes the core of fluorescence imaging systems.

The software consumables segment is expected to generate a notable share in the market during the forecast period. The segment includes the software applications and tools essential for data analysis, image processing, and system control. Fluorescence imaging software facilitates tasks such as image acquisition, processing, and quantification of fluorescence signals. It plays a crucial role in extracting meaningful information from raw imaging data. Additionally, software consumables may include updates, add-ons, and modules that enhance the capabilities of fluorescence imaging systems.

End User Insights

The research laboratories segment held the largest share of the fluorescence imaging systems market in 2024. Research laboratories constitute a significant end-user segment for fluorescence imaging systems. These laboratories, typically associated with academic institutions, biotechnology companies, and research organizations, leverage fluorescence imaging for a wide range of scientific studies. It includes applications in cell biology, molecular biology, neuroscience, drug discovery, and other research disciplines.

The diagnostics centers segment is expected to generate a notable revenue share in the market. Diagnostics centers specifically dedicated to medical imaging and diagnostics form another essential end-user category. Fluorescence imaging plays a role in diagnostic imaging, especially in techniques like fluorescence in situ hybridization (FISH) for genetic analysis and pathology-related examinations. Diagnostics centers leverage fluorescence imaging for accurate and detailed assessments of biological samples.

Regional Insights

North America led the global market with the highest market share in 2024. due to its advancements in research and healthcare, well-established infrastructure, and a robust presence of key market players. The region has a strong emphasis on innovation and technology adoption across various industries, contributing to the growth of the fluorescent imaging market.

Additionally, the North America, particularly the United States, is a hub for biomedical research and life sciences. Fluorescent imaging systems play a crucial role in studying cellular and molecular processes, leading to a high demand for advanced imaging technologies in research institutions, universities, and biotechnology companies.

Asia-Pacific is expected to witness the fastest rate of growth during the forecast period due to various factors such as increasing research and development activities, growing healthcare infrastructure, and the adoption of advanced imaging technologies in various countries across the region. The expansion and modernization of healthcare infrastructure in countries like China, India, Japan, and South Korea contribute to the demand for diagnostic and imaging technologies, including fluorescent imaging systems. The emphasis on advanced medical equipment enhances the market prospects.

Meanwhile, Europe is growing at a notable rate in the fluorescence imaging systems market driven by advancements in medical research, healthcare infrastructure, and the presence of key players in the imaging technology sector. Europe exhibits a strong commitment to scientific research and technological innovation, contributing to the growth of the fluorescent imaging market.

Recent Developments

- In October 2023, Lambert Instruments launched its camera-based Fluorescence Lifetime Imaging Microscopy (FLIM) turnkey vision system, LIFA vTAU. It features a single photon avalanche diode (SPAD) detector that can capture up to 100 lifetime images per second, and provide multiple image modes, consisting time-lapse recordings and regular frequency domain FLIM.

- In June 2021, CytoSmart Technologies launched Lux3 FL Duo Kit and the Multi Lux3 FL, two new fluorescence live-cell imaging systems. The launch helps in aiming to offer and develop versatile and flexible solutions to life scientists.

- In September 2023, Nikon Corporation (Nikon) launched ECLIPSE Ji, a smart imaging system which utilizes AI to analysis of cellular images and automate the acquisition, streamlining research workflows involving nerve and cancer disease.

Fluorescence Imaging Systems Market Companies

- Amscope

- Anmo Electronics Corp.

- Bruker Corp.

- Cairn Research Ltd.

- Chongqing Coic Industrial Co. Ltd.

- Delmic B.V.

- Doric Lenses Inc.

- Edmund Optics Inc.

- Etaluma Inc.

- Euromex Microscopen BV

Segments Covered in the Report

By Type

- inverted fluorescence microscopy

- upright fluorescence microscopy

By Technology

- Wide-field imaging

- Total internal reflection fluorescence imaging

- Confocal imaging

By Component

- Equipment

- Software Consumables

By End User

- Research Laboratories

- Hospitals

- Diagnostics Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting