What is the Foley Catheters Market Size?

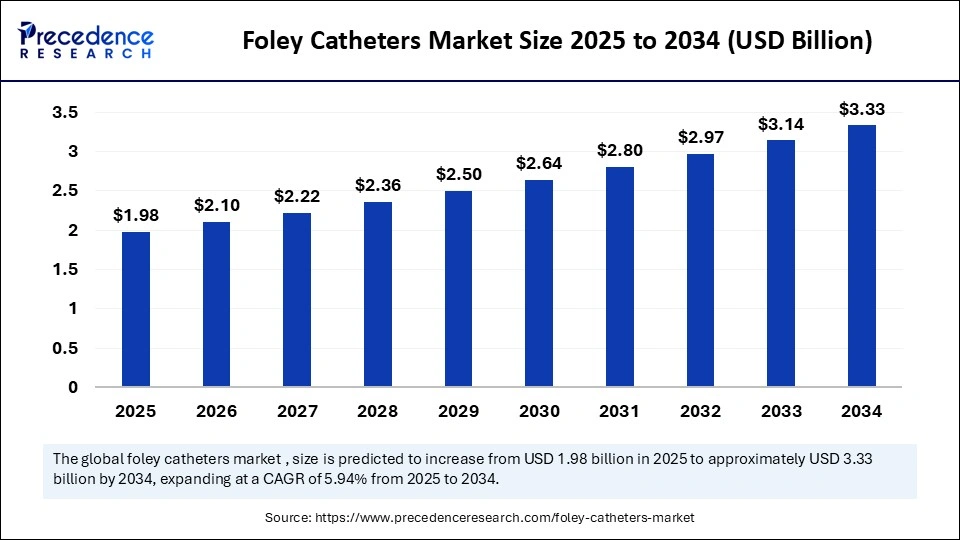

The global foley catheters market size is calculated at USD 1.98 billion in 2025 and is predicted to increase from USD 2.10 billion in 2026 to approximately USD 3.33 billion by 2034, expanding at a CAGR of 5.94% from 2025 to 2034.The growth of the Foley catheters market is driven by rising prevalence of urological disorders, growing elderly population, and increasing demand for long-term urinary catheterization in hospitals and home care settings.

Market Highlights

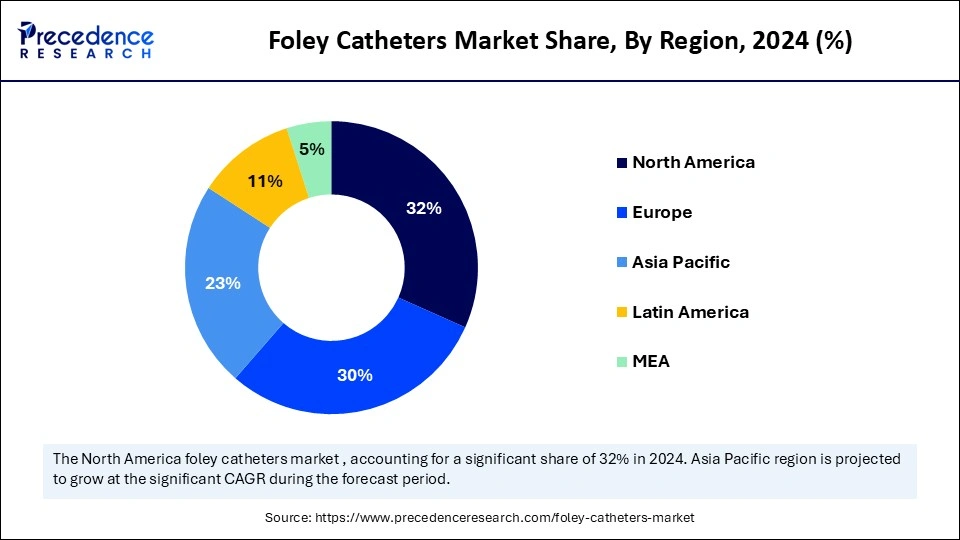

- North America dominated the Foley catheters market with the largest market share of 32% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast years.

- By product type/material, the latex Foley catheters segment captured the biggest market share in 2024.

- By product type/material, the hydrophilic coated Foley catheters segment is expected to grow at the fastest CAGR over the forecast period.

- By size & configuration, the male/standard adult sizes segment contributed the highest market share in 2024.

- By size & configuration, the female/pediatric sizes segment is anticipated to show considerable growth over the forecast period.

- By sterility & single-use vs reusable, the sterile, single-use Foley catheters segment led the market in 2024.

- By sterility & single-use vs reusable, the reusable/re-sterilizable Foley catheters segment is anticipated to show considerable growth in the market over the forecast period.

- By application/indication, the short-term use segment held a significant share in 2024.

- By application/indication, the long-term use segment is expected to grow at the highest CAGR over the projection period.

- By end-user/customer segment, the hospitals/clinics segment generated the major market share in 2024.

- By end-user/customer segment, the home care & long-term care facilities segment is anticipated to expand at a rapid pace in the upcoming period.

Market Size and Forecast

- Market Size in 2024: USD 1.87 Billion

- Market Size in 2025: USD 1.98 Billion

- Forecasted Market Size by 2034: USD 3.33 Billion

- CAGR (2025-2034): 5.94%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are Foley Catheters?

The Foley catheters market is significantly growing as the world is experiencing an increasing number of the geriatric population who are more prone to urinary tract infection, incontinence, as well as prostate enlargement. An indwelling urinary catheter, also known as a Foley catheter, is a flexible tube inserted into the bladder to facilitate the continuous drainage of urine. It is made in a balloon shape at the tip, which can be filled with sterile water to keep the catheter in place, ensuring the urine flow remains intact. Foley catheters are available in various sizes and are applied according to the patient's medical condition. They are regularly utilized in hospitals, nursing homes, and home care settings, especially when patients are affected with urinary retention, post-operative complications, or neurological disorders that affect the ability of the bladder to empty.

The growing number of urological cases, including benign prostatic hyperplasia (BPH), urinary incontinence, and bladder obstruction, is one of them, requiring a long-term urinary management solution. The increase in the number of surgeries, particularly in urology, gynecology, and oncology, is another factor driving market growth, as Foley catheters are often used during and after these procedures. The use of technological advancements, including antimicrobial-coated Foley catheters, has improved patient safety by preventing catheter-associated urinary tract infections, thereby increasing adoption.

What Factors are Fueling the Growth of the Foley Catheters Market?

- Increasing Prevalence of Urological Disorders: The rising levels of urinary incontinence, bladder obstruction, as well as benign prostate hyperplasia are increasing the demand for Foley catheters. Such situations are especially prevalent among the aging population, which predicts a stable, high demand for long-term catheterization and the sustained growth of the global markets.

- Technological Advancements: Some technological innovations, such as antimicrobial-impregnated and hydrophilic Foley catheters, are enhancing patient safety and reducing the rates of catheter-associated urinary tract infections. These technological advancements enhance integration among healthcare providers, and treatment outcomes also improve, which spurs a rapid expansion of the Foley catheters market worldwide.

- Home Healthcare Expansion: The increasing trend toward home-based patient care is accelerating the use of Foley catheters outside hospitals. Cost-effectiveness, convenience, and improved accessibility of medical equipment for home-based treatment of chronic diseases are key forces driving market growth, especially in areas where healthcare facilities are expanding and more people are becoming aware of these options.

Foley Catheters Market Outlook

- Market Growth Overview: The market is poised for rapid growth between 2025 and 2034, as hospitals, clinics, and home care settings are increasingly seeking competent urinary management devices. Antimicrobial coatings and smart catheters, which enhance patient safety, reduce the risk of infections, and improve clinical outcomes, are further innovations that will help the company continue to expand its market presence in both developed and emerging economies.

- Global Expansion: The Foley catheters market is growing worldwide, enabling manufacturers to reach underserved regions with growing healthcare needs, especially in Asia-Pacific, Latin America, and Africa. This broader market reach boosts product availability, improves patient access to care, and drives demand through enhanced distribution and localized manufacturing.

- Major Investors: The main players in the Foley catheters business include manufacturers of medical devices, private equity firms, and venture capital funds specializing in urology. Such prominent investors include Becton Dickinson (BD), Teleflex, and Hollister Incorporated, which have contributed to innovations such as modern and antimicrobial Foley catheters around the world.

- Startup Ecosystem: The Foley catheter's new business setting is expanding with emphasis on patient-friendly, technologically sophisticated, and home-care-based solutions. Cogentix Medical, Medline Industries, and UroGen Pharma are among the key startups partnering with hospitals and other established firms to expand production and address the growing global needs for urinary care.

Key Technological Shifts in the Foley Catheters Market

Smart catheters powered by AI are on the rise and can be used to track urine flow, identify infections, and notify healthcare providers about abnormal conditions in real-time. The innovations enhance patient safety, minimize the risk of catheter-associated urinary tract infections, and improve clinical decision-making. The introduction of AI in predictive analytics will enable the diagnosis of high-risk patients, who are likely to experience complications, thereby preventing them from occurring. Smart catheter systems utilize AI-based data to support patient-centered care, enabling clinicians to optimize treatment and reduce hospitalizations. The applicability of Foley catheters in the home care environment is also extended with the combination of AI and telemedicine, and remote patient monitoring.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.98 Billion |

| Market Size in 2026 | USD 2.10 Billion |

| Market Size by 2034 | USD 3.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.94% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type / Material, Size & Configuration, Sterility & Single Use vs Reusable, Application / Indication, End-User / Customer Segment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in Healthcare Infrastructure

Ongoing technological improvements in healthcare infrastructure, especially in emerging economies, are driving the growth of the Foley catheters market. The introduction of modern hospitals, specialized clinics, and telemedicine delivery is increasing access to medical services, allowing patients in underserved areas to seek prompt treatment for urinary disorders. Better infrastructure will ensure that healthcare providers can provide more comprehensive urologic care, including catheterization, monitoring, and follow-up services, which will increase the use of Foley catheters. Moreover, online health services, consultations, and education on urinary health, early diagnosis, and treatment options are increasing awareness among the population about the issue. The installation of modern diagnostic and surgical equipment in hospitals and clinics ensures that the catheterization process is safer and more effective, thereby increasing the confidence of healthcare workers and patients.

Restraint

Catheterization is a Painful Process

Catheterization can also be accompanied by friction and irritation when there is poor lubrication, which may result in bleeding, infections, or patient discomfort. These negative experiences usually make patients avoid using catheters unless there is an absolute necessity to do so. Moreover, catheter-associated urinary tract infections (CAUTIs) and other complications must also be carefully managed, making routine use even more complicated. Healthcare providers are advised to exercise particular caution during the insertion and maintenance process, thereby complicating it and reducing its convenience.

There are other types of treatment or non-invasive treatment that are sometimes preferred to catheterization, especially in patients who temporarily experience or have mild incontinence. The pain associated with catheters and the risk of infection can discourage the frequent use of catheters by both patients and healthcare professionals, particularly in home care settings.

Opportunity

Rise of Home Care Settings

The increasing interest in the principles of home-based healthcare and remote patient monitoring is presenting significant business opportunities for manufacturers of Foley catheters. With the growing number of patients choosing to receive medical attention from the comfort of their own homes, there is a corresponding need to find urinary management solutions that are safe, convenient, and easy to apply in non-clinical settings, such as outside homes. The manufacturers can take advantage of this change and make their Foley catheters home care-friendly, targeting user-friendly characteristics that will make the catheters more comfortable for patients and simplify the catheterization process. This focus is a strategic growth target for the Foley catheters market, driven by increasing awareness of home care solutions and the expansion of telehealth infrastructure.

Segment Insights

Product Type/Material Insights

Why Did the Latex Foley Catheters Segment Lead the Market?

The latex Foley catheters segment led the Foley catheters market, accounting for the largest revenue share in 2024. This is because latex catheters offer better elasticity and comfort, making them a more suitable alternative for both short-term and long-term catheterization. They are cheaper than silicone-based ones, making them more affordable in developing and low-income healthcare markets. Additionally, latex Foley catheters can be easily produced in various sizes and coatings, including silicone-coated versions, which are used for irritation resistance and allergy-free applications. The high rate of adoption of latex catheters in both hospital and home care environments, as well as their increasing acceptance in urological procedures, contribute to their significant market share. Although there are concerns that people may be allergic to latex, inventions such as latex-silicone hybrids have alleviated some of these concerns.

The hydrophilic coated and antimicrobial Foley catheters segment is expected to grow at a significant CAGR over the forecast period due to the growing awareness of catheter-associated urinary tract infections and the increasing demand for more sophisticated, infection-resistant solutions. These catheters have been designed to minimize friction during insertion and limit bacterial colonization on the catheter surface, thereby reducing the risk of infection and ensuring patients feel more comfortable. These added features are gaining popularity as safety is the primary concern of healthcare providers, particularly when the catheter is used over a long-term period. In addition, an increasing rate of chronic diseases, including urinary retention, prostate enlargement, and neurodegenerative conditions, further increases the necessity of long-term catheterization, which further promotes the demand for antimicrobial and hydrophilic catheters. Regulatory bodies and healthcare institutions are also promoting infection-preventive devices, thus leading to widespread use.

Size & Configuration Insights

What Made Male/Standard Adult Sizes the Dominant Segment in the Market in 2024?

The male/standard adult sizes segment dominated the Foley catheters market in 2024. This is mainly due to the increased rate of urological diseases like benign prostatic hyperplasia, urinary retention, and prostate cancer amongst the male population, particularly in the elderly population. Such conditions typically require chronic catheterization, which necessitates the use of regular-sized catheters suitable for adults. Additionally, male Foley catheters typically have more complex and advanced designs, which tend to attract higher unit prices, thereby contributing a greater share to the overall market revenue. Standard sizes are often available in hospitals, long-term care facilities, and home healthcare settings since they are very universal. Additionally, the innovation of products and the use of better materials in male catheters, including antimicrobial coatings, is improving comfort and safety, thereby increasing their use even more in both clinical and home care settings.

The female/pediatric sizes segment is expected to grow at the fastest rate in the coming years, driven by rising awareness, improved diagnosis, and an increase in the number of women and children with urological conditions. Short-term to mid-term catheterization is required in females in cases of urinary tract infections, post-operative urinary retention, and bladder dysfunctions. Moreover, pediatric-specific Foley catheters are in higher demand for the treatment of congenital bladder disorders and neurological bladder disorders in children. Healthcare providers are becoming increasingly aware of the benefits of using anatomically correct catheter sizes to prevent pain and complications, as well as to improve outcomes, particularly in vulnerable patient populations such as women and children. The demand for these size-specific catheters is expected to continue increasing as more people gain access to specialized pediatric and women's healthcare, particularly in emerging economies.

Sterility & Single Use vs Reusable Insights

How Does the Sterile, Single-Use Foley Catheters Segment Lead the Foley Catheters Market?

The sterile, single-use Foley catheters segment led the market, accounting for the largest revenue share in 2024. This is mainly due to the increased focus on infection prevention and patient safety. Single-use catheters are prone to lower the risk of cross-contamination and catheter-associated urinary tract infections. Clinics and hospitals are more than ever favoring sterile and disposable products due to stringent hygienic standards and regulatory requirements. The use of these catheters is extended to acute care, surgical, and emergency procedures, which have widely adopted them. Additionally, as more people become aware and medical-grade disposables are introduced in new markets, demand is expected to continue increasing. Single-use, sterile Foley catheters are more costly on a unit-price basis but overall contribute more to reducing infection rates and improving patient outcomes than any other type of catheter.

The reusable/re-sterilizable Foley catheters segment is expected to grow at a significant CAGR over the forecast period. This is due to their cost-effectiveness and increasing sustainability concerns, which are likely to drive demand for reusable or re-sterilizable Foley catheters. Reusable catheters offer an economical alternative to single-use products in areas with limited healthcare expenditures or high patient volumes, such as state hospitals in developing nations. Moreover, the rise of environmental awareness and the growing concern about medical waste is prompting health practitioners to use reusable equipment whenever possible. The sterilization processes are also becoming safer and more efficient due to technological advances, including autoclaving and high-level disinfection systems, thus making reuse more feasible and safer without compromising the safety of end-users. Reusable catheters are being increasingly tested in both developed and developing markets as health systems strive to optimize the cost, sustainability, and clinical outcomes of their reusable catheters.

Application/Indication Insights

Why Did the Short-Term Use Segment Dominate the Market in 2024?

The short-term use segment dominated the Foley catheters market, accounting for the largest revenue share in 2024. Temporary catheterization, typically lasting no more than 30 days, is often performed during the postoperative period for the treatment of acute urinary retention and for diagnostic purposes. Demand also depends on the high volume of surgical cases, primarily in orthopedics, urology, and gynecology. Additionally, short-term Foley catheters are frequently used in emergency and intensive care units to monitor fluid intake and drain the bladder. Infection control recommendations and the prevention of hospital-acquired infections align with the preferences of hospitals that opt for short-term options to minimize the risk of infection. The short-term use of Foley catheters is one of the primary drivers of market growth, as surgical procedures have been increasing worldwide, and the healthcare systems of developing countries are improving.

The long-term use segment is expected to grow at the highest CAGR over the forecast period, driven by the rise in the elderly population and the associated chronic conditions that will lead to prolonged catheterization needs. The use of indwelling Foley catheters is often needed in patients with neurological issues (e.g., spinal cord injuries, multiple sclerosis), a big prostate, or incontinence, for weeks to months. The demand for long-duration catheter solutions is increasing steadily due to the prolonged life expectancy and the development of both home-based and long-term care services. Long-term catheterization is also becoming safer and more comfortable with innovations such as antimicrobial coatings and hydrophilic surfaces, which minimize complications like infections and encrustation. Moreover, insurance coverage and home healthcare support in most countries are enhancing access to long-term catheter products.

End-User / Customer Insights

How Does Hospitals/Clinics Contribute the Most Revenue in 2024?

The hospitals/clinics segment contributed the largest revenue share in 2024 due to the high volume of procedures involving catheterization, particularly in surgical, emergency, and intensive care units. Foley catheters are also regularly used for short-term urinary drainage after surgeries, acute urinary retention, and critical care monitoring, all of which are primarily performed in hospitals. These facilities are generally highly innovative, with infection control policies that prefer sterile, single-use catheters, which are more expensive but have a greater volume. Moreover, procurement contracts typically involve large-scale purchases by hospitals, accounting for a significant portion of the market revenue. Moreover, the high level of hospitalization owing to chronic diseases, ageing, and an increase in surgical procedures around the world has continued to make this segment highly demanded.

The home care & long-term care facilities segment is expected to expand at the fastest rate in the Foley catheters market. This is primarily due to the rising focus on affordable and patient-centered care in these settings. The aging population and the rising number of chronic illnesses and conditions, such as neurogenic bladder, dementia, and prostate issues, are driving the necessity to support long-term catheterization, and this is most comfortably done in the home or nursing facilities. Improvements in the design of the catheters, such as antimicrobial and hydrophilic coatings, have enhanced the safety and convenience of long-term management, enabling healthcare providers to support at-home management. Due to the increasing use of Foley catheters in home and long-term care services, as healthcare systems shift towards outpatient care and insurance covers home-based treatments, the acceptance of these catheters is likely to rise at a robust rate.

Region Insights

U.S. Foley Catheters Market Size and Growth 2025 to 2034

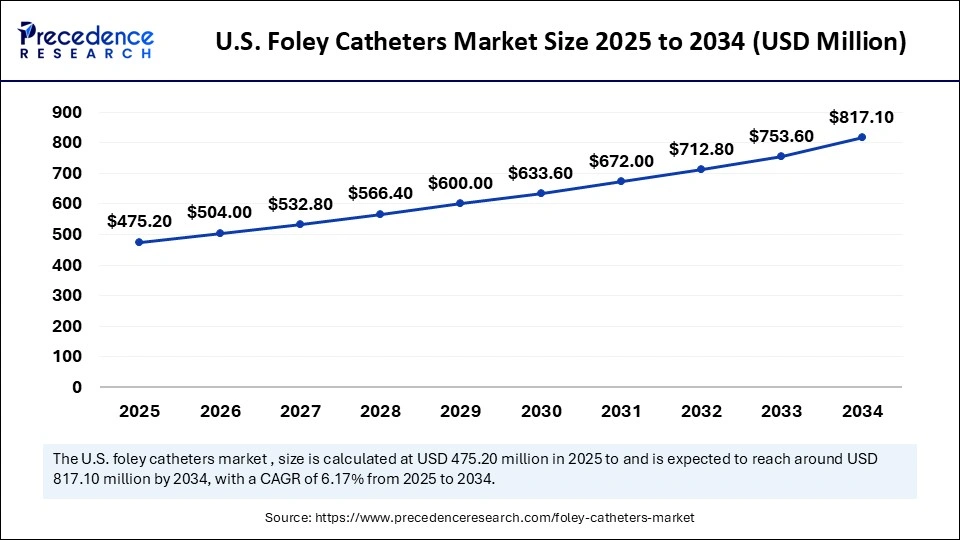

The U.S. foley catheters market size is exhibited at USD 475.20 million in 2025 and is projected to be worth around USD 817.10 million by 2034, growing at a CAGR of 6.17% from 2025 to 2034.

What Made North America the Dominant Region in the Foley Catheters Market in 2024?

North America dominated the market in 2024, capturing the largest share due to its developed healthcare system, high awareness of urinary issues, and a mature medical device market. The area is also exhibited by some of the largest medical device manufacturers, including Becton Dickinson, Teleflex, and Hollister Incorporated, which are producing the most diverse innovative Foley catheters, including both antimicrobial-coated and smart catheter systems. The U.S. and Canada have the best diagnostic and surgical technologies installed in their hospitals, clinics, and long-term care centers, which allows the implementation of high-tech urinary management solutions. Furthermore, Foley catheters are used in both inpatient and outpatient services, as they are encouraged by high healthcare spending, high reimbursement coverage, and strong regulatory support.

The U.S. is the major contributor to the North America Foley catheters market. This is mainly due to the increasing prevalence of urinary tract infections, benign prostatic hyperplasia, incontinence, and other urological conditions, which contribute to the steady demand for Foley catheters in hospitals, long-term care facilities, and homes. Moreover, the rising trend of home-based healthcare and telemedicine in the U.S. has increased the past use of catheters outside the hospital, thereby enhancing the ability to manage chronic urinary conditions more effectively. The availability of Foley catheters to patients has been enhanced by government programs aimed at supporting elderly care and the management of chronic diseases, in addition to having a robust healthcare infrastructure.

What Makes Asia Pacific the Fastest-Growing Market for Foley Catheters?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This is primarily due to the increasing incidence of urinary disorders, including incontinence, benign prostate hyperplasia, and urinary tract infections, which are creating pressure on the need to find effective solutions to catheterization. The increase in knowledge about urinary health, easy access to medical facilities, and the realization of better medical hygiene standards are among the factors that have led to more people seeking treatment. Additionally, the development of healthcare infrastructures, government programs targeting the elderly, and increased utilization of home-based health services are all favoring the market. Emerging technologies in higher-level Foley catheter systems, including antimicrobial and smart monitoring devices, are also enhancing patient safety and promoting the accelerated adoption in hospitals, clinics, and home care environments.

China is a major player in the Asia Pacific Foley catheters market. The increasing awareness of urinary health and hygiene, along with rising healthcare expenditures, is enabling more patients to access advanced Foley catheter solutions. The adoption is being facilitated by the government's efforts to enhance elderly care and manage chronic diseases, both in hospitals and through home care. Furthermore, catheter usage escalates with investments in modern medical facilities, such as urology departments with specialized units, telemedicine facilities, and home care services.

How is the Opportunistic Rise of Europe in the Foley Catheters Market?

Europe is experiencing a notable growth in the market, primarily driven by an aging population, a high prevalence of urinary incontinence, and sophisticated healthcare systems. Stringent quality and safety regulations set by the European Union drive innovation towards high-quality, infection-resistant products. The market is competitive, with major global medical device companies focusing on research and development of advanced coatings, such as silver-coated, hydrophilic coatings, to minimize hospital-acquired urinary tract infections (HAUTIs) and improve patient care.

Germany is a major contributor to the European market, known for its high standards in medical technology, a comprehensive and efficient healthcare system, and a large aging population. The market focuses on patient safety, quality assurance, and a preference for advanced, clinically proven Foley catheters. Demand remains consistently strong in both hospital and long-term care settings, supported by a robust supply chain and a preference for reliable products to ensure optimal patient outcomes and reduce healthcare-associated infections.

What Potentiates the Growth of the Latin American Foley Catheters Market?

The market in Latin America is mainly driven by an aging population, an increasing prevalence of chronic diseases such as urinary tract infections (UTIs) and bladder disorders, and a rise in surgical procedures. Although challenges related to healthcare infrastructure in some rural areas and cost considerations persist, the market is shifting towards advanced products, such as antimicrobial-coated catheters, that help reduce infection risks. Countries like Brazil and Mexico are leading the adoption of these devices, supported by greater government and private investment in healthcare facilities and awareness campaigns focused on urinary incontinence, which attract international suppliers to the region.

Brazil is the largest and most developed market for Foley catheters in Latin America, driven by high hospital admissions and surgical procedures. This market is supported by a growing geriatric population and an increasing prevalence of urinary retention issues and UTIs. There is strong demand for cost-effective, high-quality products, along with a noticeable trend towards advanced materials such as silicone and coated catheters that enhance patient comfort and safety, to supply public and private healthcare systems.

What Opportunities Exist in the Middle East and Africa for the Foley Catheters Market?

The Middle East and Africa (MEA) offer significant opportunities for market growth. The region benefits from higher healthcare spending and better infrastructure compared to much of Africa. Key drivers include an increase in the number of hospitals, rising rates of chronic conditions like diabetes, which can lead to bladder complications, and a rise in surgical procedures. Despite challenges with awareness and access in some African countries, there is growing interest in single-use, infection-control-focused catheter technologies to meet evolving healthcare standards.

Saudi Arabia leads the market in the region, driven by substantial investments in healthcare infrastructure, an aging population, and rising rates of lifestyle diseases. The demand for high-quality, safe, and reliable Foley catheters is strong, particularly in modern hospitals and clinics across the country. The government is focused on improving healthcare outcomes, including adopting best practices for infection control, which has led to increased demand for advanced coated catheters and single-use sterile products from global medical device manufacturers.

Country-level Investments & Funding Trends for Foley Catheters Market

- U.S.: The U.S. is the world leader in investment in the Foley catheter market, and there is a substantial amount of funds distributed in the area of research and development. Becton Dickinson (BD), Teleflex Incorporated, Hollister Incorporated, Medtronic plc, and C.R. Bard, these major companies, are targeting antimicrobial catheters, robotic-assisted insertion tools, as well as homecare-oriented solutions to increase their market share.

- Germany: European investments in Foley catheters are led by Germany, which is keen on innovations in minimally invasive equipment, antimicrobial coating, and hospital-based applications. The leading companies are Coloplast A/S, B.Braun Melsungen AG, and Paul Hartmann AG, which specialize in enhancing patient safety and augmenting the urological care infrastructure.

- China: In China, there is a surge in investments in Foley catheters due to the growing aging population and rising cases of urinary disorders. There are state-sponsored initiatives and investment initiatives aimed at using advanced catheter solutions, intelligent monitoring, and home care products. Teleflex, Becton Dickinson (BD), Medtronic plc, and Mindray are among the key companies involved in the market.

- Japan: Japan's investment activities focus on elderly care, the integration of digital monitoring, and the development of minimally invasive catheters. Local and international producers are investing in research and the application of safer and more user-friendly alternatives. The major players are Olympus Corporation, Terumo Corporation, Coloplast A/S, and Becton Dickinson (BD).

Global Regulatory Landscape for Foley Catheters

|

Country |

Regulatory Body |

Classification |

Key Requirements |

|

U.S. |

FDA |

Class II |

510(k) Premarket Notification; compliance with ISO/ASTM standards. |

|

EU |

EC (EU MDR) |

Class IIa/IIb |

CE Marking via Notified Body; extensive clinical data required. |

|

China |

NMPA |

Class II |

Mandatory local type testing; compliance with national GB standards. |

|

Japan |

PMDA & MHLW |

Risk-based |

Third-party certification; local Marketing Authorization Holder (MAH) required. |

|

India |

CDSCO |

Risk-based |

Registration is required for imported and local devices; compliance with BIS/ISO standards. |

Value Chain Analysis

- Research and Development & Material Science Innovation

This stage focuses on innovating catheter designs, coatings, and materials to reduce infection risk and improve patient comfort.

Key Players: Medtronic plc, Becton, Dickinson and Company (BD), Cardinal Health, Inc., Teleflex Incorporated. - Clinical Trials and Regulatory Approval

New catheter designs and material innovations must undergo rigorous testing to ensure safety and efficacy.

Key Players: Medtronic, BD, Cardinal Health, Teleflex Incorporated - Manufacturing and Production

This involves the large-scale, high-precision, and sterile manufacturing of various types of Foley catheters.

Key Players: Medtronic, BD, Cardinal Health, and Teleflex. - Distribution and Supply Chain Management

Products are distributed globally to hospitals, clinics, long-term care facilities, and direct-to-patient suppliers.

Key Players: Owens & Minor, Cardinal Health, and McKesson. - Service Delivery and Application

This stage is where the catheters are utilized by healthcare professionals for urinary management in various clinical settings.

Key Players: Physicians, nurses, long-term care facilities, clinics, and home health agencies - Patient Support, Post-Procedure Care, and Payments

This involves managing patient education, ensuring proper post-procedure care to prevent complications.

Key Players: Government bodies (CMS) and private health insurance companies managing reimbursement codes and coverage policies.

Top Companies in the Foley Catheters Market & Their Offerings

- B. Braun Melsungen AG: B. Braun is a manufacturer of Foley catheters in different types of silicone and latex, both suitable for hospitals and homes. Their products are based on patient safety, easy insertion, and the reduction of the chances of infections.

- Hollister Incorporated: Hollister also offers Foley catheters, which are comfortable and long-term use, and also has antimicrobial-coated catheters. The company focuses on home care solutions and easy designs for the patients and caregivers.

- Coloplast A/S: Coloplast creates new Foley catheters, including intermittent and indwelling catheters, which contain properties to minimize infection and enhance drainage. The company has its subsidiaries, such as Symmetry Medical, which increase its distribution around the globe and the availability of its products.

- Teleflex Incorporated: Teleflex has numerous urological devices, including the safety and comfort options with advanced Foley catheters. Their products are also commonly used in hospitals, surgical facilities, and home care units to manage urinary incontinence securely.

Tier I – Major Players

These are the dominant companies in the Foley catheter market. Each of them holds a significant share individually, and together, they account for approximately 40–50% of the total market revenue.

- Becton, Dickinson & Company (BD)

- Cardinal Health

- B. Braun SE

- Teleflex Inc.

Tier II – Mid-Level Contributors

These companies have a strong market presence but are not as dominant as Tier I players. Collectively, they contribute around 30–35% of the market.

- Coloplast A/S

- Medline Industries, LP

- ConvaTec Group plc

- Cook Medical

- Hollister Inc.

Tier III – Niche and Regional Players

These are smaller or regionally-focused companies with limited global reach. Individually, their contributions are modest, but together they hold around 15–20% ofthe market.

- Bactiguard AB

- ANGIPLAST Private Limited

- Sterimed Group

- Other local manufacturers and emerging companies

Exclusive Expert Analysis on Foley Catheters Market

The global Foley catheters market is poised for steady growth driven by the rising prevalence of urological disorders, expanding geriatric population, and increasing surgical procedures worldwide. Tier I players such as BD, Cardinal Health, and B. Braun continue to dominate the competitive landscape through broad product portfolios, strong distribution networks, and continuous innovation in infection-resistant and antimicrobial catheter technologies. However, mid-tier and regional manufacturers are increasingly capturing market share in emerging economies by offering cost-effective alternatives and leveraging local regulatory advantages. With hospital-acquired infections (HAIs) and patient comfort becoming central concerns, the market is witnessing a shift toward silicone-based and coated Foley catheters. Going forward, strategic partnerships, product differentiation, and a focus on outpatient and home care settings are expected to shape the next phase of market evolution.

Segment Covered in the Report

By Product Type / Material

- Latex Foley Catheters

- Silicone Foley Catheters

- Hydrophilic Coated Foley Catheters

- Antimicrobial / Silver-coated Foley Catheters

By Size & Configuration

- Standard Balloon (5-30 mL)

- Large / High Capacity Balloon (≥ 30 mL)

- Female / Pediatric Sizes

- Male / Standard Adult Sizes

By Sterility & Single Use vs Reusable

- Sterile, Single-Use Foley Catheters

- Reusable / Re-sterilizable Foley Catheters

By Application / Indication

- Short-term use (postoperative, catheterization for a few days)

- Long-term use (chronic retention, neurogenic bladder)

- Intermittent use vs continuous drainage

- Specialty uses (urology surgery, ICU, trauma care)

By End-User / Customer Segment

- Hospitals / Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- Long-term Care Facilities (nursing homes)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting