What is the Food Contract Manufacturing Market Size?

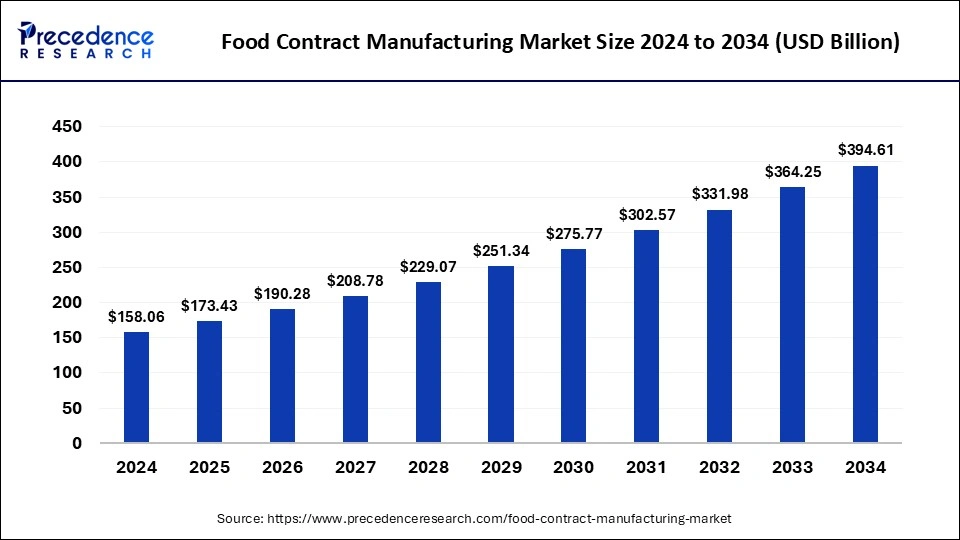

The global food contract manufacturing market size is calculated at USD 173.43 billion in 2025 and is predicted to increase from USD 190.28 billion in 2026 to approximately USD 426.24 billion by 2035, expanding at a CAGR of 9.41% from 2026 to 2035.

Food Contract Manufacturing Market Key Takeaways

- The global food contract manufacturing market was valued at USD 173.43 billion in 2025.

- It is projected to reach USD 426.24 billion by 2035.

- The food contract manufacturing market is expected to grow at a CAGR of 9.41% from 2026 to 2035.

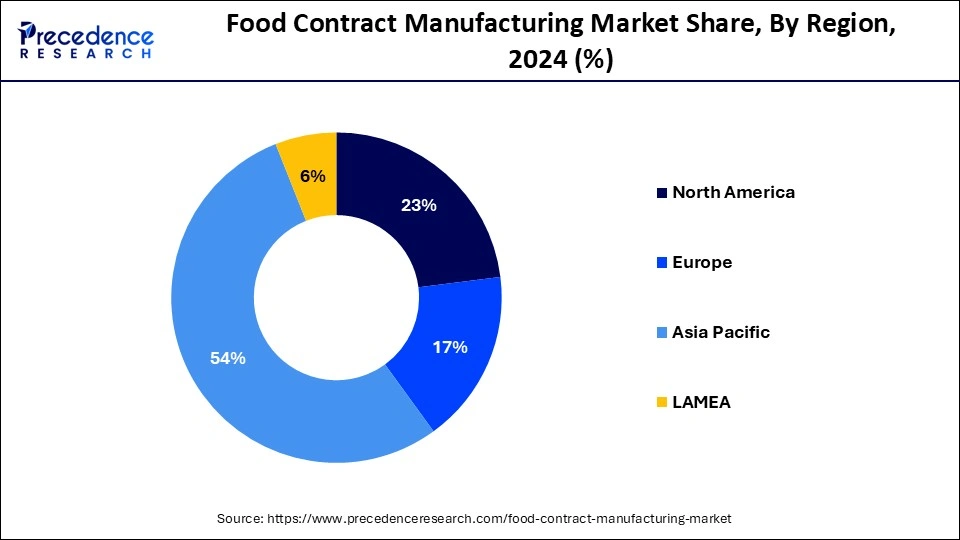

- Asia Pacific dominated the food contract manufacturing market with the largest revenue share of 54% in 2025.

- North America is expected to grow at the highest CAGR in the market during the forecast period.

- By service, the manufacturing segment has contributed more than 68% of revenue share in 2025.

- By service, the custom formulation and R&D segment is expected to grow at the highest CAGR of 11.46% during the forecast period.

Market Overview

The food contract manufacturing market encompasses the practice of contract manufacturing of food, sometimes referred to as co-packing, whereby food production processes are outsourced to a third-party producer. In this arrangement, a food firm or brand collaborates with a contract manufacturer to make food items in accordance with their requirements, recipes, and standards for quality. For food firms looking to maximize production efficiency, cut costs, and maintain excellent product quality while concentrating on company growth and market expansion, food contract manufacturing provides a strategic outsourcing alternative.

Food Contract Manufacturing Market Growth Factors

- The rising trend in food products, customized food items, and individualized nutrition can grow the food contract manufacturing market.

- Contract manufacturing provides the advantage of scaling up the process quickly, which can fulfill the growing demand for food and beverages.

- The demand for packaged and processed foods is driven by the rising trend of ready-to-eat meals, which can boost the food contract manufacturing market.

- It helps save money as hiring a third party is cheaper than starting from scratch.

- Hiring a third allows the company to focus on other critical functions of the company, especially when it comes to research and development.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 426.24 Billion |

| Market Size in 2025 | USD 173.43 Billion |

| Market Size in 2026 | USD 190.28 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.41% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for packaged and processed foods

The growing demand for packaged and processed foods can boost the food contract manufacturing market. Convenient, prepared, and packaged meals are in greater demand as a result of consumers' busy lifestyles and rising disposable incomes. The need for contract manufacturing services is increased by this development.

Increasing awareness of health

The increasing awareness about health can boost the food contract manufacturing market. There is an increasing demand for specialty food items like organic, gluten-free, and non-GMO foods as customers become more health-conscious. These specialty items are frequently produced by contract manufacturers.

Restraint

Difficulties in quality control

The issues and difficulties in quality control may hamper the growth of the food contract manufacturing market. The food sector places a high value on maintaining consistent product quality. The contract manufacturer and the brand they are producing for may suffer from a loss of business as a result of any quality control failures.

Opportunity

New product development and innovation

New product development and innovation can be the opportunity to grow the food contract manufacturing market. The food contract manufacturers can create themselves as vital partners for food firms striving to maintain competitiveness, satisfy customer wants, and propel market expansion by emphasizing innovation and product development.

Value Chain Analysis

- Raw Materials Sourcing

In this stage, contract manufacturers source raw materials such as grains, dairy, fruits, vegetables, preservatives, proteins etc. based on the client's recipes and requirements. This stage takes quality control quite seriously, especially for safety, cross contamination, allergen control and traceability. The rising demand for vegan and gluten free items is increasing the complexity of raw material sourcing. It mainly involves diverse supply bases, regional sources and long term contracts.

Key Players: Cargill, Bunge, ADM - Manufacturing and Processing

This stage involves actual food production, processing, blending, cooking and formulation. It is then followed by packaging, often under a private label or small scale brand contracts. This enables food brands to avoid large amounts of capital investments in plants, thus offering scalability, flexibility and the capacity to already existing expand product lines.

Key Players: General Mills, Kerry Group, Dawn Foods - Quality Control and Compliance

Many contract manufacturers now offer value added services that go beyond basic production processes, thus enabling brands to focus more on marketing and product designing rather than production infrastructure. The increasing consumer demand for plant based, organic and functional foods is driving contract manufacturers to expand their research and development activities even more.

Key Players: Kerry Group, Tree House Foods, Bunge

Segment Insights

Service Insights

The manufacturing segment dominated the food contract manufacturing market by service in 2025. The food goods may be produced at scale by contract manufacturers who specialize in manufacturing services because they have the infrastructure, tools, and knowledge required. They provide full manufacturing capabilities, which include labeling, packing, filling, mixing, and food processing. The contract manufacturers with an emphasis on manufacturing are able to adjust production levels in response to customer demand. The capacity to scale is essential for meeting the demands of many brands, market trends, and seasonal variations in product requirements. For food manufacturers, it is frequently more affordable to outsource manufacturing to specialist facilities rather than building and maintaining their own production facilities. Production costs can be decreased by contract manufacturers by utilizing economies of scale and operational efficiency.

The custom formulation and R&D segment is expected to grow at the highest CAGR in the food contract manufacturing market by service during the forecast period. Food businesses are putting more emphasis on product innovation and differentiation in order to adapt to changing customer trends and market conditions. The brands may create distinctive goods that are suited to certain dietary requirements, nutritional profiles, and flavor profiles by using custom formulation and R&D services. The demand for healthier and more useful food products such as organic, natural, plant-based, and fortified foods is rising. The contract manufacturers may produce goods that follow these wellness and health trends with the help of custom formulation services. The demand for bespoke formulation capabilities is being driven by the growing popularity of specialist and niche food items, such as gluten-free, allergen-free, and vegan choices. The products that target certain customer categories can be developed by contract manufacturers with R&D experience.

Regional Insights

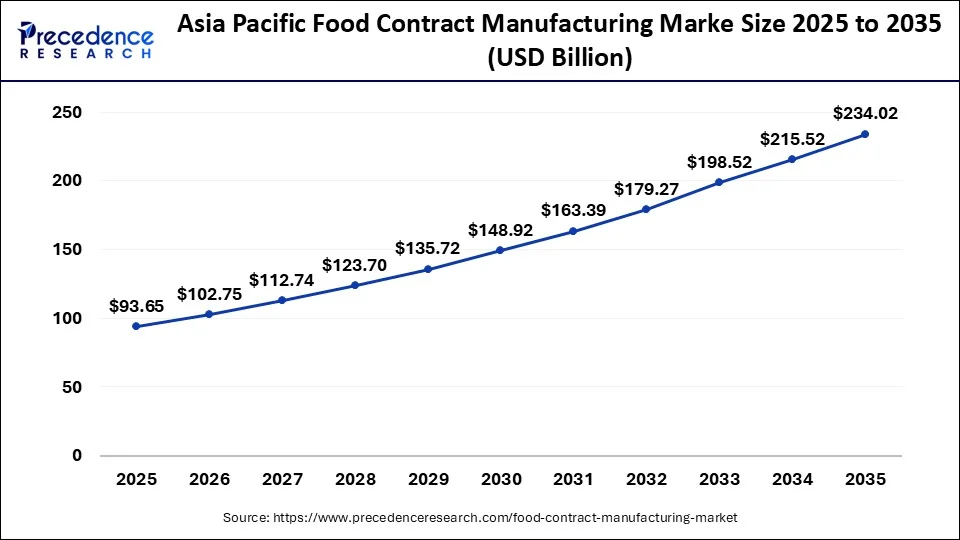

The Asia Pacific food contract manufacturing market size is exhibited at USD 93.65 billion in 2025 and is projected to be worth around USD 234.02 billion by 2035, poised to grow at a CAGR of 9.59% from 2026 to 2035.

Asia Pacific dominated the food contract manufacturing market by region in 2025. The demand for a variety of food goods has surged due to the region's vast and quickly expanding population, rising disposable incomes, and urbanization. The Asia Pacific contract manufacturers meet this need by providing a broad selection of specialized food items and mixes. Asia Pacific is renowned for its ability to produce goods at a reasonable cost, particularly when it comes to labor and operating expenditures when compared to Western markets. The food companies looking for competitive and efficient manufacturing solutions are drawn to this cost advantage.

The need for contract manufacturing services is fueled by the rise of the food and beverage sectors in Asia Pacific, which is being driven by dietary changes and economic growth. Contract manufacturers are essential to businesses in industries like drinks, convenience foods, and snacks because they enable scalable manufacturing and market development.

- In July 2023, Gopal Food Product, which has a plant at UPSIDC, Kotwan Industrial Area, Mathura, Uttar Pradesh, and Annapurna Swadisht, a fast-moving consumer food firm based in Eastern India, entered into an exclusive contract manufacturing arrangement. The new factory can produce 150 MT of snacks, 60 MT of namkeen, and 1000 MT of biscuits per month. The unit may serve the following areas: North Madhya Pradesh, South and West Uttarakhand, Delhi NCR, West and Central UP, East and North Rajasthan, and more.

North America is expected to grow at the highest CAGR during the forecast period. Convenient foods, such as frozen dinners, snacks, and ready-to-eat meals, are becoming more and more popular among consumers. These handy food items are produced by food contract manufacturers in North America with a focus on meeting the needs of modern lifestyles and shifting dietary preferences. The demand for natural, organic, and functional food items is being driven by consumers' growing emphasis on health and well-being in North America.

The region's contract manufacturers are skilled in creating and manufacturing healthier substitutes that satisfy both customer demands and legal requirements. North America is at the forefront of food innovation and product customization, prioritizing distinctive tastes, dietary requirements (such as gluten-free and veganism), and nutritional characteristics. R&D-capable contract manufacturers are well-positioned to satisfy these demands in the food contract manufacturing market.

- For instance, the whole production complex of Phoenix Formulation in the U.S. is state-of-the-art. The business uses cutting-edge methods and tools to provide quality custom-formula nutraceuticals. To assist in ensuring the quality and safety of the finished product, they rely on four metal detection systems, three X-ray inspection rigs, and five checkweighers, all made by Mettler Toledo. Phoenix has eight packaging lines to put powders, capsules, and tablets into jars, gusseted bags, composite cans, single-serving pouches, stick packs, and bulk containers. Its product portfolio includes energy drink mixes and meal replacements.

Europe is witnessing steady growth throughout the forecast years. This growth is driven by its strict environmental regulations, energy efficiency mandates, and sustainable development goals regarding food. Nations within this region are seen actively adapting to these stringent quality standards, thus encouraging the adoption of compliant, advanced food contract manufacturing solutions. In addition to that, increasing disposable incomes, rising urban populations, and a burgeoning middle class are driving demand for processed and packaged foods in this region.

Latin America is expected to witness a good growth rate throughout the forecast period, with Brazil leading the region. This is due to its substantial agricultural resources and expanding food processing capabilities. The region's contract manufacturing sector also benefits from competitive production costs, abundant raw materials and growing domestic consumption. The region also provides cost advantages for contract manufacturers, especially in grain-based products, beverages, and protein processing. This leads to growth and development.

The Middle East and Africa is expected to pick up the pace in the upcoming years. The region's contract manufacturing sector is developing at a rapid pace, driven by population growth, urbanization and increasing food security initiatives. The competitive dynamics of this region are further influenced by factors such as rapid technological advancements, service differentiation, and increased strategic partnerships. Companies in this region are actively investing in state-of-the-art facilities, innovative technologies, and quality assurance measures in order to gain a competitive edge and attract clients from various segments.

Food Contract Manufacturing Market Companies

- Fibro Foods

- Hindustan Foods Limited

- Hearthside Food Solutions LLC

- Nikken Foods

- Christy Quality Foods (CQF)

- De Banketgroep B.V.

- HACO AG

- SK Food Group

- Pacmoore Products Inc.

- Cremica

- Kilfera Food Manufacturers Ltd

- Nutrascience Labs, Inc

- Thrive Foods LLC.

- Orion Food Co., Ltd

- Omni blend

Recent Developments

- In March 2025, Arla Foods signed a contract manufacturing agreement with Valley Queen, which helped to strengthen its position to meet the growing demand for protein rich dairy. The South Dakota-based dairy processor will produce ingredients from the Nutrilac ProteinBoost product range. The patented microparticulate whey protein concentrate is used to increase protein levels in food and beverage products while retaining texture and taste.

(Source:www.arla.com) - In February 2024, EVERY Company, which developed the technology to produce egg proteins through precise fermentation, announced that, in an effort to satisfy demand, it would be starting this year with major food businesses. Although a very impressive amount, the $233 million raised by the firm Clara Foods, created by Arturo Elizondo and David Anchel in late 2014, is far less than the astounding $840 million raised by Perfect Day to attempt and launch its animal-free dairy business.

(Source: www.bing.com ) - In February 2024, EVERY Company, which developed the technology to produce egg proteins through precise fermentation, announced that, in an effort to satisfy demand, it would be starting this year with major food businesses. Although a very impressive amount, the $233 million raised by the firm Clara Foods, created by Arturo Elizondo and David Anchel in late 2014, is far less than the astounding $840 million raised by Perfect Day to attempt and launch its animal-free dairy business.

- In November 2023, with an initial round of $18 million, Keychain, a new AI-powered platform, was officially launched. It enables consumer brands and merchants to find bespoke production partners more quickly. With participation from Box Group, Afore Capital, SV Angel, and more than twenty CPG specialists, the fundraising round, led by Lightspeed Venture Partners, intends to create the world's most complete platform for the CPG supply chain via simplicity and clarity.

- In August 2023, PakTech's current clients in these regions included Hawkers Brewery in Australia, Billson's of Beechworth, and The Apple Press in New Zealand. The public's desire for ecologically friendly packaging and practices is growing at the same time as its debut in Australia. American and Australian shopping habits are fairly similar. PakTech has had significant organic growth in the last several years, and it expects this pattern to persist. For PakTech, its clients, and all Australians who care about sustainability and our impact on the environment, establishing a physical local presence in the region is really exciting.

Segment Covered in the Report

By Service

- Manufacturing

- Convenience Foods

- Bakery Products

- Dietary Supplement

- Confectionery

- Dairy Products

- Others

- Packaging

- Convenience Foods

- Bakery Products

- Dietary Supplement

- Confectionery

- Dairy Products

- Others

- Custom Formulation and R&D

- Convenience Foods

- Bakery Products

- Dietary Supplement

- Confectionery

- Dairy Products

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting