What is the Gabapentin Market Size?

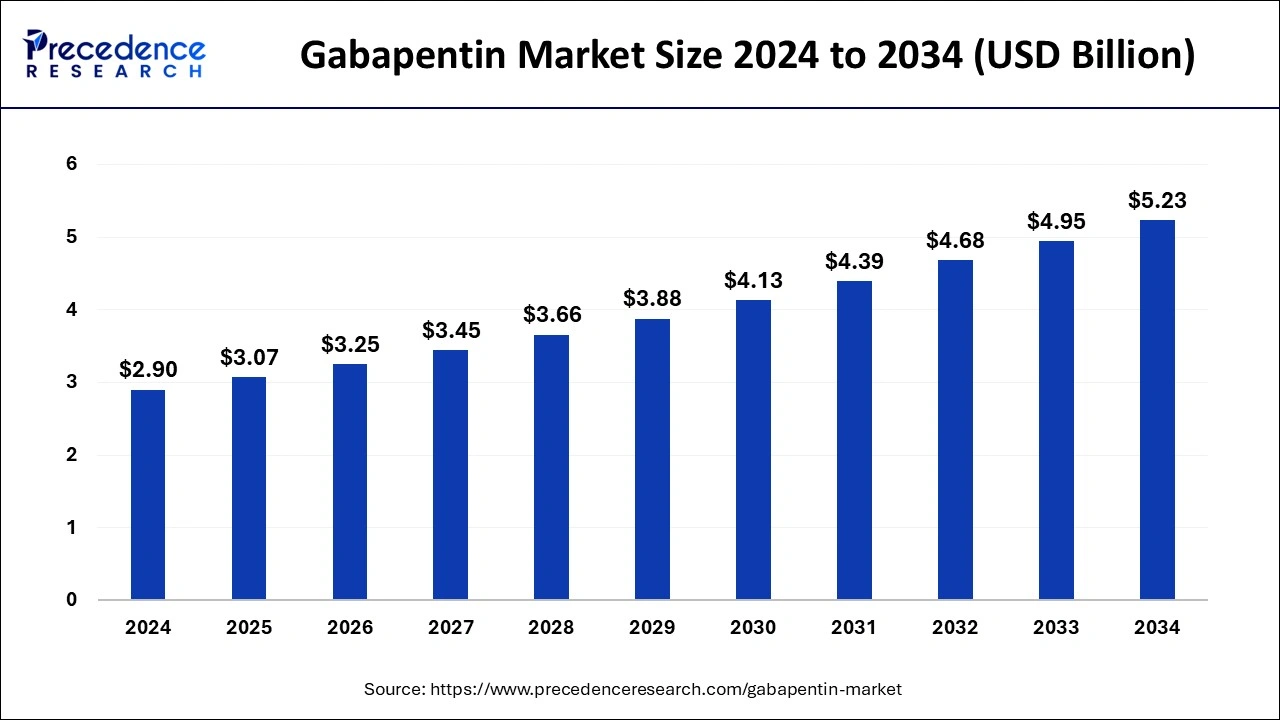

The global gabapentin market size is calculated at USD 3.07billion in 2025 and is predicted to increase from USD 3.25 billion in 2026 to approximately USD 5.23 billion by 2034, expanding at a CAGR of 6.07% from 2025 to 2034. Increasing health awareness among people, such as diabetes and neuropathy due to continuously changing lifestyles, is influencing the demand for gabapentin market.

Gabapentin Market Key Takeaways

- In terms of revenue, the gabapentin market is valued at $3.07 billion in 2025.

- It is projected to reach $5.23 billion by 2034.

- The gabapentin market is expected to grow at a CAGR of 6.07% from 2025 to 2034.

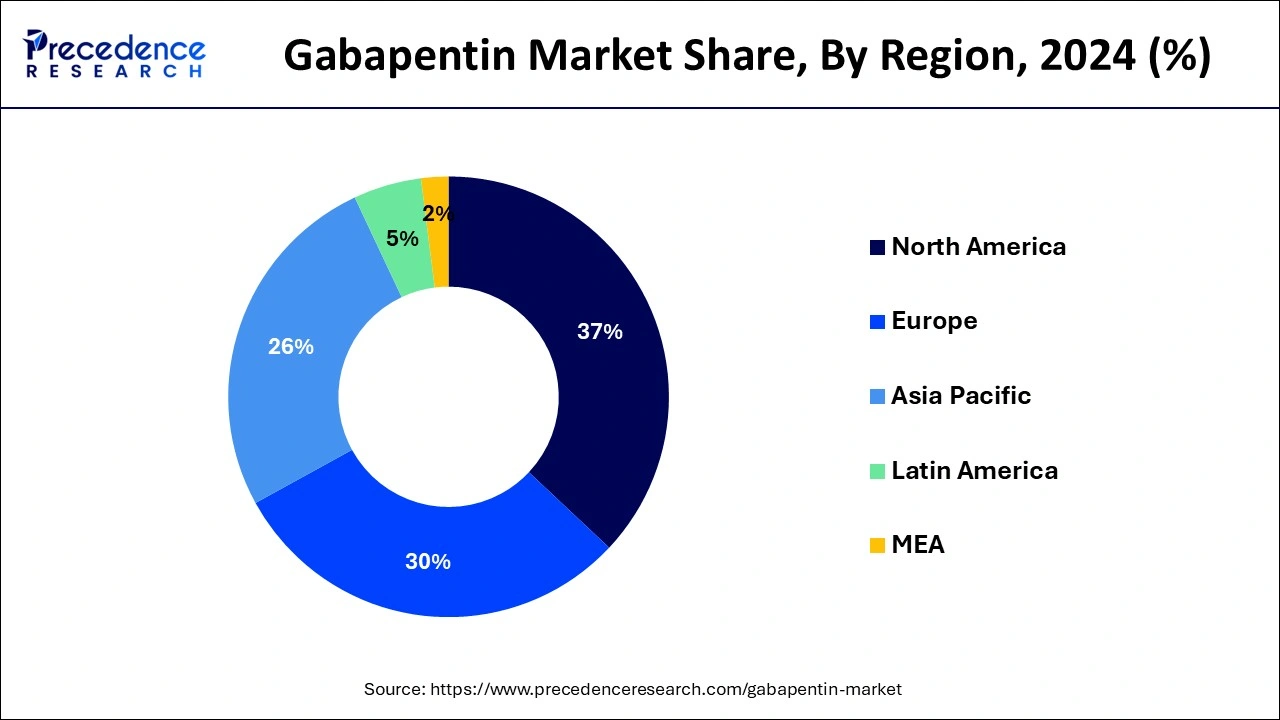

- North America contributed more than 37% of revenue share in 2024.

- Asia-Pacific region is predicted to grow at the fastest CAGR during the forecast period.

- By Dosage, the capsules segment has held the highest market share in 2024.

- By Dosage, the tablet segment is anticipated to expand at a noteworthy CAGR during the projected period.

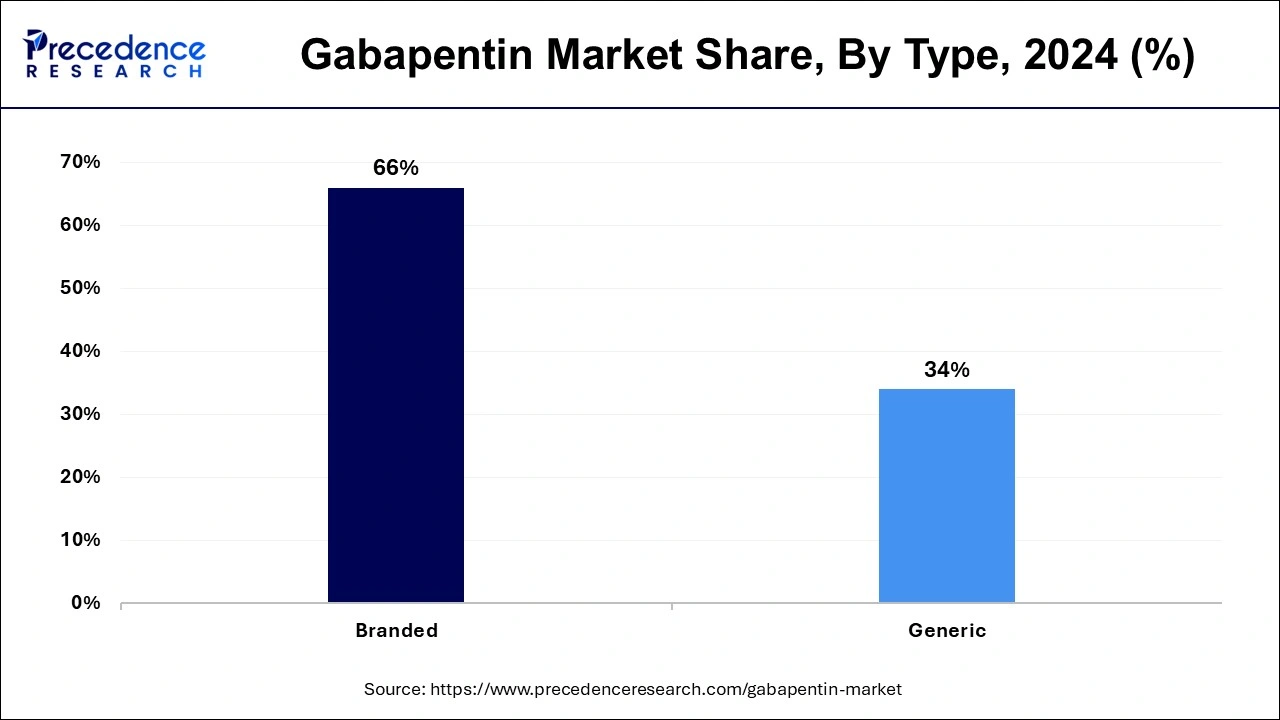

- By Type, the generic segment held the largest revenue share in 2024.

- By Type, the branded segment is anticipated to grow at the fastest CAGR over the predicted period.

- By Application, the epilepsy segment has held the largest market share in 2024.

- By Application, the neuropathic pain segment is anticipated to grow at the fastest rate over the projected period.

- By Distribution Channel, the hospital pharmacy segment registered the highest market share in 2024.

- By Distribution Channel, the online pharmacies segment is projected to expand at the fastest CAGR over the projected period.

Market Overview

Gabapentin is a pharmaceutical drug used in the management of neurological conditions, particularly epilepsy and neuropathic pain. It operates by modulating nerve activity in the brain and nervous system. This medication is a vital component in the healthcare sector, aiding in the treatment of a variety of conditions marked by abnormal nerve signaling.

Role of AI in the Gabapentin Market

AI has influenced the gabapentin market as it contributes to market analysis, personalized treatment, and drug development. The growing research and development of drugs in the pharmaceutical sector result in the preparation of advanced formulations; such huge datasets are analyzed by AI algorithms to identify the potential of the drugs. These artificial intelligence tools are also useful in predicting market demand, which helps pharmaceutical companies decide whether to produce drugs that lead to the reduction of wastage. It can detect early if there are any side effects of the drugs to any patient.

Gabapentin Market Outlook

- Industry Growth Overview:Between 2024 and 2034, the gabapentin market is expected to grow steadily as neuropathic pain and chronic neurological disorders continue to increase worldwide. Use of gabapentin as a frontline therapy is becoming more common in clinical practice as healthcare providers look for safer, non-opioid options for pain management after the world took steps to reduce opioid use and issued new prescribing guidelines. The aging populations in North America, Europe, Japan, and South Korea, where diabetic neuropathy and spinal diseases are on the rise, are also fueling demand.

- Rising Clinical Acceptance:Gabapentin's role in treating neuropathic pain is reinforced in clinical guidelines from major organizations like AAN, the European Pain Federation, and NICE (UK). Real-world data published in journals such as JAMA Neurology, Pain, and Neurology demonstrate its clinical stability in chronic conditions. Gabapentin is increasingly used for diabetic neuropathy and post-operative neuropathic pain. As opioid use restrictions grow in Europe and the U.S., gabapentin is becoming a trusted alternative in multimodal pain management.

- Manufacturing & Supply Chain Expansion:Global manufacturers are ramping up production to meet rising demand, preventing the shortages that previously disrupted the U.S. and European markets. Discovery Pharmaceuticals is vertically integrating its gabapentin API production, reducing reliance on third-party suppliers and improving cost efficiency. Companies like Teva, Aurobindo, Lupin, and Dr. Reddy are involved, and several FDA- and EMA-approved facilities in India, Europe, and North America have been upgraded to the latest GMP standards, ensuring a stable supply.

- Regulatory Landscape:Regulators in the U.S., UK, and parts of the EU have tightened oversight on gabapentin due to concerns around misuse and co-abuse with opioids. New classification rules, monitoring protocols, and dispensing restrictions have been implemented. Despite this increased scrutiny, prescription volumes remain strong, as physicians recognize gabapentin's effectiveness in treating chronic pain when properly prescribed and monitored. While these regulations are shaping market behavior, they do not diminish the drug's clinical or commercial relevance.

- R&D & Formulation Innovation:Innovation in gabapentin formulations is growing as companies aim for better pharmacokinetics, less frequent dosing, and increased patient adherence. Next-generation products are being developed through research on controlled-release and gastro-retentive delivery systems. This is highlighted in journals like the European Journal of Pharmaceutical Sciences and Drug Development and Industrial Pharmacy. Recent advances in nanocarrier technology and enzyme excipient technologies are enabling more efficient absorption and allowing the use of lower-dose regimens.

- Investment Landscape:The gabapentin market continues to attract significant interest from private equity firms and generic pharmaceutical consolidators due to its stable demand and attractive margins. Various companies, such as KKR, Blackstone Life Sciences, Advent International, and Carlyle Healthcare, are expanding into neurological therapeutics through firms with strong CNS portfolios, including gabapentin. The interest in this market is growing alongside rising trends in neurology, pain management, and chronic disease care.

Gabapentin Market Growth Factors

- The gabapentin market characteristics are shaped by a combination of industry trends, growth factors, challenges, and promising business prospects, highlighting its essential role in addressing a wide range of neurological and pain-related disorders.

- One of the foremost trends propelling the gabapentin market is the escalating prevalence of neuropathic pain, commonly associated with conditions such as diabetes and post-herpetic neuralgia. This increasing incidence fuels the demand for gabapentin as an effective treatment option.

- Furthermore, gabapentin's widespread use in epilepsy management contributes significantly to market growth, with the rising prevalence of this neurological disorder necessitating reliable treatment options.

- The healthcare sector's growing emphasis on pain management strategies further boosts gabapentin's demand, given its proven efficacy in addressing neuropathic pain.

- The drug's off-label applications, including its use in mood disorders and as an adjunct therapy in addiction treatment, contribute to market expansion.

- The aging global population, which is more susceptible to neurological disorders and chronic pain conditions, represents a substantial driver in increasing the need for gabapentin.

- Despite its growth potential, the gabapentin market faces notable challenges. Generic competition poses a considerable threat to brand-name manufacturers, potentially impacting their profit margins. The medication's associated side effects and the development of tolerance among some patients necessitate careful monitoring and management, presenting clinical and regulatory challenges.

- Regulatory bodies closely scrutinize the prescription and use of gabapentin due to concerns regarding its potential for misuse.

- To thrive in the gabapentin market, companies can explore various business opportunities. Innovating in drug formulations, such as the development of extended-release versions, can offer opportunities for market differentiation and the extension of patent protection.

- The global expansion into emerging markets with increasing healthcare access and rising prevalence of neurological disorders offers a path to tap into new patient populations and expand market reach.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Market Size in 2026 | USD 3.25 Billion |

| Market Size in 2025 | USD 3.07 Billion |

| Market Size by 2034 | USD 5.23 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Dosage, By Type, By Application, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing neuropathic pain prevalence and expanding use in epilepsy treatment

Growing neuropathic pain prevalence amplifies the demand for gabapentin due to its recognized effectiveness in managing such pain conditions. Gabapentin's recognized efficacy in managing neuropathic pain makes it a sought-after medication, offering relief and improved quality of life to those suffering from these conditions. Consequently, the increasing incidence of neuropathic pain fuels the demand for gabapentin within the healthcare sector.

Moreover, the expanding use of gabapentin in epilepsy treatment significantly surges market demand. With the increasing prevalence of epilepsy, a neurological disorder characterized by recurrent seizures, Gabapentin's effectiveness in seizure control has become increasingly recognized. Physicians are prescribing gabapentin as an integral component of epilepsy management. This growing demand is fueled by the imperative need for safe and reliable therapies, positioning gabapentin as a key pharmaceutical choice in addressing this neurological condition.

Restraints

Patient non-compliance and side effects

Patient non-compliance presents a significant restraint on the gabapentin market. Non-compliance with prescribed gabapentin treatment regimens can hinder optimal therapeutic outcomes, potentially worsening patients' medical conditions. Reasons for non-compliance vary and may include forgetfulness, concerns regarding side effects, or a lack of comprehension about the critical role of consistent medication adherence in managing their health conditions. This non-adherence can impact the effectiveness of gabapentin treatment and overall patient well-being. This hindrance to treatment effectiveness not only impacts patient health but also limits the market's growth potential as the full benefits of gabapentin may not be realized.

Moreover, Side effects associated with gabapentin can act as a restraint on market demand. These side effects can result in patient discomfort and non-compliance, affecting treatment outcomes. Healthcare providers may be cautious in prescribing gabapentin due to these potential side effects, impacting its market demand, especially in cases where alternative treatments with fewer side effects are available.

Opportunities

Innovative formulations and combination therapies

Innovative formulations of gabapentin have the potential to significantly boost market demand. The development of new delivery methods, such as extended-release versions or alternative dosage forms, can enhance patient convenience and compliance. These innovations can offer improved treatment options, reduce the frequency of dosing, and potentially enhance the therapeutic efficacy of gabapentin. Patients and healthcare providers are likely to be more inclined to choose these innovative formulations, thus driving increased demand within the gabapentin market.

Moreover, Combination therapies involving gabapentin can significantly surge market demand. These therapies leverage gabapentin's effectiveness in managing neurological conditions and neuropathic pain while complementing it with other medications to achieve synergistic therapeutic effects. This approach not only enhances treatment outcomes but also broadens the scope of gabapentin's applications. Healthcare providers and patients seek comprehensive treatment regimens that address multiple aspects of their medical conditions, driving the demand for gabapentin in combination therapies.

Technological Advancement

Technological advancements in the gabapentin market feature telemedicine. Telemedicine resembles telecommunications, computers. This technology is interconnected to telehealth services. It's a significant part of the telehealth market, enabling health providers to work remotely and render services through phone consultation or video calls. This technology is beneficial for healthcare providers and patients.

Telemedicine technology can also be used for follow-up appointments, medication management, surgery, and monitoring of chronic conditions. Telemedicine also promotes tele-intensive care, mainly used to treat critical patients, by multiple doctors connecting from different locations. Elimination of time constraints contributes to the health and safety measures.

Segement Insights

Dosage Insights

By dosage, the capsules segment registered its dominance over the global market in 2024. Gabapentin capsules are oral dosage forms of the medication used to treat neurological conditions and neuropathic pain. In the gabapentin market, there is a growing trend toward the development and availability of extended-release capsules, which offer convenient once-daily dosing and improved patient adherence. These formulations enhance the therapeutic experience for patients by reducing the frequency of medication administration, a trend that aligns with patient-centric healthcare approaches and fosters market growth.

The tablet segment is anticipated to grow with the highest CAGR in the market during the study. Tablets are oral pharmaceutical forms of the medication, providing measured doses of Gabapentin. Gabapentin tablets are oral pharmaceutical forms of the medication, providing measured doses of Gabapentin. In the gabapentin market, tablet formulations have witnessed trends towards the development of extended-release versions, enhancing dosing convenience and patient adherence. These formulations offer sustained gabapentin release, reducing the frequency of daily doses. Patients and healthcare providers increasingly favor such tablet innovations for improved treatment outcomes and enhanced patient comfort in managing neurological and pain-related conditions.

Type Insights

By type, the generic segment held a dominant presence in the market with share of 66% in 2024. In the gabapentin market, generic medications are non-brand-name versions of gabapentin. These generics contain the same active ingredient, but they are typically more affordable than brand-name counterparts. A key trend in the gabapentin industry is the increasing availability and adoption of generic gabapentin formulations. As patents expire for brand-name gabapentin, generic versions are becoming more prevalent, providing cost-effective alternatives for patients and healthcare systems while contributing to market competition and affordability.

By type, the branded segment is anticipated to grow with the highest CAGR in the market during the studied years. In the gabapentin market, the branded segment refers to pharmaceutical products marketed and sold under proprietary brand names. Branded gabapentin medications are typically developed by pharmaceutical companies, patented, and promoted for their unique qualities. Trends in the branded gabapentin segment include the introduction of innovative formulations to improve patient adherence, increased marketing efforts to differentiate products, and a focus on extended-release versions to enhance therapeutic convenience. Branded gabapentin products often command premium pricing due to their recognized quality and efficacy.

Application Insights

By application, the epilepsy segment dominated the market globally. Epilepsy, a neurological disorder characterized by recurrent seizures, is a primary application of gabapentin. Market trends indicate a growing demand for gabapentin in managing epilepsy. This aligns with the continuous mission to improve the quality of life for individuals with epilepsy by providing enhanced treatment choices, including gabapentin, well-known for its effectiveness in managing the condition.

On the other hand, the neuropathic pain segment is projected to grow at the fastest rate over the projected period. In the gabapentin market, there is a growing trend in utilizing gabapentin to alleviate neuropathic pain, given its established effectiveness. This trend reflects a rising awareness of gabapentin's therapeutic benefits in addressing this debilitating condition. As the prevalence of neuropathic pain continues to increase, the market for gabapentin as a treatment option for this specific application is expected to expand.

Distribution Channel Insights

By distribution channel, the hospital pharmacy segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Hospital pharmacy in the gabapentin market refers to the distribution channel within healthcare facilities where gabapentin and other medications are dispensed to inpatients and outpatients. Trends in hospital pharmacy include improved inventory management systems to ensure medication availability, increased emphasis on patient education regarding gabapentin use and potential side effects, and the integration of electronic health records to enhance prescription accuracy and tracking, all aimed at optimizing patient care and medication management within hospital settings.

The online pharmacies is anticipated to expand at the fastest rate over the projected period. Online pharmacies are digital platforms that enable consumers to purchase medications, including gabapentin, over the internet. These platforms offer convenience, cost savings, and easy access to medications. The gabapentin market has seen a growing trend of consumers opting for online pharmacies due to the increased adoption of telehealth and e-prescriptions. This trend aligns with the broader shift toward digital healthcare solutions, providing patients with a convenient and accessible way to obtain gabapentin and manage their health conditions.

Regional Insights

North America has held the largest revenue share 37% in 2025

In North America, the gabapentin market exhibits several notable trends. The region witnesses a continued demand for gabapentin, driven by the rising prevalence of neuropathic pain conditions, such as diabetic neuropathy and post-herpetic neuralgia. Additionally, an aging population prone to neurological disorders contributes to sustained market growth. Regulatory scrutiny and efforts to combat misuse and abuse of Gabapentin have also shaped prescription practices in this region, emphasizing the importance of careful medication management.

North America is dominating the gabapentin market. North America has the largest share of the market. The increased pharmaceutical industries and the demand for medications have propelled. The innovative advancement and technology in testing and formulation of the drugs makes this region the highest producing drugs market. The attentive research and development by the government unleashes the market strategy. The active participation of the regulatory body encourages advancement in the industries.

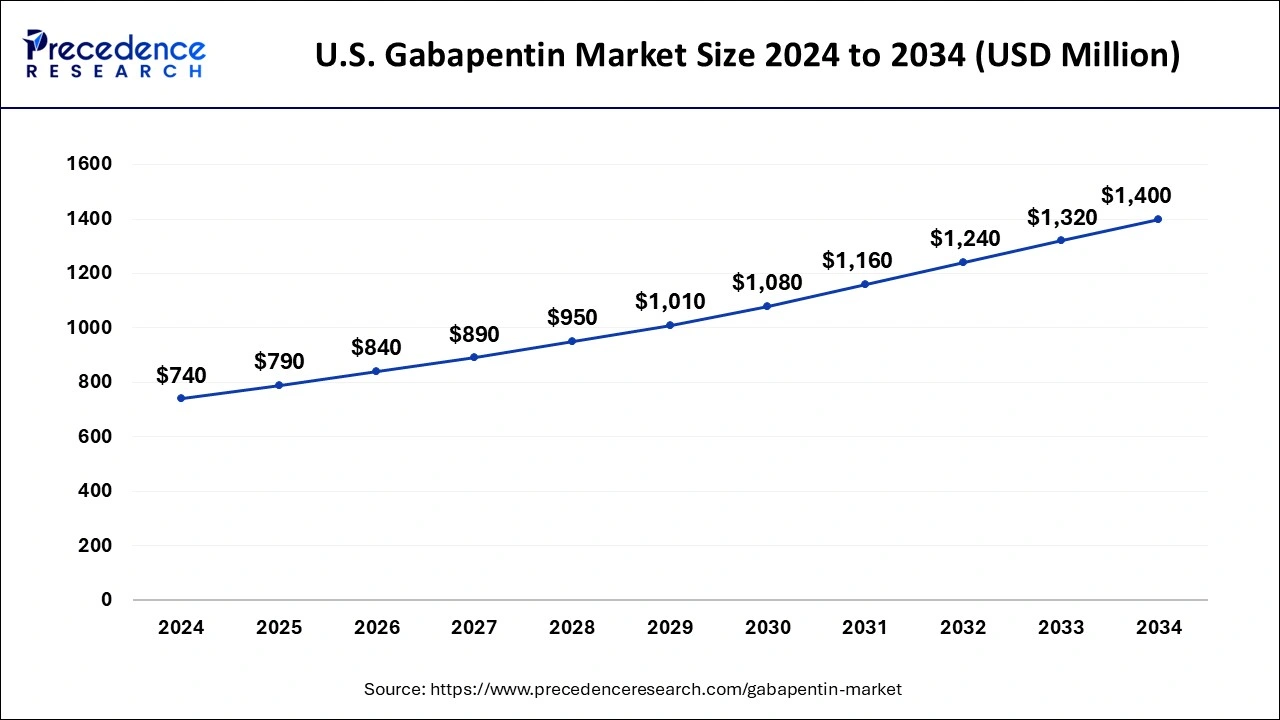

U.S. Gabapentin Market Analysis

The U.S. leads the North American gabapentin market, driven by its widespread use for neuropathic pain, spinal nerve compression, and diabetic neuropathy. Prescription volumes remain strong, as major institutions like the Mayo Clinic, Cleveland Clinic, and Johns Hopkins integrate gabapentin into their standard chronic pain treatment protocols. With federal restrictions on opioid prescriptions, the use of gabapentin is expected to rise, as doctors turn to non-opioid alternatives. The American Academy of Neurology's clinical guidelines support this prescribing trend.

U.S. Gabapentin Market Size and Forecast 2025 to 2034

The U.S. gabapentin market size accounted for USD 790 million in 2025 and is estimated to reach around USD 1,400 million by 2034, growing at a CAGR of 6.58% from 2025 to 2034.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the gabapentin market is witnessing notable trends. The market is expanding due to the region's growing aging population, leading to increased cases of neurological disorders and chronic pain conditions. Additionally, improved access to healthcare services and rising awareness about Gabapentin's efficacy are driving its demand. However, the market also faces challenges related to regulatory variations across countries. Overall, Asia-Pacific presents significant growth potential for the gabapentin market, driven by demographic shifts and healthcare advancements.

India Gabapentin Market Analysis

India dominates regional consumption of gabapentin, driven by a large patient base with diabetic neuropathy, post-herpetic neuralgia, and alcohol-related nerve damage. Prescription volumes are rising as diagnosis accuracy improves in tertiary hospitals across Mumbai, Delhi, Chennai, and Bengaluru. Increased physician education through neurology conferences and CME programs is also expected to boost therapeutic uptake in the country.

Why is Europe Considered a Notably Growing Area in the Gabapentin Market?

Europe is expected to grow at a notable rate in the market, driven by the widespread use of gabapentin in treating chronic neuropathic pain in the UK, Germany, France, and Spain. Updated clinical guidelines from NICE and the European Pain Federation recommend non-opioid treatments for peripheral neuropathy, likely boosting prescription volumes. Additionally, the strong use of generics and well-established public healthcare systems are expected to further support market growth.

Germany Gabapentin Market Analysis

Germany plays a key role in the European market, driven by the high prevalence of neuropathic disorders related to aging, spinal degeneration, and diabetes. The use of cost-effective generics is expected to become part of existing chronic pain treatment protocols in hospital formularies in major cities such as Berlin, Munich, and Frankfurt. Additionally, Germany's advanced diagnostic infrastructure and leading neurology centers ensure its ongoing dominance in the European market.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing an opportunistic rise in the gabapentin market, supported by increasing diagnoses of neuropathic complications linked to diabetes and post-viral infections. The growth is likely to be driven by Brazil and Mexico, as public hospitals are incorporating cost-effective generics in managing chronic pain. Additionally, the expansion of telemedicine improves access to neurological consultations and supports the steady increase in prescriptions.

Brazil Gabapentin Market Analysis

Brazil dominates the regional market due to its growing diabetic population and increasing cases of peripheral neuropathy across public and private healthcare systems. Prescribing is expected to rise as neurologists follow systematic protocols for chronic pain management in major urban areas like São Paulo and Rio de Janeiro. Public sector reform initiatives aimed at expanding neurology services are also expected to boost long-term prescription growth.

What Potentiates the Growth of the Middle East and Africa Gabapentin Market?

The market in the Middle East and Africa (MEA) is expected to grow steadily over the forecast period, driven by the rising prevalence of chronic diseases, especially diabetes-related neuropathy. The Gulf Cooperation Council countries are likely to see gradual growth, as they have robust healthcare facilities and are actively procuring neuropathic pain products. Additionally, increased efforts by neurological associations to raise awareness of pain management are likely to improve therapeutic acceptance in the region.

Saudi Arabia Gabapentin Market Analysis

Saudi Arabia leads the MEA market due to its advanced healthcare system, strong neurology departments, and high treatment-seeking behavior among chronic pain patients. The partnership between Indian manufacturers and GCC distributors is expected to improve supply in both public and private pharmacies. Rising levels of lifestyle diseases such as obesity and diabetes are already estimated to create additional barriers to demand in outpatient and specialty clinics.

Gabapentin Market – Value Chain Analysis

- Active Pharmaceutical Ingredient (API) Sourcing & Raw Material Procurement

The value chain begins with sourcing key chemical intermediates, such as cyclohexanone, sodium hydroxide, and other reagents, essential for the synthesis of the gabapentin API. These materials undergo stringent quality validation to meet pharmacopeial standards (USP, EP, IP).

Key Players: Aurobindo Pharma, Teva API, Dr. Reddy's Laboratories, Cambrex, Hikal Ltd. - API Manufacturing & Purification

Chemical intermediates are processed through multi-step synthesis to create high-purity gabapentin API, followed by crystallization, filtration, milling, and GMP-grade quality assurance. API manufacturers ensure compliance with regulatory guidelines (USFDA, EMA, MHRA).

Key Players: Aurobindo Pharma, Cadila Healthcare (Zydus), Dr. Reddy's Laboratories, Lupin, Zhejiang Huahai Pharmaceutical. - Formulation Development & Dosage Manufacturing

The purified API is formulated into capsules, tablets, or oral solutions using excipients, coatings, and controlled-release technologies. This stage includes granulation, compression, encapsulation, packaging, and stability testing in accordance with global regulatory norms.

Key Players: Pfizer (Neurontin), Teva Pharmaceuticals, Mylan (Viatris), Sun Pharma, Amneal Pharmaceuticals, Glenmark, Hikma Pharmaceuticals, Torrent Pharma. - Quality Control, Regulatory Compliance & Packaging

Finished products undergo dissolution testing, bioequivalence validation, impurity profiling, and conformity assessments aligned with pharmacopoeias. Packaging ensures product stability, tamper resistance, and anti-counterfeiting serialization.

Key Players: Pfizer, Sandoz, Apotex, Lupin, Cipla, Aurobindo Pharma. - Distribution to Pharmacies, Hospitals & Global Markets

Wholesalers, distributors, and hospital networks deliver finished gabapentin products to retail pharmacies, online pharmacies, clinics, and healthcare institutions worldwide. Logistics partners manage temperature-stable transport, inventory forecasting, and regulatory documentation.

Key Players: Cardinal Health, McKesson, AmerisourceBergen, Walgreens Boots Alliance, CVS Health, Phoenix Group (Europe).

Gabapentin Market Companies

- Pfizer Inc. – Pfizer offers a range of branded and generic gabapentin formulations, helping to drive availability in key markets.

- Teva Pharmaceutical Industries Ltd. – Teva is a leading global supplier of generic gabapentin, making it widely accessible in multiple regions.

- Mylan N.V. – Mylan (now part of Viatris) is a major player in the global generics market, providing cost-effective gabapentin options to patients worldwide.

- Sun Pharmaceutical Industries Ltd. – Sun Pharma manufactures and markets generic gabapentin, particularly in the U.S. and India, addressing growing demand for neuropathic pain treatments.

- Aurobindo Pharma Ltd. – Aurobindo produces affordable gabapentin formulations, contributing significantly to the market, especially in Europe and North America.

- Novartis AG – Through its generics division Sandoz, Novartis offers gabapentin as part of a broad portfolio of treatments for neuropathic pain.

- Amneal Pharmaceuticals, Inc. – Amneal supplies generic gabapentin, expanding its reach in the U.S. and helping to meet rising demand for non-opioid pain management.

- Glenmark Pharmaceuticals Ltd. – Glenmark manufactures and markets gabapentin in several regions, offering an alternative to branded formulations in the generics space.

- Hikma Pharmaceuticals PLC – Hikma is a prominent supplier of generic gabapentin, making it an accessible option for patients in the U.S. and other global markets.

- Lupin Limited – Lupin produces and distributes generic gabapentin, particularly in North America and Europe, helping reduce costs for patients with neuropathic pain.

- Torrent Pharmaceuticals Ltd. – Torrent offers a range of gabapentin products, supporting the growing demand for affordable pain management options.

- Cadila Healthcare Ltd. (Zydus Cadila) – Zydus Cadila manufactures and distributes generic gabapentin formulations, catering to both emerging and developed markets.

- Dr. Reddy's Laboratories Ltd. – Dr. Reddy's produces generic gabapentin, contributing significantly to the market, particularly in the U.S. and European regions.

- Apotex Inc. – Apotex offers cost-effective generic gabapentin formulations, helping increase accessibility in various global markets.

- Sandoz International GmbH – A division of Novartis, Sandoz provides high-quality generic gabapentin, meeting the rising demand for non-opioid treatments worldwide.

Recent Developments

- In February 2025, Zydus received approval from the United States Food and Drug Administration USFDA for gabapentin tablets. The drug will be manufactured at the group's formulation manufacturing facility at Moraiya.

- In November 2024,Torrent Pharmaceuticals received a green signal from the Subject Expert Committee (SEC) functional under the Central Drug Standard Control Organization (CDSCO).

- In June 2024, two UCF-trained physicians found an alternative treatment option for alcohol-related liver diseases. The gabapentinoids can be used to prevent seizures and are commonly used for nerve pain, and help in reducing alcohol withdrawal symptoms.

- In March 2024, Strides Pharma received approval from the United States Food and Drug Administration USFDA for neurology medication gabapentin. The announcement of approval took place during a release on the exchanges.

- In January 2024, Zydus Lifesciences Limited announced that they had secured the approval of the United States Food and Drug Administration (USFDA) for Gabapentin Tablets (Once daily), available in 300 mg and 600 mg variants.

- In March 2024, Strides Pharma Science Limited (Strides) announced that they had received the approval of the United States Food & Drug Administration (USFDA) for Gabapentin Tablets USP, in strengths of 600 mg and 800 mg.

Segments Covered in the Report

By Dosage

- Tablet

- Capsule

- Oral Solution

By Type

- Generic

- Branded

By Application

- Epilepsy

- Neuropathic Pain

- Restless Legs Syndrome

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting