What is the Neuropathic Pain Market Size?

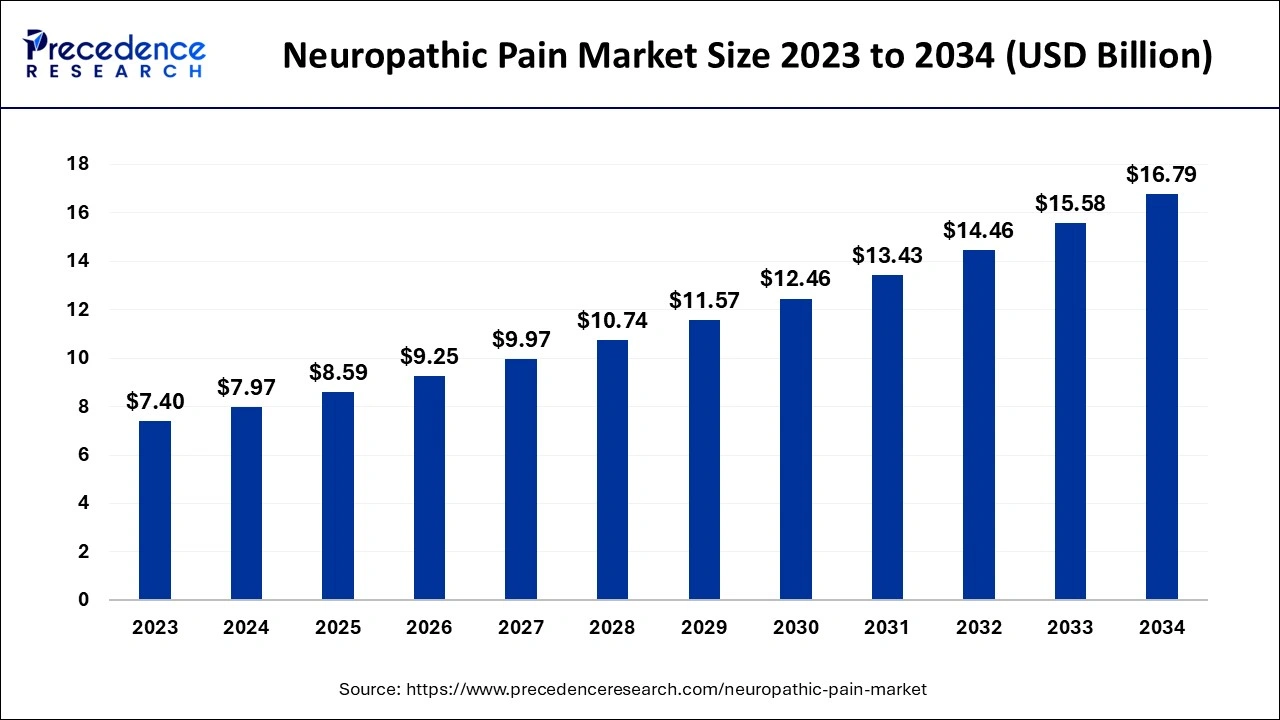

The global neuropathic pain market size is valued at USD 8.59 billion in 2025 and is predicted to increase from USD 9.25 billion in 2026 to approximately USD 16.79 billion by 2034, expanding at a CAGR of 7.74% from 2025 to 2034. The growing burden of neuropathic pain among patients suffering from chronic diseases is the key factor driving the neuropathic pain market growth. Also, an increase in demand for neuropathic treatment drugs coupled with the rise in government initiatives can fuel market growth further.

Neuropathic Pain Market Key Takeaways

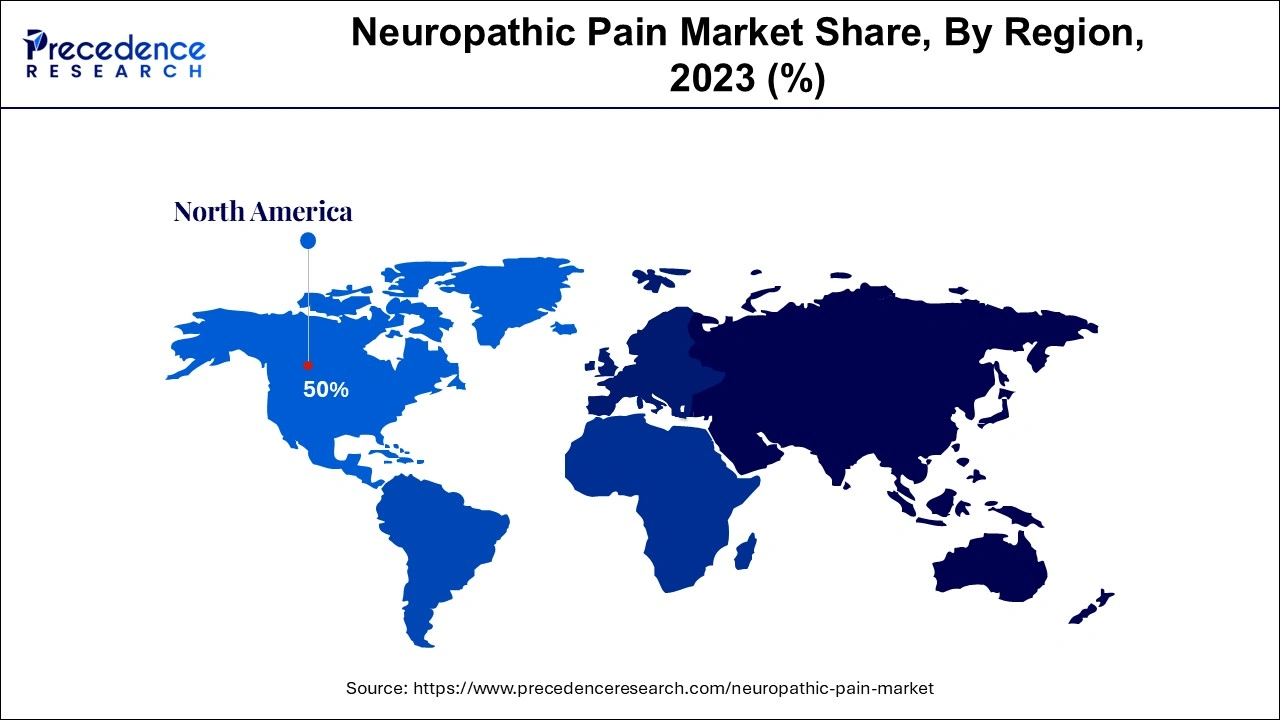

- North America dominated the global market with the largest market share of 50% in 2024.

- Asia Pacific is anticipated to grow at a significant CAGR during the projected period.

- By drug class, the anticonvulsant segment dominated the market in 2024.

- By drug class, the tricyclic antidepressant (TCA) segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the chemotherapy-induced neuropathy segment led the market in 2024.

- By application, the diabetic neuropathy segment is anticipated to expand at a CAGR from 2025 to 2034.

- By route of administration, the oral segment contributed the highest market share in 2024.

- By route of administration, the parenteral is projected to grow at a significant CAGR during the forecast period.

- By distribution channel, the retail pharmacy segment captured the biggest market share in 2024.

- By distribution channel, the online pharmacy segment is anticipated to grow significantly during the forecast period.

Market Overview

The neuropathic pain market is an industry for products and services associated with the treatment of neuropathic pain, a chronic condition that can occur due to disease or damage to the nervous system. Common symptoms of this pain are numbness, feelings of coldness or burning, needles, and pins., Anticonvulsants, Opioids, antidepressants, and Capsaicin are some of the most common types of medications used to control neuropathic pain.

Role of Artificial Intelligence (AI) in Chronic Pain Management

Artificial intelligence is transforming the chronic pain management system by offering new insights into the body's response to chronic pain. Innovative imaging methods like arterial spin labeling (ASL) and functional MRI (fMRI) are increasingly used to navigate the neural response of pain. Furthermore, AI's ability to process complex information provides customized treatment recommendations for pain management solutions.

- In September 2024, Nevro Corp. announced the launch of HFX iQ with HFX AdaptivAI. It also received U.S. Food and Drug Administration (FDA) approval and limited market release of a responsive, individualized pain management platform powering the HFX iQ spinal cord stimulation (SCS) system.

Market Outlook

- Industry Growth Overview: The neuropathic pain market is expected to experience steady growth between 2025 and 2034, driven by the rising prevalence of nerve-related disorders. Growing awareness of chronic pain management, advancements in drug formulations, and the development of new therapeutic targets are fostering innovation, while expanding healthcare infrastructure and R&D investments support global market growth.

- Global Expansion: The market is growing worldwide due to increasing diagnostic capabilities, improved access to pain management treatments, and rising healthcare investments in emerging economies. Pharmaceutical companies and key players in the market are expanding their reach through strategic partnerships, clinical collaborations, and innovative drug launches, thereby enhancing treatment access and raising awareness of neuropathic pain management.

- Major investors:Major investors in the market include leading pharmaceutical companies such as Pfizer, Eli Lilly, Novartis, and Teva Pharmaceuticals, which are investing heavily in R&D for advanced pain therapeutics. Institutional investors like BlackRock and Vanguard support these firms, driving innovation, clinical development, and expansion of global pain management portfolios.

- Startup Ecosystem: The neuropathic pain market's startup ecosystem is expanding rapidly, focusing on novel drug discovery, neurostimulation technologies, and precision pain management solutions. Emerging biotech firms are leveraging AI, genomics, and nanotechnology to develop targeted therapies. Collaborations with academic institutions and pharmaceutical giants enhance clinical validation, expand access to funding, and accelerate innovation in chronic pain treatment.

Neuropathic Pain Market Growth Factors

- Increasing awareness among medical professionals and patients regarding neuropathic pain is expected to boost neuropathic pain market growth shortly.

- The increasing of chronic pain conditions across the globe can propel market growth further.

- The surge in the global burden of patients suffering from trigeminal neuralgia, HIV, and fibromyalgia will likely contribute to market expansion soon.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 16.79 Billion |

| Market Size in 2026 | USD 9.25 Billion |

| Market Size in 2025 | USD 8.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.74% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Application, Route of Administration, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

Increasing shift toward patient-centric care

The rising shift towards more individualized medication in the neuropathic pain market fuels specialized treatment approaches. Healthcare providers are prioritizing the patient's preferences and need to develop holistic and more effective strategies. In addition, the increasing focus on detailed chronic pain management programs optimizes holistic interventions and interdisciplinary approaches.

- In October 2024, MIRA Pharmaceuticals announced that its novel oral ketamine analog, Ketamir-2, outperforms FDA-approved neuropathic pain treatments Pregabalin and Gabapentin in preclinical studies.

Restraint

Side effects of treatment

Side effects associated with traditional neuropathic pain treatments like opioids and other antidepressants hinder the growth of the neuropathic pain market. Patients' unwillingness to follow this line of treatment due to its potential adverse reactions impacts the overall expansion of the market. However, this approach constrained the flow of investment in this line of treatment and boosted demand for safer therapeutic alternatives.

Opportunity

The development of topical patches

The development of topical patches is the new trend in the neuropathic pain market. The topical patches provide a multimodal approach to neuropathic pain management with less absorption and an enhanced safety profile compared to traditional solutions. Furthermore, Researchers have discovered numerous solutions for topical use, such as capsaicin, anti-inflammatory drugs, tricyclic antidepressants, and ketamine, which can be utilized in combination with other drugs.

- In October 2024, Tonik launched its transdermal patches formulated with homeopathic formulations for sleep and stress relief into more Asian markets while also preparing to unveil four new SKUs in the next six months.

Drug Class Insights

The anticonvulsant segment dominated the neuropathic pain market in 2024. This dominance can be attributed to the growing demand for innovative pain management solutions for diabetic neuropathy coupled with the easy availability of anticonvulsant drugs like Horizant, Gralise, Lyrica, etc. Additionally, this drug can also treat conditions such as migraine, anxiety, fibromyalgia, and restless leg syndrome.

- In March 2024, the Epilepsy Foundation announced a collaboration with Iaso Ventures, a prominent venture capital firm, to establish the Iaso NeuroImpact Fund. This advanced fund serves as a cornerstone for advancing the development of pioneering therapeutics.

The tricyclic antidepressant (TCA) segment is expected to grow at the fastest rate in the neuropathic pain market over the forecast period. The growth of the segment can be linked to the increasing consumption of this drug in the treatment of chronic pain, insomnia, bedwetting, and anxiety disorders. However, TCA has some side effects such as urinary retention and cardiac arrhythmias. Some commonly prescribed TCAs are imipramine, desipramine, amitriptyline, and doxepin.

Application Insights

The chemotherapy-induced neuropathy segment led the neuropathic pain market in 2024. The dominance of the segment can be credited to the increasing prevalence of cancer across the globe, which leads to a surge in the amount of patients undergoing chemotherapy treatment. Also, more healthcare professionals prefer chemotherapy treatments as the first line of action to cure cancer and related diseases.

The diabetic neuropathy segment is anticipated to grow at the fastest rate in the neuropathic pain market over the projected period. This growth can be driven by the rising focus of biotechnology and pharmaceutical companies on the development of reliable and more effective therapeutics. Furthermore, this neuropathy pain can be controlled with topical treatments and a combination of different medications.

- In January 2024, Neuralace Medical, Inc., an innovator in pain management technology, announces the FDA clearance of its groundbreaking product, axon therapy (PNS), for the treatment of chronic painful diabetic neuropathy (PDN).

Route of Administration Insights

The oral segment dominated the global neuropathic pain market in 2024. The dominance of the segment is due to the increasing availability of a number of oral therapeutics for effective pain management such as Pregabalin, Amitriptyline, Gabapentin, and Tramadol-acetaminophen. The oral route of administration is the most convenient way to take these drugs, which have the least side effects when administered orally.

The parenteral segment is expected to show the fastest growth in the neuropathic pain market during the forecast period. The growth of the segment is driven by the growing emphasis of the biopharmaceutical and pharmaceutical industries on the research and development of effective therapeutics. Parenteral drugs such as ceftriaxone and lidocaine are primarily used to treat neuropathic pain. These drugs work by blocking the pain sensory receptors in the body.

Distribution Channel Insights

The retail pharmacy segment led the global neuropathic pain market. The dominance of the segment is linked to the escalating need for topical nerve pain medicines like AneCream5 and Elavil, which are available easily in retail pharmacies. Furthermore, retail pharmacies offer a wide range of analgesic drugs to treat the neuropathy pain prescribed by medical professionals.

The online pharmacy segment is estimated to grow at the fastest rate in the neuropathic pain market over the projected period. The growth of the segment can be credited to the growing availability of off-label drugs and prescriptions on online pharmacy channels. In addition, the growing preference for patients to purchase products easily without visiting the pharmacy stores is also contributing to the segment's growth further.

Regional Insights

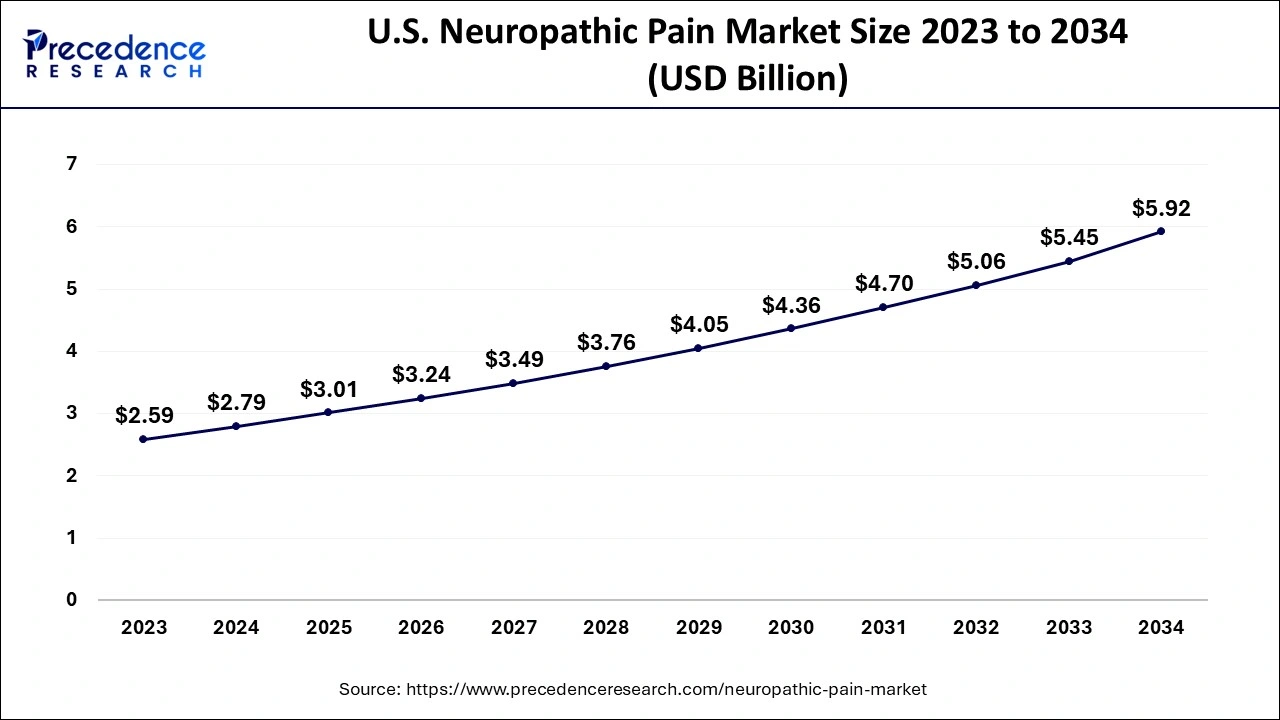

U.S. Neuropathic Pain Market Size and Growth 2025 to 2034

The U.S. neuropathic pain market size is exhibited at USD 3.01 billion in 2025 and is projected to be worth around USD 5.92 billion by 2034, growing at a CAGR of 7.81% from 2025 to 2034.

North America dominated the global neuropathic pain market in 2024. The region's dominance can be attributed to the strong presence of major market players like Azurity, Almatica, Viatrsi Inc., etc. The region also witnesses the high prevalence of cancer and other chronic diseases like diabetes, which leads to neuropathy pain. Strategic initiatives, new product launches, and collaborations also contributed to the market expansion in the region.

U.S. Neuropathic Pain Market Analysis

In the U.S., there is a strong shift toward non-opioid therapies and new mechanisms of action, such as sodium-channel blockers and NGF antagonists, to meet the growing demand for safer, more effective pain relief. At the same time, there is increasing adoption of digital health and neuromodulation technologies, integrating wearable devices, remote monitoring, and personalized treatment plans to improve patient outcomes and manage chronic neuropathic conditions. These factors are contributing to market growth.

Why is Asia Pacific Considered a Significantly Growing Area in the Neuropathic Pain Market?

Asia Pacific is anticipated to grow at a significant rate in the neuropathic pain market over the projected period. The growth of the region can be driven by an increase in clinical trial activities coupled with a surge in research and development followed by innovative product launches in emerging economies such as India and China. Furthermore, the increasing awareness regarding the effective therapeutics that control pain effectively can raise the demand for neuropathic pain treatment drugs in the region.

Japan Neuropathic Pain Market Analysis

Japan emerges as a major contributor to the neuropathic pain market in Asia Pacific, owing to its advanced healthcare infrastructure, high patient awareness of chronic pain disorders, and a large ageing population that drives demand for nerve pain therapies. Simultaneously, robust adoption of innovative treatment modalities and established pharmaceutical and device ecosystems in Japan further strengthen its leadership position in the market.

- In July 2022, Novaremed AG and NeuroFront Therapeutics entered an exclusive partnership for Novaremed's non-opioid investigational drug, NRD.E1, for diabetes-associated and other neuropathic pain indications.

How is the Opportunistic Rise of Europe in the Neuropathic Pain Market?

Europe is expected to experience substantial growth in the market, driven by its aging population, increasing rates of diabetes and neurological disorders, and its strong healthcare infrastructure. Rising investments in pain research, supportive reimbursement policies, and greater adoption of advanced therapies create a favorable environment for innovation and continued market expansion across the region.

Germany Neuropathic Pain Market Analysis

Germany's neuropathic pain market is driven by a high prevalence of diabetes and chronic nerve disorders, advanced healthcare systems, and robust pharmaceutical R&D. The country's focus on personalized medicine, government support for pain management programs, and collaborations between biotech startups and research institutes foster continuous innovation and advancements in treatment.

UK Neuropathic Pain Market Analysis

The UK neuropathic pain market is supported by increasing awareness of chronic pain conditions, a robust healthcare framework under the NHS, and strong clinical research capabilities. Growing adoption of innovative pain therapies, supportive government initiatives, and collaborations among universities, hospitals, and pharmaceutical companies continue to drive advancements in neuropathic pain management.

How Crucial is the Role of Latin America in the Neuropathic Pain Market?

Latin America offers significant opportunities for expanding the neuropathic pain market due to the rising prevalence of diabetes and nerve-related disorders, improved healthcare access, and increased awareness of pain management therapies. Growing pharmaceutical distribution networks, government healthcare initiatives, and higher investment in chronic disease treatment further enhance regional market growth.

Brazil Neuropathic Pain Market Analysis

Brazil leads the Latin America neuropathic pain market due to its well-established healthcare infrastructure, large patient population, and rising prevalence of diabetes and neurological conditions. Strong government focus on chronic disease management, expansion of hospital networks, and increased access to advanced pain therapies reinforce Brazil's dominant position in the regional market.

How Big is the Opportunity for the Neuropathic Pain Market in the Middle East and Africa?

The Middle East and Africa offer significant opportunities in the neuropathic pain market, driven by improving healthcare infrastructure, rising prevalence of diabetes and nerve disorders, and increasing awareness of chronic pain management. Expanding pharmaceutical presence, government healthcare investments, and greater access to advanced pain treatment options further support regional market growth.

UAE Neuropathic Pain Market Analysis

The UAE leads the Middle East and Africa neuropathic pain market due to its advanced healthcare infrastructure, rapid adoption of innovative pain management therapies, and strong government initiatives supporting chronic disease care. High prevalence of diabetes, growing pharmaceutical investments, and collaborations with international healthcare providers further reinforce the country's leadership in neuropathic pain treatment and research.

Value Chain Analysis

- Research and Development (R&D)

In this stage, companies identify molecular targets linked to neuropathic pain, develop new drug candidates, and conduct preclinical studies focusing on efficacy, mechanism of action, and safety.

Key Players: Pfizer Inc., Eli Lilly and Company, Novartis AG, and Teva Pharmaceuticals. - Clinical Trial and Regulatory Approval

This phase involves multi-stage clinical testing (Phases I–III) to evaluate drug safety, dosing, and efficacy in patients with neuropathic pain. After successful trials, companies compile regulatory documentation and submit applications for approval while ensuring compliance with international quality and safety standards.

Key Players: Major regulatory bodies, such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the Pharmaceuticals and Medical Devices Agency (PMDA). - Patient Support and Service

After product approval, companies focus on patient education, therapy adherence programs, and pain management counseling.

Key Players: Healthcare networks such as Mayo Clinic, Cleveland Clinic, and Johns Hopkins.

Neuropathic Pain Market Companies

- Nevro Corp (U.S.) – Develops high-frequency spinal cord stimulation devices that provide non-opioid pain relief for chronic neuropathic pain patients.

- Lilly(U.S.) – Focuses on developing novel pharmacological therapies targeting neuropathic pain mechanisms, including sodium-channel and nerve growth factor modulators.

- Astellas Pharma Inc. (Japan) – Offers a range of therapeutic solutions for neuropathic pain, emphasizing innovative drug development and clinical research.

- Biogen (U.S.) – Invests in neurological research and therapies targeting nerve-related pain conditions, leveraging its expertise in neurodegenerative diseases.

- Cirtec(U.S.) – Provides design and manufacturing services for medical devices, including implantable neuromodulation systems for neuropathic pain management.

Integer Holdings Corporation (U.S.) – Supplies advanced medical device components and contract manufacturing for pain management devices. - B. Braun SE (Germany) – Develops infusion and drug delivery systems that support administration of analgesics and neuropathic pain medications.

- Medtronic(Ireland) – Leads in neuromodulation therapies, including spinal cord stimulators and peripheral nerve stimulation devices for neuropathic pain.

- Abbott (U.S.) – Offers neuromodulation devices and digital health solutions to manage chronic neuropathic pain and improve patient outcomes.

- Boston Scientific Corporation (U.S.) – Develops advanced neuromodulation and neurostimulation technologies to provide relief from chronic neuropathic pain.

- OMRON Healthcare Co., Ltd.(Japan) – Produces non-invasive neuromodulation devices for home-based management of chronic pain conditions.

- ElectroCore, Inc.(U.S.) – Focuses on non-invasive vagus nerve stimulation therapies that help alleviate certain types of neuropathic pain.

- Polar Medical Ltd(U.K.) – Specializes in wearable neuromodulation and electrotherapy devices targeting chronic nerve-related pain.

- SunMED Medical (U.S.) – Develops and manufactures spinal and neuromodulation devices for the treatment of neuropathic pain.

- NeuroMetrix, Inc.(U.S.) – Offers wearable neurostimulation devices and digital health solutions for peripheral neuropathy and chronic pain management.

Latest Announcement by Market Leaders

- In June 2024, Abbott announced the U.S. Food and Drug Administration (FDA) clearance for two new over-the-counter continuous glucose monitoring (CGM) systems, Lingo™ and Libre, Rio™.which are based on Abbott's leading FreeStyle Libre continuous glucose monitoring technology.

- In November 2024, Boston Scientific Corporation announced that it has entered into a definitive agreement to acquire Intera Oncology Inc., a privately held medical device company that offers the Intera 3000 Hepatic Artery Infusion Pump and floxuridin.

Recent Developments

-

In January 2025, Vertex Pharmaceuticals received U.S. regulatory approval for its novel non-opioid drug Suzetrigine (Journavx). This breakthrough therapy represents a major shift in neuropathic pain management by targeting pain transmission pathways without the addictive risks of opioids. Its approval marks a key milestone in the development of safer and more effective chronic pain treatments.

(Source: news.vrtx.com) -

In April 2025, Lyka Labs (India) was granted a patent for its Pregabalin Gel 8% topical formulation designed to treat diabetic neuropathic pain. The innovation offers a localized, non-systemic approach, reducing side effects associated with oral formulations. This development highlights India's growing focus on novel delivery systems for chronic pain management.

(Source: medicaldialogues.in) -

In July 2025, AlzeCure Pharma (Sweden) presented new Phase IIa clinical data for its investigational drug ACD440, a TRPV1 antagonist gel, at the NeuPSIG 2025 Pain Conference. Results demonstrated promising efficacy in reducing peripheral neuropathic pain with minimal adverse effects, reinforcing the company's leadership in topical, non-opioid pain therapies.

(Source: alzecurepharma.se) -

In September 2025, Lexicon Pharmaceuticals (U.S.) announced encouraging clinical findings for its AAK1 inhibitor Pilavapadin in diabetic peripheral neuropathic pain. The data showcased meaningful pain relief and improved nerve function, positioning the candidate as a next-generation oral therapy aimed at addressing the unmet needs of chronic neuropathic pain patients.

(Source: investors.lexpharma.com) - In May 2024, May 2024: Lexicon Pharmaceuticals Inc. chose Medidata, a Dassault Systèmes company, to propel its PROGRESS initiative. PROGRESS is a Phase 2b study of LX9211 aimed at treating diabetic peripheral neuropathic pain (DPNP).

- In September 2022, AlgoTx announced a phase 2 clinical trial for ATX01, a topical amitriptyline addressing chemotherapy-induced peripheral neuropathy (CIPN). Across 40 U.S. and European centers, the trial evaluates ATX01's efficacy for adults with CIPN, shaping the neuropathic pain market's growth.

Segment Covered in the Report

By Drug Class

- Anticonvulsant

- Tricyclic Antidepressants

- Opioids

- Capsaicin

- Steroids

- Others

By Application

- Diabetic Neuropathy

- Spinal Stenosis

- Chemotherapy-Induced

- Peripheral Neuropathy

- Others

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting