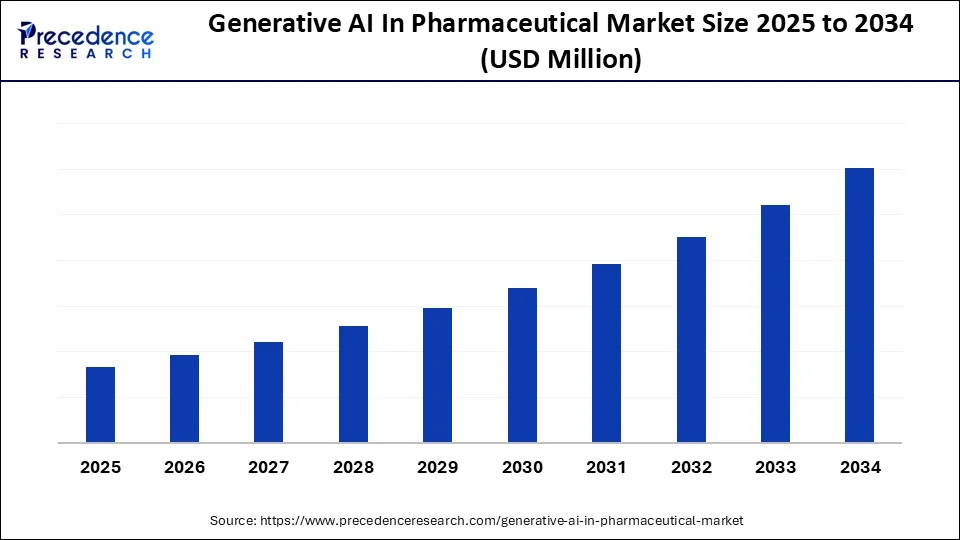

Generative AI in Pharmaceutical Market Size and Forecast 2026 to 2035

The global generative AI in pharmaceutical market is surging, with an overall revenue growth expectation of hundreds of millions of dollars during the forecast period from 2026 to 2035.

Generative AI in Pharmaceutical Market Key Takeaways

- North America holds the largest share of the market, the region is expected to sustain the growth during the forecast period.

- By technology, the deep learning segment is expected to dominate the market over the forecast period.

- By drug type, the small molecule segment is expected to hold the largest market share over the forecast period.

- By application, the drug discovery segment is expected to dominate the market growth during the forecast period.

Market Overview

Generative AI is a subset of AI that employs formulas to generate data that is comparable to training data. The original data might be anything, including images, written text, or even molecular structure. Generative AI employs what is known as neural networks as a component of machine learning to recognize patterns in the original data and generate new data that resembles it. When it comes to finding and creating novel medications, this technology offers enormous potential in the pharmaceutical sector. Generative AI can speed up the drug development process, assisting pharmaceutical companies in developing novel medications more quickly and efficiently by producing new molecules with certain properties.

The numerous kind of generative AI tools used in the pharmaceutical industry includes generative adversarial networks, recurrent neural networks, variational autoencoders, deep reinforcement learning, and transformer models. GANs are utilized in pharmacy research to produce compounds and develop novel drugs. The generator network in GANs creates synthetic samples, while the discriminator network determines whether or not these samples are real. New molecules with the appropriate properties are produced as a result of this procedure.

Recurrent Neural Networks are utilized to generate sequential data that may be used to develop novel chemical structures or enhance the characteristics of medications. RNNs can create new sequences with the appropriate properties by learning the patterns in sequential data.

Variational Autoencoders aids in the development of new drugs. These tools are capable of producing new molecules with specified properties and are aware of the dispersion of chemical structures. They are incredibly helpful in exploring the chemical universe and developing a variety of substances.

According to the National Institutes of Health, Genomic data production is rapidly nearing 40 billion gigabytes annually. Findings that will expand knowledge of human health and promote precision medicine depend on the ability to exchange, analyze, and interpret genetic data.

Future Trends

- Drug discovery by AI: Multimodal AI holds the potential to revolutionize the pharma industry by offering a more comprehensive and nuanced delivery of scientific data. Acceleration of drug discovery is possible with the convergence of multimodal AI. For instance, a leading player, Bayer, is leveraging AI to transform drug discovery with the analysis of extensive datasets. Bayer offers a solution to automate 80% of regulatory dossiers and help speed up access for patients.

- Optimizing workflows with AI agents: AI agents are playing a crucial role in revolutionizing the healthcare market. Highly advanced AI tools are able to construct and automate complex tasks. Automation includes genomic data analysis, clinical trial design use for report creation and others. A major advantage that these agents offer is that, by performing repetitive tasks and data-intensive work, researchers find sufficient time to reflect upon strategies to push the boundaries of existing healthcare work.

- Potential new discoveries: Natural language processing facilitates researchers and professionals to conduct clinical trials and research where manual reviews have been paramount for decades. Now it's possible to complete these tasks in no time with the help of Gen AI. Enterprises like Ginko Bioworks are effectively using GEN AI to tap into their huge codebase and offer exactly relevant data.

Generative AI in Pharmaceutical Market Growth Factors

- Pharmaceutical sector prioritizing use of AI virtual chatbots to improve their consumer engagements.

- Increased demand for personalized medicines is holding potential for generative AI in pharmaceutical industry.

- Generative AI is seeking growth in pharmaceutical for the requirement of clinical trial optimization, and prediction capability to reduce cost and risks of clinical trials.

- Utilization of AI algorithms has increased in pharmaceutical sector for effective identification of potential drug targets.

- AI is able to learn from previous data and libraries about certation of new chemical structures with improved drug-related qualities, which can help pharmaceutical manufacturer industry to reduce risk and product toxicity.

Market Scope

| Report Coverage | Details |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Drug Type, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Adoption of AI for precise decision making

Pharmaceutical companies are adapting generative AI for better decision making. Pharmaceutical industries often face challenges for several designs of management of portfolio to pricking of products. AI enable to make easy and quick decisions by overcoming the boundaries. AI can analysis patient data, clinical outcomes, and market trend information. It helps companies to make intelligent choice and risk reductions, and invests money more systematically by including AI technologies in their decision-making process. Generative AI are capable to increase business growth and enhance patient care. Generative AI powered technology is driving its demand among medical experts and clients for better advice.

Restraint

Ethical concerns

Market growth of generative AI can be restraint due to ethical concerns. Deep learning models uses in generative AI uses limited clarity and accessibility. Generative AI are made up of numerous layers, which provides different judgments according to the data they have already learn. Pharmaceutical industries can face difficulties while explaining models' decisions. Additionally, several models can cat harmful and can be dangerous to customers.AI training with biased data collection likely to led them to false judgements. Generative AI are required to be trained and execute with cloud data management and data filters.

Segment Insights

Technology insights

The Natural Language Processing (NLP)segment is projected as the fastest growing technology segment due to increased use of generative AI in pharmaceutical data. Date provided by drug discovery needed to be organized with support of natural language processing. It also helpful to detect the patient reactions on pharmaceuticals, allowing pharmaceutical companies to handle drug-related issues more effortlessly and efficiently. With the aim of enhancing data quality and shorter the time to market for new drugs, and to simplify research methods, natural language is necessary for understanding of complex language and gain relevant information. Need for improvement in productivity and innovations are driving the use of natural language processing, that boosting the use of generative AI in pharmaceuticals.

Application insights

The clinical trial research segment is accounted as the fastest growing segment in the market. generative AI utilizes in clinical trails research to improve patient selection and trail design, that is essential to boost the effectiveness and outcomes of clinical rails. AI can helps obtaining useful knowledge to design effective clinical trial research by recruiting and analysing numerous data from previous clinical studies. AI helps to promote suitable candidate for clinical trail process by studies their historical records, disease and health state. Additionally, clinical trial scientists have increased adaption of AI to keep eye on candidate while providing treatments. Ongoing innovations and need of clinical trails research holding great market potential for AI in pharma.

Regional Insights

North America is expected to dominate the market during the forecast period. The regional growth is driven by several factors including increasing AI usage in pharmaceutical clinical trials, rising drug discovery and development, rising prevalence of chronic diseases, and technical breakthroughs in the pharmaceutical sector. Moreover, the presence of major market players and growing business activities such as product launch, partnerships and collaboration are the key factors that propel the market growth in the region.

- In January 2023, Absci Corporation (Nasdaq: ABSI), which is a generative AI drug creation company, introduced its first creation and vailidation de novo antibodies in silico by using zero-shot generative AI, which was the key turning point for the biotechnology industry.

- For instance, in March 2022, Insilico Medicine and EQRx formed a strategic partnership to combine their respective capabilities in de novo small molecule creation, clinical development, and commercialization.

Collaboration of Singapore Health Services with the National University of Singapore (NUS) encouraged the innovation of SELENA+, which is an excellent AI eye imaging tool, utilizes for detection of early diagnosis of diabetic retinopathy, age-related macular degeneration, and glaucoma.

China detected as the leading country country in developments and adaption of AI tools for health. Chinese government is continuously focusing on the novel innovations in clinical trials and drug discovery. For instant, In August 2024, Children's Hospital of Soochow University located in Jinji Lake, China has developed an LLM-based clinical decision support system for Gaucher disease, which is a rare illness poses by a high risk of misdiagnosis and delayed triage. This system helps experts in diagnosis treatment and monitors patients individually for the high-risk indicators according to the huge amount of data contained in electronic medical records.

- In august 2023, Pharos iBio, a South Korea based company, introduced a first AI-driven anticancer medication which addresses the FLT3 gene mutation. This innovation detected the wide rage application of AI methods in anti-cancer drug designs.

European Growth through Innovative Collaboration in Pharmaceutical AI Technology

The growth of AI in healthcare continues to accelerate in Europe, thanks to established and ongoing partnerships between academia and industry, sound regulatory structures for AI in healthcare, and increasing public funds for the development of AI in healthcare. The adoption of generative AI is also expected to accelerate within the drug discovery process, the conduct of clinical trials, and the monitoring of the safety of medications over time (pharmacovigilance).

Germany Generative AI in Pharmaceutical Market Trends

Germany continues to lead the European market for the growth of biopharmaceuticals and biotechnology products, primarily based on strong existing infrastructure to support biotechnology and AI research efforts, as well as federal government initiatives to promote hybrid digital health technologies.

Growth of AI-powered transformation in Latin America

Over the last several years, Latin America has become a significant market for pharmaceutical companies looking to leverage generative AI to create access to medications, reduce costs associated with conducting clinical research, and create data-driven innovations to solve the region's specific health problems.

Brazil Generative AI in Pharmaceutical Market Trends

Brazil is continuing to experience rapid growth due to an ongoing trend toward digitizing healthcare, as well as the increase in private investment into pharmaceuticals that use AI to power their research and development. Generative AI is also enhancing clinical trial design, patient stratification, and data interpretation, while supporting operational areas like regulatory processing, pharmacovigilance, and supply chain optimization.

Strategic Development in the Middle East and Africa (MEA)

Governments throughout the MEA are investing heavily in building the necessary infrastructure to support and establish local manufacturing of pharmaceuticals. Generative AI is rapidly becoming an interest for service-based sectors in the MEA, primarily as a means to reduce reliance upon pharmaceuticals manufactured outside of the region.

Saudi Arabia Generative AI in Pharmaceutical Market Trends

Saudi Arabia is establishing itself as the fastest-growing market in the MEA, driven largely by investments associated with the Kingdom's Vision 2030 program and the establishment of multiple innovation hubs that focus on new product research and development for traditional pharmaceuticals.

Value Chain Analysis of the Generative AI in Pharmaceutical Market

- Data Generation and Curation: High-quality biomedical data sourced from clinical trials, genomic sequencing, electronic health records, and real-world evidence forms the foundation of the Generative AI in Pharma Market.

Key Players: IQVIA, Tempus, and Illumina. - AI Model Development and Algorithm Training: The second stage of the value chain takes the curated pharmaceutical data and creates actionable insights using deep learning, natural language processing, and generative models.

Key Players: Nvidia, Google DeepMind, and Insilico Medicine. - Integration, Deployment, and End User Applications: The final stage of the value chain is to incorporate generative AI into existing workflow processes within the pharmaceutical industry, including clinical decision support, personalized medicine, and/or automated drug formulation processes.

Key Players: IBM, Microsoft, and Schrödinger.

Generative AI in Pharmaceutical Market Companies

- Bayer AG

- Insilico Medicine Inc.

- Atomwise Inc.

- BenevolentAI Ltd.

- Numerate Inc.

- XtalPi Inc.

- Berg Health LLC

- Conduent Incorporated

- Fujitsu

- OKRA.ai

Recent Developments

- In May 2025, the U.S. FDA announced completion of the first AI-assisted scientific review pilot and an aggressive agency-wide AI rollout timeline. The GEN AI tools enable FDA researchers and subject-matter experts to escalate their workings without being trapped in monotonous administrative working patterns, which affect and slow down the review processes.

- In May 2025, a global leader in endoscopic AI technologies, Virgo Surgical Video Solution, Inc., announced the launch of EndoML officially on the occasion of the Digestive Disease Week 2025. EndoML is a highly developed and AI-backed platform designed for pharma researchers and gastroenterologists to enhance their journey from conceptual AI to clinical applications with the help of AI.

- In June 2023, Eli Lilly & Company and XtalPi Inc. launched an AI drug development partnership worth up to $250 million in upfront and milestone payments. The partnership will make use of XtalPi's robotics platform and integrated AI capabilities to create and deliver medication candidates from scratch for an unnamed target. In a partnership with the Lilly team, XtalPi will offer a novel chemical using their effective one-stop AI drug discovery solution, which Lilly will then pursue clinical and commercial development.

- In June 2023, the functioning of a conversation tool utilizing generative AI was disclosed by Sumitomo Pharma Co., Ltd. The Tool is an interactive online tool that performs duties similar to "ChatGPT" offered by OpenAI Inc. Although OpenAI's AI engine is utilized, the parameters prevent OpenAI from using the data in any other way. All workers of the company are expected to utilize the tool.

- In January 2023, Conduent Incorporated, a worldwide technology-led business process solutions provider, introduced the IntelliHealth module for healthcare provider interaction. This new module is an end-to-end solution to assist pharmaceutical businesses in improving access to and engagement with, healthcare professionals to generate targeted pharmaceutical sales and marketing. With powerful analytics, multichannel communication, and seasoned sales professionals and medical science liaisons, IntelliHealth allows pharma enterprises to power quicker and more effective product commercialization. The platform's robustness enables pharma businesses to decrease risk, control expenses, and gain competitive advantages while delivering ROI over the entire life cycle of medicinal treatment.

Segments Covered in the Report

By Technology

- Deep Learning

- Natural Language Processing

- Querying Method

- Context-aware Processing

- Others

By Drug Type

- Small Molecule

- Large Molecule

By Application

- Clinical Trial Research

- Drug Discovery

- Research And Development

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting