Geosynthetic Cementitious Composite Mats Market Size and Forecast 2025 to 2034

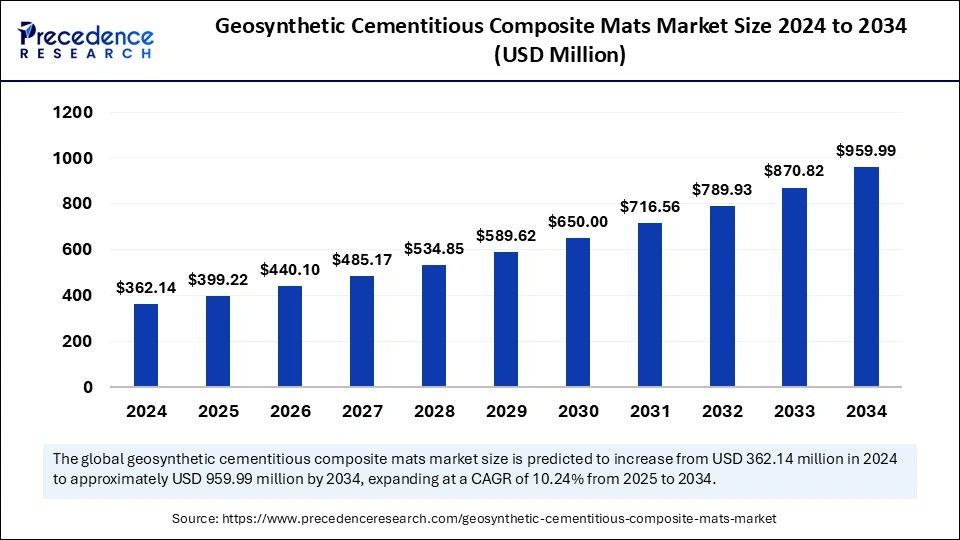

The global geosynthetic cementitious composite mats market size accounted for USD 362.14 million in 2024 and is predicted to increase from USD 399.22 million in 2025 to approximately USD 959.99 million by 2034, expanding at a CAGR of 10.24% from 2025 to 2034. The growing need for innovative infrastructure solutions is the key factor driving market growth. Also, a growing emphasis on cost-effective materials coupled with time-efficient construction materials can fuel market growth further.

Geosynthetic Cementitious Composite Mats Market Key Takeaways

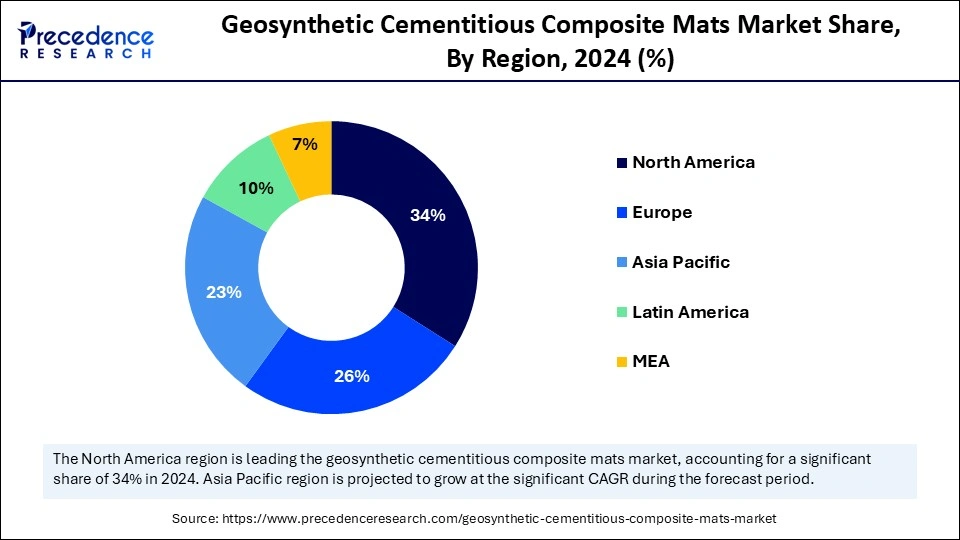

- North America dominated the market by holding more than 34% of market share in 2024.

- Asia Pacific is expected to grow at the fastest rate over the forecast period.

- By material type, the polypropylene segment held the largest market share in 2024.

- By material type, the polyester segment is estimated to grow at the fastest CAGR during the projected period.

- By form, the performed mats segment dominated the market by holding the largest share in 2024.

- By form, the rolls segment is projected to grow at the fastest CAGR over the forecast period.

- By application, the slope stabilization segment dominated the market in 2024.

- By application, the ground reinforcement segment is expected to grow at a CAGR over the forecast period.

- By end use, the environmental applications segment led the global market in 2024.

- By end use, the transportation sector segment is anticipated to grow at the fastest rate over the forecast period.

Role of Artificial Intelligence (AI) in Geosynthetic Cementitious Composite Mats Market

Artificial intelligence is playing a crucial role in transforming the geosynthetic cementitious composite mats market. AI-powered technologies improve the production and designing processes of GCCMs, which leads to enhanced efficiency and performance. Furthermore, AI automation optimizes quality control and production processes, raising consistency in GCCM products and decreasing overall manufacturing costs.

- In July 2024, AJAX Engineering, a concreting equipment manufacturer, launched Concrete GPT, an AI-driven platform designed specifically for India's construction and concreting industry. Concrete GPT aims to serve millions of construction and concrete specialists by offering a vast repository of expert-validated technical information on market insights, innovations, and regulatory updates.

U.S. Geosynthetic Cementitious Composite Mats Market Size and Growth 2025 to 2034

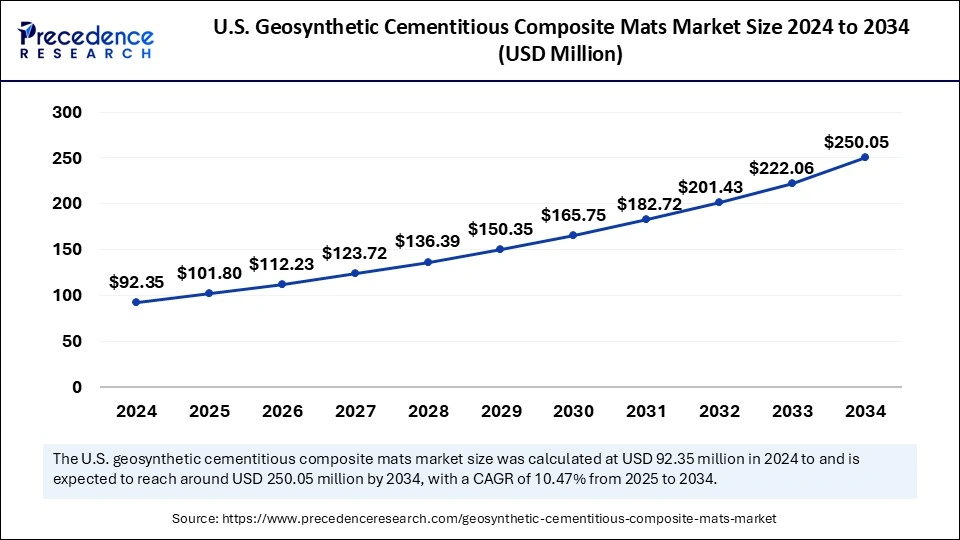

The U.S. geosynthetic cementitious composite mats market size was exhibited at USD 92.35 million in 2024 and is projected to be worth around USD 250.05 million by 2034, growing at a CAGR of 10.47% from 2025 to 2034.

North America dominated the geosynthetic cementitious composite mats market in 2024. The dominance of the region can be attributed to the growing emphasis on sustainable construction practices coupled with the investment in infrastructure rehabilitation projects, particularly in countries like the U.S. and Canada. Moreover, in these countries, GCCMs are used for soil stabilization and erosion control.

In North America, the U.S. led the market. The dominance of the country can be credited to the strict environmental regulations facilitating the use of sustainable construction materials and increasing infrastructure development trends in the country.

Asia Pacific is expected to grow at the fastest rate in the geosynthetic cementitious composite mats market over the forecast period. The growth of the region can be linked to the increasing need for efficient water management solutions and rapid urbanization in emerging economies in the region, such as China and India. Furthermore, advanced applications in geotechnical engineering and infrastructure initiatives are driving regional growth soon.

In Asia Pacific, China dominated the market. The dominance of the country is driven by growing investment in sustainable building technologies by major market players in the country. The extensive need across the country underlines the global applicability of GCCMs, enabling them as a unique solution for contemporary civil engineering hurdles.

Market Overview

The geosynthetic cementitious composite mats market is a fast-paced industry within the global civil engineering and construction industry, emphasizing the utilization of advanced materials to improve infrastructure development. These are a combination of geosynthetic and cement materials that offer cost-effective and sustainable solutions for slope stabilization, erosion control, and other applications where conventional concrete is used.

Geosynthetic Cementitious Composite Mats Market Growth Factors

- Growing environmentally friendly solutions in the construction sector is expected to boost geosynthetic cementitious composite mats market growth soon.

- Ongoing urbanization and land development projects are increasing the demand for GCCMs for applications like slope protection and soil stabilization, propelling market expansion.

- The rising use of GCCM in mining and other industrial applications will likely contribute to market growth shortly.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 959.99 Million |

| Market Size in 2025 | USD 399.22 Million |

| Market Size in 2024 | USD 362.14 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.24% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for erosion control

The need for efficient erosion control options, especially in areas subject to coastal erosion or heavy rainfall, boosts the demand for GCCMs. They offer efficient and cost-effective solutions for stabilizing slopes and managing soil erosion. In addition, ongoing land development projects followed by rapid urbanization increase the need for GCCMs for applications such as slope protection, soil stabilization, and drainage systems.

- In April 2023, Concrete Canvas Ltd. (CC) and TechFab India signed an exclusive partnership contract for the sales, marketing, and distribution rights of CC's patented product range of geosynthetic cementitious composite mats (GCCMs) across all market sectors of India. The agreement brings together two companies that have demonstrated strong growth over the last 15+ years.

Restraint

Competition from other technologies

GCCMs confront competition from soil stabilization technologies and other erosion control technologies, including geotextiles, control blankets, and vegetative solutions. Moreover, these alternatives can be preferred in some applications because of their cost-effectiveness and performance. Also, proper installation of GCCMs is important for their performance. Concerns related to the quality of installation can impact market growth negatively.

Opportunity

Improved environmental sustainability

The increasing focus on environmental sustainability is the major factor creating lucrative opportunities in the market. As more countries are striving to fulfill international environmental standards, the need for sustainable construction materials is surging. Furthermore, GCCM offers an efficient solution as they use natural resources while reducing the ecological footprint of building projects.

- In December 2023, Concrete Canvas Ltd. announced a groundbreaking partnership with Kabbani Construction Group (KCG) that it says is set to redefine the construction landscape in the Kingdom of Saudi Arabia (KSA). This exclusive partnership will offer a unique, patented product range of geosynthetic cementitious composite mats to a number of market sectors in the KSA.

Type Insights

The polypropylenesegment held the largest geosynthetic cementitious composite mats market share in 2024. The dominance of the segment is due to its durability and versatility, which makes it sophisticated for a wide range of applications. Polypropylene materials are gaining popularity for their improved performance characteristics, integrating the features of various materials.

- In June 2024, HP made a set of announcements demonstrating its continued 3D printing and digital manufacturing momentum and industry leadership. Helping to expand the overall market and unlock new applications for customers, HP is delivering first-of-its-kind Polypropylene (PP) material for additive manufacturing. The new HP 3D High Reusability PP, enabled by BASF, is versatile, durable, and chemically resistant.

The polyester segment is estimated to grow at the fastest rate during the projected period. The growth of the segment is owing to low maintenance requirements and high durability of these materials. Their resistance to humidity and mold makes them a key choice for lasting building components. Moreover, polyester resins are utilized for pipes, flat roofs, and other waterproofing linings.

Form Insights

In 2024, the performed mats segment dominated the geosynthetic cementitious composite mats market by holding the largest share. The dominance of the segment can be linked to the increasing adoption of these mats in construction applications as they play an essential role in improving the efficacy of cementitious materials and for fast deployment in construction projects, which makes it important in the civil engineering sector.

The rolls segment is projected to grow at the fastest rate over the forecast period. The growth of the segment is because of the ease of handling and flexibility it provides in construction projects which makes them a popular option among builders and contractors. Furthermore, ongoing development and innovations in the construction industry are opening up new avenues for the segment to grow.

Application Insights

The slope stabilization segment dominated the geosynthetic cementitious composite mats market in 2024. The dominance of the segment can be attributed to the wide range of functionalities of GCCM aimed at solving numerous challenges in civil engineering and construction. Additionally, the growing focus on maintaining structural integrity and safety in inclines by market players is impacting the segment's growth positively further.

The ground reinforcement segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing focus and growing adoption of sustainable infrastructure solutions across the globe. This shift indicates a major trend toward using geosynthetic technologies to enhance the longevity of civil projects and tackle environmental challenges.

End Use Insights

The environmental applications segment led the global geosynthetic cementitious composite mats market in 2024. The dominance of the segment can be linked to the increasing demand for sustainable solutions, using this material for supporting green initiatives and managing contaminated sites is also benefiting the segment's growth. In addition, GCCM's crucial role in civil engineering projects is expanding the reach of its applications.

The transportation sector segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the efficient performance and high durability of these materials in railway and road construction, ensuring raised reliability and longevity of infrastructure. Also, it strengthens the transportation sector by offering sustainable construction. The environmental applications segment led the market in 2024. The dominance of the segment can be linked to the increasing demand for sustainable solutions, using this material for supporting green initiatives and managing contaminated sites is also benefiting the segment's growth. In addition, GCCM's crucial role in civil engineering projects is expanding the reach of its applications.

Geosynthetic Cementitious Composite Mats Market Companies

- ACE Geosynthetics

- Huesker Synthetic

- TenCate Geosynthetics

- Propex

- Soverin

- Solmax

- Corinth Pipeworks

- CETCO

- GSE Environmental

- NAUE

- Tensar International

- Geosynthetic Institute

Latest Announcement

- In October 2024, Solmax, a global leader in geosynthetic solutions, announced the launch of GEOLUX, an innovative product designed to significantly enhance the efficiency of bifacial solar panels. By increasing ground albedo to approximately 75%, GEOLUX maximizes solar energy capture, resulting in more efficient and cost-effective solar installations.

Recent Developments

- In January 2024, National Composites announced a strategic partnership with North American compression mold maker Laval. With this partnership, Laval will concentrate on the SMC/ BMC molding process while national composites will help enrich the final product with value-added services, which include advanced Class A painting and final assembly.

- In February 2024, Owens Corning acquired Masonite for USD 3.9 million. The acquisition will strengthen the company's position in the glass reinforcement business in the building materials and its composites segment.

In June 2023, Solvay is partnered with Spirit Aerosystems. Both companies will be involved in holistic development. This merger will see collaborative research on sustainable aviation technology and processes with Spirit's engineering, academic, and supply chain partners.

Segments Covered in the Report

By Material Type

- Polypropylene

- Polyester

- Composite Materials

- Geogrid

By Form

- Preformed Mats

- Rolls

- Panels

By Application

- Erosion Control

- Slope Stabilization

- Ground Reinforcement

- Canal Lining

By End-Use

- Civil Engineering

- Environmental Applications

- Transportation

- Mining

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting