What is the Wood Plastic Composite Market Size?

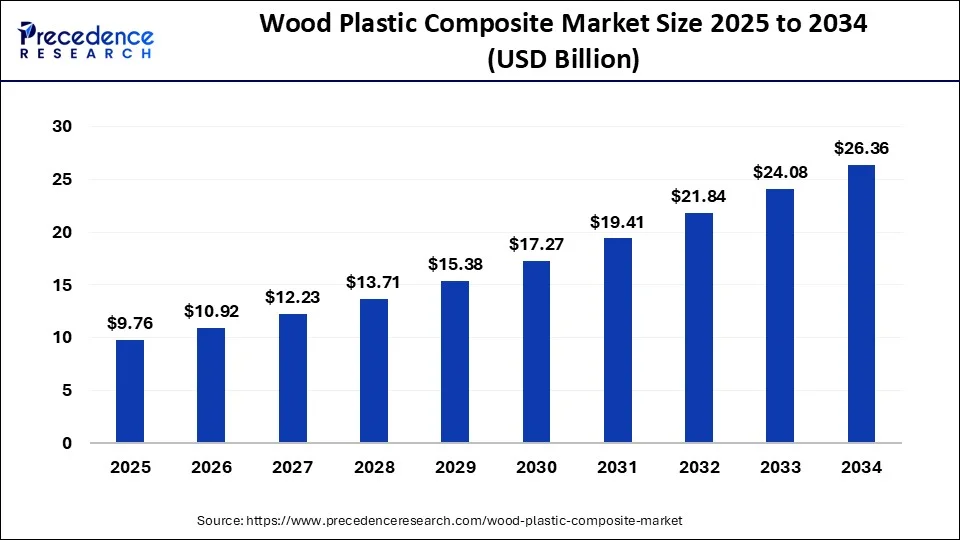

The global wood plastic composite market size is accounted at USD 9.76 billion in 2025 and predicted to increase from USD 10.92 billion in 2026 to approximately USD 26.36 billion by 2034, representing a CAGR of 14.81% from 2025 to 2034.

Wood Plastic Composite Market Key Takeaways

- Asia Pacific region has contributed the largest market share in 2024.

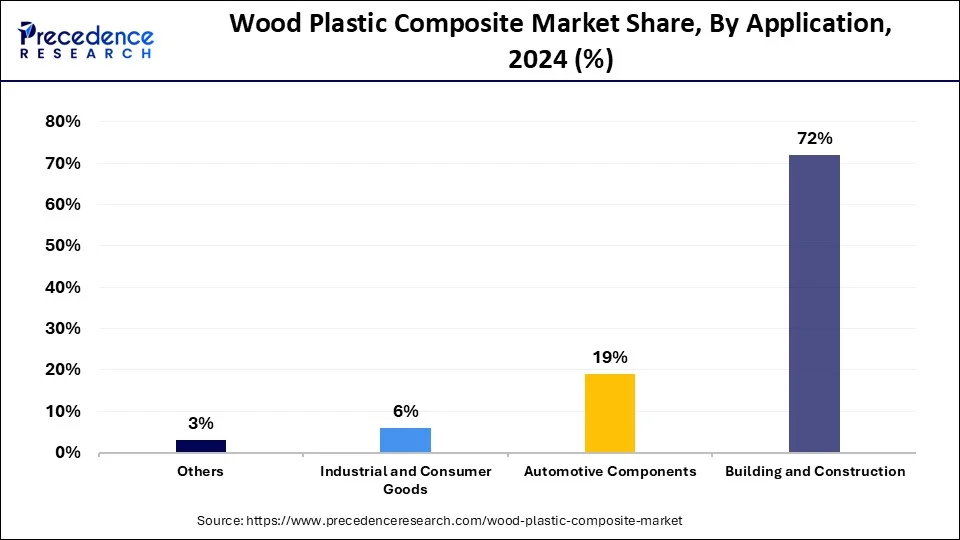

- By application, the building and construction segment hit 72% of the total revenue share in 2024.

- By product, the polypropylene segment hit 13% revenue share in 2024.

- The polyvinylchloride product segment is expected to grow at a CAGR of 12% between 2025 to 2034.

What is Wood Plastic Composite?

The wood plastic composite is a mixture of natural wood like wood shavings or saw wood or plastics fibers. The WPC upsurges the strength and humidity resistance of outdoor and indoor applications. The market is accepting different approaches to increase competitive advantage, and therefore withstand the growing business competition. The company is pampered with acquisitions & mergers, and also with production volume development plans to increase a strong position in the market.

The businesses choose multiple acquisitions & mergers in a proposal to increase market share in a specific area. The rivalry in the wood plastics complex is increasing in the period of forecast. The expansion of innovative products will be more in the market of wood plastics composites. The expansions of the market, collaborations, partnerships, and mergers in the market of wood plastics are increasing. The income rates are likely to be raised more due to sufficient market development. The corporations developed technical partnerships to develop innovative products with greater performance features to grow the company's returns.

Wood Plastic Composite Market Outlook

- Industry Growth Overview: The wood plastic composite market is poised for strong growth from 2025 to 2034, driven by rising demand for sustainable, durable building materials. WPCs are a popular choice for decking, fencing, and automotive interiors due to their longevity, low maintenance, and environmental benefits.

- Major Trend: A major trend in the market is the development of advanced WPC formulations with enhanced properties such as UV resistance and fire retardancy. Additionally, the industry is increasingly incorporating sustainable, recycled raw materials and alternative non-wood natural fibers to expand the applications and appeal of wood-plastic composites.

- Global Expansion:The market is expanding worldwide, driven by increasing construction activities, infrastructure development, and growing environmental awareness. Emerging regions offer significant opportunities driven by increasing investments in sustainable construction and rapid urbanization.

- Major Investors: Large building materials and chemical companies like Trex Company, Inc., Universal Forest Products, Inc., and Fiberon are major investors. R&D initiatives focusing on improved product capabilities and greener production processes also drive investment.

- Startup Ecosystem:A startup ecosystem is emerging, with emerging companies focusing on niche innovations in WPC formulations and sustainable applications. Startups are attracting funding to develop WPCs from alternative waste streams, such as coffee waste, and to innovate with bio-based adhesives and bonding agents.

Wood Plastic Composite Market Growth factors

The market of wood plastics has important applications in the automotive, technical application, decking, siding and fencing, consumer goods, furniture, and others. In the wood plastic composite market, the decking segment has more demand due to its water resistance ability and finishing. This composite will increase the strength and durability of decking and also increase the quality of concrete material. It is mainly used in the flooring of balconies and terraces because of its lightweight. It found important applications in the kitchen, wall cladding, bathroom, and false ceiling due to its durable, antibacterial, non-corrosive nature. From the polymer limonene acrylate, the researcher from the Wallenberg wood science developed a transparent wood plastic composite. This new product is used in different areas for glass replacement in building construction. It upsurges the material durability as it is harder than glass.

The global market of wood plastic composite is expected to observe constant development in the upcoming years. The market growth is driven by the increase in the building & construction segment, particularly in the North America and Europe regions. The segment of automobiles also drives the market. The new progress in this sector is predicted to directly affect the wood plastic composites market due to its use on large scale for reduction of vehicle weight. It is made utilizing recyclable material and generates less hazardous waste because of this characteristic the consumer is started using this market to protect the surrounding environment.

More potential is likely to grow the WPC market in the next years. It helps in decreasing disforestation, as the timber used for the wood-plastic complex is a by-product of the wood furniture business. Wood dust flour is hygroscopic and required to be moistened appropriately with the usage of a thermoplastic resin matrix which absorbs moisture, important for the growth of weak automated properties, undesirable aromas, and microbial infective attacks. The method needs expertly skilled laborers and composite machine arrangements lead to an increase in the total product cost. This can limit the growth of the market in the next coming years.

Major tech companies like Cisco, Microsoft, and IBM are participating in mega-projects to build sustainable, smart cities all over the world. The funding in these smart cities is likely to grasp USD 136 trillion in the next coming years. Also, global megaprojects like Masdar City and Hudson Yards have some chances for internal construction producers which is ensuing in increasing demand for the market of the wood plastic complex in the coming years.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 |

USD 9.76 Billion |

| Market Size in 2026 |

USD 10.92 Billion |

| Market Size by 2034 |

USD 26.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.81% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Type, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Depending on the type, the market for wood plastic composite is segmented into polypropylene, polyethylene, polyvinyl chloride, and others. A segment of polyethylene holds the largest market share owing to its molecular arrangement and distinct structure of the molecules. The segment of polyethylene has gained interest in academics as well as technical areas as they combined the polyethylene belongings of wood with versatility, mechanical, and processability. As per need and requirement, polyethylene can be shaped or molded into different sizes and different shapes. Because of this, it takes important in making windows and doors with fine polishing and an ironic look. However, wood plastic composite material is a cost-effective and promising auxiliary for plywood.

Though, polyethylene (PE)-based mixtures of wood-plastic are mainly used for creating floorings like hollow filler profiles, wall cladding, molding strips, lumber, hollow boards, and furniture materials. An increase in building construction across the world expands the market growth of wood plastic composites.

Wood-filled PVC is creating acceptance because of its strength, moisture resistance, thermal stability, and stiffness. however, it is highly expensive as compared to unfilled PVC. Wood plastic composites have applications in different sectors around the world, even though their methods are different. For long life, the wood-filled PVC squeezes out with an unfilled PVC cap stock, though others squeeze out a PVC core with a decorated wood-occupied PVC surface. Growing demand for the market of wood plastic composite in the production of sound barriers for sheet pilings for street construction, landscaping, and garden furniture is likely to grow the product demand over the forecast period. The increasing demand for the market of wood plastic composite in the production of consumer goods like, showpieces and toys are likely to propel the growth of the market in the coming years.

Application Insights

Based on application, the market for wood plastic composite is segmented into technical applications, decking, building, and construction products, sliding, fencing, automotive components, consumer & industrial goods, and others. The segment of decking grasps the major market share in the world. This composite is mainly used in the construction area as decking has more growth and high demand. The use of mixtures in flooring has more importance, it helps in improving the quality of concrete materials and also helps to improve strength and durability. These also have an automotive application as a recyclable material for conservative plastics. The building & construction segments are stated for the maximum market share, due to the more demand for decking. Eradication of blockades to sponsor foreign investments coupled with moving customer attention to green buildings is likely to increase the request for the market of wood plastic composite in the structure construction trade in the future.

The use of biodegradable or recyclable wood-plastic complexes in automobiles is anticipated to expand acoustic performance and mechanical strength, reduce fuel consumption and material weight, advance passenger protection and reduce manufacturing costs, and resist performance will enhance the petition for wood-plastic compounds in the automotive industry. The manufacturers of Business & customer goods establish an additional huge section that uses a mixture of wood-plastic. Though it is more expensive as compared to unfilled PVC, the PVC of wood-filled has acquired more demand because of its thermal stability, strength balance, stiffness, and moisture resistance. Many production industries around the world contribute wood plastic composites to their business or product line. Patent action is more in this part. They squeeze out PVC of the wood-filled complex with an empty PVC cover stock for their strength, while some businesses squeeze out a PVC essential with a PVC of wood-filled external which is painted.

Regional Insights

What Made Asia Pacific the Dominant Region in the Market?

The Asia-Pacific dominated the wood plastic composites market with the highest share. The Asia Pacific region is anticipated to occur as the more growing market due to the rise in the capita income fixed with fast industrialization. Growth in construction in the region of Asia-Pacific countries like India, China, and Japan owing to financial improvements and increase in income of the persons upsurge the request for market of wood plastic composites. Wood plastic composites are chosen due to their lightweight, pest resistance, and decent chemical related to conventional wood. The change in China's fragmented distribution, growing local competition, consumer behavior, and rising double income are likely to generate chances for key producers during the forecast period.

India Wood Plastic Composite Market Trends

India is a major contributor to the market in Asia Pacific. In India, the market is driven by increasing domestic demand, rapid urbanization, and government initiatives to adopt eco-friendly alternatives. The focus is on leveraging WPCs as a cost-effective, durable substitute for natural wood in applications such as furniture and panels, with significant potential given the massive construction activities and national sustainability goals. There's growing adoption of WPCs made from recycled plastics and wood waste, driven by rising environmental awareness and India's push for sustainable construction.

What Influences the Growth of the North American Wood Plastic Composite Market?

North America has the maximum demand owed to the increase in the automotive industry. The rising demand due to industrial development is high. It is an initial acceptor of wood plastics composites. The key player's presence profits the market. Urbanization, Expansion, and construction industries have developed in the market. After North America, Europe is the market with the major expansion rate.

U.S. Wood Plastic Composite Market Trends

The U.S. holds a dominant position in the North American wood plastic composite market, emphasizing technological innovation and high-value, sustainable building materials. Strong environmental regulations and growing consumer demand for durable, low-maintenance alternatives drive the country's leadership in R&D for applications such as advanced decking and eco-friendly construction solutions. There is high demand for WPC decking, fencing, and garden furniture due to their low maintenance, rot resistance, and long lifespan, which is driving market growth.

Why is the Wood Plastic Composite Market in Europe Expanding?

Europe is the region with automotive giants which raised the demand and there will be more scope for these regions during the forecast period. The building and construction companies in South America generally keep on robust even after the financial crash due to the COVID-19 pandemic. Factors like doubt regarding the economic rule and modifications in Brazil, and new social conflict in many countries like Ecuador, Chile, Bolivia, and Colombia are likely to harm financial growth.

Germany Wood Plastic Composite Market Trends

Germany is an important market in Europe, recognized for its emphasis on high-quality engineering and sustainable building methods. The market is supported by the country's strong construction and automotive sectors, which use WPC for decking, fencing, and interior applications. German consumers and manufacturers place high importance on durability and environmental certifications, driving the market toward advanced solutions.

How Does Latin America Contribute to the Wood Plastic Composite Market?

Latin America presents substantial market opportunities, fueled by a rising shift in the construction sector toward sustainable building materials and aesthetic appeal. The region's expanding tourism industry has also increased demand for wood plastic composite in outdoor uses such as decking and fencing for resorts and hotels. While traditional materials still dominate, the market benefits from growing environmental consciousness and the practical advantages of wood plastic composite.

Brazil Wood Plastic Composite Market Trends

Brazil is a major player in Latin America, with growth mainly driven by its extensive construction sector and a strong domestic push for environmentally friendly solutions. The country's abundant supply of wood waste and recycled plastics provides a solid feedstock for WPC production. Key uses include decking, cladding, and industrial products like pallets, supported by local manufacturers and increasing consumer awareness of the material's durability.

What Potentiates the Middle East & Africa Wood Plastic Composite Market?

In the Middle East & Africa (MEA), the market is fueled by extensive infrastructure development and a growing preference for durable, weather-resistant building materials. The harsh climate conditions, such as high heat and humidity in some regions, make wood plastic composite an appealing alternative to traditional wood for outdoor uses like decking and cladding. The market is marked by rising urbanization and investments in sustainable construction projects.

UAE Wood Plastic Composite Market Trends

The UAE is a key contributor to the market, driven by its ambitious construction projects and strong emphasis on sustainable architecture and green building certifications. The high demand for WPC in outdoor applications such as decking, pergolas, and cladding is evident in numerous resorts, residential complexes, and commercial developments, driven by its durability and low maintenance. As a regional trade hub, the UAE is a key importer and distributor of WPC products, meeting the domestic market's demand.

Value Chain Analysis

Raw Material Procurement

This involves sourcing wood fibers and polymers (PE, PP, PVC), often from recycled sources, along with additives like colorants.

- Key Players: SABIC, ExxonMobil, LyondellBasell, BASF, Clariant, and Avient Corporation.

Research and Development (R&D)

This focuses on developing new WPC formulations to improve durability and fire resistance.

- Key Players: Trex Company, Inc., Fiberon LLC, UPM, Dow Chemical Co., and AIMPLAS.

Manufacturing and Production

The compounded WPC is shaped into products such as decking and fencing through extrusion, injection molding, and other techniques.

Key Players: Trex Company, Inc., UFP Industries, Inc., AZEK Co. Inc., and Beologic N.V.

Distribution and Supply Chain Management

Finished WPC products are distributed to end-user markets via strong logistics and distribution networks.

Key Players: Patterson Companies, Inc., UPS Supply Chain Solutions, FedEx Corp, and C.H. Robinson.

Recycling and Disposal

This focuses on managing the end-of-life of WPC products, including recycling, energy recovery, and composting.

- Key Players: Trex Company, Inc., and Ecoste.

Top Companies in the Wood Plastic Composite Market and Their Offerings

- Trex Company, Inc.: Composite decking, railing, and outdoor living products using 95% recycled content.

- UFP Industries, Inc.: Composite decking (Deckorators brand), treated lumber, and construction components.

- Fiberon, LLC: Durable, low-maintenance, and sustainable decking/railing systems using recycled content.

- CertainTeed Corporation: WPC siding and profiles for residential and commercial building materials.

- AERT, Inc.: Sustainable, high-performance WPC decking and cladding using advanced polymer recycling.

Other Key Players

- AIMPLAS

- Axion Structural Innovations LLC

- Beologic N.V.

- Croda International Plc

- Dow

- Fkur Kunststoff GmbH

- Fortune Brands Inc.

- HARDY SMITH

- Jelu-Werk Josef Ehrler GmbH & Co. KG

- Meghmani Group

- Polymera, Inc.

- PolyPlank AB

- Seven Trust

- TAMKO Building Products, Inc.

- TimberTech

- Woodmass

Key Market Developments

- Teknor apex co. a plastic compounding company introduces a new extremely weatherable complex for external coatings of wood plastic composite decking in February 2021. Wood-plastic complex flooring is a combination of wood dust and polyolefin plastics which is gaining acceptance in old-style treated timber. An innovative compound offers an important advantage to wood plastic composite as compared to wood by giving a long lifespan, lesser maintenance necessities, and superior appearance.

- KTH Royal IOT researcher-developed 100% renewable translucent wood composite by changing lignin in the wood with the help of limonene acrylate, this limonene acrylate is produced from the recycled citrus fruit covering waste generated in the orange extract business in May 2021. The wood plastic composite technologically advanced is strategized to be used due to its striking physio-chemical properties for structural purposes.

- A complex board producer AZEK announced the construction of a company in Idaho, U.S. for increasing its production with recycled PE to form composite lumber in March 2021. By the year ending, the construction and retrofitting of the ability will recruit said the Chicago producer and plant are organized to be operative in the year 2022. The Boise plant is planned for capacity expansion according to the US$180 MN program. The Timber tech brand lumbar is manufactured with recovered wood and PE by AZEK.

- The developing market has more demand for bio-degradable compounds. Owing to this, the market is using more wood components as compared to plastics. The counties like the Middle East and other developing countries have more development in the market.

Segments are Covered in the Report

By Application

- Building and Construction

- Decking

- Molding & siding

- Fencing

- Automotive Components

- Industrial and Consumer Goods

- Others

By Type

- Polyethylene

- Polyvinylchloride

- Polypropylene

- Other

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting