Composite Adhesive Market Size and Forecast 2025 to 2034

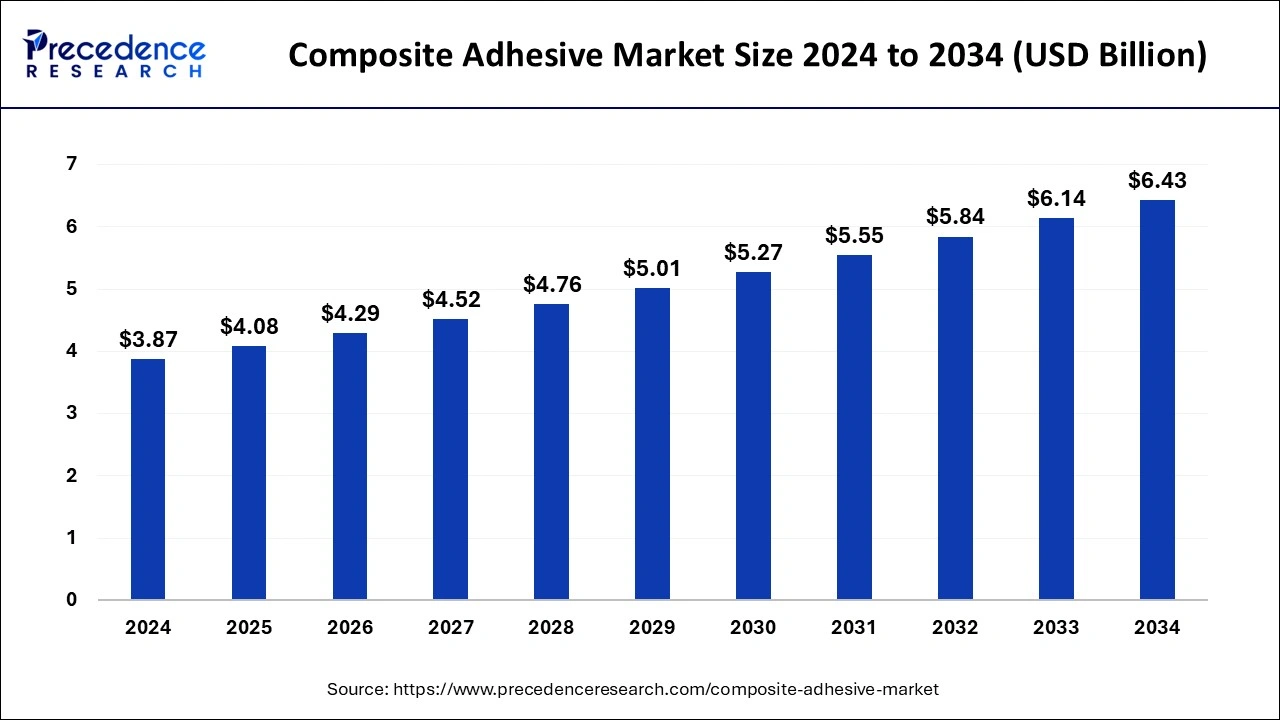

The global composite adhesive market size was estimated at USD 3.87 billion in 2024 and is predicted to increase from USD 4.08 billion in 2025 to approximately USD 6.43 billion by 2034, expanding at a CAGR of 5.21% from 2025 to 2034. This is majorly attributed to the penetration of lightweight composites with superior strength and low-density properties in different industries, which is expected to propel the demand for composite adhesives in the projected period.

Composite Adhesive MarketKey Takeaways

- The global composite adhesive market was valued at USD 3.87 billion in 2024.

- It is projected to reach USD 6.43 billion by 2034.

- The composite adhesive market is expected to grow at a CAGR of 5.21% from 2025 to 2034.

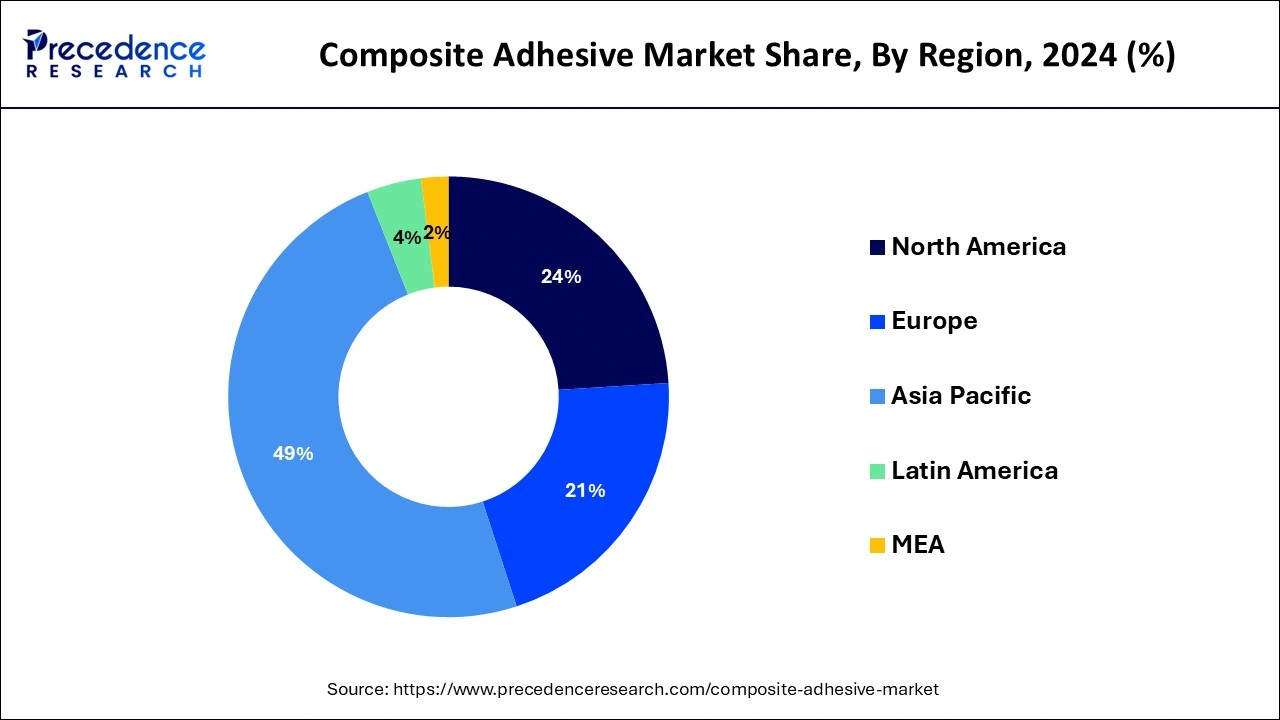

- Asia-Pacific dominated the market with the largest market share of 49% in 2024.

- North America is expected to be the fastest-growing region over the projected period.

- By product, the epoxy segment has contributed more than 37% of market share in 2024.

- By product, the polyurethane segment is expected to witness significant growth over the forecast period.

- By application, the aerospace and defense segment has held the largest market share of 19% in 2024.

- The automotive segment is likely to grow significantly in the upcoming years.

Asia PacificComposite Adhesive Market Size and Growth 2025 to 2034

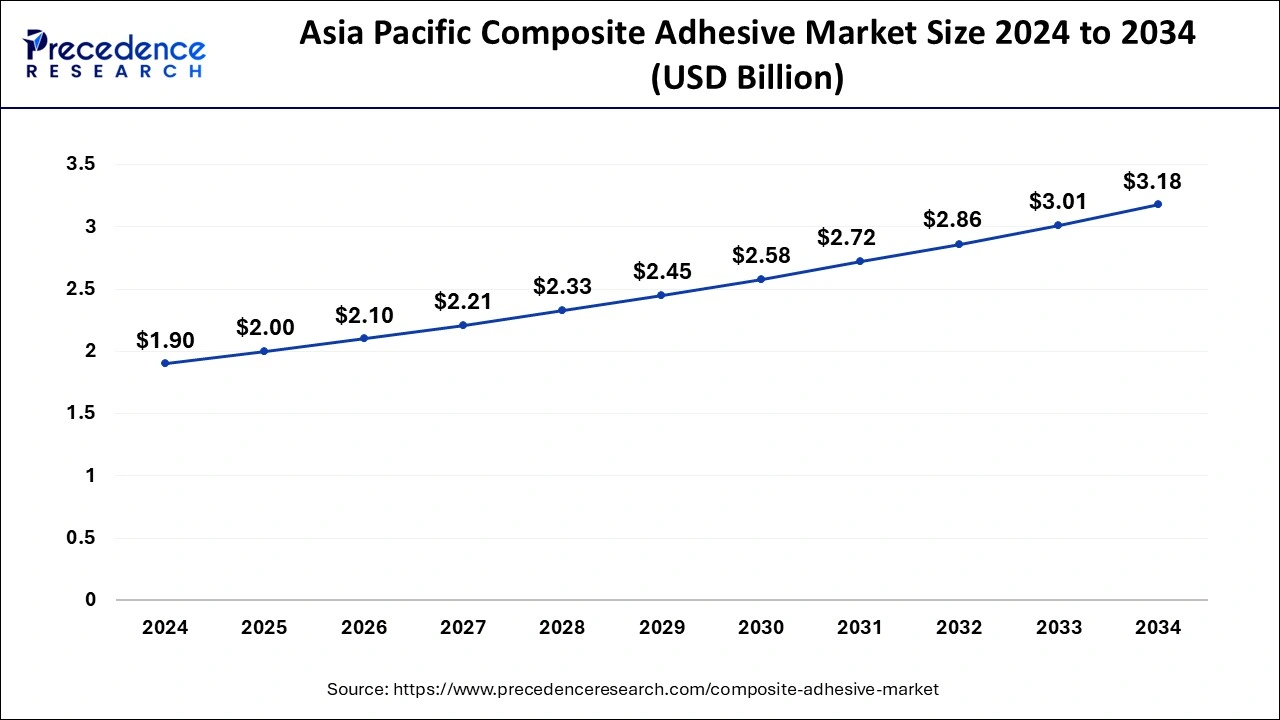

The Asia Pacific composite adhesive market size was estimated at USD 1.90 billion in 2024 and is projected to surpass around USD 3.18 billion by 2034 at a CAGR of 5.29% from 2025 to 2034.

Asia-Pacific dominated the global composite adhesives market in 2024, This trend is expected to continue throughout the forecast period. The region is experiencing significant industrial growth and infrastructure development, leading to a rising demand for cost-effective and high-performance materials like composites.

Industries such as automotive, aircraft, construction, and wind energy are particularly driving this demand. Also, there's a growing focus on fuel efficiency and sustainability, which is fueling the development of composite materials. This further increases the need for specialized adhesives to effectively bond these materials together.

North America is expected to be the fastest-growing region over the projected period.The region is home to technologically advanced transportation, aerospace, and manufacturing industries, which are important end uses of these materials. Composite parts are also used to reduce the weight of aircraft components like wings, fuselage, and empennage. These factors can lead to the market expansion of composite adhesives in the region shortly.

Market Overview

Composite adhesives are applied to composite materials to enhance their structural strength and longevity. They provide various benefits, like resistance to shocks, high temperatures, and chemical corrosion, as well as insulation against heat and electricity.

The composite adhesive market is in high demand across industries such as construction, electronics, energy, automotive, transportation, and healthcare for various applications. Commonly used types of composite adhesives include epoxy, polyurethane, acrylic, and cyanoacrylate. Epoxy is the most popular due to its strong adhesion and numerous benefits. However, acrylic adhesives are also gaining popularity due to their ease of use and sufficient adhesion for structural integrity.

Composite Adhesive MarketGrowth Factors

- The rapidly expanding automotive and EV industries are the primary factors driving the growth of the composite adhesive market.

- The increase in construction expenditure in different economies is projected to create future opportunities in the composite adhesive market.

- Government initiatives towards developing infrastructure boost the market's growth during the forecast period.

- Key players are extensively investing in the production of composite adhesives, which is fueling the market growth.

- Technological advancement in the production of composite adhesives is also driving the growth of the composite adhesive market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.21% |

| Market Size in 2025 | USD 4.08 Billion |

| Market Size by 2034 | USD 6.43 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rise in adoption of automation technology

The increasing adoption of automation technologies in manufacturing composite parts is significantly influencing the global composite adhesive market. With automated production lines taking over repetitive tasks, there's a growing demand for adhesives designed for machine dispensing and application. Robotics offer greater precision and consistency in adhesive application compared to manual methods, leading adhesive manufacturers to develop new formulations tailored for robotic use.

Adhesives that require minimal surface preparation or curing are particularly appealing for automated composite fabrication. This shift to automated manufacturing enables faster, more cost-effective production of composite parts with less variability compared to manual methods. As a result, the products and services of the composite adhesive market are becoming viable for a wider range of applications, including automotive interior panels and wind turbine blades.

Utilization in a wide range of industries

Industries like transportation, construction, marine, wind energy, and others are driving the growth of the composite adhesive market. Composite materials are becoming more popular across different uses because they offer benefits like high strength, durability, and corrosion resistance, all while being lightweight. Adhesives play a crucial role in bonding these composite materials together effectively, making assembly easier.

As infrastructure projects continue to expand globally and new constructions are on the rise, the construction industry is thriving. This has led to a growing demand for lightweight and durable construction materials such as fiber-reinforced plastics and composites, thus boosting the composite adhesive market.

- In February 2022, Venturi Aviation collaborated with Airborne, a business that provides innovative composite solutions, to use lightweight composite structures for an all-electric commuter aircraft, Echelon 01.

Restraint

Constant fluctuations in raw material prices

Fluctuations in raw material prices significantly impact the composite adhesive market in various ways. When raw material prices sharply rise, production costs for composite adhesives can increase by reducing manufacturers' profit margins. This may also result in higher prices for customers, making composite adhesives less competitive compared to alternative bonding methods.

The uncertainty caused by fluctuating raw material costs can disrupt market stability, making it challenging for companies to plan their operations and manage inventory effectively. These uncertainties can also lead to changes in supply and demand dynamics, further affecting the stability of the composite adhesive market. Hence, these factors collectively hinder the global market.

Opportunity

Escalating demand from the aerospace and defense industry

Manufacturers in the aerospace sector are working to make aircraft lighter for better fuel efficiency. This has led to increased use of composite materials in aircraft manufacturing. Composite adhesives play a crucial role in assembling advanced aircraft made from composites. They help bond different materials like carbon fiber to aluminum, forming aircraft structures. These adhesives also aid in the repair and maintenance of aircraft fleets.

The commercial aviation industry is growing steadily, driving demand for new aircraft and related services like maintenance and repair. This, in turn, boosts the need for high-performance composite adhesives in aerospace. Additionally, with increasing geopolitical tensions worldwide, defense budgets are rising, leading to the procurement of advanced military aircraft and vessels that utilize products of the composite adhesive market.

- In October 2023, Solvay, a materials company, partnered with BETA Technologies, an electric aviation company, to supply advanced composite materials for BETA's electric aircraft. Solvay will support BETA in producing its ALIA CTOL and ALIA VTOL electric aircraft, which are designed for various applications, including medical, cargo, and passenger transportation.

Ongoing research and development activities

Continuous research and development play a critical role in driving the growth of the composite adhesive market. As industries like aerospace, automotive, and construction increasingly use composite materials for their lightweight and strong properties, the demand for better adhesive solutions rises. Manufacturers invest in research and development to create composite adhesives that offer strong bonding, durability, and compatibility with various composite substrates.

Innovations in formulation and application techniques lead to adhesives that can withstand challenging weather conditions, temperature fluctuations, and mechanical stress. Furthermore, advancements in nanotechnology and materials science contribute to improving adhesive properties, including adhesion strength and fatigue resistance.

Product Insight

The epoxy segment dominated the composite adhesive market in 2024 and is expected to grow at the fastest CAGR during the forecast period, linked to its increased use in various industries like oil and gas. Epoxy adhesives also have great strength and adhesion to a wide range of substrates, including metals, plastics, and composites. They are also resistant to different atmospheric conditions, such as chemicals, moisture, and extreme temperatures. These properties also make epoxy a great fit for attaching composite materials in sectors that include automotive, marine, and construction.

The polyurethane segment is expected to witness significant growth over the forecast period. This is attributed to its good abrasion, fast curing and chemical resistance, and great bond strength on several substrates like glass, wood, rubber, and plastic. Polyurethane adhesives are produced from polymers possessing urethane linkages in their molecular structure.

- In September 2023, Covestro and Poland-based construction chemicals producer Selena Group collaborated to craft a more sustainable range of polyurethane (PU) foams for enhancing building thermal insulation. Selena has incorporated Covestro's bio-attributed methylene diphenyl diisocyanate (MDI) in an enhanced version of its Ultra-Fast 70 one-component foam, primarily used in the installation of windows and doors.

Application Insights

The aerospace & defense sector led the composite adhesive market with approximately the total revenue in 2024. Composite adhesives play a crucial role in this sector because they offer strong bonding to composite materials. These materials are extensively used in aircraft and military vehicle manufacturing. The increasing use of composite materials in different parts of aircraft, such as engines, interiors, windows, electrical systems, and other structures, is driving the demand for composite adhesives in this industry.

In the composite adhesive market, the automotive segment is likely to grow significantly in the upcoming years by seeking lightweight materials to improve fuel efficiency and reduce emissions. Composite materials like carbon fiber and fiberglass offer a solution due to their lightweight and sturdy nature. Composite adhesives play a crucial role in bonding these materials, ensuring durability and strength in car components such as body panels, chassis, and interior trim.

Moreover, composite adhesives offer benefits such as corrosion resistance, vibration damping, and design flexibility, making them attractive to car manufacturers. As the automotive industry focuses on weight reduction and sustainability, the demand for composite adhesives is expected to increase, driving innovation and advancements in this market segment.

Composite Adhesive Market Companies

- 3M

- Bostik

- Dow

- Henkel AG & Co. KGaA

- H.B. Fuller

- Huntsman International LLC.

- Illinois Tool Works Inc.

- Permabond LLC

- Parker Hannifin Corp

- Sika AG

Recent Developments

- In February 2023, Henkel AG & Co. KGaA announced a collaboration with the International Centre for Industrial Transformation's participation program. The business's adhesive technologies business department wants to employ INCIT's tools and frameworks to accelerate its processes' digital transformation by joining INCIT's partner network.

- In March 2022, 3M, a diversified technology business, introduced their new Scotch-Weld Multi-Material Composite Urethane Adhesive DP6310NS. This glue is intended to attach a variety of composite components and has good impact resistance and durability.

- In February 2022, Arkema completed its acquisition of Ashland's Performance Adhesives division. Structural adhesives are among the products available in this area. The acquisition was worth USD 1.65 billion. The acquisition bolstered Arkema's Adhesive Solutions sector and was in line with the company's objective of becoming a pure specialty material provider by 2024.

Segments Covered in the Report

By Product

- Acrylic

- Epoxy

- Polyurethane

- Cyanoacrylate

- Others

By Applications

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Construction & Infrastructure

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting