Gesture Recognition Market Size and Forecast 2025 to 2034

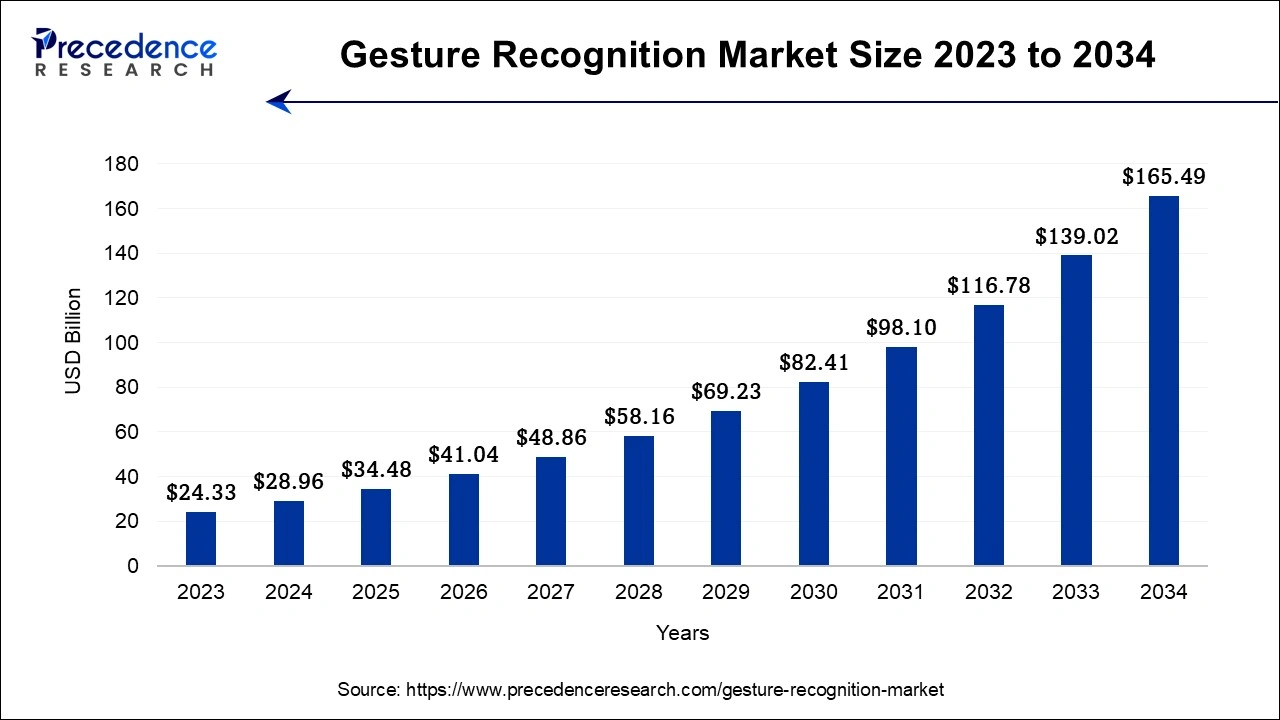

The global gesture recognition market size was calculated at USD 28.96 billion in 2024 and is projected to be worth around USD 165.49 billion by 2034, expanding at a solid CAGR of 19.04% from 2025 to 2034.

Gesture Recognition Market Key Takeaways

- In terms of revenue, the market is valued at $34.48 billion in 2025.

- It is projected to reach $165.49 billion by 2034.

- The market is expected to grow at a CAGR of 19.04% from 2025 to 2034.

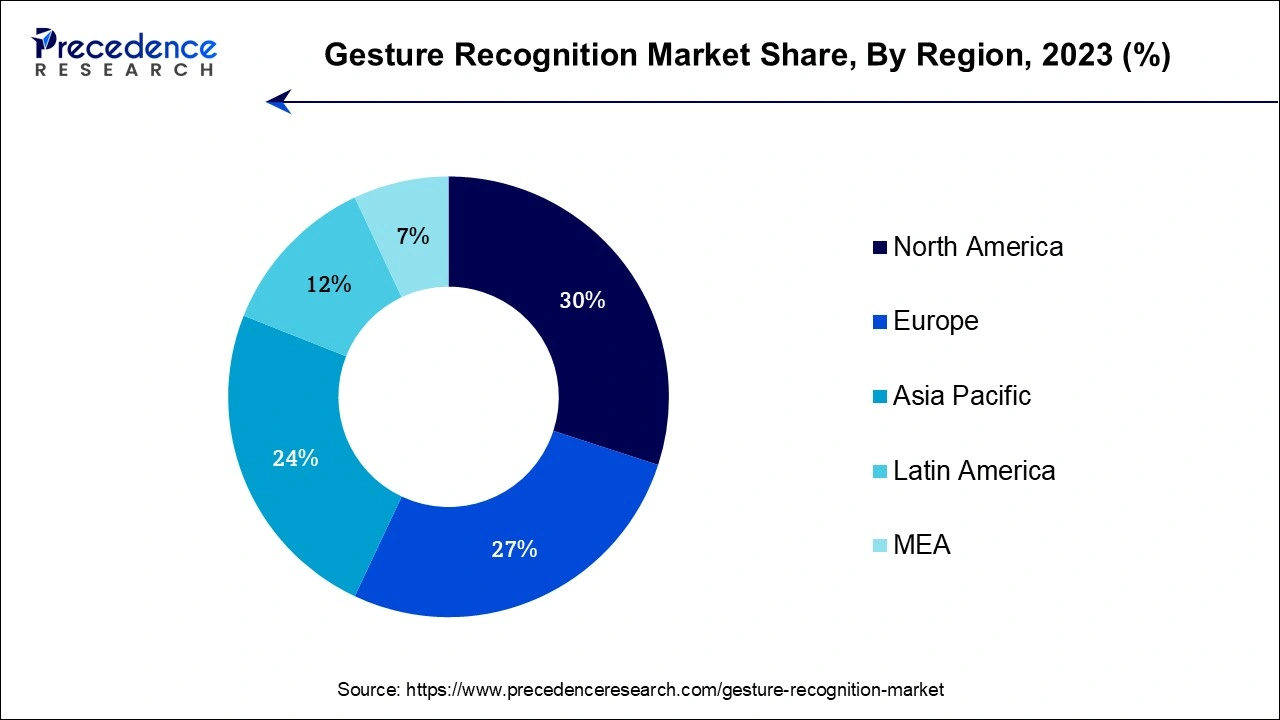

- North America dominated the global market in 2024.

- By Technology, the Touch-based gesture recognition segment held the largest market share in 2024.

- By End User, the automobile segment retained a dominating market share in 2024.

U.S. Gesture Recognition Market Size and Growth 2025 to 2034

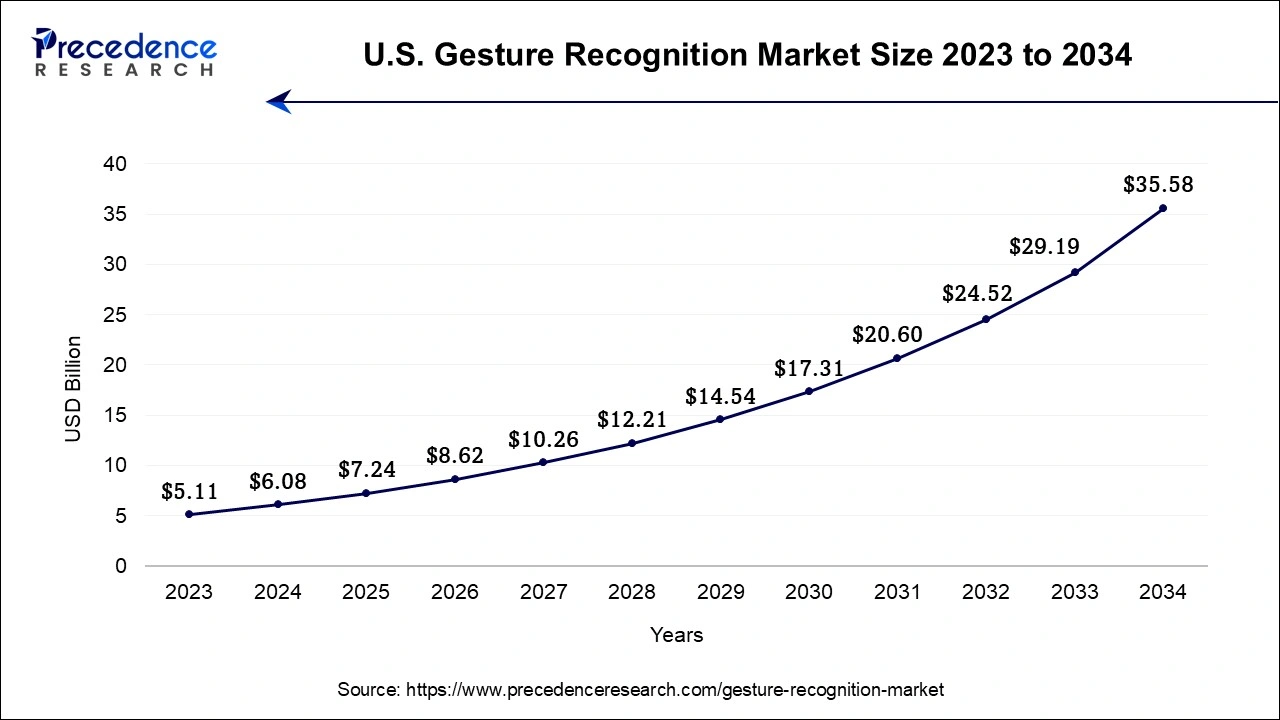

The U.S. gesture recognition market size was exhibited at USD 6.08 billion in 2024 and is projected to be worth around USD 35.58 billion by 2034, poised to grow at a CAGR of 19.32% from 2025 to 2034.

The gesture recognition industry was dominated by North America in 2024. Innovating in gesture recognition, North America has been at the forefront of technical development. A robust ecosystem of technological firms, academic institutions, and start-ups is present in the area and is dedicated to creating and promoting solutions for gesture detection.

Early adopters of gesture recognition technology include the automobile, healthcare, and consumer electronics sectors in North America. The market in this area has been pushed by consumer desire for the touchless interfaces, cutting-edge driver assistance technologies, and immersive gaming experiences. The presence of leading technical companies and academic institutions in North America has led to major research and development activities in gesture recognition. Innovative technologies and solutions have been produced as a result.

Asia Pacific is observed to expand at a rapid pace during the forecast period. The growth of the region is attributed to the rising popularity of gaming applications, rising investment in AI and sensor technologies, increasing acceptance of interactive technologies, and rising demand for advanced and latest technologies, such as augmented and virtual reality. The rapid expansion of the consumer electronics market in countries such as China, Japan, South Korea, and India is expected to spur demand for more innovative and user-friendly interfaces of gesture recognition solutions. For instance, according to the IBEF, India is considered a popular manufacturing hub and has grown its domestic electronics production from US$ 29 billion in 2014-15 to US$ 101 billion in 2022-23. The electronics sector of India contributes around 3.4% of the country's Gross Domestic Product (GDP). The market has observed that the rising demand for AI-powered gesture control in smart devices, gaming applications, and virtual reality improves user experience and convenience. Moreover, the growing adoption of touchless interfaces across various industries such as automotive, consumer electronics, defense & military, BFSI, and healthcare sectors significantly fuels the market's revenue in the region.

Furthermore, the rising strategic initiatives adopted by key players, such as product launches, partnerships, collaboration, research studies, and acquisitions, to expanding and strengthening their position in the industry. For instance, in May 2025, Huawei announced the launch of its latest flagship smartwatch, the Watch 5, to focus on health monitoring, refined design, and improved usability. The new wearable debuts the company's proprietary X-Tap sensor for fingertip SpO₂, ECG, eSIM calling & gesture controls, a multi-sensing module designed to streamline health tracking and enable faster interactions.

Market Overview

Gesture recognition is a technology that enables devices to interpret human gestures, such as hand movements, body gestures, and facial expressions, as input commands. It has gained significant attention and popularity in recent years, offering a more natural and intuitive way of interacting with electronic devices and systems. The gesture recognition market has experienced substantial growth due to advancements in sensor technology, artificial intelligence, and computer vision algorithms. These developments have allowed for more accurate and reliable gesture recognition systems.

The increasing adoption of gesture recognition in various industries, such as gaming, automotive, healthcare, consumer electronics, and retail, has contributed to market expansion. The development of gesture recognition has been significantly aided by the video game industry. Motion-sensing gaming platforms like the Microsoft Kinect and the Nintendo Wii have increased interest in gesture-based gaming. As a result of this trend, game developers are now including gesture recognition in their products, thus expanding the industry.

Gesture recognition technology is used in the healthcare industry for patient monitoring, rehabilitation, and surgery. It enables surgeons to operate on medical pictures and data without using their hands, enabling more accurate and effective surgeries. Gesture recognition technologies help patients complete exercises and monitor their progress throughout rehabilitation. Additionally, by offering alternate input options, gesture recognition can improve accessibility for people with impairments. To improve consumer experiences, the retail industry has also incorporated gesture recognition technologies. Gestures may be used to manipulate interactive displays and virtual shopping assistants, making it easier and more immersive for customers to browse items, get information, and make purchases.

Algorithms for machine learning and artificial intelligence are essential for increasing the precision of gesture recognition. These algorithms analyse and decipher gestures by learning from massive datasets, allowing computers to recognise a variety of gestures and adjust to the preferences and routines of individual users. Even though the market for gesture recognition has expanded significantly, there are still certain issues to resolve. The accuracy and dependability of gesture detection systems may be increased, power consumption can be decreased, and gesture-based interactions can be made private and secure.

Gesture Recognition Market Growth Factors

The market for gesture recognition has grown significantly as a result of technological developments, rising demand for touchless interfaces, and industry acceptance. Gesture recognition is anticipated to continue developing with continuous research and development activities, providing new opportunities and applications in the future. The rising need for touchless and contactless interfaces is one of the main factors driving the gesture recognition industry. The ability to manage equipment without having to physically touch it is made possible by gesture recognition technology, which is especially useful in applications where accessibility, convenience, and hygiene are key considerations. By minimizing distractions, touchless control in automobile entertainment systems, for instance, increases driving safety.

- Advancements in AI and machine learning: Advncements in AI and machine learning are improving gesture recognition's accuracy and responsiveness. These advancements enable systems to understand more complex human gestures better, resulting in better adoption in a variety of industries, including automotive, gaming, and healthcare.

- Increasingly popular in consumer electronics: Gesture recognition is becoming increasingly part of consumer electronics such as smart TVs, smartphones, and wearables. As consumer demand for devices that are intuitive and provide immersive experiences increases, manufacturers are implementing gesture controls to help diversify their products and improve consumer engagement.

- Growing adoption by the automotive industry: Automakers are integrating gesture control systems to control infotainment systems and other driver assistance functions in vehicles. These systems will promote market growth by increasing the driving experience's safety and convenience; this is obtained by allowing users to control functions with minimal distraction from the road.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 165.49 Billion |

| Market Size in 2025 | USD 38.48 Billion |

| Market Size in 2024 | USD 28.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Augmented reality and virtual reality

Increasing demand for touchless and contactless interfaces in various industries is driving the popularity of the gesture recognition market. Advancements in sensor technology, AI, and computer vision algorithms have improved gesture recognition accuracy. Furthermore, the growth and acceptance of contactless payment systems is one of the trending applications across industrial verticals.

Restraint

High implementation costs

Developing and implementing gesture recognition technology is costly, particularly for advanced touchless systems that require specialized sensors and powerful processing capabilities. High implementation costs are a deterrent for some industries or businesses with limited budgets.

Opportunity

Touchless interfaces demand

The increasing demand for touchless interfaces in various industries presents significant opportunities for gesture recognition technology. Touchless interfaces have become more relevant due to hygiene concerns and the need to minimize physical contact in public spaces, healthcare, retail, and other domains.

Challenge

Regulatory and ethical considerations

Regulation and ethical issues must be considered as gesture recognition becomes more commonplace and has more uses. Responsible market growth depends on ensuring compliance with data protection laws and setting moral standards for the use of gesture data.

Technology Insights

Touch-based gesture recognition held a dominant market share in the gesture recognition market in 2024. It offers fine-grained control over user interactions, enabling accurate and detailed input. This is advantageous in applications where precise manipulation or navigation is required, such as graphic design, virtual keyboards, and image editing. Touch-based gesture recognition allows users to interact with devices in a natural and intuitive manner by directly touching the screen or surface. This driver is particularly relevant for applications that require precise input control, such as drawing, typing, or gaming. Touch-based gestures have become familiar to users due to the widespread adoption of smartphones and tablets. Users are accustomed to swiping, tapping, pinching, and other touch-based gestures, making touch-based gesture recognition an intuitive and user-friendly interface.

The COVID-19 epidemic has increased interest in and demand for touchless gesture recognition. By allowing users to engage with gadgets without making physical touch, it lowers the danger of spreading germs and encourages cleanliness in public areas, healthcare facilities, and other places. Touchless gesture detection enables users to control devices or systems without making physical contact. This driver is useful in situations where physical touch is impracticable, unpleasant, or limited, such as cleanrooms or dangerous places, or while hands are busy. The user experience offered by touchless gesture detection is futuristic and totalizing. It enables users to operate gadgets with hand, body, or facial motions, enhancing user engagement and interaction with game consoles, smart home automation systems, and virtual reality or augmented reality settings. The identification of touchless gestures improves accessibility for those with physical limitations or restricted mobility. For people who might struggle with touch-based interactions, it offers other input techniques that are more accessible and simpler to use, enabling a wider spectrum of users.

End-user Insights

Automotive

- The automobile sector retained a dominating market share in the end-user industry in 2024. It allows for the touchless operation of several in-car features, including infotainment systems, temperature control, and lighting. Drivers may change settings without removing their hands from the wheel by utilizing hand or body movements, increasing safety, and minimizing distractions. By identifying driving gestures and offering tailored help, gesture recognition can also improve driver monitoring systems. The car sector is always investigating novel uses for gesture recognition, such as augmented reality displays, simple HMIs, and tailored user interfaces.

- According to the China Association of Automobile Manufacturers (CAAM) in May 2025, in April, vehicle production and sales volumes totaled 2.619 million units and 2.59 million units, up 8.9% y/y and 9.8.% % y/y, respectively.

Healthcare

- The need for touchless gesture recognition in the healthcare industry has grown recently. During surgical operations, surgeons may manage medical pictures without touching them by using touchless gestures. This improves accuracy and lowers the possibility of contamination. In rehabilitation settings, gesture recognition is often used to help patients complete exercises and monitor their development. Systems for monitoring patients' vital signs and mobility make use of gesture recognition to enable non-intrusive, contactless monitoring. In hospital settings, these applications increase effectiveness, precision, and cleanliness.

Consumer Electronics

- Gesture recognition is becoming more and more common in consumer electronics, especially in gadgets like smartphones, tablets, and smart TVs. Touch-based gesture recognition enables users to do movements like swiping, pinching, and scrolling, resulting in user interfaces that are simple to use and entertaining. Additionally, touchless gesture detection makes it possible for the users to engage with gadgets by using hand or body movements, increasing convenience, and opening new possibilities. Gesture recognition is still being incorporated into many goods by the consumer electronics sector, which makes them more engaging and user-friendly.

- According to the article published by Canalys (now part of Omdia) in April 2025, the latest research reveals that Mainland China's smartphone market shipped 70.9 million units in Q1 2025, marking a 5% year-on-year growth. The growth was primarily driven by national subsidy policies and a gradual rebound in consumer sentiment. Xiaomi shipped 13.3 million units in the quarter, up 40% year on year, regaining the pole position in Mainland China's smartphone market for the first time in a decade.

Gaming

- According to gesture detection, immersive and alluring experiences have drastically altered the gaming industry. Motion-sensing gaming consoles, like Microsoft Kinect and Sony PlayStation Move, detect players' body movements using the touchless gesture recognition, allowing users to control games via in-game gestures. New opportunities for virtual reality, augmented reality, and mixed reality games have been made possible by this technology. A more natural and intuitive method to interact with games is made possible by gesture detection in gaming, which also increases player engagement and physical activity.

- According to Newzoo's data published in July 2024, across more than 73,000 consumers worldwide, 85% engage with games in one way or another, 64% view gaming content, and 35% engage in other ways, such as listening to gaming podcasts, following esports, discussing games in online communities, creating content, and a whole lot more. Most importantly, 80% of consumers play video games.

Aerospace and Defense

- Gesture recognition technology has uses in both the aerospace and defense industries. Gesture recognition technologies in aircraft allow pilots to operate a variety of cockpit operations without making direct physical touch, minimizing distractions, and improving flight safety. Unmanned aerial vehicle (UAV) control, gesture-controlled surveillance systems, and virtual training simulators are examples of uses in the defense sector. For these crucial applications, gesture recognition provides simple, hands-free engagement that boosts situational awareness and operational effectiveness.

- According to the Facts and Figures published by the Aerospace Industries Association (AIA), the U.S. aerospace and defense industry generated more than $955 billion in sales in 2023, a 7.1% increase from the previous year. Commercial direct sales in 2023 totaled over USD 311 billion. The sales include aircraft, space equipment, cybersecurity, and land & sea systems.

- The industry generated $455 billion in economic value nationally, or 1.6% of the nominal GDP. According to the data, the top five states for aerospace and defense related economic value are California at $70.4 billion, Washington ($55.2 billion), Texas ($40.7 billion), Arizona ($34.1 billion) and Connecticut ($25.1 billion).

Gesture Recognition Market Companies

- Microsoft Corporation

- Apple Inc.

- Google LLC

- Intel Corporation

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Infineon Technologies AG

- Texas Instruments Incorporated

- Microchip Technology Inc.

- Cognitec Systems GmbH

- Eyesight Technologies Ltd.

- Gesture Tek Inc.

- Soft Kinetic (Sony Depth sensing Solutions)

- Omron Corporation

RecentDevelopments

- In September 2024, Doublepoint, the pioneering startup known for its award-winning gesture detection technology, announced the launch of WowMouse Presenter, a groundbreaking app that turns your Wear OS Smartwatch into a gesture-controlled remote for PowerPoint and Google Slides presentations.

- In March 2024, OmniVision launched the OV50K40 image sensor, incorporating TheiaCel technology for enhanced high dynamic range (HDR) capabilities. This sensor, featuring 50 megapixels, is designed for high-end smartphones and offers improved low-light performance.

- In December 2024, Samsung XR Glasses announced to launch in January 2025 along with the Galaxy S25 series. The glasses will be powered by Qualcomm's AR1 chip, and are likely to feature AI-powered capabilities like natural language processing and gesture recognition.

- In October 2024, Xiaomi launched Watch S4 with interchangeable bezels and gesture control. The Watch S4 features a digital crown for navigating menus and zooming in on maps. A new addition is gesture recognition, allowing users to perform specific actions like turning on a smart home light with a simple flick of the wrist.

- In August 2022, Radar technology startup Steradian Semiconductors Private Limited, situated in Bengaluru, has entered into an agreement to be acquired by Renesas Electronics Corporation, a well-known name in the semiconductor business. The portfolio of HMI (Human-machine Interface) products offered by Renesas, including gesture recognition, is anticipated to grow as a result of this acquisition.

- In August 2022, A pioneer in the production of semiconductors, STMicroelectronics, has introduced the new FlightSense Time-of-Flight (ToF) multi-zone sensors. Using ToF technology, these sensors are able to map and gather information without a camera. The new sensors can be utilized for intruder alert systems, user detection, gesture recognition, and other applications.

Segments Covered in the Report

By Technology

- Touch-based Gesture Recognition

- Touchless Gesture Recognition

By End User

- Automotive

- Healthcare

- Consumer Electronics

- Gaming

- Aerospace

- Defense

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting