What is the Glass Mat Market Size?

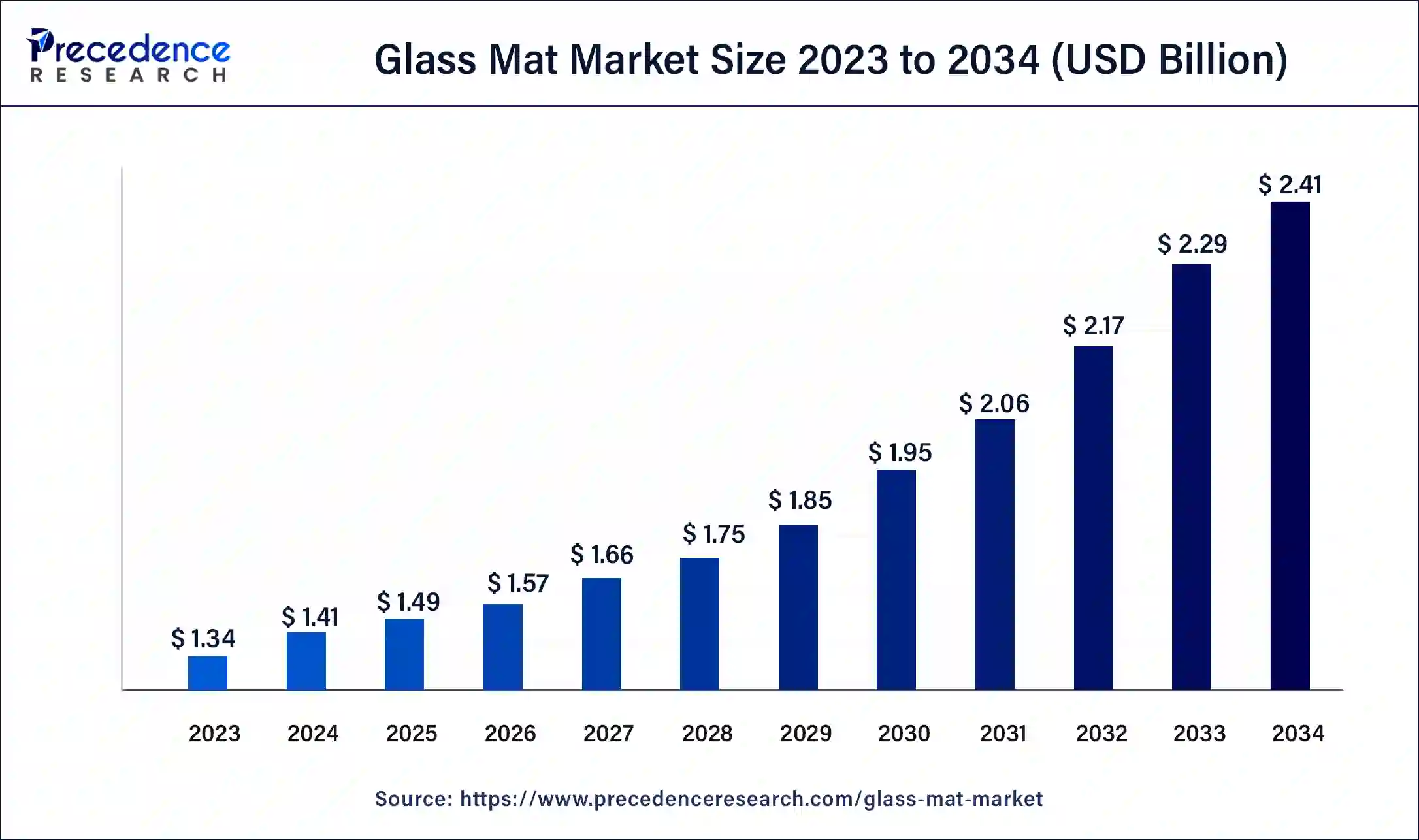

The global glass mat market size is calculated at USD 1.49 billion in 2025 and is predicted to increase from USD 1.57 billion in 2026 to approximately USD 2.53 billion by 2035.expanding at a CAGR of 5.44% from 2026 to 2035. The growth in construction and infrastructural activities in regions is driving the market.

Glass Mat Market Key Takeaways

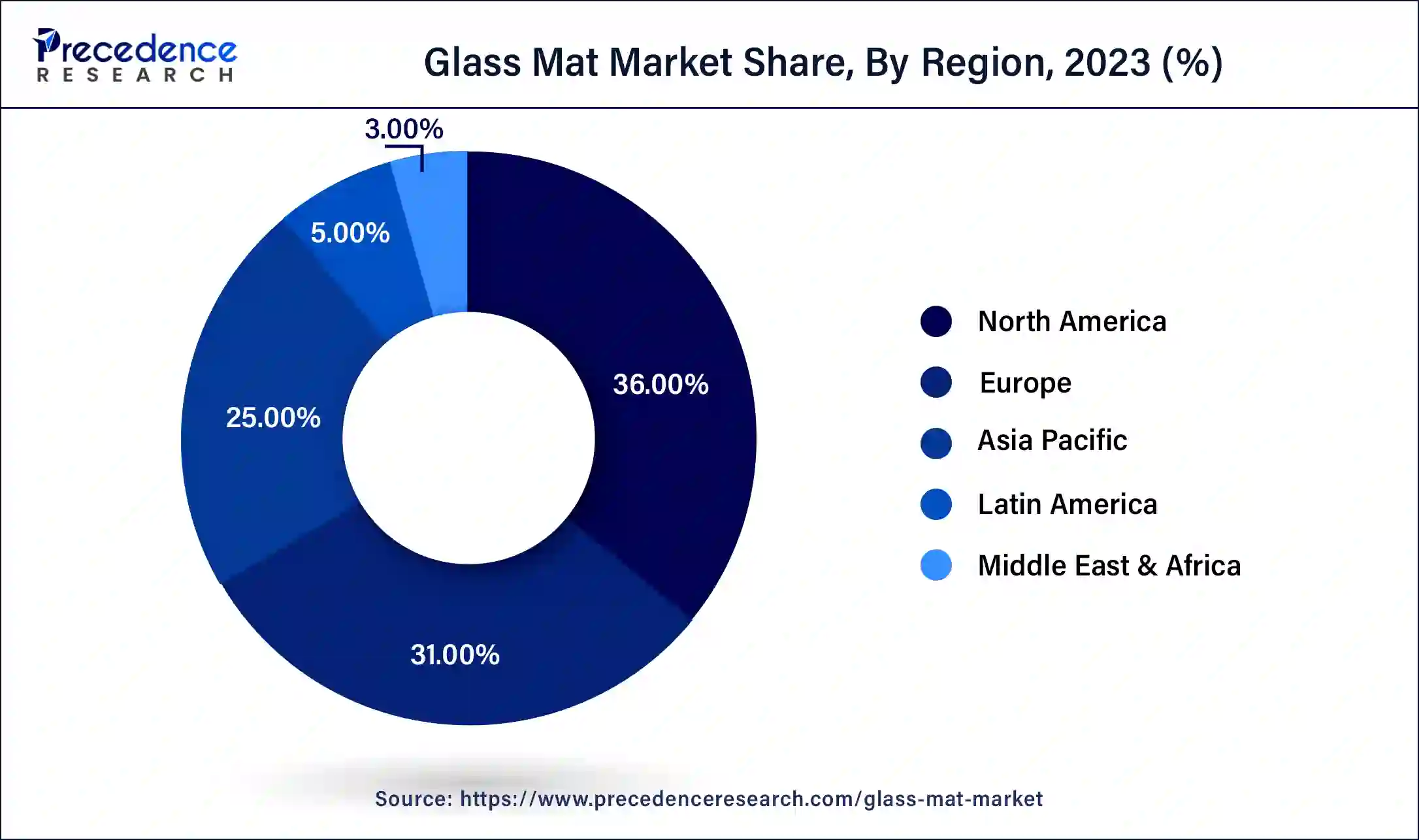

- North America dominated the market with the largest market share of 36% in 2025.

- Asia Pacific is the fastest-growing region of the global market.

- By mat type, the chopped-strand glass mats segment has contributed more than 64% of the market share in 2025.

- By mat type, the continuous filament glass mats segment is expected to expand at the fastest CAGR during the forecast period.

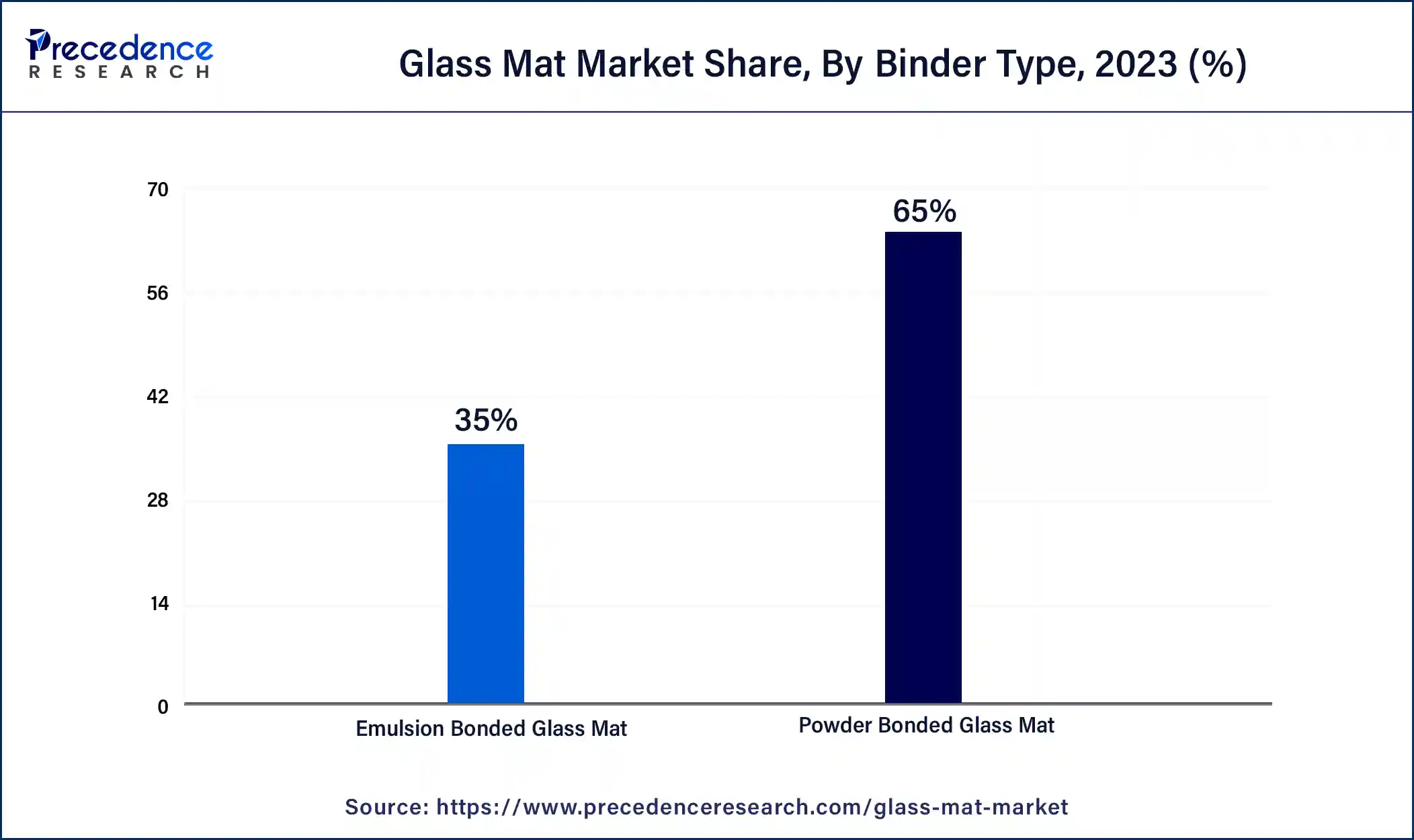

- By binder type, the powder bonded glass mat segment has held a major market share of 65% in 2025.

- By binder type, the emulsion bonded glass mat segment is expected to grow significantly over the forecast period.

- By application, the construction & infrastructure segment led the market with the highest market share of 44% in 2025.

What is a glass mat?

The glass mat market comprises the industry involved in producing and distributing fiberglass mats. These mats are made from randomly spread glass fibers bonded together with a binder. Due to their high strength, durability, and resistance to chemicals and moisture, they find extensive use across various sectors. Glass mats are commonly used in composite materials to reinforce finished products, providing them with added strength and rigidity. They also serve as thermal and acoustic insulators in applications such as building construction and automotive components. In infiltration systems, glass mats effectively filter particulates from liquids or gases, offering protection against corrosion, chemicals, and moisture.

Glass mats improve acoustics and noise reduction in automotive and architectural settings. The appeal of glass mats lies in their endurance and long-lasting performance, thanks to their exceptional tensile strength and dimensional stability.

Glass Mat Market Growth Factors

- Infrastructural growth, urbanization, and the need for eco-friendly solutions are driving the growth of the glass mat market.

- Innovations such as higher strength and enhanced fire resistance further fuel the growth of the glass mat market.

- The rise in demand for glass mats from the automotive and chemical industries has increased drastically in the forecast period.

- The growth of the wind energy sector, aligning with the rise in the production of wind turbine sharp edges, can contribute to the glass mat market expansion.

- Glass mats are more flexible and resilient, which makes them a better choice than other materials.

What are the New Initiatives and Trends in the Glass Mat Industry?

The glass mat industry is witnessing a high demand for lightweight, high-strength composites and materials in order to meet global fuel efficiency standards, especially when it comes to electric vehicles. Rising investments in sustainable building materials and pre-fabricated components are opening up new avenues of opportunities, thus fostering innovation. Packaging, consumer electronics, and industrial equipment sectors are also seen exploring the innovative uses of glass mats.

Key players such as Owens Corning, Johns Manville, and Saint-Gobain dominate the global landscape due to their strong research and development activities and well-established distribution channels. The presence of various regional and niche players helps to create a competitive environment, encouraging differentiated offerings. Strategic collaborations with OEMs and material suppliers are also gaining traction, helping accelerate market penetration. There is also a shifting emphasis on using recyclable, bio-based, and high-performance composites to meet regulatory and sustainability demands.

Glass Mat Market Outlook

- Industry growth Overview: The glass mat market is expected to grow rapidly between 2025 and 2030, due to increased consumption of glass mats in construction, automotive, and wind energy. Growth was based on the demand for lightweight, durable, and cost-effective reinforcement materials, driven by consumption in Asia-Pacific and Europe.

- Global Expansion: Leading glass mat producers expanded their footprint across Southeast Asia in response to growing infrastructure and renewable energy projects in those markets, and investment in the Middle East and Southeast Asia continued. For instance, Jushi Group expanded its fiberglass capacity in Egypt to better serve the European and African markets.

- Key Investors: Investment companies and industry participants increasingly targeted glass mat manufacture, pointing to sustained demand in wind turbine blades and composites. Activity in strategic partnerships and M&A increased as investors pursued innovative materials that enhanced performance.

- Startup Ecosystem: New entrants began work on advanced processing of glass fiber, automation, and integration of bio-based resins. Startups in China and India, for example, EcoMatTech and FibraGreen, advanced to market with sustainable and high-strength mats targeting the automotive and construction sectors.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 5.44% |

| Market Size in 2025 | USD 1.49 Billion |

| Market Size in 2026 | USD 1.57 Billion |

| Market Size by 2035 | USD 2.53 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Binder Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rapid urbanization in developing countries

Developing countries like India are witnessing rapid urbanization coupled with increasing housing demand. It is projected that the Indian real estate market will grow exponentially with cost-effective housing. The Indian government is also supporting several innovative building technologies to address this issue with traditional construction, such as sustainability, labor recruiting, productivity, and safety. Moreover, government advancements in the construction industry across the globe can also boost the glass mat market during the forecast period.

- In November 2023, Saint-Gobain, through its building products subsidiary CertainTeed Roofing, held a groundbreaking ceremony to mark construction toward a new, state-of-the-art roofing manufacturing and distribution center in Bryan, Texas.

Restraint

High cost of glass mat

The cost of high-quality glass mats is quite high, and because there are cheaper alternatives like glass fibers available, the market growth for glass mats might be limited in the future. Also, in developing countries, there's a shift from using glass mats to other products like glass cloth and glass wicks because they're easier to use with automated processes and newer mold applications. This change is making it harder for the glass mat market to grow.

Opportunities

Rise in construction and infrastructure projects

The increase in construction and infrastructure projects worldwide is driving up the demand for glass mats. These mats are tough and durable, preventing leaks and lasting a long time. They're flexible, can withstand heat and moisture, won't catch fire easily, and are resistant to water damage and mold. Because of these qualities, they're being used more in flooring, roofing, insulation, and vehicles. This rising demand from industries like construction, chemicals, and automotive is expected to boost the glass mat market revenue in the future.

Utilizations of glass mat in various industries

The electrical and electronics industry uses glass mats because they're great at insulating against both heat and electricity. This creates various opportunities in the glass mat market. They're used in things like appliances, transformers, and circuit boards to keep them safe and working well. In the marine industry, glass mats are handy for boat parts like hulls and decks because they resist corrosion, repel water, and last a long time in tough conditions. Furthermore, glass mats are also used to make wind turbine blades and aerospace parts because they're light but strong, which is important for those applications.

- In January 2023, Blackburn, following success in a project for recycling carbon composites with its multi-patented Deecom 'proteolysis' process, UK-based B&M Longworth, is part of a new consortium that will explore the recycling of glass fiber composites.

Segment Insights

Type Insights

The chopped strand glass mats segment dominated the market share in 2025 and is expected to maintain its position throughout the forecast period. This is especially due to its demand in the construction and automotive sectors and its affordable nature. Chopped strand mat is extensively used in mold making and to produce low-cost GRP moldings like panels and small boat hulls.

The continuous filament mats segment is expected to be at a significant pace over the foreseen period. A continuous filament mat (CFM) has better mechanical properties than a chopped strand mat (CSM), as it is stronger, stiffer, and more stable in shape. Because of this, CFM is preferred for things that need to be strong and stiff, like wind turbine blades, aerospace parts, and car components. It's also lighter than materials like metal or concrete, which is great for making things like airplanes and wind turbine blades that need to be lightweight. People want composites more because they're strong, stiff, and light. CFM is a big part of composites, so it's boosting the glass mat market.

- In February 2023, the European Glass Fibre Producers Association commissioned PwC – Sustainable Performance and Strategy to prepare a report on the life cycle assessment (LCA) of continuous filament glass fiber products.

Binder Type Insights

The powder bonded segment held the largest share in the glass mat market in 2025. This is attributed to its cost-effectiveness and convenient application in various sectors. Additionally, the growing demand for eco-friendly coating solutions will drive the segment's growth over the projected period.

The emulsion segment is expected to grow significantly over the forecast period. Emulsion-bonded glass mats are popular in the vehicle industry because people want lighter cars and use less fuel. Using these glass mats can make vehicles lighter, which means they can go further on less fuel. Emulsion-bonded glass mats are better than powder-bonded ones because they're more flexible, easier to work with, and stick better. This makes them stronger and longer lasting in whatever they're used for.

Application Insights

The construction & infrastructure segment held a significant share of the glass mat market in 2025 and is expected to grow substantially during the forecast period. Construction is booming all over the world because cities are growing fast, the population is increasing, and there's a lot of new infrastructure being built. Glass mats are used a lot in construction for things like roofs, walls, floors, and insulation. Because there's so much construction happening, there's a big demand for glass mats. They're great because they're strong, last a long time, resist moisture, and don't catch fire easily, which makes them perfect for building stuff. As more people learn about how good glass mats are, the demand for them in construction keeps going up.

- In June 2022, Owens Corning announced its agreement to acquire Natural Polymers, LLC, an innovative manufacturer of spray polyurethane foam insulation for building and construction applications based in Cortland, Illinois.

Regional Insights

What is the U.S. Glass Mat Market Size?

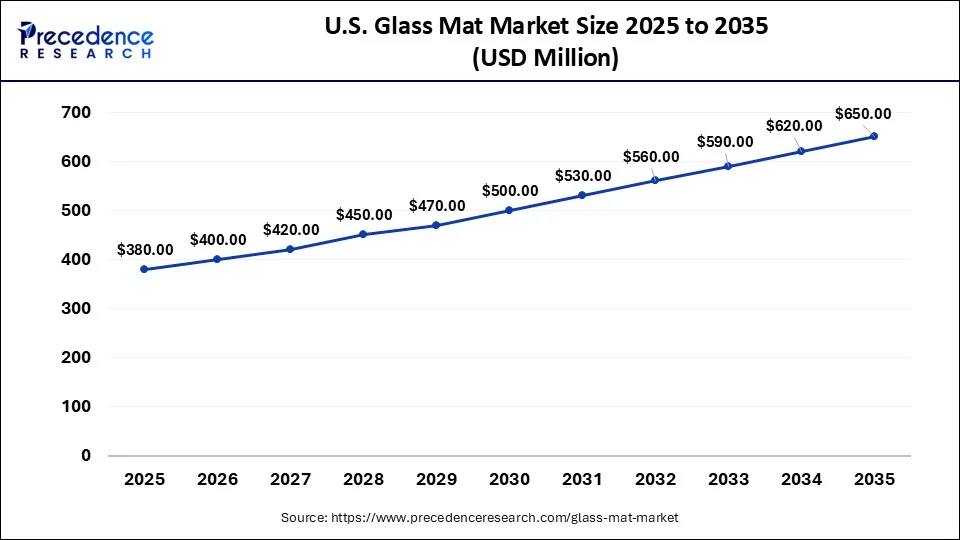

The U.S. glass mat market size is estimated at USD 380 million in 2025 and is predicted to be worth around USD 650 million by 2035, at a CAGR of 5.51% from 2026 to 2035.

North America: U.S. Glass Mat Market Trends

The U.S. dominates the North American glass mat market due to its well-established automotive and construction industries, which are major consumers of glass mats. Advanced manufacturing technologies and a strong focus on high-quality production contribute to its leadership. The country's emphasis on innovation and adoption of sustainable materials further drives demand.

North America dominated the glass mat market in 2025, fueled by well-established industries in construction, automotive, and aerospace. The United States played a key role in the market due to its rising construction and automotive sectors. Moreover, the market players' focus on innovation and technological advancements further contributes to the market expansion in the region.

Asia Pacific: China Glass Mat Market Trends

China dominates the Asia Pacific market due to its large-scale manufacturing and rapid industrial growth. The country's expanding automotive, construction, and electronics sectors drive strong demand for glass mats. China also benefits from advanced production capabilities and cost-effective manufacturing, making it a key supplier in the region.

Asia-Pacific is predicted to be the fastest-growing region in the glass mat market over the forecast period. This is because there's a lot of demand for glass mats in this region, especially in building and construction, automotive, and other industries, as the area is experiencing rapid industrialization and growth.

The construction sector in Asia Pacific is booming due to more infrastructure projects, new architectural ideas, a push for eco-friendly buildings, and a high demand for modern construction methods. As construction keeps growing and expanding, the need for glass mats for things like floors, ceilings, walls, and other uses is expected to keep rising. That's why glass mats are expected to stay dominant in the region in the coming years.

Asia Pacific is the fastest-growing region for the glass mat market as a result of government investments in industrialization, construction development, and increased automotive and electronics manufacturing. Countries like China, India, and South Korea are implementing composite materials for lightweight, durable structures, which leads to further growth in the region. Government regulations supporting clean energy technologies and construction development support the demand for glass mat products.

- According to the International Trade Administration (ITA), the construction sector in China is estimated to grow by 8.6% between the years 2022 and 2030.

- According to the National Investment Promotion & Facilitation Agency, the Indian construction industry is expected to reach US$ 1.4 trillion by the year 2025.

Europe is another growing region in the market for glass mat products as a result of environmental sustainability initiatives and a high utilization of advanced composite materials. The automotive and construction sectors are large industries in Europe, which are utilizing glass mat products to improve performance and efficiency for the automobile and construction industries. Government regulations are supporting eco-friendly products with more sustainable manufacturing processes that boost the window for growth and ultimately increase the demand for glass mat products.

Europe: Germany Glass Mat Market Trends

Germany dominates the European market due to its strong automotive and construction industries, which are major consumers of glass mats. The country has a well-established manufacturing infrastructure and advanced technological capabilities, supporting high-quality production. Germany's focus on innovation and sustainable materials also drives demand for glass mats in insulation and composites.

Why did Latin America grow considerably in the glass mat market?

The glass mat market in Latin America saw healthy growth driven by the construction, automotive, and renewable industries. Economic recovery and urbanization in key countries such as Brazil, Mexico, and Chile helped increase demand. Low labor costs and a rise in foreign investment made it feasible to expand manufacturing. The government supported wind and solar initiatives, which provided opportunities for the use of fiberglass materials.

Brazil Glass Mat Market Trends

Brazil led the glass mat market in Latin America through major government investments in key infrastructure and renewable energy projects. Strong wind energy development in Brazil and an expanding construction sector increased glass mat product usage. Many of the government-funded programs that promoted sustainable building materials increased foreign investment in the glass mat and composite materials industry. Local producers focused more on improving the quality of the glass fiber as well as increasing production efficiency to increase the quality of their products to meet export standards for positioning in the international composite materials markets.

What made the glass mat market in the Middle East & Africa region experience considerable growth?

The glass mat market in the Middle East & Africa region experienced considerable growth, attributed to construction and renewable energy projects. Gulf nations such as Qatar and Saudi Arabia invested in solar energy, the completion of green buildings, and the overhaul of existing infrastructure. In the Middle East & Africa, demand for durable, heat-resistant materials accelerated. Expanding industrial areas and publicly funded infrastructure projects provided opportunities for fiberglass producers. Growth potential was also seen in Africa's housing development and renewable energy programs.

The UAE Glass Mat Market Trends

The UAE has taken a lead in the regional glass mat market due to large-scale investments in infrastructure and renewable energy. Government initiatives to advocate for green buildings and sustainable urban planning increased market demand in the UAE. Local companies pursued partnerships with multinational companies to produce fiberglass mats for wind and solar applications.

Value Chain Analysis of the Glass Mat Market

- Raw Material Sourcing: This stage deals with the sourcing and selection of raw materials such as silica sand, limestone, alumina, soda ash, and boron compounds.

Key Players: Owens Corning, Nippon, PPG Industries - Manufacturing Process: This stage deals with the production process and involves forming the glass mats. The process involves layering, molding, compression and cooling.

Key Players: Johns Manville, Taishan, Nittobo - Distribution Process: After the final finishing and inspection, these glass mats are shipped to manufacturers for integration into various products, such as automotive panels or electrical enclosures.

Key Players: Gurit, Ashland, Hexcel

Glass Mat Market Companies

- Shandong Fiberglass Group Co. Ltd.: Produces chopped strand mats and wet-laid tissues for automotive parts and building materials.

PFG Fiber Glass Corporation: Specializes in glass mats and yarns for high-end electronics and sports equipment. - Taishan Fiberglass Inc.: Manufactures high-tensile chopped strand mats for corrosion-resistant industrial components.

- Jushi Group Co. Ltd.: Supplies high-volume E-glass mats for boat hulls and wind energy applications.

- Owens Corning: Provides high-performance non-woven mats for roofing and advanced closed-mold processes.

- Chongqing Polycomp International Corp.: Offers flat-fiber mats that improve mechanical properties in thermoplastic composites.

- Xingtai Jinniu Fiberglass Co. Ltd.: Produces chopped strand mats primarily for general reinforcement and large-scale mesh production.

- Johns Manville: Focuses on durable glass mats specifically for roofing shingles and carpet tiles.

- Saint-Gobain:Develops specialized mats for high-performance insulation and energy sector reinforcements.

- Glasstex Fiberglass Materials Corp.: Manufactures wet-laid mats tailored for bitumen-based construction products.

- Nippon Electric Glass Co. Ltd.: Supplies advanced reinforcement mats for precision electronics and automotive composites.

- CPIC Abahsain Fiberglass M.E. W.L.L.: Produces E-glass mats for the Middle Eastern infrastructure and piping markets.

- Zibo Zhuoyi Fiberglass Material Co. Ltd.: Offers fiberglass mats designed for thermal insulation and fire protection.

Recent Developments

- In March 2025, Ahlstrom launched an absorbent glass mat battery separator platform. Next-generation AGM separators deliver product uniformity, optimized fiber dispersion, and superior electrolyte retention. As the demand for high-performance energy storage solutions accelerates, AGM lead-acid batteries continue to be a cornerstone of high-performance power solutions. (Source: nonwovens-industry.com )

- In April 2025, AGY, a leading producer of high-performance glass fiber reinforcements, announced the development and commercial launch of its new single-end lightweight S2 Glass roving, engineered to deliver exceptional strength, stiffness, and impact resistance for advanced composite applications. Patrick Hunter, Executive Vice President, Commercial for AGY, stated, “With this advancement, we are opening the possibility for designers to use the world's strongest glass fiber in many new applications."(Source: businesswire.com )

- In December 2024, Owens Corning launched its new glass nonwoven production line in Fort Smith, featuring the world's highest-performing nonwoven technology. The technological highlights include the world's largest inclined wire former, HydroFormer, the FiberDry glass mat dryer, and a comprehensive Papermaking 4.0 and automation package to increase efficiency, product quality, and machine availability. (Source: fibre2fashion.com )

- In October 2023, Ahlstron OYJ, a renowned supplier of fiber-based products, announced the launch of a new glass fiber tissue. The newly launched glass fiber is suitable for high-performance construction materials, which are in high demand on a global level.

- In March 2023, Fortis3D, a start-up based in Canada focused on providing 3D printing materials, announced the launch of its new glass fiber nylon filaments for 3D printing applications back.

- In April 2022,ENTEK announced the expansion of the absorbent glass mat (AGM) separator materials into the U.S. and India to fulfill the demand from the automotive sector.

- In September 2022,SABIC, a leading name in the glass fiber products space, announced the launch of its new glass-fiber-reinforced polypropylene compounds for structural applications in the automotive industry.

Segments Covered in the Report

By Type

- Chopped Strand Glass Mat

- Continuous Filament Glass Mat

By Binder Type

- Powder Bonded Glass Mat

- Emulsion Bonded Glass Mat

By Application

- Construction & Infrastructure

- Industrial Application

- Automotive

- Marine

- Sports & Leisure Goods

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content