What is the Glycerol Market Size?

The global glycerol market size was estimated at USD 5.19 billion in 2025 and is predicted to increase from USD 5.29 billion in 2026 to approximately USD 6.28 billion by 2035, expanding at a CAGR of 1.92% from 2026 to 2035. The market is gaining traction due to its versatility for various industries, including personal care, food and beverages, and pharmaceuticals, where it is primarily used as a humectant.

Glycerol Market Key Takeaways

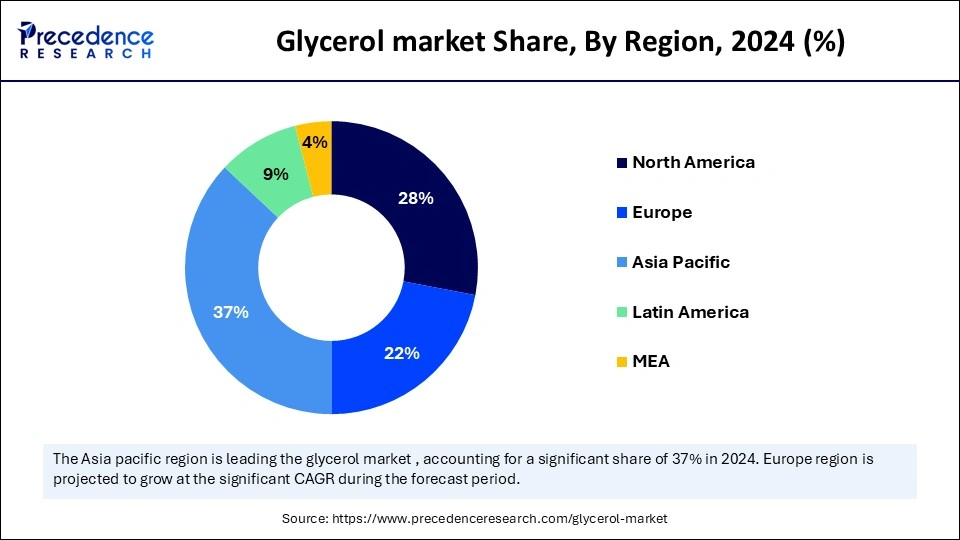

- Asia Pacific dominated the global market with the largest market share of 37% in 2025.

- Europe is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By source, the biodiesel segment contributed the highest market share of 60% in 2025.

- By source, the fatty alcohol segment is expected to expand at a CAGR between 2026 and 2035.

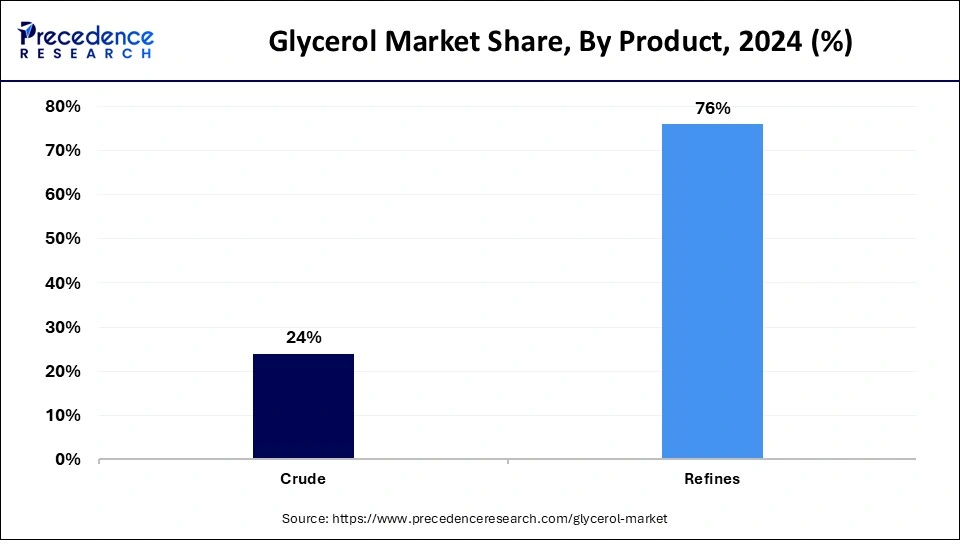

- By product, the refined segment has generated the largest share of 76%in 2025.

- By product, the crude segment is projected to grow at the fastest CAGR between 2026 and 2035.

- By application, the personal care segment held a significant market share in 2025.

- By application, the pharmaceutical is anticipated to grow at a remarkable CAGR during the forecast period.

Market Overview

Glycerol is a colorless, odorless, sweet-tasting liquid, which is a naturally occurring alcohol used in various industries such as food, pharmaceutical, and cosmetics. Also known as glycerine, Glycerol is a chemical name, and glycerine is a commercial name. Glycerol, the sugar alcohol, is derived either from plant or animal sources. Glycerin occurs naturally in plants through the fermentation of sugar; nowadays, most of the glycerin is produced from the hydrolysis of fats and oils. At present times, the glycerin used in commercial products is 95% pure. Several commercially produced glycerin products consist of different amounts of glycerin and other impurities, including organic compounds, salt, water, and many more.

How is Artificial Intelligence (AI) Changing the Glycerol Market?

Integrating artificial intelligence into glycerol facilitates predicting the activity of heterogeneous catalyst systems involving glycerol. The techniques used in the prediction of glycerol activity include the AI-Cat method, which uses two neural networks, and a Monte Carlo tree search to predict reaction patterns and energy barriers. It can be used to build a reaction database and predict the activity of heterogeneous catalytic systems. Global neural network (G-NN) has the potential to explore reactions on the surface.

Glycerol Market Growth Factors

- Bio-based glycerol: There is a significant rise in demand for naturally occurring glycerol, which is obtained as a byproduct of the production of biodiesel from plant oils. It is renewable compared to the fossil-derived chemical; it is used in various industries, including cosmetics, pharmaceuticals, and food production, due to its humectant properties.

- Food industry: Glycerol is popularly used in the food industry as a humectant and sweetening agent in several foods and beverages. The application of glycerol as fillers for commercially available low-fat food items such as cookies. It is sometimes used as a thickening agent in the preparation of liqueurs.

- Skin health: in the cosmetic industry, glycerin is known as the most effective humectant. It is a water-absorbing substance that helps keep the skin moist. This property helps retain the moisture in the skin from within the body. Research shows that applying glycerin to the stratum corneum enhances the ability to retain moisture.

- Improves athletic performance: consumption of glycerin before exercise has the potential to optimize athletic performance by inducing a state of hyperhydration. The body can later retain more fluid compared to usual times. This is due to the glycerol's osmotic properties.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 6.28 Billion |

| Market Size in 2025 | USD 5.19 Billion |

| Market Size in 2026 | USD 5.39 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 1.92% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source, Product, Application and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Wide application of Glycerol

Glycerol has more than 1,500 applications, and its versatility and safety make it a staple in various industries. Some common applications are pharmaceuticals, food and beverages, cosmetics, and even the production of explosives. Its ability to attract water makes it ideal for use in skin and hair products because of its moisturizing properties.

The standard of living is rising across the world, especially in developing countries that have a growing demand for pharmaceutical and personal care products. This leads to a larger international consumption of glycerol. However, the high consumption of glycerol is continuous, but the prices are low. One factor that may increase the price is biodiesel production, which is also known as bio-diesel-revolution. The rising innovation and expanding applications are growing more.

Restraint

Fluctuating prices

A fluctuation in raw material prices has been noticed in the glycerol market, which hinders its growth. Fluctuations in raw material prices have an extensive impact on glycerol production costs. When there is a change in supply and demand, the prices may differ. This makes it challenging for manufacturers to maintain a stable profit market. Other factors that interfere with price changes are currency rates, production facilitates disruption, international trade disruptions, and Middle East tension.

Opportunity

Rapid urbanization

The growing demand for personal care products, expanding pharmaceutical and healthcare sectors, increasing demand for food and beverages, and infrastructure development and industrial growth are boosting the glycerol market and will continue to do so. There will be a rising demand for cosmetics and toiletries within urban populations that have disposable incomes. People are becoming aware of skincare and hygiene, promoting more glycerol-based products. The increasing investment in healthcare and pharmaceutical infrastructure includes hospitals, clinics, labs, and research institutes.

Segment Insights

Source Insights

The biodiesel segment captured most of the shares of the glycerol market in 2025. Glycerol is a byproduct derived during the biodiesel manufacturing process. For every 100 pounds of biodiesel product, there is approximately 10 pounds of crude glycerol created. The biodiesel industry is rapidly expanding with the mass production of glycerol. Generally, for the separation of glycerol from biodiesel, the traditional method of removal is used, which is mainly by gravity separation of centrifugation.

The fatty alcohol segment is expected to expand at a CAGR between 2025 and 2034. Glycerol cannot be obtained directly from fatty alcohol; however, it is created from triglyceride (fats or oil) through the process of hydrolysis. Triglycerides are hydrolyzed into three molecules of fatty acids and one molecule of glycerol by the enzyme lipase. It is primarily used as a precursor for the body to synthesize new triglycerides.

Product Insights

The refined segment has generated the largest share of the glycerol market in 2025. The broad utility of refined glycerine contributes to the dominance of this segment. It is used in many products, including food, pharmaceuticals, and personal care. Refine glycerin is well-known for its safety profile and biodegradability. Its unique properties, such as solubility in water, non-toxicity, and hygroscopic nature, make it an ideal ingredient in various products and processes.

The crude segment is projected to grow at the fastest CAGR between 2026 and 2035. Crude glycerol is the actual byproduct derived from biodiesel production. This is commonly used to make chemicals, polymers, and animal feeds. Other than that, it is used as a fuel for transportation. It is made from oleaginous crops and other biomass-derived oils. In comparison to pure glycerol, crude glycerol is less pure and usually has a brown color. It is high in energy and less expensive than pure glycerol.

Application Insights

The personal care segment held a significant glycerol market share in 2025. The antimicrobial nature of glycerol makes it a suitable product for personal care, contributing to the dominance of this segment. It is commonly observed in products such as shaving cream, toothpaste, mouthwash, soaps, skin care products, and hair care products. According to the Personal Care Product Council, glycerin is used at a concentration of 99.4% in some beauty products that offer effective skin care. Additionally, people suffering from meningitis, encephalitis, central nervous system trauma, and stroke are given glycerin intravenously to lower the pressure inside the brain.

The pharmaceutical is anticipated to grow at a remarkable CAGR during the forecast period. The growth of this segment is observed with the rising utilization of glycerol in the pharmaceutical industry to treat wounds and certain types of burns with its antiviral and antimicrobial ability. Using an 86% solution of glycerol helps in reducing inflammation in the wounded area. However, glycerol is strictly prohibited to use on third-degree burns. Furthermore, glycerol is also used in cough syrups, allergen immunotherapies, and elixirs. In cough syrups, glycerol acts as a thickening agent, a humectant that is also sweet and lubricating to the sore throats associated with colds.

Regional Insights

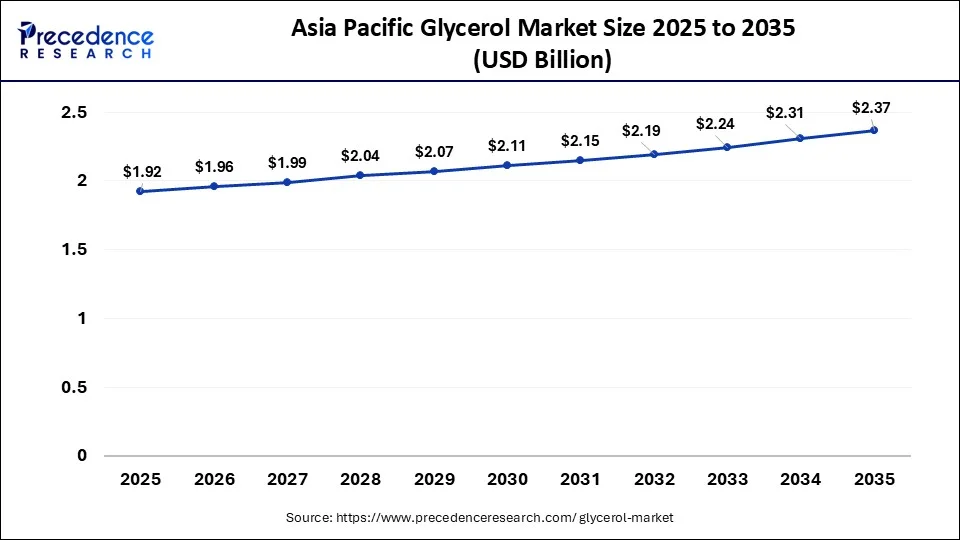

What is the Asia Pacific Glycerol Market Size?

Asia pacific glycerol market size was exhibited at USD 1.92 billion in 2025 and is projected to be worth around USD 2.37 billion by 2035, growing at a CAGR of 2.13% from 2026 to 2035.

Asia Pacific dominated the glycerol market with the largest share in 2025. The dominance of this region is observed in the robust growth of end-user industries such as pharmaceuticals, food processing, and personal care. The expansion is particularly noted in countries such as China and India, as they have rising usage of glycerol in products, including soaps, cosmetics, and medication. Malaysia is the largest producer and exporter country of glycerin products. Along with this, the population of Asia Pacific has an increasing demand for convenience food, a growing pharmaceutical industry that is expanding various applications, and growing personal care products.

Europe is expected to grow at the fastest CAGR in the glycerol market between 2026 and 2035. The expansion of this region has led to the largest import and export of glycerol, particularly in countries such as Germany, Spain, and the Netherlands. Europe is continuously increasing biodiesel production, which is linked with the European Union directive- Transport Biofuels Direct 2003/30/EC. This promotes the use of biodiesel as an alternative to fossil fuels (diesel/petrol). Additionally, Europe has set some strict quality standards for glycerol, according to the European regulatory bodies, which ensure high-purity products.

Biodiesel-Derived Glycerol Market Trends in North America

North America shows a significant growth during the forecast period. It is driven by increasing need across diverse sectors like pharmaceuticals, food & beverages, personal care, and industrial applications. Glycerol, also called glycerin, is a versatile, biodegradable, and renewable compound mainly derived from biodiesel production and natural sources. Its eco-friendly profile works with the region's rising emphasis on sustainable and green chemistry solutions.

Chemical Intermediates and Industrial Uses of Glycerol in Latin America

Latin America shows a notable growth during the forecast period. Latin America, especially Brazil and Argentina, is a top global manufacturer of soybean-based biodiesel. For every 10 liters of biodiesel produced, nearly 1 liter of crude glycerol is generated as a byproduct. The massive rise in biodiesel production contributed to an oversupply of glycerol. Because it is a byproduct of biodiesel, the expense of crude glycerol has historically been very low. This has made it economical to use in applications where more expensive, conventional chemicals were once used.

Value Chain Analysis for the Glycerol Market

- Product Conceptualization and Design: It focuses on changing the massive surplus of crude glycerol, a by-product of biodiesel, along with oleochemical production, into high-value, purified, and or derivative products.

Key Players: Cargill, Incorporated, Wilmar International Limited, Emery Oleochemicals - Raw Material Procurement: It is mainly a by-product sourcing model driven by the massive growth of the biodiesel industry.

Key Players: Wilmar International Ltd., Cargill, Incorporated, KLK OLEO - Manufacturing and Assembly: It mainly revolves around the extraction of crude glycerol as a by-product of biodiesel production, soap-making, and fat splitting, followed by refining it into high-purity industrial, food, and even pharma-grade glycerin.

Key Players: BASF SE, Musim Mas Group, Emery Oleochemicals Group

Glycerol Market Top Companies

- Wilmar International Ltd.: Wilmar International Ltd. is a global leader in the oleochemicals market, providing a comprehensive range of glycerol products mainly derived from palm oil via its integrated agribusiness model.

- IOI Oleochemical: IOI Oleochemical provides a range of high-purity, palm-driven Palmac Glycerine for industrial, food, and pharmaceutical applications. As a major, sustainable oleochemical manufacturer, they offer refined glycerine, likely USP or EP grade, catering to sectors like personal care, food additives, cosmetics, and pharmaceutical products.

- Musim Mas Group: The Musim Mas Group provides a comprehensive portfolio of MASCEROL brand glycerol products, thus, ranging from crude to high-purity refined grades, derived from sustainable, vegetable-origin sources. As a fully integrated palm oil player, they offer high-quality glycerol, including 99.5% along with 99.7% refined glycerine, which meets stringent international pharmacopoeia standards.

- Ecogreen Oleochemicals: Ecogreen Oleochemicals provides a significant portfolio of refined, natural-driven glycerol to the global market, mainly derived from sustainable, non-GMO vegetable oils. They are a recognized producer of high-quality glycerol, which is sold alongside their main products, like fatty alcohols and esters.

Other Major Key Players

- Emery Oleochemicals

- Kao Corporation

- Oleon NV

- KLK OLEO

- Croda International

- Procter and Gamble Chemicals

Recent Developments

- In October 2024, Argent Energy, a leading European biofuel manufacturing company, launched Europe's largest facility dedicated to producing bio-based, technical-grade glycerine and its Port of Amsterdam. This development is set to produce 50,000 tons of bio-based glycerine.

- In February 2024, SEA (Solvent Extractor's Association) is demanding the imports of finished products such as stearic acid, soap needles, oleic acid, and refined glycerine should be placed under a restricted item list.

Segments Covered in the Report

By Source

- Biodiesel

- Fatty Alcohols

- Fatty Acids

- Soap

By Product

- Crude

- Refines

By Application

- Food and beverages

- Pharmaceutical

- Nutraceutical

- Personal Care and Cosmetics

- Industrial

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting