What is the GMO Testing Market Size?

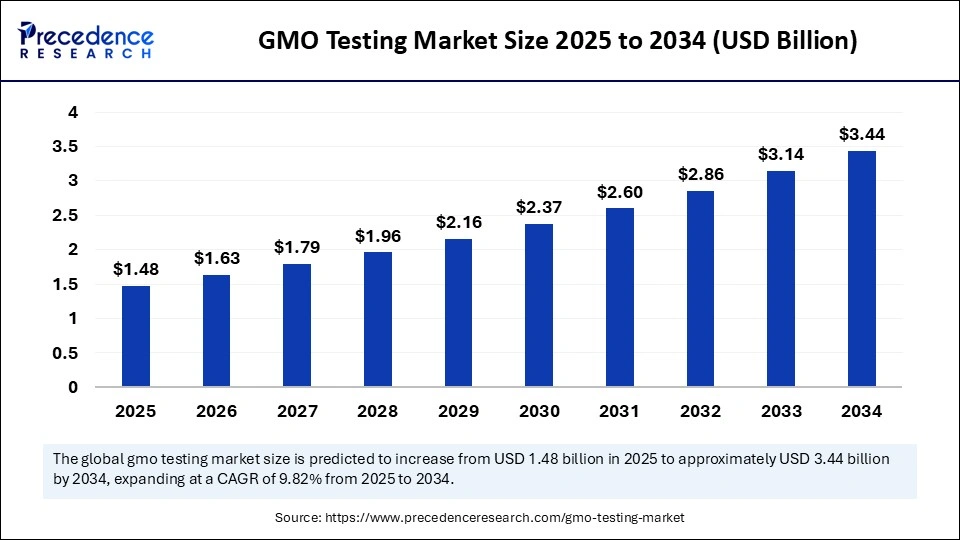

The global GMO Testing market size accounted for USD 1.35 billion in 2024 and is predicted to increase from USD 1.48 billion in 2025 to approximately USD 3.44 billion by 2034, expanding at a CAGR of 9.82% from 2025 to 2034. The market growth is attributed to increasing regulatory requirements and advancements in high-precision GMO detection technologies.

Market Highlights

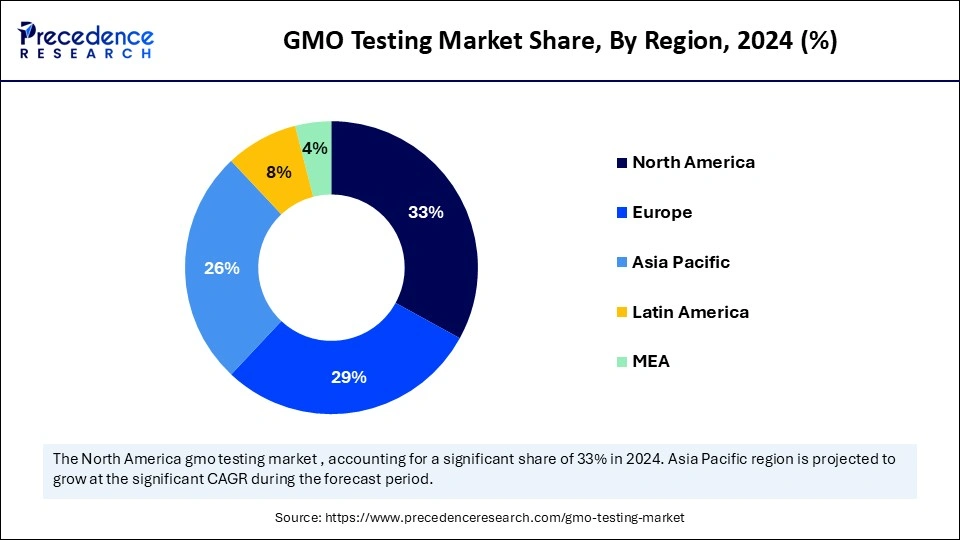

- North America segment held a dominant presence in the market in 2024, accounting for an estimated 33% market share.

- Rhe Asia Pacific segment is expected to grow at the fastest rate in the GMO testing market during the forecast period of 2025 to 2034.

- By test type, the event-specific tests (qPCR quantification) segment accounted for a considerable share of the market in 2024 that holding a market share of about 40%.

- By test type, the sequencing-based tests (Targeted NGS) segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- By technology, the real-time PCR (qPCR) segment led the market, accounting for an estimated 45% market share.

- By technology, the digital PCR (dPCR) segment is set to experience the fastest rate of market growth from 2025 to 2034.

- By sample type, the processed foods & ingredients segment registered its dominance over the GMO testing market in 2024, which held a market share of about 35%.

- By sample type, the seeds & planting material segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By offering, the testing services (third-party labs) segment dominated the market, accounting for an estimated 50% market share.

- By offering, the test kits & reagents (on-site rapid kits) segment is projected to expand rapidly in the GMO testing market in the coming years.

- By target/assay focus, the quantification (% GMO content) segment maintained a leading position in the market in 2024 that holding a market share of about 40%.

- By target/assay focus, the adventitious presence / low-level contamination detection segment is predicted to witness significant growth in the market over the forecast period.

- By end user, the food & beverage manufacturers segment captured a significant portion of the market in 2024, accounting for an estimated 35% market share.

- By end user, the seed companies & plant breeders segment will gain a significant share of the market over the studied period of 2025 to 2034

Market Size and Forecast

- Market Size in 2024: USD 1.35 Billion

- Market Size in 2025: USD 1.48 Billion

- Forecasted Market Size by 2034: USD 3.44 Billion

- CAGR (2025-2034): 9.82%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Is Encompassed in the GMO Testing Market?

The growing global need to be more transparent in food labelling is one of the major movers of the GMO testing market. In 2024, the Food and Drug Administration (FDA) of the United States outlined that genetically modified (GM) foods should be as safe as the rest of the foods. Thus, it reiterates the fact that strict testing procedures are necessary.

Such a regulatory position has resulted in large-scale use of sophisticated tests of the testing technology, especially polymerase chain reaction (PCR) methods. The sensitivity and specificity of quantitative PCR (qPCR) have made it the gold standard in the detection of GMOs. It is highly sensitive and specific and has the capability of quantifying GM content in food products accurately. Additionally, with the ongoing increase in demand for products without GMOs, the application of PCR-based testing technologies is bound to grow, moving the market even further.(Source: https://www.fda.gov)

Key Technological Shifts in the GMO Testing Market

The GMO testing market is undergoing technological changes to a high perception due to the requirements of a more accurate detection and quicker turnaround time. The most significant change is the use of next-generation sequencing (NGS) and digital PCR (dPCR). This can be more sensitive and cover a larger range of genetic information than in the case of conventional PCR. As an illustration, QIAGEN N.V. has developed its NGS systems to support targeted GMO detection using its systems in greater precision with reduced time to serve both regulatory agencies and food producers.

The other challenge that presents a significant change is the incorporation of AI and automation into the process of detecting GMOs. Some of the companies that have been using machine learning algorithms to optimise data analysis. These enhancements to the interpretation of complex genetic data are Eurofins Scientific and Thermo Fisher Scientific, which have significantly lowered human error. On-site testing equipment is also becoming popular, especially on agricultural supply chains, where it allows the real-time testing of GMOs.

Impact of Artificial Intelligence on the GMO Testing Market

GMO testing is quickly being transformed by the use of artificial intelligence (AI). They have brought into practice new high-tech tools capable of dramatically enhancing accuracy, speed, and reliability in identifying GMOs.

Artificial intelligence (AI) algorithms process the intricate genetic sequencing information to recognise modifications more cost-effectively than conventional laboratory assays. Furthermore, the machine learning systems are used to design plasticity and improve testing workflows, allowing laboratories to process high amounts of samples with a high level of accuracy.

Key Trade & Industry Developments Shaping the GMO Testing Market

In 2024, the U.S. Department of Agriculture (USDA) reported that over 92% of corn and soybean acreage in the U.S. consisted of genetically engineered varieties, significantly increasing the demand for GMO testing in both export and domestic supply chains. (Source: https://www.ers.usda.gov)

The European Commission's Joint Research Centre (JRC) published a report in 2024 on imported soybean products into the EU that contained GMO content, emphasising the need for robust testing and traceability systems. (Source: https://publications.jrc.ec.europa.eu)

Brazil's Ministry of Agriculture confirmed in early 2025 that GMO soybean cultivation grew year-on-year, making Brazil a key driver in the global GMO testing industry due to stricter export compliance regulations. (Source: https://www.tridge.com)

In 2024, Canada's CFIA (Canadian Food Inspection Agency) increased inspection frequencies for imported corn and canola, citing concerns over unintended GMO presence — a policy projected to further fuel demand for precise testing. (Source: https://achesonfoodsafetyconsulting.com)

A 2024 study from Eurofins Scientific showed that GMO detection outsourcing increased by over 27% in APAC markets, driven by rising regulatory demands in China, India, and Southeast Asia. (Source: https://www.eurofins.com)

Japan's Food Safety Commission announced updated GMO labelling thresholds in mid-2024, requiring more frequent GMO quantification, directly expanding testing service demand.(Source:https://label-bank.com)

Emerging Regulatory Trends & Testing Guidelines in the GMO Testing Market

| Country / Region | Regulatory Body | Key Regulations / Guidelines | Focus Areas | Notable Notes |

| United States | USDA (U.S. Department of Agriculture) + FDA (Food & Drug Administration) | National Bioengineered Food Disclosure Standard (NBFDS) - USDA-APHIS regulations for genetically engineered organisms | GMO labeling requirements - Testing & compliance for imports - Bioengineered content disclosure | NBFDS requires disclosure for foods containing more than 5% bioengineered content. USDA provides guidance on GMO detection methods and compliance. |

| European Union | European Food Safety Authority (EFSA) + European Commission | Regulation (EC) No 1829/2003 on GM food and feed - Regulation (EC) No 1830/2003 on traceability and labeling | GMO safety assessment - Labeling and traceability - Import compliance | EFSA mandates event-specific testing (qPCR) for GMO detection. Microarray and sequencing methods are increasingly adopted for low-level presence (LLP) detection. |

| China | Ministry of Agriculture and Rural Affairs (MARA) + China National Center for Food Safety Risk Assessment (CFSA) | Administrative Measures for the Safety Assessment of Agricultural Genetically Modified Organisms - GM Food Labeling Management Measures | GMO safety evaluation - Labeling for imports - Event-specific detection | China updated its GMO labeling rules in 2024, expanding testing obligations for both domestic and imported products, including soy and corn. |

| India | Genetic Engineering Appraisal Committee (GEAC) + Food Safety and Standards Authority of India (FSSAI) | Rules for Manufacture, Use, Import, Export, and Storage of Hazardous Microorganisms/Genetically Engineered Organisms - FSSAI labeling regulations | GMO food labeling - Safety assessment - Testing protocols | India is developing more stringent GMO labeling guidelines. FSSAI recommends qPCR-based testing for routine compliance. |

| Japan | Ministry of Health, Labour and Welfare (MHLW) + Food Safety Commission (FSC) | Food Sanitation Act (amended for GMO labeling) - Cartagena Act (for living modified organisms) | GMO safety evaluation - Labeling requirements - Detection methodology | Japan mandates GMO labeling for all foods containing over 5% GMO content. Event-specific PCR and sequencing are standard testing methods. |

| Brazil | Ministry of Agriculture, Livestock and Supply (MAPA) + National Technical Commission on Biosafety (CTNBio) | Normative Resolutions for GMO authorization and monitoring - Law No. 11,105 (Biosafety Law) | GMO registration - Field monitoring - Labeling of GMO foods | Brazil approved over 70 GMO events as of 2024. CTNBio guidelines require event-specific testing before commercial release and regular post-market monitoring. |

| Australia | OGTR (Office of the Gene Technology Regulator) + FSANZ (Food Standards Australia New Zealand) | Gene Technology Act 2000 - Food Standards Code (Chapter 1 Part 1.5) | GMO safety assessment - Labeling compliance - Detection and traceability | Australia mandates GMO labeling for foods containing novel DNA or protein resulting from genetic modification. qPCR is the standard testing protocol. |

GMO Testing Market Growth Factors

- Rising Stringency in Global Food Safety Regulations: Increasing regulatory enforcement worldwide is driving higher demand for accurate and standardised GMO testing protocols.

- Growing Adoption of Advanced Detection Platforms: Technological progress in PCR, digital PCR, and NGS platforms is boosting testing efficiency and accuracy across the food and agriculture sectors.

- Expanding Demand for Non-GMO and Organic Products: Rising consumer preference for transparency and non-GMO labelling is fuelling the need for independent GMO verification services.

- Increasing Biotechnology Investments in Agriculture: Growing funding for genetic engineering and precision breeding is propelling demand for advanced GMO testing at early production stages.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.35 Billion |

| Market Size in 2025 | USD 1.48 Billion |

| Market Size by 2034 | USD 3.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.82% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Technology / Methodology, Sample Type, Offering, Target / Assay Focus, End User, Compliance / Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rising Adoption of Genetically Modified Crops Driving Demand in the GMO Testing Market?

Increasing adoption of genetically modified crops is projected to drive demand for advanced testing solutions. Agribusinesses and farmers worldwide are engaging in GM crops in order to enhance their yields, pest resistance, and nutritional value. Strict testing is required by regulatory authorities to verify the safety and labelling standards. That drives testing laboratories to scale up and acquire new state-of-the-art analytical methods.

Increased GM crop production in places like North America, South America, and Asia promotes the urgency of quality detection services. The adoption of herbicide-tolerant (HT) soybean acreage was at its highest point in 2024, which is higher than 94% in 2014. In the same year, HT cotton and corn were 93% and 90% respectively, indicating a lot of adoption of GM crops in U.S. agriculture. Furthermore, the growing regulatory requirements and stringent food safety standards are anticipated to boost the testing market in the coming years.(Source: https://www.ers.usda.gov)

Restraint

How is Regulatory Variability Holding Back the GMO Testing Market?

Regulatory variability across different regions is projected to restrain the GMO testing market. The lack of or non-uniform monitoring methods and labelling needs to create more chances of GMOs finding their way to the food supply chain without detection. These differences make it difficult to come up with standardised testing procedures and certification. Additionally, the growing consumer preference for non-GMO products is likely to impede the GMO testing market.

Opportunity

How Are Advancements in Detection Technology Transforming Efficiency and Accuracy in the Market for GMO Testing?

Spurring advancements in detection technology is likely to create favourable opportunities for the players competing in the market. Molecular biology advancements, such as real-time PCR, digital PCR, and next-generation sequencing, enhance the rate of detection and make genetic changes (even low levels) more sensitive.

In 2024, Eurofins Scientific announced the introduction of a GMO screening platform that is a high-throughput system. That handles samples 30% faster than other systems and detects them with a 99+% accuracy. Portable field testing devices have received significant momentum, especially in agricultural supply chains. They are capable of verifying GMOs on-site within hours as opposed to days. Furthermore, the surging consumer awareness regarding genetically modified products is expected to influence testing demand.(Source: https://www.eurofins.com)

Segment Insights

Test Type Insights

Why Did Event-Specific Tests (qPCR Quantification) Dominate the GMO Testing Market in 2024?

Event-specific tests (qPCR quantification) segment dominated the GMO testing market with a 40% share in 2024, accounting for an estimated 40% market share, due to the qPCR being highly sensitive, specific, and cost-effective in identifying and quantifying GMO incidences within food, feed, and seed matrices.

The widespread use of qPCR was supported by the recognition of regulatory authorities such as the EFSA and the U.S. FDA as a standard technique of detection. Furthermore, the added advantage of scalability and well-established protocols that enhance the leadership of qPCR in detecting GMOs.

The sequencing-based tests (Targeted NGS) segment is expected to grow at the fastest rate in the coming years, as it offers the ability to do comprehensive analysis. This provides the ability to detect a wide range of known and new GMO events with the highest accuracy.

Genetic modification of the crops and the need to more tightly control them make high-resolution detection systems in demand. EFSA released guidance in 2024 that underscored the use of NGS due to its capability to confirm stacked GMO events and unauthorised modifications. Furthermore, the sequencing-based developments probably transform compliance and traceability requirements, making targeted NGS a significant catalyst in the development of GMO testing.(Source: https://efsa.onlinelibrary.wiley.com)

Technology Insights

How Did Real-Time PCR (qPCR) Become the Largest Technology Segment in GMO Testing in 2024?

Real-time PCR (qPCR) segment held the largest revenue share in the GMO testing market in 2024that held a market share of about 45%, due to the qPCR having a high sensitivity and being cost-effective in the detection. Moreover, the scalability of qPCR and its compatibility with the current laboratory operations are a guarantee of its further growth and retention of its leadership in the detection technology segment.

The digital PCR (dPCR) segment is expected to grow at the fastest CAGR in the coming years, as they are highly sensitive and quantitative. It detects the low-level incidences of GMOs with a level of precision than other available tests. Additionally, the complexity of stacked GMO traits is are factor driving the use of dPCR across the world.

Sample Type Insights

Why Did Processed Foods & Ingredients Dominate GMO Testing in 2024?

The processed foods & ingredients segment dominated the GMO testing market in 2024, accounting for 35% of the market share, due to the growing demand for processed foods in the world and strict regulatory aspects of labelling and safety standards. Furthermore, the recent developments in sample preparation and detection technologies allow the effective work with complicated processed matrices that strengthen the leading role of the segment in GMO testing.

The seeds & planting material segment is expected to grow at the fastest rate in the coming years, owing to the increased adoption of genetically modified crops worldwide. Further pushing the need to tighten seed-level testing to guarantee that there is compliance with the biosafety regulations. Moreover, the development of portable and rapid testing instruments enables field-level GMO testing, and seeds and planting materials are a strategic goal for the future in compliance and traceability.

Offering Insights

What Led Testing Services (Third-Party Labs) to Dominate the GMO Testing Market in 2024?

The testing services (third-party labs) segment held the largest revenue share in the GMO testing market in 2024, accounting for 50% of the market share. Due to the growing regulation demands and the need to have independent verification, all contribute to this domination.

Laboratories of the third party provide professional experience, verified procedures, and adherence to the international standards, including ISO 17025. Furthermore, the demand for third-party testing grew with new regulations on the labelling of GMOs in Europe, North America, and the Asia-Pacific region.

The test kits & reagents (on-site rapid kits) segment is expected to grow at the fastest CAGR in the coming years, owing to the escalating demand for fast, affordable, and convenient testing methods. Particularly in the area of agricultural output and supply chain testing. Moreover, the trend toward the increased use of on-site rapid kits is expected growing global regulations of GMOs.

Target / Assay Focus Insights

Why Did Quantification (% GMO Content) Become the Leading Focus in GMO Testing in 2024?

Quantification segment dominated the GMO testing market in 2024, accounting for an estimated 40% market share, due to the regulatory requirements in other regions like the European Union, the United States, and the Asia Pacific. This makes it mandatory that the GMO content in food, feed, and seed products be accurately labelled.

Government bodies, including the EFSA and the U.S. USDA, have established rigid limitations on the amount of GMOs present in their products, and thus have required very accurate quantitative techniques. Furthermore, the data analysis software contributes to the accuracy, efficiency, and reproducibility of quantification and strengthens its dominance in the process of GMO detection.

The adventitious presence / low-level contamination detection segment is expected to grow at the fastest rate in the coming years. Owing to the escalating regulatory inspection and consumer pressure demanding zero tolerance for unapproved GMOs. Additionally, the necessity to protect the supply chains and keep the stringent GMO labelling laws in countries like the European Union and Japan is expected to fuel the segment demand in the coming years.

End User Insights

How Did Food & Beverage Manufacturers Become the Largest End User in the GMO Testing Market in 2024?

The food & beverage manufacturers segment held the largest revenue share in the GMO testing market in 2024, accounting for 35% of the market share, due to the growing consumer need to know more about products and comply with regulations. The trust the brand is what has been fuelling this domination in areas with stringent GMO labelling laws like the European Union, Japan, and the United States.

Nestle S.A., PepsiCo Inc., and Danone S.A. are the major players that developed the testing programs in 2024 with the aim of complying with more stringent regulations globally and guaranteeing quality assurance. Furthermore, the growing demand for processed foods, functional ingredients, and plant-based products is further pushing the demand for the GMO verification technology.(Source: https://www.pepsico.com)

The seed companies & plant breeders segment is expected to grow at the fastest CAGR in the coming years, owing to the increased demand for sophisticated testing at the seed and breeding stages.

The Food and Agriculture Organisation in 2024 emphasised that the global use of gene-edited seeds grew nearly 1.9% in 2024, which led to the necessity of performing a thorough genetic screening. Additionally, the high growth in this sub-segment is expected to continue at high rates through with increased use of precision breeding methods and the development of hybrid crops.

Regional Insights

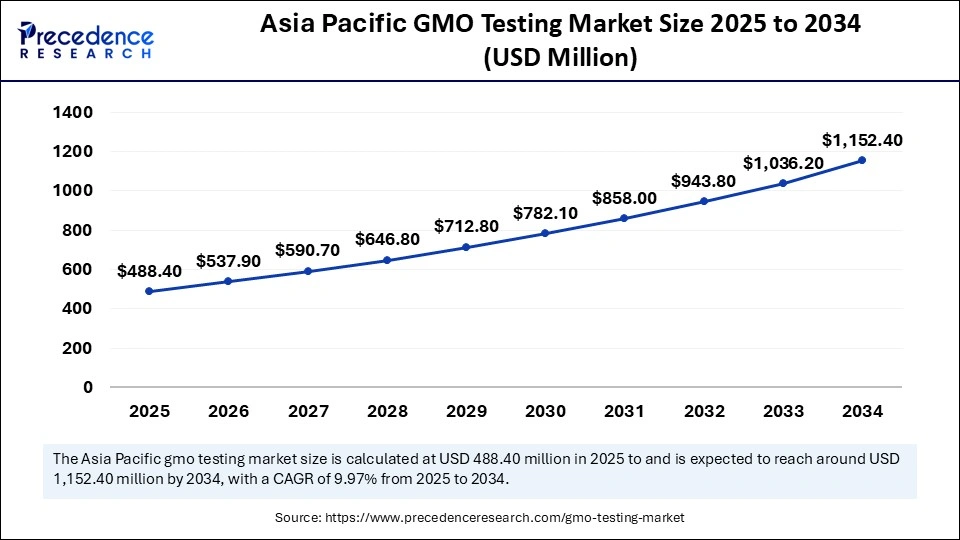

Asia Pacific GMO Testing Market Size and Growth 2025 to 2034

The Asia Pacific GMO Testing market size was exhibited at USD 445.50 million in 2024 and is projected to be worth around USD 1,152.40 million by 2034, growing at a CAGR of 9.97% from 2025 to 2034.

Why Did North America Dominate the GMO Testing Market in 2024?

North America led the GMO testing market, capturing the largest revenue share in 2024, as the regulatory environment has made North America a prime location for GMO testing innovation and infrastructure. The USDA 2024 report additionally stated that more than 90% of U.S. soybean and corn acreage targeted genetically modified varieties, which justifies the need to conduct extensive testing.

This supremacy is fuelled by stringent policies such as the National Bioengineered Food Disclosure Standard (NBFDS) that mandates the labelling of foodstuffs with GMOs. Large testing companies like Eurofins Scientific and SGS increased laboratory capacity in 2024 to handle an increasing demand. Moreover, the strong compliance, technology, and innovation ecosystem has maintained the domination of North America in the GMO testing market.(Source: https://www.ers.usda.gov)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the growing biotechnology uptake and increasing regulatory standards. In 2024, the Ministry of Agriculture of China announced that the number of approved genetically modified crop varieties included 12 new types of GM soybean. (Source: https://www.reuters.com)

The need to control the quality of food in the region through strict measures has increased the pressure on the quality of food and consequently intensified the testing needs. New guidance on GMO labelling was announced by the Codex Alimentarius Commission in 2024, further compelling stakeholders of the region to implement testing guidelines with reliability, thus boosting the market in the coming years.(Source:https://www.fao.org)

Top Vendors in the GMO Testing Market & Their Offerings

- Eurofins Scientific SE (Luxembourg): A global leader in laboratory testing services, Eurofins offers comprehensive GMO testing, including event-specific qPCR, digital PCR, and next-generation sequencing.

- SGS Société Générale de Surveillance SA (Switzerland): SGS delivers advanced GMO testing solutions through certified laboratories worldwide.

- Neogen Corporation (USA): Neogen specializes in rapid, on-site GMO detection kits and laboratory testing services.

- Intertek Group plc (UK): Intertek provides a wide range of GMO testing services, including qualitative and quantitative analysis, sequencing-based identification, and compliance verification.

- Bio-Rad Laboratories Inc. (USA): Bio-Rad offers advanced GMO detection kits, reagents, and equipment, including PCR-based solutions for event-specific and multiplex GMO testing.

- Thermo Fisher Scientific Inc. (USA): Thermo Fisher delivers high-performance GMO testing solutions, including targeted NGS, qPCR, and digital PCR technologies.

- QIAGEN N.V. (Netherlands): QIAGEN provides comprehensive GMO testing kits and molecular biology solutions for detection and quantification.

- Bia Diagnostics (USA): Specialising in rapid screening, Bia Diagnostics develops portable GMO detection tools and laboratory assays. Its focus on speed and ease-of-use serves food processors, traders, and regulatory bodies needing on-site results.

GMO Testing Market Companies

- Agilent Technologies, Inc. – Provides genomics tools, reagents, and instruments for molecular biology, food testing, and diagnostics.

- ALS Limited – Global testing, inspection, and certification company offering analytical testing for food, environment, and life sciences.

- Applied DNA Sciences, Inc. – Specializes in DNA-based security, authentication, and molecular tagging solutions.

- Bio-Rad Laboratories, Inc. – Supplies instruments and reagents for life science research, including PCR and food pathogen testing.

- Bio-Techne Corporation (Novus Biologicals / R&D reagents) – Produces reagents, proteins, and molecular tools for diagnostics and research.

- Bureau Veritas – Provides testing, inspection, and certification services, including food and agricultural safety.

- Certest Biotec S.L. – Spanish biotech firm specializing in rapid tests, molecular diagnostics, and food safety solutions.

- Eurofins Scientific – Leading global testing services provider with expertise in food, environment, pharma, and genetic analysis.

- Genetic ID / Eurofins Genetic Testing Units – Focuses on GMO testing, food authenticity, and genetic analysis.

- Illumina, Inc. – Global leader in next-generation sequencing (NGS) platforms for genomics and diagnostics.

- Integrated DNA Technologies (IDT) – Provides custom oligos, qPCR reagents, CRISPR tools, and synthetic biology products.

- Intertek Group plc – Offers quality assurance and testing services, including food safety and genetic testing.

- LGC Group (including food & feed testing) – UK-based leader in genomics tools, reference standards, and food/feed testing.

- Merck KGaA (MilliporeSigma) – Supplies reagents, lab consumables, and molecular biology tools for research and industry.

- Mérieux NutriSciences – Provides food safety testing, quality assurance, and nutritional analysis services globally.

- Neogen Corporation (incl. Romer Labs) – Develops food safety diagnostics, including pathogen, allergen, and GMO test kits.

- QIAGEN N.V. – Specializes in sample prep, PCR, and NGS kits for molecular biology and diagnostics.

- SGS SA – Swiss-based TIC leader offering food testing, genetic analysis, and certification services.

- Takara Bio Inc. – Japanese biotech providing PCR, NGS, and cell biology reagents for research and diagnostics.

- Thermo Fisher Scientific – Global supplier of sequencing platforms, PCR kits, reagents, and food/genetic testing solutions.

Recent Developments

- In January 2025, the Non-GMO Project unveiled Non-UPF Verified, a pioneering initiative developed under the newly formed Food Integrity Collective. This program expands beyond traditional GMO avoidance to tackle a growing public health crisis — the prevalence of ultraprocessed foods (UPFs), which now account for over 50% of calories consumed in Western countries. (Source: https://www.laboratoire-cellmade.fr)

- In February 2025, CellMade, a leader in mycotoxin detection, announced a major advancement in testing technology with the launch of its latest product suite. These innovations are designed to set a new industry benchmark for precision and reliability in mycotoxin analysis. CellMade's offerings now include ELISA, Rapid Lateral Flow Strips, High-Purity Mycotoxin Standards, Certified Matrix Reference Materials, and dedicated testing services utilising ELISA, HPLC, and LC-MS methodologies. The company emphasises that these developments will significantly enhance accuracy, reduce turnaround times, and support stronger food safety standards.(Source:https://www.nongmoproject.org)

Segments Covered in the Report

By Test Type

- Screening Tests

- GMO screening (promoter/terminator targets)

- Event-Specific Tests

- Quantitative (qPCR / dPCR)

- Qualitative (presence/absence)

- Protein-Based Tests

- ELISA assays

- Lateral-flow strip tests

- Sequencing-Based Tests

- Targeted NGS assays

- Whole-gene / whole-genome sequencing

- Other Molecular Tests

- Digital PCR (dPCR)

- Isothermal amplification methods

By Technology / Methodology

- Real-Time PCR (qPCR)

- Digital PCR (dPCR)

- Next-Generation Sequencing (NGS)

- Immunoassays (ELISA)

- Lateral Flow / Rapid Test Strips

- Capillary Electrophoresis / Chip-based platforms

By Sample Type

- Seeds & Planting Material

- Raw Grains & Commodities (corn, soy, canola)

- Processed Foods & Ingredients

- Animal Feed

- Environmental & Soil Samples

- Seed Lots / Breeder Samples

By Offering

- Testing Services (third-party laboratories/contract testing)

- Test Kits & Reagents

- Instruments & Consumables

- Software & Data Analysis Tools

- Validation & Accreditation Services

By Target / Assay Focus

- Screening Targets (35S, NOS, PAT, etc.)

- Trait-Specific Assays (herbicide tolerance, insect resistance)

- Event Identification (approved events, e.g., MON810)

- Quantification (% GMO content)

- Adventitious Presence / Contamination Testing

By End User

- Food & Beverage Manufacturers

- Seed Companies & Plant Breeders

- Livestock & Feed Producers

- Contract Testing Labs & CROs

- Regulatory Agencies & Inspection Bodies

- Retailers & Brand Owners

- Research & Academic Institutions

By Compliance / Application

- Labeling Compliance Testing

- Import/Export & Trade Compliance

- QA/QC & Supplier Verification

- R&D & Breeder Selection

- Environmental Monitoring

By Distribution Channel

- Direct Sales (OEM / instrument vendors)

- Distributors & Resellers

- Online Marketplaces (kits & reagents)

- Contract / Third-party Lab Networks

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting