Healthcare Service Robots Market Size and Forecast 2025 to 2034

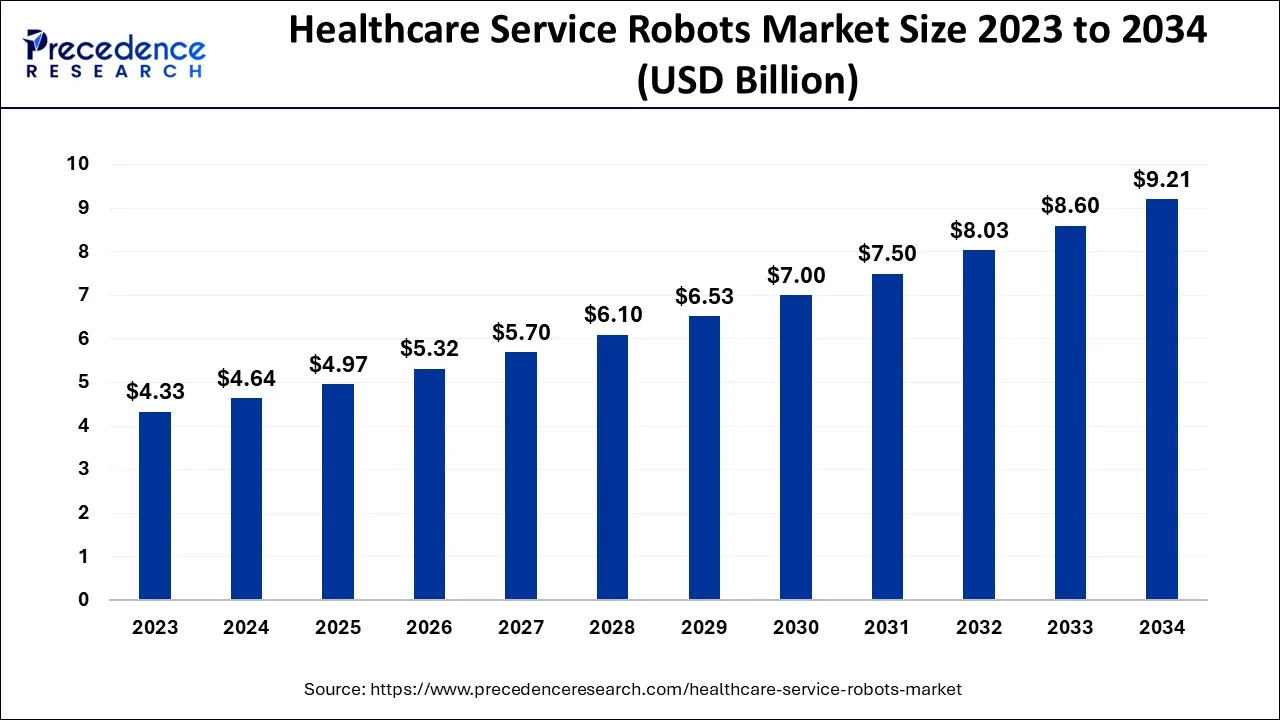

The global healthcare service robots market size was USD 4.64 billion in 2024, estimated at USD 4.97 billion in 2025, and is anticipated to reach around USD 9.21 billion by 2034, expanding at a CAGR of 7.10% from 2025 to 2034.

Healthcare Service Robots Market Key Takeaways

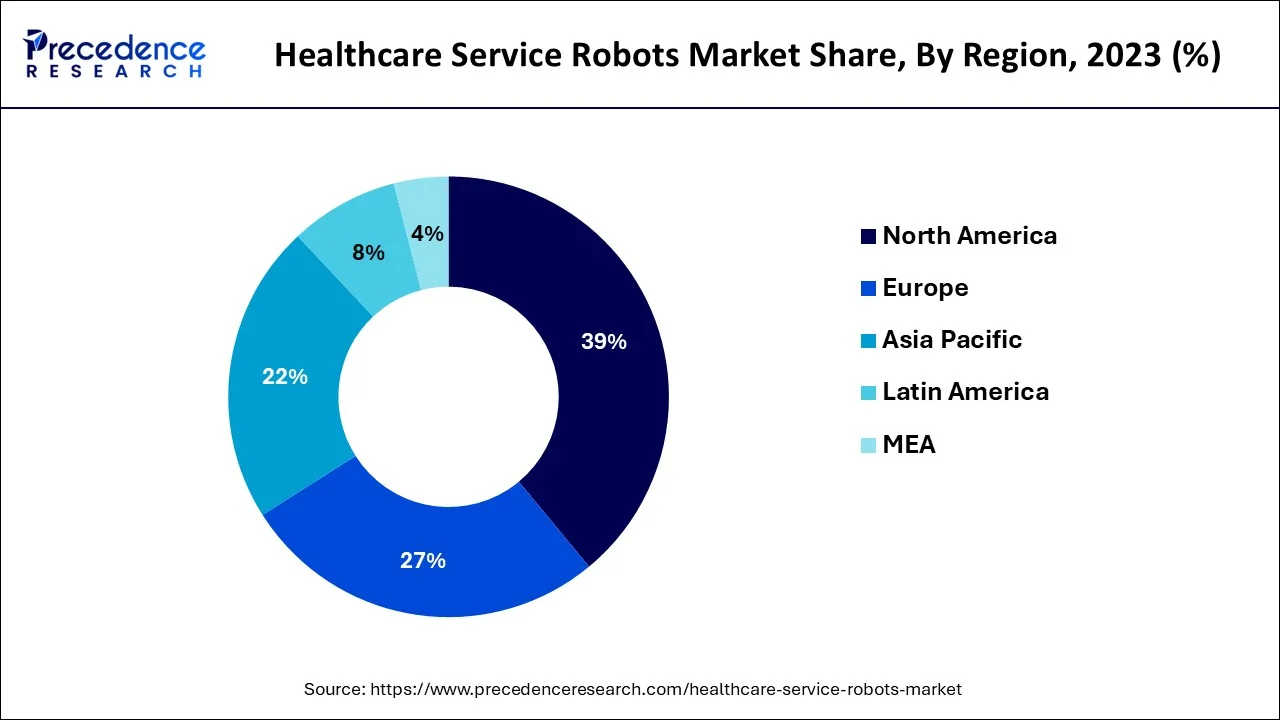

- North America dominated the global market with the largest market share of over 39% in 2024.

- By products, the disinfection robots segment was the second-highest revenue holder in the market with around 18.9% in 2024.

U.S. Healthcare Service Robots Market Size and Growth 2025 to 2034

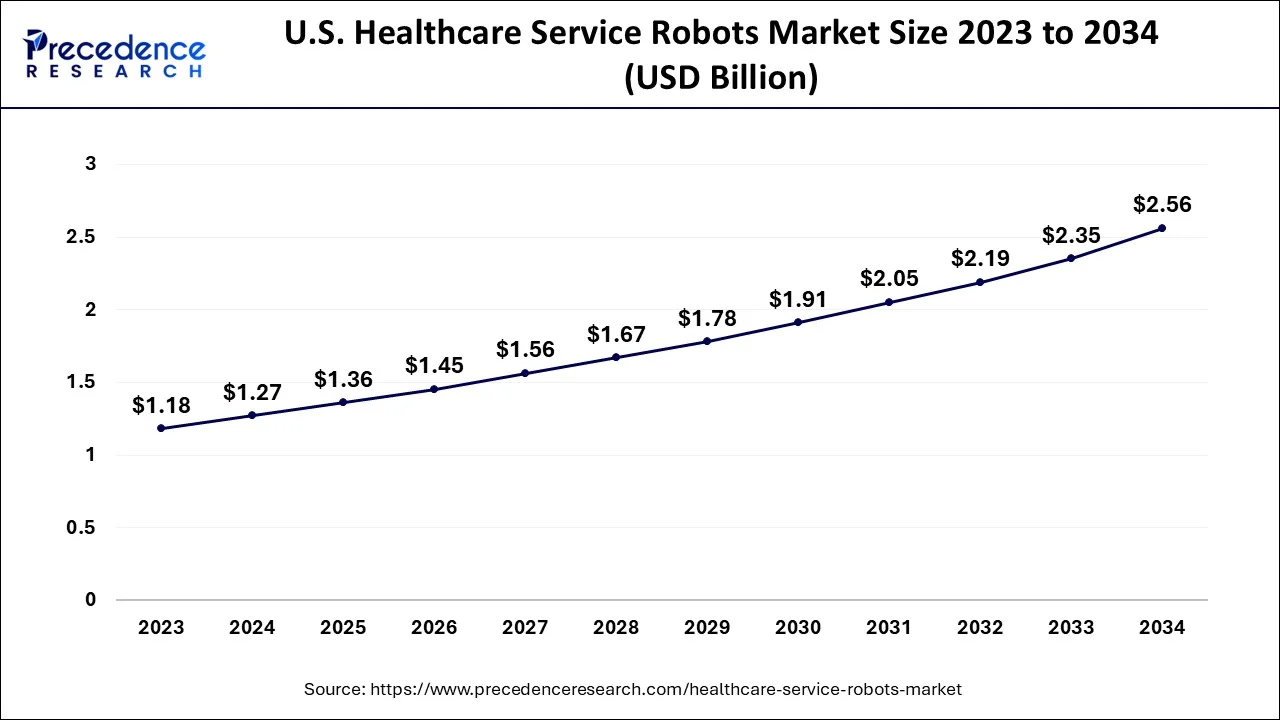

The U.S. healthcare service robots market size was evaluated at USD 1.27 billion in 2024 and is predicted to be worth around USD 2.56 billion by 2034, rising at a CAGR of 7.26% from 2025 to 2034.

North America is anticipated to dominate the global healthcare service robot market. The US is the largest market share in the global market during the forecast period. Due to having enough knowledge of the use of cutting-edge, modern technology that opens the door to enormous potential growth in this field, North America is one of the market leaders formedical robots. The forecast period is expected to see market growth as a result of rising healthcare costs and an increase in innovation and technologies. Moreover, the US is home to several leading service robot companies. The huge investments by the US-based service robot companies in the Cross-Floor Moving Solution advancements have led to the significant demand for healthcare service robots. The North American region has a larger market share due to the significant increase in the acceptance of surgical robots in the healthcare industry. 26 Robots are being used in several Texas hospitals to fill the gap. But rather than automating nursing chores like checking vital signs or changing bedpans, the robot function in addition to the current nursing personnel by doing tasks that are not patient-facing.

East Asian country South Korea is anticipated to dominate the global healthcare service robots. The country's robot density has been rising by 10% annually. South Korea is one of the global leaders in the healthcare service robot market. The idea of robots was a very common theme for science fiction works during the final decades of the 20th century. The project to create a surgical robotic system prototype was started by the Advanced Biomedical Technologies Program of the Defence Advance Project Agency to help injured soldiers on the battlefield in isolated area around the world however till now they didn't lunch any specific application for that.

Market Overview

Thereare various factors such as technological innovations concerning cognition, interaction, and manipulation of service robotics are the major factors that are expected to boost the growth of the global healthcare service robots market during the forecast period. The various market players in the healthcare industry are increasingly investing in the adoption of service robots-based technologies to remain competitive in the market, which is boosting the demand for the clinical robots service field. Robots could replace people in the service sector, according to the Department for Business, Energy and Industrial Strategy 30% of UK jobs are potentially at risk from the advances in AI and 38% of US jobs have a high risk of becoming obsolete by 2030.

Moreover, the increasing adoption of surgical robots is one of the main reasons for the growth of the healthcare service market. Surgeons can perform gentle and complex surgery that may difficult sometimes may be impossible with another method, robotic surgery makes minimally invasive surgery possible. Each day, new inventions, ideas, and more advanced models for robotic surgery have developed and functionality has been increased, dimensions have been reduced and technology has been facilitated with the help of 3D Images. In Turkey, robotic surgical systems are used in a total of 32 centers in eight cities, and approximately 132 surgeons currently use this method. The method uses online adaptive strategies to enable the system to adjust to the changing environment, as well as Feedforward Artificial Neural Networks (ANN) to develop the offline kinematic model of the robot.

In addition, rising advantages offered by robotic-assisted surgery also influence the growth of the healthcare service market, it includes various type of advantages including reducing the risk of infection due to smaller incisions, it can reduce discomfort and pain, minimum hospitalization, and quick recovery time and patient will return to routine activities. However, globally the growth of the surgical robotics sector is being restrained by high production costs and a lack of appropriate clinical proof of the efficacy of surgical robotic systems. Additionally, rising healthcare expenditure in developing countries and an increase in surgical operations are anticipated to drive the market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.97 Billion |

| Market Size by 2034 | USD 9.21 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.10% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Deployment, Application, Component, End-Users, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

COVID-19 Impact

The COVID-19 pandemic affected the economy and industries of many different countries. because of the COVID-19 outbreak, the healthcare service robots market become negatively affected from the supply side in the relaxation of the world. The disruption in supply lines of electronics and semiconductors in 2020 prompted this obstacle. however, from the call for side, the healthcare service robots marketplace changed into unaffected. For an instance, at the end of 2020, Samsung introduced it witnessed a 218% increase in smartwatch income in Q1 of 2020 compared to Q1 of 2019 and it'll be producing smartwatches and health bands in Brazil. also, several production centers and government corporations showcased the usage of the superior era along with AR and VR. for instance, the UAE police commenced using clever helmets to combat the pandemic. The smart helmet utilized by police officers is powered through thermal scanning competencies, which allows the officers to become aware of human beings with excessive temperatures in public places.

Offering Insights

The orthopedic surgery segment is anticipated to dominate the global healthcare service robots. Increasing per-capita healthcare expenses in developing nations, rising demand for minimally invasive surgeries (MIS) or the Da Vinci System, and rapid advancements in surgical robot technology are a few of the key reasons in the global market that contribute to a greater share of surgical robots.

On the other hand, component robots, and security systems have the widest use. Indoor commercial space robots gain from technology and expenses for sensors, computer science, machine learning, and open-source software, although billions are spent on Research & Development. The market for safety robots is anticipated to grow significantly as commercial security budgets increase and a completely unexplored market becomes more accessible.

Application Insights

The disinfection robots segment is expected to dominate the global healthcare service robots. The Cbot, an autonomous mobile disinfection robot from CIRQ+, sprays an "all-natural, non-toxic" solution that has been authorized for use against COVID-19 as per the U.S. Environmental Protection Agency and those are the major factors that have led to the growth of the disinfection robots' segment in the global healthcare service robot's market. The disinfection segment is fastest-growing segment during the forecast period, owing to the rising investments by the top service robot companies in the adoption of digital technologies.

Deployment Insights

The Laparoscopy segment is expected to dominate the global healthcare service robot market. Due to various advantages of laparoscopic surgery over traditional ones, including its quick recovery time, quick and effective outcomes, low risk of infection, small or no incision, and minimal pain, laparoscopy is more frequently chosen than traditional ones. Moreover, this segment is progressing because of a growing preference for minimally invasive laparoscopic equipment.

Orthopedic surgery is expected to be the most opportunistic segment during the forecast period and increase in the prevalence of orthopedic injuries and musculoskeletal illnesses that restrict movement and cause excruciating physical pain and this is the growth factor of demand for these devices during the forecast period.

Healthcare Service Robots Market Top Companies

- iRobot Corporation.

- SoftBank Robotics Group.

- Auris Surgical Robotics.

- Inc. AMP Robotics.

- Medrobotics.

- Intuitive Surgical.

- Microbot Medical.

- Kongsberg Maritime.

Recent Developments

- In Dec 2020, GE Healthcare is introducing a new version of the angiography system it's all about the image guide system it's called Allia IGS 7 angiography system. The new system's moveable gantry makes it easier to convert to open operations or provide patient access.

- In September 2020, Bear Robotics, a robotics and artificial intelligence firm collaborated with SoftBank Robotics. The organizations would introduce ‘Servi' (It is a service robot) to the hospitality and food service industries as part of this agreement. Additionally, Bear Robotics' unmatched robotics technology and their extensive expertise in commercializing and growing SoftBank Robotics were combined to create the Servi robot.

- In January 2021, Globus Medical (musculoskeletal solutions company) announced the latest addition, the first surgeries performed with the intelligent, intraoperative, and Excelsius3D 3 in 1 imaging platform.

- In May 2022, Johnson & Johnson Med Tech Ethicon company announced FDA approval for Monarch endourological surgery it's the first and only flexible robotic solution and multispecialty for use in both bronchoscopy and urology. The robot can be used to remove kidney stones according to the system.

Segments Covered in the Report

By Offering

- Orthopedic Surgery

- Cardiology

- Neurosurgery

By Deployment

- Laparoscopy

- Pharmacy Applications

- Orthopedic Surgery

- External Beam Radiation Therapy

- Physical Rehabilitation

- Neurosurgery

- Other

By Application

- Disinfection Robots

- e Assistance

- Medical TRobotic Nurselepresence Robots

- Delivery Robots

- Dispensing Robots

- Others

By Component

- Security Systems

- Locomotive Systems

- Interface Applications

- Software Platforms

- Power Resources and Visualization Systems

By End-Users

- Hospitals

- Rehabilitation Centers

- Ambulatory Surgery Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting