What is Herbal Extract Market Size?

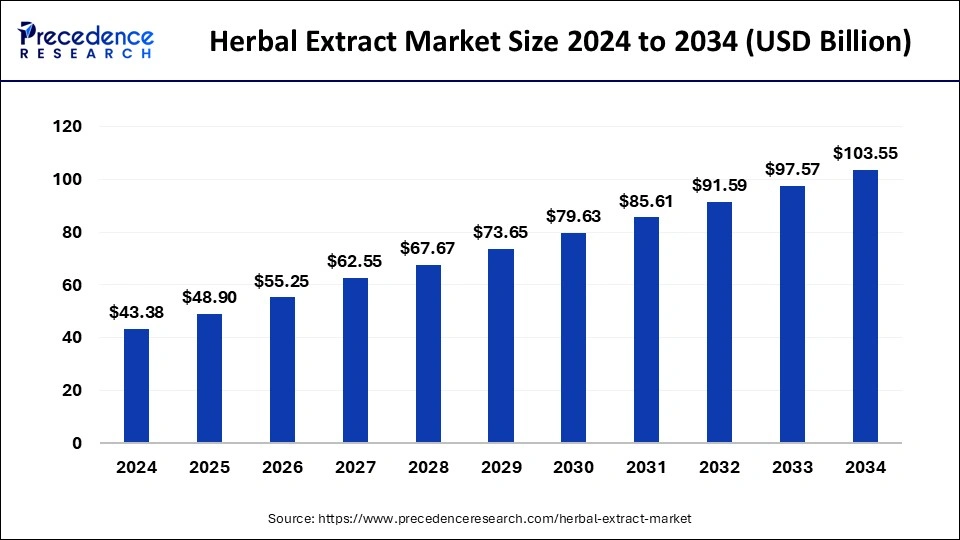

The global herbal extract market size is calculated at USD 48.90 billion in 2025 and is predicted to increase from USD 55.25 billion in 2026 to approximately USD 109.53 billion by 2035, expanding at a solid CAGR of 8.4% from 2026 to 2035.

Market Highlights

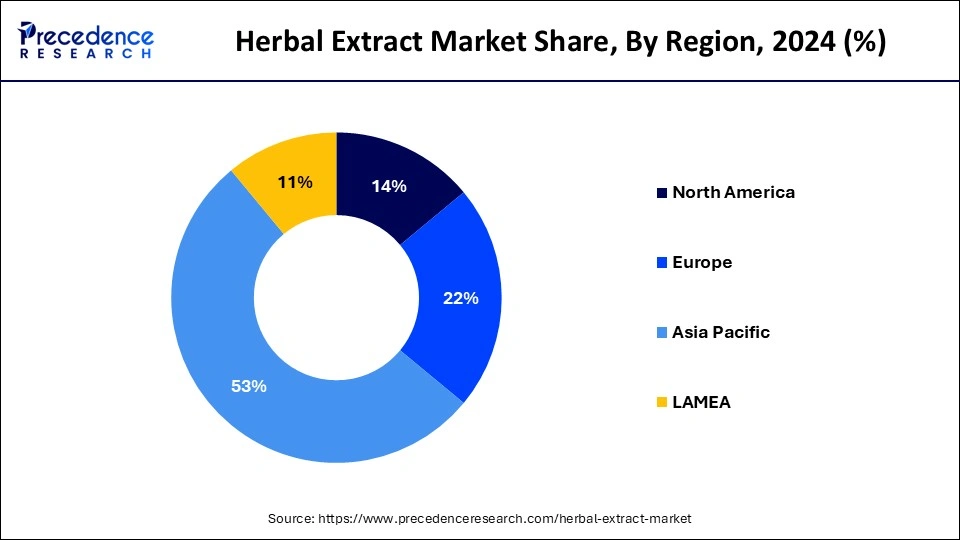

- Asia Pacific generated more than 53% of revenue share in 2025.

- By source, fruits, flowers and bulbs segment has dominated the market with the largest market share of 45.85% in 2025.

- By type, the phytomedicines segment has accounted market share of 35.97% in 2025.

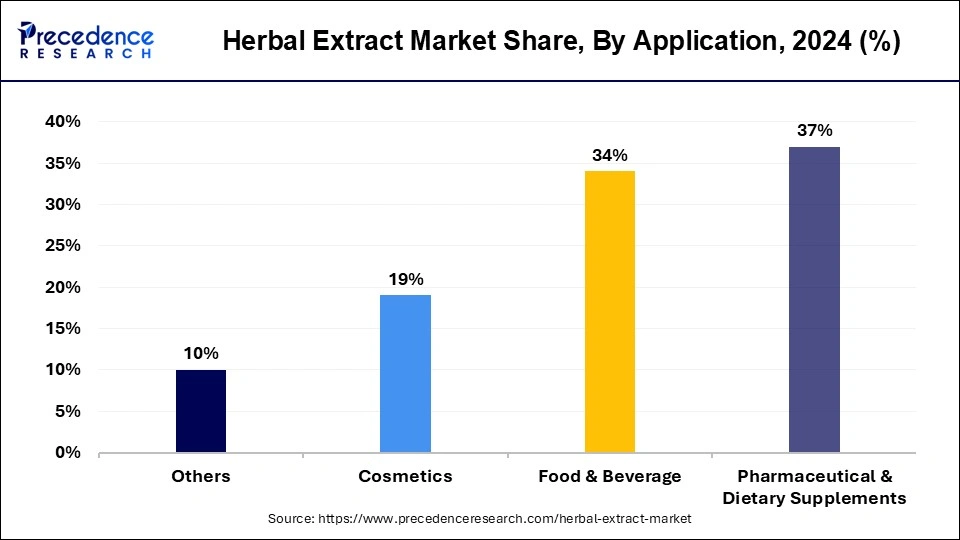

- By application, the pharmaceutical & dietary supplements segment has accounted market share of 37% in 2025.

Market Overview

The herbal extract market refers to the industry that revolves around the extraction, processing, and commercialization of bioactive compounds obtained from plants for multiple applications. Herbal extracts are concentrated forms of plant materials that contain beneficial compounds, such as phytochemicals, flavonoids, alkaloids, and essential oils. These extracts are obtained through various extraction methods, including solvent extraction, distillation, cold pressing, and supercritical fluid extraction.

Herbal extracts have applications in diverse industries, including pharmaceuticals, cosmetics, food and beverages, dietary supplements, and aromatherapy. They are used for their potential health benefits, flavoring properties, fragrance, and therapeutic applications. The herbal extract market encompasses manufacturers, suppliers, distributors, and end-users who are involved in the production and utilization of these extracts.

Herbal Extract MarketGrowth Factors

The herbal extract market is experiencing significant growth due to several key factors. Firstly, there is an increasing global demand for natural and plant-based products, driven by the growing awareness of health and wellness. Consumers are seeking alternatives to synthetic ingredients and are showing a greater interest in traditional and herbal remedies. Secondly, there is a surge in research and development activities focused on herbal extracts, leading to innovations in extraction techniques, formulation methods, and product development.

Additionally, favorable regulatory frameworks in many countries are supporting market growth by ensuring safety, quality, and efficacy standards. The market is also benefiting from advancements in technology, such as improved extraction methods and analytical techniques, which enhance the quality and consistency of herbal extracts.

Furthermore, the strong tradition of herbal medicine in many cultures, coupled with increased consumer trust and acceptance, is driving the market forward. Overall, these growth factors are propelling the herbal extract market and opening up new opportunities for manufacturers, suppliers, and consumers alike.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 48.90 Billion |

| Market Size in 2026 | USD 55.25 Billion |

| Market Size by 2035 | USD 109.53 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.4% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Source and Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising utilization from the nutrition industry

The rising utilization of herbal extracts in the nutrition industry is driven by consumer demand for natural and functional ingredients, the growth of nutraceuticals and functional foods, the clean labeling movement, scientific research supporting health claims, and the trend toward customization and personalization. Herbal extracts, derived from plant sources, are seen as natural ingredients that align with clean labeling trends. The nutrition industry is responding to this demand by incorporating herbal extracts as natural flavorings, colorants, and functional ingredients in various nutritional products. Extensive scientific research is being conducted to explore the health benefits and mechanisms of action of herbal extracts. This research provides the scientific evidence necessary to support health claims associated with herbal extracts, this element is expected to fuel the growth of the market.

Restraint

Slower results in the medicinal process

Despite the ability to treat a wide range of illnesses, herbal remedies typically take longer to work than conventional drugs. Conventional pharmaceutical drugs often provide faster symptom relief or targeted therapeutic effects compared to herbal extracts. When receiving herbal treatment, one must possess extreme tolerance. In certain situations, using herbal remedies might result in adverse responses. This slower timeframe for results may deter some consumers who are seeking immediate solutions or quick relief. As a result, the market demand for herbal extracts may be limited.

Opportunity

Rising investments in the research and development activities

Increased investment in research and development activities allows for the exploration of new herbal sources, extraction techniques, and formulation methods. This leads to the development of innovative herbal extract products with enhanced efficacy, improved bioavailability, and targeted applications. Such investments foster the creation of unique offerings, and this opens a plethora of opportunities for the market to grow. Increased investment in R&D enables the exploration of new therapeutic applications for herbal extracts. Researchers can investigate the potential of herbal extracts in addressing specific health conditions, developing new treatments, and discovering novel drug leads. This expands the market opportunities for herbal extracts in pharmaceuticals and healthcare industries.

Segment Insights

Source Insights

Leaves segment dominated the herbal extract market. Leaves serve as the main organ for photosynthesis in plants and therefore have a high concentration of bioactive compounds that offer health advantages to humans. Numerous frequently utilized herbs such as thyme, oregano, sage, basil, lavender, mint, and others are obtained from their leaves, which possess recognized healing attributes. The leaves of these plants contain considerable amounts of antioxidants, vitamins, minerals, and various phytochemicals. They are used as flavoring and preserving agents in food and cosmetic items because of their anti-microbial properties. Additionally, leaves are widely used in herbal remedies and nutritional supplements due to their easy accessibility and processing.

Fruits, flowers and bulbs segment is observed to grow at the fastest rate during the forecast period. The bulbs, flowers, and fruits provide numerous health advantages. Various medicinal properties are present in different parts of the plant, with the fruit offering unique benefits. Flowers such as clove and chamomile are rich in medicinal compounds, while the garlic bulb and onion varieties possess their own nutritional benefits.

Type Insights

Essential oils segment held the largest share of the market in 2025. The need for essential oils is increasing in the cosmetic, fragrance, food and beverage, aromatherapy, and personal care sectors. They are important in the flavor and fragrance sectors as well as in food processing and industrial seasoning fields. Essential oils from oranges and lemons are the most commonly utilized in the cosmeceutical sector due to their ability to enhance skin elasticity and firmness while also aiding in the healing of stretch marks, acne, and scars. The antibacterial properties of orange and lemon oils also render them outstanding substances for hair and skin. Furthermore, as consumers gain more awareness of their health, they are attracted to organic products and drinks that include plant-derived essential oils.

Flavors & fragrances segment is seen to grow at a notable rate during the predicted timeframe. The demand for herbal fragrance and flavor components is increasing as more customers seek natural, organic, and skin-friendly options. The demand for herbal fragrance components has risen due to heightened awareness of the possible harmful impacts of synthetic chemicals in fragrances. Herbal scent components are widely utilized in beauty, personal care, and wellness items that provide natural aroma without harmful effects on the skin. This movement stimulates innovation in product creation, with producers emphasizing clean-label items and clear sourcing practices. With the trend moving towards environmentally friendly and health-oriented options, the market for herbal fragrance ingredients is expected to continue its steady growth until 2035.

Application Insights

The Food and Beverages segment dominated the market with the largest share in 2025; the region will continue to grow significantly during the forecast period. The growth of the segment is attributed to the increasing demand for herbal, plant-based, or natural products by consumers. In recent times, consumers preferably choose natural and minimum processed foods in their daily routine. Herbal extract helps to improve the quality of the product and helps to increase its shelf life for more prolonged use, which is expected to increase the use of herbal extract by the food and beverage manufacturer. Growing concern about health and fitness in the consumer will fuel the growth of the herbal extract market in the forecast period.

The personal care and cosmetics segment is expected to grow at a robust pace in the market during the predicted time frame. The growth of the segment is expected to be boosted due to the shifting consumer preferences from synthetic chemical products to herbal products. Herbal extract products do not harm the skin and don't create other personal hygiene issues.

Regional Insights

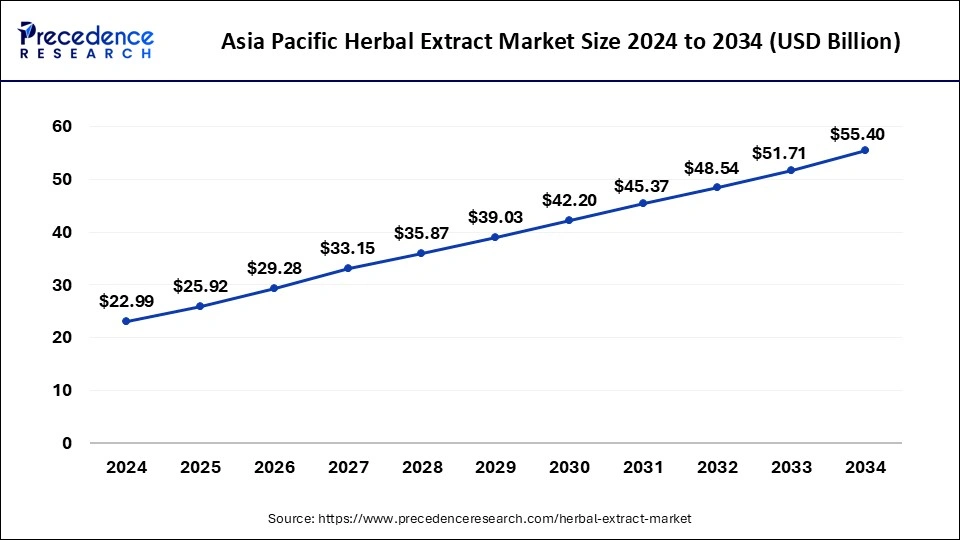

Asia Pacific Herbal Extract Market Size and Growth 2026 to 2035

The Asia Pacific herbal extract market size is exhibited at USD 25.92 billion in 2025 and is projected to be worth around USD 58.74 billion by 2035, growing at a CAGR of 8.53% from 2026 to 2035.

Asia Pacific held a significant share of the market in 2025; the region is expected to sustain its position during the forecast period. Asia Pacific carries a diverse range of plant species with medicinal properties. Countries such as China, India, Japan, and South Korea have a long history of traditional medicine practices that utilize herbal extracts. These countries also carry knowledge and expertise in identifying, cultivating, and processing medicinal plants, giving them a competitive advantage in the herbal extract market.

Some countries in the Asia Pacific have favorable policies that support the herbal extract industry. For instance, China has a well-established system for registering and regulating traditional Chinese medicine products, including herbal extracts. Such regulatory frameworks provide a conducive environment for the growth and development of the herbal extract market.

The region's dominance in the herbal extract market is driven by its ability to meet the increasing demand from international buyers. Countries like China and India have well-established export networks and robust trade systems with countries around the world, allowing them to capture a significant share of the global herbal extract market.

According to the report published by Pharmabiz in 2022, the exports of herbal products from India increased by 41.5% in the last five years. The Ministry of Ayush, India, is adopting the standardization and certification of herbal pharmaceutical products according to the guidelines of the World Health Organization (WHO); this element is observed to offer a global expansion for herbal products from India while driving the growth of the market.

China Herbal Extract Market Trends

The Chinese herbal extract market has experienced substantial expansion in recent years, fueled by a rising consumer understanding of the health advantages associated with traditional herbal treatments. With a lengthy history exceeding 2,500 years, traditional Chinese medicine (TCM) is increasingly popular not only in China but worldwide, attracting health-focused consumers looking for natural options to pharmaceuticals.

Multiple elements drive the growing demand for Chinese herbal extracts. The growing elderly population, increasing rates of chronic illnesses, and heightened focus on preventive healthcare are significant influences.

North America

North America is another fastest-growing region in the herbal extract market; North America is actively involved in research and innovation related to herbal extracts. Academic institutions, research organizations, and companies in the region are conducting studies on herbal extracts' medicinal properties, efficacy, and safety. These research efforts contribute to the development of new and improved herbal extracts, further strengthening the region's position in the market.

U.S. Herbal Extract Market Trends:

The U.S. herbal extract market is projected to expand as consumers increasingly favor natural ingredients and seek transparent labeling. Modern consumers seek transparent labels and are increasingly knowledgeable about the ingredients in every item they buy. Shoppers are increasingly opting for products that contain recognizable, natural ingredients instead of synthetic chemicals or artificial enhancements.

Producers can satisfy consumer demands for items free from synthetic flavors, colors, and preservatives by utilizing the extract. It provides a natural alternative to synthetic additives, allowing companies to create clean-label items that attract health-conscious consumers.

- For instance, in July 2025, BioVivo Science, a leader in the development of superior, scientifically supported botanical extract ingredients, officially opened its new 100,000-square-foot, cGMP-certified manufacturing facility in Jeffersonville, Indiana. For premium botanical components produced in the USA, this $70 million investment greatly increases supply chain resilience and domestic production capabilities. Also, collaborated with U.S. farmers for sustainable sourcing of the ginseng.

Europe:

Herbal extract market of the Europe is growing at notable rate during the forecast period. The demand for herbal extracts in personal care items is increasing as consumers favor natural components. The increasing consciousness among consumers about the health advantages and effectiveness of naturally sourced products is boosting market demand. Germany, France, and the UK continue to lead in this expansion thanks to their effective regulations that encourage consumers to adopt safe and high-quality plant-based proteins. Another element that boosts the adoption of herbal extracts in the area is sustainability and clean-label products.

Herbal Extract MarketCompanies

- Symrise

- Kancor

- Synthite Industries Ltd.

- Ransom Naturals Ltd.

- India Essential Oils

- A.G. Industries

- Flavex Naturextrakte GmbH

- Arjuna Natural Pvt. Ltd.

- Firmenich SA

- Robertet Group

- Sami Spices

- doTERRA

Recent Developments

- In November 2024, Purple Life Sciences, a firm dedicated to utilizing natural ingredients for medical therapies, introduced PSOCARE, an oil for psoriasis treatment, at an event today. This item represents one of the early products from the research-focused organization, designed to address psoriasis symptoms such as red spots, dry and cracked skin, itching, burning, flaking, scaling, and plaque development.

- In September 2024, Givaudan Active Beauty launched a new era of active botanical extracts aimed at transforming make-up with its [N.A.S.] ™ Vibrant Collection. This collection of active extracts from entirely natural origins marks a major advancement in performance and skin advantages, guaranteeing color stability and durability.

- In March 2025, Health Canada approved Shoden, the ashwagandha extract from Nutraceutical company Arjuna Natural, as a Natural Health Product. This action reinforces Canada's position on the safety of ashwagandha when utilized as a soothing, antioxidant dietary supplement component.

Segments Covered in the Report

By Source

- Fruits, flowers and bulbs

- Leaves

- Barks & stems

- Rhizomes & roots

- Others

By Type

- Phytomedicines

- Essential oils

- Spices

- Flavors & fragrances

By Application

- Pharmaceutical & dietary supplements

- Food & Beverage

- Cosmetics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting