Herceptin Market Size and Forecast 2025 to 2034

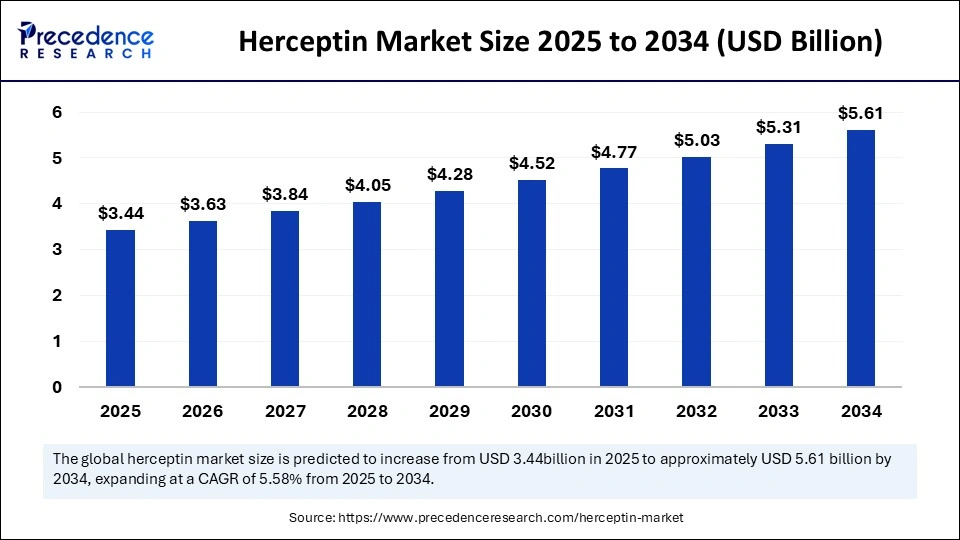

The global herceptin market size accounted for USD 3.26 billion in 2024 and is predicted to increase from USD 3.44 billion in 2025 to approximately USD 5.61 billion by 2034, expanding at a CAGR of 5.58% from 2025 to 2034. The market growth is driven by the growing number of HER2-positive cancer patients, rising acceptance of precision medicine, and expanding global healthcare systems.

Herceptin Market Key Takeaways

- In terms of revenue, the herceptin market is valued at $3.44 billion in 2025.

- It is projected to reach $5.61 billion by 2034.

- The market is expected to grow at a CAGR of 5.58% from 2025 to 2034.

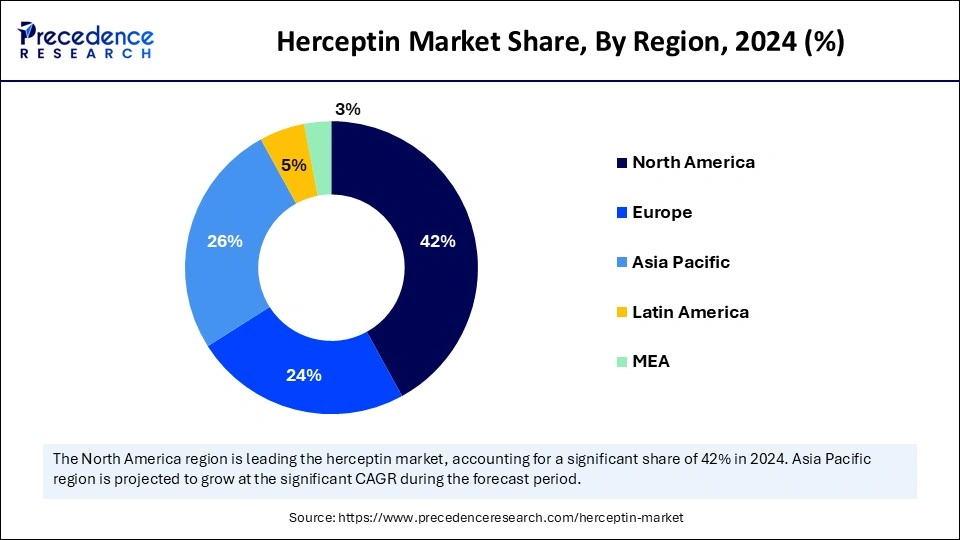

- North America dominated the market with the largest share of 42% in 2024.

- Asia Pacific is expected to grow at a CAGR of 8% during the forecast period.

- By product, the biosimilar segment held a significant share of 52% in 2024.

- By product, the biologic segment is anticipated to witness notable growth in the market over the projection period.

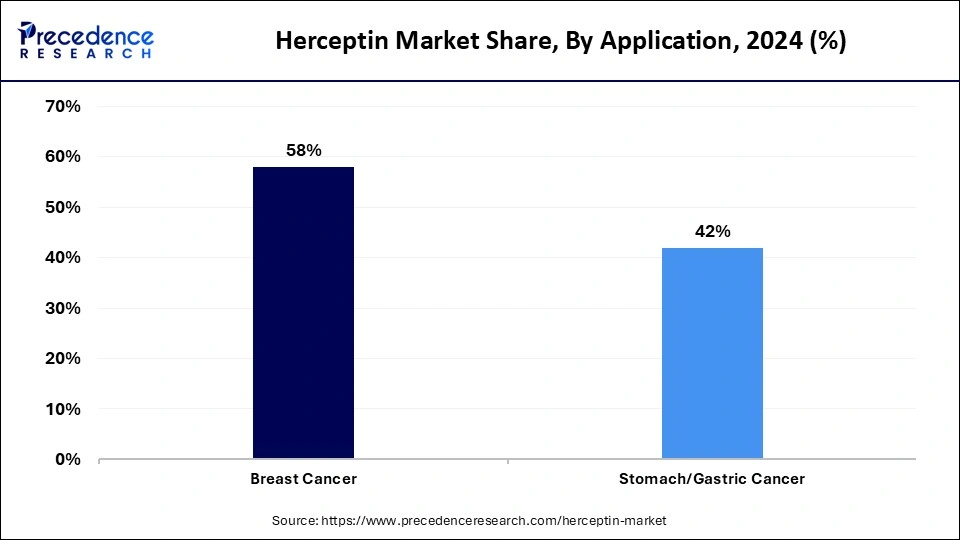

- By application, the breast cancer segment contributed the biggest market share of 58% in 2024.

- By application, the stomach/gastric cancer segment is anticipated to grow at the fastest rate in the coming years.

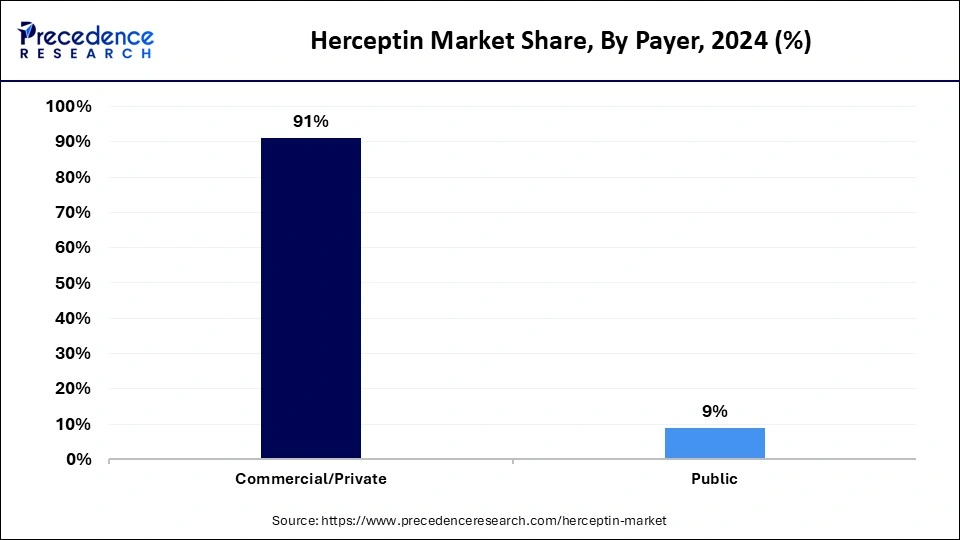

- By payer, the commercial/private segment accounted for the highest market share of 91% in 2024.

- By payer, the public segment is expected to expand at the fastest rate between 2025 and 2034.

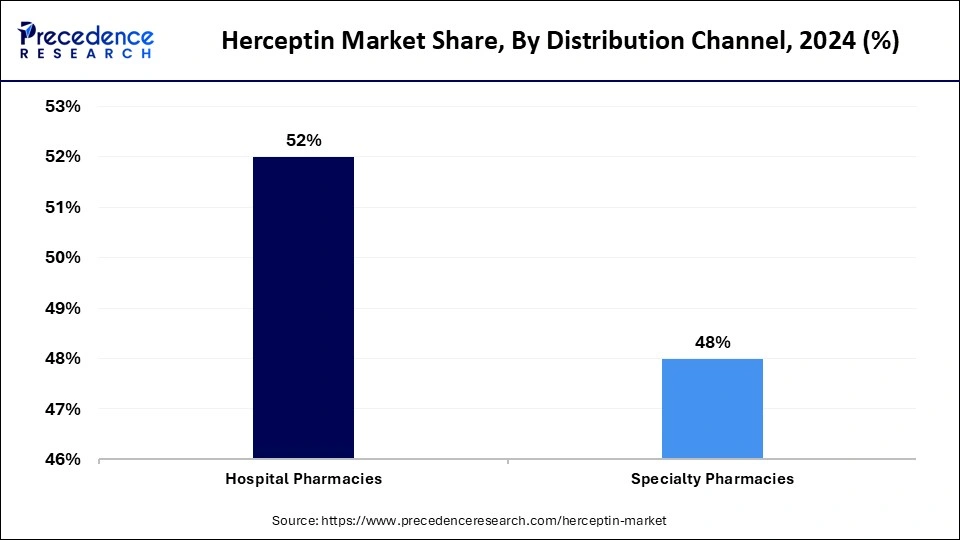

- By distribution channel, the hospital pharmacies segment generated the highest market share of 52% in 2024.

- By distribution channel, the specialty pharmacies segment is anticipated to grow at a rapid pace during the upcoming period.

Impact of Artificial Intelligence on the Herceptin Market

The market for Herceptin is experiencing transformation through Artificial Intelligence (AI) technology because it improves diagnostic accuracy and treatment planning while monitoring patients. AI helps in the analysis of extensive patient data, including genetic information, treatment outcomes, and actual patient responses in clinical practices, which is helpful in the complex process of treatment selection. AI-powered supply chain management solutions reduce the costs and improve the patient's access to Herceptin and biosimilars. AI also helps in identifying new drug targets.

U.S. Herceptin Market Size and Growth 2025 to 2034

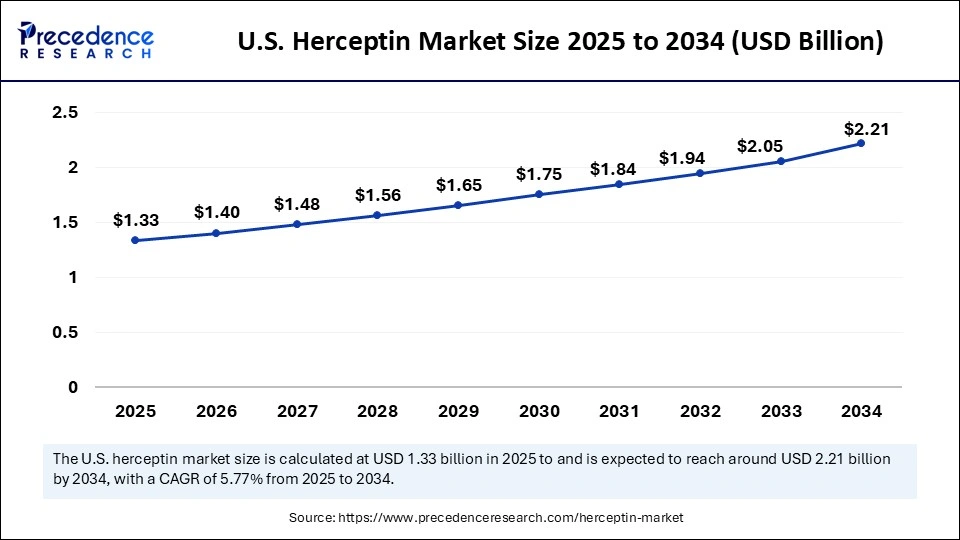

The U.S. herceptin market size was exhibited at USD 1.26 billion in 2024 and is projected to be worth around USD 2.21 billion by 2034, growing at a CAGR of 5.77% from 2025 to 2034.

North America held the dominant share of the Herceptin market in 2024. Biosimilars receive strong support from the region's high healthcare spending and strong regulatory frameworks. The region is home to various well-known pharmaceutical companies that actively conduct biosimilar research. The U.S. FDA's regulations that enhance the approval process for biosimilars further bolstered the growth of the market.

There is an increased prevalence of cancer, particularly breast cancer, in the U.S. This prompted the discovery of novel cancer drugs, opening up new avenues for the Herceptin market.

In addition, the U.S. is a major hub for pharmaceutical research, leading to advancements in cancer treatments and increased utilization of Herceptin. Healthcare coverage from Medicare and Medicaid and private insurers enables easy accessibility to Trastuzumab for diverse patient groups.

- In September 2024, Accord BioPharma, a U.S. subsidiary of Intas Pharmaceuticals, secured FDA approval to release HERCESSI (Trastuzumab-strf) as a biosimilar for Herceptin treatment of HER2-positive breast and gastric cancers. The FDA approval of the 150mg dose earlier, along with the new 420mg dosage, makes the company ready to bring its first biosimilar to the U.S. market early in 2025.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The growth of the market in the region is attributed to the rising introduction of cost-efficient Trastuzumab alternatives. Favorable regulations and reduced manufacturing costs help pharmaceutical companies and biosimilar developers reach middle-income populations. Biosimilar manufacturing is rising within India and China because these countries possess strong research facilities. The National Medical Products Administration (NMPA) of China and the Central Drugs Standard Control Organization (CDSCO) of India have built streamlined biosimilar approval processes to enable more new product releases. The rising number of cases of breast cancer and clinical trials related to Trastuzumab further support regional market growth.

Europe is considered to be a significantly growing area. The growth of the Herceptin market in Europe can be driven by ongoing research into cancer. The availability of reimbursement policies for cancer drugs influences the market. In addition, the increasing burden of breast cancer and the region's well-established healthcare sector contributes to the growth of the market in the region.

- In July 2024, Prestige Biopharma announced that the CHMP of the European Medicines Agency had recommended Tuznue, its biosimilar to Herceptin (Trastuzumab), for marketing authorization. Tuznue, which completed Phase 1 and Phase 3 trials demonstrating that it is bio-similar in effectiveness, safety, and immunogenicity.

Market Overview

Herceptin is a targeted therapy that treats primarily HER2-positive breast cancer. Its generic name is Trastuzumab. Herceptin functions as a monoclonal antibody that selectively attaches to the human epidermal growth factor receptor 2 (HER2) protein that various cancers exhibit through excessive expression. The U.S. Food and Drug Administration approved Herceptin as a treatment for metastatic breast cancer in 1998. Herceptin receives attention for medical use for breast cancer at various stages of progression while treating some cases of HER2-positive gastric cancers.

The Herceptin market is witnessing rapid growth due to rising healthcare investments and the introduction of subcutaneous versions for enhanced convenience. The rapid expansion of the healthcare infrastructure and increasing investments in novel drug discovery and development further contribute to market expansion. Trastuzumab, an active ingredient in Herceptin, gains status as a vital treatment component for global oncology strategies because of improved diagnostic methods and growing public and private healthcare funding.

Herceptin Market Growth Factors

- Advancements in Diagnostic Tools: An expansion of diagnostic techniques, especially in emerging markets, enlarges the group of patients eligible for Herceptin treatment and enhances the market opportunity for global expansion while promoting the routine use of targeted therapies.

- Subcutaneous Formulation Uptake: The introduction of Herceptin subcutaneous formulations provided better convenience for treatment and improved patient response to therapy. The subcutaneous delivery method reduces healthcare costs while saving time for administration and enabling potential medical care within the home environment compared to the intravenous procedure.

- Biosimilar Expansion: The need for Trastuzumab biosimilars has expanded globally, benefiting high as well as low-income areas. The market benefits from biosimilars because they maintain competition levels while promoting innovative solutions and economic practices.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.61 Billion |

| Market Size in 2025 | USD 3.44 Billion |

| Market Size in 2024 | USD 3.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.58% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Payer, Distribution Channel, Region |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Personalized Medicine

The rising demand for personalized medicine is a major factor that drives the growth of the Herceptin market. Medical practitioners can use genetic and companion diagnostics to provide care to HER2-positive tumor patients with fewer adverse effects. The specified treatment approach delivers superior results for patients with better healthcare resource efficiency. With the increasing prevalence of HER2-positive breast and genetic cancers, the need for personalized medicine is rising. Personalized medicine emerged as the fundamental treatment in oncology practice, strengthening its position in the precision medicine approach.

Restraint

Patent Expiry and Growing Biosimilar Competition

One of the significant challenges in the Herceptin market is the expiry of the drug. The additional supply of biosimilars puts enormous pressure on pharmaceutical companies to discontinue their efforts in product innovation, the adoption of new drug delivery technology, and the development of combinational treatment approaches. The loss of brand loyalty and decreased exclusive status becomes a major challenge for companies to recover their original research and development investments. Biosimilar competition and patent expiry are major factors that reduce research and development progress within the market. Moreover, the availability of other HER2-targeted therapies restrains the market's growth.

Opportunity

Shift Toward Combination and Sequential Therapies

The Herceptin market continues to surge in the coming years due to rising doctors' recommendations for combination therapy and sequential treatments. This refers to the infusion of Trastuzumab with chemotherapy drugs, biologics, and antibody-drug conjugates (ADCs) that clinicians are using as the primary goal to improve the therapeutic outcomes of HER2-positive cancer patients. Patients with advanced conditions show better clinical outcomes using these combination treatments. These treatments make Herceptin effective throughout different therapeutic stages to enhance disease control. The increased use of combination treatments and sequence regimens expands the scope of applications of Herceptin, making it a vital component of advanced HER2-positive cancer therapy options.

Product Insights

The biosimilar segment led the Herceptin market with the largest share in 2024. This is mainly due to the increased acceptance of biosimilars in the treatment of HER2-positive cancer. Biosimilar adoption rates keep increasing because of the expiration of Herceptin patents. As healthcare providers seek affordable oncology treatments, the demand for biosimilars increases. Biosimilars are inexpensive, making them accessible to patients. The biologic segment is anticipated to witness notable growth in the market over the projection period. The growth of the segment is attributed to the increasing demand for personalized medicine. Biologics are suitable for personalized medicine, allowing for tailored treatments based on individual profiles. HER2-positive cancer can be effectively treated using biological drugs, serving as primary treatments.

Application Insights

The breast cancer segment held the largest share of the Herceptin market in 2024 and is expected to grow at a steady rate throughout the forecast period. This is mainly due to the rising prevalence of HER2-positive breast cancer worldwide, prompting the demand for Trastuzumab. Improved diagnostic methods and lifestyles and genetic changes have increased the number of breast cancer diagnoses, creating a greater need for effective treatments. Herceptin become more significant because of its proven efficacy in treating breast cancer. It is also used as a targeted HER2 treatment.

The stomach/gastric cancer segment is anticipated to grow at the fastest rate in the coming years. High numbers of diagnosed HER2-positive gastric and gastroesophageal junction (GEJ) cancers encourage the use of Herceptin. Therapeutic use of Herceptin expanded beyond first-line therapy after regulatory bodies approved its use in major markets such as North America, Europe, and Asia Pacific, enabling more patients to access this targeted therapy. Expanding research to explore the therapeutic effects of Trastuzumab in immunotherapy and chemotherapy is likely to continue to increase its role in evolving gastric cancer treatments.

Payer Insights

The commercial/private segment dominated the Herceptin market with the largest share in 2024. This is mainly due to the increased commercial insurance coverage for trastuzumab originator versions and their biosimilar counterparts, which sustains patient treatment access. The increased prevalence of breast cancer and the high costs associated with treatments encourage commercial insurance providers to offer more insurance coverage that covers treatments. HER2-targeted therapy demand and increasing cancer rates reinforce the segment's position in the market.

The public segment is expected to expand at the fastest rate over the studied period. The rising healthcare programs and oncology funding by governments serve as the driving force behind the segmental growth. Public insurers such as Medicare and Medicaid are providing coverage for biosimilar trastuzumab because these alternatives help manage HER2-positive cancer. The expansion of public trastuzumab treatment significantly reduces healthcare costs.

Distribution Channel Insights

The hospital pharmacies segment contributed the largest market share in 2024. This is mainly due to the increased volume of patient with HER2-positive cancer. Herceptin and its biosimilar versions are typically administered intravenously, requiring professional supervision for proper monitoring. Hospital pharmacies often have skilled pharmacists, which help patients with administering Herceptin. The availability of insurance coverage and reimbursement policies for hospital treatments further bolstered the segment's growth. Hospital pharmacies maintain their position as the main distribution channel due to the increased government support.

The specialty pharmacy segment is expected to grow substantially in the Herceptin market. Specialty pharmacies specializing in handling complex medications, including Herceptin. The rising demand for subcutaneous formulations and outpatient cancer treatments drives the growth of the segment. Specialty pharmacies deliver personalized services and counselling services, attracting more patients. These pharmacies collaborate with payers to secure payments and deliver the most suitable therapy to patients. Specialty pharmacies act as essential distribution channels by optimizing drug utilization while providing superior patient care services for trastuzumab treatments.

Recent Developments

- In March 2025, Aurobindo Pharma announced that it had received marketing authorization in India for its trastuzumab biosimilar developed by its subsidiary Curateq Biologics Pvt Ltd, which will be responsible for manufacturing trastuzumab biosimilars. Approved for HER2-positive breast cancer and metastatic gastric cancers, the biosimilar will be a cost-effective alternative to Herceptin in the Indian market.

- In February 2025, Merck announced that Health Canada had approved KEYTRUDA (pembrolizumab) in combination with trastuzumab and chemotherapy for the first-line treatment of adults with HER2-positive, PD-L1-expressing advanced gastric or gastroesophageal junction (GEJ) adenocarcinoma.

- In January 2025, AstraZeneca announced that its drug Enhertu (trastuzumab deruxtecan) was approved by the U.S. Food and Drug Administration (FDA) for the treatment of HER2-positive breast cancer, following prior treatment with trastuzumab-based therapy.

Herceptin Market Companies

- Roche Holding AG (Genentech)

- Pfizer Inc.

- Samsung Bioepis Co., Ltd.

- Amgen Inc.

- Celltrion Healthcare Co., Ltd.

- Biocon Limited

- Mylan N.V. (Viatris)

- Prestige Biopharma

- Shanghai Henlius Biotech, Inc.

- AryoGen Pharmed

- Dr. Reddy's Laboratories

Segments Covered in the Report

By Product

- Biologic

- Biosimilar

By Application

- Breast Cancer

- Stomach/Gastric Cancer

By Payer

- Commercial/Private

- Public

By Distribution Channel

- Hospital Pharmacies

- Specialty Pharmacies

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting