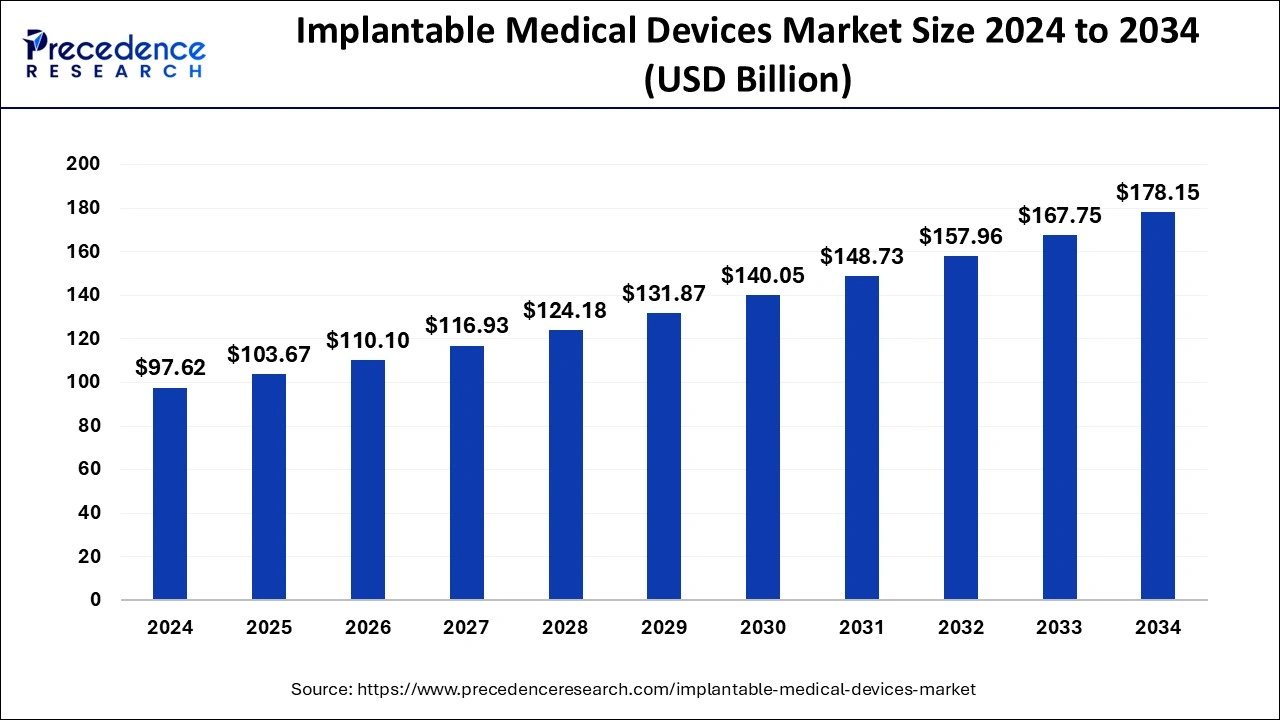

What is the Implantable Medical Devices Market Size?

The global implantable medical devices market size is accounted at USD 103.67 billion in 2025 and predicted to increase from USD 110.1 billion in 2026 to approximately USD 178.15 billion by 2034, representing a CAGR of 6.20% from 2025 to 2034.

Implantable Medical Devices Market Key Takeaways

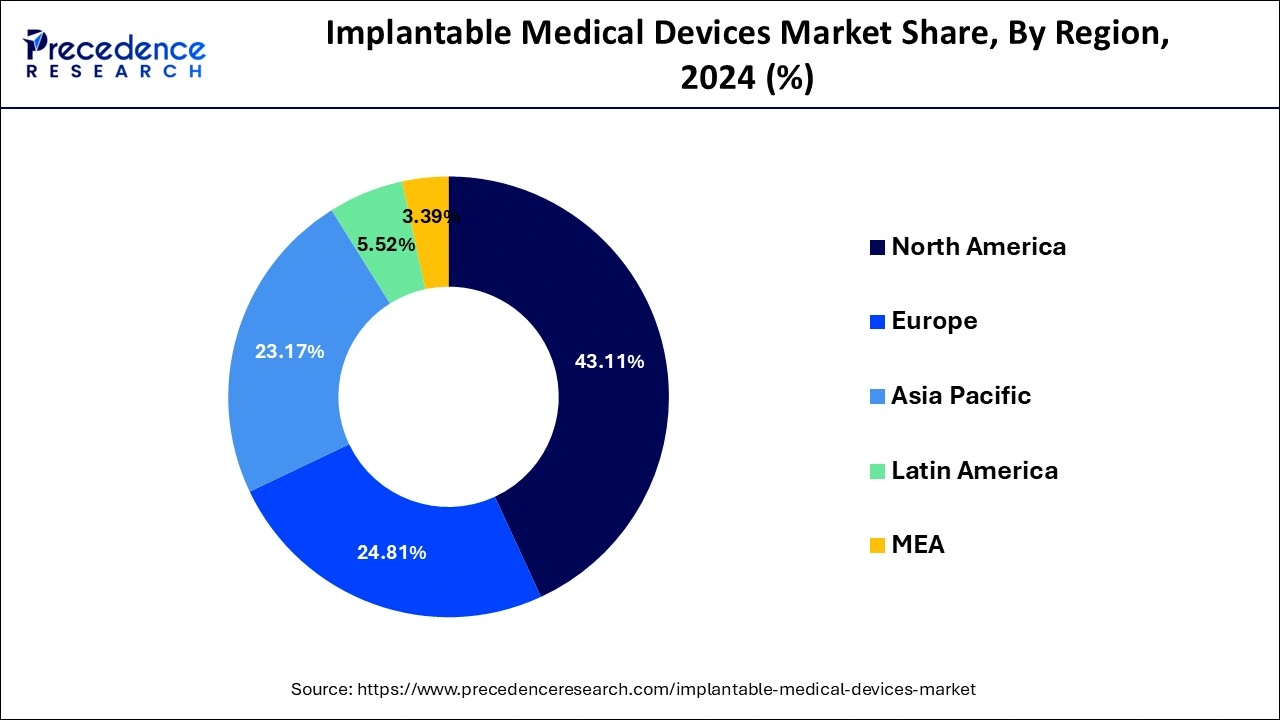

- North America dominated the global implantable medical devices market and contributed the highest market share of 43.11% in 2024.

- By product type, the orthopedic implants segment contributed more than 46% of market share in 2024.

- By biomaterial, the metallic segment accounted for the biggest market share of 50% in 2024.

Market Overview:

The implantable medical devices market is expected to experience significant growth from 2025 to 2034. This rise is driven by increasing chronic illnesses, faster technological integration, and a growing population of individuals over 60 years old. Segments such as cardiac implants, orthopedic reconstruction systems, and neurostimulators are projected to see high volumes. Additionally, growing healthcare spending in Asia-Pacific and North America, along with the introduction of minimally invasive and customized implant solutions, is accelerating the market's value growth.

Implantable Medical Devices Market Growth Factors

The technological advancements in the healthcare industry has allowed the people to improve their looks and enhance their beauty by implanting medical devices such as dental implants, breast implants, pectoral implants, deltoid implants, and cochlear implants. The rising concerns regarding the aesthetics and physical appearances among the population is another factor that drives the demand for the implantable medical devices. Moreover, the presence of numerous market players and various developmental strategies adopted by them plays a prominent role in influencing the market. Furthermore, the rising number of accident cases in which limbs or organs are damaged is a major factors that may drive the demand for the implantable medical devices across the globe. All these factors are expected to drive the growth of the global implantable medical devices market during the forecast period.

The increasing awareness regarding the availability of implantable medical devices, presence of advanced healthcare infrastructure, rising disposable income, and increasing consumer expenditure on healthcare are the prominent drivers that boosts the adoption of the implantable medical devices among the patients. Furthermore, the rising prevalence of chronic diseases ad growing geriatric population across the globe are the primary drivers of the global implantable medical devices market.According to the United Nations, there were around 382 million old age people, aged 60 years or above, across the globe in 2017 and this number is expected 2.1 billion by 2050. The old age people are prone to various chronic diseases such as cardiovascular diseases, endovascular diseases, orthopedic disorders, and dental disorders, which can foster the demand for the implantable medical devices across the globe. The kidney implants, joints implants, eye implants, and heart implants are some of the common implantable medical devices among the geriatric people. Moreover, availability of wider range of different implantable medical devices serves a wider need for the implants such as cardiovascular implants, orthopedic implants, and various other types of implants.

Implantable Medical Devices Market Outlook

- Technological Innovation Trends: Bioelectronics, 3D printing, new biomaterials, and AI-based surgical planning are fueling the next wave of market change. To enhance clinical outcomes, manufacturers are developing next-generation implants that can monitor remotely and transmit data in real-time. Additionally, additive-manufactured parts and bioresorbable implants are improving patient recovery and reducing the need for revision surgeries.

- Regulatory & Regional Expansion: Leading manufacturers are increasingly present in emerging healthcare markets to meet rising surgical volumes and evolving reimbursement policies. Asia-Pacific, especially China, India, and Japan, is becoming a key hub for production and adoption, supported by regional initiatives and faster regulatory approvals. Companies like Boston Scientific and Edwards Lifesciences are expanding their distribution networks and training programs in Latin America and the Middle East to improve global access.

- Investment & M&A Landscape: The implantable device market has attracted the interest of private equity and strategic investors due to strong double-digit returns, high barriers to entry from intellectual property, and long product cycles. Recent investments by firms like Blackstone, KKR, and Carlyle include companies in neuromodulation, orthopedic implants, and cardiac rhythm management. Meanwhile, strategic acquisitions such as Abbott's diversification into neurostimulation devices and Stryker's spine technology acquisitions are transforming the competitive landscape into an integrated device ecosystem.

- Startup & Innovation Ecosystem: The implantable medical device ecosystem is beginning to gain momentum in neuroprosthetics, wireless implants, and regenerative biointerfaces. Synchron (USA), Neuralink (USA), Mainstay Medical (Ireland), and Relievant Medsystems (USA) are companies pushing the boundaries of bioelectronic medicine. These organizations are attracting significant venture capital investment because they have the potential to revolutionize treatments for paralysis, chronic pain, and neurological disorders. The combination of biotechnology, microelectronics, and digital health opens new frontiers in the implantable device market over the next decade.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 178.15 Billion |

| Market Size in 2026 | USD 110.1 Billion |

| Market Size in 2025 | USD 103.67 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Biomaterial, End User, and Region |

Product Type Insights

The orthopedic implants segment accounted largest revenue share in 2024. Orthopedic implants are extensively used across the globe for replacing the missing bones or joints and to support the damaged bones. The rising cases of accidents that leads to damage bones and joints is augmenting the growth of this segment. Further the rising cases of rheumatoid arthritis is giving rise to the elbow joint replacement surgeries. According to the Australia Bureau of Statistics, around 458,000 people have rheumatoid arthritis. In 2017-18. Moreover, according to the Arthritis Report UK, around 17.8 million people were living with a musculoskeletal condition in 2018. Hence, this is resulting in the increased number of orthopedic surgeries that may boost the growth of the orthopedic implants in the upcoming years.

On the other hand, the dental segment is estimated to be the most opportunistic segment during the forecast period. This is simply attributed to the rising demand for the dental implants to improve physical appearances of face. According to the American Academy of Implant Dentistry (AAID), around 3 million US people have dental implants and it is expected to grow by 500,000 per year. Hence, the rising adoption of dental implants is estimated to drive the market growth in the forthcoming years.

Biomaterial Insights

Based on the biomaterial, the metallic segment dominated the global implantable medical devices market in 2024, in terms of revenue. This can be attributed to the rising cases of road accidents and trauma cases across the globe coupled with the rising demand for the minimally invasive surgeries among the people. Moreover, the dominance of this segment is attributed to the increased adoption of the metal implants in the orthopedic surgeries to provide strong support to the damaged bones or joints. Hence, this segment is further expected to grow owing to the rising cases of arthritis among the global population.

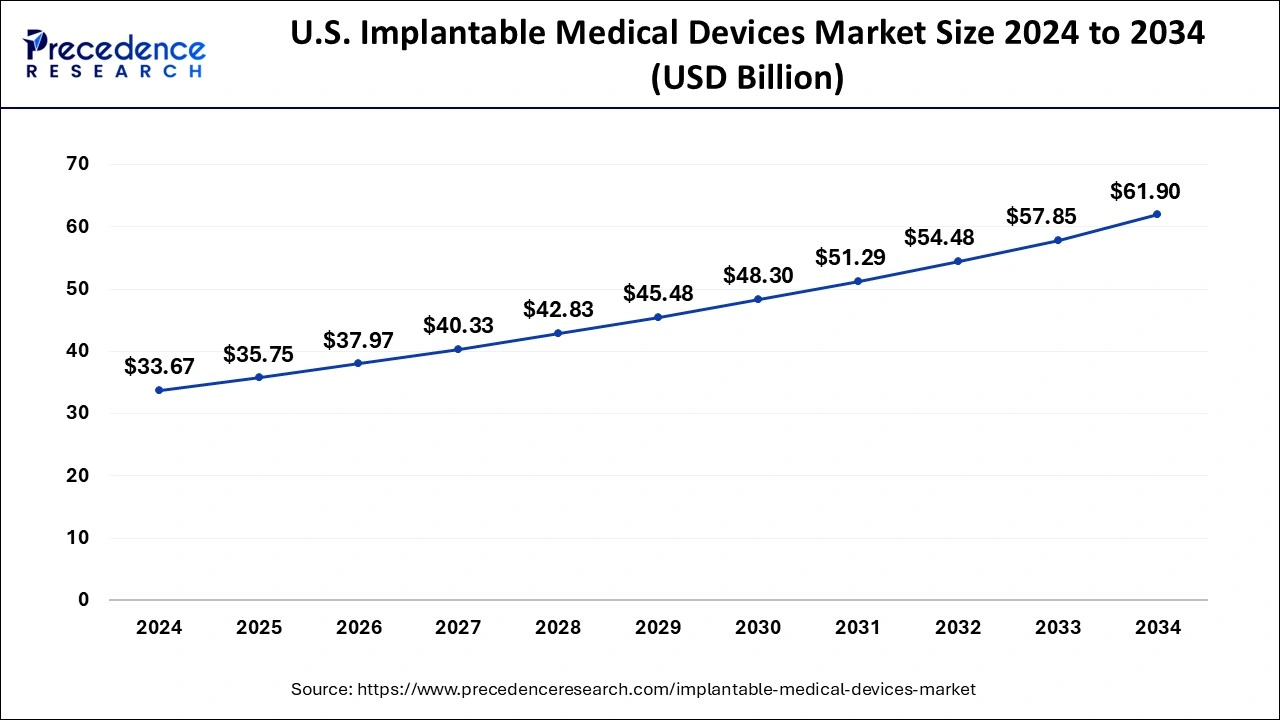

U.S. Implantable Medical Devices Market Size and Growth 2025 to 2034

The U.S. implantable medical devices market size was evaluated at USD 35.75 billion in 2025 and is predicted to be worth around USD 61.90 billion by 2034, rising at a CAGR of 6.27% from 2025 to 2034.

North America dominated the global implantable medical devices market and contributed the highest market share of 43.11% in 2024. North America is characterized by the increased prevalence of various chronic diseases and increasing geriatric population. Further, the increased disposable income, presence of advanced healthcare infrastructure, increasing adoption of minimally invasive surgeries, and rising consumer expenditure on healthcare are the major factors that are expected to drive the growth of the medical implants market in the region. Further, the number of medical visits in the US is rising. According to the CDC, approximately 64% of the US population of age between 18 years to 64 years, visited clinics related to their medical health in 2017. Moreover, the increased awareness among the population in North America regarding the availability of various medical implants has significantly contributed towards the market growth in the past.

On the other, Asia Pacific is estimated to be the most opportunistic market during the forecast period. This is attributed to the rising geriatric population. According to the United Nations, around 80% of the global geriatric population is expected to be living in the low and middle income nations. Further, the rising government and corporate investments in the development of advanced healthcare infrastructure in the region is anticipated to boost the market growth in the region.

Implantable Medical Devices Market – Value Chain Analysis

Raw Material Sourcing - The foundation of implantable medical device manufacturing lies in sourcing high-grade materials that ensure biocompatibility, durability, and precision. Key materials include medical-grade titanium, stainless steel, cobalt-chromium alloys, ceramics, medical polymers (such as PEEK and silicone), and bioresorbable composites. These materials form the structural and functional base of devices used in orthopaedic, cardiovascular, and neurological applications.

- Key Players: Heraeus Medical, Carpenter Technology Corporation, Materion Corporation, Allegheny Technologies Incorporated (ATI), Carpenter Additive, and Evonik Industries AG.

Component Fabrication - At this stage, raw materials are processed into critical device components such as electrodes, casings, leads, connectors, drug reservoirs, and microelectronic modules. Precision machining, micro-molding, additive manufacturing, and coating processes (e.g., hydroxyapatite and polymer coatings) are essential to achieve medical-grade performance and long-term safety within the body.

- Key Players: Integer Holdings Corporation, TE Connectivity, Resonetics, Greatbatch Medical, Heraeus Group, and Celestica Medical Technologies.

Device Design & Engineering - Design and prototyping involve the integration of mechanical, electrical, and biological systems to meet clinical functionality and patient-specific needs. This stage includes 3D modeling, biocompatibility assessment, and testing for reliability, hermetic sealing, and miniaturization. Advanced simulation and digital twin technologies are increasingly used to enhance design precision and reduce time-to-market.

- Key Players: Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, Zimmer Biomet Holdings Inc., and Johnson & Johnson (DePuy Synthes).

Manufacturing & Sterilization - This phase covers the large-scale production of fully functional implants under strict regulatory and quality control standards, such as ISO 13485 and FDA 21 CFR Part 820. Manufacturing includes assembly of components, encapsulation, and sterilization (via gamma irradiation, ethylene oxide, or electron beam) to ensure safety and efficacy. Robotics, cleanroom environments, and precision automation are vital at this stage.

- Key Players: Medtronic, BIOTRONIK SE & Co. KG, LivaNova plc, Terumo Corporation, MicroPort Scientific Corporation, and Integer Holdings Corporation.

Regulatory Approval & Quality Assurance - Implantable medical devices undergo rigorous preclinical and clinical validation to meet regulatory standards across global jurisdictions. Companies must secure approvals from agencies such as the U.S. FDA, European Medicines Agency (EMA), Pharmaceuticals and Medical Devices Agency (PMDA, Japan), and China's NMPA. Continuous quality assurance and post-market surveillance ensure adherence to evolving safety and performance criteria.

- Key Organizations: U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), Pharmaceuticals and Medical Devices Agency (PMDA), National Medical Products Administration (NMPA), and International Medical Device Regulators Forum (IMDRF).

Distribution to Hospitals & Clinics - Once approved, finished implantable devices are distributed globally through direct sales networks, third-party distributors, and hospital procurement systems. Major OEMs partner with healthcare providers, surgical centers, and group purchasing organizations (GPOs) to ensure timely delivery and technical support for surgical integration.

- Key Players: Medtronic, Abbott, Boston Scientific, Stryker, Zimmer Biomet, Edwards Lifesciences, Smith+Nephew, and B. Braun Melsungen AG.

Post-Market Surveillance & Maintenance - After implantation, device manufacturers monitor product performance through clinical follow-up, data collection, and real-world evidence analysis. Remote monitoring technologies and AI-driven diagnostics play a crucial role in tracking device efficacy, predicting malfunctions, and improving future designs. This stage also includes recall management and software updates for smart and connected implants.

- Key Players: Abbott (Merlin.net), Medtronic (CareLink), Boston Scientific (Latitude NXT), BIOTRONIK (Home Monitoring), and Edwards Lifesciences (HemoSphere).

Key Players in Implantable Medical Devices Market & Their Offerings:

- Smith+Nephew plc (UK): Smith+Nephew manufactures implantable devices used in orthopedic reconstruction, sports medicine, and advanced wound management. Its implants are recognized for biocompatible materials, improved osseointegration, and regenerative healing properties.

- Biotronik SE & Co. KG (Germany): BIOTRONIK specializes in cardiovascular and cardiac rhythm management implants, including pacemakers, ICDs, and implantable cardiac monitors. The company integrates sensor-based diagnostics and remote monitoring in its product lines for precision cardiology.

- LivaNova plc (UK): LivaNova focuses on implantable neuromodulation and cardiovascular systems, particularly vagus nerve stimulation (VNS) therapy devices and cardiac surgery implants. It continues to advance bioelectronic medicine and therapeutic implants targeting neurological disorders.

- Terumo Corporation (Japan): Terumo produces a wide range of cardiovascular and neurovascular implantable devices, including stent grafts, embolization coils, and blood access implants. The company is expanding into next-generation minimally invasive implant technologies.

- MicroPort Scientific Corporation (China): MicroPort offers implantable cardiovascular, orthopedic, and neuro-interventional devices. It has rapidly expanded its global footprint through innovations in bioresorbable stents and artificial joints tailored for emerging markets.

- Straumann Group (Switzerland): Straumann is a leading manufacturer of dental implants, biomaterials, and digital restorative solutions. Its portfolio includes titanium and ceramic implant systems, guided surgery tools, and regenerative biomaterials for oral reconstruction.

- Dentsply Sirona Inc. (USA): Dentsply Sirona provides advanced dental implant systems and restorative technologies. The company's research emphasizes precision-guided implant placement and durable materials for long-term oral health outcomes.

- Cochlear Limited (Australia): Cochlear is the global pioneer in implantable hearing solutions, including cochlear, bone conduction, and acoustic implants. The company focuses on integrating wireless connectivity and AI-driven sound optimization in its next-generation devices.

- Nevro Corp. (USA): Nevro is known for its spinal cord stimulation systems used in the management of chronic pain. Its HF10 therapy platform has set new standards in high-frequency stimulation technology, minimizing side effects and enhancing patient comfort.

- Axonics Inc. (USA): Axonics develops implantable sacral neuromodulation devices for bladder and bowel dysfunction. The company's miniaturized, rechargeable implants have transformed the landscape of urological care and patient convenience.

Implantable Medical Devices Market Companies

- Abbott Laboratories

- Boston Scientific Corporation

- C. R. Bard, Inc.

- Cardinal Health, Inc.

- CONMED Corporation

- Globus Medical, Inc.

- Integra Lifesciences Holdings Corporation

- Johnson & Johnson

- Medtronic plc

- NuVasive, Inc.

- St. Jude Medical, Inc.

- InstitutStraumann AG

Segments Covered in the Report

By Product Type

- Cardiovascular Implants

- Orthopedic Implants

- Opthalmology Implants

- Dental Implants

- Cochlear Implants

- Microchip Implants

- Others

By Biomaterial

- Ceramic

- Metallic

- Polymers

- Natural

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting